Global Markets – Weekly Review

全球市场 - 每周回顾

A crisis of historic magnitude — and lasting significance.

一场历史性规模的危机——具有持久的重要性。

110+ Charts & Commentary on all major Markets — for your weekend reading.

110+ 图表和对所有主要市场的评论 — 供您周末阅读。

KEY TOPICS COVERED 重点主题覆盖

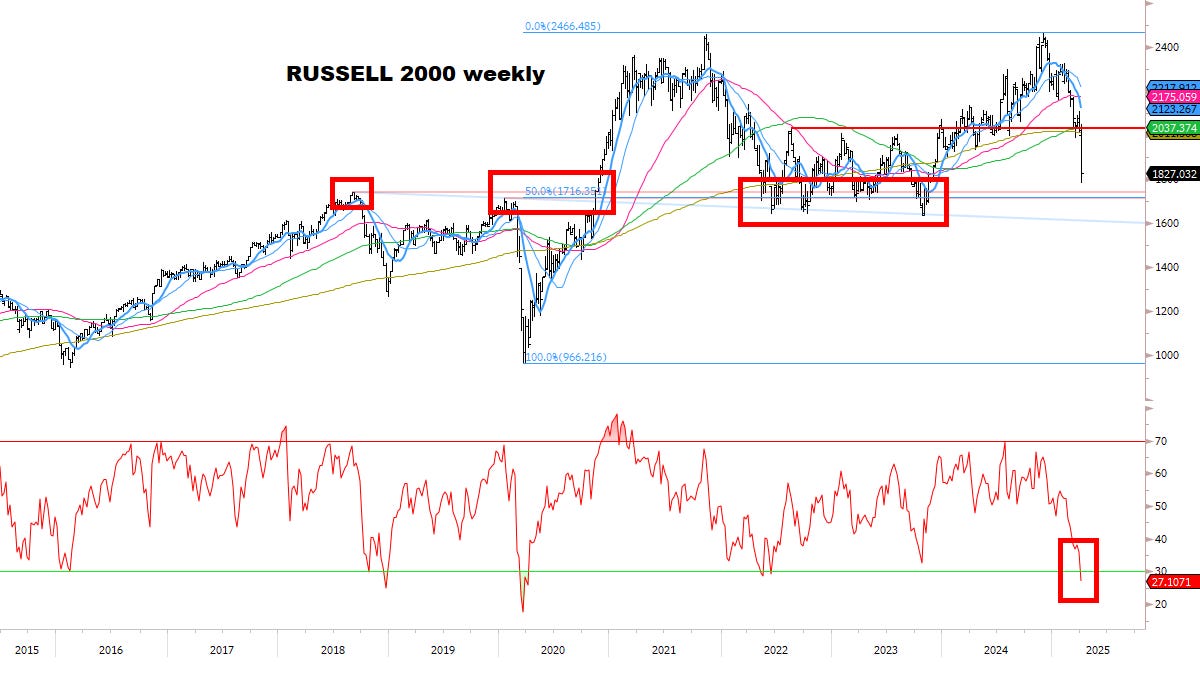

We came into the week making an urgent case for a lower low in Stocks, based on historical patterns.

我们在这一周开始时急切地认为股市将出现新的低点,这基于历史模式。We continue to hold elevated cash balances, looking for an opportunity to make a significant move.

我们继续保持高额现金储备,寻找机会进行重大投资。Preparing for next week: this report will update my plan at this critical moment.

为下周做准备:这份报告将在这个关键时刻更新我的计划。Always remember: experience to understand what’s happening, paired with the discipline to execute under extreme conditions, is what sets true winners apart — especially in rough times. Stay focused — and good luck to everyone next week.

永远记住:理解发生的事情的经验,加上在极端情况下执行的纪律,才是使真正的赢家与众不同的因素——尤其是在艰难时期。保持专注——祝大家下周好运。*Actionable* & Comprehensive Analysis of Key Market Signals.

*可操作的* & 综合市场信号分析。Complete list of Buy/Sell setups we’re watching.

我们关注的买入/卖出设置的完整列表。Detailed Charts & Commentary: Core Models, Global Equities & Sectors, Volatility, Rates & Credit, Currencies, Commodities, Bitcoin.

详细图表与评论:核心模型、全球股票及行业、波动率、利率与信用、货币、大宗商品、比特币。

WHAT MAJOR LOWS LOOK LIKE — MY CHECKLIST:

主要低点的样子 — 我的检查清单:

Down Friday / Down Monday capitulation sequence is *again* in play. Some of the biggest bottoms in history were formed this way. Data and Charts presented in detail throughout this report.

周五下跌/周一下跌的投降序列*再次*在进行中。历史上最大的一些底部就是这样形成的。报告中详细呈现的数据和图表。On watch for (1) news of a fund or strategy blow-up / closure, (2) breakages in market systems or functions: price limit locks, volatility halts, NAV breaks, ETF liquidations, trading platform restrictions, (3) capitulation language from fund managers / global policymakers & politicians / corporate leaders / media commentators.

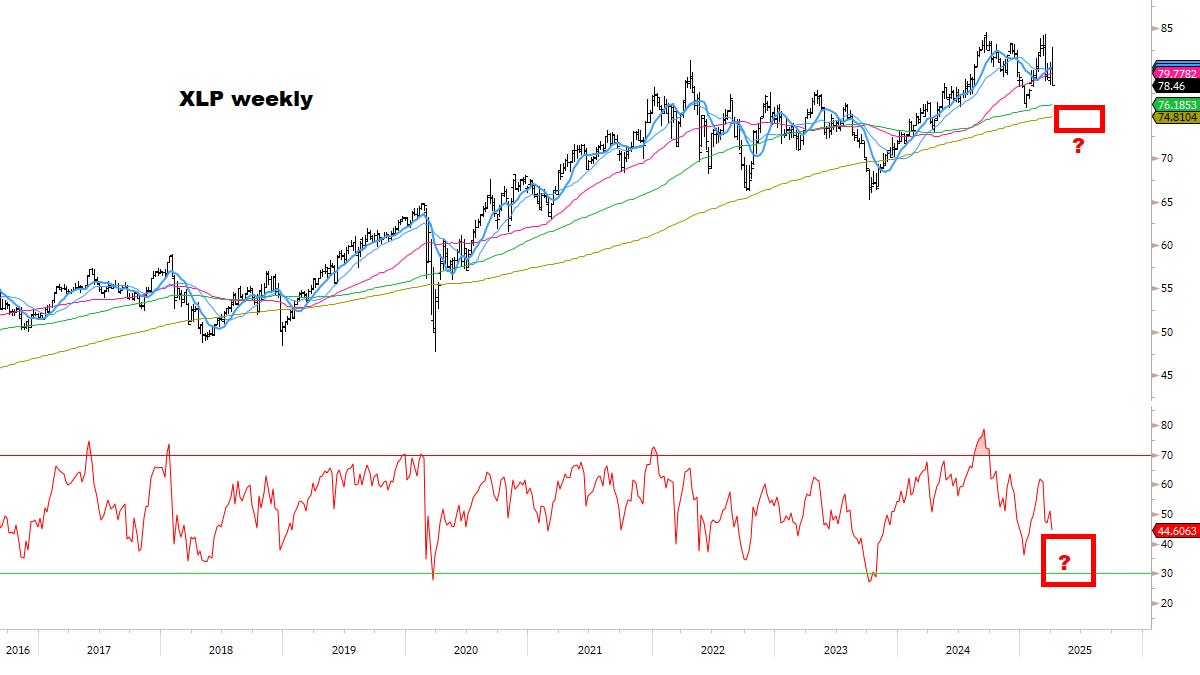

关注(1)基金或策略的崩溃/关闭消息,(2)市场系统或功能的故障:价格限制锁定、波动性暂停、净资产价值破裂、ETF 清算、交易平台限制,(3)来自基金经理/全球政策制定者和政治家的投降语言/企业领导/媒体评论者。On watch for price anomalies: (1) Volatility making lower highs even as Stocks keep falling, (2) a few select Indexes, Stocks, Currencies, Commodities, and Rates markets stop going down even as most Stocks keep falling (some initial evidence of this on Friday), (3) indiscriminate liquidation of all Stocks including defensives (happening), (4) record spikes in Volume, Flow, Sentiment or other metrics (happening).

关注价格异常:(1)尽管股票继续下跌,但波动性创造了更低的高点,(2)一些特定的指数、股票、货币、大宗商品和利率市场在大多数股票继续下跌时停止下跌(周五已有一些初步证据),(3)所有股票的无差别清算,包括防御性股票(正在发生),(4)交易量、流动或情绪等指标的创纪录激增(正在发生)。More details covered extensively throughout this report.

本报告中详细涵盖了更多细节。

Market Dashboard 市场仪表板

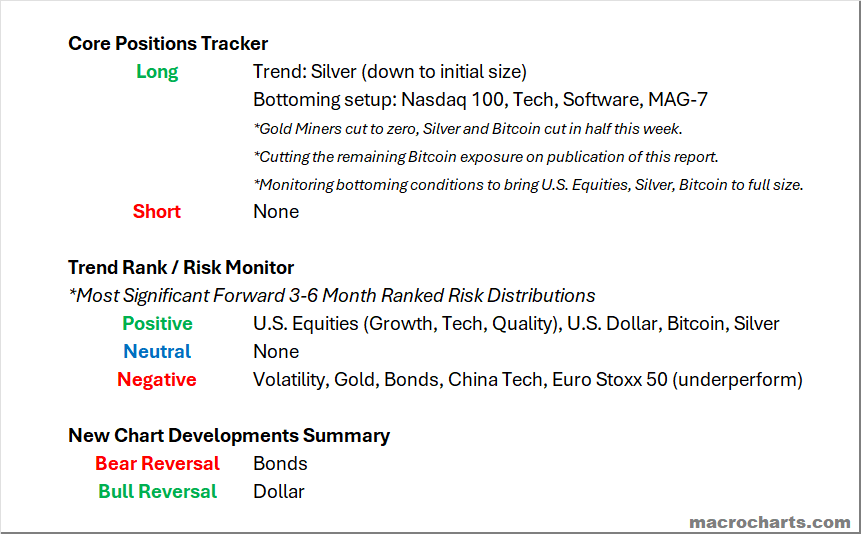

Core Positions Tracker: Planned ahead of market conditions, and include (1) reasoning, (2) chart context, (3) entry/stop levels, and (4) price projections.

核心头寸追踪器:根据市场情况进行规划,包括(1)理由,(2)图表背景,(3)入场/止损水平,以及(4)价格预测。Trend Rank / Risk Monitor: Model-driven system which includes Positioning, Sentiment, and Momentum to generate forward 3-6 month ranked risk distributions. These can become Core Positions if/when Trends are confirmed.

趋势排名 / 风险监测:基于模型的系统,包括定位、情绪和动量,以生成未来 3-6 个月的排名风险分布。如果趋势得到确认,这些可以成为核心头寸。New Chart Developments Summary: Notable chart patterns of the week, developing potential key inflection or acceleration points.

新图表发展摘要:本周显著的图表模式,正在形成潜在的关键拐点或加速点。

A crisis of historic magnitude — and lasting significance.

