Getting this out early as I finish up the morning wrap…

NVDA: Solid quarter. Bullish call. Story intact as BW begins to ramp into next year

Key points from the call:

Scaling isn’t dead

BW on track to exceed prior guide of "several billions dollars” while it’s possible Hopper grows into Jan Q

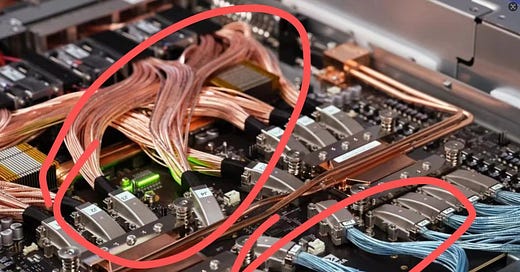

Networking was weak -15% q/q but will grow in Jan Q

Gross margins will decline to 71-72.5% before rebounding to mid 70s mid year

NVDA beat this q’s guide by $2.5B and guided the next q up by $2.5B, which is above their typical cadence of $2B/$2B (last quarter was $2B / $2.5B) so assuming another $2.5B beat (which talking to some buysiders think is conservative), we get to ~$40B+ which is around where buyside is shaking out for Jan Q and where they were before going into the print.

Main nitpick is why networking down…no clear answer but co said it would return to growth next q

Sell-side raising targets and Citi adds as a positive catalyst watch heading into CES. Next catalysts are TSM Nov data, UBS conf in beginning of Dec, Jensen keynote/analyst mtg at CES, then Jan Q, then GTC

What does stock do today?

Does it grind higher on a bit of relief as investors need to re-gross ahead of Blackwell? Does it just flatline/slight down as market continues its shift away from semis? Either it’s possible, but key point is the story here remains fully intact.

Key quotes from the call…

“Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026.”

Scaling:

A foundation model pre-training scaling is intact and it's continuing. As you know, this is an empirical law, not a fundamental physical law, but the evidence is that it continues to scale. What we're learning, however, is that it's not enough that we've now discovered two other ways to scale. One is post-training scaling. Of course, the first generation of post-training was reinforcement learning human feedback, but now we have reinforcement learning AI feedback and all forms of synthetic data generated data that assists in post-training scaling.

And one of the biggest events and one of the most exciting developments is Strawberry, ChatGPT o1, OpenAI's o1, which does inference time scaling, what's called test time scaling. And so we now have three ways of scaling and we're seeing all three ways of scaling. And so my expectation is that for the foreseeable future, we're going to be scaling pre-training, post-training as well as inference time scaling and which is the reason why I think we're going to need more and more compute and we're going to have to drive as hard as we can to keep increasing the performance by x factors at a time so that we can continue to drive down the cost and continue to increase their revenues and get the AI revolution going.

BW Production:

Blackwell production is in full steam. We will deliver this quarter more Blackwells than we had previously estimated

Hopper Demand:

Hopper demand will continue through next year, surely the first several quarters of the next year.We have seen substantial growth for our H200, not only in terms of orders but the quickness in terms of those that are standing that up. It is an amazing product and it's the fastest-growing and ramping that we've seen.

We will continue to be selling Hopper in this quarter, in Q4 for sure, that is across-the-board in terms of all of our different configurations and our configurations include what we may do in terms of China. But keep that in mind that folks are also at the same time looking to build out their Blackwell. So we've got a little bit of both happening in Q4. But yes, is it possible for Hopper to grow between Q3 and Q4, it's possible, but we'll just have to see.

Gross margins:

We will start growing into our gross margins, but we do believe those will be in the low 70s in that first part of the ramp. So you're correct, as you look at the quarters following after that, we will start increasing our gross margins and we hope to get to the mid-70s quite quickly as part of that ramp…Could we reach the mid-70s in the second half of next year? And yes, I think it is reasonable assumption or a goal for us to do, but we'll just have to see how that mix of ramp goes. But yes, it is definitely possible…Low, of course, is below the mid, and let's say we might be at 71%, maybe about 72%, 72.5%, we're going to be in that range

Networking:

The growth year-over-year is tremendous and our focus since the beginning of our acquisition of Mellanox has really been about building together the work that we do in terms of -- in the Data Center. The networking is such a critical part of that. Our ability to sell our networking with many of our systems that we are doing in data center is continuing to grow and do quite well.

So this quarter is just a slight dip down and we're going to be right back up in terms of growing. They're getting ready for Blackwell and more and more systems that will be using not only our existing networking but also the networking that is going to be incorporated in a lot of these large systems that we are providing them to.

Inference:

Our hopes and dreams is that someday, the world does a ton of inference. BW enables up to 30x faster inference performance and a new level of inference scaling throughput and response time that is excellent for running new reasoning inference applications like OpenAI's o1 model…

Mizuho: Enterprise AI rev up >3x y/y, with NIM and NeMo driving inference performance and as inference time scaling improves model quality