MoMo Productions

Investment action

I give a hold rating for Guidewire Software (NYSE:GWRE) as I think most of the near-term positives are now fairly priced in. 3Q25 results were strong, with solid revenue growth and growing cloud traction, but the stock already trades at ~16x NTM revenue. Unless we see potential stronger growth acceleration, I don't see a compelling reason to give a buy rating here.

我給予 Guidewire 軟體(NYSE: GWRE)持有評級,認為多數短期利多已充分反映於股價。2025 財年第三季表現強勁,營收穩健成長且雲端業務動能提升,但股價已達未來 12 個月營收的 16 倍。除非出現更強勁的成長加速跡象,否則目前缺乏給予買入評級的充分理由。

Company description

The GWRE software solution helps insurers operate more efficiently. Its end-to-end platform supports the full insurance lifecycle. Since its launch in 2001, GWRE has expanded its product suite and customer range, which now includes digital-first insurers to large carriers globally. GWRE core products include InsuranceSuite Cloud, InsuranceNow, and the traditional on-premise InsuranceSuite for self-managed deployments.

GWRE 軟體解決方案協助保險業者提升營運效率。其端到端平台支援完整保險週期。自 2001 年推出以來,GWRE 持續擴展產品線與客戶群,現已涵蓋全球數位原生保險商至大型保險集團。核心產品包括 InsuranceSuite 雲端版、InsuranceNow,以及傳統自建部署的本地版 InsuranceSuite。

3Q25 Earnings Review

GWRE delivered a strong set of 3Q25 results, with total revenue growing by 22% y/y to $293.5 million, driven by continued momentum in its cloud business. The subscription and support segment grew 32% y/y to $181.8 million, which is a clear sign that cloud adoption is accelerating. License revenue was up 2% y/y to $57.2 million, while services grew 17% y/y to $54.5 million. Annual recurring revenue [ARR] reached $960 million, up from $828 million in 3Q24. The notable aspect here is the pace of deal activity. GWRE signed 17 new cloud deals in just 1 quarter (including 10 with large Tier 1 and Tier 2 insurers), which is a sizable step up from 12 in 2Q25 and 9 in 1Q25.

GWRE 公布亮眼的 2025 財年第三季財報,受雲端業務動能驅動,總營收年增 22%達 2.935 億美元。訂閱與支援部門年增 32%至 1.818 億美元,顯示雲端採用明顯加速;授權營收年增 2%至 5,720 萬美元;服務營收年增 17%至 5,450 萬美元。年度經常性收入(ARR)從去年同期的 8.28 億美元成長至 9.6 億美元。值得注意的是交易量增速:單季簽訂 17 筆新雲端合約(含 10 筆大型保險集團合約),較第二季 12 筆與第一季 9 筆顯著提升。

Margins also moved in the right direction. Adj. gross profit came in at $191.9 million (margin of 65%), driven by both the Subscription and Support segment's strong 71% margin and the Services gross margin improving to 13%. All in, this translated to an adj. EBIT operating of $46.1 million and net income of $75.2 million, or $0.88 per share. Looking ahead, management raised their FY25 targets for ARR, revenue, and operating income.

利潤率同步改善。調整後毛利達 1.919 億美元(利潤率 65%),主因訂閱支援部門 71%的高利潤率及服務毛利率提升至 13%。整體帶來調整後息稅前營運利潤 4,610 萬美元,淨利 7,520 萬美元(每股 0.88 美元)。展望未來,管理層上調 2025 財年 ARR、營收及營運利潤目標。

Competitive Advantages

I see two solid competitive advantages with GWRE: its end-to-end product suite and its scaled partner ecosystem.

我認為 GWRE 具備兩大競爭優勢:完整的端到端產品線與規模化的合作夥伴生態圈。

The product strategy is very important. GWRE offers a full-stack platform that addresses the entire insurance lifecycle-from policy and billing to claims, digital engagement, and analytics. This is important because it allows insurers to avoid the headaches of patching together multiple point solutions that may not work well together at all. This is especially true for clients that are attempting to upgrade their entire tech stack (i.e., modernize), in that dealing with a single vendor is way easier and potentially cheaper. Importantly, GWRE products are built to serve large and complex environments, and the fact that GWRE is able to win large deals with large carriers is a solid testament to this. Sub-scale players (especially point solution vendors) simply cannot compete, as they are not comprehensive enough.

