China’s Credit Bazooka Isn’t What It Used to Be

The rest of the world is showing that China is losing the power to move their markets.

Particularly shameless version of a ‘Fed put.’

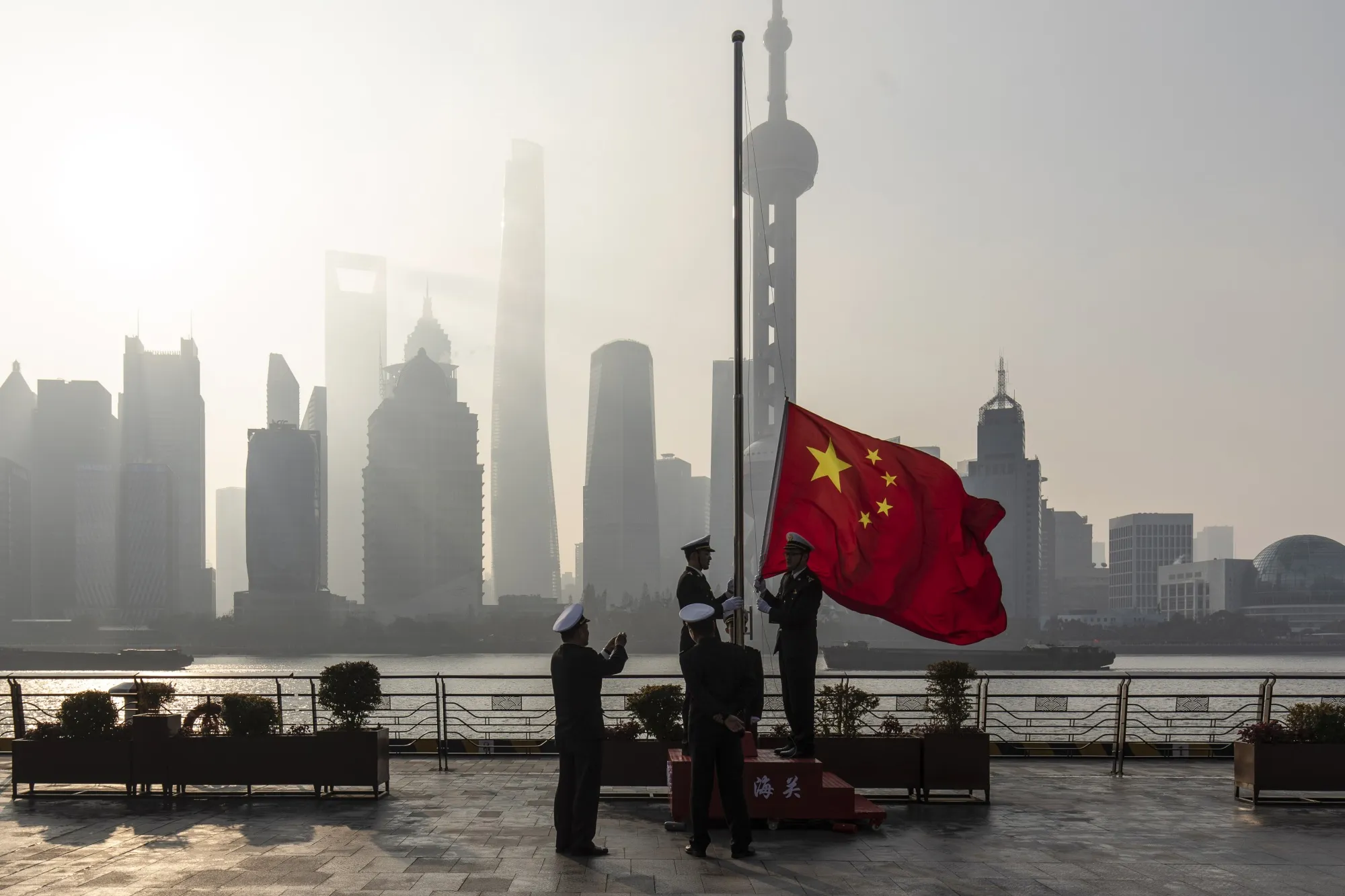

Photographer: Greg Baker/AFP/Getty ImagesTo get John Authers' newsletter delivered directly to your inbox, sign up here.

Today’s Points:

• China’s credit bazooka isn’t a bazooka.

• Stimulus will probably boost China's stocks for a while.

• But meaningful improvement will need fiscal policy.

• Asset allocators have convinced themselves that the Chinese economy doesn’t matter any more.

• AND: More songs about stars.

Stayin’ Alive

China’s latest raft of easing measures, announced with uncharacteristic fanfare, is a last-ditch effort at halt the economy from slipping further into an abyss. In classic central bank terminology, there were calls for a bazooka; and if there had been any doubt about the lengths Beijing would go to revive its economy, the policy campaign unveiled by Pan Gongsheng, governor of the People’s Bank of China, should provide the answers. It involved lower rates, lower reserve requirements for banks, direct support for the stock market and for mortgages. The markets’ reaction showed investors’ thirst for any semblance of “we got this” assurance from the government.

