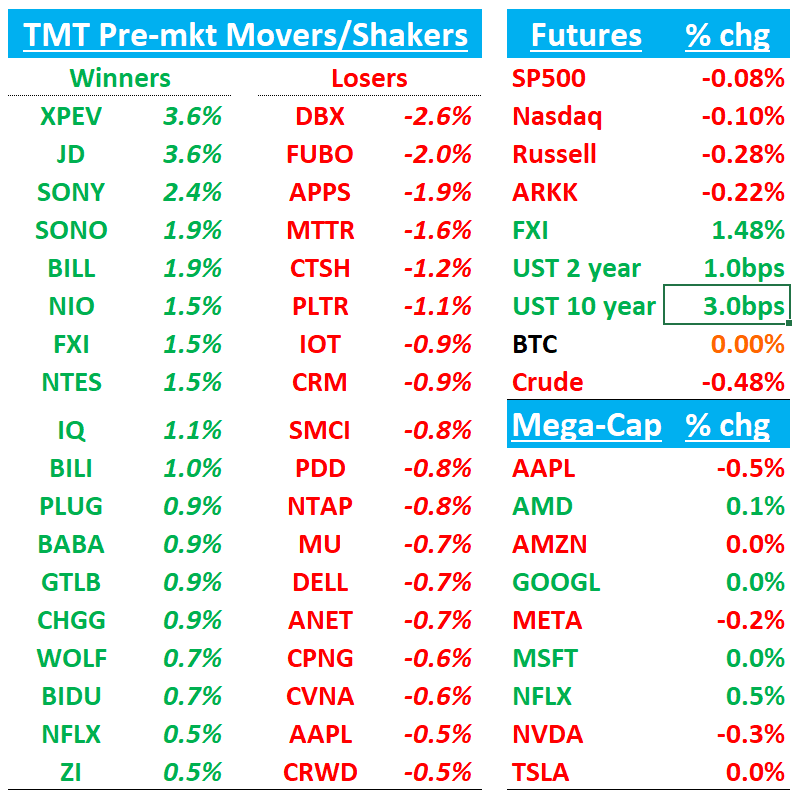

Good morning. QQQs flattish; BTC -2%; yields ticking up slightly. China +1.5% as , China Industrial Profit figures showed an acceleration in July vs June and earnings from China’s Trip.com helping travel names along with JD’s buyback. L

Let’s get straight to it…

AAPL: CFO Maestri to transition from his role on Jan 1st, 2025; Maestri will continue to lead the Corp Services teams; Kevan Parekh, Apple's VP of Financial Planning & Analysis, will become CFO and join the executive team

Street generally fine with the change:

Citi views as “a bit negative” since Maestri helped Apple expand gross margin by 7% and is highly regarded within the investor community.

KEYBanc also sees as a modest negative and believes AAPL’s financial disclosures could certainly be improved where more key performance indicators, such as installed base of active devices across products, unit sales by product, and paid subscriptions in services, "could all be useful metrics for investors." However, KeyBanc doubts new management will make any changes.

Morgan Stanley noted that Parekh's ascension to CFO is similar to Maestri's path a decade ago. This CFO transition is "well-telegraphed" and should provide key stakeholders with confidence that the CFO succession plan has been well-thought and planned out, says the analyst, who adds that the firm has "been impressed by Mr. Parekh in the limited interactions we've had with him."

Melius Research thought a CFO change at Apple could happen soon, noting CFOs don't typically do it longer than 10 years "just about anywhere" and Luca Maestri just celebrated his 10-year anniversary as CFO. Apple "methodically groomed his successor" Kevan Parekh and "there probably is no better time to do this than now" as we enter a multi-year upgrade cycle for iOS devices, the analyst tells investors in a research note. The firm says Maestri staying on to lead Corporate Services is "likely to make sure things go off without a hitch."

