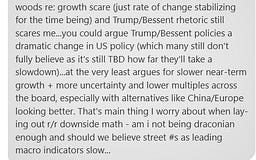

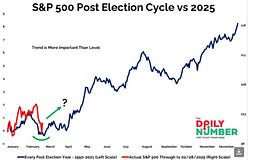

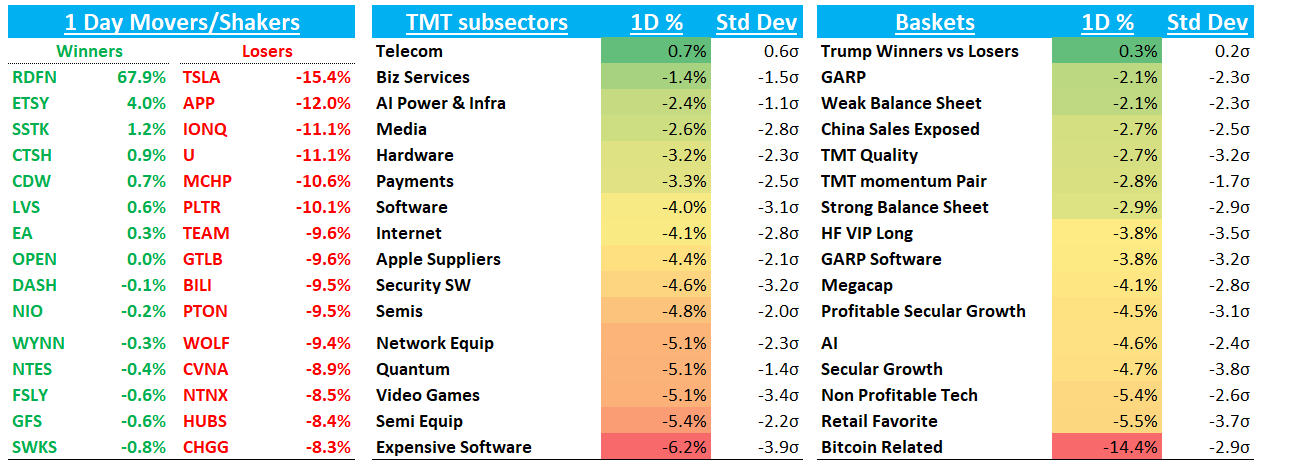

Another day of indiscriminate selling as QQQs - 3.8% with SOX -5%, ARKK -9% and BTC -5%. It felt like our “tactical bounce” call was swatted away before we even had a chance to shoot and we were stopped out pretty early (we took our hit and shifted back to “protect pnl” mode) as market fears around growth and Trump/Bessent continue to take center stage — no investor ever likes to hear words like “detox” and “period of disruption”— along with continued fears around HF de-grossing. Here’s what we wrote yesterday in the chat that expresses something similar re: Trump/Bessent:

又是无差别抛售的一天,QQQ 下跌 3.8%,SOX 下跌 5%,ARKK 下跌 9%,BTC 下跌 5%。感觉我们的“战术反弹”预测还没等我们有机会出手就被打掉了,我们很早就止损了(我们承受了损失并切换回“保护利润”模式),因为市场对增长以及特朗普/贝森特的担忧继续占据主导地位——没有投资者喜欢听到“排毒”和“动荡期”这样的词——再加上对对冲基金去杠杆化的持续担忧。以下是我们昨天在聊天中写的关于特朗普/贝森特的内容,表达了类似的观点:

Add to that indiscriminate de-grossing flows and you can usually throw your r/r’s out the window in the short-term…Here’s some snippets from desks on where we are in terms of HF de-grossing before the day started…

再加上那些不加区别的去杠杆化资金流动,短期内你通常可以把你的风险/回报比率抛诸脑后……以下是交易台在当天开始前关于对冲基金去杠杆化情况的一些摘录……

Here’s GS: 以下是高盛:

Overall book Gross leverage +1.2 pts to 286.5% (5-year high) and Net leverage -1.0 pts to 76.3% (47th percentile 1-year). Overall book L/S ratio -1.0% to 1.726 (1-year low). Fundamental L/S Gross leverage +0.1 pts to 200.1% (93rd percentile 1-year) and Net leverage -1.6 pts to 54.6% (17th percentile 1-year).