一场历史性规模的危机——具有持久的重要性。

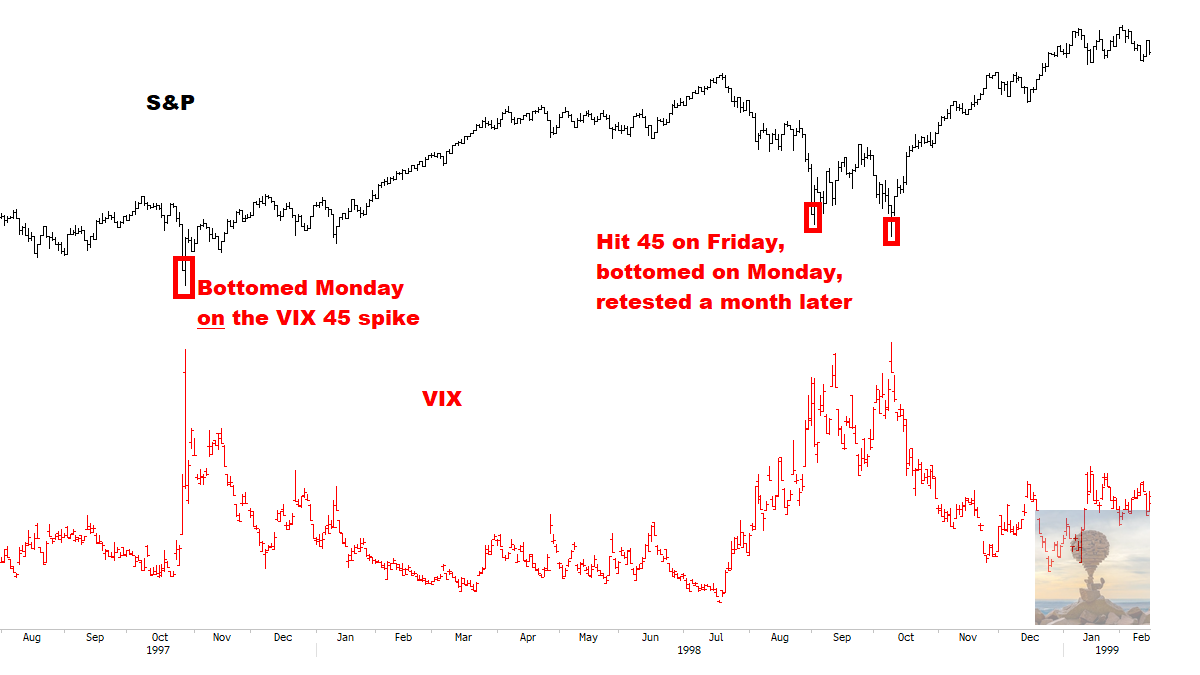

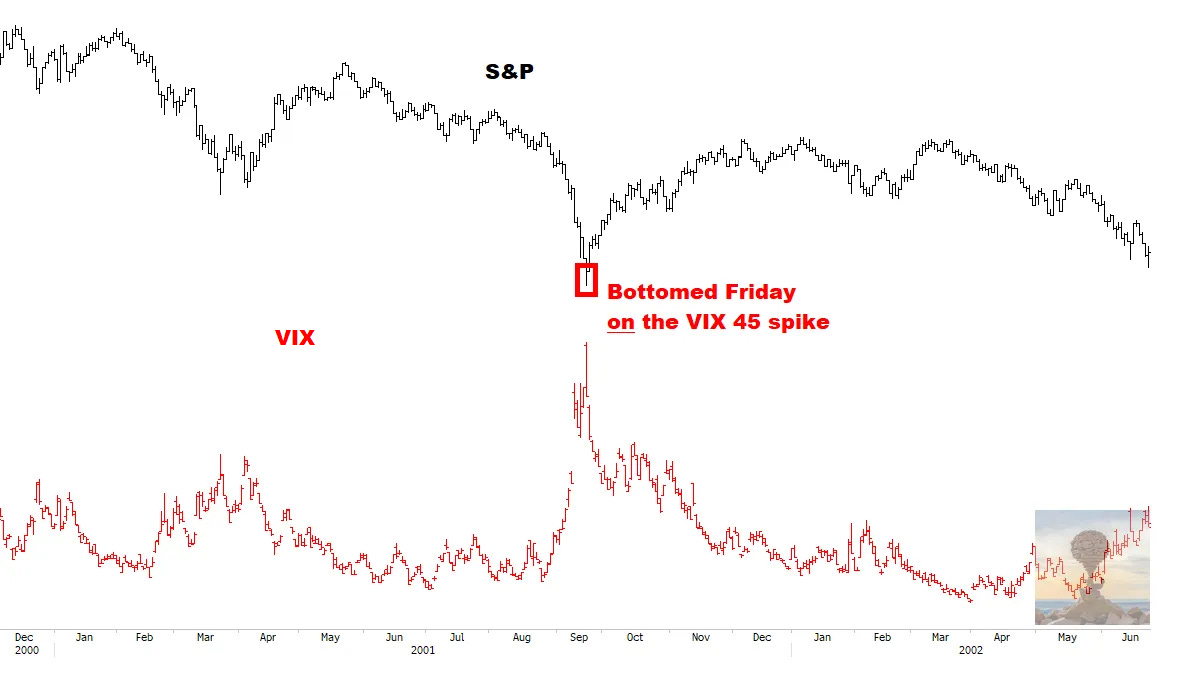

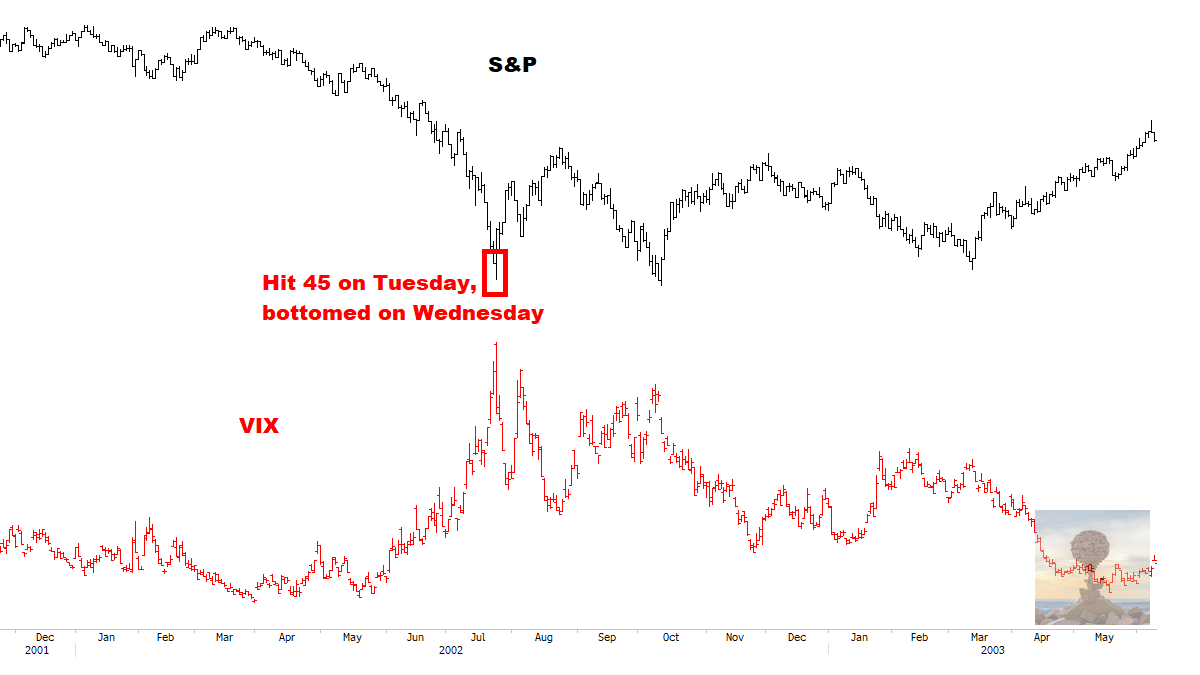

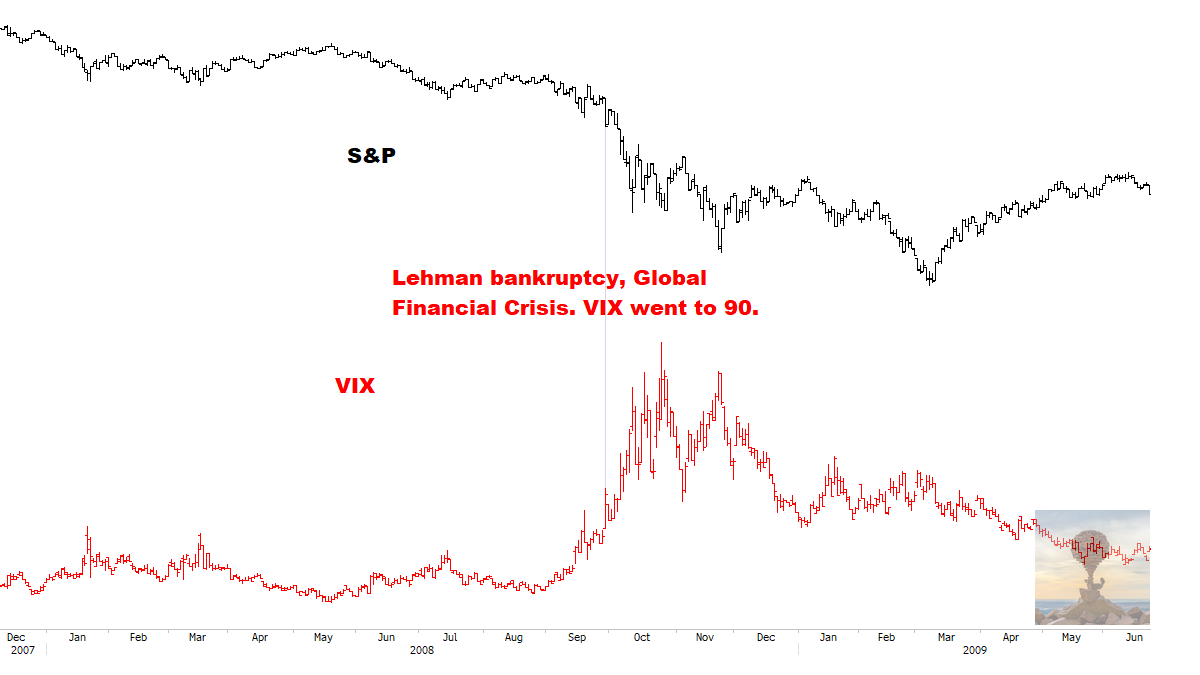

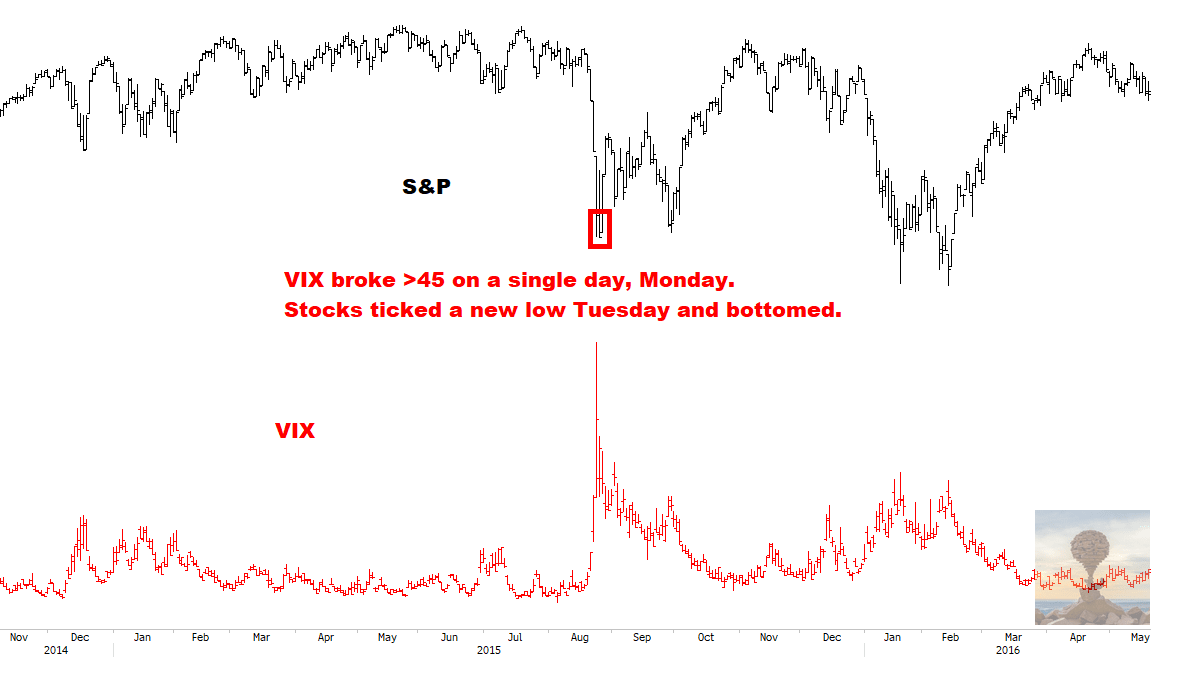

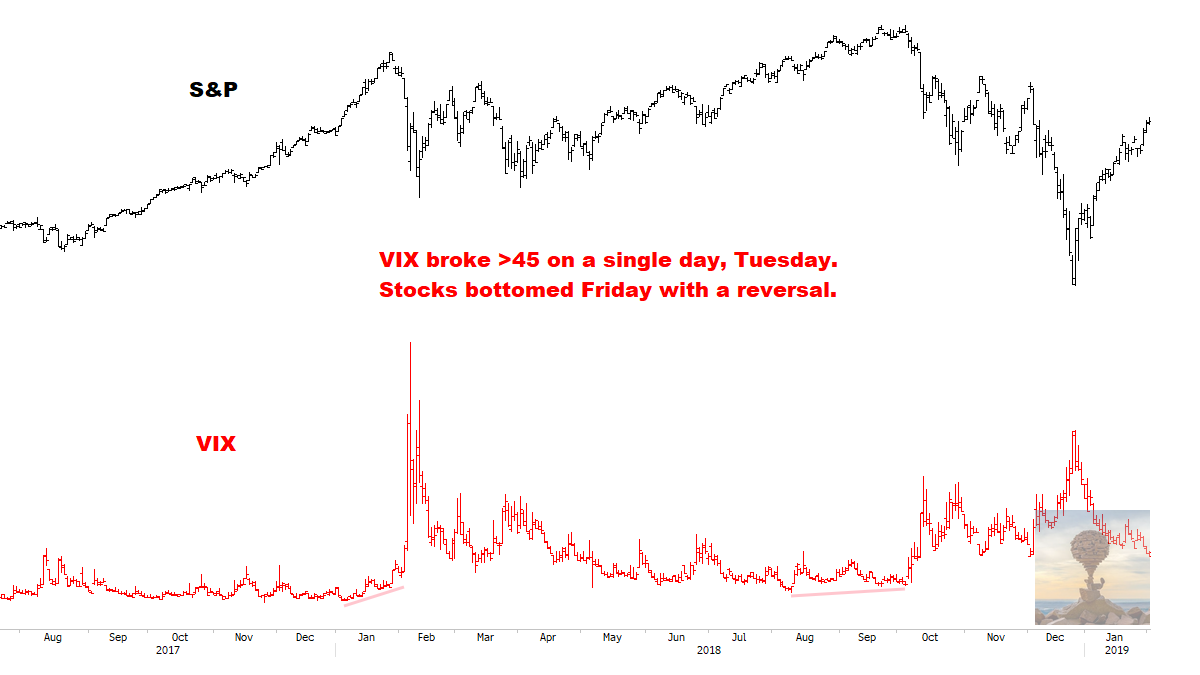

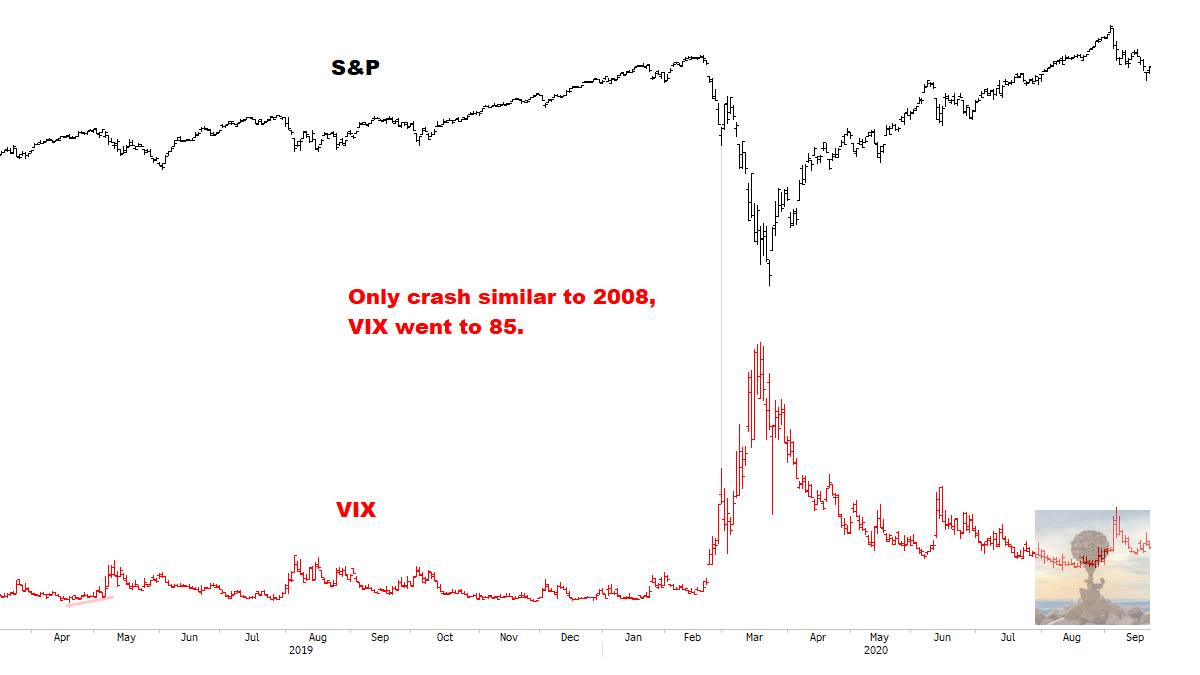

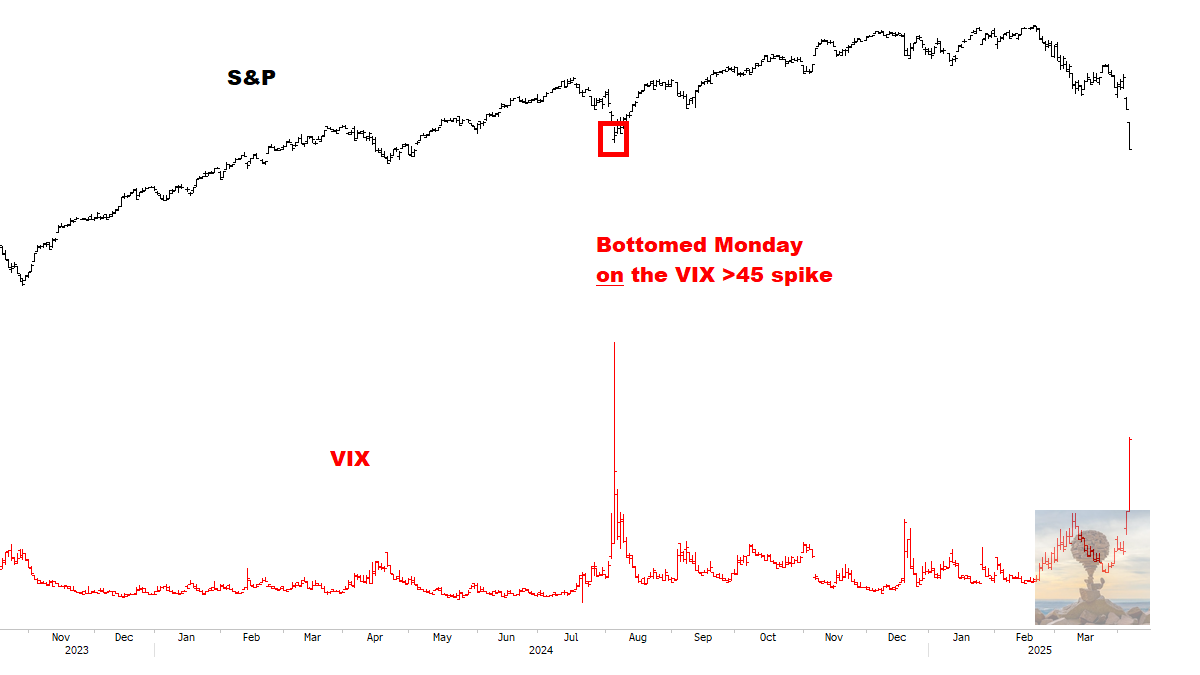

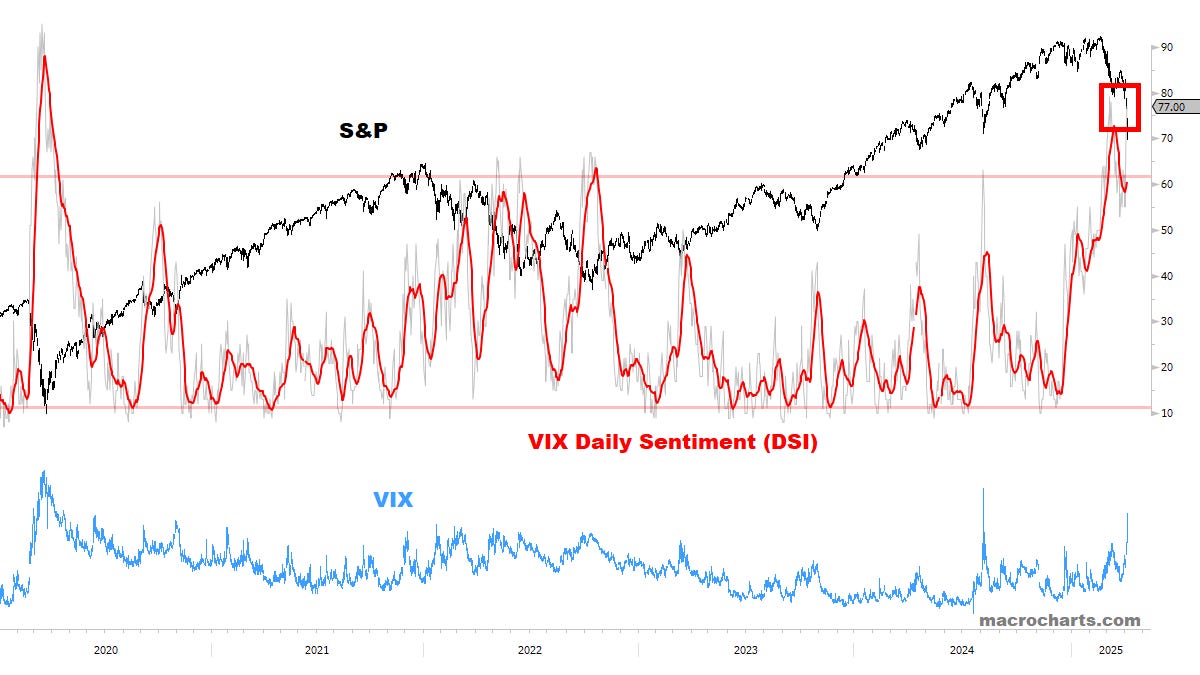

VIX broke 45 on Friday — among the biggest spikes in history.

VIX 在周五突破了 45——这是历史上最大的波动之一。

Note the historical patterns:

请注意历史模式:

1997 and 1998 — contagion from Asia and Russia/LTCM, respectively

1997 年和 1998 年 — 分别来自亚洲和俄罗斯/LTCM 的传染影响

2001 Bear Market and 9/11 Attack

2001 年熊市和 911 事件

2002 Bear Market Bottom (later retested)

2002 年熊市底部(后续再次测试)

2008

2010

2011 — EU Crisis 2011 — 欧盟危机

2015 — Yuan devaluation 2015 — 人民币贬值

2018 — VIX ETF Blowup

2018 年 — VIX ETF 爆炸

2020 — Global Pandemic 2020 年 — 全球疫情

2024 — Carry Trade Unwind

2024 — 利差交易解除

Summary: 摘要:

Volatility should peak on Monday at the latest, if it didn’t peak in Friday’s session.

波动性在周一应该会达到顶峰,如果它没有在周五的交易中达到顶峰的话。Stocks have a strong probability of bottoming on Monday, if not Tuesday morning at the latest — as historically they tend to form an initial bottom the day after Volatility peaks.

股票在周一有很强的可能性触底,最迟在周二早上——因为历史上它们往往在波动性达到顶峰的第二天形成初步底部。Stocks could retest the lows later on, but if big levels get tested on Monday, will be looking to put capital to work — see levels covered extensively throughout the Technical Charts section.

股票可能会在之后再次测试低点,但如果在周一测试大的支撑位,我将考虑投入资金——请参考技术图表部分中涵盖的水平。To be clear: I think markets are trading a Panic, not a Crash scenario like 2008 or 2020.

明确来说:我认为市场正在交易的是恐慌,而不是像 2008 年或 2020 年那样的崩盘情形。

CORE MODELS & DATA 核心模型与数据

A crisis of historic magnitude:

一场历史性的危机:

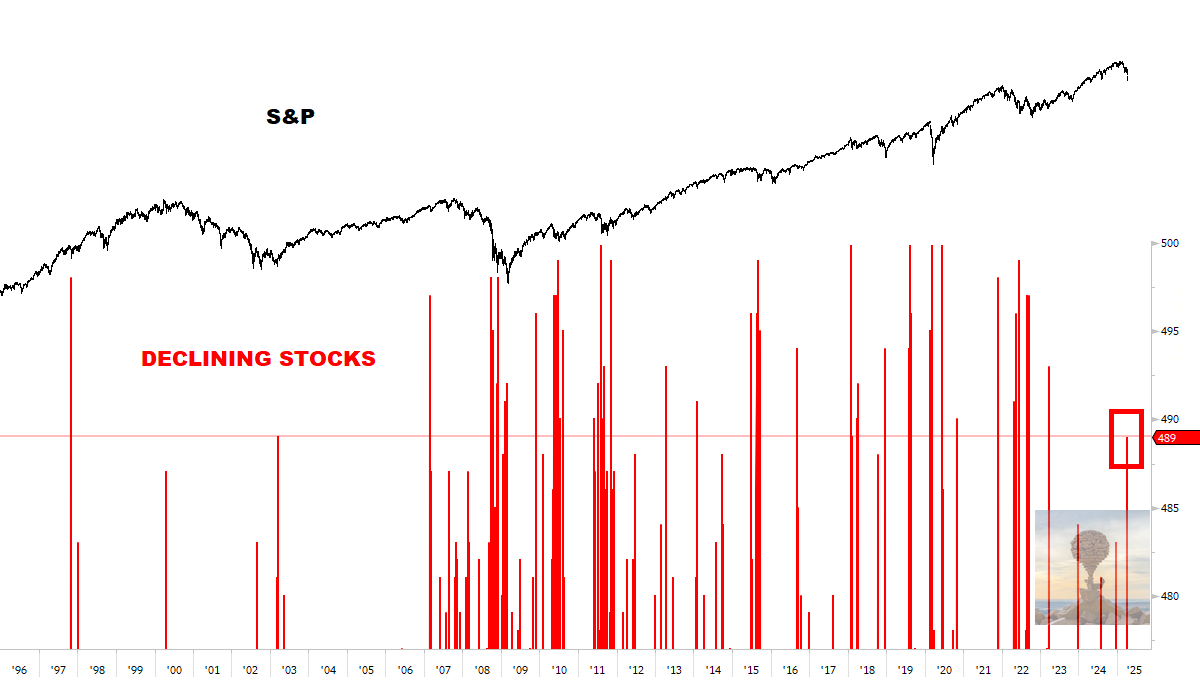

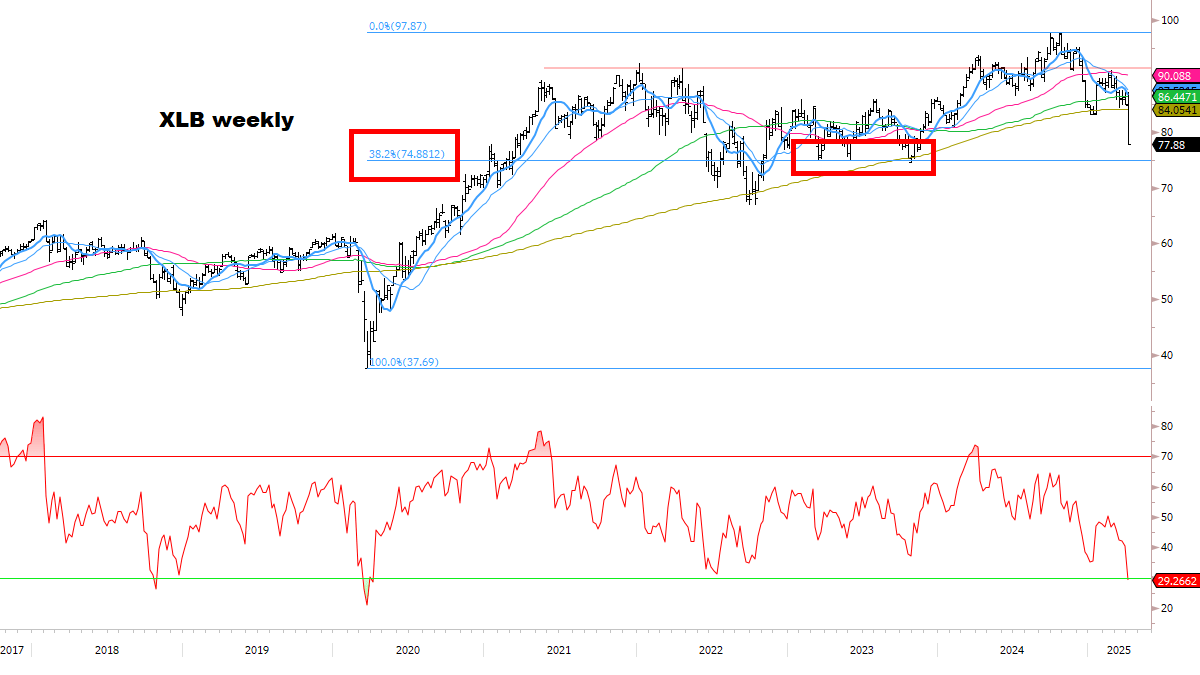

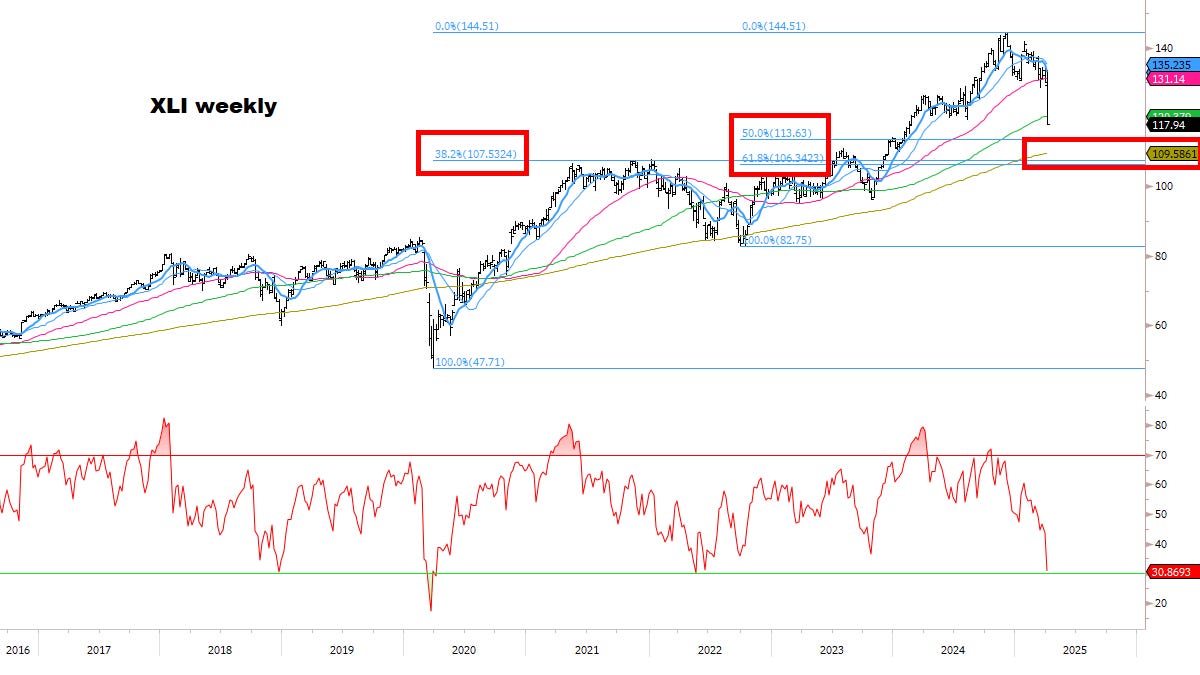

One of the most indiscriminate selling days in history:

历史上最不加区分的抛售日之一:

*The kind of selling that happens at the deep end of Bear Markets.

*在熊市的深处发生的那种抛售。

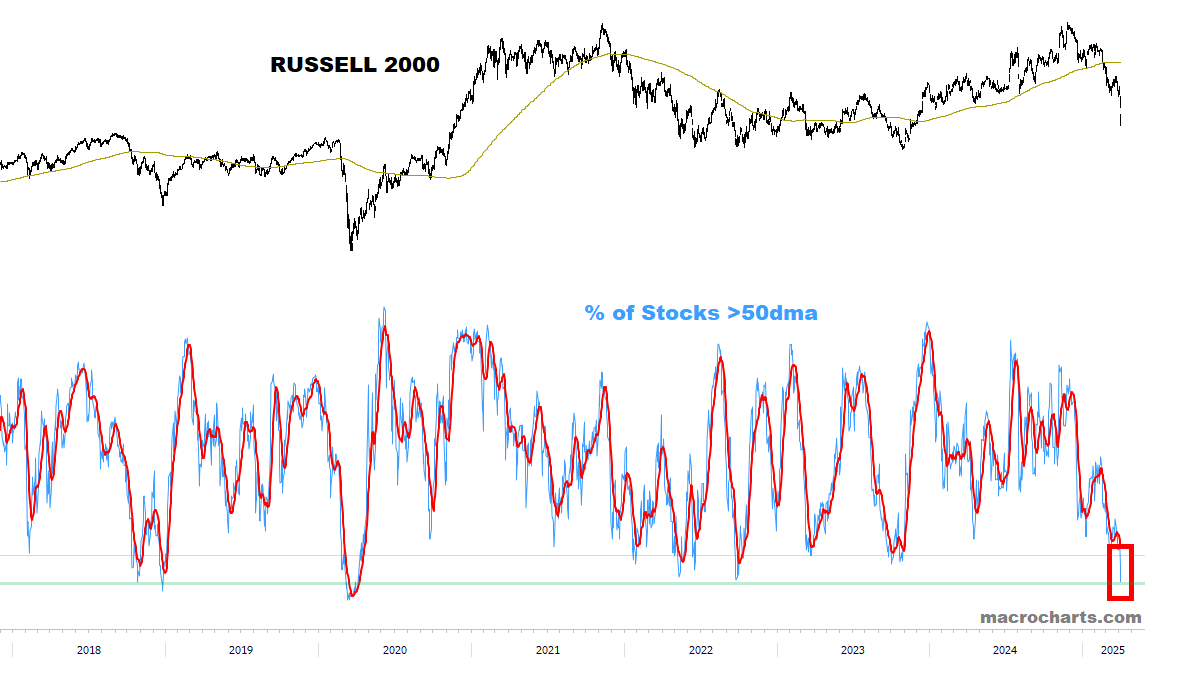

Any residual selling Monday would push Stocks to MAJOR bottoming levels.

周一的任何剩余卖盘将推动股票达到主要底部水平。

*Note it’s already worse than the 2022 Bear Market bottom.

