A YEAR OF NEW OPPORTUNITIES

充满新机遇的一年

“Don’t think about the start of the race, think about the ending.”

“不要考虑比赛的开始,而要考虑结束。”

— Usain Bolt — 尤塞恩·博尔特

90+ updated Charts & Commentary on all major Markets — for your weekend reading.

90 多个关于所有主要市场的更新图表和评论 - 供您周末阅读。

“Don’t start the week without it”

“没有它就不要开始新的一周”

NEW DEVELOPMENTS 新进展

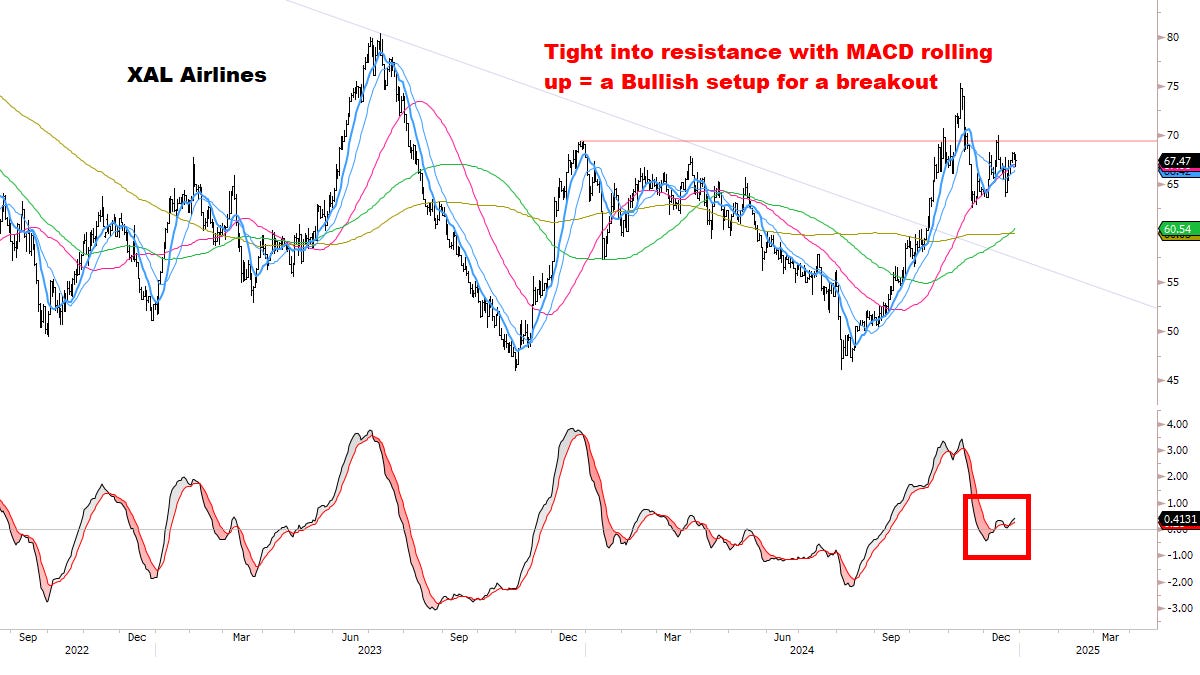

STOCKS — “IT’S TIME” (continued).

股票—— “是时候了”(续)。BUILDING ON THE SPECIAL REPORT — watching Signals closely.

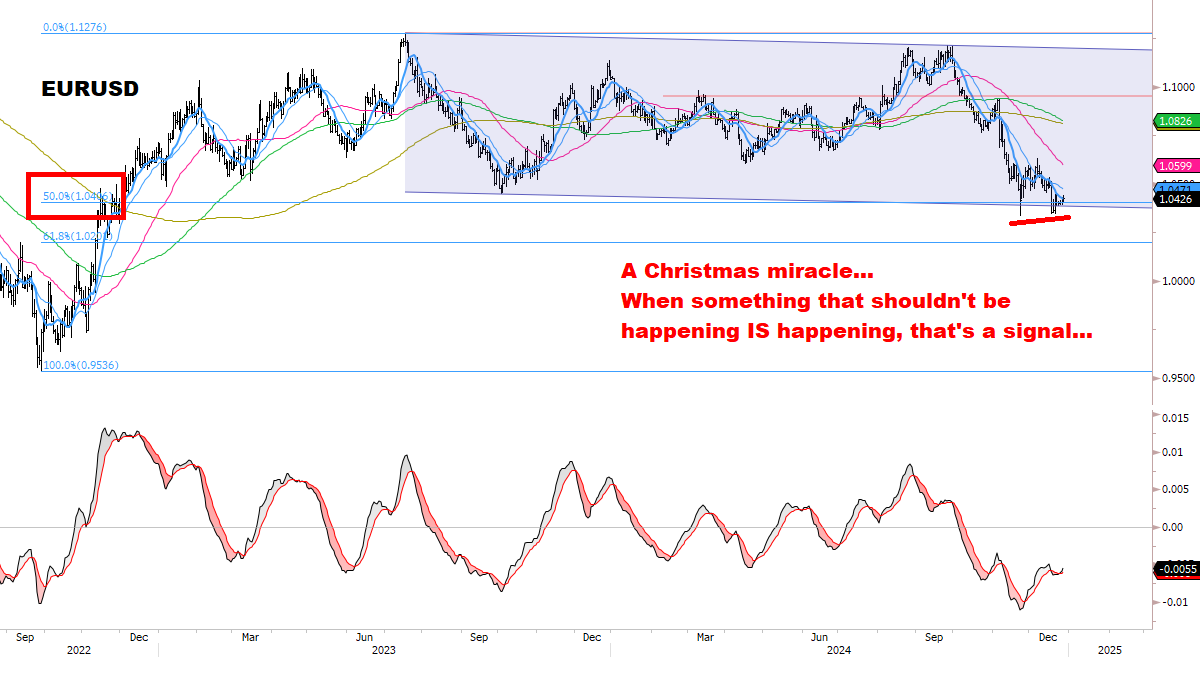

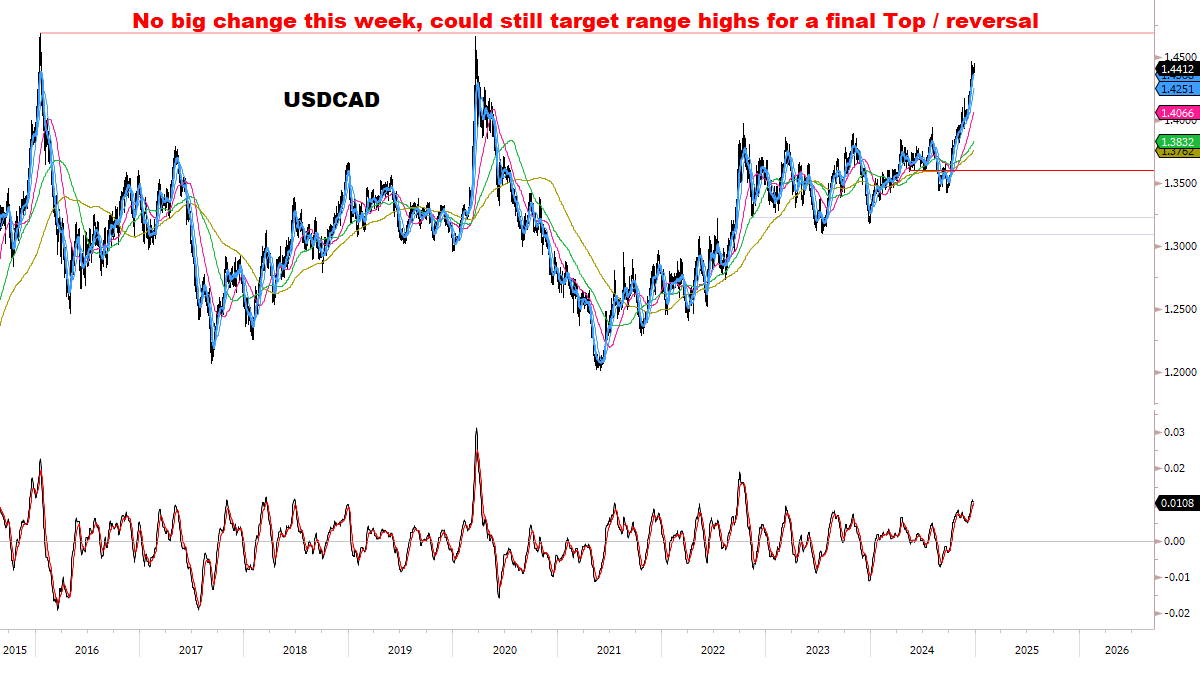

以特别报告为基础——密切关注信号。RATES and FX — A HISTORIC CAPITULATION.

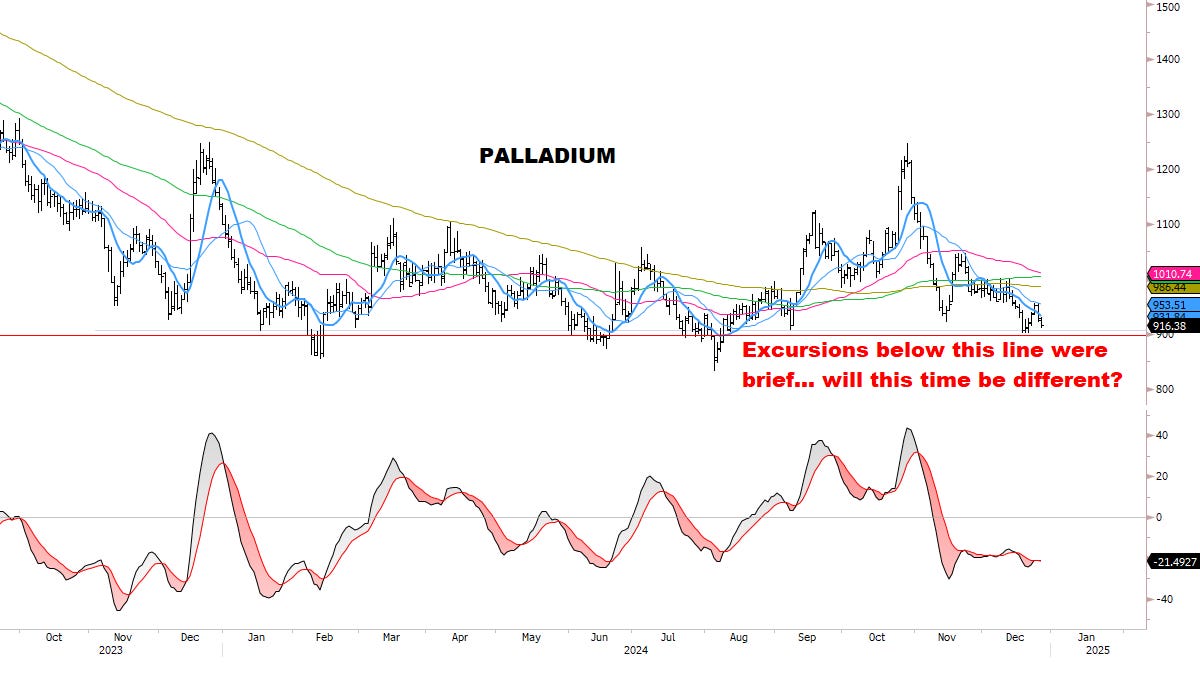

利率和外汇——历史性的投降。METALS — A classic setup.

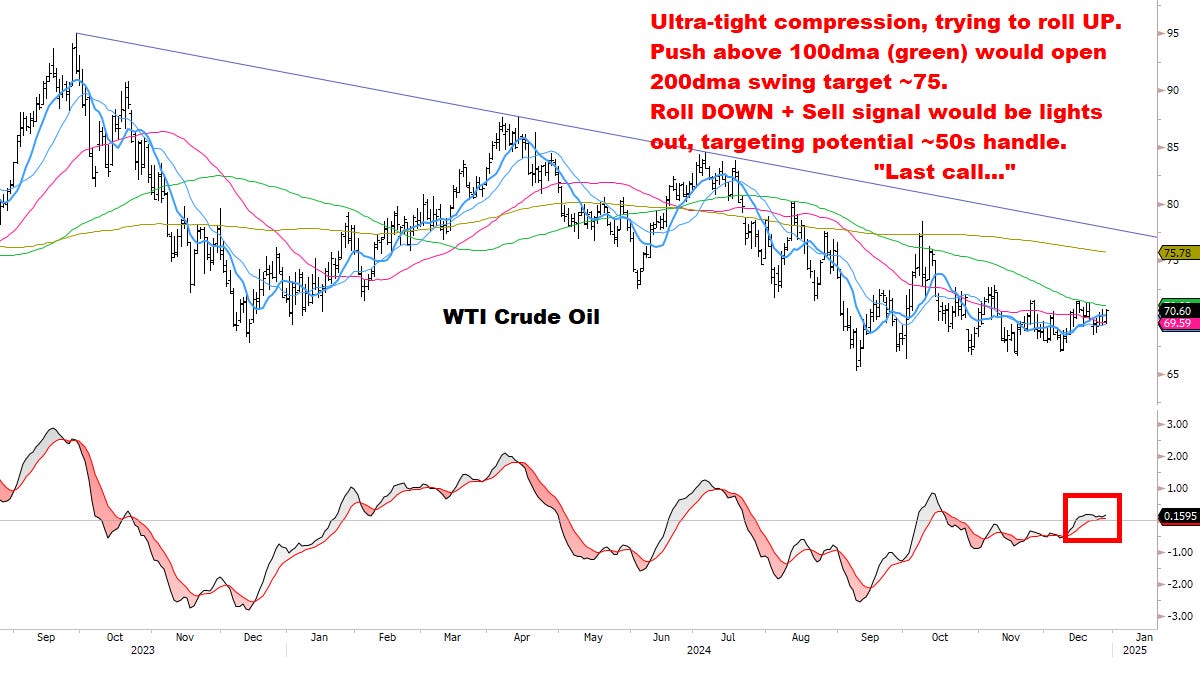

金属 —经典设置。OIL & ENERGY — “Last call…”

石油与能源—— “最后的召唤……”Complete review of KEY Market Signals.

