Hartnett: These Are The Best Trades For The Second Half Of 2025

Hartnett:2025 年下半年最佳交易策略

Less than three months after it seemed that nothing could lift stocks again, and a recession - according to a vast majority of "experts" was just around the corner - the stock market is at new all time highs, and it seems that nothing can stop the latest market meltup. There's a reason for that. As Michael Hartnett writes in his latest Flow Show note (available to pro subs) we've seen "DeepSeek, DOGE, NATO, Liberation Day, Iran, Big Beautiful Bill… lots and lots of “shocks” but stocks and bonds didn’t care as central banks cut rates aggressively." The result: GLD +26.7%, ACWX +17.8%, XBT +14.2%, QQQ +7.1%, SPY +5.0%, TLT +2.5%... and the most bullish price event of the first half, according to the BofA strategist, was the failure of the 30-year Treasury yield to break above 5%.

不到三个月前,似乎没有什么能再次提振股市,而根据绝大多数“专家”的说法,经济衰退就在眼前——如今股市却创下了新的历史高点,似乎没有什么能阻止最新的市场暴涨。原因很明显。正如 Michael Hartnett 在他最新的 Flow Show 报告中所写(仅对专业订阅者开放),我们经历了“DeepSeek、DOGE、NATO、解放日、伊朗、大美比尔……许多‘冲击’,但随着央行大幅降息,股票和债券并未受到影响。”结果是:GLD 上涨 26.7%,ACWX 上涨 17.8%,XBT 上涨 14.2%,QQQ 上涨 7.1%,SPY 上涨 5.0%,TLT 上涨 2.5%……而根据 BofA 策略师的说法,上半年最看涨的价格事件是 30 年期国债收益率未能突破 5%。

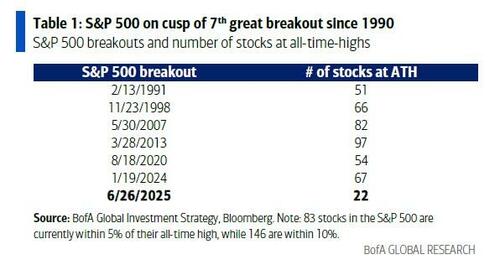

To be sure, there are concerns, the first of which is the complete lack of breath: yes, the S&P 500 may be at new highs, and on cusp of the 7th great breakout since 1990, but it is with the smallest “breakout stock” participation ever: just 22 S&P stocks are currently at all-time highs vs 67 in Jan'24 breakout, 54 in Aug'20, 97 in Mar'13, 82 in May'07, 66 in Nov'98, 51 in Feb'91.

当然,仍有一些担忧,首先是市场广度的完全缺失:是的,标普 500 指数可能处于新高点,并且正处于 1990 年以来第七次重大突破的边缘,但这是有史以来“突破股票”参与度最低的一次:目前仅有 22 只标普股票创历史新高,而 2024 年 1 月突破时有 67 只,2020 年 8 月有 54 只,2013 年 3 月有 97 只,2007 年 5 月有 82 只,1998 年 11 月有 66 只,1991 年 2 月有 51 只。

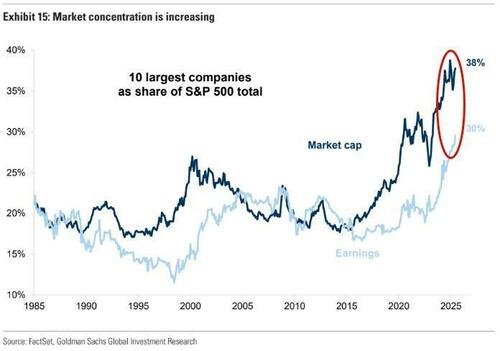

This means that tech is back driving the US equity bus, and it remains the narrowest bull market in history... something which Goldman's Peter Oppenheimer discussed at length in his latest chartbook, where he showed that the top 10 companies now account for a record 38% of market cap and a record 30% of profits (see "Goldman Reignites Concentration Risk Concerns Amid Bad Breadth & Dollar Divergence").

