TMTB EOD Wrap

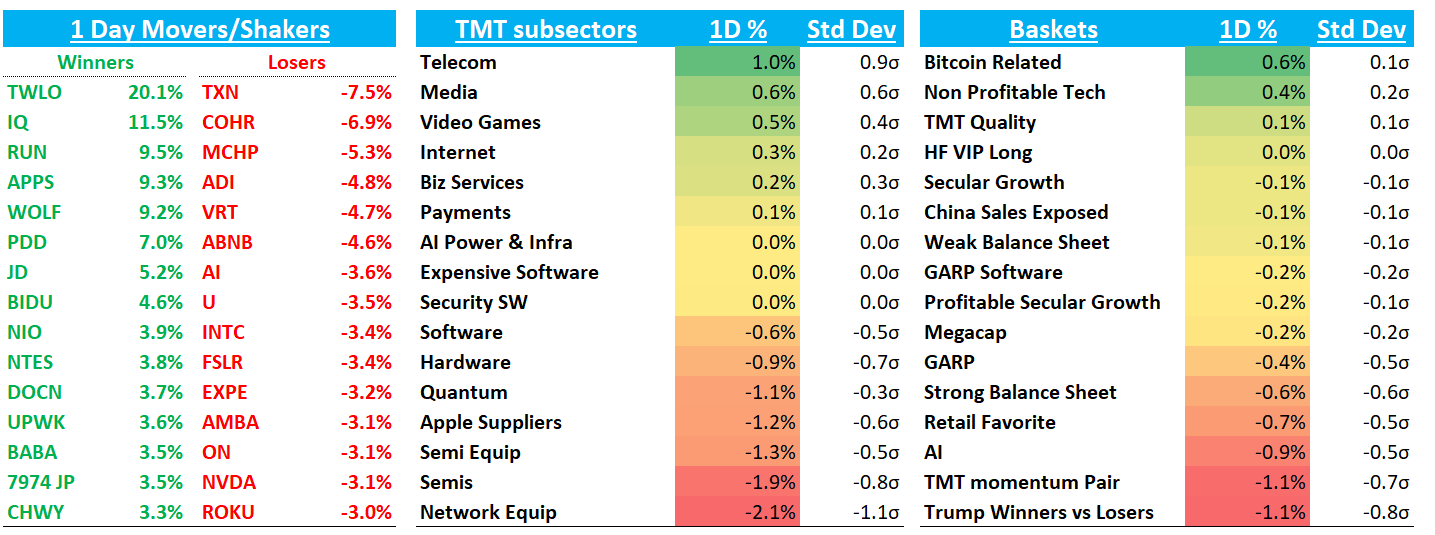

QQQs -57bps as Deepseek and META capex dominated news flow today (see below for more details). Yields fell 2bps across the curve as flash PMIs revealed a slowdown in services sector - fed expects still holding steady around 40bps worth of cuts.

Internet

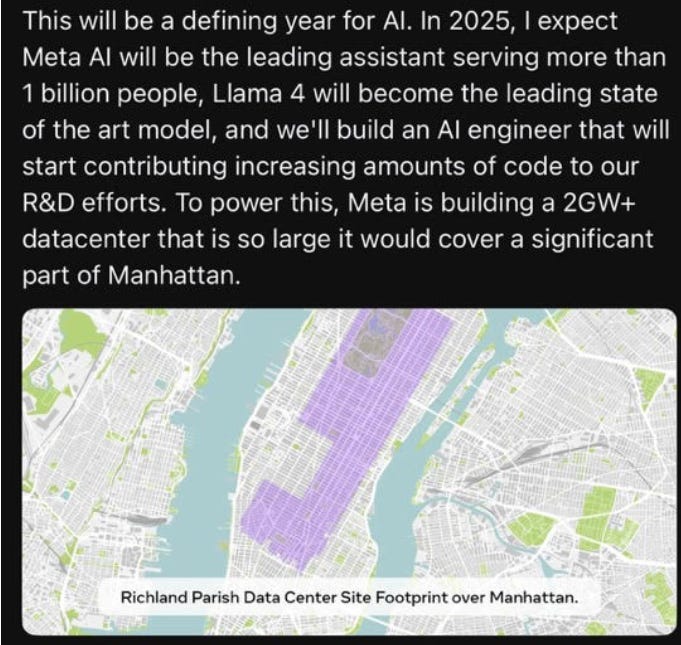

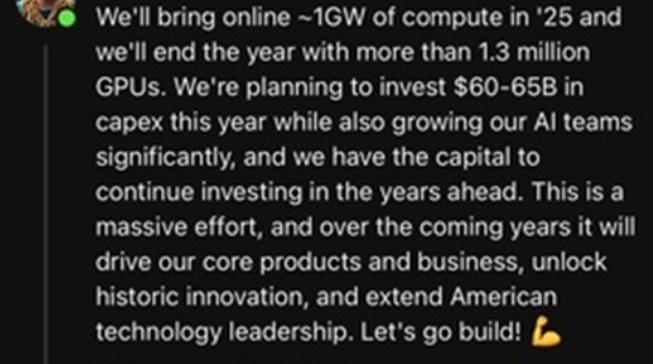

META +1.75% to new highs: Zuck guided 2025 capex at $60-$65 to support AI build out which is inline with buyside expects and above street at $51B (JPM was street high at $64B). That’s +61% at the mid point, an acceleration from 45% capex growth in ‘25.