对关键市场信号的完整审查。Full Charts & Commentary:

完整图表和评论:Core Models 核心模型

Global Equities & Sectors

全球股票和行业Volatility 挥发性

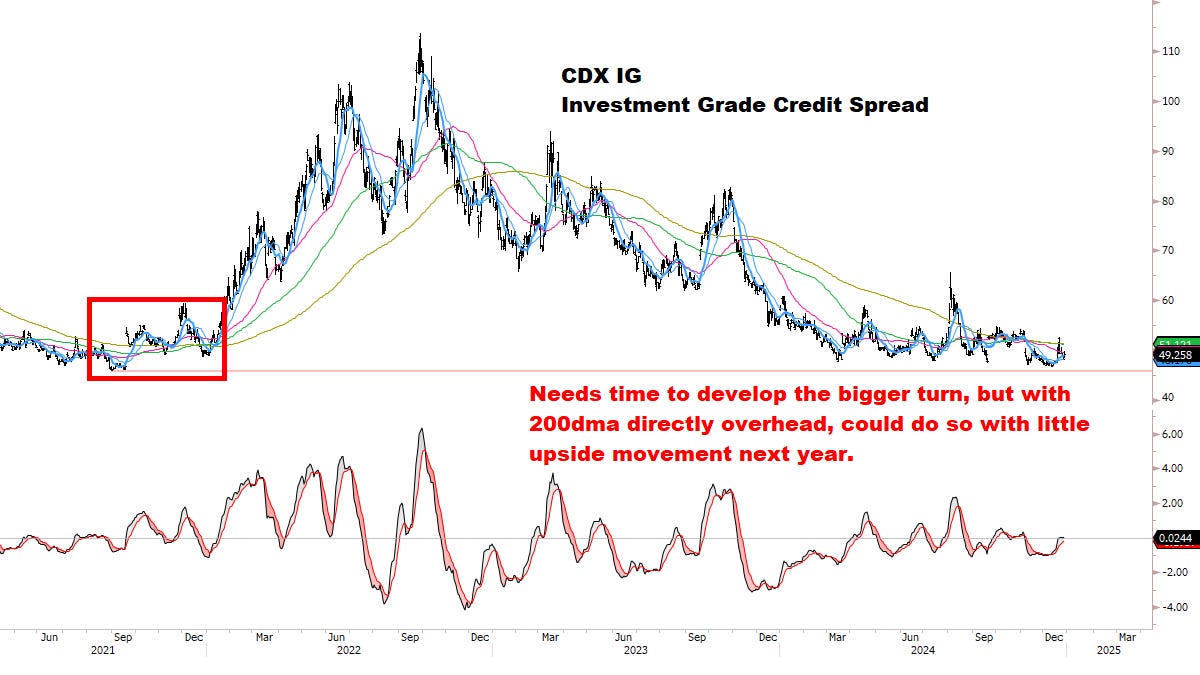

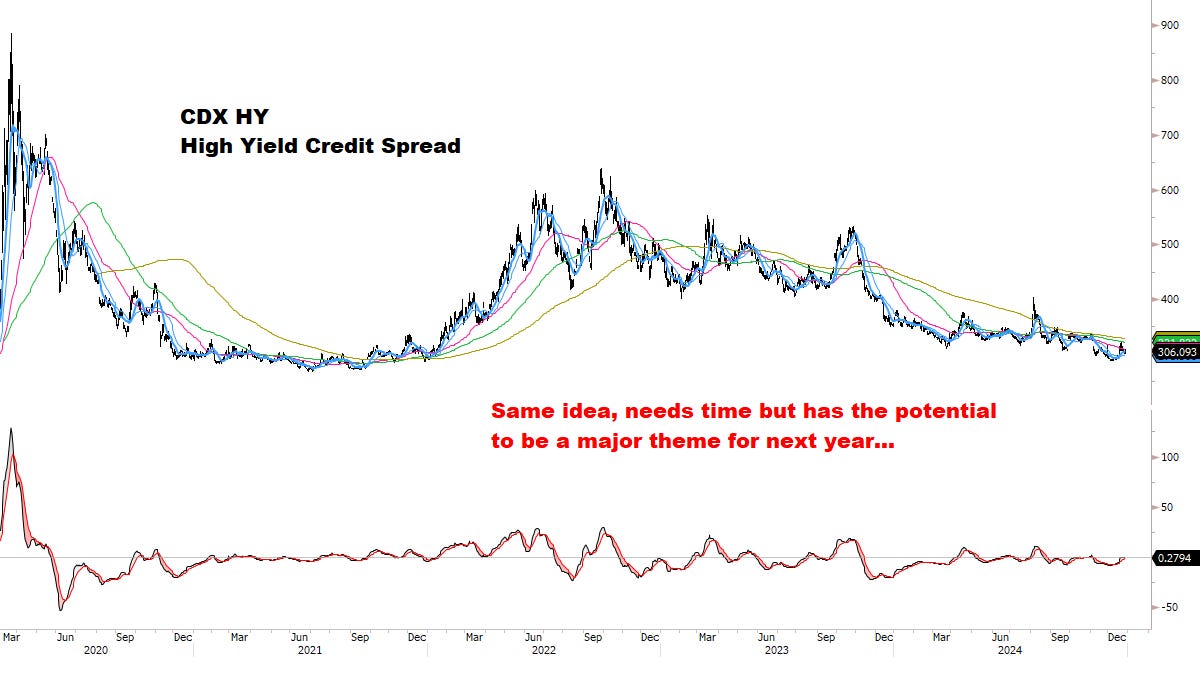

Rates & Credit 利率和信用

Currencies 货币

Commodities 商品

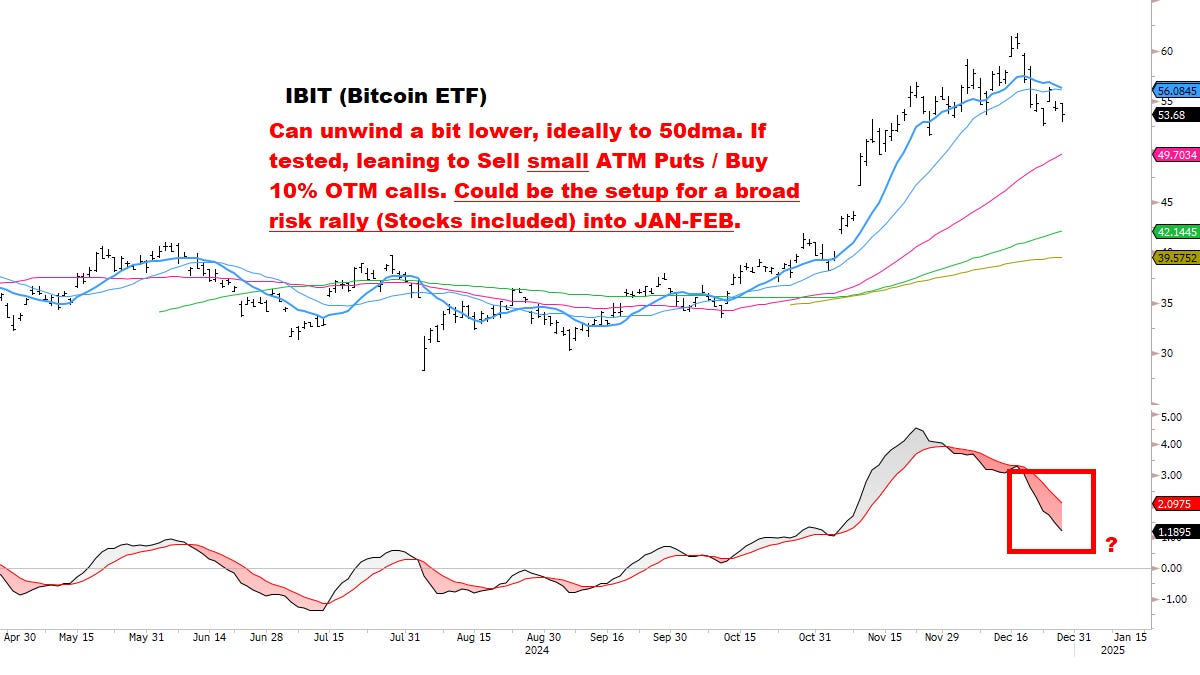

Bitcoin 比特币

Let’s get started: 让我们开始吧:

SECTION 1 第 1 节

CORE MODELS & DATA 核心模型和数据

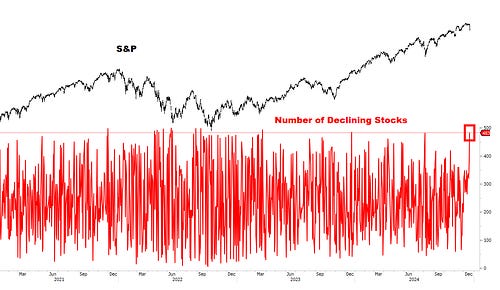

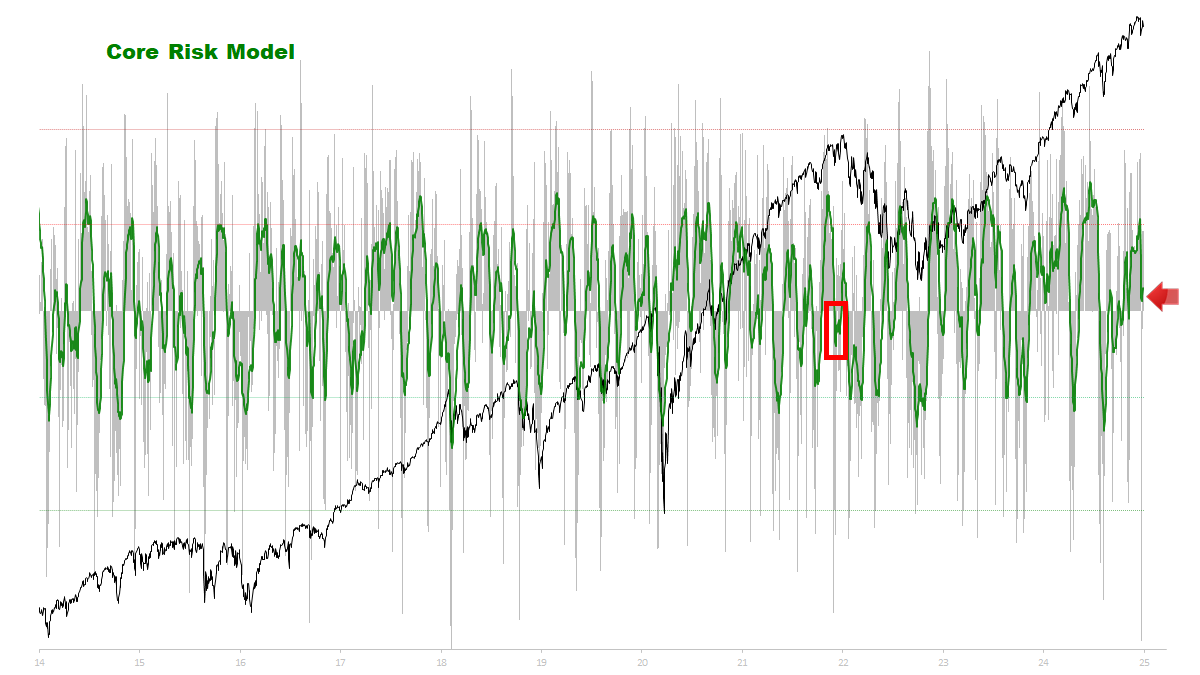

Core Risk had little downside progress this week.

