TMTB Morning Wrap

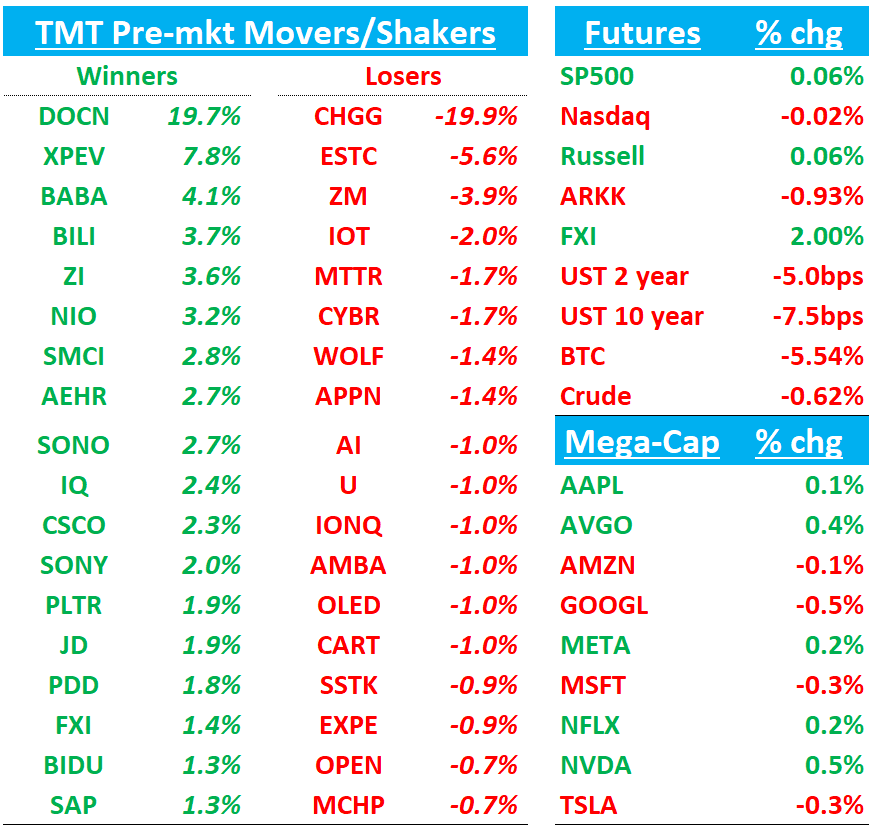

QQQs hovering around flat as yields move lower 5-8bps across the curve. BTC -5% now below $90k. China +1.5% (BABA +4%). Let’s get straight to it…

Nvidia's H20 chip orders jump as Chinese firms adopt DeepSeek's AI models

Similar to what we have been hearing from sell-side checks over the past couple of weeks…

Chinese companies are ramping up orders for Nvidia's (NVDA) H20 artificial intelligence chip due to booming demand for DeepSeek's low-cost AI models, six people familiar with the matter said.

The surge in orders, which is being reported for the first time by Reuters, underlines Nvidia's dominance of the market and could help alleviate concerns that DeepSeek might cause a slide in AI chip demand.

Tencent (0700.HK), Alibaba (BABA) and ByteDance have "significantly increased" orders of the H20 - a chip specific to China due to U.S. export controls - since the Chinese AI startup burst into the global public consciousness last month, two of the people said.

NVDA: Truist/ISI preview the q

Truist maintains Buy rating and $204 price target on NVIDIA, citing encouraging industry feedback ahead of Q4 results. Recent channel checks indicate high-volume GB200 NVL72 system shipments and installations, viewed as "highly constructive" for Q2 revenue and profits. The firm addresses three key investor concerns: Hopper transition (deemed a "passing concern"), production challenges (concentrated in NVL72 density/rollout), and potential DeepSeek-driven capex pauses. However, they note "downright constructive" recent data points, including strong capex guidance from major hyperscalers, Project Stargate, and positive commentary from semiconductor supply chain companies. The firm anticipates positive stock reaction, with GTC in March providing the next catalyst.