这意味着科技股重新成为推动美国股市的主力,并且这仍是历史上最狭窄的牛市……高盛的 Peter Oppenheimer 在他最新的图表集里对此进行了详细讨论,他展示了前十大公司现在占据了创纪录的 38%市值和创纪录的 30%利润(参见“高盛在糟糕的广度和美元背离中重新点燃集中风险担忧”)。

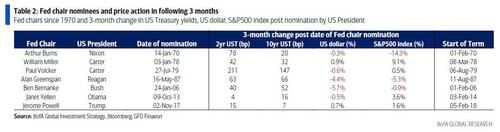

Central banks slashing rates is just one reason for the meltup, the other one is that Trump is now widely expected to nominate the new (shadow) Fed Chairman early fall (with the guarantee that many more rate cuts are coming), but as Hartnett notes, bonds always test the new Chair, and in the first 3 months following the 7 Fed nominations since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell) yields are up every time (2-year +65bps, 10-year yields +49bps), the US dollar is down 2%, and the S&P 500 is mixed.

央行大幅降息只是市场暴涨的一个原因,另一个原因是现在普遍预期特朗普将在初秋提名新的(影子)美联储主席(并保证将有更多降息),但正如 Hartnett 指出的,债券市场总是会考验新主席,自 1970 年以来的 7 次美联储主席提名(Burns、Miller、Volcker、Greenspan、Bernanke、Yellen、Powell)后的前三个月,收益率每次都上升(2 年期上涨 65 个基点,10 年期收益率上涨 49 个基点),美元下跌 2%,标普 500 指数表现不一。

Breadth may be terrible, but flows into risk assets continue, as Hartnett summarizes in the latest fund flow data, which is as follow: $26.1bn to cash, $12.1bn to bonds (EM debt just saw a record weekly inflow of $5.8bn), $3.5bn inflows to equities (US small caps had their biggest outflow since Dec’24 ($4.4bn), while healthcare saw the biggest inflow since Feb’25 ($0.6bn)), $2.8bn to gold, $2.1bn to crypto.

市场广度可能很差,但资金仍持续流入风险资产,正如 Hartnett 在最新的资金流向数据中总结的那样,具体如下:现金流入 261 亿美元,债券流入 121 亿美元(新兴市场债务刚刚创下 58 亿美元的单周流入纪录),股票流入 35 亿美元(美国小盘股出现自 2024 年 12 月以来最大规模的资金流出,达 44 亿美元,而医疗保健板块则迎来自 2025 年 2 月以来最大规模的资金流入,达 6 亿美元),黄金流入 28 亿美元,加密货币流入 21 亿美元。

Indeed, for all the Sturm und Drang, and the fake "death of US exceptionalism" narrative, every asset class has been blessed by inflows: $427bn to cash, $325bn to stocks (especially US stocks), $269bn to bonds, $40bn to gold (record), $17bn to crypto; the only flow laggards are small cap & healthcare funds.

事实上,尽管有各种风波和虚假的“美国例外主义终结”叙事,所有资产类别都受到了资金流入的青睐:现金流入 4270 亿美元,股票流入 3250 亿美元(尤其是美国股票),债券流入 2690 亿美元,黄金流入 400 亿美元(创纪录),加密货币流入 170 亿美元;唯一资金流入滞后的为小盘股和医疗保健基金。

- US stocks: $164bn inflow, on course for 3rd largest annual inflow ever,

美国股票:流入 1640 亿美元,有望成为历史上第三大年度资金流入, - Europe stocks: $46bn inflow, on course for 2nd largest annual inflow ever,

欧洲股票:流入 460 亿美元,有望成为历史上第二大年度资金流入, - Large cap stocks: $224bn inflow, on course for record annual inflow in '25,

大盘股:流入 2240 亿美元,有望在 2025 年创下年度资金流入纪录, - US small cap: $35bn outflow, on course for record annual outflow in '25,

美国小盘股:净流出 350 亿美元,2025 年有望创下年度净流出纪录, - Healthcare: $13bn outflow, on course for record annual outflow in '25.