*注意,这已经比 2022 年熊市底部更糟糕。

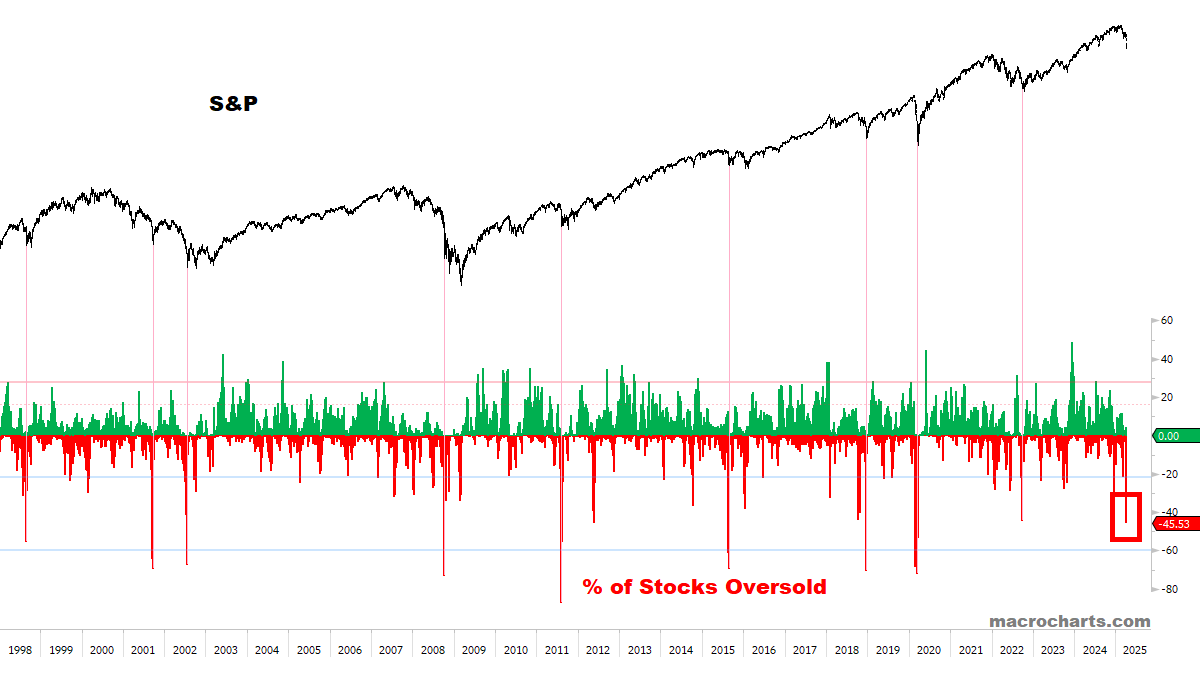

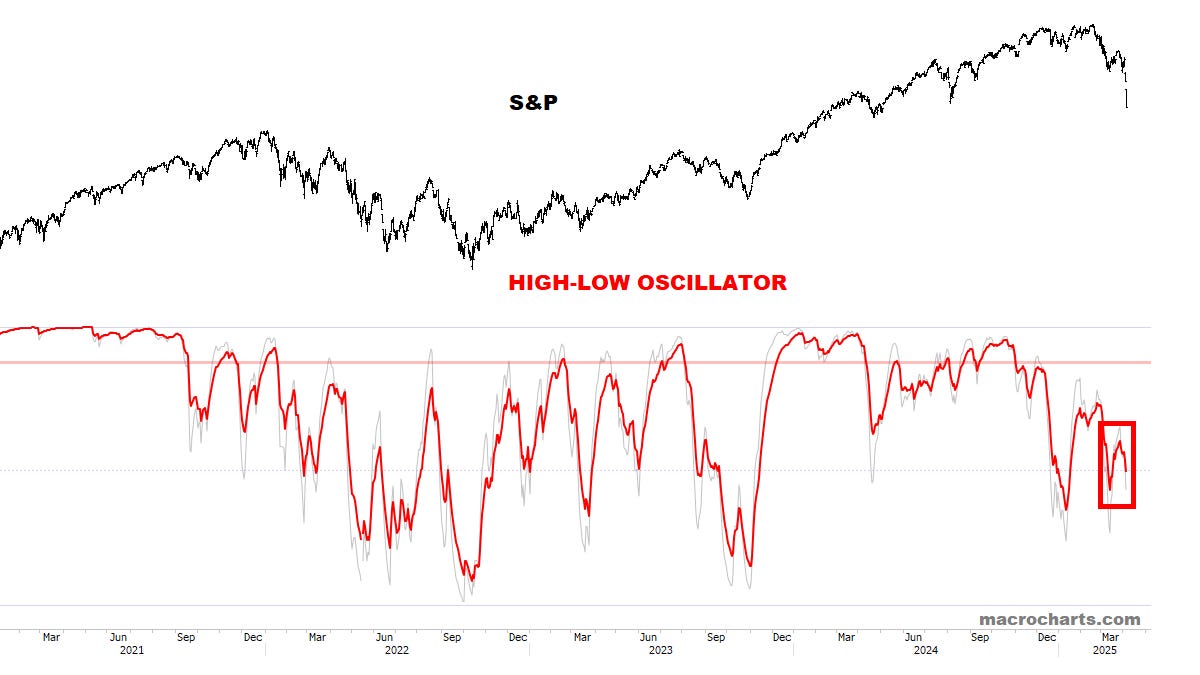

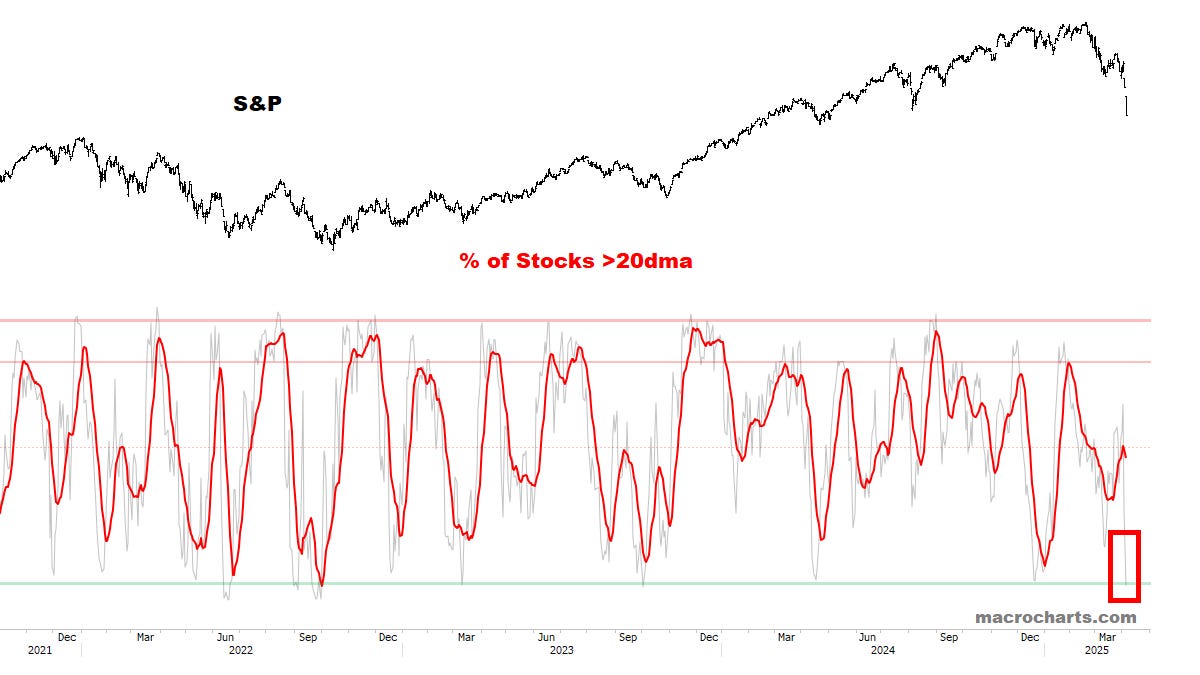

S&P 45% oversold — at 60% would match nearly every major bottom of the last 30 years. Only exception was 2008 (price went lower).

标普指数超卖 45%——在超卖 60%时将与过去 30 年的几乎所有主要底部相匹配。唯一的例外是 2008 年(价格更低)。

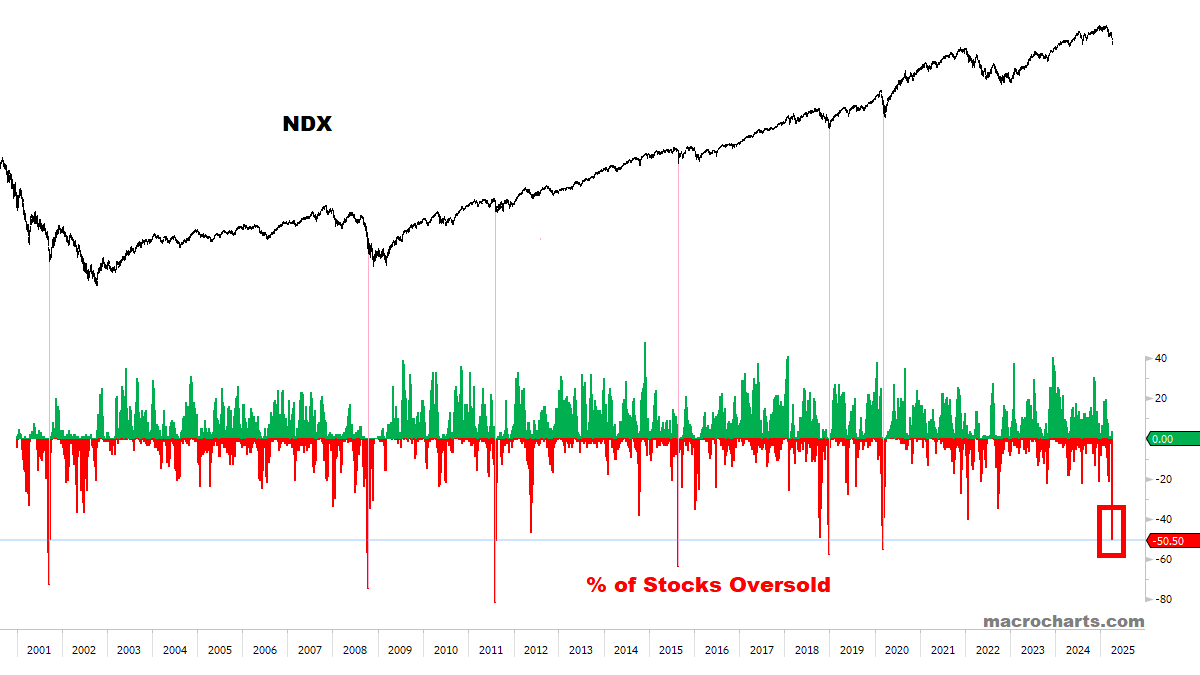

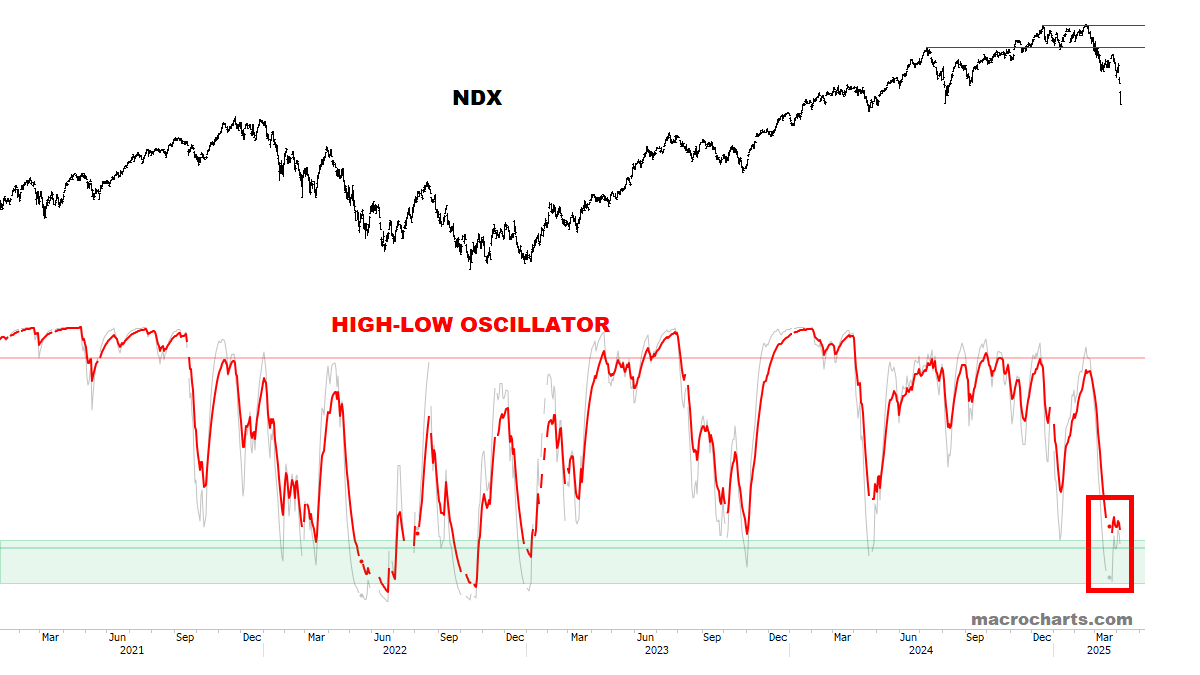

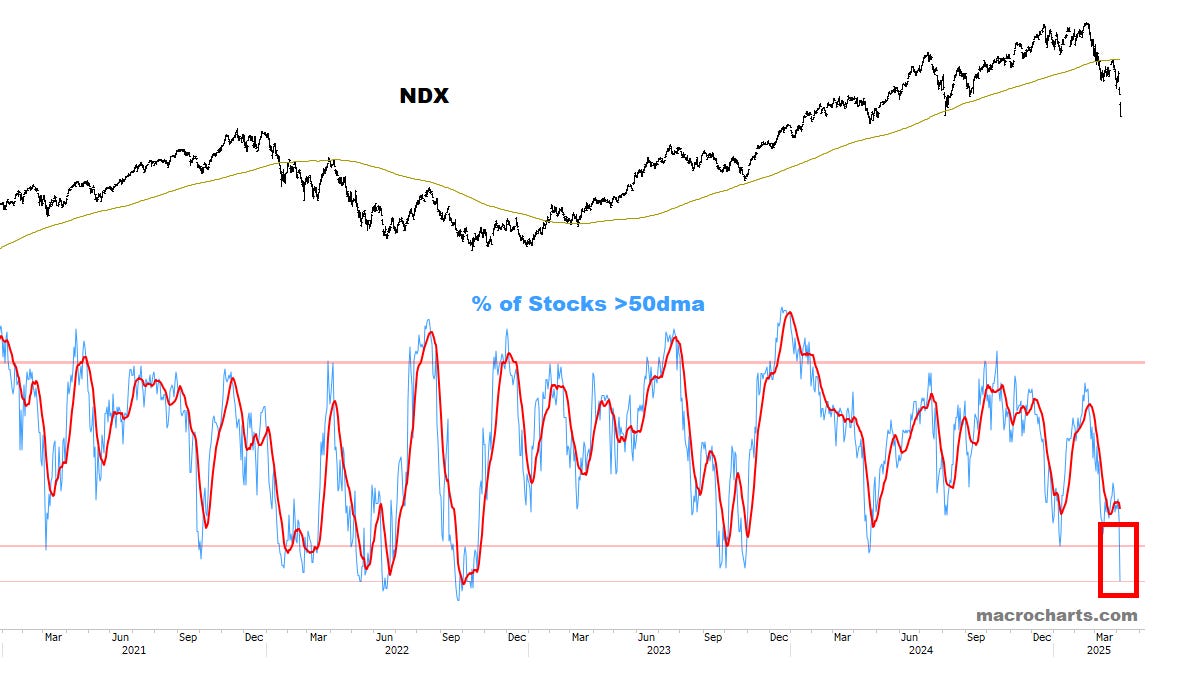

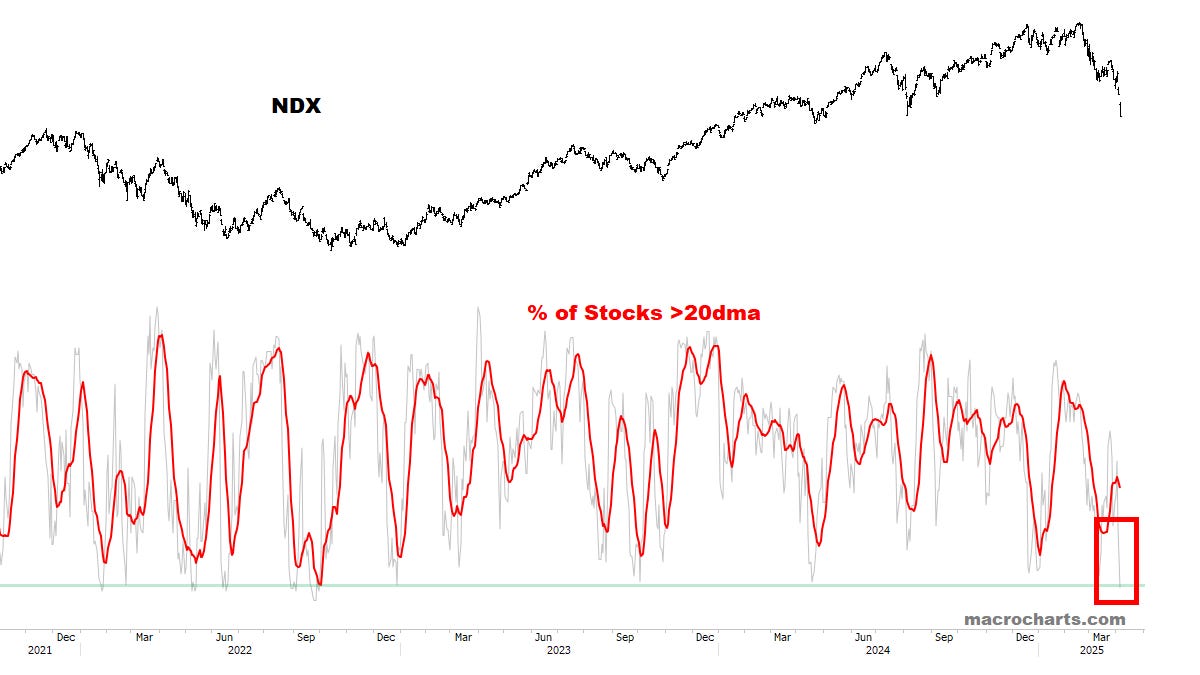

NDX 50% oversold — at 55-65% would match nearly every major bottom of the last 30 years. Only exception was 2008 (price went lower).

NDX 50% 超卖 — 在 55-65% 时将几乎与过去 30 年的每个主要低点相匹配。唯一的例外是 2008 年(价格更低)。

*Another key data point: during the 2020 COVID crash, NDX broke -50% Oversold only ONCE, on March 12. From that close, NDX had an additional loss of 3.4% to the final bottom (closing basis), and 6.8% (intraday basis). This residual downside could quickly be reached on Monday’s session.

另一个关键数据点:在 2020 年 COVID 崩盘期间,NDX 仅在 3 月 12 日突破-50%超卖。从那个收盘开始,NDX 还有额外的 3.4%损失到最终底部(收盘基础),和 6.8%(盘中基础)。这种剩余的下行趋势可能会在周一的交易中快速达到。

I wrote this last week and it’s valid for next week again:

我上周写的内容,这一观点下周仍然适用:

Friday’s decline increases the risk of a Down Monday setup and capitulation / reversal on the balance of next week. It’s not required, but would accelerate the process of finding a bottom for this correction.

周五的下跌增加了周一下跌的风险,并可能在下周的平衡中出现抛售/反转。这不是必需的,但会加速寻找此次修正底部的过程。

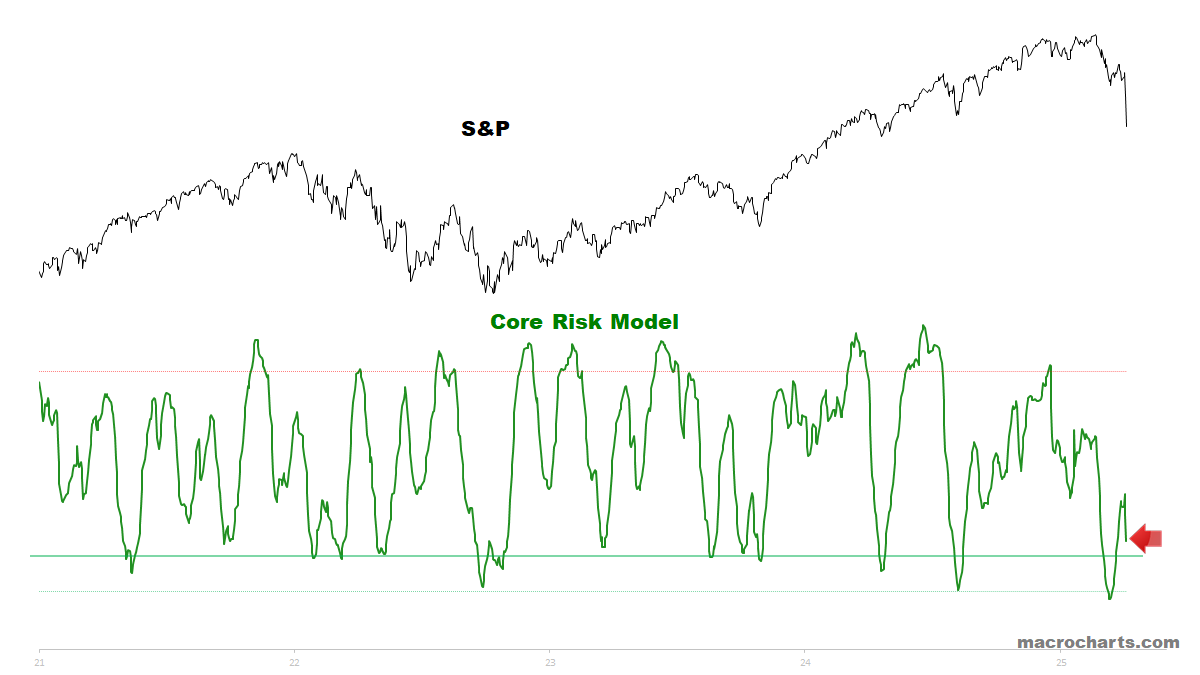

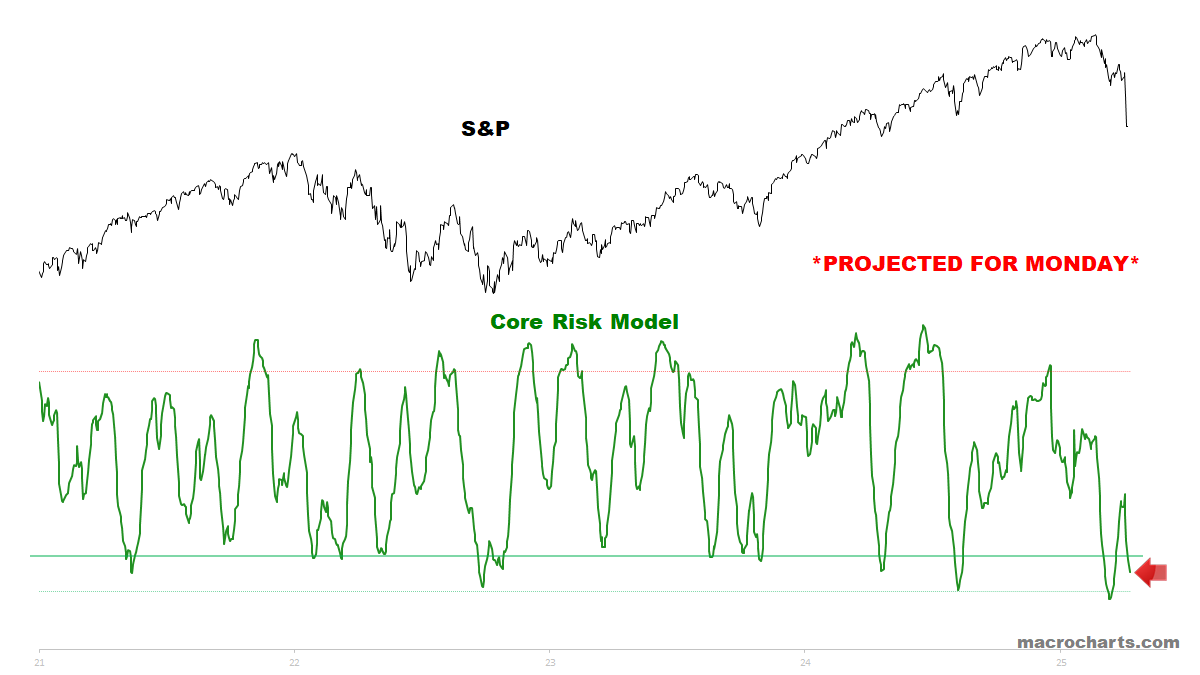

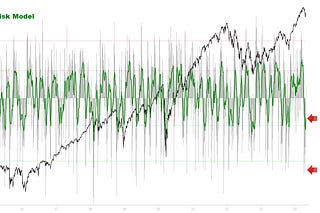

Core Risk will be fully oversold on Monday:

核心风险在周一将完全超卖:

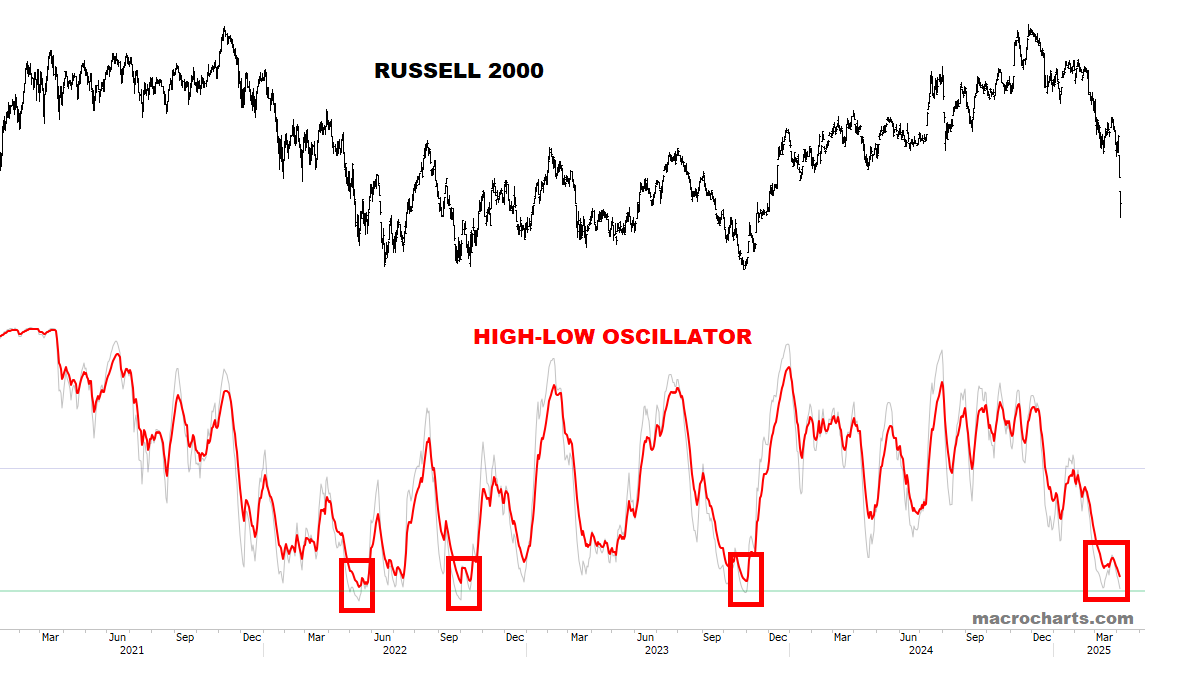

S&P High-Low Oscillator could finally get oversold next week, joining the others which are fully there.