整体投资组合总杠杆率上升 1.2 个百分点至 286.5%(五年高点),净杠杆率下降 1.0 个百分点至 76.3%(一年内第 47 百分位)。整体投资组合多空比率下降 1.0%至 1.726(一年低点)。基本面多空总杠杆率上升 0.1 个百分点至 200.1%(一年内第 93 百分位),净杠杆率下降 1.6 个百分点至 54.6%(一年内第 17 百分位)。

Here’s MS: 这是 MS:

Hedge Fund net exposure is now down to 46%, or just the 22nd percentile going back to 2010, but gross leverage for US L/S funds remains elevated at 210% (100th %ile since 2010 and only down 3 pts from the high)…Friday specifically was a bigger de-gross day than Thursday and was the 2nd largest day of long selling YTD (trailing only DeekSeek Monday) with the focus shifting to covering shorts (de-netting vs de-grossing prior)

对冲基金的净敞口现已降至 46%,即自 2010 年以来的第 22 百分位,但美国多空基金的总杠杆率仍高达 210%(自 2010 年以来的第 100 百分位,仅比高点下降了 3 个百分点)…具体而言,周五的减仓规模大于周四,成为年内第二大长线卖出日(仅次于 DeekSeek 周一),且焦点转向了空头回补(与之前的减仓相比,此次为净回补)

And DB on today: 以及今日的 DB:

In option land back on Dec. 18 and Aug. 5, the spikes in the VIX on a percentage basis were far bigger relative to the declines in the S&P 500. Monday, both the VIX and the VVIX — the vol of vol — are off their highs, with VIX options volumes about average and few signs of traders betting on bigger moves with far upside calls. The relatively modest increase in volatility during this stock slump suggests that investors are closing out positions and reducing exposure, rather than buying protection against bigger market swings.

在 12 月 18 日和 8 月 5 日的期权市场中,VIX 指数的百分比涨幅相对于标普 500 指数的跌幅要大得多。周一,VIX 和 VVIX——波动率的波动率——均从高点回落,VIX 期权交易量接近平均水平,几乎没有迹象显示交易员通过大量看涨期权押注更大波动。此次股市下跌期间波动率的相对温和上升,表明投资者正在平仓并减少风险敞口,而非购买保护以应对更大的市场波动。

So overall with Gross still at 200%+ still seems like there could be plenty to go as PnL pain starts to increase as L/S managers turn negative for the year.

因此,总体来看,尽管总杠杆率仍保持在 200%以上,随着多空策略管理者的年度收益转为负值,损益压力开始增加,市场似乎仍有较大下行空间。

Here’s Jack Atherton at JPM at his best this afternoon:

这是今天下午 JPM 的 Jack Atherton 的最佳表现:

Today we have started to see the LO capitulatory selling, taking on the reigns from HF sellers last week, and as the day has progressed we are seeing a big acceleration in tech supply (mostly software). The supply today closely resembles the LO activity we saw in 2022… a trimming of the tails to hunker down in known winners / defensives… e.g. it’s hard to justify owning a 50bp position in Confluent when “vibes” is no longer a credible investment thesis and you can’t comfortably explain what the company does (using CFLT just as an example rather than anything specific).

今天我们已经开始看到 LO(长线投资者)的投降式抛售,接替了上周对冲基金卖家的角色,并且随着时间推移,科技股(主要是软件类)的供应出现了大幅加速。今天的抛售行为与 2022 年我们观察到的 LO 活动极为相似……即削减尾部仓位,转而固守已知赢家/防御性股票……例如,当“氛围”不再是一个可信的投资论点,并且你无法轻松解释公司业务时,持有 Confluent(仅以 CFLT 为例,并无特指)50 个基点的头寸就很难自圆其说了。

GS also said CTAs short $10B of equities after selling $39B in last 5 sessions, saying there have been only 15 instances in their dataset of grater magnitude (all occurred in ‘18 and ‘20)

GS 还表示,在过去的 5 个交易日中,CTAs 卖出了 390 亿美元的股票后,目前持有 100 亿美元的空头仓位,称在他们的数据集中仅有 15 次规模更大的实例(均发生在 2018 年和 2020 年)

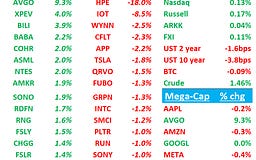

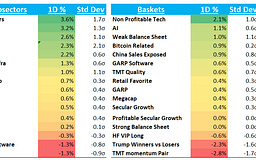

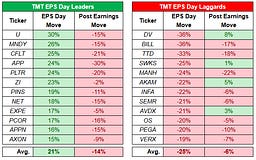

On a day like today, a lot of moves more indiscriminate rather than fundamentally driven, but we’ll call out some that caught our eye:

在像今天这样的日子里,许多操作更为随意而非基本面驱动,但我们会指出一些引起我们注意的:

Post-close, ORCL’s +5.5% bookings steal the show….Q3 missed slightly and OCI 51% cc, slightly light of bogeys. But RPO was very strong +62% y/y $130B up from $97B last q (street at $103B, bogeys at $110B and the most bullish bogeys at $120B ) and said backlog will drive 15% of total rev growth next FY (street at 13%) . OPM also beat at 44% vs 43.6%.

收盘后,ORCL 以+5.5%的预订量抢尽风头……第三季度略微未达预期,OCI 按固定汇率计算增长 51%,略低于目标。但 RPO 表现非常强劲,同比增长 62%,达到 1300 亿美元,高于上季度的 970 亿美元(市场预期为 1030 亿美元,目标为 1100 亿美元,最乐观的目标为 1200 亿美元),并表示积压订单将推动下一财年总营收增长 15%(市场预期为 13%)。营业利润率也超出预期,达到 44%,而预期为 43.6%。

CEO Safra Catz:

"Oracle signed sales contracts for more than $48 billion in Q3. This record sales number pushed our Remaining Performance Obligations, or RPO, up 63% to over $130 billion. We have now signed cloud agreements with several world leading technology companies including: OpenAI, xAI, Meta, NVIDIA and AMD. We expect that our huge $130 billion sales backlog will help drive a 15% increase in Oracle's overall revenue in our next fiscal year beginning this June. And we expect RPO to continue to grow rapidly—as we look forward to signing our first Stargate contract—yet another big opportunity for Oracle to expand both its AI training and AI inferencing businesses in the near future."

Oracle 在第三季度签署了超过 480 亿美元的销售合同。这一创纪录的销售数字使我们的剩余履约义务(RPO)增长了 63%,达到超过 1300 亿美元。目前,我们已经与包括 OpenAI、xAI、Meta、NVIDIA 和 AMD 在内的多家全球领先科技公司签署了云协议。我们预计,从今年 6 月开始的下一财年,我们庞大的 1300 亿美元销售积压将推动 Oracle 整体收入增长 15%。随着我们期待签署首份 Stargate 合同,我们预计 RPO 将继续快速增长——这将是 Oracle 在不久的将来扩展其 AI 训练和 AI 推理业务的又一重大机遇。

