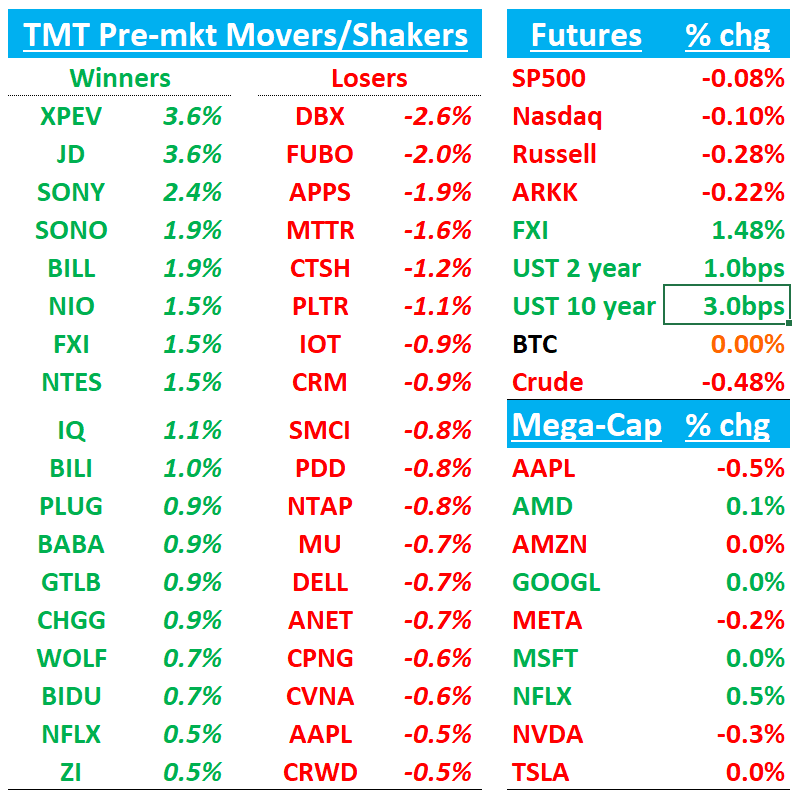

Good morning. QQQs flattish; BTC -2%; yields ticking up slightly. China +1.5% as , China Industrial Profit figures showed an acceleration in July vs June and earnings from China’s Trip.com helping travel names along with JD’s buyback. L

早上好。QQQs 平稳;BTC 下跌 2%;收益率略微上升。中国上涨 1.5%,因为中国工业利润数据显示 7 月相比 6 月有所加速,以及中国的 Trip.com 的收益推动了旅游相关股票,JD 的回购也起到了帮助作用。

Let’s get straight to it…

让我们直接进入主题……

AAPL: CFO Maestri to transition from his role on Jan 1st, 2025; Maestri will continue to lead the Corp Services teams; Kevan Parekh, Apple's VP of Financial Planning & Analysis, will become CFO and join the executive team

AAPL:首席财务官马埃斯特里将于 2025 年 1 月 1 日卸任;马埃斯特里将继续领导企业服务团队;苹果财务规划与分析副总裁凯文·帕雷克将成为首席财务官并加入执行团队

Street generally fine with the change:

街道通常因变化而良好:

Citi views as “a bit negative” since Maestri helped Apple expand gross margin by 7% and is highly regarded within the investor community.

花旗将其视为“有点负面”,因为马埃斯特里帮助苹果将毛利率提高了 7%,并在投资者社区中备受推崇。

KEYBanc also sees as a modest negative and believes AAPL’s financial disclosures could certainly be improved where more key performance indicators, such as installed base of active devices across products, unit sales by product, and paid subscriptions in services, "could all be useful metrics for investors." However, KeyBanc doubts new management will make any changes.

KEYBanc 也认为这是一个适度的负面因素,并认为 AAPL 的财务披露确实可以改进,更多的关键绩效指标,例如各产品的活跃设备安装基础、按产品划分的单位销售和服务中的付费订阅,“都可能是投资者有用的指标。”然而,KeyBanc 对新管理层是否会做出任何改变表示怀疑。

Morgan Stanley noted that Parekh's ascension to CFO is similar to Maestri's path a decade ago. This CFO transition is "well-telegraphed" and should provide key stakeholders with confidence that the CFO succession plan has been well-thought and planned out, says the analyst, who adds that the firm has "been impressed by Mr. Parekh in the limited interactions we've had with him."