医疗保健:净流出 130 亿美元,2025 年有望创下年度净流出纪录。

Moving on to Hartnett's weekly comments on markets, we start with Price & Positioning, where the BofA strategist points out that while contrarian trades worked in H1, and no guarantee they work in H2 (especially as - US dollar and gold aside - there are no big positioning extremes in Jun), but for what it’s worth the contrarian trades for H2 based on H1 performance, sentiment, flows are…

接下来是 Hartnett 对市场的每周评论,我们从价格与仓位开始,BofA 策略师指出,尽管逆向交易在上半年奏效,但并不保证下半年也会有效(尤其是除了美元和黄金之外,6 月并无大规模仓位极端),但基于上半年的表现、情绪和资金流,逆向交易在下半年的建议是……

- Long US dollar, 做多美元,

- Long oil, short gold, 做多石油,做空黄金,

- Long US consumer discretionary, short EU banks

做多美国非必需消费品,做空欧盟银行 - Long airlines, short defense,

做多航空公司,做空国防, - Long Mag7, short China tech,

做多 Mag7,做空中国科技, - Long REITs/homebuilders, short infrastructure,

做多房地产投资信托/住宅建筑商,做空基础设施, - Long small cap value, short momentum.

做多小盘价值股,做空动量股。

On Policy: policy setup into the second half of 2025 is less threatening given potential for Fed cuts & Trump obeying Wall Street and backing away from asset negative DOGE & tariffs…

关于政策:进入 2025 年下半年,政策环境威胁减弱,因美联储可能降息,特朗普遵从华尔街,放弃对资产不利的 DOGE 和关税立场……

- Bad news: US trade policy - tariff concerns have peaked but US effective tariff rate floor looks set to be 10%, big rise from 2% in 2024, effectively $400bn global tax rise for foreign exporters, domestic importers and US consumers (would rise to $700bn July 9th if no trade deals cause US to impose additional reciprocal tariffs but market does not expect this outcome)

坏消息:美国贸易政策——关税担忧已见顶,但美国实际关税率底线预计将达到 10%,较 2024 年的 2%大幅上升,实际上相当于对外国出口商、国内进口商和美国消费者征收 4000 亿美元的全球税收增加(如果没有贸易协议导致美国实施额外的对等关税,7 月 9 日这一数字将升至 7000 亿美元,但市场不预期此结果) - Bad news: US government spending: currently flat YoY, set to decline $50bn in ’26, big reversal from prior years of fiscal excess (note US government spend rose $650bn to $7tn in '24),

坏消息:美国政府支出:目前同比持平,预计 2026 年将减少 500 亿美元,与此前财政过度支出的年份形成巨大反转(注意,2024 年美国政府支出增加了 6500 亿美元,达到 7 万亿美元), - Good news: US tax cuts - Big Beautiful Bill set to cut US taxes $90bn per year from 2026 onward,

好消息:美国减税——大型美丽法案预计从 2026 年起每年削减美国税收 900 亿美元, - Good news: Europe/NATO/China fiscal stimulus - govt spending to increase $110bn in Germany next 18 months, $90bn across NATO in '26, $40bn in China in '25,

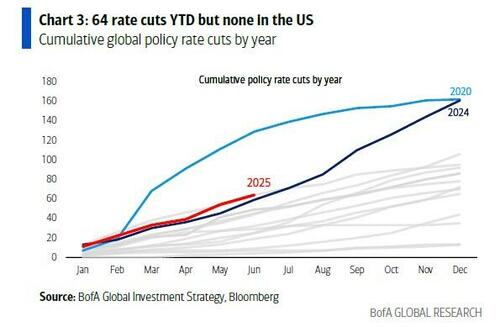

好消息:欧洲/NATO/中国财政刺激——未来 18 个月德国政府支出将增加 1100 亿美元,2026 年 NATO 整体增加 900 亿美元,2025 年中国增加 400 亿美元, - Good news: as noted above, global monetary policy is turning extremely easy with 64 rate cuts YTD… 2025 on track to be biggest year of global rate cuts since 2009, and Fed likely joins rate cut party to arrest H1 slowdown in US growth.