ISI maintains Buy on NVIDIA heading into January quarter earnings, seeing favorable setup despite investor concerns. They identify four key worries: DeepSeek reducing AI demand, shifting compute to ASICs, Blackwell delays, and potential hyperscaler capex digestion. While not expecting significant beat/raise results, the firm notes NVIDIA's 30x NTM P/E represents the cheapest AI stock in their coverage. They believe even modest upside coupled with positive commentary on visibility and second-half 2025 Blackwell outlook could serve as a positive catalyst.

3P Roundup:

CVNA: Yip saying unit sales accelerated to 50% y/y in week ending 2/23 an 8ppt improvement from prior week driven by tax seasonality

CHWY: M-sci saying Q1D growth has accelerated 200-300bps

NVDA: M-sci saying new accelerator deployment tracked up significantly in 1H Feb

ZM: Decent Q4 and Initial FY26 guide inline after adj for fx

Overall, nothing to get too excited either way on the print. Sentiment/Positioning was neutral heading in and this print won’t change either bulls or bears minds. The after hours sell off was driven by mgmt’s FY26 guide which was just in line at 3.1% fx adjusted which fell a bit short of bulls hopes of acceleration, although bulls will say the guide is conservative given new CFO. Despite slight miss, bulls will hold onto hopes that workvivo, international expansion, growing partner ecosystem, and initiatives for front line workers will drive a re-acceleration back to 4%+ while AI Companion 2.0 launch in April could provide a much-needed sentiment boost (although meaningful contribution won’t be this year). Bears will say stock is unexciting here and say co didn’t do enough to give investors confidence in re-acceleration.

ZM 2026 F/Y GUIDANCE

- Guides revenue $4.79B to $4.80B, EST $4.81B

- Guides ADJ EPS $5.34 to $5.37, EST $5.37

- Guides free cash flow $1.68B to $1.72B, EST $1.62B

GUIDANCE: Q1

- Guides operating income $440.0M to $445.0M, EST $452.7M

- Guides ADJ EPS $1.29 to $1.31, EST $1.31

RESULTS: Q4

- Revenue $1.18B, +3.3% y/y, EST $1.18B

- ADJ EPS $1.41 vs. $1.42 y/y, EST $1.31

- Free cash flow $416.2M, +25% y/y, EST $245.8M

- Cash and cash equivalents $1.35B, -13% y/y, EST $1.37B

ANET: MS Defends saying higher ROI for GenAI means more networking spend

MS sees a $30B opportunity for AI networking and transceiver use cases in the coming years and they see ANET as best positioned, noting the “Ethernet opportunity is set to grow at 30%+ CAGR through ‘28”. Morgan Stanley defends ANET against recent selloff driven by Meta revenue concerns and Microsoft capex worries. The firm argues Meta revenue declines reflect normal cycles after 329%/8% growth in 2022/2023 during 400G upgrades, which created challenging comparisons for 2024. Meanwhile, other major cloud customers plus Apple grew approximately 30% year-over-year, even before significant AI contributions. MS thinks the recent sell off in ANET misses the fact that 1) AI opportunity is still scaling 2) higher ROI increases should increase front-end space 3) EOS still highly differentiated.

PYPL +3%: Targets dd EPS growth by 2027, high single-digit transaction margin growth and low teens+ non-GAAP EPS growth by 2027, with LT ambitions of 20%+ EPS growth

CRM: Citi lowers PT to $350 from $390 as they preview the q citing mixed checks / JPM preview cites more positive checks / RBC positive checks as well

Citi analyst Tyler Radke lowered the firm's price target on Salesforce to $350 from $390 and keeps a Neutral rating on the shares ahead of the Q4 report on February 26. The firm's partner checks suggest mixed demand trends for Salesforce. with higher 2025 growth targets and strong Agentforce activity, but heavy discounts to drive adoption. Citi expects the company's revenue and bookings growth to "remain constrained" in the high-single-digits, though it generally sees consensus estimates as achievable for Q4 and Q1.

