QQQs +25bps as we all await the big NVDA print tonight - market pricing a 1% day move tomorrow. BTC +2% to new highs. Yields ticking up 2-4bps across the curve. More geopolitics headlines with Reuters reporting Putin open to ceasefire talks with Trump, though won't make any territorial concessions and insists Ukraine scrap efforts to join NATO. FT said Marc Rowan (Apollo) has emerged as top contender for Treasury Secretary and will meet with Trump today. Follows recent reports that former Fed governor Kevin Warsh was the frontrunner for the job.

Bogeys for tonight:

NVDA:

Q3 Total Revs: $34.5B vs street at $33.2B ($2B ahead of the guide)

Q3 DC Revs: $31B vs street at $29.3B

Q3 GMs: 75%+ vs street at 75% and guide 74.4% to 75%

Q4 Total Revs: Total Rev guide $38B at midpt vs street at $37B - key number

Q4 GMs: Inline with street at 73.3% at the midpoint

PANW:

Q1 Billings: $2.2B, 8.5% y/y vs street at 6.5% y/y

Q1 NGS NNARR: ~$175M vs street $170M

Q2 NGS NNARR guide: $290M (street $285M)

SNOW:

Q3 Product revs: $875M vs guide $850-$855M

Q3 RPO: $5.3M vs street $5.25B

Q4 Product rev guide: $900M vs street at $895M

Good luck!

Let’s get to it…

AMZN: Will not increase US referral and FBA fees and will not introduce and new fees in 2025, while decreasing some new fees - link to AMZN blog

Was out yesterdaybut Wells Fargo has a note out this morning on this saying it is potentially a $2B headwind to N America OI and they think that Walmart’s competitive logistics and fulfillment offering likely having some impact. They note a $2B impact to NA OI would be a 7% cut to 2025 NA OI, implying something closer to 6.1% OI margins vs street at 7.2%

3P Roundup:

NFLX: Now we know why stock so strong last two days - Hearing 3p data saying Paul v Tyson was largest single day gross add in UCAN since 2020 and only 10% of those have cancelled since then. They also saw an uptick internationally

PINS: Hearing 3p saying MAU growth 11-12% y/y vs street at 10% for Q4

AMZN: Hearing slight downtick in NA retail data, but still tracking couple ppts above street

FN: B Riley downgrades to Sell with $178 PT down from $194

Interesting note here as BR thinks the trend of unbundling NVDA GPU platforms will adversely impact Fabrinet's optics business. BR notes that AMZN MSFT and META have been buying Nvidia's GPU platforms, such as HGX H100, that contain other components, including optics; however, Riley's latest checks indicate Amazon is about to change its purchasing model to buy just Nvidia's GPUs, and make their own platforms. This won't impact Nvidia's GPU business, but will impact Nvidia's optics business since it is about to lose one a major customer in Amazon, contends Riley. Riley thinks this unbundling trend could threaten Fabrinet's optics business, since it is "just a matter of time before" Microsoft and Meta follow Amazon's footsteps.

Watch COHR here as well although GOOGL and MSFT the big customers there.

DELL: ISI adds to tactical outperform list

ISI think ISG segment expected to drive upside to consensus ($24.69B rev/$2.07 EPS) with AI server shipments exceeding $3.1B and projected $3B in new AI orders, maintaining $3-4B backlog. ISI thinks storage strength from competitive portfolio and pricing should offset AI-driven margin pressure, supporting path to 11-14% ISG EBIT margins by FY25 exit noting that while PC segment shows weakness, investors likely to focus on AI momentum. ISI’s bull case of $10-12+ EPS supports $160-170+ valuation. Catalysts include improving ISG margins, AI server upside, and positive Blackwell FY26 commentary.

APP: Piper initiates at Buy with $400 PT / Wells positive after checks

Piper thinks APP has re-rated appropriately following an AI driveen acceleration, but Piper still sees upside as APP’s tech has driven advertising rev growth well above the market and there is room to drive monetization and growth higher. Piper notes scale is “impressive” at 1.4B global DAUs using apps with MAX meditation, rivaled only by META and APP is now just expanding into a 4x larger e-comm vertical

Wells also out this morning with positive checks saying they reveal strong early eCommerce performance: advertiser ROI matching META/GOOGLE levels, with DTC brands scaling to 15-20% of acquisition spend without ROAS deterioration. Wells notes large FMCG brands now testing the platform. Success drivers include distinctive eComm creative against gaming ads, rewarded video effectiveness, and strong mobile targeting signals. Wells upps their #s: raises revenue estimates 4%/8%, EBITDA 5%/10%, new PT $360 (26x '26).