ORCL RESULTS: Q3 ORCL 财报:第三季度

- ADJ revenue $14.13B, +6.4% y/y, EST $14.39B

- ADJ 营收 141.3 亿美元,同比增长 6.4%,预期 143.9 亿美元

- Revenue in constant currency +8%, EST +9.09%

- 按不变汇率计算的收入增长+8%,预期增长+9.09%

- ADJ EPS $1.47 vs. $1.41 y/y, EST $1.49

- 调整后每股收益(ADJ EPS)为 1.47 美元,去年同期为 1.41 美元,预期(EST)为 1.49 美元

- Cloud revenue (IaaS plus SaaS) $6.2B, EST $6.3B

- 云收入(IaaS 加 SaaS)$6.2B,预期$6.3B

- Cloud revenue (IaaS plus SaaS) in constant currency +25%, EST +26.5%

- 云收入(IaaS 加 SaaS)按固定汇率计算增长 25%,预估增长 26.5%

- Cloud Infrastructure revenue (IaaS) $2.7B, EST $2.71B

- 云基础设施收入(IaaS)$2.7B,预估$2.71B

- Cloud Infrastructure revenue (IaaS) in constant currency +51%, EST +54.2%

- 云基础设施收入(IaaS)按固定汇率计算增长 51%,预期增长 54.2%

- Cloud services and license support revenue $11.01B, +10% y/y, EST $11.18B

- 云服务和许可支持收入 $11.01B,同比增长 10%,预期 $11.18B

- Cloud license and on-premise license revenue $1.13B, -10% y/y, EST $1.2B

- 云许可和本地许可收入 $1.13B,同比下降 10%,预期 $1.2B

- Hardware revenue $703M, -6.8% y/y, EST $718.2M

- 硬件收入 7.03 亿美元,同比下降 6.8%,预期 7.182 亿美元

- Service revenue $1.29B, -1.2% y/y, EST $1.28B

- 服务收入$1.29B,同比下降 1.2%,预估$1.28B

- ADJ operating income $6.20B, +7% y/y, EST $6.25B

- ADJ 营业收入 $6.20B,同比增长 7%,预期 $6.25B

- ADJ operating margin 44% vs. 44% y/y, EST 43.6%

- ADJ 营业利润率 44% 同比持平,预期 43.6%

Internet 互联网

ABNB -1.7% outperformed on Jefferies upgrade saying SOTP indicates ABNB’s valuation only accounts for its core lodging operations and take rate increases/experiences are all optionality.

ABNB -1.7%因 Jefferies 升级而表现优异,称 SOTP 显示 ABNB 的估值仅反映其核心住宿业务,而费率提升和体验业务均为附加价值。DASH flat on SP500 Add

DASH 在 SP500 上持平RDDT -20% CEO was at DB’s MIT Conference - We didn’t hear anything particularly interesting that would cause a -20% move, but this was the most crowded SMID internet stock just a couple months ago and now down 50%+. Full notes from CEO presentation all the way down….Clev was also out somewhat positive saying partners expect to see “significant momentum in 2025”

RDDT -20% CEO 出席了 DB 的 MIT 会议——我们没有听到任何特别引人注目的消息会导致股价下跌 20%,但就在几个月前,这还是最热门的 SMID 互联网股票,如今已下跌超过 50%。CEO 演讲的完整记录一路下滑……Clev 也发表了一些积极言论,称合作伙伴预计“2025 年将看到显著的增长势头”。GOOGL -4.6% as DOJ didn’t do them any favors and Clev was out mixed saying partners calling out moderating search spend and lower share of wallet due to ROI pressure, although they were positive on Gen AI adoption continuing to grow

GOOGL 下跌 4.6%,因司法部未予优待,且 Clev 评价不一,称合作伙伴指出由于 ROI 压力,搜索支出减少和钱包份额下降,尽管他们对生成式 AI 的持续增长持积极态度Ad names potentially weaker as Trump said four bidders in play for TikTok deal “soon”: META -4.4%; SNAP -7%; PINS -8%

由于特朗普表示 TikTok 交易的四个竞标者“很快”将参与角逐,广告名称可能走弱:META -4.4%;SNAP -7%;PINS -8%SPOT -8% used to be a hiding spot but no place to hide…M-sci was out this morning saying Q1 net adds trending above street

SPOT -8% 曾经是避风港,如今无处可藏……M-sci 今早发布报告称,第一季度净增用户数高于市场预期ETSY +4% benefitting from unwind as lots of books were short

ETSY +4%,受益于空头回补,因许多账户做空

Semis 半导体

SNDK +4.5% as Mizuho initiated at outperform

SNDK 上涨 4.5%,因瑞穗初评给予跑赢大盘评级Despite better TSM -4% #s, AI complex underperformed: AVGO -5.5%; MU -6%; ARM -7.5%; MRVL -8%; ANET -7%; CLS -7%; ARM -8%

尽管 TSM -4%的数据较好,AI 板块表现不佳:AVGO -5.5%;MU -6%;ARM -7.5%;MRVL -8%;ANET -7%;CLS -7%;ARM -8%Analogs all over the place: MCHP -10%; TXN -2%; ON -3%; ADI -4%…Been a long time since I’ve seen such large performance disparity within analogs

各地同类股表现:MCHP -10%;TXN -2%;ON -3%;ADI -4%…很久没见到同类股之间如此大的表现差异了

Software 软件

CTSH +1% as activist Mantle Ridge built a $1B stake

CTSH 上涨 1%,维权投资者 Mantle Ridge 建立 10 亿美元持仓ADBE -3% outperformed the rest of sw a bit as M-sci was positive on AI attach rate ramp in Feb - co reports on Thursday

ADBE -3% 略优于其他软件股,因 M-sci 对 2 月份 AI 附加率提升持正面态度 - 公司周四将发布报告APP -12% as they didn’t get added to SP500 - Citi out with a note that said APP pricing in 50% of being worth 0 positive on e-comm ramp and share repurchases

APP -12%,因未被纳入标普 500 指数 - 花旗发布报告称,APP 的定价反映了 50%的归零可能性,但对电商业务增长和股票回购持积极态度NOW -8% after nearing deal to buy AI assistant maker Moveworks