JPMorgan's partner survey shows first above-plan performance (+1.2%) in 10 quarters ahead of Salesforce earnings. Agentforce momentum continues with highest-ever product momentum — 60% of partners have closed Agentforce deals (up from 8% last quarter), with approximately 9% of Salesforce customers having purchased the product, mostly in small deployments. Partner feedback shows 40% positive vs 12% skeptical. Despite these strong results, JPM still thinks guide will come in conservative although they note investors may find comfort in potential Agentforcec +Datacloud ARR disclosure

RBC hosted an investors call with RBC Wealth Mgmt Head of Tech and he interestingly noted that previous to implementing Agentforce, he didn’t have a major requirement for Data Cloud, but with rollout and usage of Agentforce, he has found significant use in Data Cloud

CART: BofA has a mixed preview out

BofA maintains Neutral rating on Instacart while raising price target to $53, seeing modest upside to Street estimates with Q4 GTV/revenue/EBITDA projected at $8.64B/$886M/$239M versus consensus of $8.61B/$891M/$240M. The firm expects Q1 guidance to bracket Street estimates on GTV but come in slightly below on EBITDA. BofA notes mixed Q4 data shows BAC card data indicating 5% QoQ growth in US online grocery orders (acceleration from Q3's 4%), while Bloomberg Second Measure and Sensor Tower MAUs suggest slowing yearly trends. (reminder - Yipit and M-sci showing a Q4 beat and Q1 tracking 300-400bps ahead of street). BofA notes the Uber partnership appears successful alongside strong consumer trends, potentially driving modest Q4 upside despite increased marketing spend from competitors.

XYZ: Block upgraded to Equal Weight from Underweight at Morgan Stanley

Morgan Stanley upgraded Block to Equal Weight from Underweight with an unchanged price target of $65. The stock's current valuation "incorporates increased skepticism" of Block's ability to accelerate Square Seller growth, while the implied Cash App valuation is more in-line with Morgan Stanley's assumptions given a limited demographic opportunity, the analyst tells investors in a research note. The firm cites valuation for the upgrade, saying Block's challenges to Seller acceleration is now well appreciated while the implied Cash App valuation is more reasonable.

CHGG -22%: Chegg to explore strategic alternatives, files lawsuit against Google

TheFly:

Chegg (CHGG) on Monday announced that it has filed a lawsuit in federal district court against Google (GOOGL), claiming that AI summaries of search results have hurt the online education company's traffic and revenue. The company also said it has engaged Goldman Sachs (GS) to consider strategic options, including acquisitions and going private. Chegg said the actions are "connected, as we would not need to review strategic alternatives if Google hadn't launched AI Overviews or AIO, retaining traffic that has historically had come to Chegg, materially impacting our acquisitions, revenue and employees. "Chegg has a superior product for education as evident by our brand awareness, engagement and retention. Unfortunately, traffic is being blocked from ever coming to Chegg because of Google's AIO and their use of Chegg's content to keep visitors on their own platform. We retained Goldman Sachs as the financial adviser in connection with strategic review and Susman Godfrey with respect to our complaint against Google."

TCOM -8%: Strong Q4 but Ad Costs +45% weigh on margin guide

Cowen recaps the q well: “Q4 rev beat at +23% y/y vs. guide +17-20%, on better domestic share gains in an improved market and acceleration at Trip.com (GBV was +70% y/y, vs. Q3 +60%. Q1E rev trending to +14-19% on domestic share gains, strong outbound (>20%), and Trip.com rev. up >50%. After historically low ad spend in '22-23A at ~20% of revenue, ad spend was 22% of revenue in 24A (RMB +29% y/y) on Trip.com spend. 25E ad cost guided to 24% of revenue (+25% y/y) on Trip.com investments, which is also driving slightly lower gross margin, resulting in 25E NGOI margin guide ~28%, -250 bps y/y (and down from prior exp. ~29%).”

Bears will say story isn’t exciting as this is third year post China reopening and growth is normalizing with mgmt rev guide at mid teens in 2025 vs 20% in 2024 and 25% in 2023 (vs 2019), margin estimates need a reset, and China flows have shifted from non-AI to AI while bulls will say mgmt guide is usually conservative (TCOM beat initial margin guidance by 300bps), stock is still cheap at 15x P/E, and LT thesis remains unchanged (global expansion, dominant share, strong moat and multiple growth engines).

DeepSeek rushes to launch new AI model as China goes all in

DeepSeek is looking to press home its advantage.

The Chinese startup triggered a $1 trillion-plus sell-off in global equities markets last month with a cut-price AI reasoning model that outperformed many Western competitors.