核心风险本周几乎没有什么下行进展。

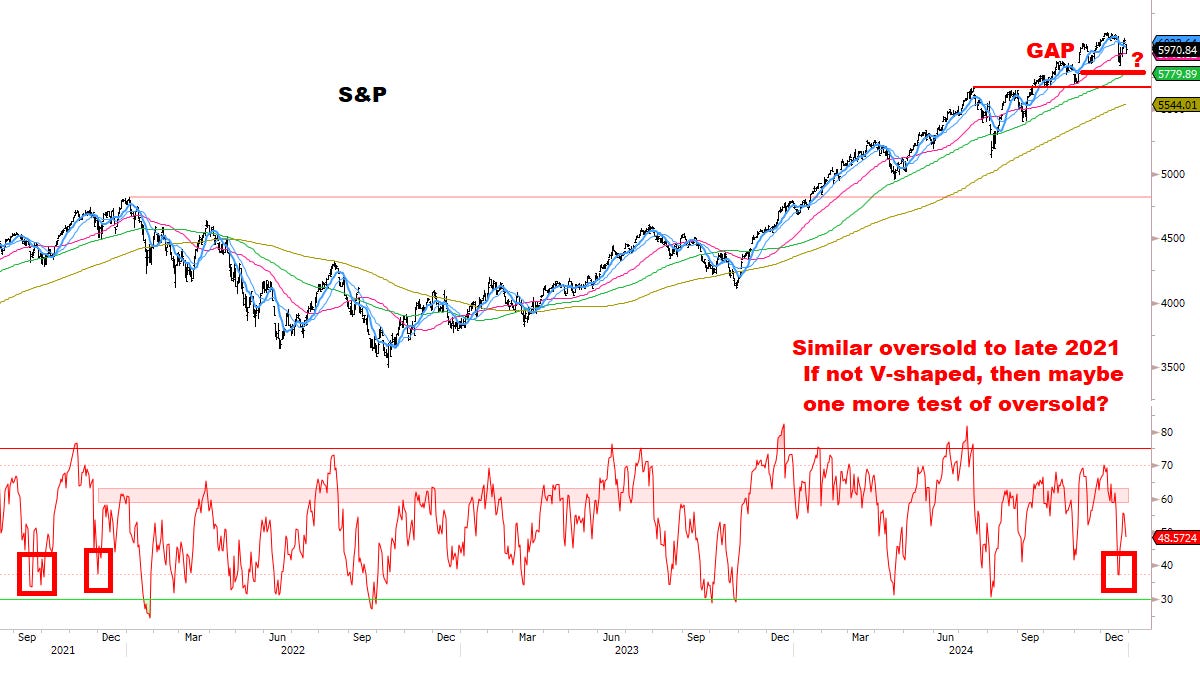

Ideally a little lower would complete the pattern vs. DEC 2021 (red box) — setting up the recovery rally.

理想情况下,略低一点将完成与 2021 年 12 月(红框)相比的模式——建立复苏反弹。

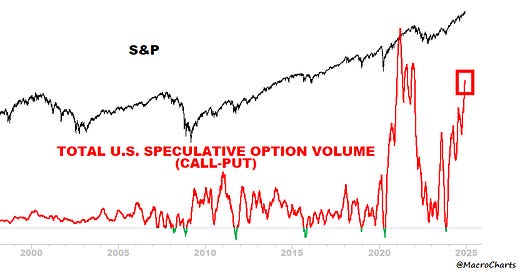

Put/Call Ratios continue to roll over.

看跌/看涨期权比率继续展期。

Watching for a divergence similar to the last big turns.

观察类似于上次大转弯的背离。Need to see more deterioration before moving fully to a Bearish bias.

在完全转向看跌偏见之前,需要看到更多的恶化。

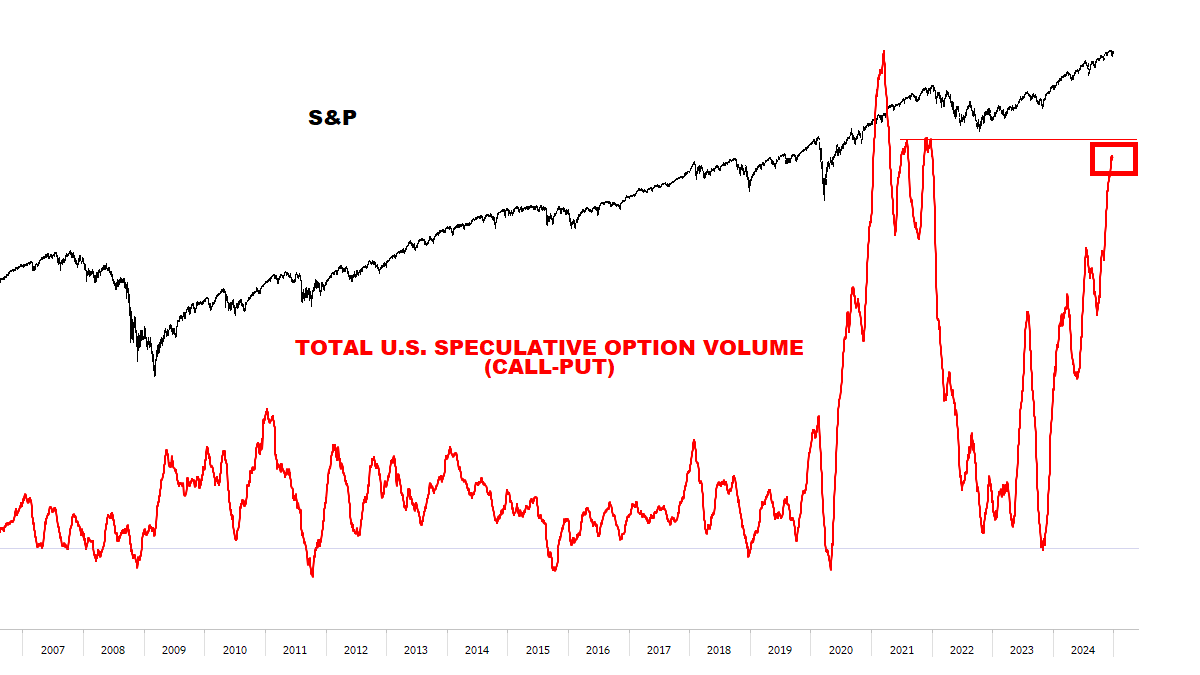

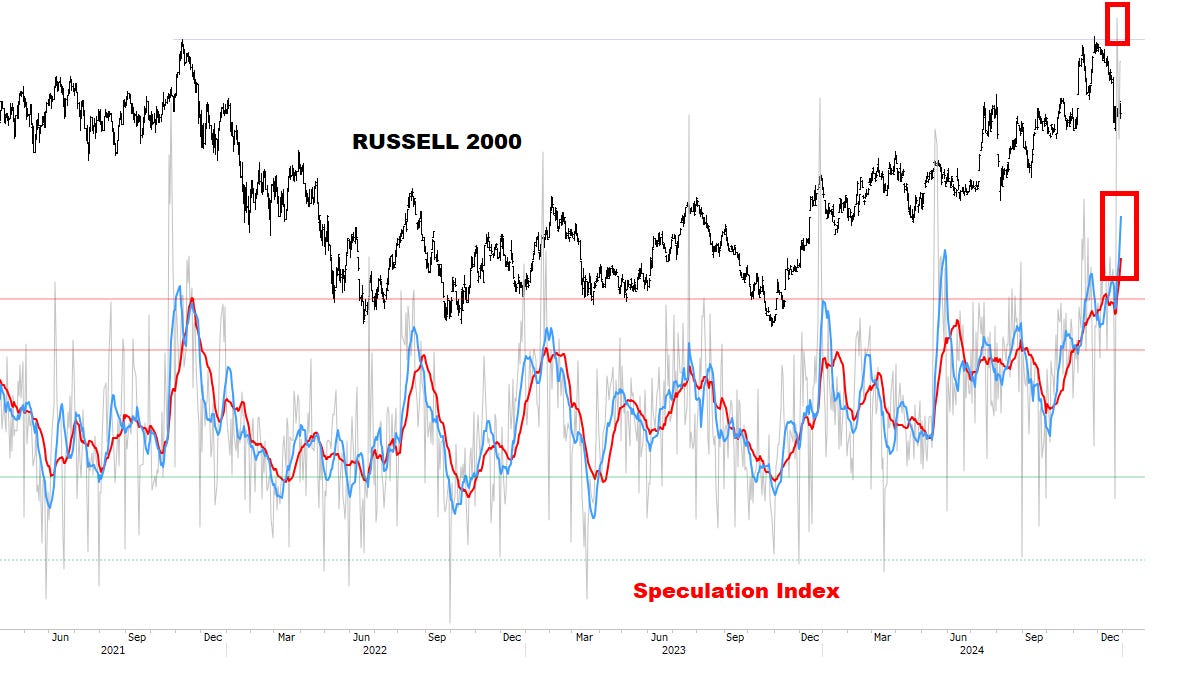

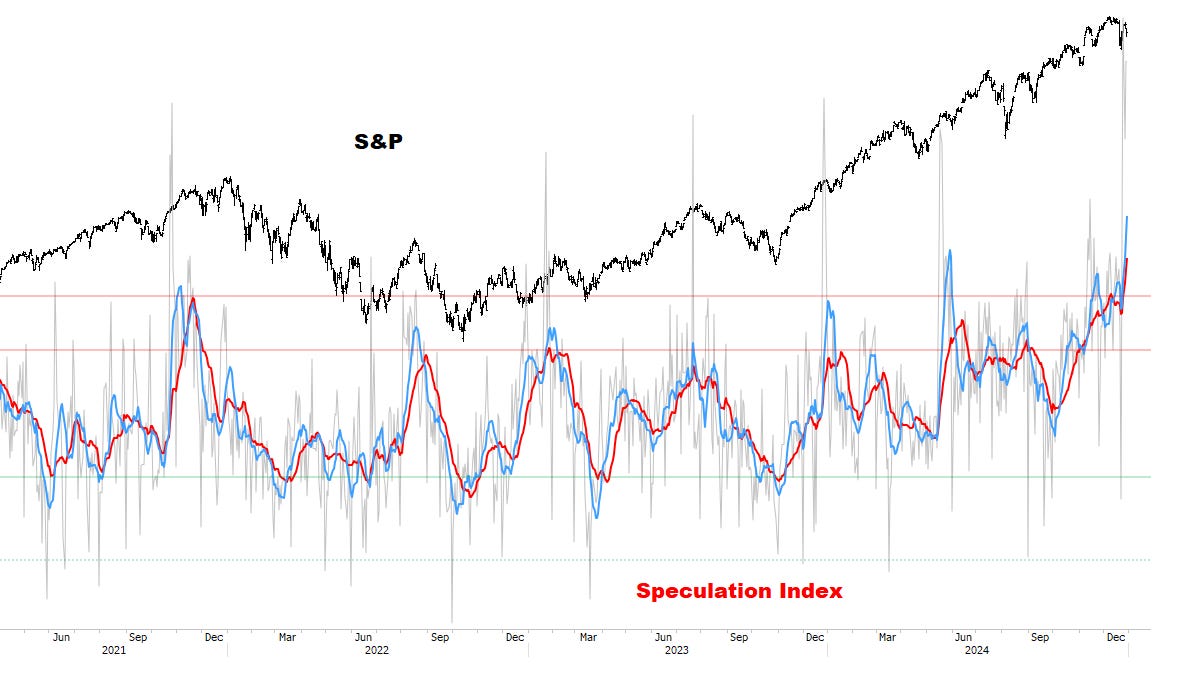

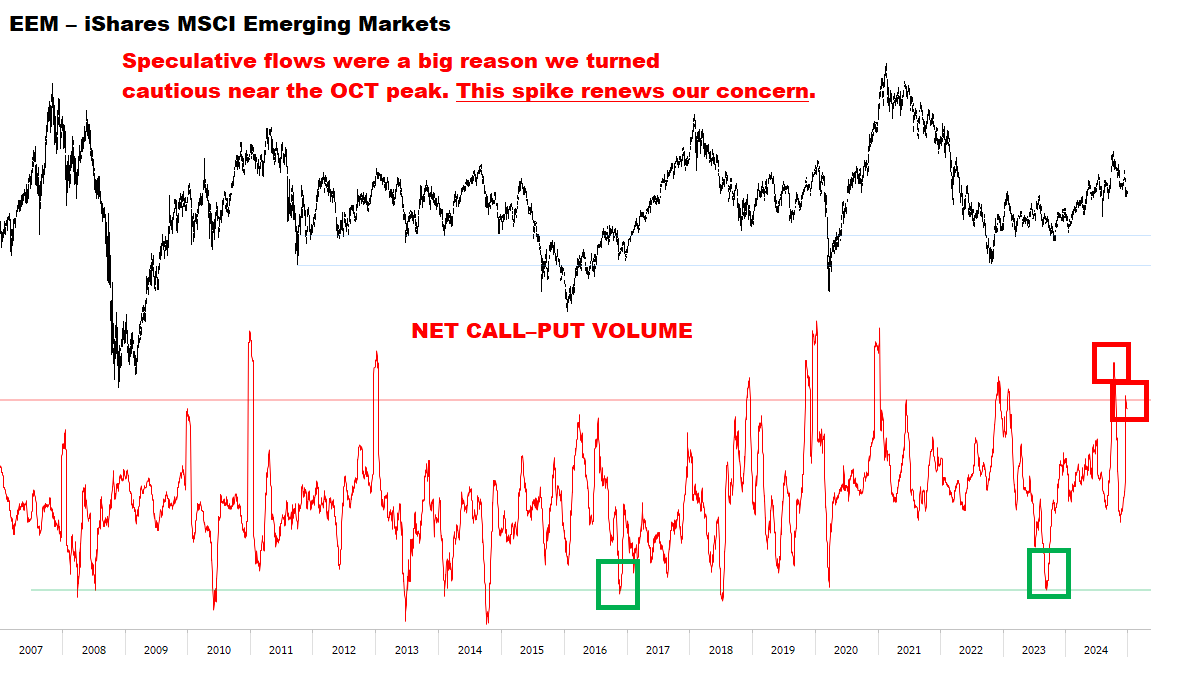

Speculative Option Volume is almost tied with NOV 2021.

投机期权交易量几乎与 2021 年 11 月持平。

Speculation Index. 投机指数。

A record spike this week, and new record highs in the red & blue lines.

本周出现创纪录的飙升,红线和蓝线创下新高。Continue to think the Russell’s failure could be leading the turn in broader Markets similar to 2021 (as discussed in prior reports).