META CEO Zuckerberg:

Why the rally? Investors took it as one of the overhangs in front of the print being out the way - as our vol friends like to say “knowledge is vol compressing.” Also the psychology of why would he release this early? My read on it is he likely feels good on the q…also who is the big winner if AI compute becomes a lot more efficient? I would argue META is one of the co’s that has the most to gain as means less capex outlay going forward and more efficient/faster AI progress = more $’s from one of the few co’s that is showing significant ROI from current spend already

CHWY +3% to new highs as Yipit saying Q4 sales will grow mid teens above street at 13%.

GOOGL +1%: Yipit said revs accelerated in latest two weeks vs prior two weeks, but ad and search revs still tracking 2-3ppts below street so far in Q1

NFLX -75bps: Bernstein ug calling out $36 in EPS vs Phillips dg based on valuation

SHOP +1.5%as Yip said GMV tracking to 4% below street for q1 but doesn’t include any impact from recent PYPL partnership, so tough to gauge what that means

EBAY flat as Yip said GMV accel’d first two weeks of Jan

China names continue to rip as Trump’s stance with China seems to be more friendly than many anticipated: PDD +7%; JD +5%; BABA +3.5%

Semis

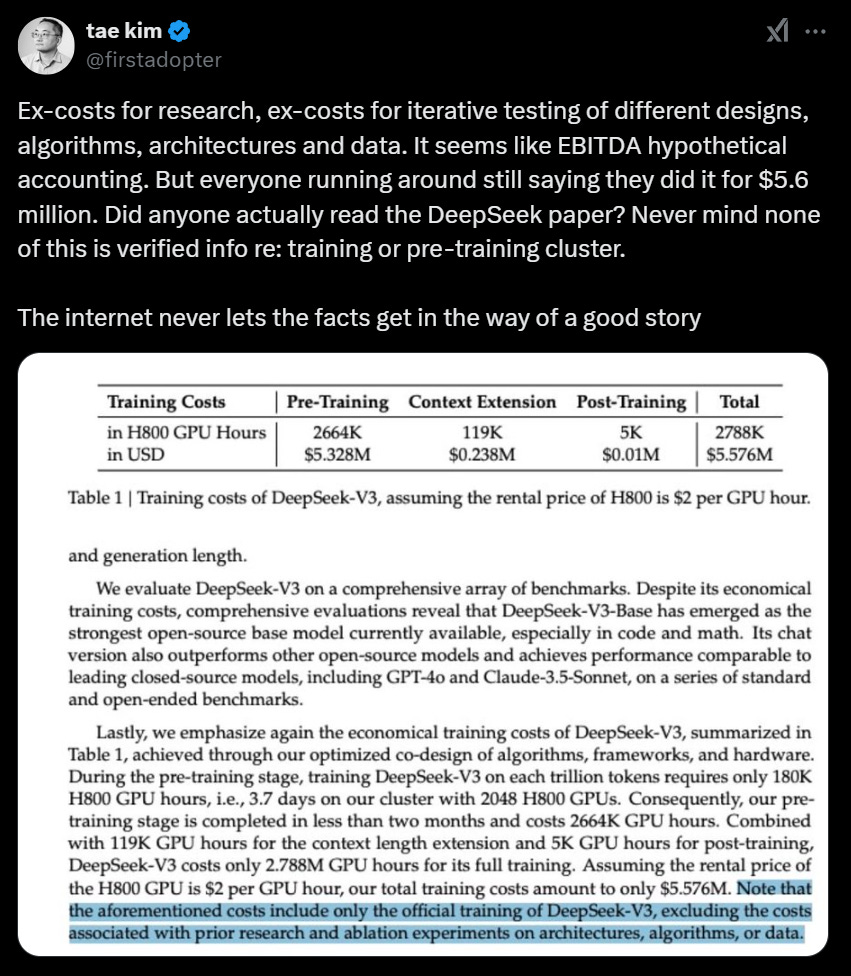

NVDA - Deepseek and what it means for compute going forward dominated the news flow today (see our morning wrap for more details). Did it only cost $5M of compute? No. Is it more efficient than traditional LLM’s with industry-best functionality? Yes…some more takes below in our AI Roundup…Edgewater was also out mixed this morning saying NVDA GPU results will be more 2H weighted as they’ll miss their 1H shipment targets and GB200/NVL system “deliveries lagging targets into early Jan 25.”

Other AI names mixed: AVGO +2% as investors like that OpenAI is building out datacenters and also building their own chip with Broadcom; AMD -16bps; TSM -1/2%; ARM -2.5%; MU -1.5%

AI networking names sold off as well: CIEN -1.6%; ALAB -6%; CRDO -4.5%

Analog names weak after TXN’s gross margin guide: TXN -7%; ADI -5%; ON -3%; NXPI -3%

Software

Slow news day here outside of TWLO +20% on +ve pre with better Q4 #s, LT targets, and $2B buyback

Elsewhere

TSLA - 1.4% despite announcing new Model Y launch in Europe and US a bit earlier than expected. Some shine coming out the Trump/Elon Bromance (politico). Not really inspiring price action here.

AAPL -40bps despite Clev coming out positive on Dec Q revs and saying US and EMEA strength driving iPhone upside

AFRM -1.4% despite locking in additional funding from Liberty Mutual

AI Roundup

BG2 Pod- Stargate, exec orders tiktok

AI Power: MS looked at Stargate power needs, which are equal to 1/4 total 25-28 US data center power projections. MS projects this capex would mean total power demand of ~15 gigawatts, ~5x the power used by Philadelphia, and ~25% of MS’ 2025-28 US DC projections.

Trump wants power plants to connect directly to data centers rather than supplying electricity through the grid. ‘You don’t have to hook into the grid, which is old and could be taken out’

TechCrunch: Perplexity launches an assistant for Android