Now, the Hangzhou-based firm is accelerating the launch of the successor to January's R1 model, according to three people familiar with the company.

Deepseek had planned to release R2 in early May but now wants it out as early as possible, two of them said, without providing specifics.

Trump Team Seeks to Toughen Biden’s Chip Controls Over China

Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under Joe Biden to limit Beijing’s technological prowess.

Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd. and ASML Holding NV engineers from maintaining semiconductor gear in China, according to people familiar with the matter. The aim, which was also a priority for Biden, is to see key allies match China curbs the US has placed on American chip-gear companies, including Lam Research Corp., KLA Corp. and Applied Materials Inc.

AMZN: AI Startup Anthropic Finalizing $3.5 Billion Funding Round

Anthropic is finalizing a $3.5 billion funding round that values the startup behind the chatbot Claude at $61.5 billion, showing how eager investors are to back promising artificial-intelligence companies despite the disruptive arrival of China’s DeepSeek.

Anthropic initially set out to raise $2 billion, but was able to increase that amount during talks with investors, according to people familiar with the matter. Founded in 2021 by former OpenAI employees, the startup was previously valued at $18 billion and is considered one of the few AI startups with enough talent and funding to compete with OpenAI.

The $61.5 billion valuation includes the cash Anthropic is raising.

Investors in the latest round include the venture firms Lightspeed Venture Partners, General Catalyst, and Bessemer Venture Partners, the people said. Abu Dhabi-based investment firm MGX is also in talks to participate.

GTLB: KEYB previews the q expecting upside and inline FY26

In terms of FY26, KEYB is expecting GitLab to guide revenue (on a $ basis) largely in line with the Street's $939M estimate. After adjusting for the potential FQ4 beat, the headline number will likely translate to a slightly lower growth rate than the current consensus estimate of 24.5% y/y. That said, KEYB would still view this trade off positively, given the past two years (FY24 and FY25) saw more conservative initial guidance from both a revenue dollar and revenue growth rate perspective, and ultimately exceeded initial expectations meaningfully each year. Also, given this will be new CEO Bill Staples first year at the helm, KEYB acknowledge that management may opt to take a more conservative approach to guidance to account for any potential transition disruptions. KEYB remains constructive on GitLab's competitive positioning in the DevOps landscape in 2025 and will be looking for further evidence of improving Duo attach rates and better large deal activity, and continue to view GitLab as one of its high conviction ideas this year

CYBR: Stifel recaps investor day

Stifel notes CyberArk's analyst day highlighted the company's growing platform to secure both Human (Workforce, IT, Dev elopers) and Machine (Devices, Workloads, and AI) identities as CyberArk goes after an $80B TAM. CyberArk introduced FY28 targets calling for a 17.6% 3-year ARR CAGR and 18.8% revenue CAGR (in-line with Stifel's expectations of 17%-20% growth but below some whisper numbers on the buy-side looking for 20% CAGR), along with a 27% FCF Margin (above buy-side expectations).While lots of opportunities remain in CyberArk's core PAM identity market, Machine Identity, IGA, and Agentic AI are three newer focus areas that represent emerging growth opportunities in coming years., notes Stifel

SNOW: Snowflake price target raised to $230 from $225 at Citi

The firm says its channel checks were "slightly mixed" on the quarter, with artificial intelligence monetization that remains early, macro caution with some partners noting a downtick in growth trend, and weaker new customer additions. Citi says that while Snowflake's near-term catalyst path is still mixed, it sees a solid entry point into the shares at current levels.

Other News:

AAPL: Indonesia and Apple Said to Agree on Terms to Lift iPhone 16 Ban - Bloomberg

AAPL: Apple’s $500 Billion U.S. Investment Is Mostly Already in the Books - WSJ WSJ

Huawei: Huawei improves AI chip production in boost for China’s tech goals…Has significantly improved the manufacturing yield of its advanced AI chips in a breakthrough for the country’s quest for self-sufficiency in this key area of technology FT

M&A: Trump FTC Chair Pledges to Keep Aggressive Merger Enforcement Bloomberg

TSLA: Tesla starts 2025 with sharp drop in sales in Europe…Sales tumbled >45% Y/Y in Europe during the month of Jan, evidence that Musk’s political activities are hurting the company’s brand - FinancialTimes