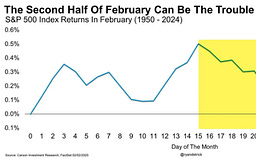

We won’t spend too much time on the macro today as not much has changed since our post last week. A continued choppy market is our base case scenario. The 2H Feb seasonal weakness played out and now we are entering a better period for stocks:

我们今天不会过多讨论宏观经济,因为自我们上周发帖以来变化不大。持续动荡的市场是我们的基本情景。2 月后半段的季节性疲软已经显现,现在我们正进入一个对股票更有利的时期:

Could we get another 3-5% down. Sure. Could the markets rally 1-3% this week. Sure. We remain focused on adding to key names at the right r/r levels as we struggle with getting too negative on the market. We saw some nice px action Thursday/Friday and saw some stocks refrain from making new lows while the QQQs went onto to make new lows by 2% on Thursday. Most of these stocks are high-quality market leaders, which is a good sign. We saw positive px divergence in AMZN, SHOP, CHWY, DASH, META, Z, RDDT, NFLX, CFLT, GTLB, PANW, APP, NOW, NET, TWLO, TEAM.

能否再下跌 3-5%。当然。本周市场能否上涨 1-3%。当然。我们仍然专注于在合适的风险回报水平上增持关键股票,因为我们难以对市场过于悲观。我们在周四/周五看到了一些不错的价格走势,并看到一些股票避免了创下新低,而 QQQ 周四则下跌了 2%,创下新低。这些股票大多是高质量的市场领导者,这是一个好兆头。我们在 AMZN、SHOP、CHWY、DASH、META、Z、RDDT、NFLX、CFLT、GTLB、PANW、APP、NOW、NET、TWLO、TEAM 中看到了积极的价格背离。

The key macro narrative remains growth scare fears given tariffs + DOGE and at what point the market shifts from bad is bad to bad is good on economic data (meaning: the econ data has gotten so bad the Fed can start easing again). On Friday, the declining Atlanta Fed GDP # helped catalyze a market rally near the end of the day and declining yields/data/inflation is helping brew the narrative that all these things are giving the Fed cover for a cut. Fed expectations have shifted from 30bps worth of cuts this year to 70bps worth of cuts. Are we completely there on the bad is good shift? We don’t think so, but the narrative is bubbling. The next Fed meeting is 3/18 and we likely get the typical tea leaves around what their thinking is beginning a week before that.

主要宏观叙事仍然是增长担忧,考虑到关税+DOGE,以及市场何时从坏事是坏事转变为坏事是好事(意思是:经济数据已经糟糕到美联储可以再次放松的地步)。周五,亚特兰大联储 GDP 数据下降帮助催化了当日收盘附近的市场反弹,而收益率/数据/通胀下降正在助长这样一种说法:所有这些都为美联储降息提供了掩护。对美联储的预期已从今年 30 个基点的降息转变为 70 个基点的降息。我们是否完全处于坏事是好事的转变中?我们不这么认为,但这种说法正在酝酿。下一次美联储会议是 3 月 18 日,我们可能会在一周前开始了解他们的一些想法。

We think macro releases will continue to play an outsized role and this week we have 2 ISMs, SOTU speech, and NFP on Friday (most impt).

我们认为宏观数据发布将继续发挥过大的作用,本周我们将迎来两次 ISM 报告、国情咨文演讲,以及周五的非农就业报告(最重要)。

Side note: BTC is +7-8% this weekend…we’ll see if that’s a precursor for risk on tomorrow.

旁注:本周末 BTC 上涨 7-8%……我们将看看这是否是明天风险偏好的前兆。

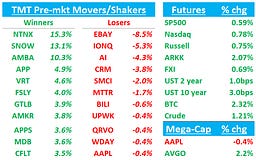

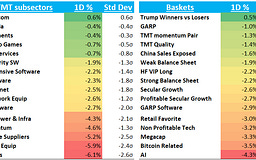

What’s on our mind in Tech after this week:

本周科技领域我们的关注点:

APP: We won’t go into much more detail on the short reports than we already did this week but liked this recap a reader sent us:

APP:我们不会比本周已经讨论的更详细地介绍简短报告,但我们喜欢一位读者发给我们的这篇回顾:We thought UBS also put it well:

我们认为瑞银的表述也很好:“mobile game ad quality has also never struck us as exceedingly high, but what drives gaming/ecom advertisers to spend more on the installs/clicks is not installs/click volume itself, but rather the spend these installs/clicks deliver from end users. Bottom line: while the reaction to this report strikes us as overblown considering the feedback we recevived from checks on ROAS/pay-back quality, his will likely remain an overhang until APP addresses these allegations head on.”

