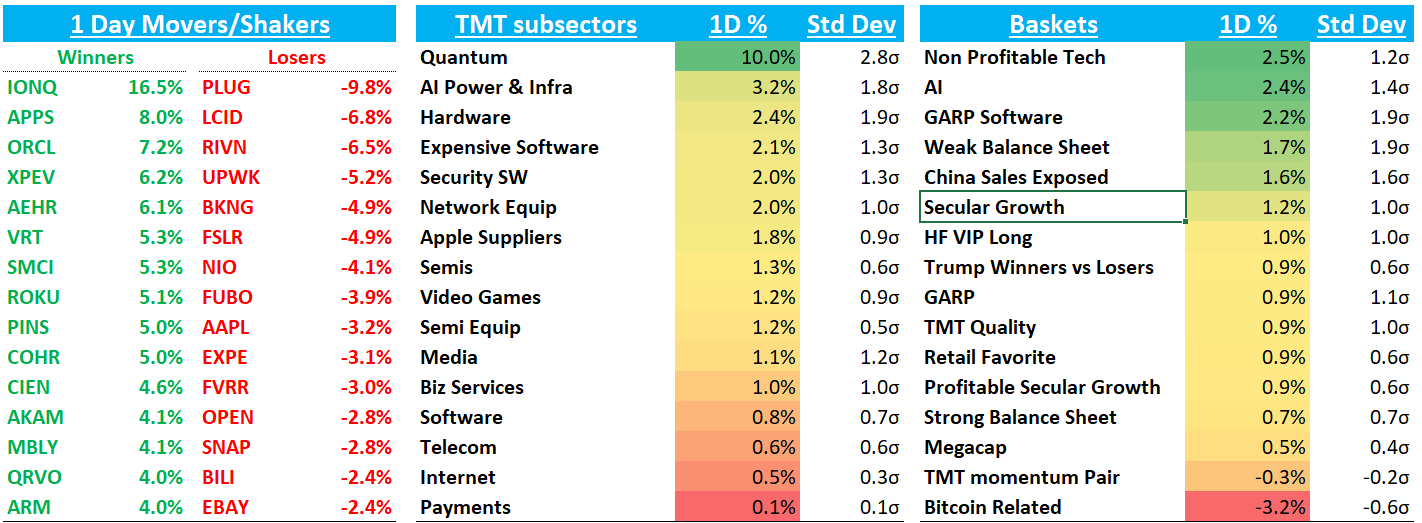

QQQs +60bps were weighed down by AAPL -3%, which caught a pair of downgrades (Jefferies + Loop) and # cuts at JPM and MS removed it as a top pick — a quad-fecta of neg news. Stock was teflon as recently as late Dec, but now down 15% from highs as investors worry about the upcoming Q1 guide following a slew of negative data, mainly coming out of China. QQQs rallying another 40bps post-close on the back of NFLX + MSFT/Stargate stuff (see below.)

Some signs animal spirits back in vogue today as Quantum basket rallied 10% and space stocks ripped as Trump talked up going to Mars yesterday. We continue to be in a little window of macro-freedom until Fed next Wednesday and bulls are taking advantage - NFLX’s goldilocks print will likely help sentiment into earnings tomorrow.

The big news today was Trump announcing new AI investment push with OpenAI, Softbank, and ORCL (Bloomberg):

Trump will be joined by Softbank’s Masayoshi Son, OpenAI’s Sam Altman, and Oracle’s Larry Ellison to announce an initial $100 billion investment — which could scale up to $500 billion over the next four years — on Tuesday afternoon, according to a White House official.

Big numbers there if they come to fruition. ORCL +7% on the news (also helped by TikTok coming online). Post-close Softbank said they will begin deploying $100B immediately and ORCL up another 4% as they said 10 DCs currently being built and plan for 20. MSFT flat on the news as some speculated this means ORCL/OpenAI getting closer as OpenAI and potential neg implications of Azure/OpenAI partnership, but post close OpenAI said relationship with MSFT growing and announced a new pact and said OpenAI recently made a new large Azure commitment. From PR:

Microsoft has rights to OpenAI IP (inclusive of model and infrastructure) for use within our products like Copilot. This means our customers have access to the best model for their needs.

The OpenAI API is exclusive to Azure, runs on Azure and is also available through the Azure OpenAI Service. This agreement means customers benefit from having access to leading models on Microsoft platforms and direct from OpenAI.

Microsoft and OpenAI have revenue sharing agreements that flow both ways, ensuring that both companies benefit from increased use of new and existing models.

In addition to this, OpenAI recently made a new, large Azure commitment that will continue to support all OpenAI products as well as training. This new agreement also includes changes to the exclusivity on new capacity, moving to a model where Microsoft has a right of first refusal (ROFR).

In other words, this means will pure Azure pnl without any of the capex burden — ORCL and Softbank take on some capex burden while MSFT maintains right of first refusal on any OpenAI new capacity…

Let’s get to the recap…

Internet

RDDT+7% to new highs. Good looking breakout on the charts as well as checks continue to come in well above where street is at despite expectations moving up:

META +60bps with some good price action despite Tiktok news as Edgewater was out positive as they raised fx neutral numbers given favorable DR feedback and impression value continuing to rise through better optimization. NFLX print should also help META tomorrow: NFLX just crushed their guide despite fx fears and META had been the other poster internet stocks where investors worried about the guide because of fx. It’s also the next large-cap stock on the earnings docket.

SNAP -3% wasn’t so lucky

EBAY -2.4% as Arete downgraded to sell

ROKU +5% on JMP positive initiation. Up a few % post-close as well on NFLX

CHWY +50bps as weekly Yipit data was better

DUOL -4% weak on the TikTok news - remember that stock ripped last week as they app was seeing a spike in usage as users migrated to other Chinese based apps, which were driving signs up in Mandarin based courses. So that reversed a bit today. SPOT also announced educational audio courses could be coming to the US. TechCrunch: “The company on Tuesday referenced one of its newer features called courses, which allow users to learn about topics in areas like business, tech, lifestyle, music, and more.”

MELI -8bps despite RJ upgrading to Strong Buy

W +8% - didnt see anything here

Semis

ALAB -7% as MS downgraded, mainly on valuation but also called out potential risks from NVDA’s Hopper-Blackwell transition and rising competition.

TER -4% as MS downgraded to sell and took numbers 9% below the street on topline for 24-26, citing ASIC and Apple growth as insufficient to alter competitive dynamics

VST +8% as fire from Friday didn’t spread and Pelosi bought some stock

AI names generally performed well: NVDA +2.2%; AMD +70bps; AVGO +1.2%; MU +3..5%; CLS +4%; ANET +1% although MRVL -80bps one of the few who ended in the red

INTC +1.3% on more speculation for a buyout and HSBC upgrading to Hold from Reduce

QRVO +4% on MS upgrade saying potential for $9.5 sustainable EPS with fundamental changes from activist

QCOM +1.6% as JPM placed on positive catalyst watch.

Software

PANW +3.6% as MS upped target on better channel checks indicating stronger platform deals and market share gains - MS sees potential for stock to 2x in 4-5 years driven by expanding platform adoption.

FRSH flat despite Wells downgrade

Elsewhere

AAPL -3% (see above)

WIX -1% despite RJ upgrade

TSLA -50bps

HOOD +4% continues to rip; XYZ (SQ) +3%

AFRM -2% on SIG downgrade