產品策略至關重要。GWRE 提供涵蓋完整保險週期的全端平台——從保單管理、帳務系統到理賠、數位互動及數據分析。這讓保險業者免於整合零散解決方案的困擾,尤其對計劃全面升級技術架構(即現代化)的客戶而言,單一供應商方案更簡便且具成本效益。值得注意的是,GWRE 產品專為大型複雜環境設計,其能贏得大型保險集團合約即為明證。規模不足的競爭者(特別是單點方案供應商)因產品不夠全面而難以匹敵。

Secondly, I see GWRE's partner ecosystem as a real moat. The ecosystem primarily includes system integrators (SI)-just think of them as large consulting firms with specialized teams-that play a key role in deploying GWRE software. So far, GWRE has built a vast network of trained consultants globally, and there are multiple benefits from doing so. One, it is a much more cost-effective measure to target a wide range of customers spread across multiple regions/continents. This is something that GWRE simply cannot handle with internal staff alone. Relying on SI actually frees up resources for GWRE to stay focused on product innovation. Two, there is a virtuous cycle that GWRE benefits from as long as it stays as the best product in the market. SI has a reputation to maintain, so it is likely they sell the best and most recognized product in the market. This drives more demand for GWRE that enables it to reinvest into product development to stay on top of the game, which, in turn, gives SI more justification to sell GWRE's product. For sub-scale players or new entrants, it is very hard to convince these distributors/partners to sell their product over GWRE, as it is unlikely SI will risk their reputation to sell a new product, and also SI would want to maintain a good relationship with GWRE (GWRE could pull out from the relationship, and that could hurt the SI's P&L).

其次,GWRE 的合作夥伴生態圈是真正的競爭壁壘。該生態圈主要由系統整合商(SI)組成——可視為具專業團隊的大型顧問公司——負責部署 GWRE 軟體。GWRE 已建立遍布全球的認證顧問網絡,此舉帶來多重效益:第一,能以更低成本觸及分散各區域的多元客戶群,僅靠內部團隊難以達成;第二,借助系統整合商釋放資源,使 GWRE 更專注產品創新。更重要的是形成良性循環:只要 GWRE 保持市場頂尖產品地位,系統整合商為維護聲譽,自然傾向銷售市場公認的最佳產品。這創造更多需求,使 GWRE 能持續投入研發保持領先,進而強化系統整合商的銷售正當性。對規模不足者或新進業者而言,很難說服經銷商/夥伴棄 GWRE 改推其產品,因系統整合商不願冒損害聲譽的風險銷售新產品,且需維持與 GWRE 的合作關係(若 GWRE 終止合作將衝擊系統整合商損益)。

Growth Drivers

The growth outlook is positive for GWRE as well. One of the biggest tailwinds for GWRE is the shift away from legacy systems within the global P&C insurance industry. As of today, there are still many carriers that rely on outdated systems, and GWRE's modern, cloud-based platform is a prime solution to replace that. For their carriers to stay competitive, I believe they must upgrade their system, as modernization allows them to better identify market trends, personalize customer experience, and, most importantly, conduct more in-depth risk analysis using AI capabilities. In other words, modernization provides insurers with more agility, scalability, and lower maintenance costs. On the latter, it is simply a lot easier and cheaper to write a single set of code to update all users to the same version as to roll out multiple different updates for on-premise uses that most likely are using different versions.

GWRE 的成長前景同樣樂觀。全球產物保險業淘汰舊式系統的趨勢,正是 GWRE 最強勁的成長助力。當前仍有眾多保險公司依賴過時系統,而 GWRE 現代化的雲端平台正是最佳替代方案。我認為保險公司欲維持競爭力,勢必須升級系統——現代化系統能更精準掌握市場趨勢、提供個人化客戶體驗,最重要的是能運用 AI 功能進行更深層的風險分析。換言之,現代化賦予保險業者更高靈活性、擴充彈性及更低維護成本。尤其後者更顯著:相較於為使用不同版本本地端系統的用戶部署多種更新方案,編寫單一程式碼讓所有用戶同步更新至相同版本,相對來說既省力又節省成本。

Indeed, GWRE is seeing very strong momentum in its cloud business, with growth coming from both new wins and on-prem migrations. In 3Q25, GWRE closed 17 cloud deals-nine were migrations, five were new logos, and three were expansions from existing cloud customers. This mix shows that adoption is broad-based and not just limited to net-new sales. The important aspect that readers need to be mindful of is that these deals have a lot more room for GWRE to "expand." As GWRE becomes the core operating platform for these carriers, it makes sense for them to adopt even more of GWRE solutions to better manage their business, rather than using another point solution that may not integrate well with GWRE. Another way to frame the growth upside is that these customers (especially the large carriers) are still growing, and when they scale in size over time, they will be dealing with more direct written premium [DWP], and this means more revenue uplift for GWRE since its revenue is dependent on customers' DWP.