继续认为罗素指数的失败可能会导致类似于 2021 年的更广泛市场的转变(如之前报告中所述)。

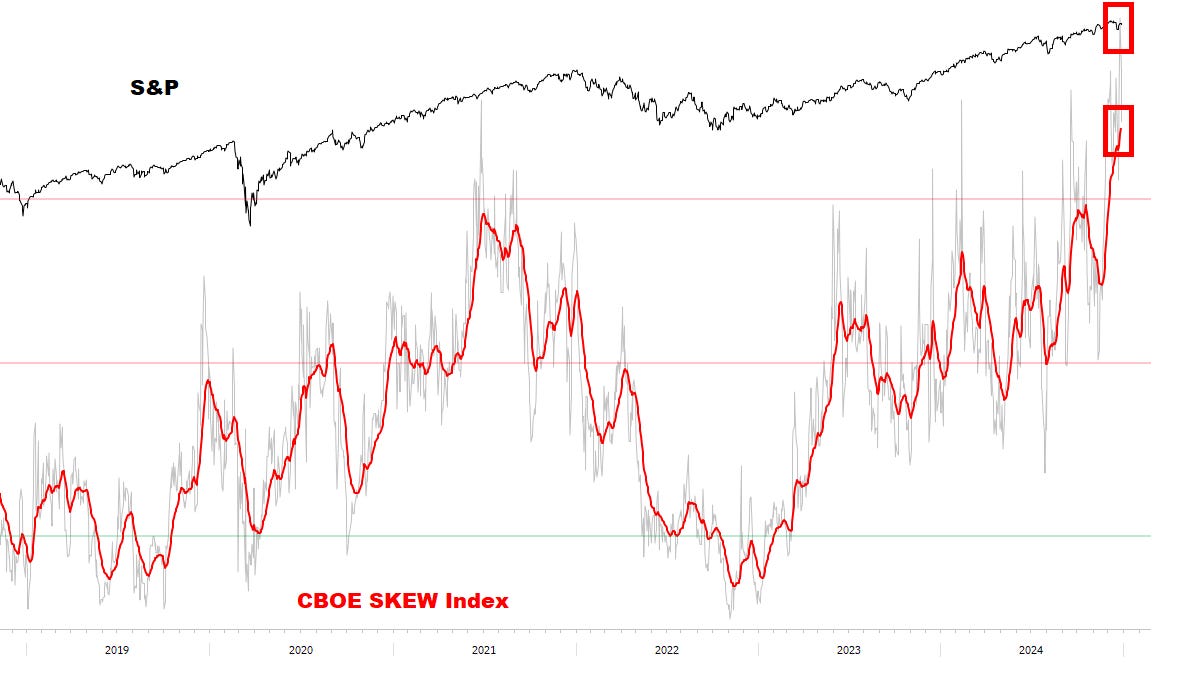

Option Skews has another record spike this week — continuing to defy all limits.

期权偏斜本周再创新高——继续挑战所有限制。

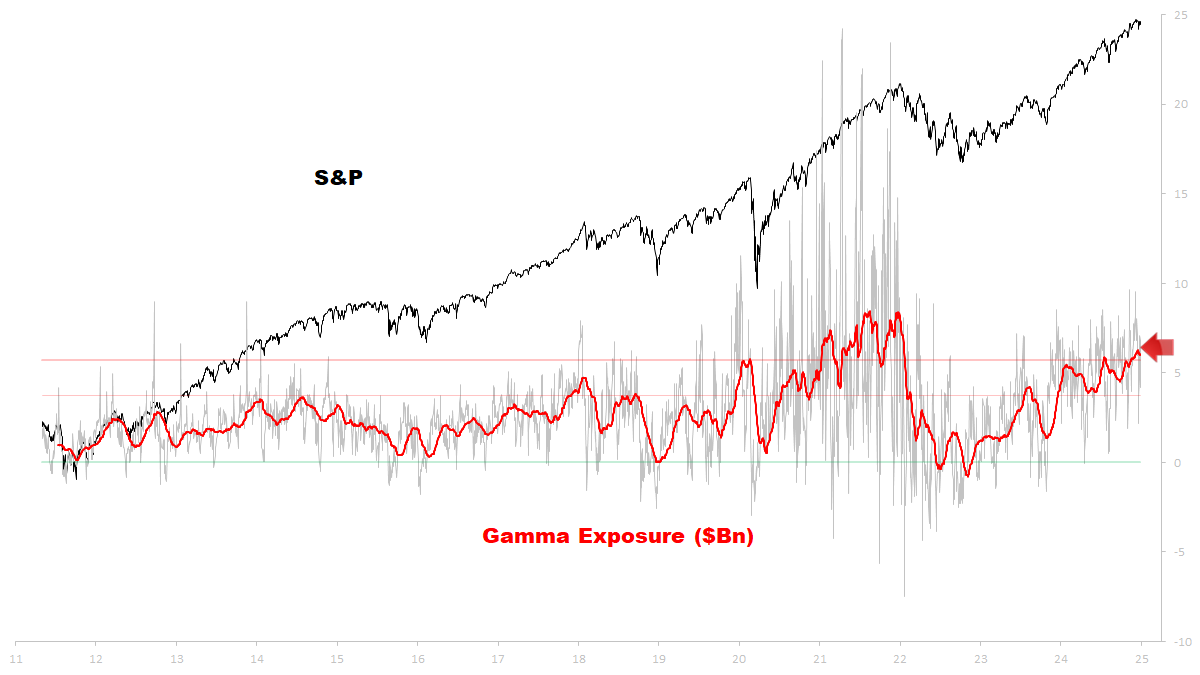

Gamma remains in extreme territory, at the highest since late 2021.

伽玛仍处于极端区域,处于 2021 年底以来的最高水平。

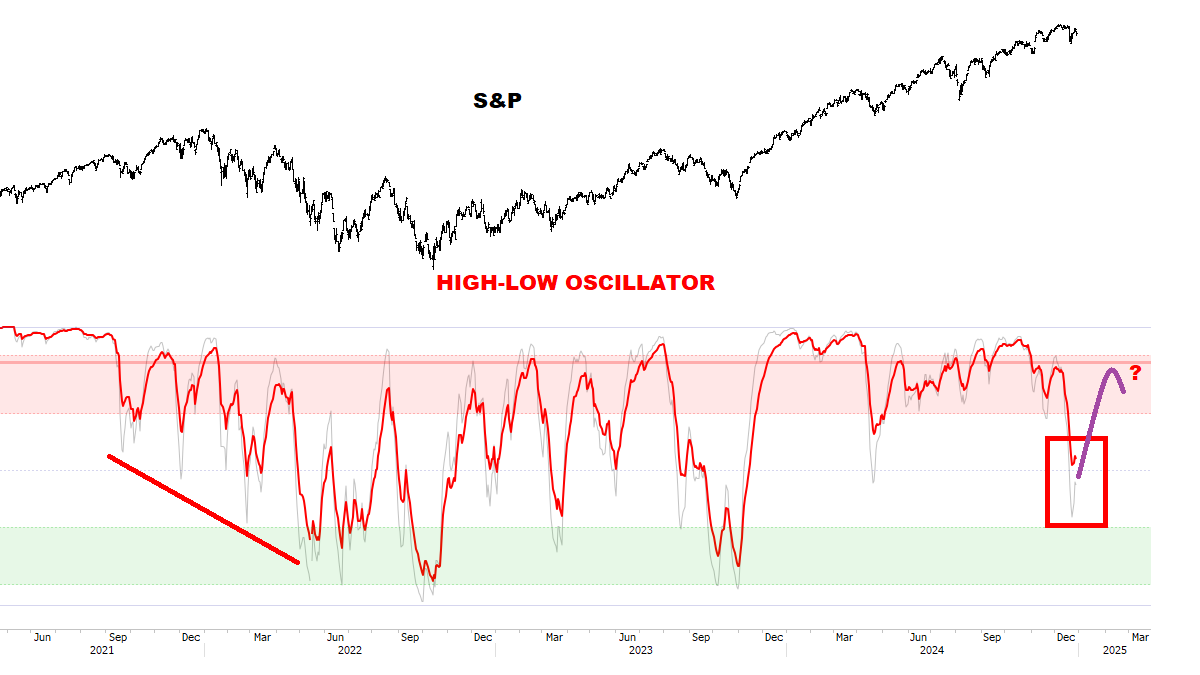

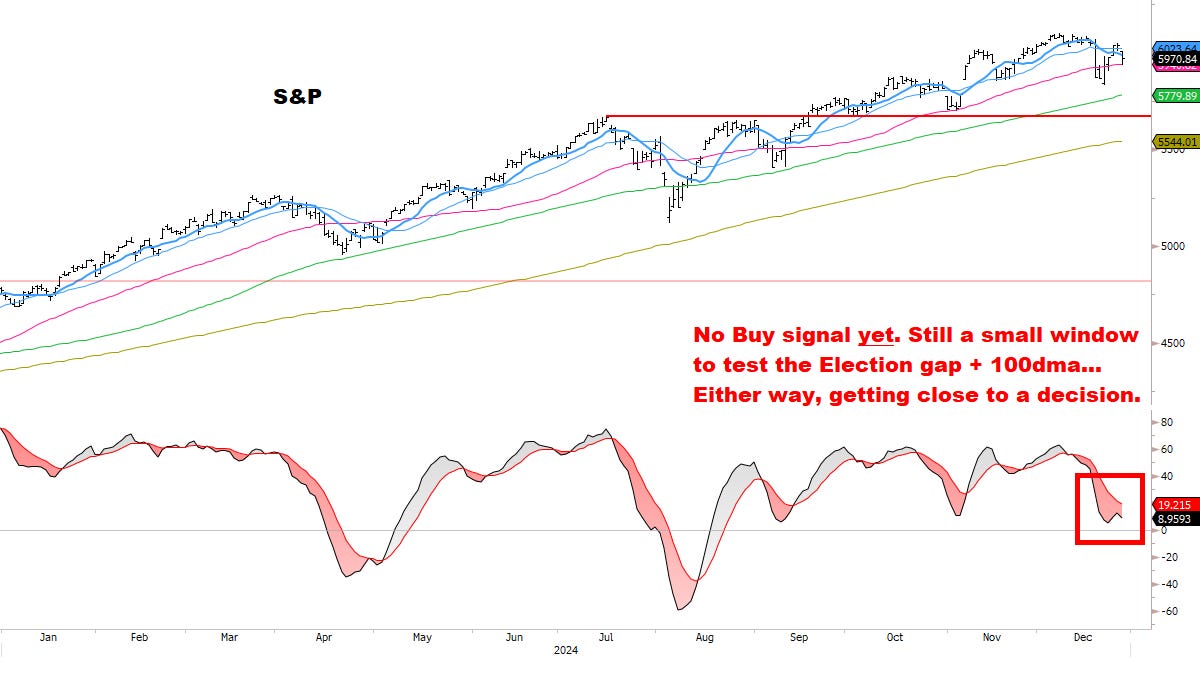

S&P High-Low Oscillators are ticking up and in position to trigger a Tactical Buy signal.

标准普尔高低振荡指标正在上升并处于触发战术买入信号的位置。

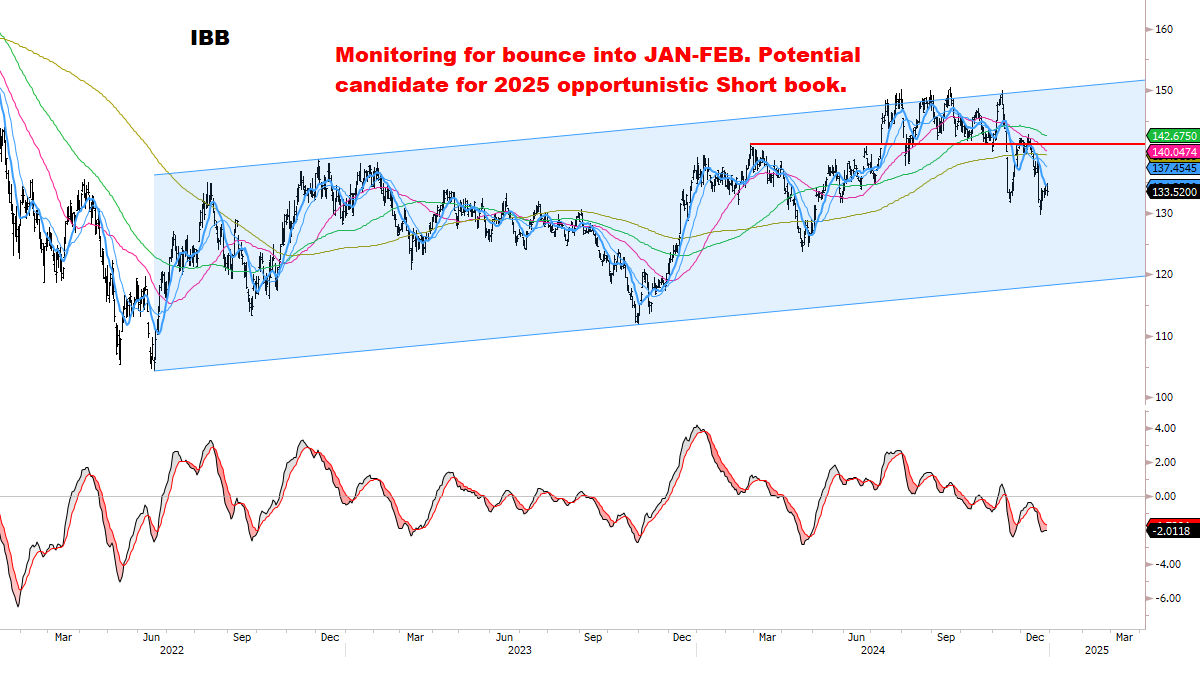

Continuing from last week, they remain near bottoming range — and support a Tactical rally into JAN-FEB (ideally to new highs in S&P).