摩根士丹利指出,Parekh 晋升为首席财务官的过程与十年前 Maestri 的路径相似。这一首席财务官的过渡是“早有预兆”,应该能让关键利益相关者对首席财务官的继任计划充满信心,分析师表示,并补充说,该公司“对我们与 Parekh 先生有限的互动印象深刻。”

Melius Research thought a CFO change at Apple could happen soon, noting CFOs don't typically do it longer than 10 years "just about anywhere" and Luca Maestri just celebrated his 10-year anniversary as CFO. Apple "methodically groomed his successor" Kevan Parekh and "there probably is no better time to do this than now" as we enter a multi-year upgrade cycle for iOS devices, the analyst tells investors in a research note. The firm says Maestri staying on to lead Corporate Services is "likely to make sure things go off without a hitch."

Melius Research 认为,苹果的首席财务官(CFO)更换可能很快就会发生,指出 CFO 在“几乎任何地方”通常不会任职超过 10 年,而卢卡·马埃斯特里刚刚庆祝了他担任 CFO 的 10 周年。苹果“有条不紊地培养了他的继任者”凯文·帕雷克,并且“现在可能是进行这一更换的最佳时机”,因为我们正进入 iOS 设备的多年度升级周期,分析师在研究报告中告诉投资者。该公司表示,马埃斯特里继续领导企业服务“可能会确保事情顺利进行。”

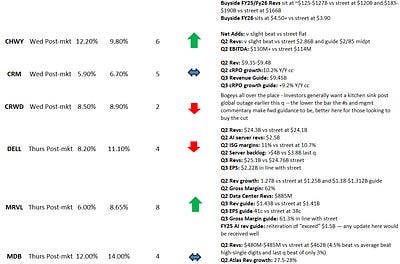

CRM: Barclays and JPM out with mixed checks ahead of the q

CRM:巴克莱和摩根大通在季度前发布了混合检查报告

Barclays says their checks came in more negatively with just 20% of resellers reporting some level of outperformance to their plans (vs. 64% last quarter), a level they had not seen in this survey since the pandemic-impacted quarters. In addition, Barclays notes the resellers polled pointed to higher levels of discounting and smaller deal sizes overall. Barclays saw 60% of resellers mention greater than normal discounting (compared to ~35% the prior two quarters) and 70% cite smaller deals (compared to just 45% in Q1)

巴克莱表示,他们的检查结果更为消极,仅有 20%的转售商报告其业绩超出计划(相比于上季度的 64%),这是自疫情影响的季度以来在此调查中未见的水平。此外,巴克莱指出,被调查的转售商提到整体折扣水平更高,交易规模更小。巴克莱看到 60%的转售商提到折扣高于正常水平(相比于前两个季度的约 35%),70%提到交易规模较小(相比于第一季度的仅 45%)。

JPM’s checks with partners finished below plan this Q (-3.2%), degrading from 1Q, with partners citing an uneven macroeconomic backdrop, elections, and summer doldrums. JPM notes that bookings expectations (degraded to -41% (from 19% last Q), and the net pace of business declined as well (though both remain well above trough). However, JPM notes partners were more positive on GenAI and Data Cloud with px increases being accepted and they see pot’l upside to rev from earlier px increases kicking in and a potential for end April sales push that may not have been fully captured by partners

JPM 与合作伙伴的检查在本季度低于计划(-3.2%),较第一季度有所下降,合作伙伴提到宏观经济背景不均衡、选举和夏季低迷。JPM 指出,预订预期已降至-41%(上季度为 19%),业务的净增长速度也有所下降(尽管两者仍远高于谷底)。然而,JPM 指出,合作伙伴对生成性人工智能和数据云的看法更加积极,价格上涨被接受,他们看到早期价格上涨带来的潜在收入上升,以及可能在四月底的销售推动,这可能尚未被合作伙伴完全捕捉。

Amazon aims to launch delayed AI Alexa subscription in October

亚马逊计划在十月推出延迟的 AI Alexa 订阅服务

Amazon is preparing to launch its delayed overhaul of personal voice assistant Alexa in October, according to internal documents obtained by The Washington Post, as it faces new competition from artificial intelligence voice assistants from rivals.