CRM: JPM raises PT to $340 from $310 after meeting with consultants around Agenforce

JPM says the they spoke with took a "distinctly positive tone" on Agentforce, expressing that "it seems like a meaningful improvement... the customers we've spoken to seem genuinely interested." JPM believes Salesforce operates a business model "that is bending, but not breaking, even within a challenging macro environment that is affecting all software companies.” JPM continues to see eventual upside from current levels as the company pivots to an efficiency playbook and balances slower growth with profitability and free cash flow generation while infusing Gen AI capabilities into its clouds.

CHWY: Chewy upgraded to Buy from Underperform at BofA

Shelters are still taking in more pets on a net basis and YoY pet spend is negative, per BAC aggregated credit & debit card data. However, BAML notes adoption trends have steadily improved since the start of '24 & pet spend appears to have bottomed. Easier comps in 1H'25 and commentary from BAML's recent pet expert call provide confidence that industry can return to consistent LSD%-MSD% growth (avg. of 4% YoY from 2011-19, per BAC card data).BAMl also notes that Chewy web traffic has accelerated significantly (+6% YoY in F'Q3 vs -11% in Q1) and is supportive of share gains & possibly better than expected customer count (key stock metric).

QCOM: Qualcomm provides new five-year financial targets for its QCT business

KEYB comments on the analyst day saying key takeaways include: 1) Updated its Auto revenue target to $8B in FY29 vs $4B in FY26, which implies a five-year 22% CAGR; 2) Projects $4B in PC revs in FY29, which assumes 11% market share; 3) Targets 14B in IoT revs (which includes PC, XR, Industrial, and Other), of which $4B is expected to be Industrial IoT, which implies a 21% five-year CAGR; 4) Expects Android Handset growth of MSD% LT. Excluding AAPL, this projects to a QCT five-year CAGR of 11%. However, KEYB notes that factoring in the ramp of AAPL's internal modem over the next several years, this would represent LSD% growth over the next several years and ~6% five-year CAGR from FY24-FY29

Barclays notes QCOM outlined a vision for 2029 showing balanced QCT revenue split (50% handsets/50% Auto-IoT) post-Apple exit. Auto leads growth ($8B by FY29), with PC, XR, and Industrial IoT contributing to a projected $14B. Skepticism centers on IoT targets - flat CAGR since last analyst day but projecting >2.5x growth over 5 years. Barclays thinks ARM penetration targets (30-50%) and XR prospects face credibility challenges. While diversification from handsets was expected, Barclays thinks the 50/50 split raises questions about handset business trajectory.

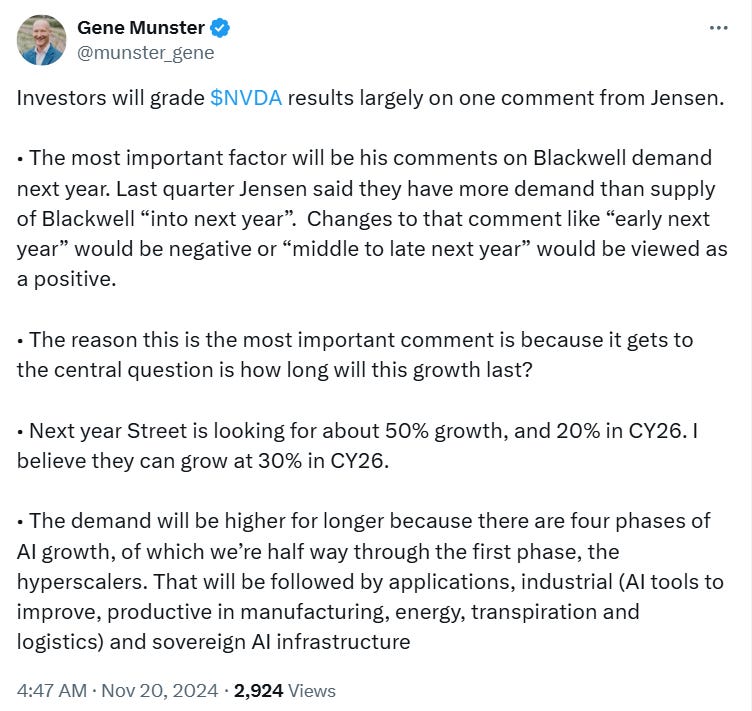

NVDA

SQ: Block downgraded to Neutral from Outperform at Exane BNP Paribas

BNP thinks the company's growth is slowing despite stock rallying and they have a more cautious view on Cash App growth calling out a mild downside risk to street estimates.

NFLX: Pivotal raises PT to $1,100 from $925

Post the "(mostly) successful" Mike Tyson and Logan Paul fight, which was streamed by a "massive" 65M households, Pivotal raised its medium and long term subscriber and average revenue per user forecasts for Netflix. When combined with a modest increase in its terminal EBITDA multiple, the Pivotal increased the price target to a Street high $1,100. The boxing match is a successful learning experience for Netflix and the technical issues will not happen again with future live events.