移动游戏广告质量也从未让我们觉得特别高,但驱动游戏/电商广告主在安装/点击上投入更多资金的,并非安装/点击量本身,而是这些安装/点击从最终用户那里带来的支出。底线是:虽然考虑到我们从 ROAS/回报质量检查中收到的反馈,对这份报告的反应让我们觉得有些夸大,但这可能会持续成为一个悬而未决的问题,直到 APP 正面回应这些指控。CEO then put out a blog post defending. Co also announced they wanted to accelerate repurchases Friday post-close. Mgmt is on the road over the next two weeks and we have potential SP500 add in 3/7. So catalyst path sounds decent over the next couple of weeks for a potential rally IF momentum can stabilize (we think 3/14 $400s worth a flier) We don’t think it’s a bad thing some weak hands have left the stock as bull case remains intact with plenty of upside to #s and now you have a mgmt team that seems angry/bent on getting their stock price up again and largely controls their destiny near-term.

首席执行官随后发表博客文章进行辩护。公司还宣布他们想在周五收盘后加速回购。管理层在接下来的两周内会四处奔波,我们可能会在 3 月 7 日增加标普 500 指数成分股。因此,如果势头能够稳定下来,未来几周潜在的催化剂路径看起来不错(我们认为 3 月 14 日 400 美元附近值得一试)。我们不认为一些弱势投资者离场是坏事,因为看涨论点依然完整,还有很大的上涨空间,而且现在你有一个似乎很生气/决心要让股价再次上涨的管理团队,并且在短期内很大程度上掌握着自己的命运。NVDA: Here’s what we wrote Thursday post-print:

NVDA:以下是我们在周四收盘后撰写的文章:

Overall - we thought print was good enough. Buyside numbers really don’t change - $6 still on the table for CY26, which means NVDA tracing at 22x that #. We like the catalyst path ahead, think the r/r is decent at these levels and think path of least resistance is up as we head through GTC in March where Jensen said they will talk about Ultra, Rubin and other AI including physical AI. This Q was a bit of a snooze fest but important because it means we’re one quarter past the ramp issues and one quarter closer to summer when beats/bw should ramp hard. We’d get more aggressive near $120.

总的来说——我们认为打印版已经足够好了。买方数据实际上并没有变化——2026 财年仍有 6 美元的预期,这意味着英伟达的估值是其 22 倍。我们看好未来的催化剂路径,认为在当前水平上的风险回报率相当不错,并且认为随着我们进入三月份的 GTC,阻力最小的路径是向上,届时 Jensen 表示他们将讨论 Ultra、Rubin 和其他 AI,包括物理 AI。本季度有点乏味,但很重要,因为它意味着我们已经度过了爬坡问题的季度,并且距离夏季(届时业绩/带宽应该大幅提升)又近了一个季度。我们会在接近 120 美元时采取更积极的策略。

Friday brought that $120 level and we got a good first bounce off it. Doesn’t necessarily mean it’s the bottom, but we continue to think r/r is attractive there. At $120, 25x street CY25 EPS is less than 10% down from here. 25x is near the bottom of the range where stock has traded since 2016:

周五达到 120 美元的水平,我们得到了不错的首次反弹。但这并不一定意味着这是底部,但我们认为在此水平上的风险回报比仍然具有吸引力。在 120 美元的价位上,基于 2025 财年每股收益的 25 倍市盈率,较目前水平下跌不到 10%。25 倍市盈率接近该股票自 2016 年以来交易区间的底部。

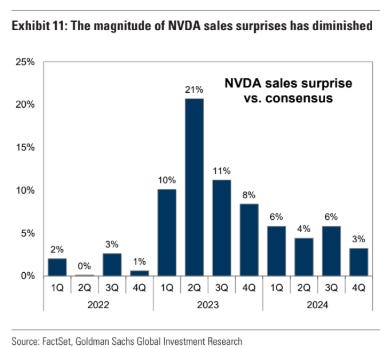

We continue to be price sensitive with NVDA and play r/r ranges as we think scaling and inference pricing overhangs unlikely to be resolved any time soon and we are still several months away from some bigger BW beats:

我们继续对 NVDA 的价格保持敏感,并利用风险回报区间进行交易,因为我们认为规模和推理定价的压力短期内不太可能解决,距离一些更大的带宽增长超过预期还有几个月的时间:

Side note: some talk over the last couple of days of CoWoS cuts for B300A chip. Here AYZ:

旁注:过去几天有一些关于 B300A 芯片 CoWoS 削减的讨论。以下是 AYZ:

NVIDIA initially secured approximately ~450k CoWoS capacity at TSMC, including around 60k for CoWoS-S and 390k for CoWoS-L. However, due to a significant reduction in the production target of its B300A chip using CoWoS-S, NVIDIA’s revised CoWoS capacity at TSMC for 2025 has been lowered to 397k wafers, with only 10k allocated to CoWoS-S and 387k to CoWoS-L.

NVIDIA 最初在台积电获得了约~450k 的 CoWoS 产能,其中约 60k 用于 CoWoS-S,390k 用于 CoWoS-L。但是,由于其使用 CoWoS-S 的 B300A 芯片的生产目标大幅下降,NVIDIA 在台积电 2025 年的 CoWoS 产能已下调至 397k 晶圆,其中只有 10k 分配给 CoWoS-S,387k 分配给 CoWoS-L。

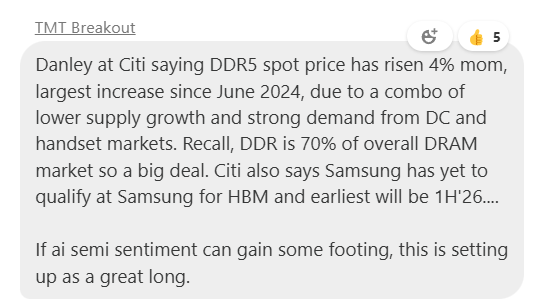

MU: We continue to like the r/r here. Any time stocks dips to $90, we like selling some Apr 80Ps and using that to fund some June 110 Cs. On Friday, Danley at Citi was out with some positive datapoints around DDDR pricing:

MU:我们继续看好这里的风险回报比。股价任何时候跌至 90 美元,我们都喜欢卖出一些 4 月 80 美元看跌期权,并用它来资助一些 6 月 110 美元看涨期权。周五,花旗的丹利发布了一些关于 DDDR 定价的积极数据点:

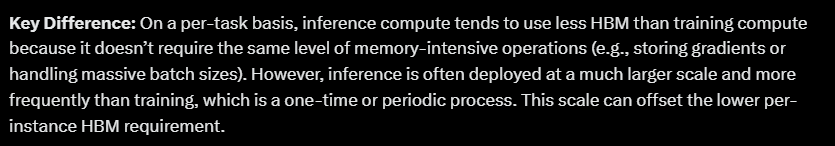

The turn in conventional DRAM pricing is looking less and less like a head fake and if it truly is the first signs of a bigger turn, we feel more comfortable stock is unlikely to drift below $85 lows of the last year. If we can get some stabilization in AI sentiment, stock could really work as Blackwell ramps. One thing to watch for in narrative/sentiment is that Inference demand uses less HBMs than training demand. Here’s our new analyst Grok 3:

传统 DRAM 价格的转变越来越不像虚晃一枪,如果这确实是更大转变的最初迹象,我们对股价不太可能跌破去年 85 美元低点的信心更足。如果 AI 情绪能够稳定下来,随着 Blackwell 的增长,股价可能会真的上涨。在叙事/情绪方面需要注意的一点是,推理需求比训练需求使用更少的 HBM。这是我们新的分析师 Grok 3:

RBLX: Got some really positive 3p datapoints this week with DAUs/Hours Engaged tracking 5-10 ppts above street and Yipit/Msci were both out positive on bookings data so far in Q1. Yipit said bookings were up close to 40% vs street at 23%. This is important as puts a kibosh on bear fears that Q4 was more than a one-time anomaly bc of tougher PS4 comps and gives mgmt’s comments around Jan accelerating credibility. We continue to like the medium/long term story here — advertising ramp, pricing change driving better bookings growth, increased amount of direct bookings, bringing more content creators to platform, AI video game generation driving increased content creation driving flywheel effect, better monetizing in-game / burgeoning partnership with SHOP. We added on Thursday on the better 3p data and think stock can go back to outperforming now that 3p trends are a tailwind.