亚马逊正在准备于十月推出其延迟的个人语音助手 Alexa 的全面改版,根据《华盛顿邮报》获得的内部文件,因为它面临来自竞争对手的人工智能语音助手的新竞争。Access to the upgraded version of the assistant will require a paid subscription, the documents said.

获取升级版助手的权限需要付费订阅,文件中提到。The release, scheduled to occur just weeks before the presidential election, will include a new “Smart Briefing” feature that provides daily, AI-generated summaries of news articles selected based on a customer’s preferences, the documents said…

该发布定于总统选举前几周进行,将包括一个新的“智能简报”功能,该功能提供基于客户偏好的每日 AI 生成的新闻文章摘要,文件中提到……Amazon has not released a general-purpose chatbot similar to ChatGPT, Google’s Gemini or Microsoft Copilot, although it has launched a shopping assistant called Rufus. But the documents said that alongside the new Alexa the company plans to launch Project Metis, a web-based product, previously reported by Business Insider, that is meant to directly compete with ChatGPT-style tools.

亚马逊尚未发布类似于 ChatGPT、谷歌的 Gemini 或微软 Copilot 的通用聊天机器人,尽管它推出了一款名为 Rufus 的购物助手。但文件显示,除了新的 Alexa 外,公司计划推出 Project Metis,这是一个基于网络的产品,之前由《商业内幕》报道,旨在直接与 ChatGPT 风格的工具竞争。

ADBE: HedgeEye launches at Buy with 20% upside

ADBE:HedgeEye 以买入评级启动,预计上涨 20%

Hedgeye says they are confident AI will not be a headwind for ADBE, contrary to what some investors think, as cross-selling will drive greater exposure for ADBE’s ecosystem and drive an acceleration in Digital Media ARR. Hedgeye thinks Digital Experience growth could accelerate in Q3 and thinks the stock should trade at 20x 2025 P/E, implying 20% upside

Hedgeye 表示,他们相信人工智能不会对 ADBE 构成阻力,这与一些投资者的看法相反,因为交叉销售将推动 ADBE 生态系统的更大曝光,并加速数字媒体年经常性收入(ARR)的增长。Hedgeye 认为数字体验的增长可能在第三季度加速,并认为该股票应以 2025 年 20 倍市盈率交易,暗示 20%的上涨空间。

NVDA Truist raises tgt to $145 from $140 ahead of earnings

NVDA Truist 将目标价从$140 上调至$145,预计财报发布前

As Truist prepared for NVDA's CQ2 (July) report after-market on Wednesday, it reached out to component buyers and sellers for updates from suppliers who sell into and alongside NVDA. Critical observations include four major points: Truist believes Blackwell is not delayed. Blackwell orders improving. Demand for GPUs appears insatiable, and there is some shift to on-prem / enterprise happening now.

随着 Truist 为 NVDA 的 CQ2(七月)报告做准备,并在周三市场收盘后发布,它联系了组件买卖双方,以获取向 NVDA 销售及与其相关的供应商的最新情况。关键观察包括四个主要点:Truist 认为 Blackwell 没有延迟。Blackwell 订单正在改善。对 GPU 的需求似乎是无法满足的,并且现在正在发生一些向本地/企业的转变。

NFLX: ISI raises PT to $750 from $710 after their US and Mexico Survey

NFLX:ISI 将目标价从$710 上调至$750,基于他们对美国和墨西哥的调查

ISI believes NFLX has more room to raise pricing and points out key takeaways from their survey: 1) NFLX metrics stable in US and Mexico while their competitive position remains as strong as ever 2) SAVOD remains a powerful Gross Adds and Anti-churn lever, now 50%+ from Gross Adds 3) Everyone likes live with potential retention and acquisition power 4) NFLX games is seeing increasing penetration

ISI 认为 NFLX 还有更多提价空间,并指出他们调查的关键要点:1)NFLX 在美国和墨西哥的指标稳定,竞争地位依然强劲 2)SAVOD 仍然是强大的新增用户和抗流失杠杆,现在新增用户中超过 50%来自 SAVOD 3)每个人都喜欢直播,具有潜在的留存和获取能力 4)NFLX 游戏的渗透率正在增加

JD: JD.com authorizes new $5.0B share repurchase program

京东:京东商城授权新的 50 亿美元股票回购计划

JD.com has approved a new share repurchase program, effective from September 2024. Pursuant to the new share repurchase program, the company may repurchase up to $5.0B worth of its shares over the next 36 months through the end of August 2027. The Board will review the share repurchase program periodically, and may authorize adjustment of its terms and size.