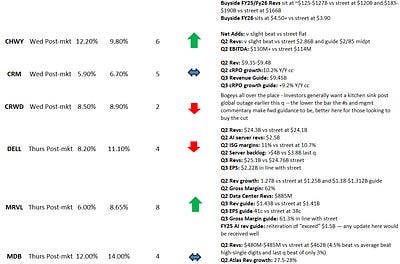

CRM: Barclays and JPM out with mixed checks ahead of the q

Barclays says their checks came in more negatively with just 20% of resellers reporting some level of outperformance to their plans (vs. 64% last quarter), a level they had not seen in this survey since the pandemic-impacted quarters. In addition, Barclays notes the resellers polled pointed to higher levels of discounting and smaller deal sizes overall. Barclays saw 60% of resellers mention greater than normal discounting (compared to ~35% the prior two quarters) and 70% cite smaller deals (compared to just 45% in Q1)

JPM’s checks with partners finished below plan this Q (-3.2%), degrading from 1Q, with partners citing an uneven macroeconomic backdrop, elections, and summer doldrums. JPM notes that bookings expectations (degraded to -41% (from 19% last Q), and the net pace of business declined as well (though both remain well above trough). However, JPM notes partners were more positive on GenAI and Data Cloud with px increases being accepted and they see pot’l upside to rev from earlier px increases kicking in and a potential for end April sales push that may not have been fully captured by partners

Amazon aims to launch delayed AI Alexa subscription in October

Amazon is preparing to launch its delayed overhaul of personal voice assistant Alexa in October, according to internal documents obtained by The Washington Post, as it faces new competition from artificial intelligence voice assistants from rivals.

Access to the upgraded version of the assistant will require a paid subscription, the documents said.

The release, scheduled to occur just weeks before the presidential election, will include a new “Smart Briefing” feature that provides daily, AI-generated summaries of news articles selected based on a customer’s preferences, the documents said…

Amazon has not released a general-purpose chatbot similar to ChatGPT, Google’s Gemini or Microsoft Copilot, although it has launched a shopping assistant called Rufus. But the documents said that alongside the new Alexa the company plans to launch Project Metis, a web-based product, previously reported by Business Insider, that is meant to directly compete with ChatGPT-style tools.

ADBE: HedgeEye launches at Buy with 20% upside

Hedgeye says they are confident AI will not be a headwind for ADBE, contrary to what some investors think, as cross-selling will drive greater exposure for ADBE’s ecosystem and drive an acceleration in Digital Media ARR. Hedgeye thinks Digital Experience growth could accelerate in Q3 and thinks the stock should trade at 20x 2025 P/E, implying 20% upside

NVDA Truist raises tgt to $145 from $140 ahead of earnings

As Truist prepared for NVDA's CQ2 (July) report after-market on Wednesday, it reached out to component buyers and sellers for updates from suppliers who sell into and alongside NVDA. Critical observations include four major points: Truist believes Blackwell is not delayed. Blackwell orders improving. Demand for GPUs appears insatiable, and there is some shift to on-prem / enterprise happening now.

NFLX: ISI raises PT to $750 from $710 after their US and Mexico Survey

ISI believes NFLX has more room to raise pricing and points out key takeaways from their survey: 1) NFLX metrics stable in US and Mexico while their competitive position remains as strong as ever 2) SAVOD remains a powerful Gross Adds and Anti-churn lever, now 50%+ from Gross Adds 3) Everyone likes live with potential retention and acquisition power 4) NFLX games is seeing increasing penetration

JD: JD.com authorizes new $5.0B share repurchase program

JD.com has approved a new share repurchase program, effective from September 2024. Pursuant to the new share repurchase program, the company may repurchase up to $5.0B worth of its shares over the next 36 months through the end of August 2027. The Board will review the share repurchase program periodically, and may authorize adjustment of its terms and size.

AFRM: Affirm could see GAAP profitability by Q4 of 2025, says Mizuho

TheFly:

Mizuho analyst Dan Dolev says Affirm is set to provide fiscal 2025 guidance on Wednesday with consensus pointing to a GAAP loss for the year. However, the firm believes Affirm has a potential to reach GAAP operating income profitability by Q4 of 2025, helped by a "dramatically lower warrant expense burden" in the second half of the year, lower interest rates, and improving scale even before any incremental benefit from Apple Pay buy now pay later volumes. The prospect of seeing potential GAAP profitability by Q4 of 2025 "could result in a step-function in the attractiveness of the AFRM stock," the analyst tells investors in a research note.

MDB: MongoDB revenue bar 'sufficiently conservative,' says Citi

TheFly:

Citi says that following a second guidance cut last quarter from MongoDB, the bar on total revenue is "sufficiently conservative." The firm is more optimistic on upside to estimates from Enterprise Advanced versus Atlas citing favorable inputs on large financial service renewals and consensus more aggressive on Atlas growth versus EA. Citi sees a better stock set-up for MongoDB in the second half of 2024, with easier compares, stronger large deal seasonality and easing of headwinds into fiscal 2026. It keeps a Buy rating on the shares with a $350 price target.