RBLX:本周获得了一些非常积极的第三方数据点,日活跃用户/参与时长追踪数据比市场预期高出 5-10 个百分点,Yipit/MSCI 对第一季度预订数据的积极预测也已出炉。Yipit 表示,预订量增长接近 40%,而市场预期为 23%。这很重要,因为它打破了空头对第四季度业绩(由于 PS4 对比基数更难)仅仅是昙花一现的担忧,并为管理层关于 1 月份加速增长的说法提供了可信度。我们继续看好该公司的中长期前景——广告收入增长、价格调整推动预订量增长、直接预订量增加、吸引更多内容创作者加入平台、人工智能游戏生成推动内容创作增加从而形成飞轮效应、游戏内货币化改进/与 SHOP 蓬勃发展的合作关系。我们在周四根据更好的第三方数据增持了该股票,并认为该股票现在可以恢复跑赢大盘的态势,因为第三方趋势已成为顺风。

MS TMT Conference Preview

微软 TMT 大会预告

Tech investors are converging on the Palace Hotel tomorrow for the beginning of the MS TMT Conference.

科技投资者将于明天在宫殿酒店齐聚,参加 MS TMT 大会。

Here’s the most recent schedule: link

最新的时间表:link

Here’s the webcast link: here

网络直播链接:here

Here are the presenting companies organized by sector:

以下是按行业组织的参会公司:

Some key names/themes I’m watching:

我关注的一些关键人物/主题:

Analogs: MCHP / NXPI / ADI / ON - The burgeoning narrative here has been that analogs are finally bottoming after better earnings/commentary from ADI a couple weeks ago. Recall ADI ‘s commentary:

类似公司:MCHP / NXPI / ADI / ON - 这里正在兴起的论点是,在几周前 ADI 公布了更好的收益/评论后,模拟芯片公司终于触底。回顾 ADI 的评论:

“the signals we monitor from lean channel inventories to gradual bookings improvements over the past 18 months support our view that we've passed the cyclical trough and the tide has turned in our favor.”

我们监测到的信号,从精益渠道库存到过去 18 个月订单逐步改善,都支持我们认为我们已经度过周期性低谷,形势已经好转的观点。

These companies usually provide decent commentary around near-term trends at conferences, so investors will be looking for confirmation from other analogs around what end-markets are doing. Expectations are for MCHP to provide a business update before they present tomorrow.

这些公司通常会在会议上就近期趋势提供不错的评论,因此投资者将寻求其他类似公司对最终市场的表现进行确认。预计 MCHP 将在明天演示前提供业务更新。

CHWY CFO: First time presenting at CFO. Co reports on 3/20 so it’s a bit weird to me their presenting during their quiet period. They don’t have a history of pre-announcing, but 3rd party data pointing to 1.5% beat to Q4 while Q1 tracking inline

CHWY 首席财务官:第一次在 CFO 会议上做报告。公司将在 3 月 20 日发布报告,所以在静默期内做报告对我来说有点奇怪。他们没有提前公布业绩的记录,但第三方数据显示第四季度超出预期 1.5%,第一季度业绩符合预期。

PINS CEO: Co. beat and raised last q, surprising investors, but stock has pulled back 10% since then. That’s not surprising to us as we think PINS needs another quarter of beating before they can get believers of the bull case (growth closer to 20%) back on board. CEO sounded really good on the earnings call so we expect more positivity and if he gives any intra-q commentary around trends, we think could help stock going again. We actually like the long r/r here. 8% down is the earnings gap from when they beat and raised and we would be very surprised to see stock go below that barring a big miss. Bull case is something like $2.3-$2.4 in EPS in FY26 and giving a 20x multiple to that is close to 30% upside. Not super sexy, but I think a decent B/B+ idea.