继上周之后,它们仍然接近底部区间,并支持 1 月至 2 月的战术性反弹(理想情况下达到标准普尔指数的新高)。If the Oscillator moves back to resistance, would be the ideal / BIG Short setup — stay tuned, this could develop into a big opportunity early next year.

如果振荡指标回到阻力位,将是理想的/大空头设置——请继续关注,这可能会在明年初发展成为一个巨大的机会。

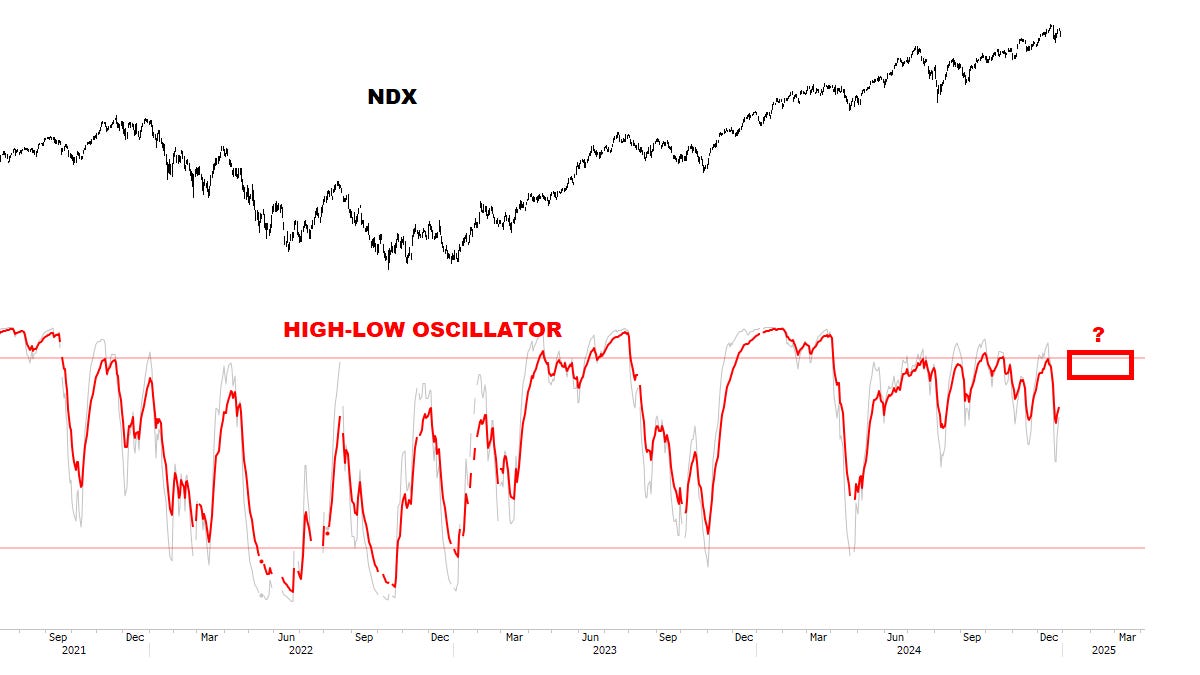

Similarly, NDX is on the cusp of a Tactical Buy signal — which could run back to key resistance for a BIG Short setup early next year.

同样,NDX 正处于战术买入信号的尖端——该信号可能会在明年初回到关键阻力位,以进行大空头设置。

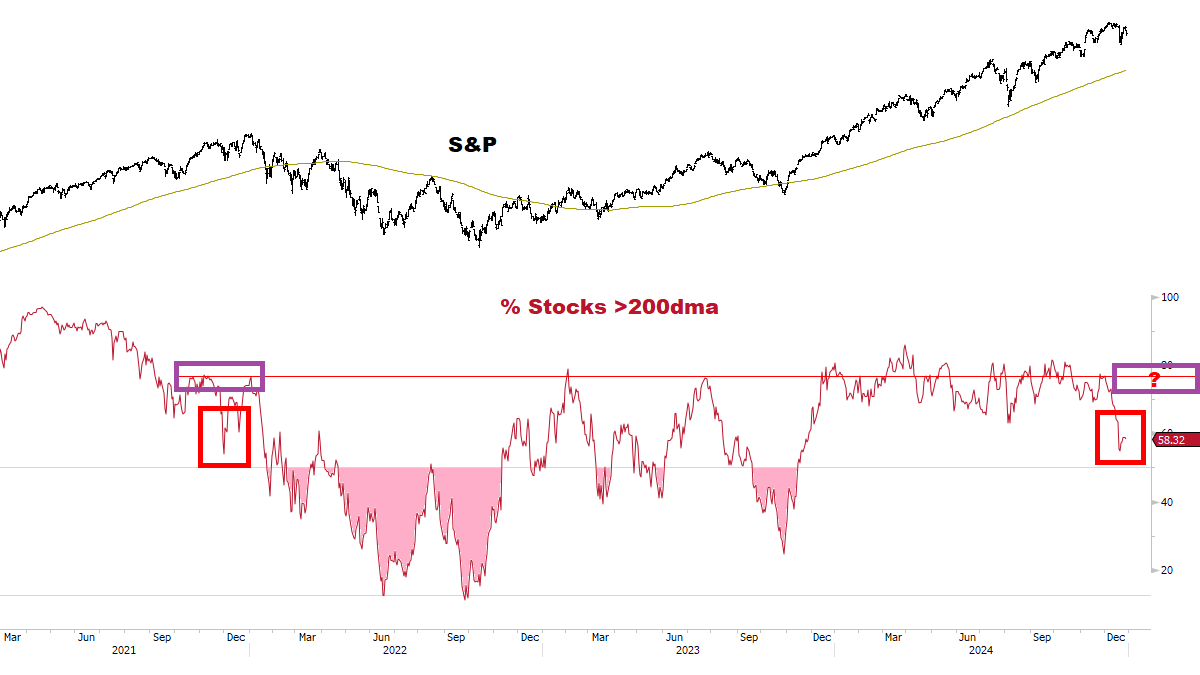

S&P 200dma Breadth is finally in position to build a Top.

标准普尔 200 日移动平均线宽度终于准备好构建顶部。

Deterioration is a classic feature of big Tops:

变质是大上衣的典型特征:

This is the weakest participation in more than a year — barely more than half of S&P Stocks are trading above their 200dmas.

这是一年多来参与度最弱的一次——只有一半以上的标普股票交易价格高于 200 日均线。Note the similarities to NOV-DEC 2021 — many historical Tops share this deterioration.

请注意与 2021 年 11 月至 12 月的相似之处——许多历史上的顶级产品都有这种恶化。To complete the Top, look for a failure at ~75 next year — stay tuned, this could be one of the best Short setups in years.

要完成顶峰,明年将在 75 左右寻找失败 - 请继续关注,这可能是多年来最好的短线设置之一。As discussed in the new Special Report, my core plan for opportunistic Shorts will be to focus on the weakest areas which develop failures early next year — potentially signaling the year’s biggest decliners.

正如新的特别报告中所讨论的,我对机会主义空头的核心计划将是关注明年初失败的最薄弱领域——这可能预示着今年最大的跌幅。

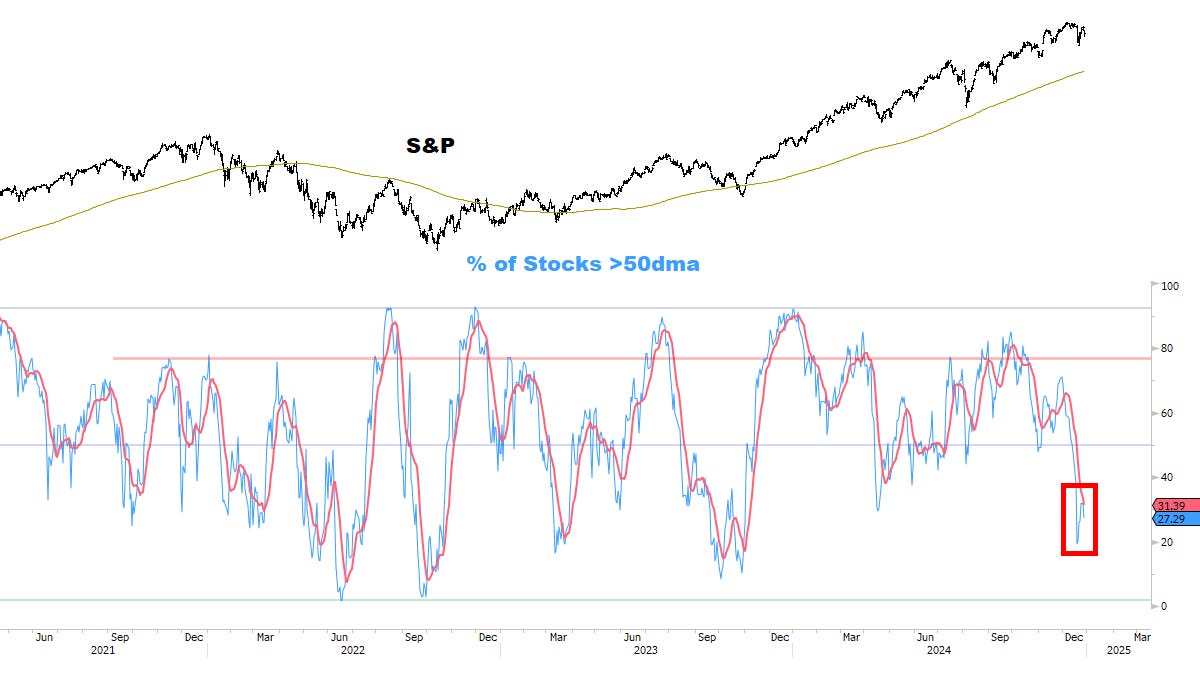

S&P 50dma Breadth hasn’t fully turned yet, but should trigger a bounce into early 2025.

标普 50 日均线宽度尚未完全转变,但应该会在 2025 年初引发反弹。

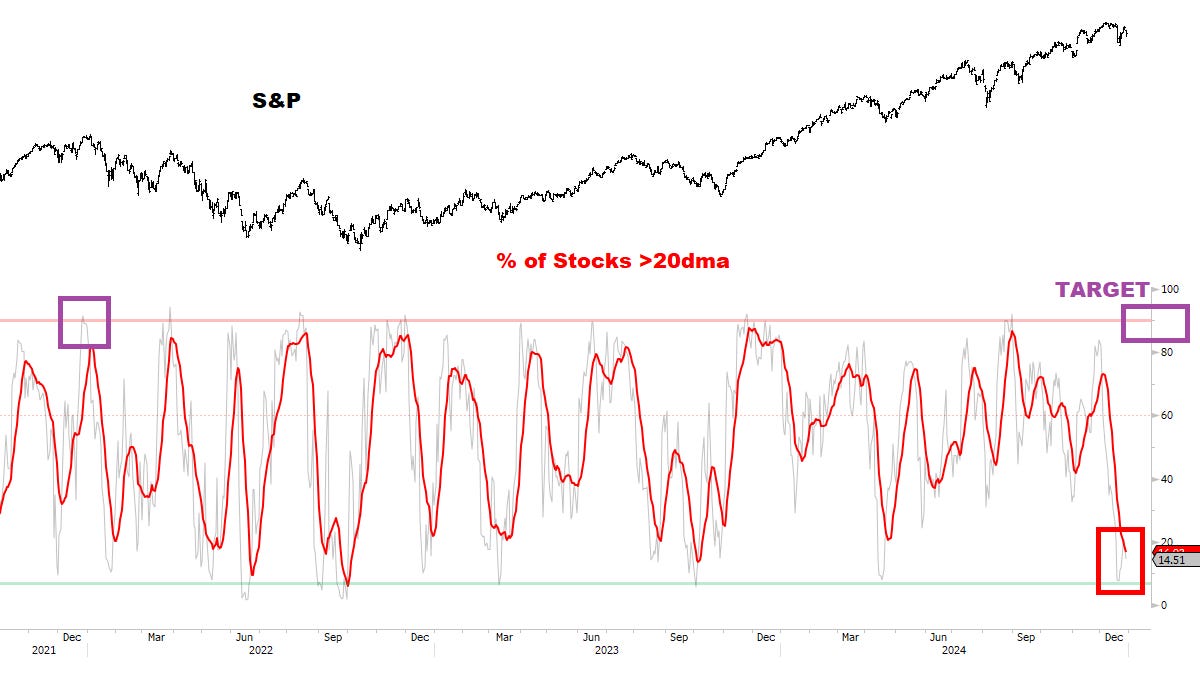

S&P 20dma Breadth remains extremely compressed and likely to turn UP soon, confirming a Tactical extension higher.

标准普尔 20 日移动均线的广度仍然受到极大压缩,并且可能很快就会回升,从而证实了战术性延伸走高。

Note the red moving average is near the lowest in years.

请注意,红色移动平均线接近多年来的最低水平。This should move back to target resistance, where we would then look to build an opportunistic Short book.