京东已批准一项新的股票回购计划,计划于 2024 年 9 月生效。根据新的股票回购计划,公司在接下来的 36 个月内(至 2027 年 8 月底)可以回购价值高达 50 亿美元的股票。董事会将定期审查股票回购计划,并可能授权调整其条款和规模。

AFRM: Affirm could see GAAP profitability by Q4 of 2025, says Mizuho

AFRM:瑞穗证券表示,Affirm 可能在 2025 年第四季度实现 GAAP 盈利

TheFly:

Mizuho analyst Dan Dolev says Affirm is set to provide fiscal 2025 guidance on Wednesday with consensus pointing to a GAAP loss for the year. However, the firm believes Affirm has a potential to reach GAAP operating income profitability by Q4 of 2025, helped by a "dramatically lower warrant expense burden" in the second half of the year, lower interest rates, and improving scale even before any incremental benefit from Apple Pay buy now pay later volumes. The prospect of seeing potential GAAP profitability by Q4 of 2025 "could result in a step-function in the attractiveness of the AFRM stock," the analyst tells investors in a research note.

瑞穗分析师 Dan Dolev 表示,Affirm 将在周三提供 2025 财年的指导,市场共识预计该年度将出现 GAAP 亏损。然而,该公司认为,Affirm 有潜力在 2025 年第四季度实现 GAAP 营业收入盈利,这得益于下半年“显著降低的认股权证费用负担”、较低的利率以及在未考虑 Apple Pay 分期付款量的增量收益之前的规模改善。分析师在研究报告中告诉投资者,预计到 2025 年第四季度可能实现 GAAP 盈利的前景“可能会导致 AFRM 股票吸引力的跃升”。

MDB: MongoDB revenue bar 'sufficiently conservative,' says Citi

MDB:摩根数据库收入条“足够保守”,花旗表示

TheFly:

Citi says that following a second guidance cut last quarter from MongoDB, the bar on total revenue is "sufficiently conservative." The firm is more optimistic on upside to estimates from Enterprise Advanced versus Atlas citing favorable inputs on large financial service renewals and consensus more aggressive on Atlas growth versus EA. Citi sees a better stock set-up for MongoDB in the second half of 2024, with easier compares, stronger large deal seasonality and easing of headwinds into fiscal 2026. It keeps a Buy rating on the shares with a $350 price target.

花旗表示,在 MongoDB 上个季度进行第二次指引下调后,总收入的门槛“足够保守”。该公司对企业高级版(Enterprise Advanced)相较于 Atlas 的估计上行持更乐观态度,理由是大型金融服务续约的有利因素以及市场对 Atlas 增长的共识更为激进。花旗预计 MongoDB 在 2024 年下半年的股票表现更佳,原因是比较基数更容易、大型交易季节性更强以及到 2026 财年逆风减弱。它对该股维持买入评级,目标价为 350 美元。

CRWD: Citi on expert call with law professor

CRWD:花旗与法学教授的专家电话会议

Net, CITI has greater comfort that CRWD's financial obligations are likely to be contained (limitation of liability clauses, most capped at ~2-3x) and will likely be enforced as such through contract law provisions should the process move towards trial. Citi notes Delta's ability to identify contract loopholes remains the biggest uncertainty, though early indicators suggest this May prove challenging, especially in the context of Delta's alleged outdated IT infrastructure a likely reason behind its prolonged recovery efforts. Allin, while Delta vs CRWD is unprecedented in case-law, Sprigman suggests a settlement appears the most-likely rational scenario.