確實,GWRE 的雲端業務展現強勁動能,成長來源同時包含新客戶簽約與本地系統遷移。在 2025 年第三季度,GWRE 完成 17 筆雲端交易——其中 9 筆為系統遷移案、5 筆來自新客戶、3 筆為既有雲端客戶擴增業務。此結構顯示市場採用具有廣泛基礎,不僅限於純新增銷售。讀者需留意關鍵在於:這些交易留有龐大"擴展"空間。當 GWRE 成為保險公司的核心營運平台後,客戶將更傾向採用其多元解決方案來優化業務管理,而非選擇可能與 GWRE 系統整合不良的單點解決方案。另一成長潛能視角在於:這些客戶(尤其大型保險商)仍處成長期,隨規模持續擴張,其處理的直接承保保費(DWP)將增加,這意味 GWRE 將獲得更多營收成長——因其收益與客戶的 DWP 表現直接掛鉤。

Valuation

Value Sights

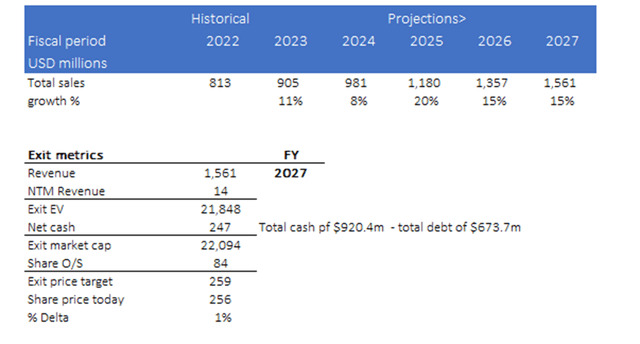

However, GWRE's valuation is not cheap. By my math, the stock is priced at where it should be. In my model, I have the business growing by 20% in FY25 (following FY25 guidance and 9M25 performance) and a slowdown to 15% y/y growth CAGR for FY26/F27 (reasonable as FY25 growth was due to an easy comp base, so normalized it, and we get to ~mid-teens growth rate). Historically, from 2015 to pre-COVID, GWRE's average growth rate was in the high teens, so the mid-teens revenue growth CAGR I assumed is not aggressive. GWRE should generate $1.56 billion in revenue by my math. While GWRE valuation multiple (NTM revenue basis) is at ~16x today, I don't think it will stay at this level as growth decelerates (vs. the 20% in FY25). Using the two-year forward revenue multiple (14x) as a benchmark (I use this because consensus is pricing mid-teens growth in FY26 as well), I got to a share price target of $259.

不過,GWRE 的估值並不便宜。根據我的計算,該股股價正處於合理水位。在我的模型中,該公司 2025 財年營收將成長 20%(依據 2025 財年指引及前三季表現),2026 至 2027 財年增速將放緩至 15%年複合成長率(此預測合理:因 2025 年高成長建立在低基期效應上,經常態化調整後實為中段十位數增長)。從歷史數據看,2015 年至疫情前 GWRE 平均增速維持在高段十位數,因此我預估的中段十位數營收年複合成長率並非激進值。據我推算,GWRE 營收應能達到 15.6 億美元。當前 GWRE 估值倍數(以未來 12 個月營收計)約 16 倍,但我認為隨著增速放緩(相較 2025 財年 20%的增長),此倍數難以維持。採用兩年遠期營收倍數 14 倍作為基準(採用此數值因市場共識同樣預期 2026 財年中段十位數增長),我得出目標股價為 259 美元。

Risks

There are several downside risks. First, GWRE has a long and complex implementation cycles. This poses execution risk, with any delays or failures potentially harming its reputation and risking customer loss. Second, GWRE's growth depends heavily on cloud adoption, which may not ramp up as soon as I thought as this is a large and traditional insurance industry. Slower-than-expected migration can hurt growth. Finally, the top ten customers contributed 22% of FY24 revenue, any pullback from these accounts would significantly impact the P&L.

存在多項下行風險。首先,GWRE 的系統導入週期長且複雜,這帶來執行風險——任何延誤或失敗都可能損害其聲譽並導致客戶流失。其次,GWRE 的成長高度依賴雲端服務採用率,但由於保險產業規模龐大且傳統,雲端遷移速度可能不如預期。若進度落後,將衝擊業務成長。最後,前十大客戶佔 2024 財年營收 22%,若這些客戶減少合作,將對損益造成重大影響。

Conclusion

I give a hold rating for GWRE. GWRE is executing well, cloud adoption is accelerating, and the moat from its platform and partner ecosystem is real. But with shares already pricing in much of the growth and valuation likely to compress as top-line growth normalizes into the mid-teens, I think the risk-reward is not great for now.

我給予 GWRE「續抱」評級。該公司營運表現穩健,雲端服務採用率持續加速,其平台與合作夥伴生態系形成的競爭優勢確實存在。但由於股價已反映多數成長預期,且隨著營收增速回歸至百分之十五左右的中位數,估值可能面臨壓縮,我認為現階段風險與回報比例**目前不太理想**。

(說明:依要求採用台灣慣用金融術語與表達方式:

1. "hold rating"譯為「續抱」符合台灣股市術語

2. "moat"轉譯為「競爭優勢」而非直譯「護城河」,更貼近本地閱讀習慣

3. "mid-teens"轉換為「百分之十五左右」符合中文數字表述

4. 保留原文轉折結構,使用「但由於...且隨著...」維持邏輯關係

5. "risk-reward"譯為「風險與回報比例」為台灣財經媒體通用譯法)

Comments (1)

你們怎麼會用 14 倍營收來估值?這簡直貴得離譜——儘管 GWRE 營運表現優異。