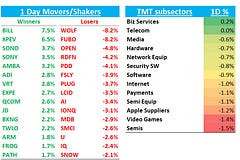

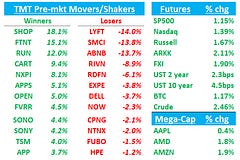

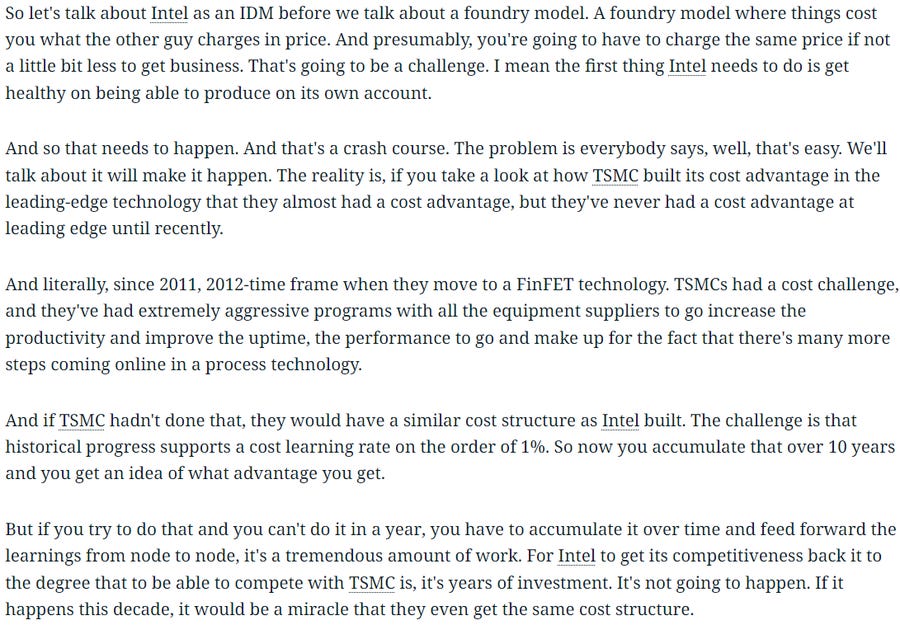

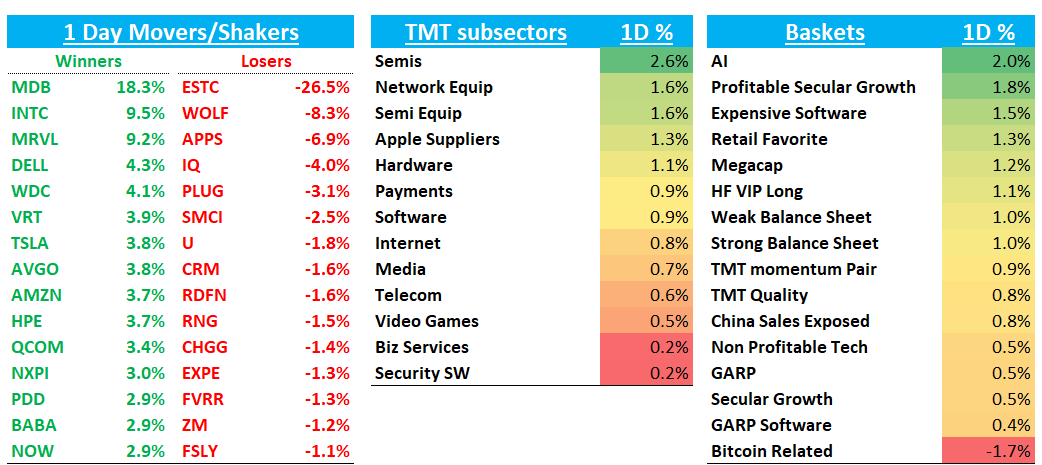

QQQs +1.2% driven by semis +2.5%, AI outperformance and some good earnings overnight. QQQs dipped briefly in the red around 12:30pm then rallied the rest of the day. VK: “Treasuries saw selling pressure on Fri following some favorable economic data in the morning and ahead of next week’s important jobs report (yields rose 3-6bp across the curve). Fed expectations didn’t shift much – the Street is anticipating a 33bp rate cut on 9/18 and 100bp for the year.”

Things should pick up in early sept as we have the Citi TMT conference starting on Wednesday then the big GS TMT conference the week after that. We’ll have agendas and recaps for you along the way…

Have a good long weekend everyone…

Let’s get to the recap..

Internet:

AMZN +3.7% as investors liked that AI Alexa would be powered by Anthropic’s Claude instead of its own internal AI, charging $5-10/month. Retail weekly data also got better near the end of the week, although still tracking slightly below street.

ROKU - 1% but was -5% intraday…some citing this article: The Trade Desk is building its own smart TV OS

BABA +3% after winning Beijing’s approval in end to years long scrutiny

NFLX +1.2% as Pivotal raised PT to street high $900 — getting very close to ATHs and would think it breaks it going into Q4

Other large cap: META +60bps; GOOGL +1%

PINS +2.7% with some outperformance

Semis

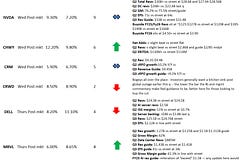

MRVL +9% as investors liked that all businesses were turning up

Other AI strong on the back of MRVL: AVGO +4%; AMD +2%; NVDA +1.5%; TSM +1.5%; ARM +70bps

INTC +9% as they hired advisors to Weigh Options Including Foundry Split to Stem Losses

Analog strong as well: NXPI +3%; ADI +2%; MCHP +1.5%

Software

MDB +18% as investors liked the Q3 and FY guide raise and thought worst is behind the company and Atlas set to accelerate in 2H

Other cloud names mixed despite the MDB strength: SNOW flat; DDOG +1%; CFLT +1.5%

ESTC - 27% as co lowered FY guide by 2%

CRWD +2% as HSBC upgraded to Buy

CRM - 1.6% / OKTA -1% with some follow through from yesterday

PLTR +1.5%

MSFT +1% / ORCL +1.3% / NOW +2.85%

Elsewhere

DELL +4% after investors liked better AI pipeline commentary despite weakness in PCs and a backlog that missed more bullish buyside expectations

AAPL -30bps underperformed

TSLA +4% with some nice strength following WB bullish initiation yesterday

Fin tech mixed: AFRM +5.5%; COIN -2.6%; PYPL -1%