PINS CEO:公司上一季度业绩超预期并上调了预期,令投资者感到意外,但股价自那以来已回调 10%。这并不让我们感到意外,因为我们认为 PINS 需要再有一个季度超出预期才能让看涨论者(增长接近 20%)重新加入。CEO 在财报电话会议上的发言非常好,因此我们预计会有更多积极因素,如果他给出任何关于趋势的季度内评论,我们认为可能会帮助股价再次上涨。我们实际上看好这里的风险回报比。下跌 8%是他们业绩超预期并上调预期时的收益差距,除非出现重大不及预期的情况,否则我们非常惊讶股价会跌破该水平。看涨情景是 2026 财年每股收益约为 2.3-2.4 美元,给予其 20 倍市盈率,接近 30%的上涨空间。不算非常诱人,但我认为这是一个不错的 B/B+级别投资想法。

GOOGL CFO: One of the first conferences for the new CFO so will be good to hear her commentary around opex, capex, spending. Last year the stock bottomed around the time of MS conference as co did a good job defending themselves from AI fears and there’s a decent catalyst path in spring (i/o conference, etc.). However, difference between last year (when we played the long trade) and this year is that last year 3p search was tracking ahead of expectations while this year search is tracking 2ppts below street so far (although has improved in recent weeks). We find it tough to be long GOOGL for a sustainable move up unless search is tracking ahead as that’s only thing that puts AI search bears on the backfoot.

GOOGL CFO:新任 CFO 参加的首批会议之一,因此倾听她对运营支出、资本支出和支出的评论将很有意义。去年,该股票在微软会议前后触底,因为该公司在应对人工智能担忧方面做得很好,并且在春季存在不错的催化剂路径(I/O 大会等)。然而,去年(我们进行长期交易时)和今年的区别在于,去年第三方搜索的业绩超出预期,而今年到目前为止搜索业绩比市场预期低 2 个百分点(尽管近几周有所改善)。除非搜索业绩超出预期,否则我们认为难以做多 GOOGL 以实现可持续的上涨,因为这是唯一能让做空人工智能搜索的投资者退缩的因素。

RDDT COO / TTD CEO: Two stocks which are down significantly since their report, but were also crowded longs with plenty of LO support before the print. Part of the reasons bulls have been a bit reluctant to step back in on RDDT is the GOOGL algo volatility that resulted in last quarter’s miss — while mgmt said in early Feb that Q1 trends were back on track, some investors questioned if this wasn’t the end of more potential changes at GOOGL. Re-affirming trends have continued to rebound since Q4 should begin to get stock back on solid footing.

RDDT 首席运营官/TTD 首席执行官:两支股票自财报发布以来大幅下跌,但在公布业绩之前,做多该股票的投资者众多,并且有充足的做多支撑。看涨者不愿重新买入 RDDT 的部分原因是 GOOGL 算法波动导致上一季度业绩不及预期——尽管管理层在 2 月份初表示第一季度趋势已恢复正轨,但一些投资者质疑这是否意味着 GOOGL 未来可能发生更多变化。重申自第四季度以来趋势持续反弹,应该能够使股价重新站稳脚跟。

TTD also has a chance to address the structural issues that have shifted it from compounder darling into the penalty box; however, CEO didn’t sound great on a BAML call last week when addressing competitive concerns re: AMZN DSP / GOOGL. Will he do a better job this time? Stock has re-rated down to our first tgt of 25x ‘26 EBITDA ($70) and we think pops will continue to get sold unless we see some narrative change and/or CEO tone change.

TTD 也有机会解决使其从备受青睐的复合增长公司变成被罚下场的结构性问题;然而,首席执行官上周在美银美林的电话会议上谈及与 AMZN DSP/GOOGL 相关的竞争担忧时,听起来并不乐观。这次他会做得更好吗?股价已重新定价至我们 25 倍 2026 年 EBITDA(70 美元)的第一个目标价,我们认为除非看到一些叙事变化和/或首席执行官语气变化,否则股价上涨将继续被抛售。

NOW CEO: Bill typically sounds good and this will be a key opportunity for him to give more clarity around pricing changes/federal weakness fears that have driven the stock down 20% since earnings in late January. We don’t think it’s a bad spot to start nibbling back on the long side here.

现任 CEO:Bill 通常听起来不错,这将是他澄清定价变化/联邦政府疲软担忧的关键机会,自 1 月末财报发布以来,这些担忧已导致股价下跌 20%。我们认为现在开始少量做多并非坏事。

NFLX CFO: CFO usually doesn’t give a ton out, but back in 2023 at a conference he gave comments around margins that were perceived as talking them down at the time (although NFLX went to beat margins significantly after) - stock was hit significantly that day so there is a history of stock moving comments here although I wouldn’t expect any this time around (I think they learned their lesson). 3p data so far has been tracking inline-ish so far in Q1 (lower than Q4 = inline with their guide) although NFLX is pulling back giving any sub #s going forward. Expect positive commentary around AVOD, sports streaming, and content slate this year.