NOW -8%,此前接近达成收购 AI 助手制造商 Moveworks 的协议U -11% as Wells Fargo had some initial negative checks on Vector

U -11%,因富国银行对 Vector 进行了一些初步的负面检查Red everywhere: GTLB -10%; CFLT -8%; CRWD -8%; SNOW -7%; PANW -4%; MDB -4%; CMR -3.5%; MSFT -3%

一片红海:GTLB -10%;CFLT -8%;CRWD -8%;SNOW -7%;PANW -4%;MDB -4%;CMR -3.5%;MSFT -3%

Elsewhere 其他地方

TSLA -16% absolutely brutal day as Elon continues cringe-worthy posts on X, UBS and Redburn negative while Bloomberg said TSLA failing in China due to BYD’s rapid rise

TSLA -16% 绝对残酷的一天,Elon 在 X 上继续发布令人尴尬的帖子,UBS 和 Redburn 持负面看法,而 Bloomberg 表示由于 BYD 的迅速崛起,TSLA 在中国市场表现不佳Fintech crushed as BTC crossed below $80k: HOOD -20%; COIN -18%; UPST -12%; AFRM -12%; XYZ -9%

金融科技股暴跌,因 BTC 跌破 8 万美元:HOOD -20%;COIN -18%;UPST -12%;AFRM -12%;XYZ -9%AAPL -5% wasn’t spared as Bloomberg was out saying they are delaying Siri upgrades indefinitely as AI concerns escalate