And yet Tuesday’s stimulus package, especially the parts targeting the real estate sector, comes as anything but a surprise. August’s disappointing economic indicators made the most robust case yet for an intervention that jolts failing consumer demand, with the Federal Reserve’s jumbo cut relieving pressure on China’s currency and cementing those calls. Indeed, the yuan actually strengthened to its highest (and the offshore yuan even broke the 7.0 barrier) since May last year in the wake of a move that should have been directly negative for it:

Yuan for the Money

China's currency rose to a 15-month high despite PBOC rate cuts

Source: Bloomberg

And many analysts complained that this package still doesn’t address the biggest problem facing China. David Roche of Quantum Strategy made trenchant criticism:

China’s core problem is mega malinvestment financed with excessive leverage. This causes legacy problems for the balance sheet, which can only be fixed by writing off the assets and loans… Fiddling with the cost of a debt mountain when corporate prices are falling thanks to deflation is like trying to catch a falling knife with bare hands.

Some of the measures still came as a surprise. Pan’s announcement of 800 billion yuan, about $113 billion, to support the onshore equities market in a “stock stabilization fund” sent the Shanghai Shenzhen CSI 300 soaring. This TS Lombard chart captures Tuesday’s rally as the central bank unpacked its reforms:

This move looks a lot like a particularly shameless version of a “Fed put,” in which traders assume the central bank will jump to the stock market’s rescue in times of trouble. The central bank pledged to create a 500 billion-yuan swap facility, allowing securities firms, funds, and insurance companies to use bonds, stocks, ETFs, and other assets as collateral to obtain highly liquid assets from the PBOC. TS Lombard’s Rory Green and Freya Beamish argue that this “put” suggests a growth recession may be in the offing. Indeed, the bank’s unusual sudden and explicit involvement in the equity markets suggests panic, the analysts argue:

We see this policy as an attempt to build confidence and foster wealth creation — or, at the very least, to prevent further equity wealth destruction. Secondly, it points to a tradable rally in Chinese equities. Onshore stocks are a policy- and momentum-driven market, and policy signals don’t get much more precise than this.

They caution that in an uncertain macroeconomic environment, the stock rally should be seen as a trade, not an investment — and one that is best approached with caution. Previous relief rallies since 2021 have been “fast and furious” and ultimately short-lived. And China has an unfortunate history of intervening clumsily in the stock market, causing bubbles in A-shares that burst in 2007 and 2015. Without serious demand-side follow-through, the current rally will likely keep within the post-Covid trend, feeding into the unmissable pessimism that preceded Pan’s latest efforts.

Is such negative sentiment justified? In recent years, stimulus policies have typically been delivered piecemeal, engendering distrust. Rayliant Global Advisors’ Jason Hsu argues that this approach is more of a “bazooka” in which authorities fire massively all at once in an attempt to maximize the impact, than the usual incrementalism:

The preciseness and the magnitude feels like a meaningful shift away from the previous incrementalism to what now feels more like what people have been asking for, more of a bazooka approach. This is also the first time where, in conjunction with the policy announcement, there was very clear articulation that the government will do what it takes to ensure that GDP growth will be on track at 5% percent.

But the general tenor of reaction has been more negative, because China’s problems appear too deep to fix with the kind of credit stimulus that it used in the past. China Beige Book says companies aren’t gloomy due to a lack of credit supply or because credit is too expensive. Rather, they’ve been unwilling for years to borrow, regardless of credit conditions, because corporate sentiment is so poor:

Will this program be big enough to durably shift sentiment on a macro level? That notion seems silly. A Required Reserve Ratio cut, for example, only matters if banks can use that liquidity to spur more borrowing. Is this going to suddenly jump-start loan demand? Nothing we’ve seen so far has done the trick in official or China Beige Book data. In CBB data, borrowing hasn’t moved much off all-time lows since 2021, despite the cost of capital collapsing since Q1 2023. And households are not going to respond to worse returns on savings by becoming suddenly more optimistic.

That leads to a swiftly forming consensus among investors; that monetary expansion and support for the stock market aren’t that important, and that instead fiscal measures will be needed to lift the economy out of what is widely seen as a Japan-style deflationary slump. The Communist Party’s intent to deliver a jolt was necessary. It drove a big rally for China’s stocks and currency, both of which were in need of some relief. But it’s hard to find any analysts outside the country who believe that this will make a durable difference. The jury is out on whether these measures will be enough to get economic growth over the 5% target.

—Richard Abbey

So What?