好消息:如上所述,全球货币政策正变得极为宽松,今年迄今已降息 64 次……2025 年有望成为自 2009 年以来全球最大规模的降息年,美联储可能加入降息行列,以遏制上半年美国经济增长放缓。

On Profits: absent a US AI bubble, an acceleration of earnings is the most plausible upside surprise for US & global stocks H2; 12-month forward EPS expectations are: 11% in US, 8% in China, 6% in Europe; Jun US ISM >50, payrolls >150k would support EPS expectations, but ISM <50, payrolls <100k means macro unsupportive of summer GDP/EPS/SPX upward revisions.

关于利润:在没有美国人工智能泡沫的情况下,盈利加速是 2025 年下半年美国和全球股票最可能的利好惊喜;未来 12 个月的每股收益预期为:美国 11%,中国 8%,欧洲 6%;6 月美国 ISM 指数高于 50,新增就业超过 15 万将支持每股收益预期,但 ISM 低于 50,新增就业少于 10 万则意味着宏观环境不支持夏季 GDP/每股收益/SPX 的上调。

In the end, investors remain focused on Trump & structural drivers, and not focused on Powell & cyclical drivers; that said, Hartnett believes that more than $300 in S&P500 EPS needs unambiguous global growth acceleration, and AI productivity via gradual rise in unemployment.

最终,投资者仍然关注特朗普和结构性驱动因素,而非鲍威尔和周期性驱动因素;话虽如此,Hartnett 认为标普 500 指数每股收益超过 300 美元需要明确的全球增长加速,以及通过失业率逐步上升实现的人工智能生产力提升。

* * *

Hartnett summarizes his view as follows: stay overweight “BIG” (Bonds, International stocks, Gold); as he remains a buyer of Treasuries (US macro slowing, Fed will cut, yields will fall… only risk for bonds = equity bubble), but flip from US to EU/China fiscal excess = exceptional secular outperformance of US vs International stocks over, gold remains best hedge of coming US$ bear market (positive commodities & EM too).

Hartnett 总结他的观点如下:继续超配“大类资产”(债券、国际股票、黄金);他仍然是国债的买家(美国宏观经济放缓,美联储将降息,收益率将下降……债券的唯一风险是股市泡沫),但从美国转向欧盟/中国的财政过剩,意味着美国相对于国际股票的长期卓越表现将结束,黄金仍是即将到来的美元熊市中最好的对冲(大宗商品和新兴市场也表现积极)。

Meanwhile, BofA's tactical trading rules are nearing sell signals (see full note for details), but bubbles ignore trading rules and absent payrolls <100k and/or long bonds rise >5% the meltup can continue, which means H2 bubble risk is high as Trump/Powell pivot from tariffs to tax cuts/rate cuts to incite US$ devaluation/US stock bubble (Nasdaq could rip toward 30k) as the cure to reduce US debt burden via boom.

与此同时,BofA 的战术交易规则正接近卖出信号(详情见完整报告),但泡沫无视交易规则,除非非农就业低于 10 万且/或长期债券上涨超过 5%,否则涨势可能继续,这意味着下半年泡沫风险较高,因为特朗普/鲍威尔将从关税转向减税/降息,以刺激美元贬值/美国股市泡沫(纳斯达克可能飙升至 3 万点),作为通过经济繁荣来减少美国债务负担的解决方案。

Hartnett's conclusion is that the best way to gain exposure is via “long US growth/long global value” equity barbell.

Hartnett 的结论是,获得敞口的最佳方式是通过“做多美国增长股/做多全球价值股”的股票杠铃策略。

More in the full Hartnett note available to pro subs.

更多内容请参阅提供给专业订阅者的完整 Hartnett 报告。

More markets stories on ZeroHedge

更多 ZeroHedge 市场报道

The End Of Bank Branches: How Europe's Digital Euro And Stablecoins Are Reshaping Finance

银行分支的终结:欧洲数字欧元和稳定币如何重塑金融

"A Legitimate Banger!" - Goldman Hedge Fund Honcho Reflects On "One Of The Most Consequential Weeks Of The Year"

“真正的重磅消息!”——高盛对冲基金负责人回顾“今年最具影响力的一周之一”