CRWD: Citi on expert call with law professor

Net, CITI has greater comfort that CRWD's financial obligations are likely to be contained (limitation of liability clauses, most capped at ~2-3x) and will likely be enforced as such through contract law provisions should the process move towards trial. Citi notes Delta's ability to identify contract loopholes remains the biggest uncertainty, though early indicators suggest this May prove challenging, especially in the context of Delta's alleged outdated IT infrastructure a likely reason behind its prolonged recovery efforts. Allin, while Delta vs CRWD is unprecedented in case-law, Sprigman suggests a settlement appears the most-likely rational scenario.

PDD: Citi downgrades Neutral

While CITI does not view rev miss as thesis changing, it struggles to reconcile if management's cautious tone on outlook citing intensified competition, shift of consumption patterns, and uncertain external environment reflects “actual challenges” amid diminishing return on its “value-for-money” moat and regulatory risk or trying to manage competition and investor expectation through “low profile” approach. Nevertheless, given limited investor communication and the lack of operating metrics and financial breakdown disclosure, together with management's intentional/proactive cautious outlook comment, Citi thinks the stock will likely be range bound until PDD is able to regain investor confidence through few quarters of consistent result beat.

UBER/GOOGL: JMP says – Waymo unit economics likely positive – suggests it will scale

With Waymo's service becoming generally available in San Francisco this summer and the company testing in more markets, like Truckee, Detroit, and upstate New York, JMP thinks unit economics flipped to positive in San Francisco, which it estimate in this note, signaling an acceleration in Waymo's expansion plans. While JMP continues to be concerned about share loss for Uber as it believes Waymo (and AVs broadly) offers a better (and ultimately cheaper) service than human-based drivers, it thinks Uber can solve this through relatively inexpensive M&A over time as the value of the number two or three AV company is limited given its view that this is a winner-take-most market

UBER/CART: Why Instacart’s Future May Hinge on Uber

Out yesterday, but likely contributed to CART +2% / UBER -2%. The Information:

“A possible precursor to a merger is the tightening alliance between its two CEOs, Uber’s Khosrowshahi and Instacart’s Fidji Simo. The pair has developed a strong rapport and shares a common thread: They both took over from embattled founders who clashed with their investors. Khosrowshahi, too, had a rough go in Uber’s early years as a public company, before he won over investors in the past year. Earlier this year, Simo approached Khosrowshahi about a potential partnership to allow Instacart customers to order restaurant delivery from Uber Eats through Instacart’s app, creating a slick integration. In doing so, she bypassed a fellow rival, DoorDash CEO Tony Xu, two people familiar with the matter said. Simo has warmer feelings toward Khosrowshahi than toward Xu, the people said. Simo attempted to negotiate a potential merger with Xu's company three years ago, following failed efforts by former Instacart CEO Apoorva Mehta. Instacart’s C-suite is also stocked with former Uber executives, including its chief product and marketing officers. Its chief financial officer, Emily Reuter, is a former Uber ride-sharing finance chief. She joined Instacart as vice president of finance in January and was elevated to the CFO role the day after the two companies announced their partnership in May.”

OKTA: BTIG comments on positive checks

BTIG talked to 8 partners and 1 CISO about demand trends and feedback was positive and improved in their checks from prior quarters. BTIG notes demand has stabilized and is potentially improving for OKTA. In addition, BTIG notes neg sentiment from the company’s breach back in Oct 2023 is gradually fading and feedback from new products such as OIG, PAM, ITDR was mixed across contacts.

Other News:

AAPL: will host its product event dubbed “It’s Glowtime” on Sept 9th – CNBC

AAPL: developing new Mac series w/ M4 processors and will unveil the new products in Oct – Economic Daily

China EVs / AV: China's BYD to use Huawei's advanced autonomous driving system in off-road EVs – Reuters

DIS: DirecTV Looks to Rewrite Pay-TV Rules in Disney Networks Talks – Bloomberg

INTC: Intel slashes marketing budget as AMD presses for market shift – Digitimes

PARA: Edgar Bronfman drops Paramount bid, clearing path for Skydance deal – Reuters

PARA: Paramount Explores Sale of 12 Local TV Stations – Bloomberg

Semicap: China’s export curbs on semiconductor materials stoke chip output fears – FinancialTimes

Sony: Sony to raise PlayStation 5 price by 20% in Japan - Reuters

TSLA: Tesla’s Rivals Still Can’t Use Its Superchargers - NYTimes

WDC: files mixed shelf of indeterminate amount