AAPL -5% 未能幸免,因彭博社报道称,随着 AI 担忧升级,他们将无限期推迟 Siri 的升级

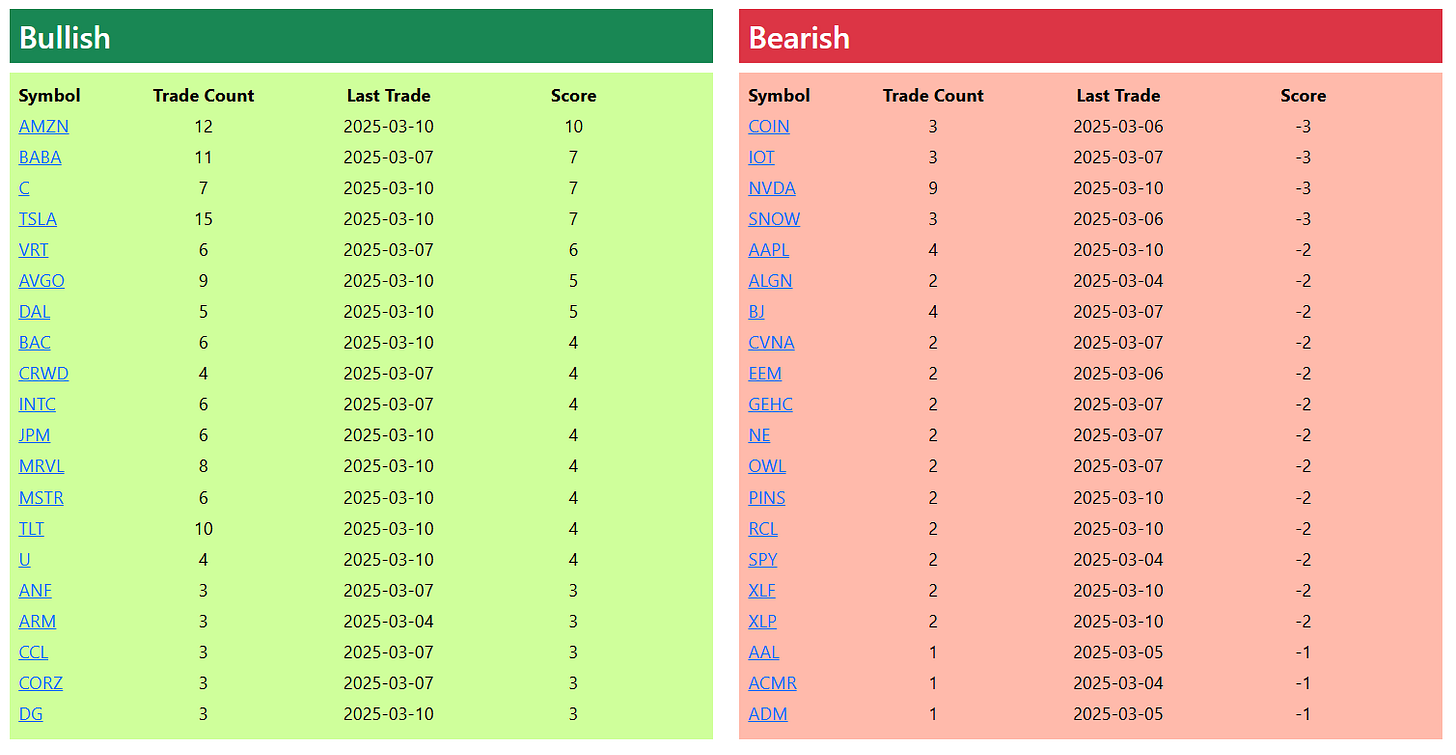

Bullish and Bearish Weekly Option Flow

看涨和看跌周期权流

RDDT CEO notes at DB MIT Conf

RDDT CEO 在 DB MIT 会议上的发言

Google Relationship and Traffic Dynamics

Google 关系与流量动态

"We basically have two traffic sources, direct to Reddit and then from Google… We saw some chop from Google… In Q4… a little bit of a swing that we’ve since recovered from… Reddit was the sixth most searched word on Google… Internet consumers broadly want Reddit’s content… We get more traffic direct, straight to Reddit… In Q4, where we saw a little Google chop, revenue was as strong as ever… Within the Google traffic… about half of that on any given day is logged-in… It’s our least valuable cohort of users from a monetization point of view."

我们主要有两个流量来源,直接访问 Reddit 和来自 Google 的流量……我们在 Q4 看到了一些来自 Google 的波动……但之后已经恢复……Reddit 是 Google 上搜索量第六高的词……互联网用户普遍想要 Reddit 的内容……我们获得的直接访问 Reddit 的流量更多……在 Q4,尽管我们看到了一些来自 Google 的波动,但收入依然强劲……在 Google 的流量中……每天大约有一半是登录用户……从变现的角度来看,这是我们价值最低的用户群体。

Search Evolution and Reddit Answers

搜索进化与 Reddit 回答

"We saw… the emergence of another use case on Reddit, which is users going through the historical Reddit Corpus, looking for answers… Our mission now is to empower communities and make their knowledge accessible to everyone… Reddit Answers… has only been online for about a month and a half… We run a basic search on Reddit… And then we use an LLM to summarize the results… It’s really, really powerful… We’ll be merging that with traditional search on Reddit… I think we can make that product much, much better… It’s one of the few products that actually hits every cohort of users."

我们看到…在 Reddit 上出现了另一个用例,即用户通过浏览历史 Reddit 语料库来寻找答案…我们现在的使命是赋能社区,让他们的知识对所有人开放…Reddit Answers…上线仅一个半月左右…我们在 Reddit 上进行基本搜索…然后使用LLM来总结结果…这真的非常强大…我们将把它与 Reddit 上的传统搜索合并…我认为我们可以让这个产品变得更好…这是少数几个真正覆盖所有用户群体的产品之一。

Revenue and Profitability Milestones

收入与盈利里程碑

"We hit… long standing goals that we crossed last year… We crossed $1 billion in revenue, which again, we’ve had our eye on that for a long time… And then we’ve got the profitability for the first time as well… In 2015, we did $12 million in revenue and we had 12 million DAU… Last quarter over 60% [revenue growth]… It was one of our best quarters last year, growing over 60% in the quarter… I don’t think we could have asked for a better year last year."

“我们实现了……去年跨越了长期以来的目标……我们的收入突破了 10 亿美元,这是我们长期以来一直关注的目标……而且我们也首次实现了盈利……2015 年,我们的收入是 1200 万美元,日活跃用户数(DAU)也是 1200 万……上个季度,我们的收入增长了超过 60%……那是我们去年表现最好的季度之一,季度增长超过了 60%……我认为去年我们不可能期待一个更好的年份了。”

User Growth and Engagement

用户增长与参与度

"We got to 100 million DAU which we’ve been chasing for a long time… We grew users 39%… We crossed that 100 million DAU mark… Logged-in users on Reddit, we grew over 27% every quarter last year… We’re at 170 million in the U.S. visit Reddit every week… We’re shifting our sites to how do we get to 1 billion DAU… In the U.S., let’s call it around 50 million DAU, but we have about 170 million people in the U.S. visit Reddit every week… That’s as big as anybody."