这应该会回到目标阻力位,然后我们将寻求建立一本机会主义的空头书。

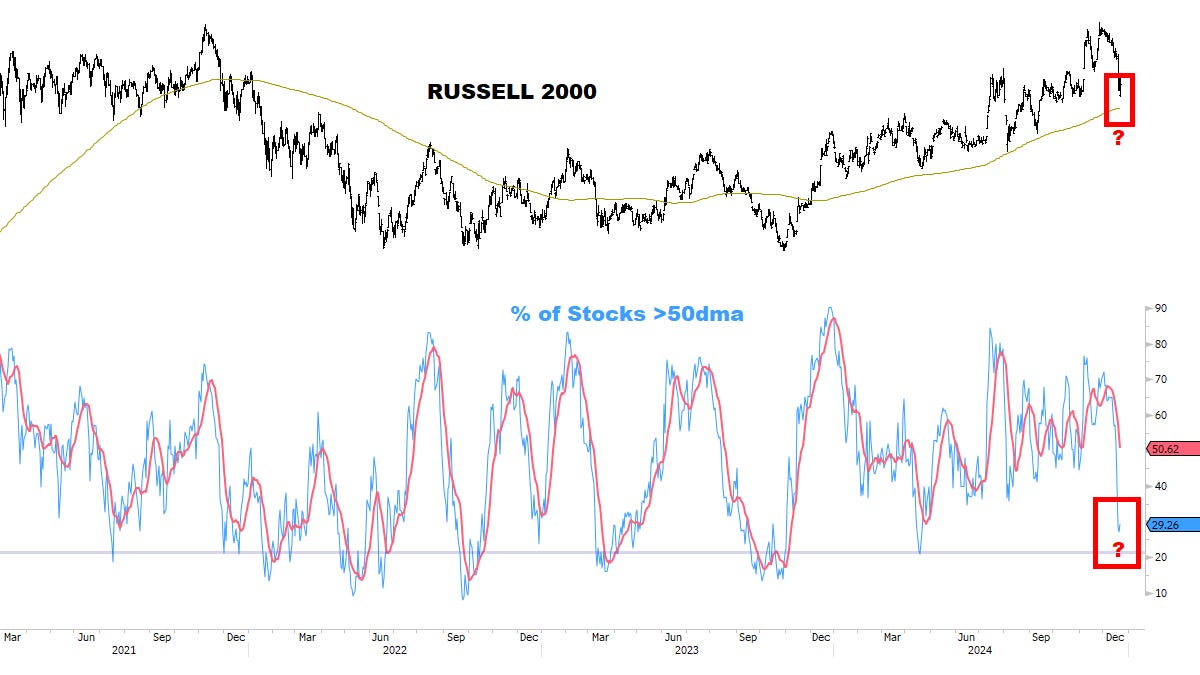

Russell has room to get oversold and test its 200dma — if seen, should likely form a Tactical bottom there.

罗素有超卖空间并测试其 200 日均线——如果看到的话,很可能会在那里形成战术底部。

Tech Breadth remains on watch for a breakdown (<50%).

Tech Breadth 仍关注细分 (<50%)。

This remains a potential catalyst for a big correction next year — pending confirmation.

这仍然是明年大幅调整的潜在催化剂——有待确认。

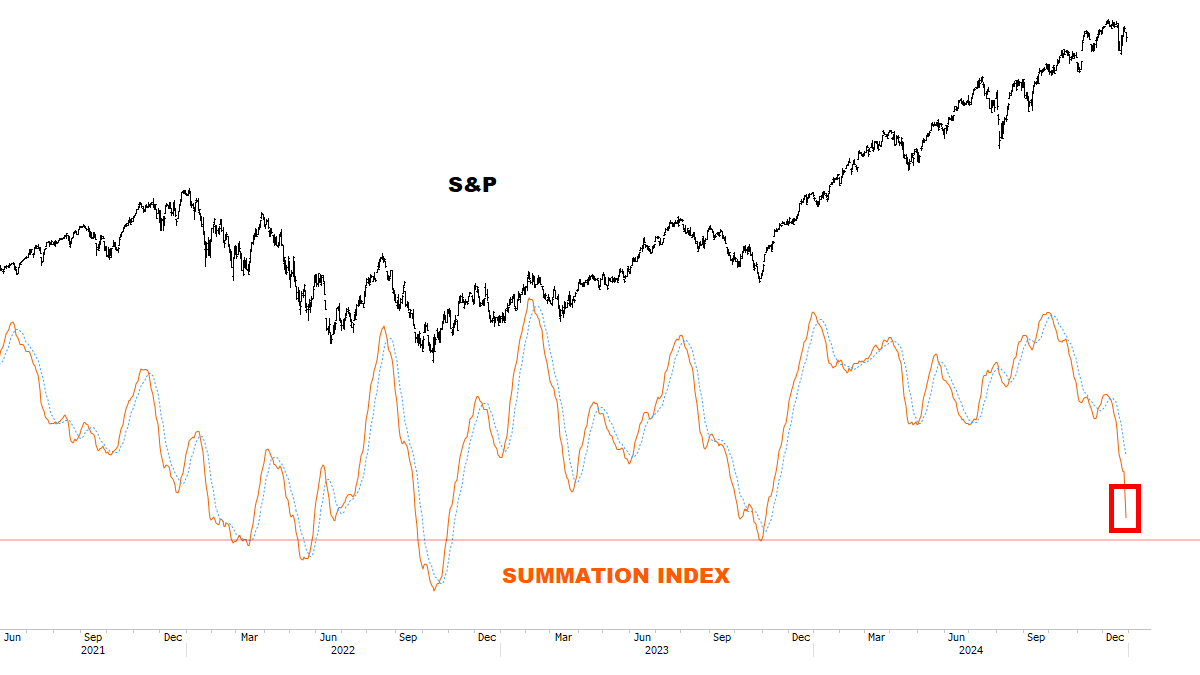

Summation Index remains on a Tactical Sell signal since DEC 10.

自 12 月 10 日以来,总和指数一直处于战术卖出信号。

Approaching the ideal oversold region where Tactical (multi-week) bounces typically begin.

接近理想的超卖区域,战术(多周)反弹通常开始于此。

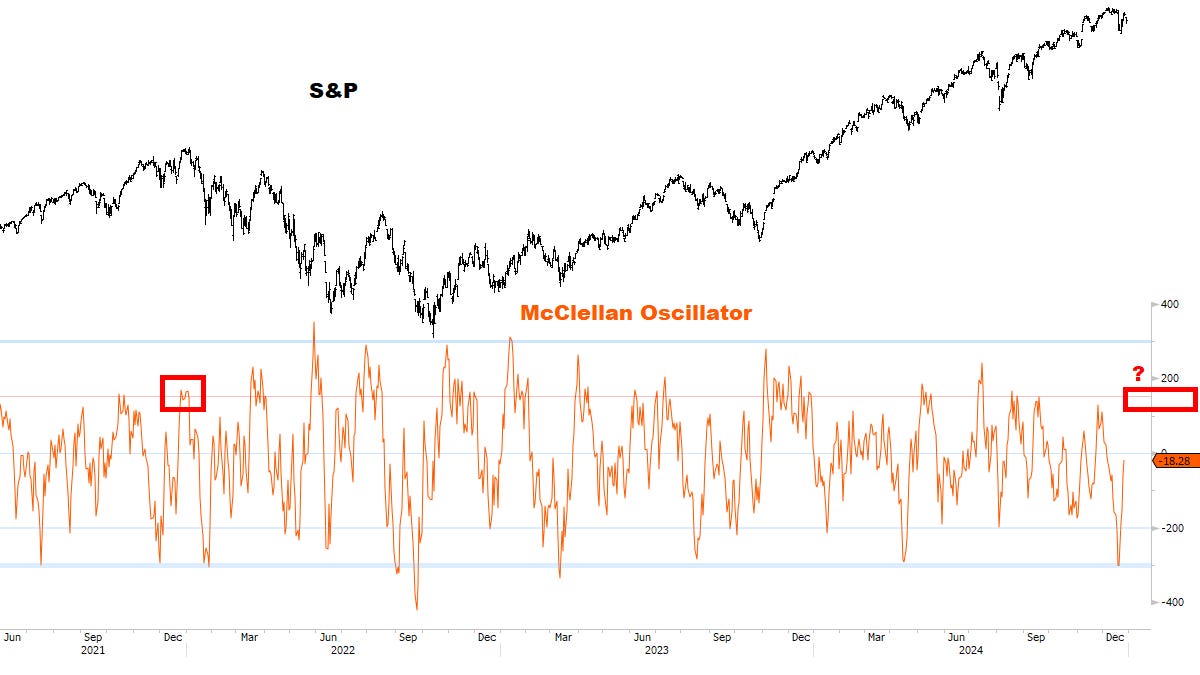

The McClellan Oscillator has turned up from extreme oversold.

麦克莱伦振荡器已从极度超卖中恢复过来。

As discussed last week, Breadth tends to bottom a few days before Price.

正如上周所讨论的,广度往往会在价格之前几天触底。Continue to think that leaning Long on residual weakness is the right approach here.

继续认为利用剩余弱点做多是正确的做法。Ideally, could see a rally into JAN-FEB which pushes the MCO back to full overbought / topping range (red rectangle).

理想情况下,可能会看到一月至二月的反弹,将 MCO 推回到完全超买/顶部范围(红色矩形)。If this develops along with other chart signals, would then look to build an opportunistic Short book.

如果这种情况与其他图表信号一起发展,那么将寻求建立一本机会主义的空头书。

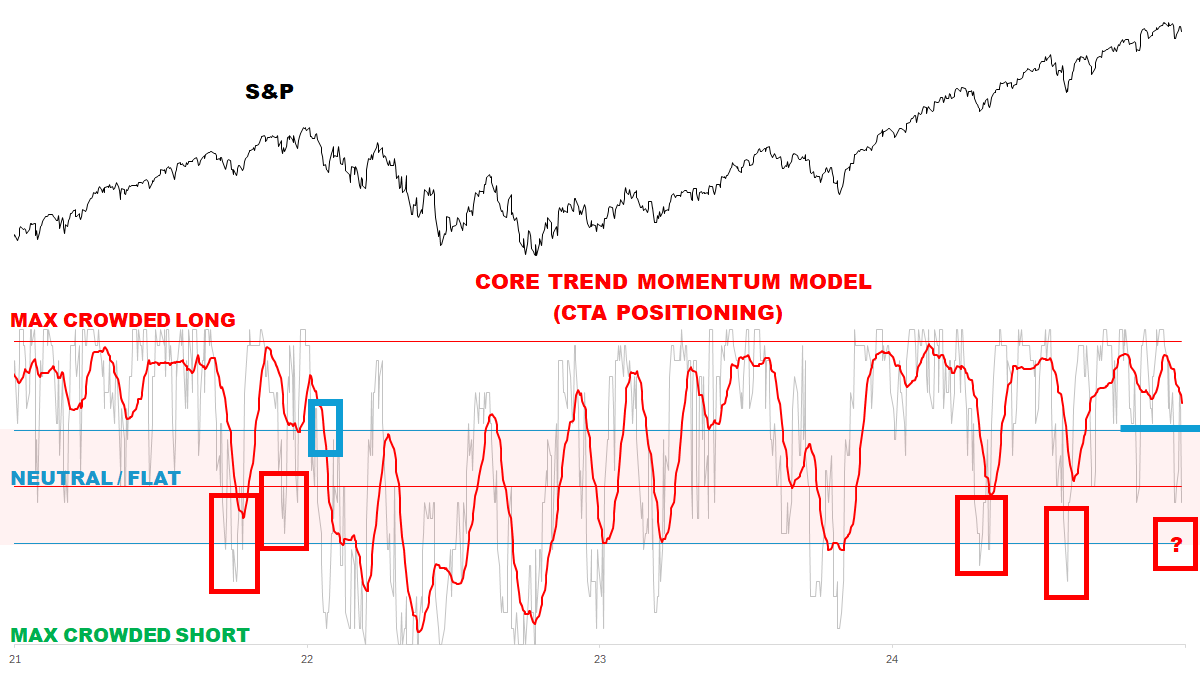

CTA Positioning for Equities.

股票的 CTA 定位。

IF there’s a brief push down, CTAs would capitulate at the bottom again.

如果出现短暂的下跌,商品交易顾问将再次跌至底部。Would be similar to late 2021, APR 2024 and AUG 2024 (four red boxes).

类似于 2021 年末、2024 年 4 月和 2024 年 8 月(四个红色方框)。

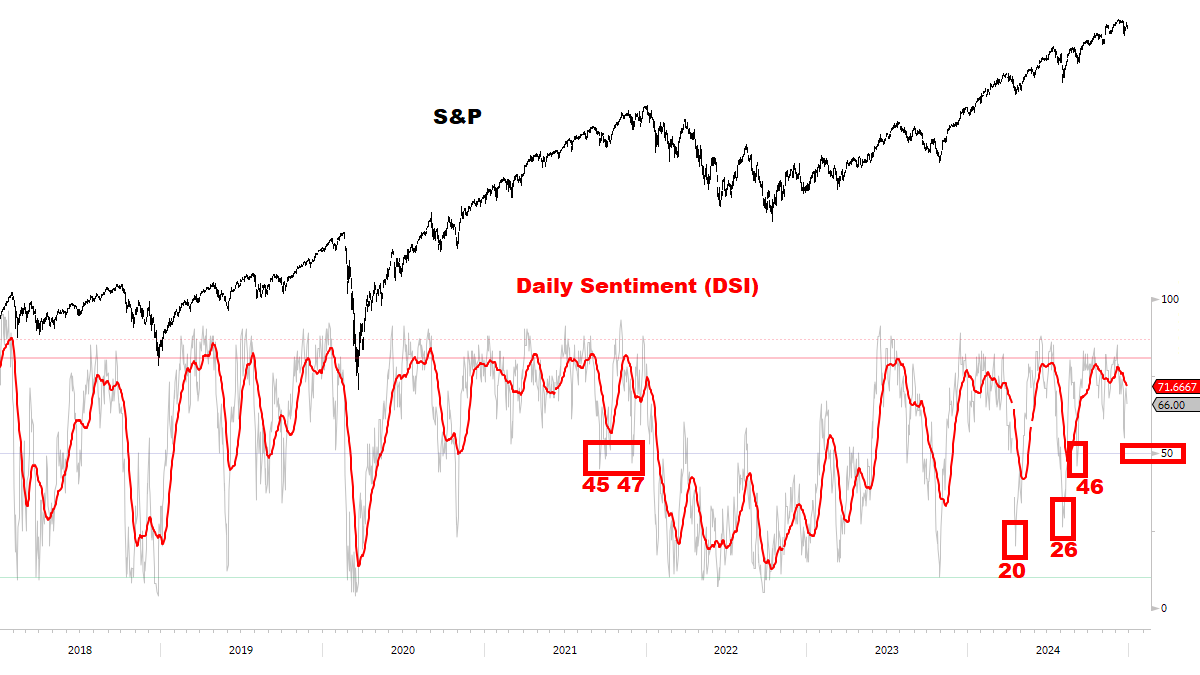

S&P Sentiment could see a print below 50, setting up the Tactical bottom similar to NOV-DEC 2021.