净而言之,CITI 对 CRWD 的财务义务可能会受到限制(责任限制条款,大多数限制在~2-3 倍)感到更有信心,并且如果程序进入审判阶段,这些条款可能会通过合同法条款得到执行。Citi 指出,Delta 识别合同漏洞的能力仍然是最大的未知数,尽管早期迹象表明这可能会面临挑战,特别是在 Delta 被指控的过时 IT 基础设施的背景下,这可能是其恢复努力延长的原因。总的来说,尽管 Delta 与 CRWD 在案例法中是前所未有的,Sprigman 认为和解似乎是最合理的可能情景。

PDD: Citi downgrades Neutral

PDD:花旗将评级下调至中性

While CITI does not view rev miss as thesis changing, it struggles to reconcile if management's cautious tone on outlook citing intensified competition, shift of consumption patterns, and uncertain external environment reflects “actual challenges” amid diminishing return on its “value-for-money” moat and regulatory risk or trying to manage competition and investor expectation through “low profile” approach. Nevertheless, given limited investor communication and the lack of operating metrics and financial breakdown disclosure, together with management's intentional/proactive cautious outlook comment, Citi thinks the stock will likely be range bound until PDD is able to regain investor confidence through few quarters of consistent result beat.

尽管 CITI 并不认为收入未达预期会改变其投资论点,但它在管理层对前景的谨慎语气与竞争加剧、消费模式转变和不确定的外部环境之间是否反映了“实际挑战”方面感到困惑,这些挑战伴随着其“物有所值”护城河的收益递减和监管风险,还是试图通过“低调”方式来管理竞争和投资者预期。然而,考虑到有限的投资者沟通以及缺乏运营指标和财务细分披露,加上管理层故意/主动的谨慎前景评论,Citi 认为该股票可能会在区间内波动,直到 PDD 能够通过几个季度的一致业绩超预期来重新获得投资者信心。

UBER/GOOGL: JMP says – Waymo unit economics likely positive – suggests it will scale

优步/谷歌:JMP 表示 – Waymo 单元经济可能为正 – 暗示其将实现规模化

With Waymo's service becoming generally available in San Francisco this summer and the company testing in more markets, like Truckee, Detroit, and upstate New York, JMP thinks unit economics flipped to positive in San Francisco, which it estimate in this note, signaling an acceleration in Waymo's expansion plans. While JMP continues to be concerned about share loss for Uber as it believes Waymo (and AVs broadly) offers a better (and ultimately cheaper) service than human-based drivers, it thinks Uber can solve this through relatively inexpensive M&A over time as the value of the number two or three AV company is limited given its view that this is a winner-take-most market

随着 Waymo 的服务在今夏在旧金山普遍可用,并且公司在更多市场进行测试,如特拉基、底特律和纽约州北部,JMP 认为旧金山的单位经济学已经转为正面,这在本备忘录中进行了估算,标志着 Waymo 扩张计划的加速。虽然 JMP 继续担心 Uber 的市场份额损失,因为它认为 Waymo(以及自动驾驶汽车整体)提供的服务比人类司机更好(并且最终更便宜),但它认为 Uber 可以通过相对低成本的并购来解决这个问题,因为它认为第二或第三大自动驾驶汽车公司的价值有限,考虑到这是一个赢家通吃的市场。

UBER/CART: Why Instacart’s Future May Hinge on Uber

UBER/CART:为什么 Instacart 的未来可能取决于 Uber

Out yesterday, but likely contributed to CART +2% / UBER -2%. The Information:

昨天发布,但可能导致 CART 上涨 2% / UBER 下跌 2%。信息:

“A possible precursor to a merger is the tightening alliance between its two CEOs, Uber’s Khosrowshahi and Instacart’s Fidji Simo. The pair has developed a strong rapport and shares a common thread: They both took over from embattled founders who clashed with their investors. Khosrowshahi, too, had a rough go in Uber’s early years as a public company, before he won over investors in the past year. Earlier this year, Simo approached Khosrowshahi about a potential partnership to allow Instacart customers to order restaurant delivery from Uber Eats through Instacart’s app, creating a slick integration. In doing so, she bypassed a fellow rival, DoorDash CEO Tony Xu, two people familiar with the matter said. Simo has warmer feelings toward Khosrowshahi than toward Xu, the people said. Simo attempted to negotiate a potential merger with Xu's company three years ago, following failed efforts by former Instacart CEO Apoorva Mehta. Instacart’s C-suite is also stocked with former Uber executives, including its chief product and marketing officers. Its chief financial officer, Emily Reuter, is a former Uber ride-sharing finance chief. She joined Instacart as vice president of finance in January and was elevated to the CFO role the day after the two companies announced their partnership in May.”