标普高低摆动指标下周可能会最终出现超卖,加入其他已经完全超卖的指标。

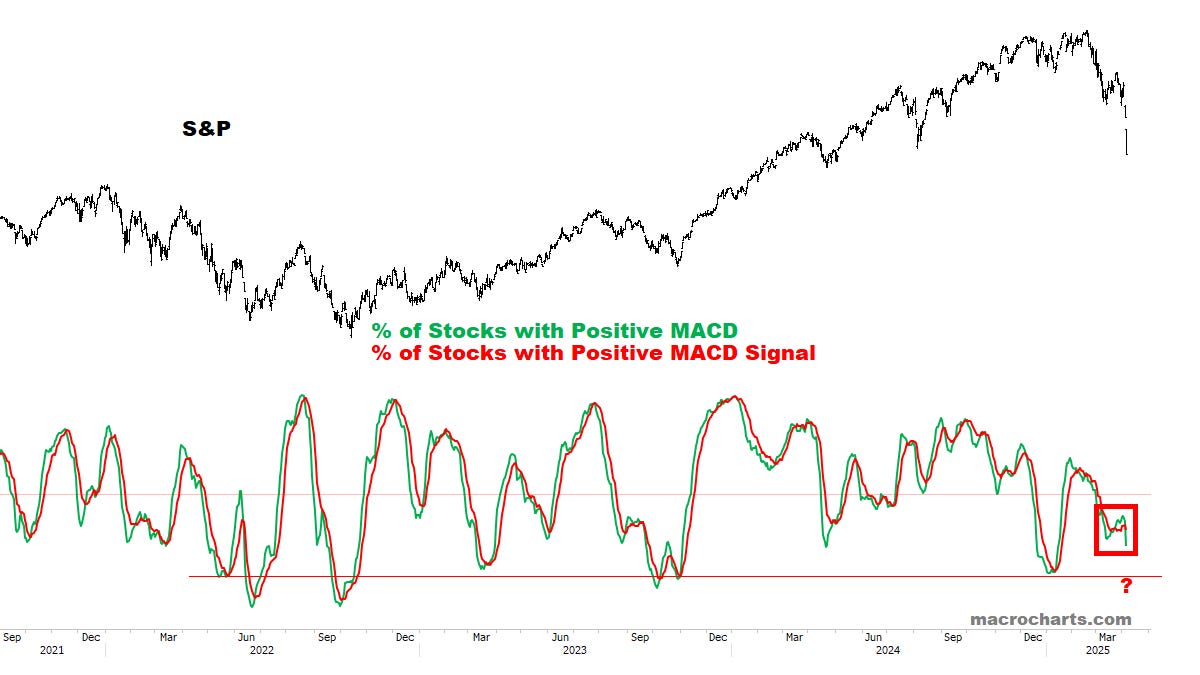

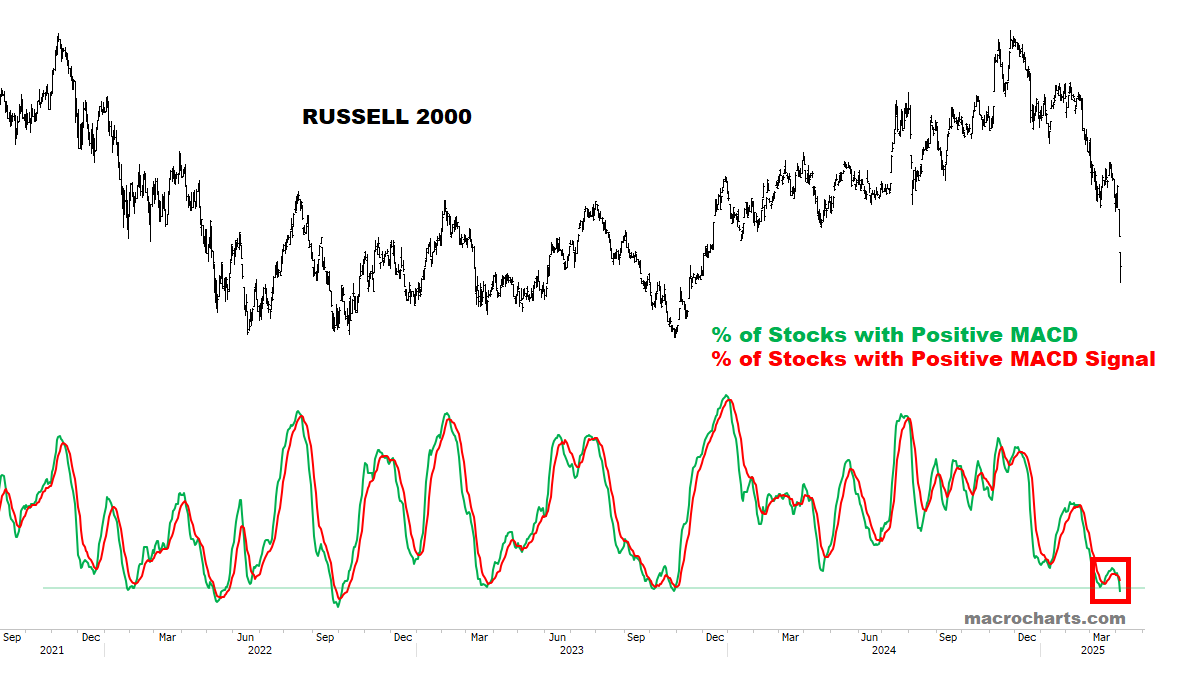

MACD Profiles have a similar message — S&P should soon join the others.

MACD 剖面传达了相似的信息——标准普尔很快应该会加入其他指数。

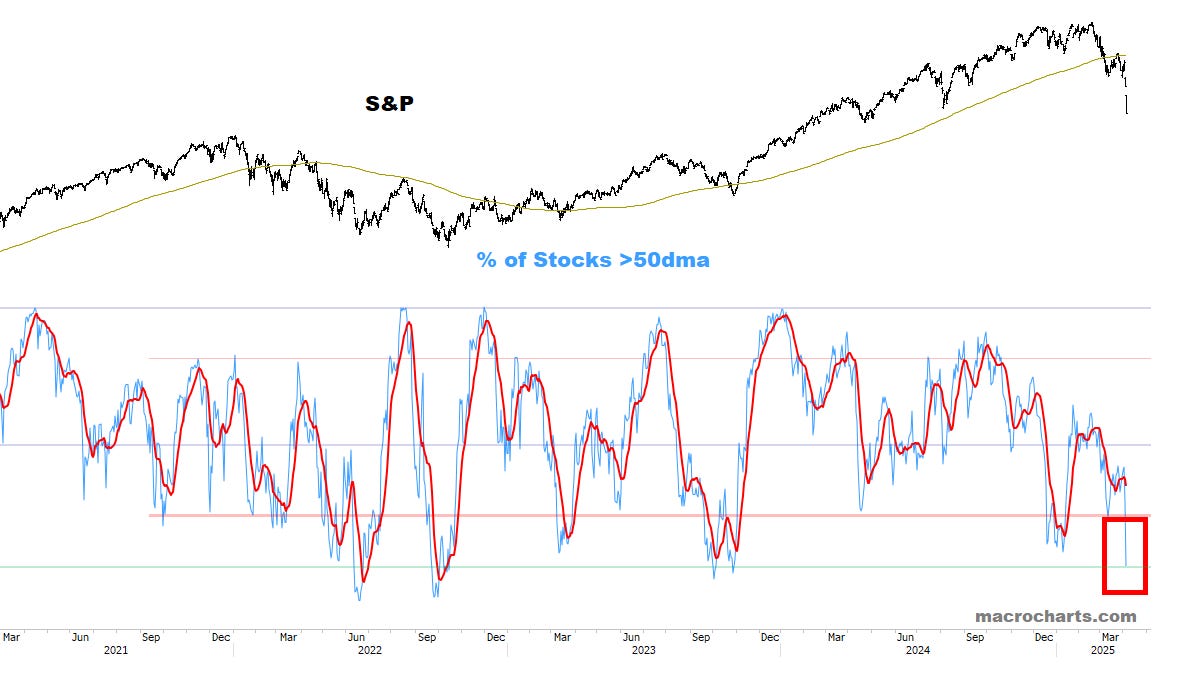

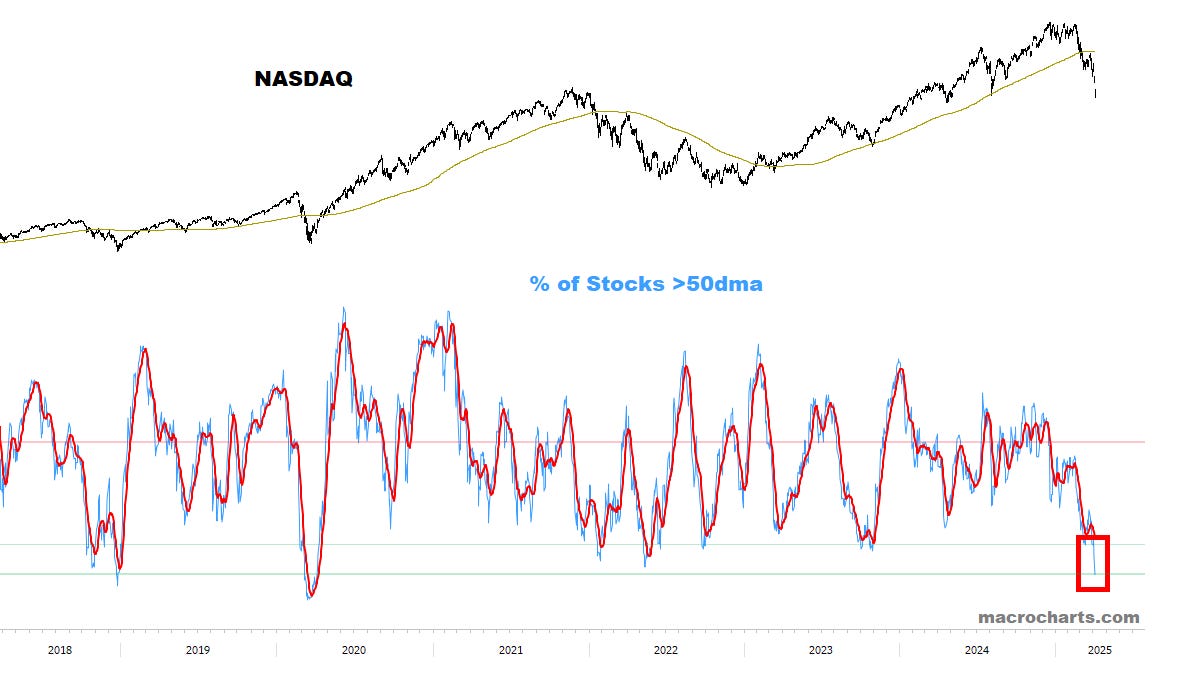

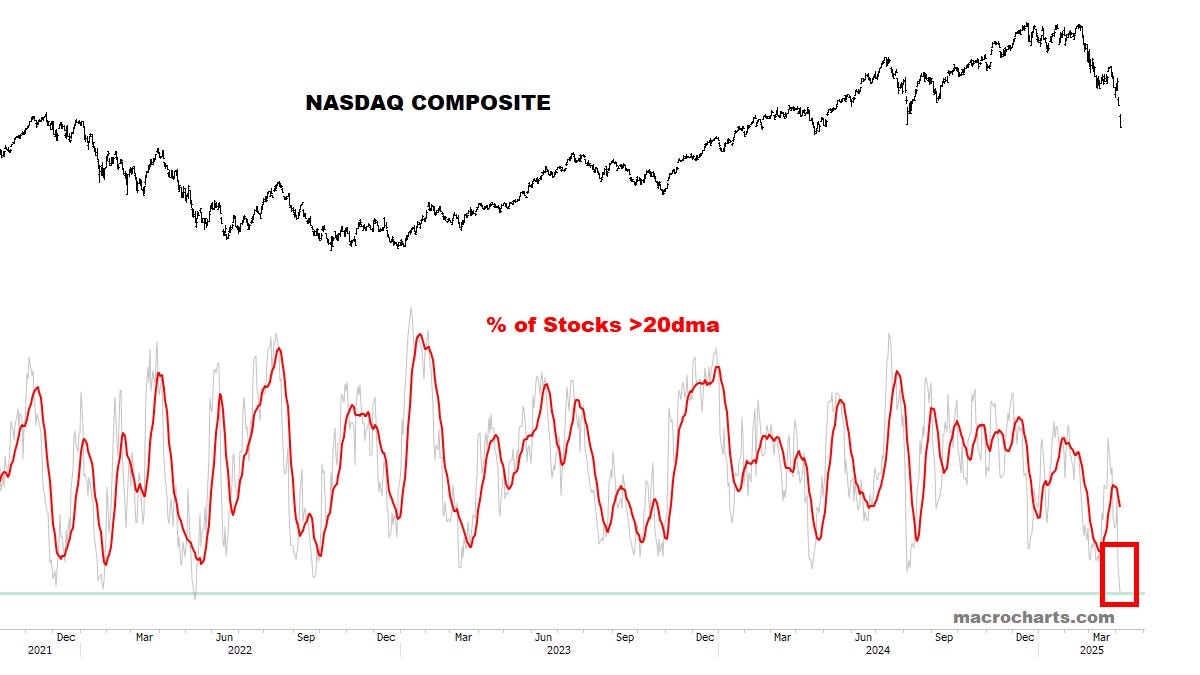

Intermediate-Term Breadth is “rock-bottom” oversold.

中期市场宽度处于“谷底”超卖状态。

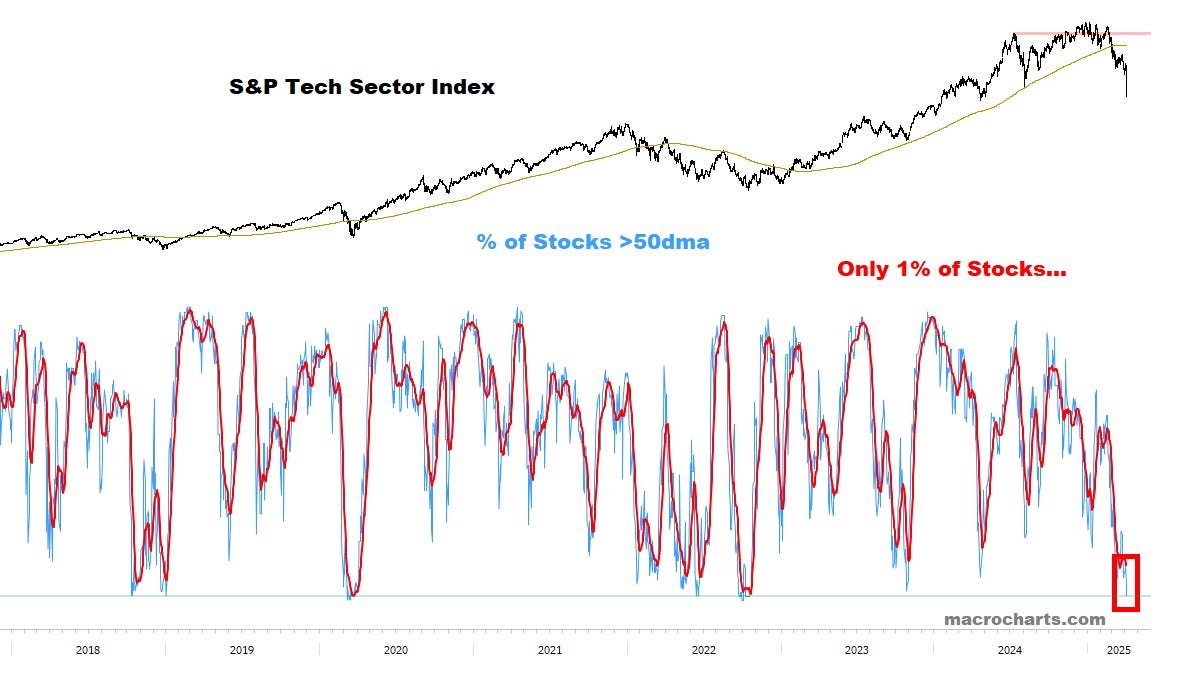

The following are at 2020-oversold levels.

S&P Short-Term Breadth has finally joined the others at “max oversold”. These are extremely rare conditions likely to produce an immediate reaction next week.

标普短期广度最终与其他指标一起达到了“极度超卖”。这些情况非常罕见,可能会在下周产生立即反应。

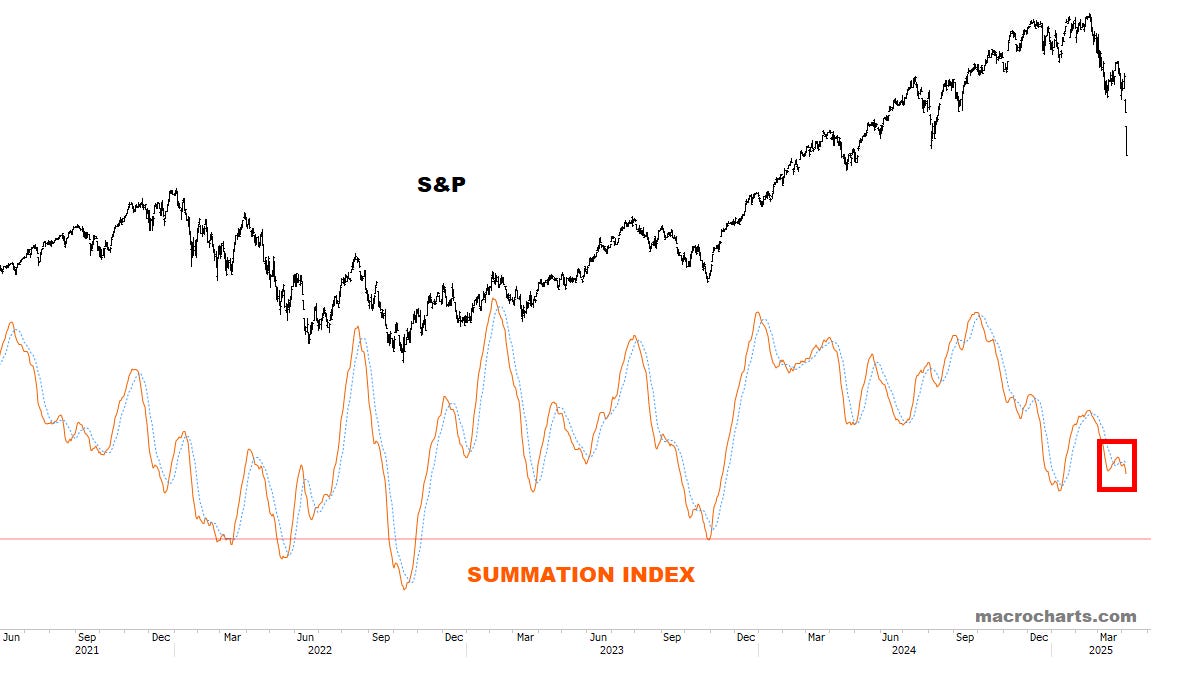

Summation Index dropped a bit this week, but could quickly turn into a Buy signal if Stocks bottom here:

汇总指数本周略有下降,但如果股票在此处触底,可能会迅速转变为买入信号:

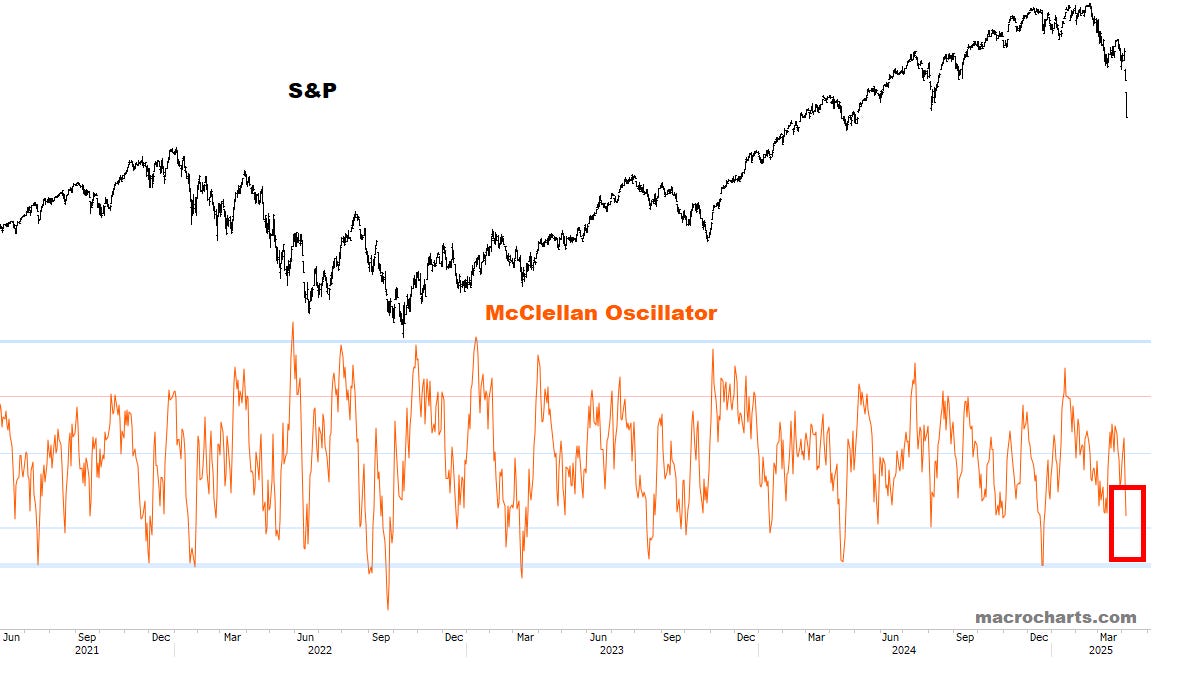

McClellan Oscillator is following the ideal setup, on track to reach full oversold next week:

麦克莱伦振荡器正在按照理想的设置运行,预计下周将达到完全超卖状态:

TREND & SENTIMENT 趋势与情绪

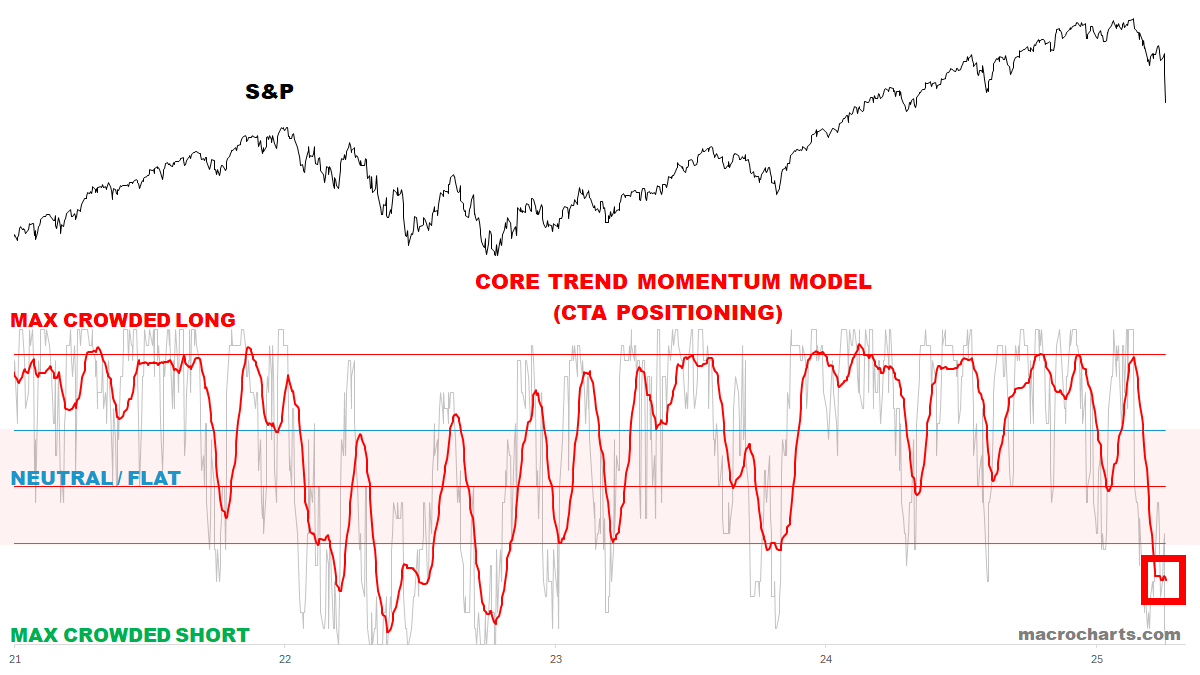

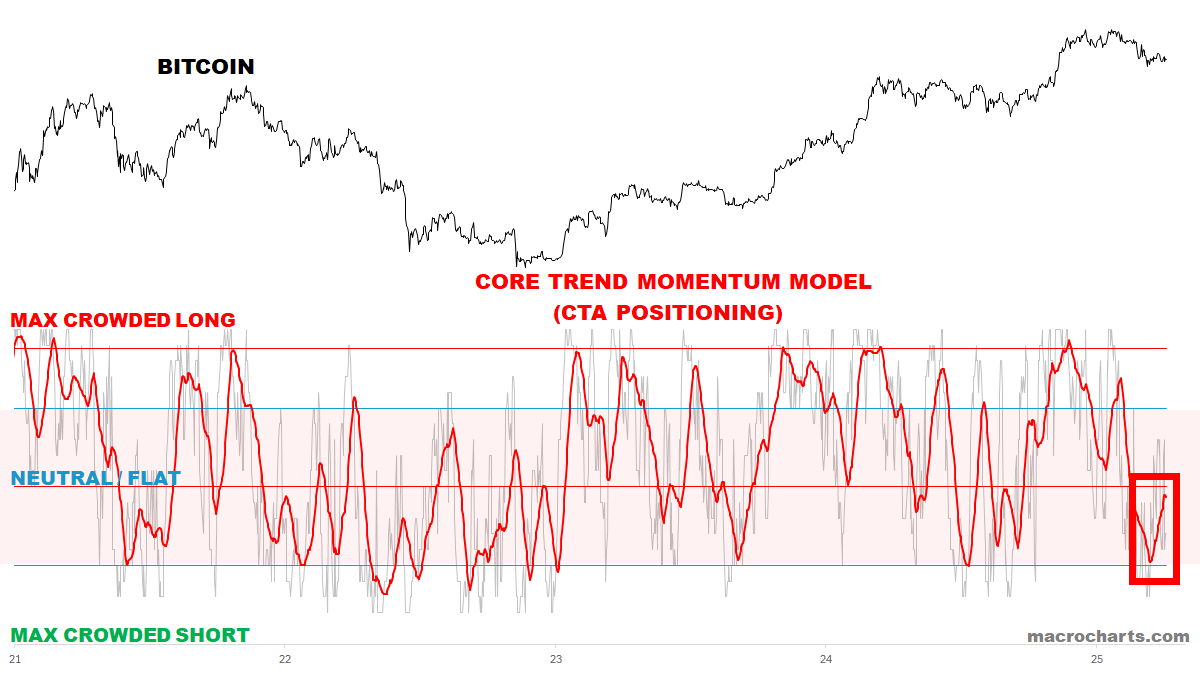

CTA Equity Positioning remains at the lowest since the October 2022 Bear Market bottom.

CTA 股票头寸保持在自 2022 年 10 月熊市底部以来的最低水平。

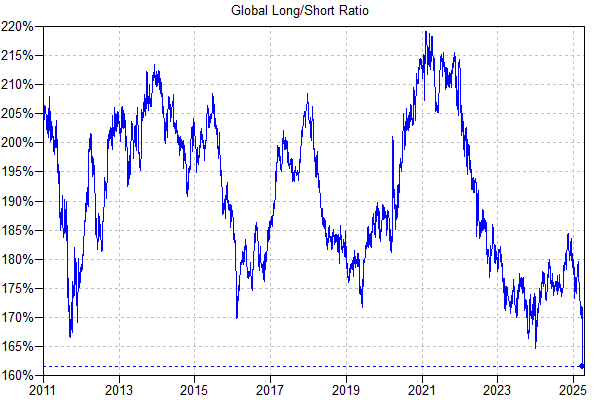

From GS, Global Funds’ Long/Short Ratio just made an all-time low.

来自高盛,全球基金的做多/做空比率刚刚创下历史新低。

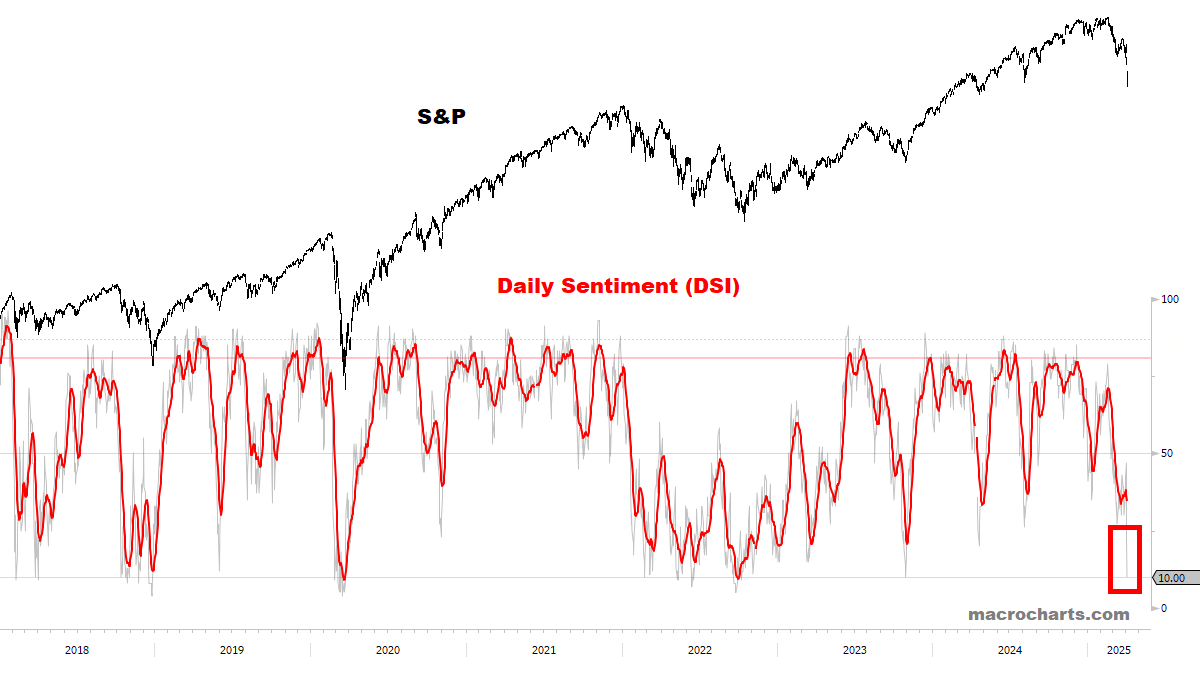

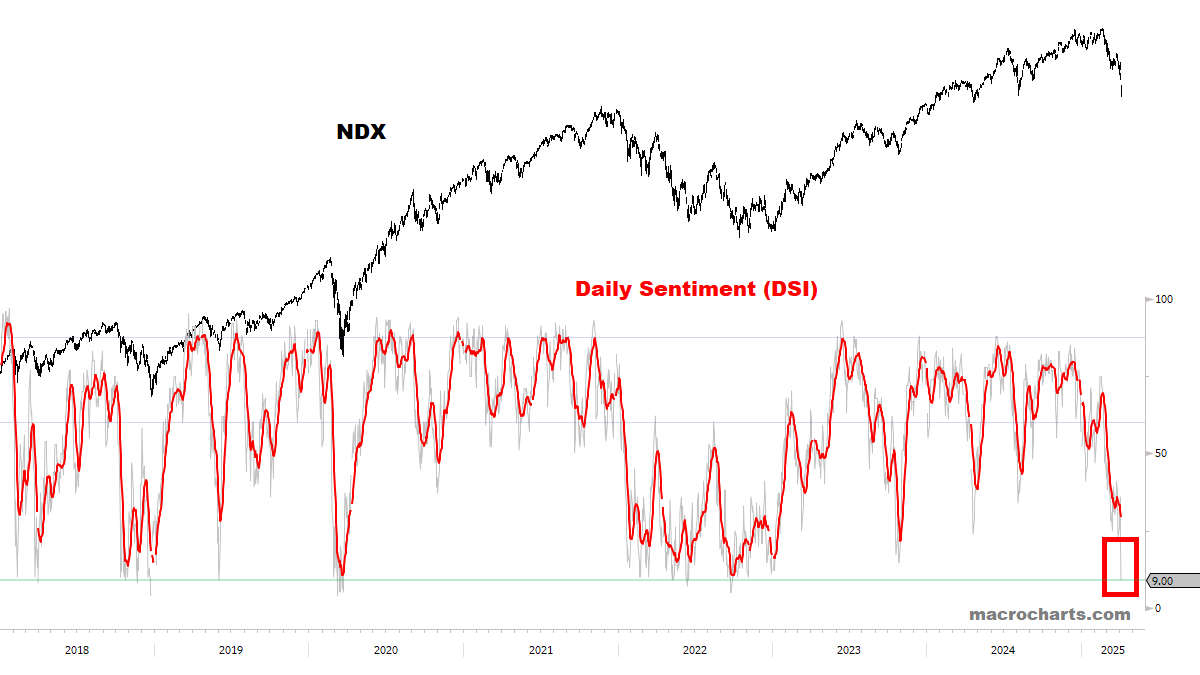

Sentiment is at full capitulation levels — fulfilling the scenario proposed last week.

市场情绪达到了完全屈服的水平——实现了上周提出的情景。

VIX Sentiment is at 77 — last time at this level was on March 10 (DSI 78). The market last bottomed March 13.

VIX 情绪指数为 77 — 上次达到该水平是在 3 月 10 日(DSI 78)。市场上次触底在 3 月 13 日。

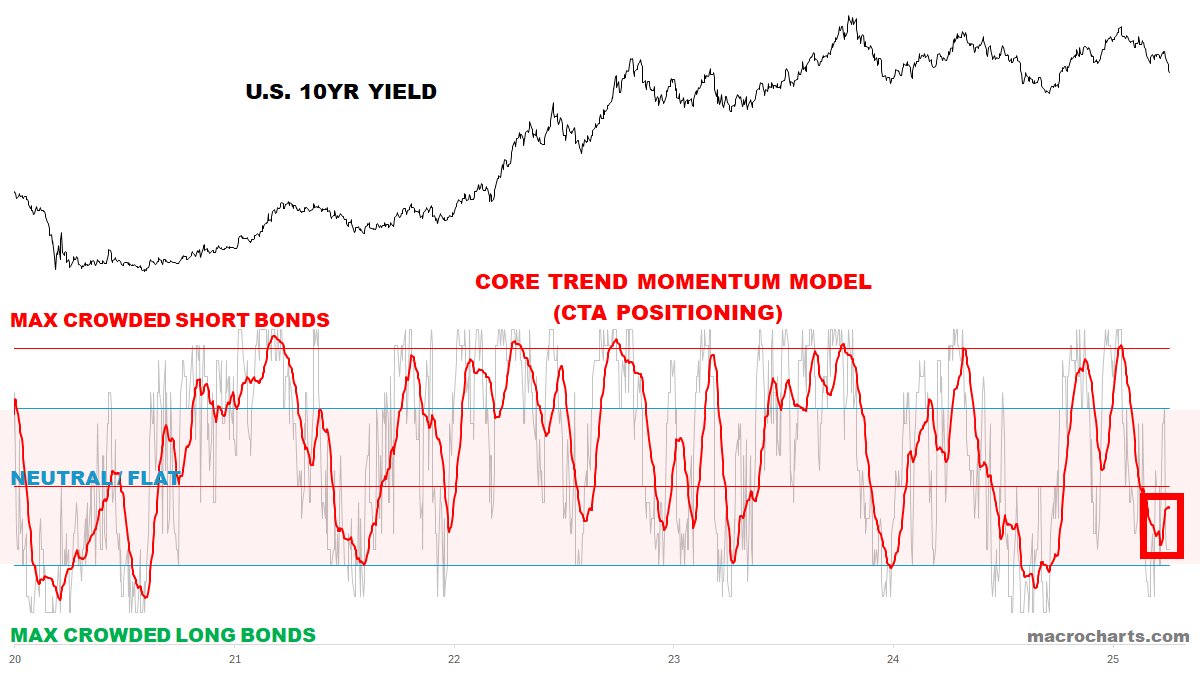

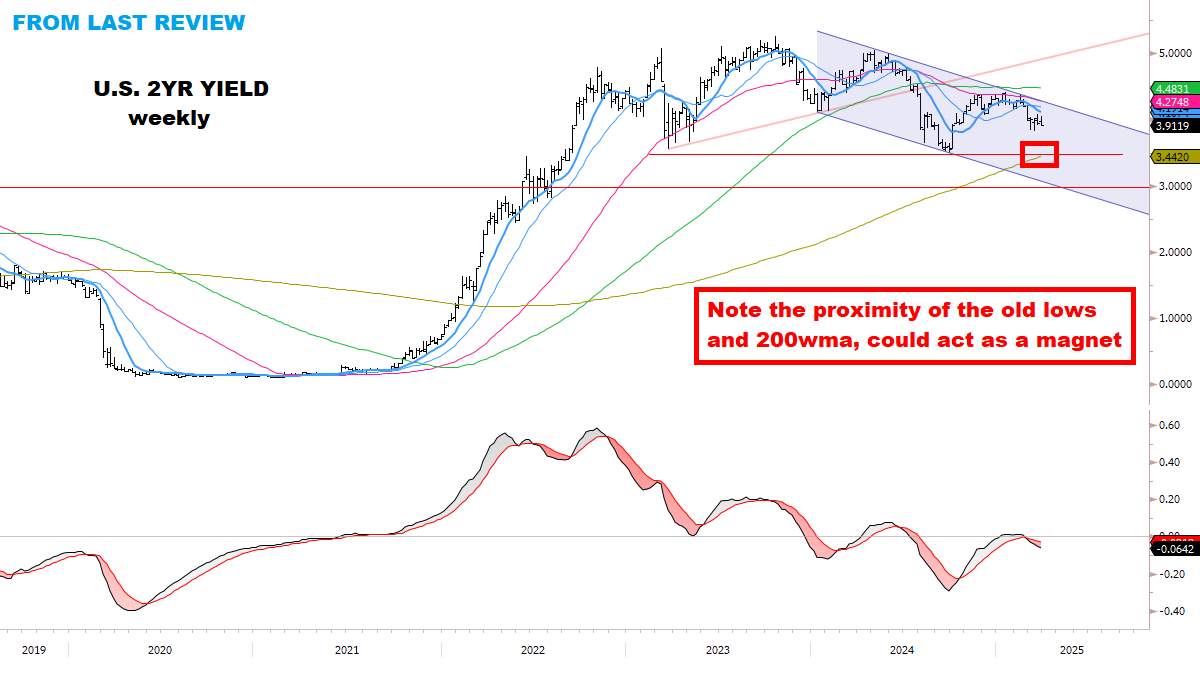

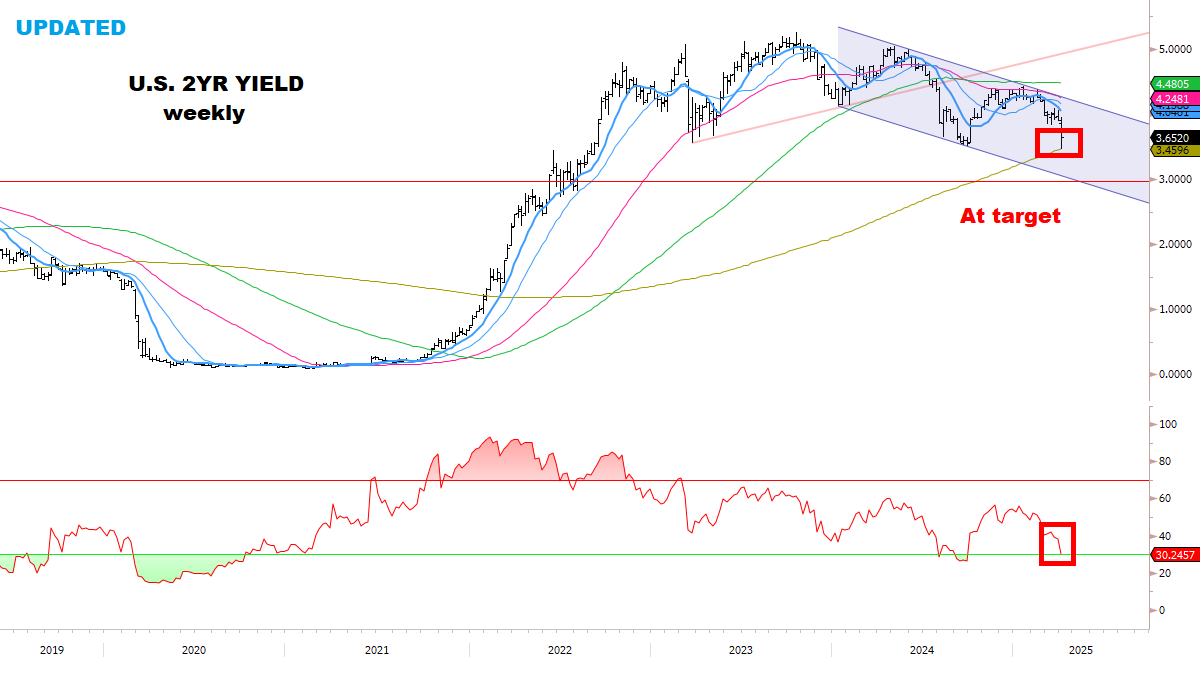

CTA Rates Positioning is in a neutral state here, turning up from the bottom of the range.

CTA 利率定位在这里处于中性状态,从区间底部反弹。

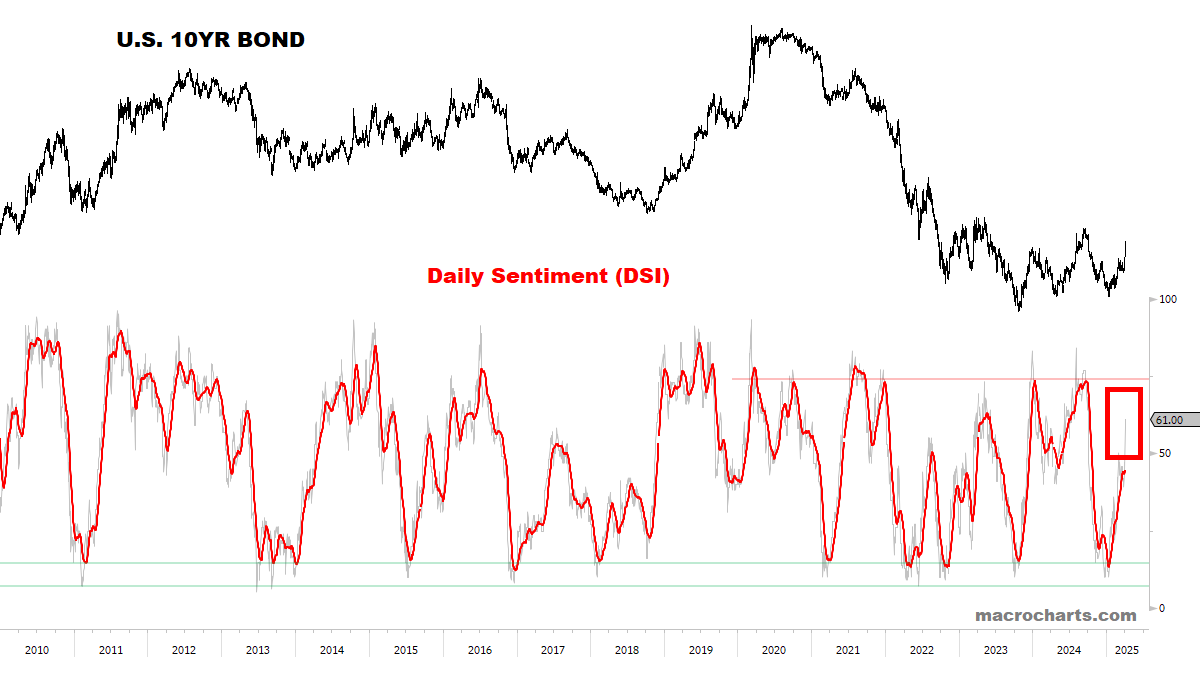

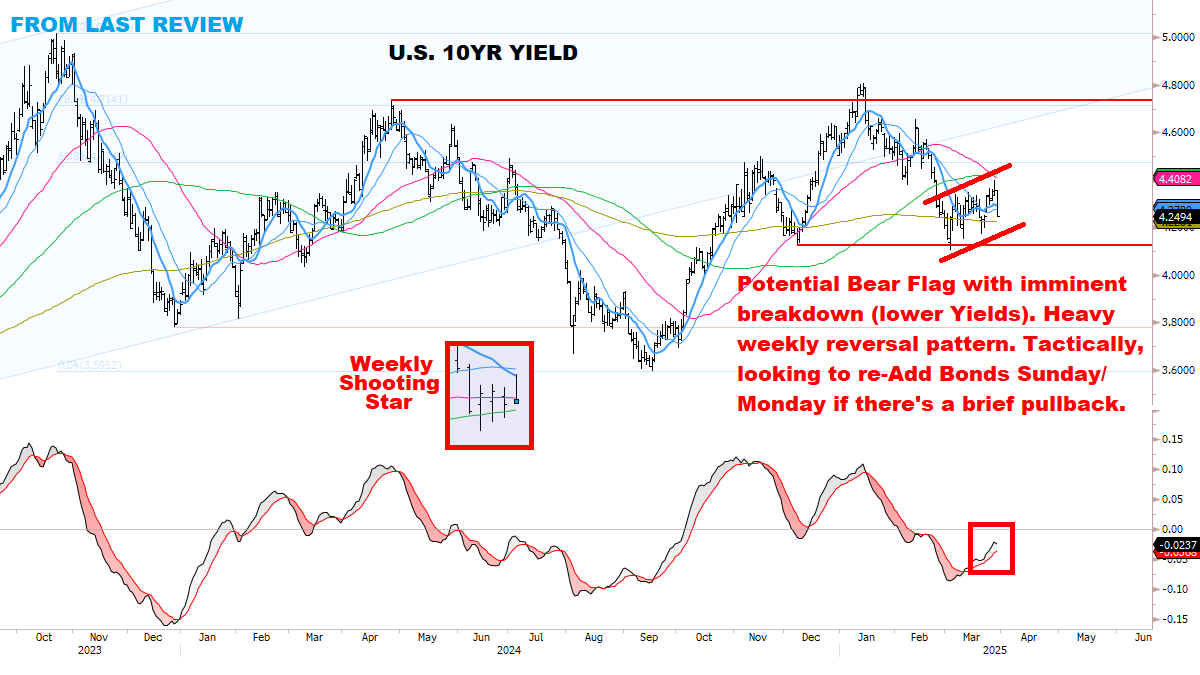

Bond Sentiment is starting to spike but is not quite overbought yet. It remains to be seen if Bonds continue their move here — we’ll discuss this in the Charts section.