标准普尔情绪指数可能会跌破 50,建立类似于 2021 年 11 月至 12 月的战术底部。

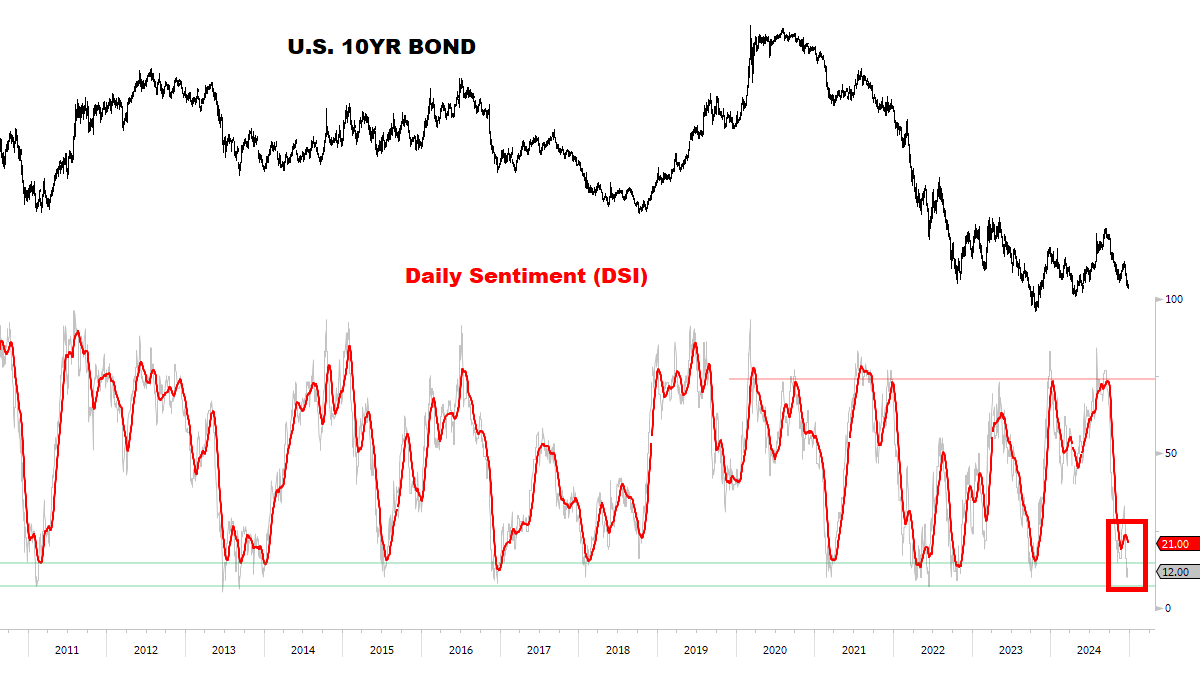

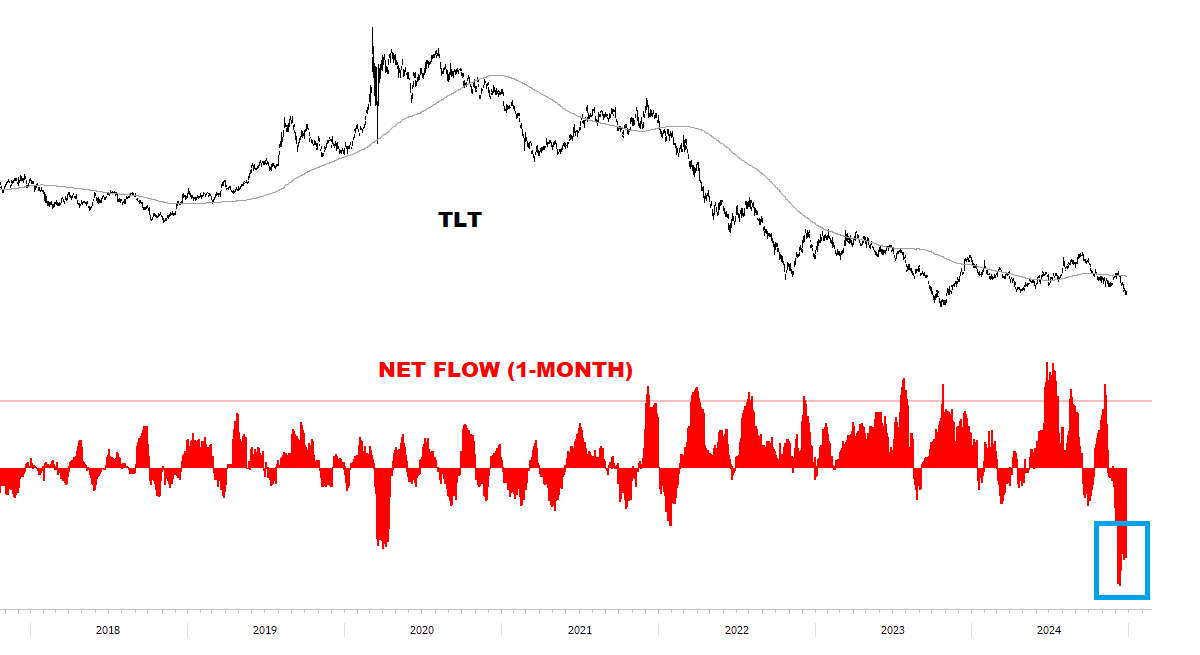

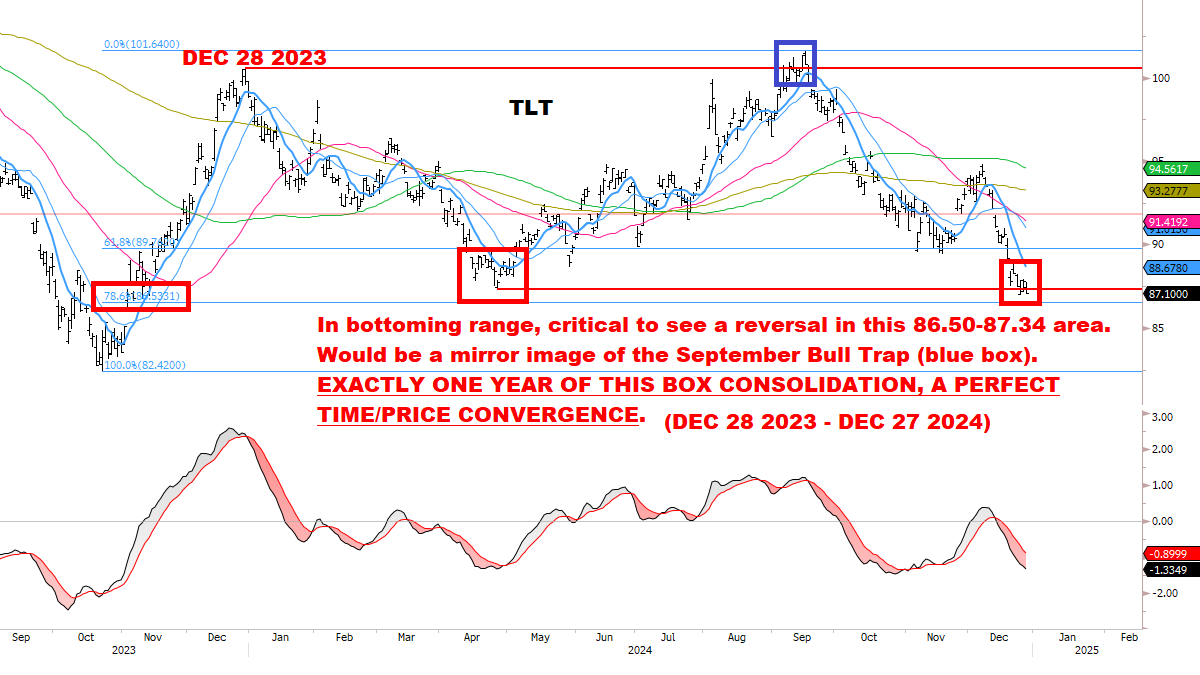

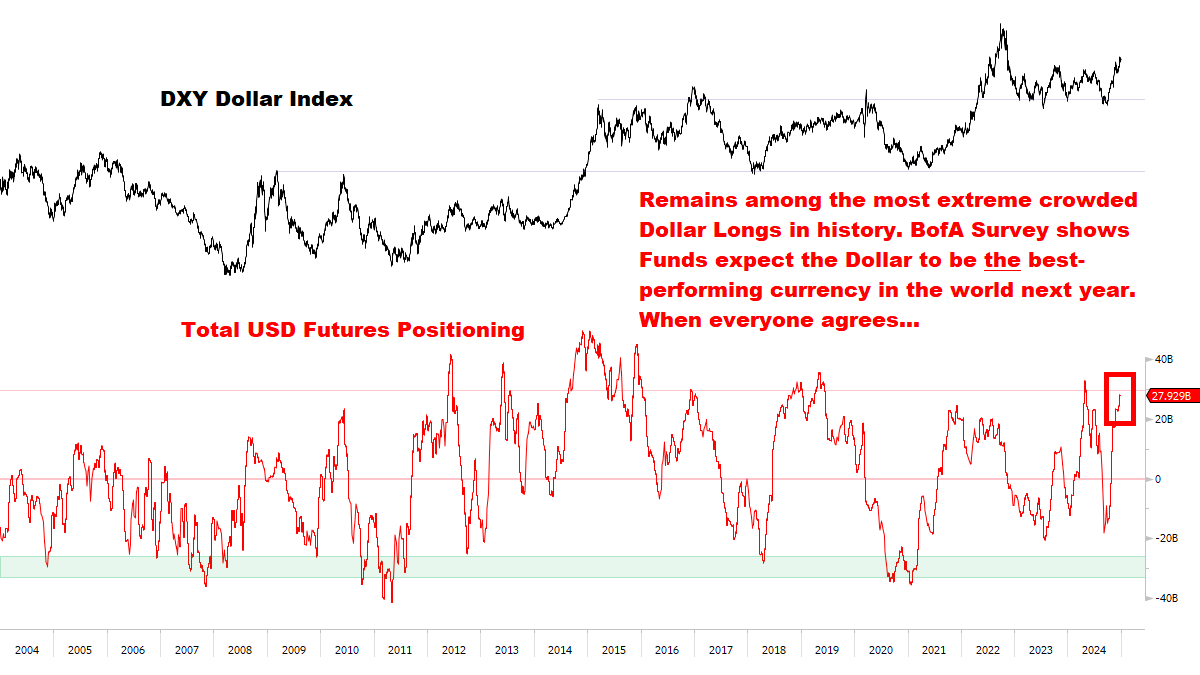

CTA Positioning for Rates is moving quickly to “Max Short Bonds”.

CTA 利率定位正在迅速转向“最大空头债券”。

Bond Sentiment remains in a historic capitulation.

债券情绪仍处于历史性的低迷状态。

The red moving average should reach “Full Oversold” within 2 weeks — monitoring for a turn UP **at or before** that time window.

红色移动平均线应在 2 周内达到“完全超卖”——监测该时间窗口**在**或之前**的反转。Holding initial size Longs here, looking to add size on upside confirmation.

在此持有初始多头头寸,希望在上行确认时增加头寸。This could be one of best opportunities for positioning in Rates for 2025 — just need a turn confirmation.