NFLX 首席财务官:首席财务官通常不会透露太多信息,但在 2023 年的一次会议上,他发表了关于利润率的评论,当时被认为是在打压利润率(尽管 NFLX 之后大幅超过了利润率预期)——当天股价受到严重打击,因此这里存在股价受评论影响的历史,尽管我这次预计不会出现这种情况(我认为他们吸取了教训)。到目前为止,第一季度第三方数据大致符合预期(低于第四季度=符合他们的预期),尽管 NFLX 正在避免给出任何具体的数字。预计今年将对 AVOD、体育流媒体和内容片单发表积极评论。

UBER CEO: Dara sounded good on the earnings call defending the stock from autonomous fears so we expect more of the same and expect investor focus to be on how he responds to any questions around rideshare market share/competition/AV rollouts. Look for positive commentary around Austin/Atlanta launches with Waymo partnership.

UBER CEO:Dara 在财报电话会议上对股票的自动驾驶担忧作出了很好的回应,因此我们预计会有更多类似的情况,并预计投资者关注的焦点将是他如何回应有关拼车市场份额/竞争/自动驾驶汽车推出的任何问题。关注围绕与 Waymo 合作在奥斯汀/亚特兰大推出的积极评论。

MSFT CFO: Investors will be looking for clarification around the Data center cancellation/delay talk we got last week and Satya’s overbuild/oversupply commentary on the Dwarkesh Patel podcast as well, as well as any traction on copilot and the future of the OpenAI relationship. Investors also would love some color around why Azure 2H acceleration guide was pulled back after last quarter as this is main issue of why stock has been in the penalty box since then.

MSFT CFO:投资者将寻求澄清我们上周收到的数据中心取消/延迟讨论以及 Satya 在 Dwarkesh Patel 播客上的过度建设/供应过剩评论,以及 Copilot 的任何进展和 OpenAI 未来关系。投资者也希望了解为什么 Azure 下半年加速指引在上个季度之后被撤回,因为这是自那以后股价受压的主要原因。

BILL CEO: Stock has been in the penalty box after missing (stock down -35%) and has failed to gain traction so any commentary addressing take rate issues and giving investors confidence around that and near-term trends would go a long way to help stock gain its footing.

BILL CEO:股价在业绩不及预期后(股价下跌-35%)一直低迷,未能获得增长动力,因此任何关于获取率问题的评论以及让投资者对该问题和近期趋势充满信心的言论,都将大有助益于股价企稳。

Open AI Sam Altman: Thursday morning and looking for any color around compute, NVDA, Stargate, MSFT, etc.

Open AI Sam Altman:周四上午,寻找关于计算、NVDA、Stargate、MSFT 等的任何信息。

TSLA’s Musk: Always entertaining

TSLA 的马斯克:永远引人注目

Anduril: Always interesting to hear Palmer Luckey talk

Anduril:帕尔默·拉奇总是很有意思

Federal Spending: Concerns around DOGE and mixed federal spending from companies like NOW. Will be interesting to hear if we get any incremental datapts from the likes of Anduril, NOW, PANW, GTLB, MSI, CSCO, etc

联邦支出:围绕 DOGE 的担忧以及 NOW 等公司混合的联邦支出。看看我们能否从 Anduril、NOW、PANW、GTLB、MSI、CSCO 等公司获得任何增量数据点,将会很有趣。

While we won’t be attending this year, but we’ll be listening to presos and passing along anything we find interesting. If you come across any interesting nuggets in meetings/presentations, please pass along.

虽然我们今年不会参加,但我们会收听报告并分享我们认为有趣的内容。如果您在会议/演示中发现任何有趣的信息,请分享。

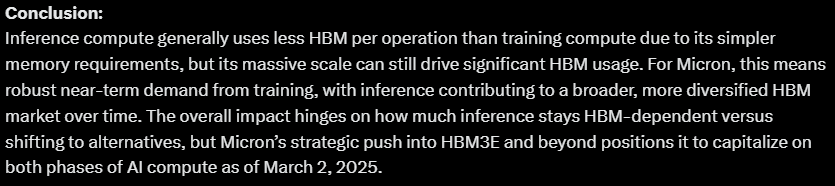

Earnings 收益

We’ll have our Earnings Matrix with some quick thoughts out tomorrow.

我们明天将发布收益矩阵及一些简短的想法。