我们达到了 1 亿日活跃用户数(DAU),这是我们长期追求的目标……用户增长了 39%……我们突破了 1 亿 DAU 大关……去年,Reddit 的登录用户每季度增长超过 27%……在美国,每周有 1.7 亿人访问 Reddit……我们正在将重心转向如何达到 10 亿 DAU……在美国,我们称之为大约 5000 万 DAU,但每周约有 1.7 亿美国人访问 Reddit……这是非常大的规模。

Advertising Performance and Growth

广告表现与增长

"Our ad revenue growth last quarter, 60%… We had a couple of quarters like that last year, outgrowing the market, outgrowing our peers… Our ads are working… The targeting is getting better, the performance is getting better… We saw particular progress in the performance side of the business… In Q4 record number of advertisers and advertiser growth… We have years of roadmap in front of us of basically known winning ideas… We’re still… early in our journey… It’s a story of investing in the ad technology and making that as performant as possible."

我们上季度的广告收入增长了 60%……去年我们也有几个季度表现如此,超越了市场,超越了同行……我们的广告正在发挥作用……定位越来越精准,效果越来越好……我们在业务绩效方面取得了显著进展……第四季度广告商数量和广告商增长创下纪录……我们面前还有多年的路线图,基本上是已知的制胜策略……我们仍处于旅程的早期阶段……这是一个投资广告技术并使其尽可能高效的故事。

International Expansion and Machine Translation

国际扩展与机器翻译

"Growing outside the U.S., big priority for Reddit… 50% of our users today are outside the U.S.… The next 850 million to get to 1 billion have to come outside the U.S.… We can use large language models to translate the English corpus of Reddit into other languages… At human quality… Countries where we started using machine translation, they’re growing 30%, 40% faster than other countries… French in France was the first country… one of our fastest growing countries… Naturally being between 80% and 95% outside the U.S. is where we’ll land."

“在美国以外发展,是 Reddit 的首要任务……如今我们 50%的用户来自美国以外……要达到 10 亿用户,接下来的 8.5 亿必须来自美国以外……我们可以利用大型语言模型将 Reddit 的英文内容翻译成其他语言……达到人类翻译水平……在我们开始使用机器翻译的国家,它们的增长速度比其他地区快 30%到 40%……法国是第一个国家……也是我们增长最快的国家之一……自然而言,用户群体中 80%到 95%位于美国以外,将是我们最终的目标。”

Product Development and Video

产品开发与视频

"We’re builders… Reddit Answers… We did it in like 90 days… We’re building another version of our app called Reddit Lite, which we’ll be testing internationally… Making Reddit… much easier to use… Video… one of our fastest growing content sites… I expect video will continue to grow… We try to make the Reddit a comfortable and effective platform for talking about any content type… Can we reimagine Reddit to make it more effective at kind of juggling these different content types? That’s one of the big things on our mind."

我们是建设者… Reddit Answers… 我们在大约 90 天内完成了它… 我们正在构建另一个版本的应用程序,名为 Reddit Lite,我们将在全球范围内进行测试… 让 Reddit… 使用起来更加简单… 视频… 是我们增长最快的内容网站之一… 我预计视频将继续增长… 我们努力使 Reddit 成为一个舒适且有效的平台,用于讨论任何类型的内容… 我们能否重新构想 Reddit,使其在处理这些不同内容类型时更加有效?这是我们心中的一大课题。

Data Licensing and AI Opportunities

数据许可与 AI 机遇

"We did a couple of deals last year, one with Google, one with OpenAI, licensing our corpus for training for their LLMs… We’ve done a number of smaller deals… to kind of like social listening services or financial institutions… There’s an incredible amount of value there… We’re… training our own models… LLM technology will become commoditized, the price will come down… Reddit… text and words, and content evaluation, and translation, and moderation, safety, ad targeting… all of these things are things that AI and LLM specifically and dramatically advance."

“我们去年做了几笔交易,一笔是与 Google,一笔与 OpenAI,授权我们的语料库用于他们的LLMs训练……我们还完成了一些较小的交易……比如社交监听服务或金融机构……那里蕴藏着巨大的价值……我们正在……训练我们自己的模型……LLM技术将变得商品化,价格会下降……Reddit……文本和词汇,内容评估,翻译,以及审核、安全、广告定向……所有这些方面都是 AI 和LLM特别且显著推动的。”