If China’s economy is in trouble, does it matter for the rest of the world? For much of this century, that has been a silly question: of course it does, a lot. The bazooka package of stimulus measures late in 2008 was crucial in restoring sentiment in the worst days of the Global Financial Crisis. But that is changing, and consciously or otherwise, investors are now placing a big bet that the great Chinese growth machine can at last start to sputter without affecting everyone else.

That’s implicit in the latest survey of global asset allocators carried out by Absolute Strategy Research, conducted last week before the flurry of news from China. For the the last three years, it’s asked whether Beijing can achieve its target of 5% growth over the next 12 months. (Before that, there was no need to ask the question as growth of at least 5% was assumed.) The survey shows a serious shift in confidence toward China over the last three months:

What’s interesting is that this big drop in confidence in China has co-existed with minimal shifts in the perceived probability of other outcomes. It simply hasn’t moved the needle much elsewhere, if at all:

Further, machine language analysis to group the respondents found that bulls and bears had no significant difference of opinion over China. It simply isn’t regarded as a pivotal issue either by those who are positive or negative. All of this amplifies the results of Bank of America Corp.’s monthly survey of fund managers, which also found a steep decline in confidence but no concern that the Chinese economy represented a tail risk. Points of Return featured this BofA chart last week:

This is, to put it mildly, a big change. The massive stimulus of 2008, but also smaller credit bazookas in 2015 and during the pandemic in 2020, drove strong performance by developed equities — even though they shouldn’t be directly affected by changing availability of finance to Chinese consumers and businesses. This chart compares changes in Bloomberg Economics’ measure of the China credit impulse (the change in new credit issued as a percentage of gross domestic product) with the MSCI World index of developed market stocks. The latest rally in the MSCI World is the first since the GFC that’s been achieved without any help from a surge in Chinese credit:

Chinese Credit's Dwindling Impact

Previous bazookas drove rallies in world stock markets

Source: Bloomberg Economics

The underlying belief that China’s economic health is essential for everyone else has taken a battering. That shows up from the relative performance of stocks and bonds in the US and China. With a brief divergence for a Chinese stock bubble in 2015, the stock/bond ratio in the two economic powers tracked each other closely until 2021. Since then, the divergence has been dramatic:

De-Coupling

Equity/bond performance has totally diverged between China and the US

Source: Bloomberg

Note: Re-based: 09/24/2014 = 100. Total Return terms

It’s not that international investors don’t think China’s growth is faltering. Rather, they believe that it just doesn’t matter. International assets most directly affected by China show significant disquiet. Copper, for which China has long been the biggest customer at the margin, suffered a slide earlier this year. Most interestingly, MSCI’s index of the 100 stocks in the MSCI World with the greatest exposure to China has dropped by almost 20% relative to the MSCI World as a whole:

Where China Does Matter

China-exposed stocks and copper have taken tumbles this year

Source: Bloomberg

Response to Tuesday’s measures outside China was positive, with US stocks up a little to new all-time highs. But it wasn’t ecstatic. And the rally does appear to be contradictory. China would seem to be central to any possibility of a hard landing, and goods inflation is falling globally in large part because China is exporting deflation. David Bowers, who compiles Absolute Strategy’s survey, suggests that psychology may have been shifted by the move toward deeming the Chinese stock market uninvestable: “You might not be able to invest in China any more, but it really makes a difference to the market environment.”

Taking the Fed’s Pulse

What’s the best trade to chase for the rest of the year, and what is the most foolish? Now that the Federal Reserve has launched its long-awaited easing cycle with a bang, how to trade it? How many more cuts this year, and which asset class will do best? This is your latest chance to share your views in a quick Bloomberg survey for MLIV Pulse.

The results should be interesting. Please give it a little of your time.

Survival Tips

We have more starry song recommendations following on from the discussion of R* or R-star. Try All Star by Smash Mouth, Big Star by Kenny Chesney, Stars by Simply Red, Rockstar by Nickelback, Rockstar by Post Malone feat. 21 Savage, Rockstar by DaBaby feat. Roddy Ricch, Written in the Stars by Tinie Tempah, “Sign of the Times” by the Belle Stars, Written in the Stars by Elton John & LeAnn Rimes, Starmaker by the Kids From Fame, City of Stars by Ryan Gosling and Emma Stone from La La Land, Rewrite the Stars from The Greatest Showman, Stars and the Moon by Jason Robert Brown (also covered by Audra McDonald), California Stars by Wilco/Billy Bragg, Walking on the Milky Way by OMD, Walking on the Milky Way by Franciscus Henri, Star Trekkin’ by The Firm, and Southern Cross by Crosby, Stills and Nash. More stars welcome.

More From Bloomberg Opinion:

- Nir Kaissar: Retail Investors Won on Fees But Are Losing on Risk

- Tyler Cowen: Is the Price of Ozempic Really So Outrageous?

- Gearoid Reidy: Japan’s Next Leader Will Be Different, and Flawed

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter.

— With assistance from Richard Abbey

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.