GOOGL: Google’s Chrome Worth Up to $20 Billion If Judge Orders Sale

Alphabet Inc's Chrome browser could go for as much as $20 billion if a judge agrees to a Justice Department proposal to sell the business, in what would be a historic crackdown on one of the world's biggest tech companies.

The department will ask the judge, who ruled in August that Google illegally monopolized the search market, to require measures related to artificial intelligence and its Android smartphone operating system, according to people familiar with the plans.

Antitrust officials, along with states that have joined the case, also plan to recommend Wednesday that federal judge Amit Mehta impose data licensing requirements, said the people, who asked not to be named discussing a confidential matter.

AAPL: Apple sales fall y/y on China's Singles' Day, Huawei up 7%, data shows

Apple sold fewer smartphones during China's Singles' Day shopping festival this year as it faced pressure from an "abnormally high" number of rival handsets launched around the event, Counterpoint Research said on Wednesday.

The iPhone manufacturer saw its sales decline year-on-year by "double digit percentages" from Oct. 18 to Nov. 10, the research consultancy said. In comparison, its main rival in China, Huawei, recorded 7% sales growth, fueled by price cuts on its Pura 70 and Mate 60 models

GFS: GlobalFoundries initiated with a Neutral at UBS

TheFly:

UBS initiated coverage of GlobalFoundries with a Neutral rating and $47 price target. The company has a favorable position but its markets are likely oversupplied, the analyst tells investors in a research note. The firm sees GlobalFoundries as favorably positioned relative to peers amid geopolitical uncertainty, but still sees mature node markets skewing to oversupply through 2026. As such, it believes the risks offset the stock's upside potential.

HOOD; Mizuho says TradePMR a good strategic deal

Mizuho says the deal gives HOOD access to the $7T RIA market (currently 75% controlled by incumbents like Schwab) through TradePMR's 350 firms, 1,000+ RIAs, and $40B AUA, also noting it helps diversify beyond active traders and accelerates penetration of HOOD's Millennial/Gen Z customer base. Revenue potential estimated at $60M annually (15bps on $40B AUA), contributing 2-3% growth post-closing.

NTAP: BAML maintains sell but acknowledges that margins have held up better than expected

BAML's NetApp VAR survey shows improving sentiment: 45% of VARs reported above-plan sales, with +1.4% weighted score versus -0.5% previously. Storage demand outlook strengthened, with 65% seeing mix of long/short-term pipeline deals, up from 15% prior. Despite positive indicators, BAML maintains Underperform rating, citing macro risks and memory pricing pressures, though acknowledges better-than-expected margin performance.

WIX: BAML raises PT to $228 from $190 after the q

Overall, another strong quarter of FCF inflection, plus starting to show acceleration on leaner cost structure BAML raises its PO from $190 to $228, based on a two-turn higher 10x FY25E Gross Profit given Wix's highly recurring revenue stream, new A.I. infused products, and higher expectations for growth & margin profile from here, partially offset by slightly higher share count. BAML's multiple is now largely in line with comps at 9.8x, given Wix's improving growth & margin profile.

EQIX: Stifel raises PT to $1080

Stifel's Equinix management meeting takeaways: Core retail business fundamentals remain strong while AI demand accelerates. Company's strategic shift to larger builds targeting AI opportunities leverages its comprehensive service portfolio across hyperscalers, enterprise, and retail colocation. While currently focused on AI training demand, Equinix is well-positioned for future inferencing growth, demonstrating adaptability to evolving AI infrastructure needs.

AAPL: Bernstein outlines their reasoning for analyst Toni S making it a top pick

Bernstein views AAPL as quality compounder with mid-single digit revenue growth, margin expansion, and capital return driving double-digit EPS growth. Negative cash conversion cycle suggests valuation less demanding than appears. Bernstein sees dual AI benefits: accelerated replacement cycle (FY26) and revenue opportunities from LLM distribution/third-party integration but notes near-term caution due to weak iPhone 16 cycle suggests tactical entry at $200 or below, particularly February-April timeframe. Bull case targets $290 based on $9 FY26 EPS at 32x multiple.

WDAY: Wells Fargo details partner checks

Wells Fargo out this morning saying partner feedback remains measured, but did improve QoQ; think recent med-term guide reset helps frame a set of more achievable targets entering FY26; expect stock to work as beat/raise cadence resumes + margins improve

Other News:

ADSK: Oct US Architecture Billings Index (ABI) rises to 50.3 vs 45.7 in September

CMCSA: Comcast Greenlights $7 Billion Spinoff of NBCUniversal Cable Channels - WSJ

ByteDance: Senator says Trump cannot ignore law requiring ByteDance to divest TikTok by next year - Reuters

MSFT, Gen AI: Microsoft Ignite Shows AI Progress Has Slowed. The Focus Turns to Profits. – link

NVDA: Exclusive | Sam Altman seeks backers for AI chipmaker to challenge Nvidia: source– NY Post