债券情绪开始飙升,但还没有完全超买。尚不清楚债券是否会在这里继续上涨 — 我们将在图表部分进行讨论。

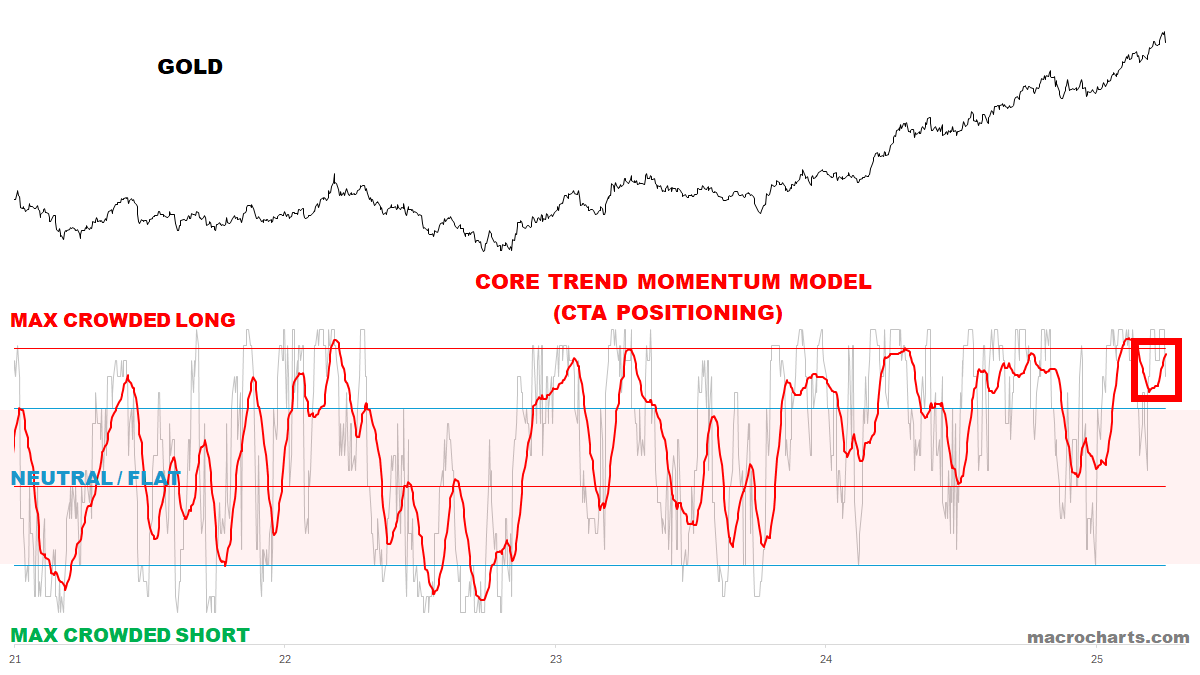

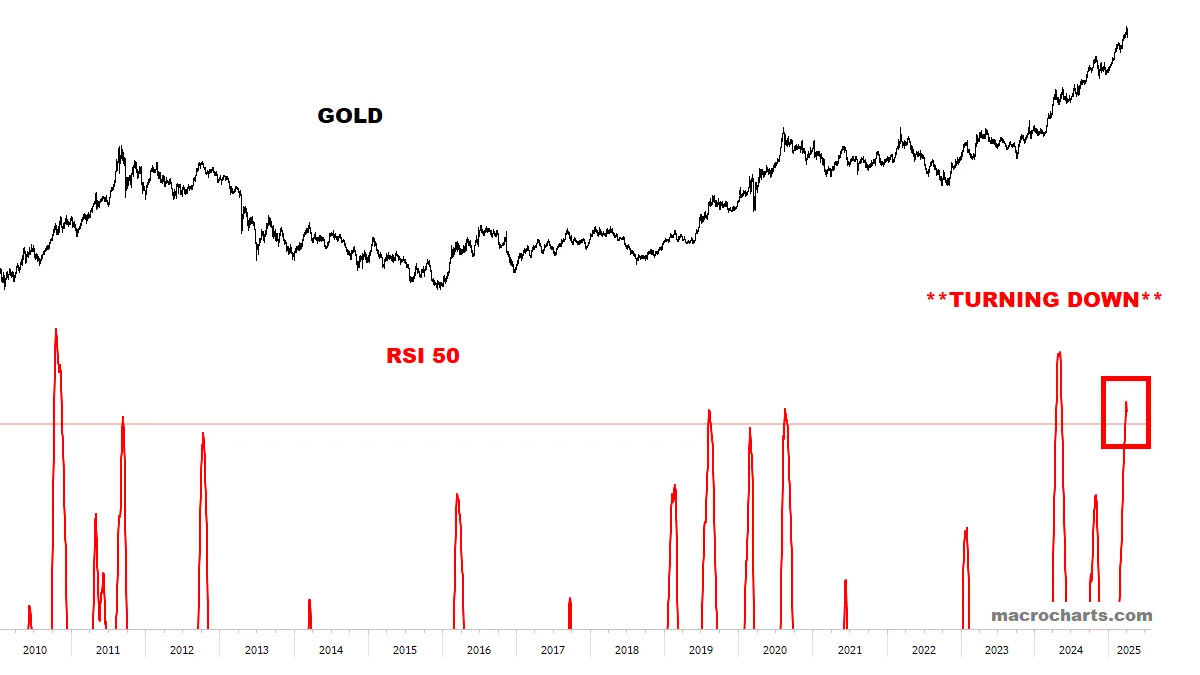

CTA Gold Positioning is stretched again.

CTA 黄金定位再次处于拉伸状态。

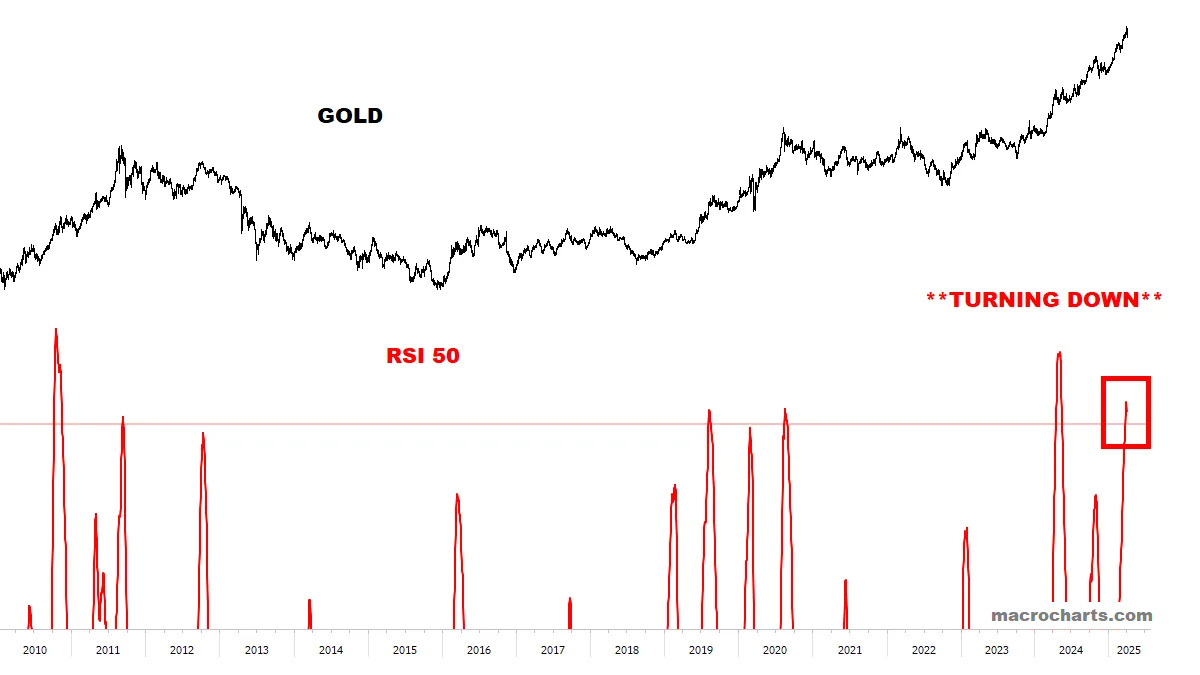

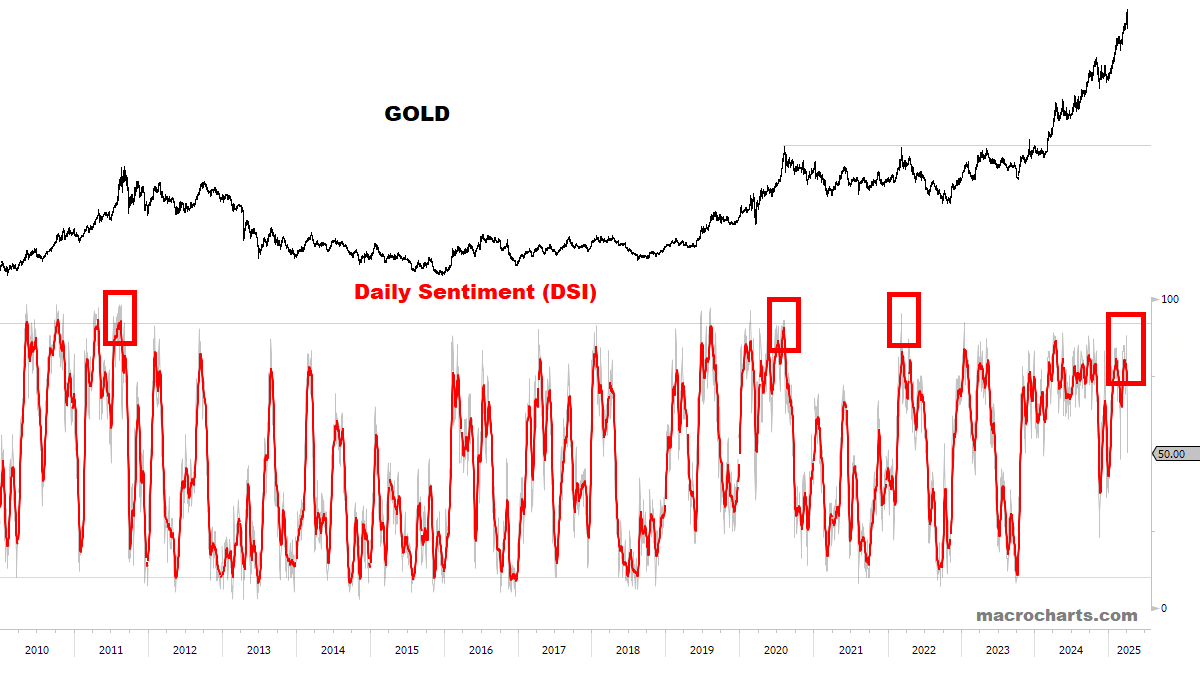

Gold is historically overbought and likely to correct for a few months — think this would strongly align with Stocks finding a bottom here:

黄金历史上被高估,可能会纠正几个月 — 我认为这与股票在此处找到底部密切相关:

*Gold is now on negative watch in our Market Dashboard.

*黄金现在在我们的市场仪表板上处于负面观察状态。

Gold Sentiment never got extended — so I’d lean to a trend correction here, rather than a major top. It may bounce next week as part of a topping process, but if Long I’d use that to start reducing exposure.

黄金情绪从未得到延伸 — 所以我倾向于这里进行趋势修正,而不是出现重大顶部。下周可能会反弹,作为顶部过程的一部分,但如果持有多头头寸,我会利用这次反弹开始减少风险敞口。

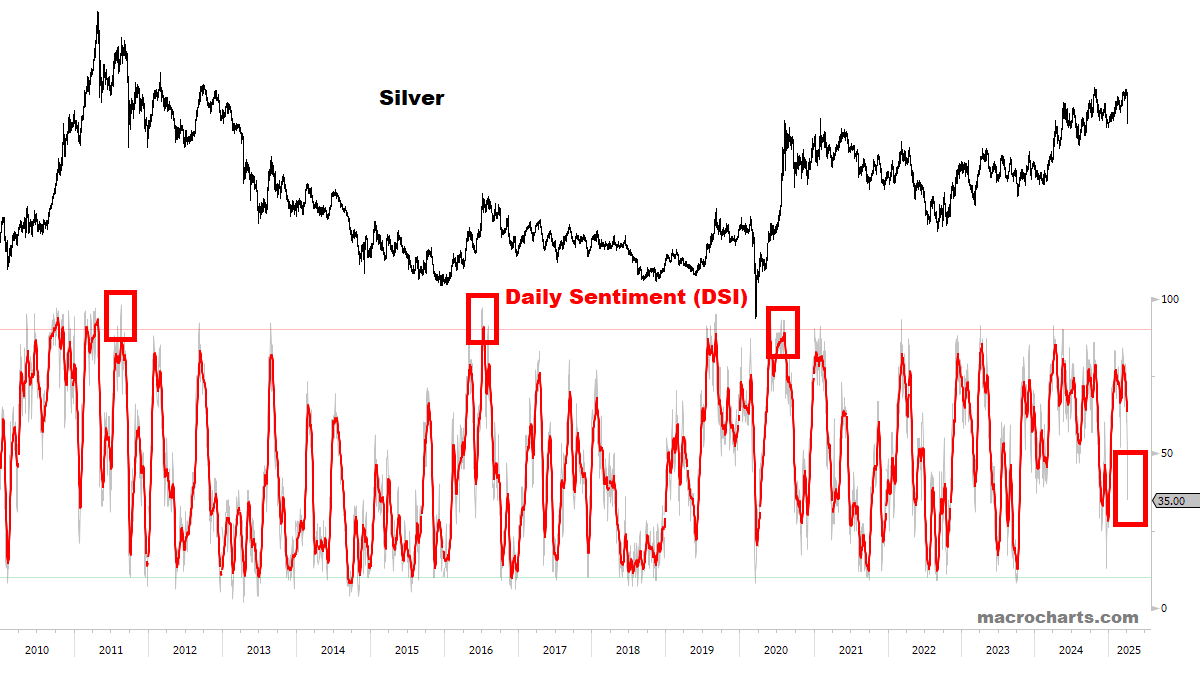

Silver has traded more like a risk-on in this tape (unlike Gold), so I’d lean to Buy it next week for a snapback rally, possibly even back to the recent highs. This is covered in the next section also.

银在这个市场中更像是风险偏好(与黄金不同),因此我倾向于在下周买入它,以期出现反弹,可能甚至回到近期高点。这在下一节也有提到。

KEY TECHNICAL CHARTS 关键技术图表

STOCKS 股票

A crisis of historic magnitude — and lasting significance.

一场历史性规模的危机——具有持久的重要性。

Tech & Semis more oversold than 2020:

科技与半导体的超卖程度超过 2020 年:

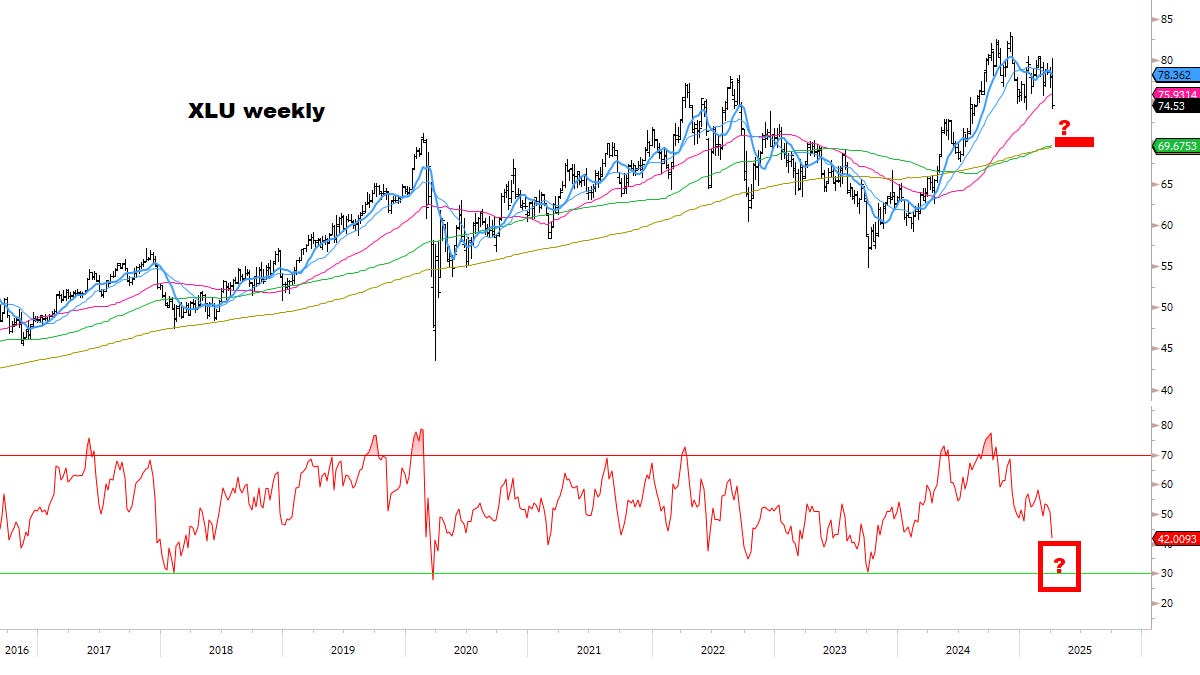

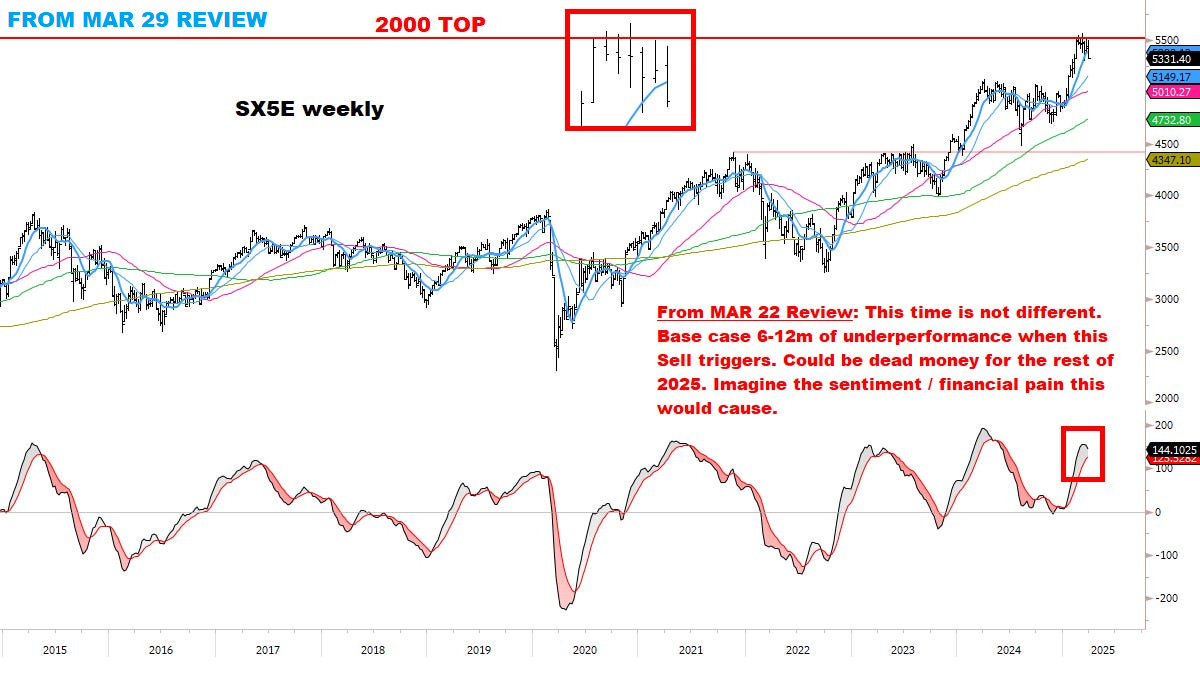

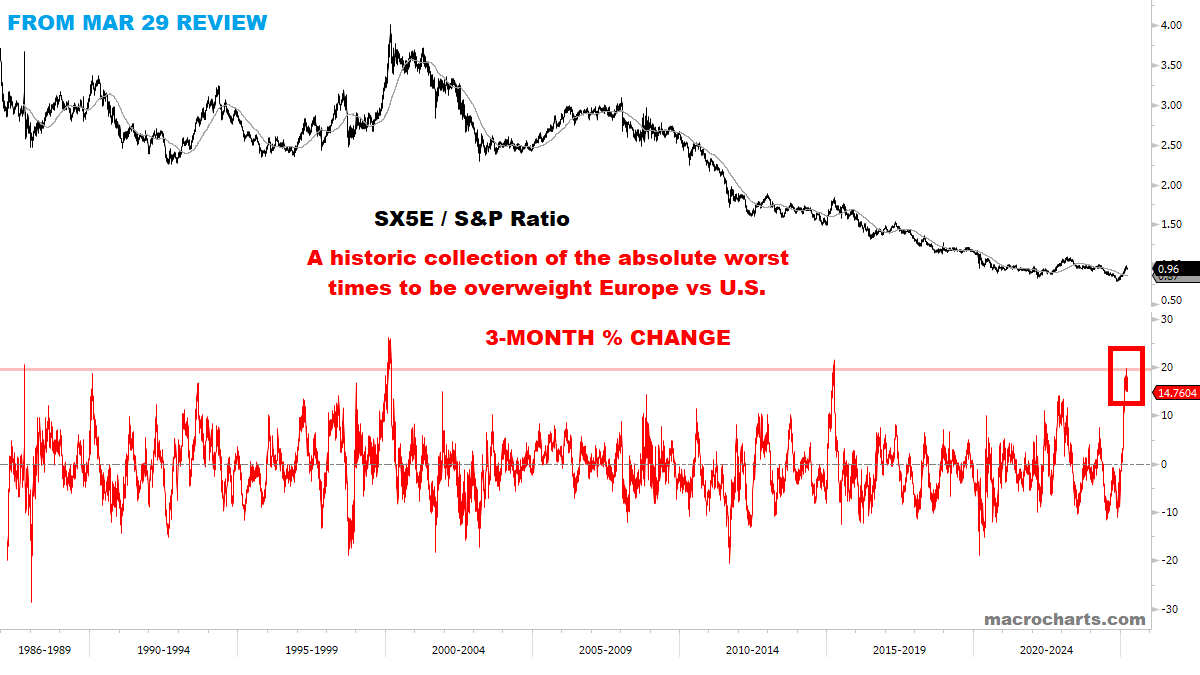

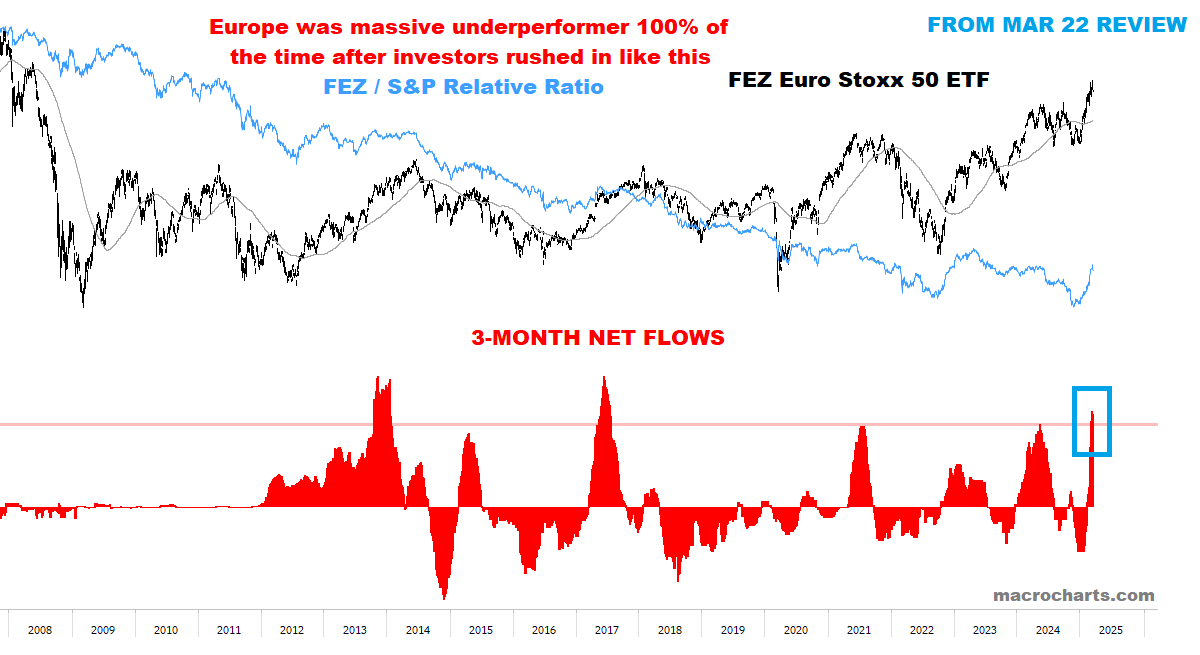

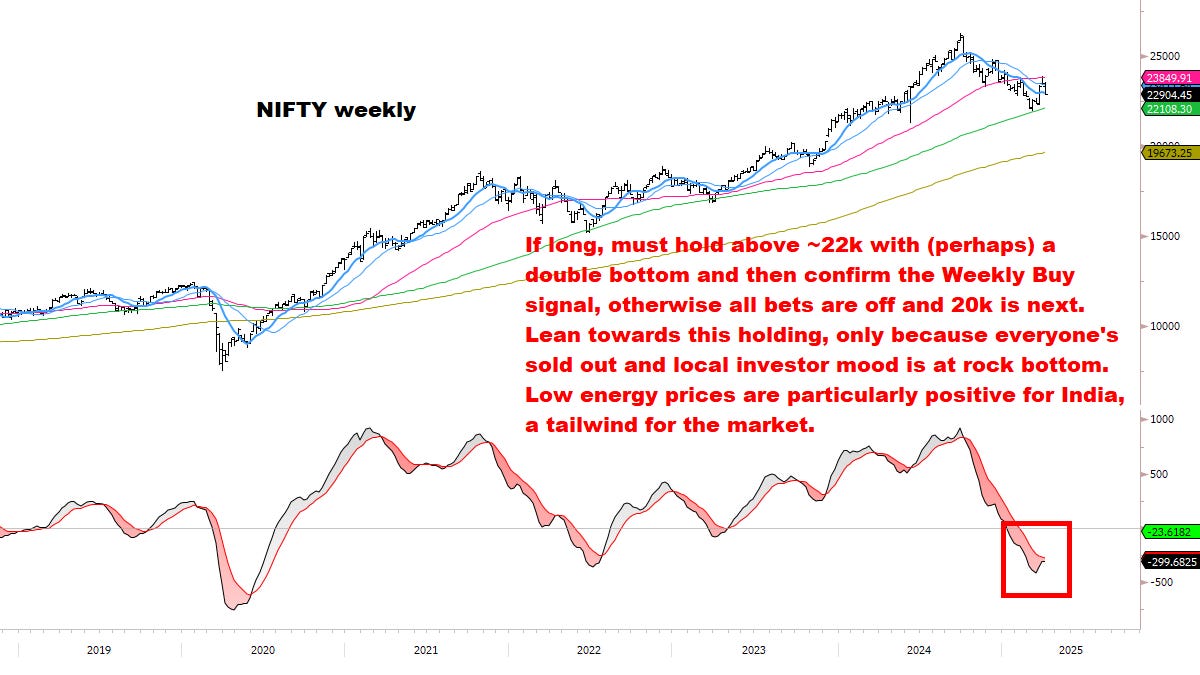

INTERNATIONAL MARKETS 国际市场

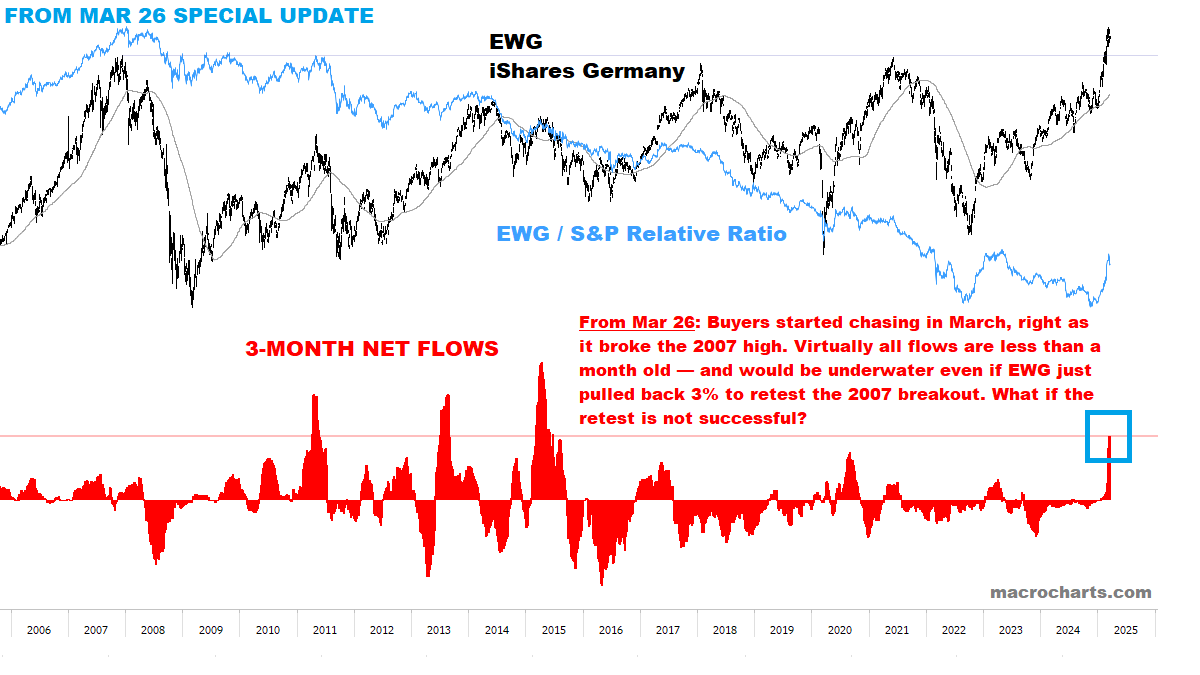

Everyone went all-in Europe during a global trade war.

在全球贸易战中,每个人都全力押注欧洲。

-14.50% from peak in SX5E Futures vs -17.50% S&P… diversification.

SX5E 期货较峰值下降了-14.50%,而标准普尔下降了-17.50%……多样化。

*Bigger picture: EU underperformance may just be getting started (especially if the world is moving into a recession — see Currencies section).

*大局:欧盟表现不佳可能只是刚刚开始(尤其是在世界进入衰退的情况下——见货币部分)。

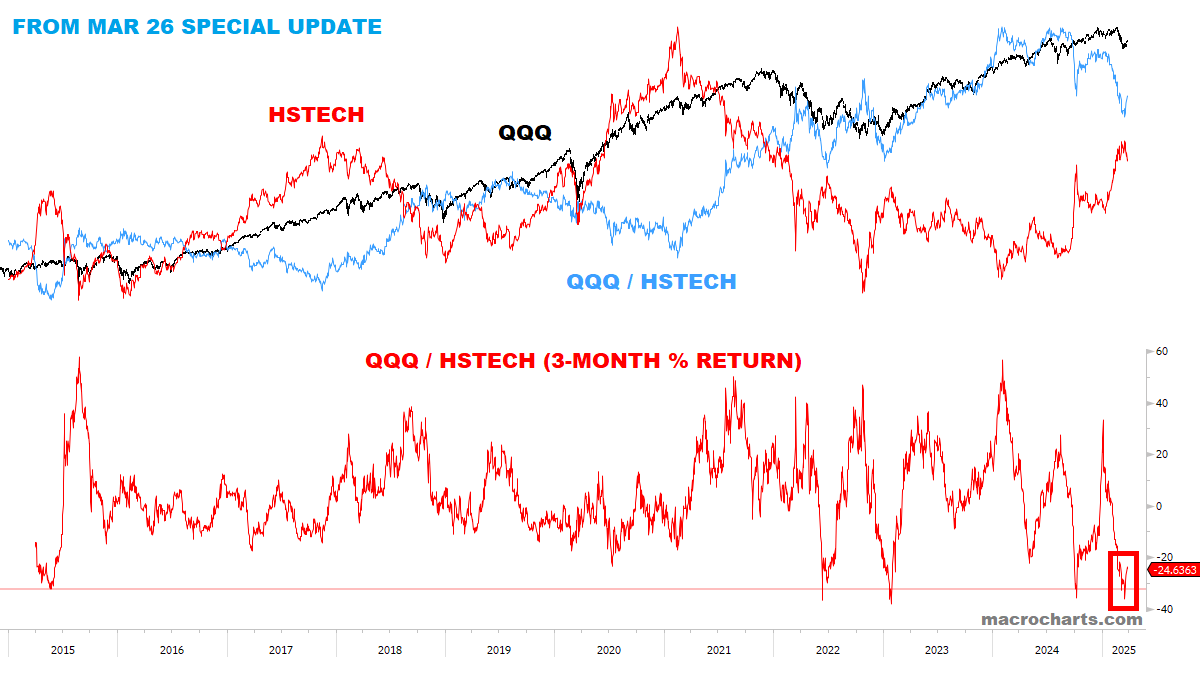

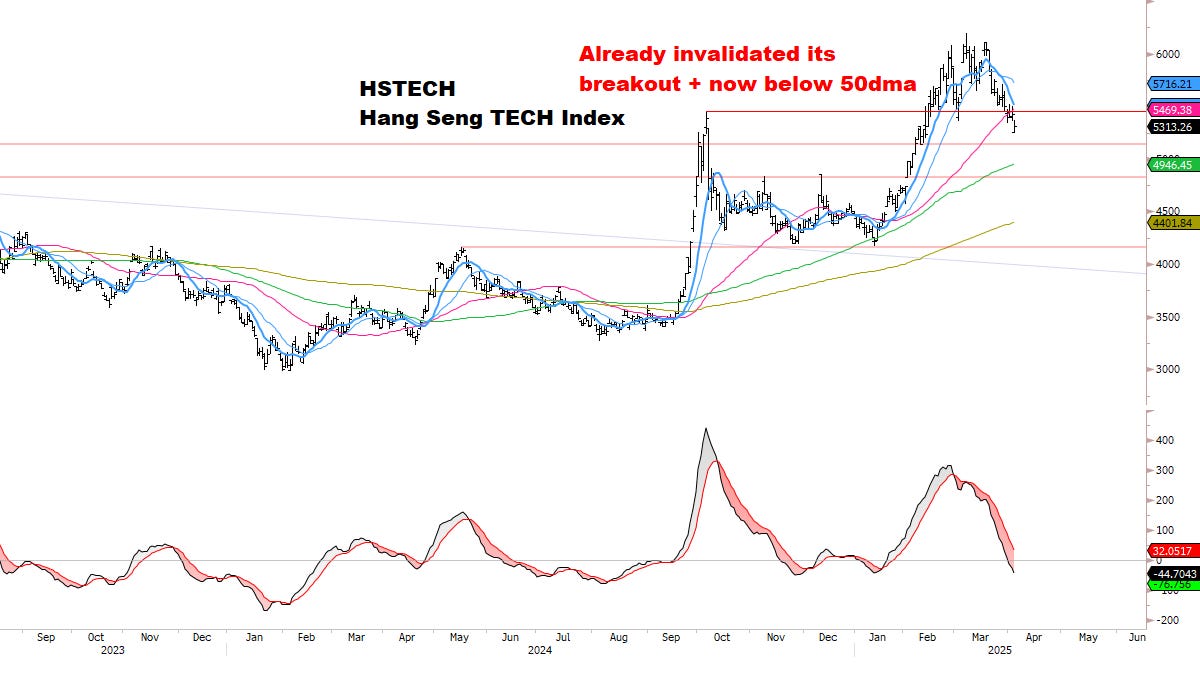

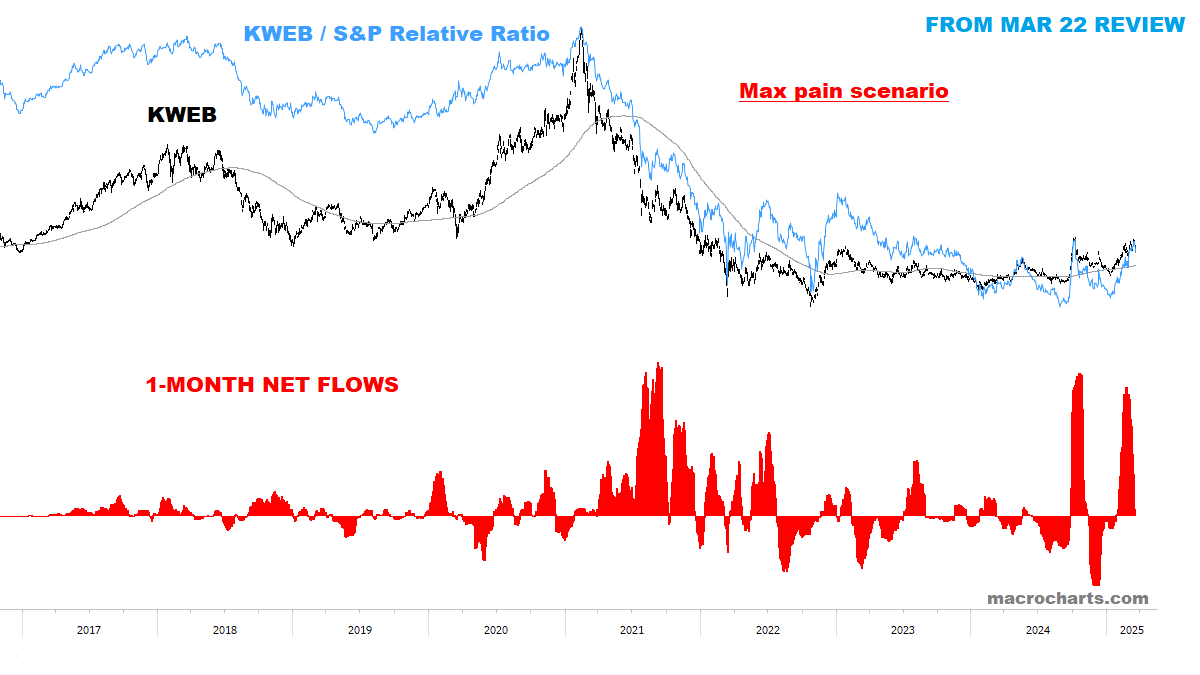

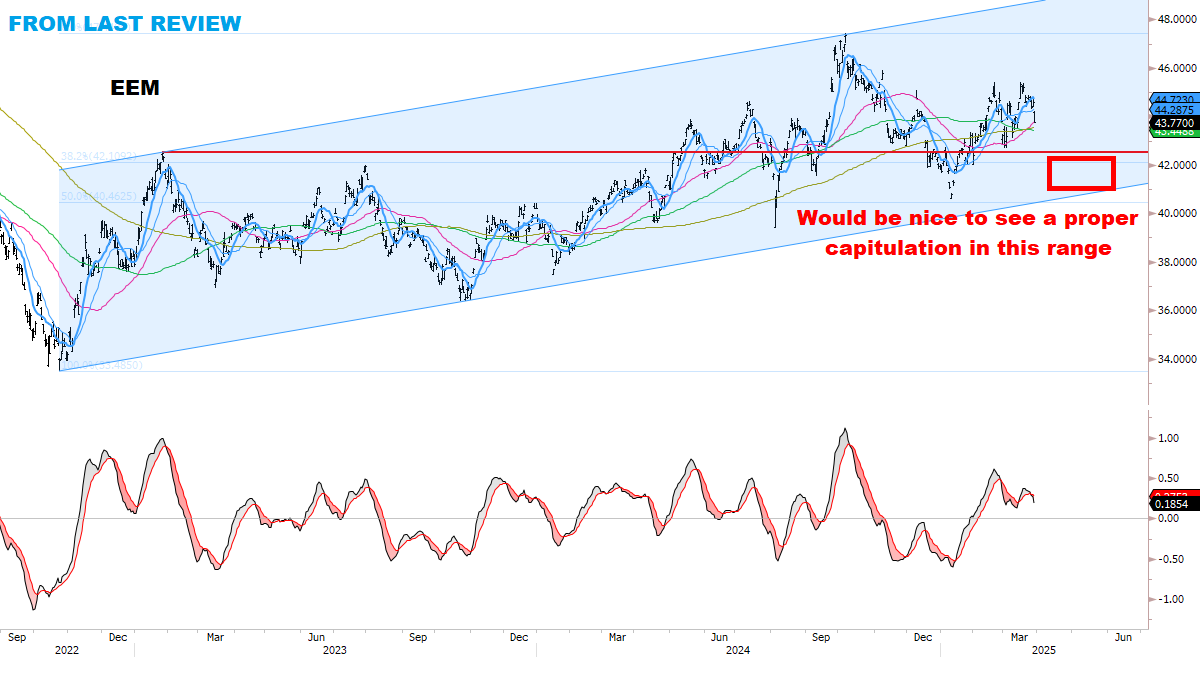

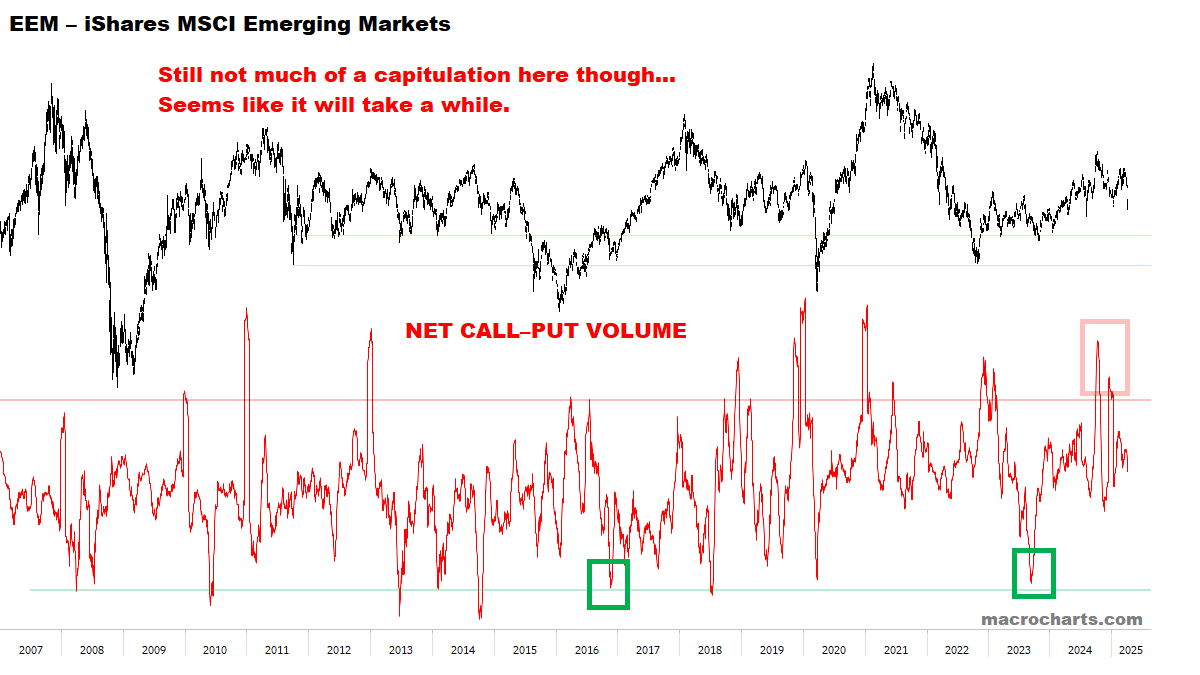

CHINA 中国

Maybe not the best place to be overweight in a global trade war either. Maintaining zero exposure / negative trend risk.

也许在全球贸易战中,这里并不是一个超配的最佳地点。保持零敞口/负趋势风险。

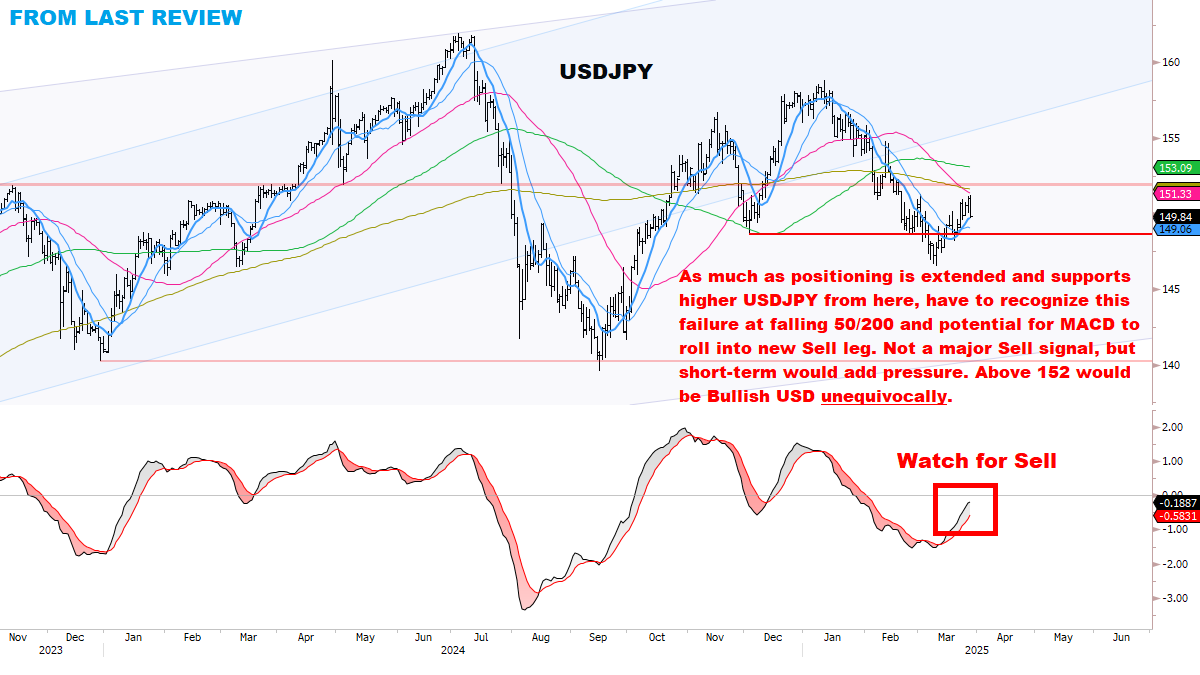

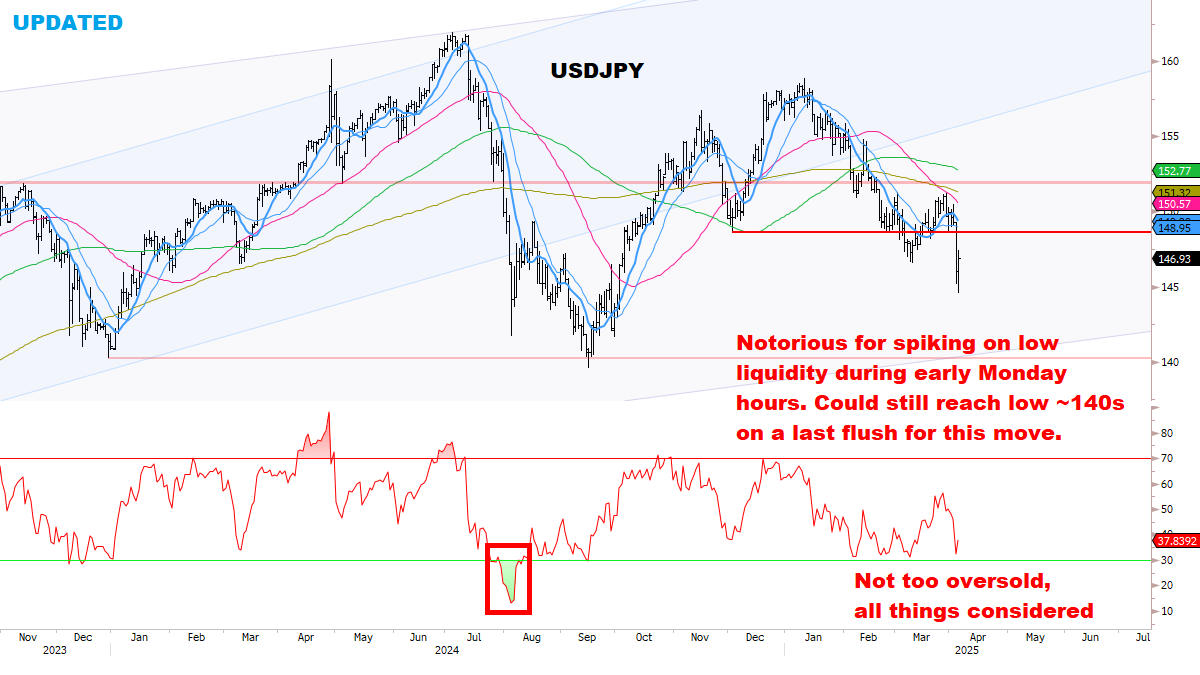

JAPAN 日本

RATES 利率

Bonds “stopped working” on Friday — that’s when real liquidation sets in. Recall back in March 2020, Bonds peaked on March 9, two weeks before Stocks bottomed. Gold peaked with Bonds on that same day. (It may be a shorter lag to the bottom in Stocks this time, we’ll see.)