可能导致合并的前兆是两位首席执行官之间日益紧密的联盟,优步的 Khosrowshahi 和 Instacart 的 Fidji Simo。这对搭档建立了强大的关系,并有一个共同点:他们都是从与投资者发生冲突的创始人手中接管的。Khosrowshahi 在优步早期作为上市公司的岁月中也经历了艰难的时光,直到去年才赢得了投资者的信任。今年早些时候,Simo 向 Khosrowshahi 提出了一个潜在的合作伙伴关系,允许 Instacart 客户通过 Instacart 的应用程序从 Uber Eats 订购餐厅外卖,创造了一个流畅的整合。这样做时,她绕过了另一位竞争对手,DoorDash 首席执行官 Tony Xu,两位知情人士表示。Simo 对 Khosrowshahi 的感情比对 Xu 更温暖,这些人说。三年前,Simo 曾试图与 Xu 的公司谈判潜在的合并,此前 Instacart 前首席执行官 Apoorva Mehta 的努力未能成功。Instacart 的高管团队中也有多位前优步高管,包括首席产品官和首席营销官。首席财务官 Emily Reuter 是前优步共享出行财务主管。 她于一月加入 Instacart 担任财务副总裁,并在两家公司于五月宣布合作的第二天晋升为首席财务官。请提供需要翻译的文本

OKTA: BTIG comments on positive checks

OKTA:BTIG 对积极的检查发表评论

BTIG talked to 8 partners and 1 CISO about demand trends and feedback was positive and improved in their checks from prior quarters. BTIG notes demand has stabilized and is potentially improving for OKTA. In addition, BTIG notes neg sentiment from the company’s breach back in Oct 2023 is gradually fading and feedback from new products such as OIG, PAM, ITDR was mixed across contacts.

BTIG 与 8 位合作伙伴和 1 位首席信息安全官进行了交谈,关于需求趋势的反馈积极,并且与之前几个季度的检查相比有所改善。BTIG 指出,OKTA 的需求已经稳定,并有可能改善。此外,BTIG 还提到公司在 2023 年 10 月的安全漏洞带来的负面情绪正在逐渐消退,来自 OIG、PAM、ITDR 等新产品的反馈在各个联系人中存在差异。

Other News: 其他新闻:

AAPL: will host its product event dubbed “It’s Glowtime” on Sept 9th – CNBC

AAPL:将于 9 月 9 日举办名为“发光时刻”的产品发布会 – CNBCAAPL: developing new Mac series w/ M4 processors and will unveil the new products in Oct – Economic Daily

AAPL:正在开发配备 M4 处理器的新 Mac 系列,并将在 10 月发布新产品 – 经济日报China EVs / AV: China's BYD to use Huawei's advanced autonomous driving system in off-road EVs – Reuters

中国电动车/自动驾驶:中国比亚迪将在越野电动车中使用华为的先进自动驾驶系统 – 路透社DIS: DirecTV Looks to Rewrite Pay-TV Rules in Disney Networks Talks – Bloomberg

DIS:DirecTV 希望在与迪士尼网络的谈判中重写付费电视规则 – 彭博社INTC: Intel slashes marketing budget as AMD presses for market shift – Digitimes

INTC:英特尔削减营销预算,AMD 推动市场转变 – DigitimesPARA: Edgar Bronfman drops Paramount bid, clearing path for Skydance deal – Reuters

PARA:埃德加·布朗夫曼放弃对派拉蒙的竞标,为 Skydance 交易铺平道路 – 路透社PARA: Paramount Explores Sale of 12 Local TV Stations – Bloomberg

PARA:派拉蒙探索出售 12 个地方电视台 - 彭博社Semicap: China’s export curbs on semiconductor materials stoke chip output fears – FinancialTimes

半导体:中国产半导体材料的出口限制加剧芯片产量担忧 – 金融时报Sony: Sony to raise PlayStation 5 price by 20% in Japan - Reuters

索尼:索尼将在日本将 PlayStation 5 价格提高 20% - 路透社TSLA: Tesla’s Rivals Still Can’t Use Its Superchargers - NYTimes

TSLA:特斯拉的竞争对手仍无法使用其超级充电站 - 纽约时报WDC: files mixed shelf of indeterminate amount

WDC:提交不确定金额的混合货架注册文件