这可能是 2025 年利率定位的最佳机会之一——只需要一轮确认。NO ONE is starting 2025 with Bond exposure — every position has been cleared…

从 2025 年开始,没有人会持有债券——所有头寸都已清空……

SECTION 2 第 2 部分

KEY TECHNICAL CHARTS 关键技术图表

U.S. EQUITIES 美国股票

“IT’S TIME” (continued). “是时候了”(续)。

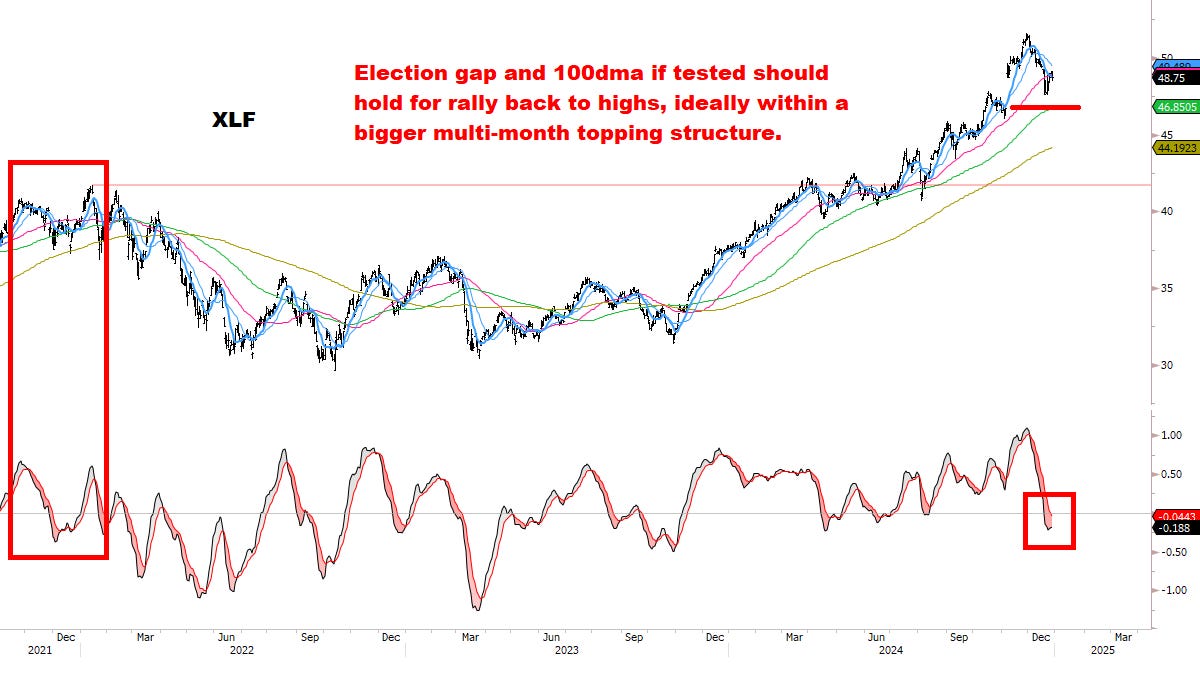

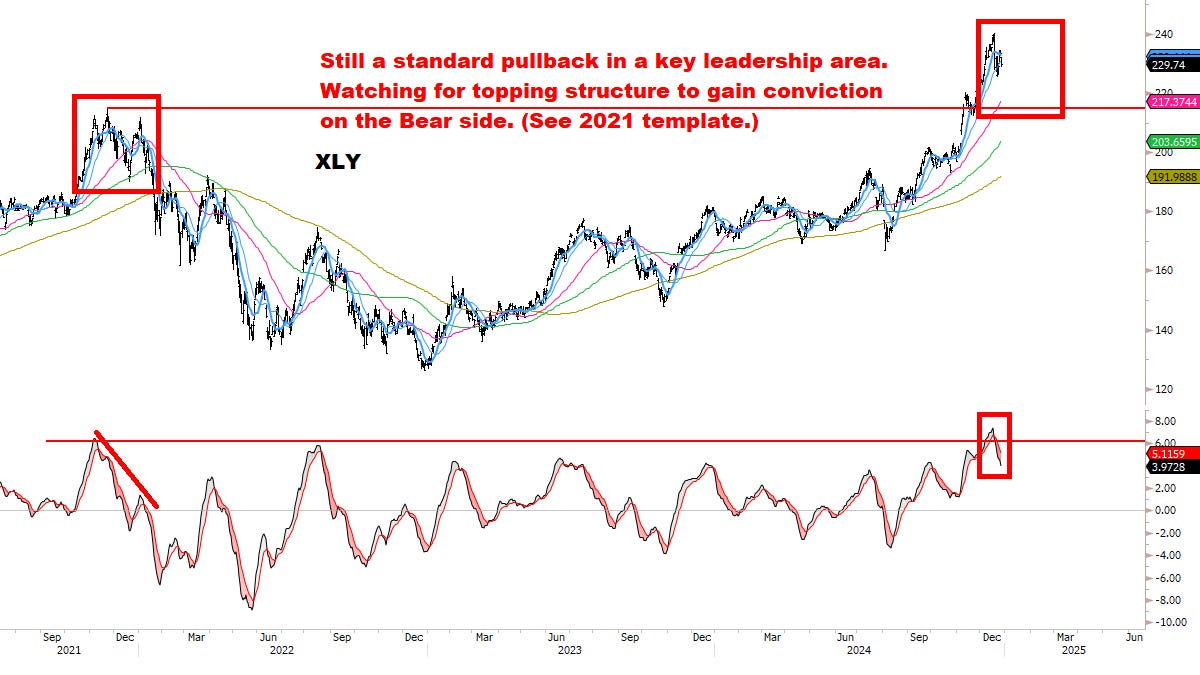

If Stocks push new lows (S&P Election gap + 100dma), some Equity Sectors & Groups may NOT confirm the move — *setting up a classic turn*.

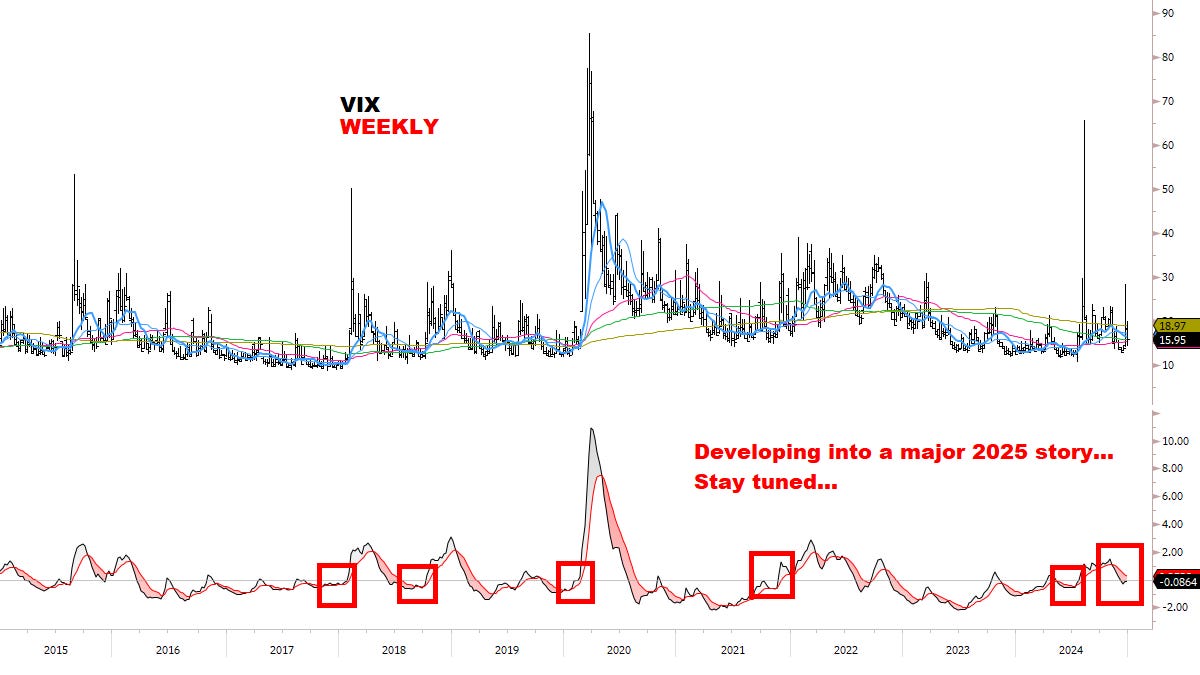

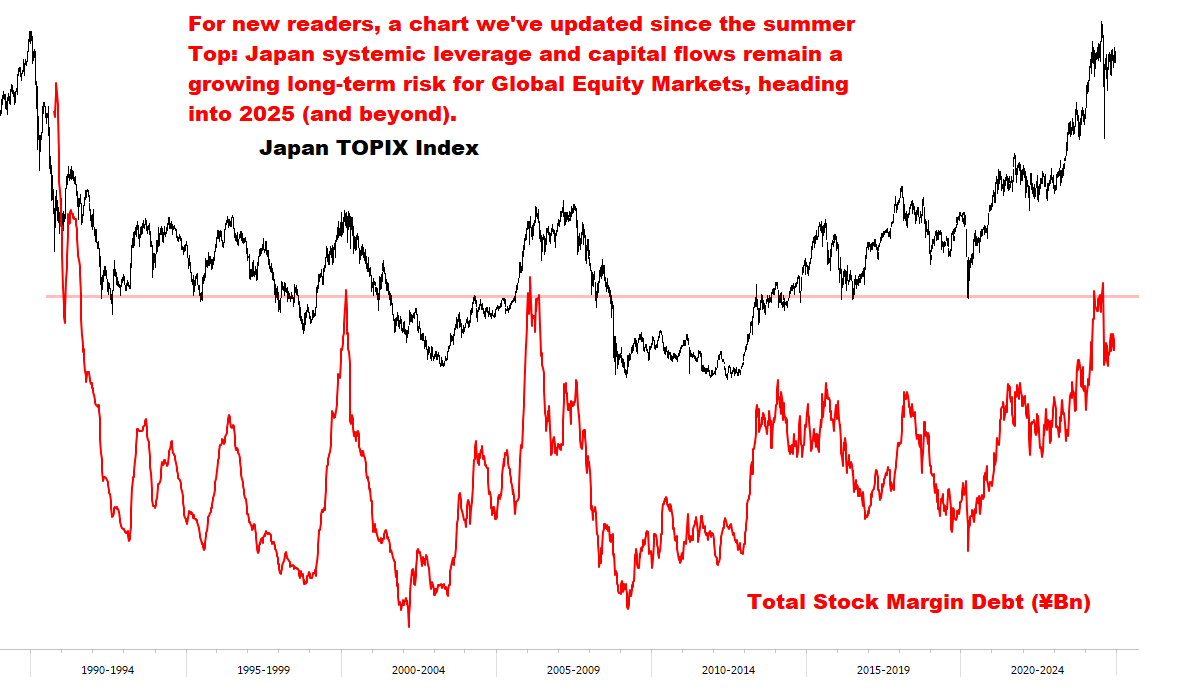

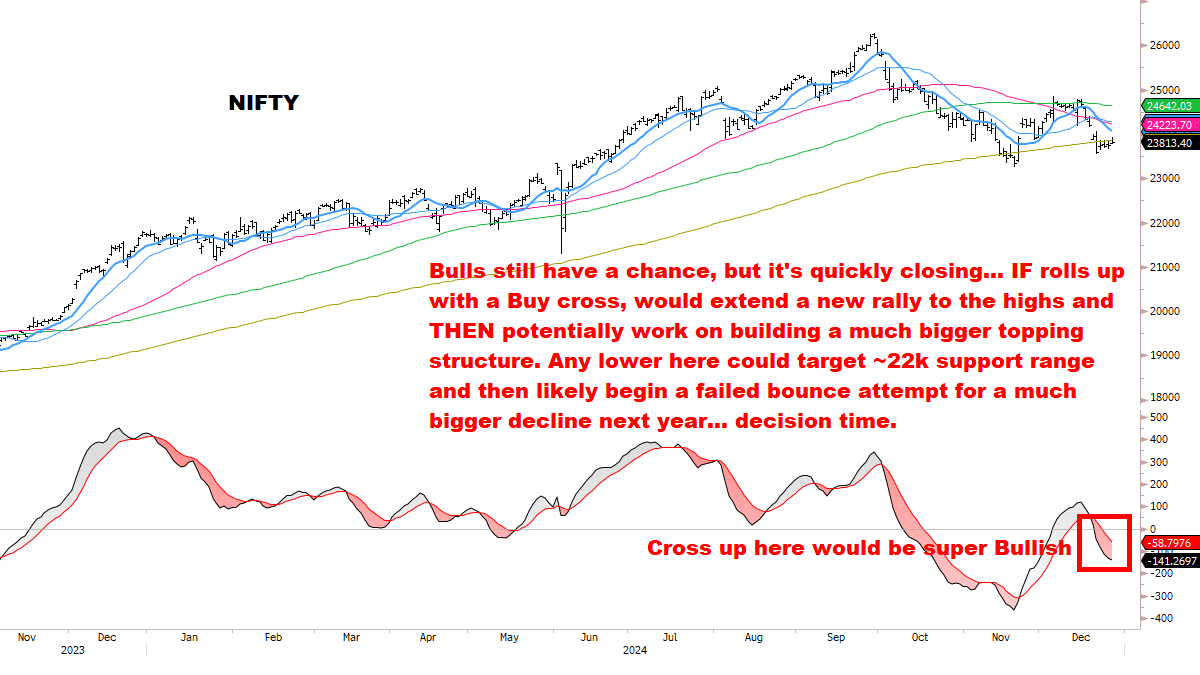

如果股市创下新低(标准普尔选举差距 + 100 日移动平均线),一些股票板块和团体可能不会确认这一走势 - *设置一个经典的转变*。Global Markets may not confirm the move either — watching VIX, Rates, FX, Gold, Silver, Miners — they could also signal a classic turn.

全球市场也可能不会证实这一走势——关注 VIX、利率、外汇、黄金、白银、矿商——它们也可能预示着一个经典的转折。There’s *already* some evidence of this — as some Markets appear to be stabilizing.

“已经”有一些证据表明这一点——一些市场似乎正在企稳。