债券在周五“停止工作”——那时真正的抛售开始。回顾 2020 年 3 月,债券在 3 月 9 日达到顶峰,比股票见底早两周。黄金在同一天与债券一起达到顶峰。(这次股票见底可能会有更短的滞后,我们拭目以待。)

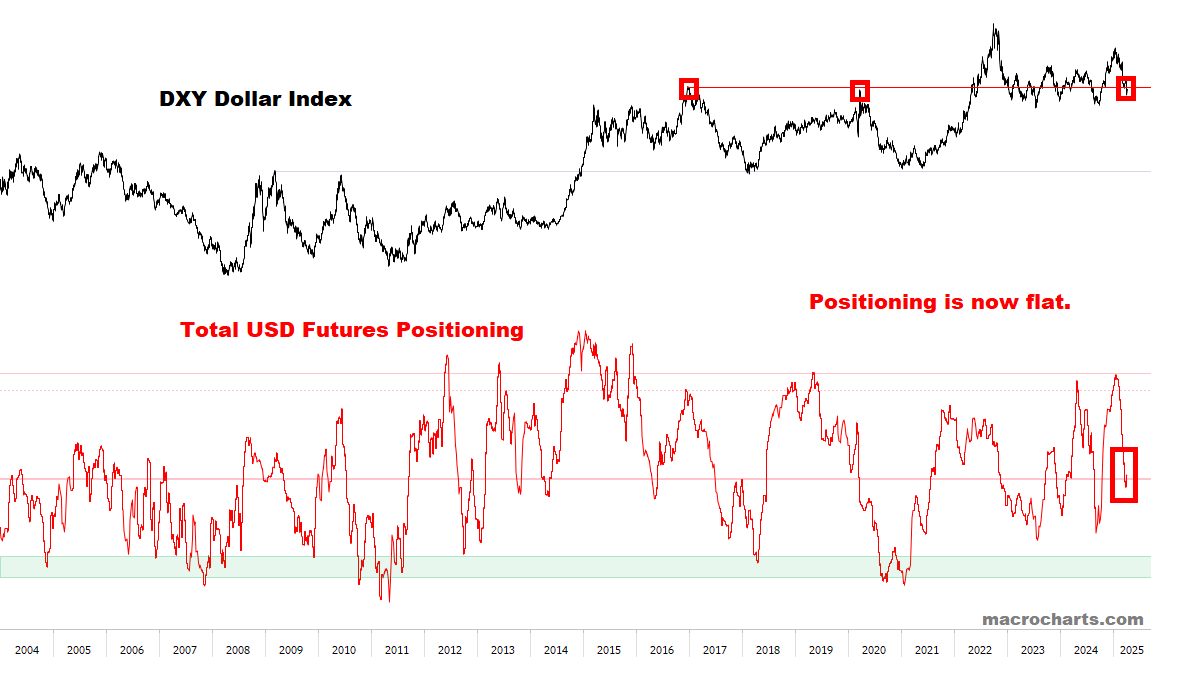

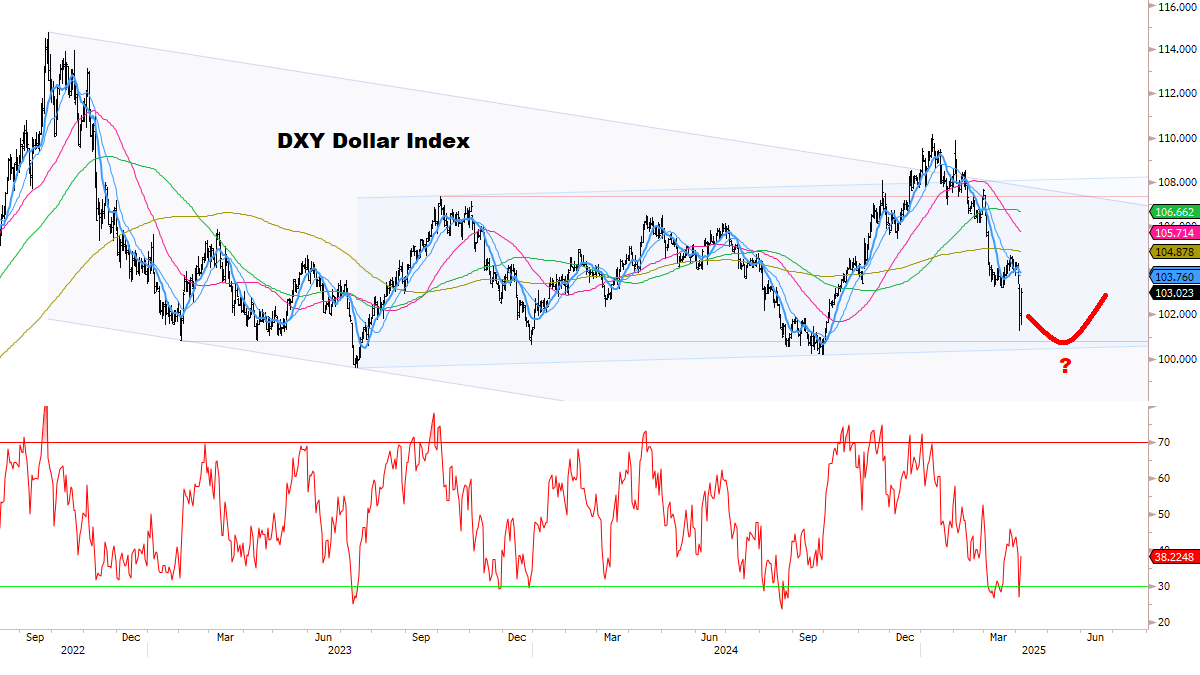

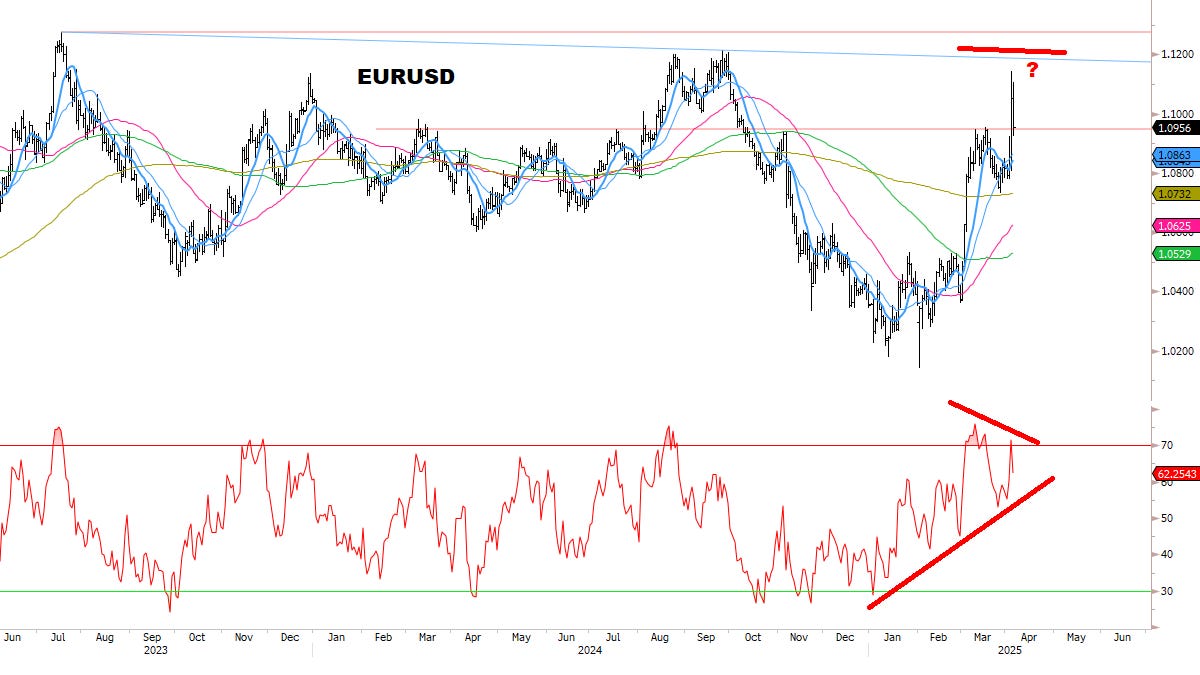

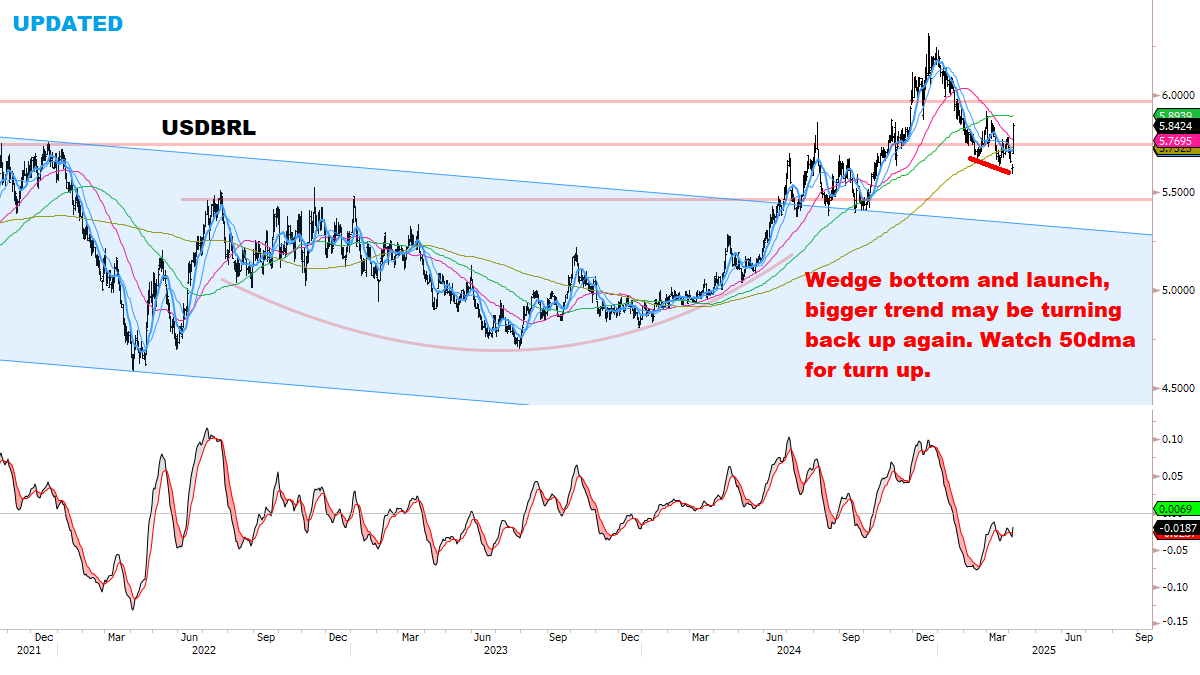

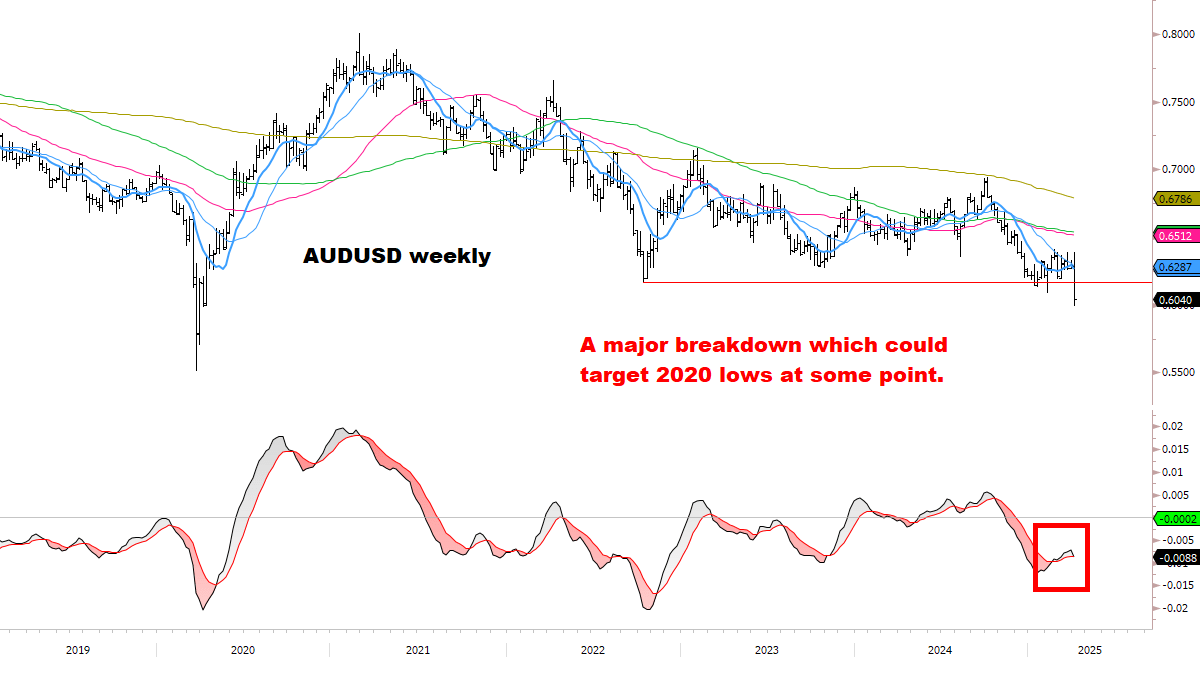

CURRENCIES 货币

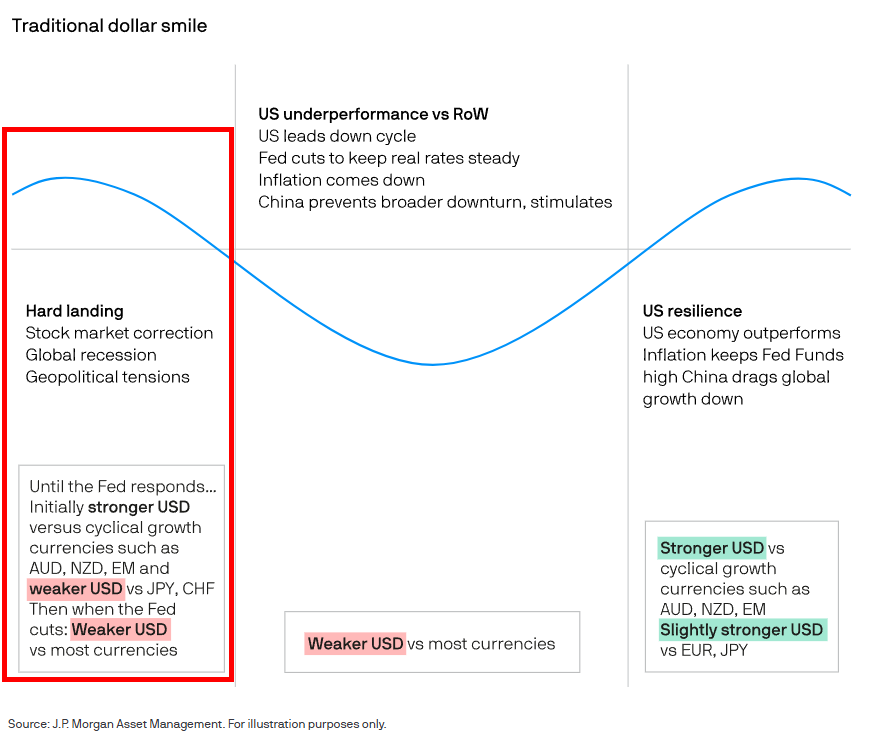

The “dollar smile” was first described 20 years ago by Stephen Jen and refers to when the U.S. Dollar outperforms other currencies in two extremely different scenarios:

“美元微笑”是斯蒂芬·詹在 20 年前首次提出的,它指的是当美元在两种截然不同的情况下相较于其他货币表现出色时:

When the US economy is strong and there is optimism in markets.

当美国经济强劲,市场充满乐观情绪时。When the global economy is doing badly and risk appetites are low (a ‘risk-off’ environment).

当全球经济表现不佳,风险偏好低(即“避险”环境)时。

Above, the left-side scenario is likely now driving markets, evidenced by Friday’s big reversal up in the Dollar — completely erasing Thursday’s selloff against many currencies.

上述左侧场景可能现在正在驱动市场,这从周五美元大幅反转上升中可以看出——完全抹去了周四对许多货币的抛售。

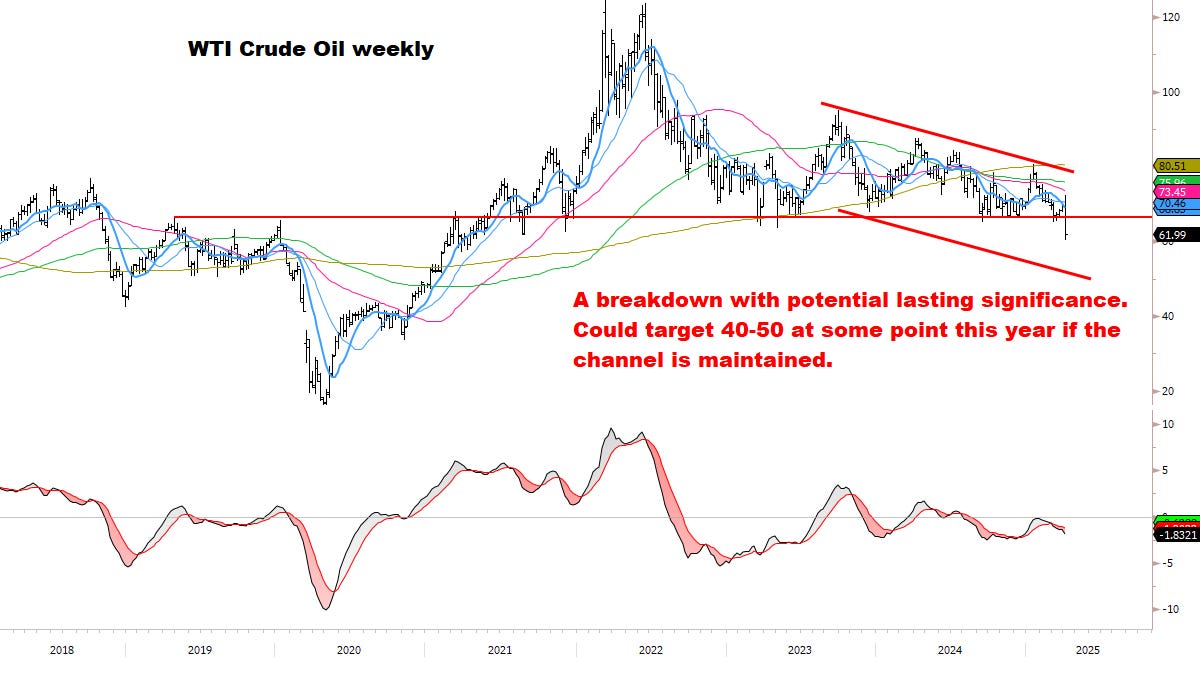

OIL & ENERGY 石油和能源

METALS 金属

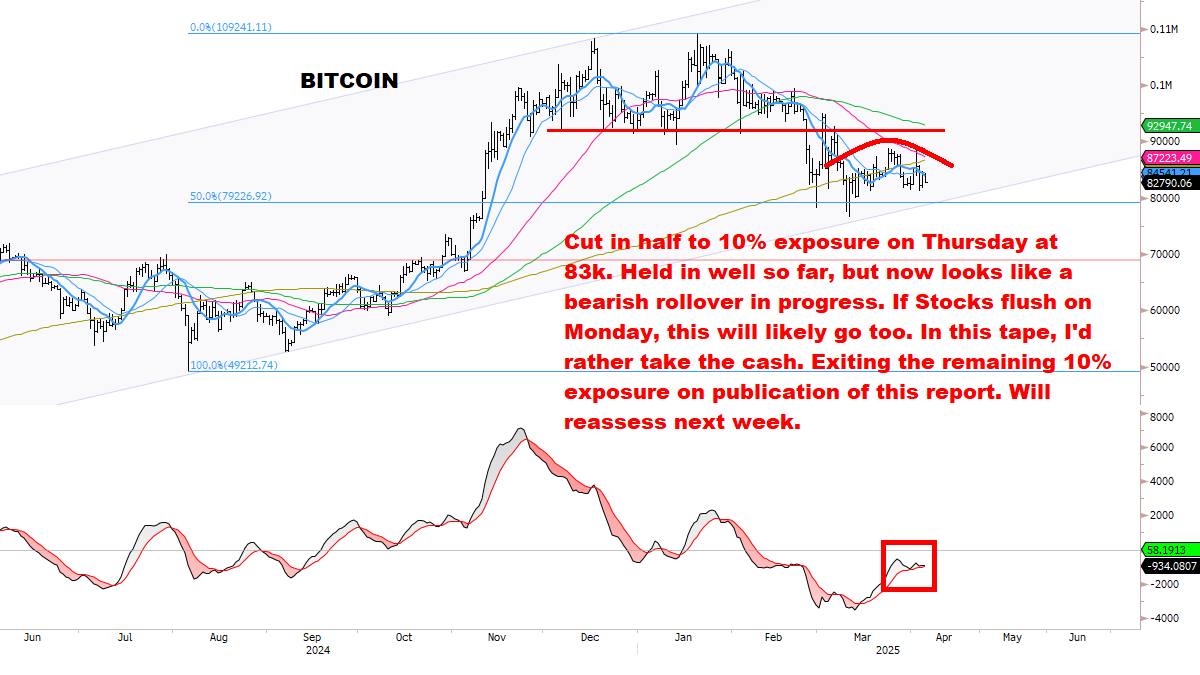

BITCOIN 比特币

EXECUTION PLAN FOR NEXT WEEK

下周执行计划

Disclaimer: this is NOT a recommendation, only what I’ll be doing for my personal portfolio. And for anyone trying to catch falling knives, never use leverage.

免责声明:这不是推荐,仅仅是我个人投资组合的操作。对于任何试图抓住下跌的投资者来说,切勿使用杠杆。Beyond next week’s (likely) extreme short-term volatility, forward 3-6 month Equity returns look significantly positive and asymmetric.

除了下周(可能)出现的极端短期波动,未来 3-6 个月的股票回报看起来显著积极且不对称。My plan is to build a medium-term allocation which I’ll be holding for a minimum window of 3-6 months, and prepared to take an initial drawdown. I’ve been fortunate to sidestep a significant amount of the volatility so far (though not all), and am in position to increase exposure accordingly.

我的计划是建立一个中期配置,我将至少持有 3-6 个月,并准备接受初始回撤。我很幸运到目前为止已经避开了相当一部分波动(尽管不是全部),并且有能力相应增加投资。IF the market follows historical patterns and residual selling is seen on Monday’s cash open: if there’s a gap down of 2-5% and big support levels are tested (as highlighted in today’s charts), I will automatically begin buying using VWAP program from the open to the close. I don’t care about the exact bottom tick, only the day’s average price.

如果市场遵循历史模式,且在周一的现金开盘时看到剩余抛售:如果出现 2-5%的跳空下跌并测试大支撑位(如今天的图表所示),我将自动开始使用 VWAP 计划,在开盘到收盘期间进行买入。我并不在乎确切的最低价格,只关注当天的平均价格。My goal is to take U.S. Equity (Tech, Growth, Quality) exposure up to 60-70%, and if a reversal is seen, build more from there.

我计划将美国股票(科技、成长、优质)的投资比例提高到 60-70%,如果出现反转,再进行更多的增持。Additionally, I’ll be looking to add to Silver and Bitcoin back to full size (if possible).

此外,我还会考虑将白银和比特币的投资回补到满仓(如果可能的话)。I’ll be in touch on subscriber chat and publish Alerts as conditions develop — good luck to you next week.

我会在订阅者聊天中保持联系,并在条件发展时发布警报—祝你下周好运。