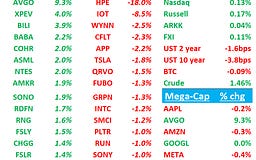

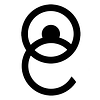

Good morning. QQQs -1.6% as yields down 4-6bps across the curve as investors continue to be worried about growth outlook. Market is now pricing in 77bps worth of cuts with a 6/18 cut at 100%. BTC flat at $82k. China -2%.

早上好。QQQ 下跌 1.6%,收益率曲线全线下降 4-6 个基点,投资者持续担忧增长前景。市场目前预计将有 77 个基点的降息,6 月 18 日降息概率为 100%。BTC 持平于 82,000 美元。中国下跌 2%。

Let’s get to it…

让我们开始吧…

DASH +4% + TKO +2% / APP -5%: DASH/TKO get nod for SP500 inclusion

DASH +4% + TKO +2% / APP -5%: DASH/TKO 获准纳入标普 500 指数

ABNB: Airbnb upgraded to Buy from Hold at Jefferies

ABNB: Airbnb 从 Jefferies 的持有评级上调至买入评级

Jefferies analyst John Colantuoni elevated Airbnb's rating to Buy from Hold while raising the price target to $185 from $165. The firm anticipates that the company's gains in lodging market share will be enhanced by growing adoption of experiences, an opportunity that Airbnb "is uniquely positioned to capitalize on." Additionally, the analyst suggests the company's growth potential is further strengthened by take rate improvements, primarily driven by the introduction of sponsored listings. Jefferies' valuation work SOTP indicates that Airbnb's current valuation only accounts for its core lodging operations, effectively assigning no value to experiences or take rate potential.

Jefferies 分析师 John Colantuoni 将 Airbnb 的评级从持有上调至买入,并将目标价从 165 美元提高至 185 美元。该机构预计,随着体验业务的日益普及,Airbnb 在住宿市场份额的增益将得到提升,这一机遇 Airbnb“独具优势,能够充分利用”。此外,分析师指出,公司增长潜力因佣金率的改善而进一步增强,这主要得益于赞助列表的引入。Jefferies 的 SOTP 估值分析显示,Airbnb 当前的估值仅反映了其核心住宿业务,实际上并未为体验业务或佣金率潜力赋予任何价值。

APP: AppLovin pricing in 50% chance of being worth zero, says Citi

APP: 花旗称 AppLovin 定价有 50%的概率归零

Citi analyst Jason Bazinet indicates that investors are currently assigning a 50% probability that AppLovin's equity holds no value. The analyst notes in a research report to investors that the stock has experienced considerable downward pressure following several negative reports, compounded by a broader momentum "reversal." While Citi acknowledges that consensus revenue projections "are ambitious," the firm remains optimistic based on AppLovin's recent announcements suggesting strong performance from its e-commerce pilot. Citi also believes modifications to the company's share repurchase strategy suggest the possibility of directing all free cash flow toward buybacks in 2025. The firm maintains a Buy rating on AppLovin with a $600 price target.

花旗分析师 Jason Bazinet 指出,投资者目前认为 AppLovin 的股权有 50%的概率一文不值。该分析师在给投资者的研究报告中提到,该股在几份负面报告后承受了巨大的下行压力,加之更广泛的市场动能“逆转”加剧了这一趋势。尽管花旗承认市场对 AppLovin 的营收预期“颇具野心”,但基于公司近期公告显示其电商试点表现强劲,花旗仍持乐观态度。花旗还认为,公司对股票回购策略的调整可能意味着在 2025 年将所有自由现金流用于回购。花旗维持对 AppLovin 的买入评级,目标价为 600 美元。

3P Roundup: 3P 综述:

ADBE: M-sci says incremental strength in Feb driven by SMB/AI with AI assistant attach rate ticking up to high teens

ADBE: M-sci 表示,2 月份的增长动力来自 SMB/AI,AI 助手的附加率上升至近 20%

SPOT: M-sci says Q1 net adds tranding above street

SPOT: M-sci 表示第一季度净增用户数高于市场预期

AMZN: Inline with other 3p data, edgewater saying NA retail tracking slightly above street while int’l / AWS inline-ish

AMZN:与其他第三方数据一致,Edgewater 表示北美零售追踪略高于市场预期,而国际/AWS 基本符合预期

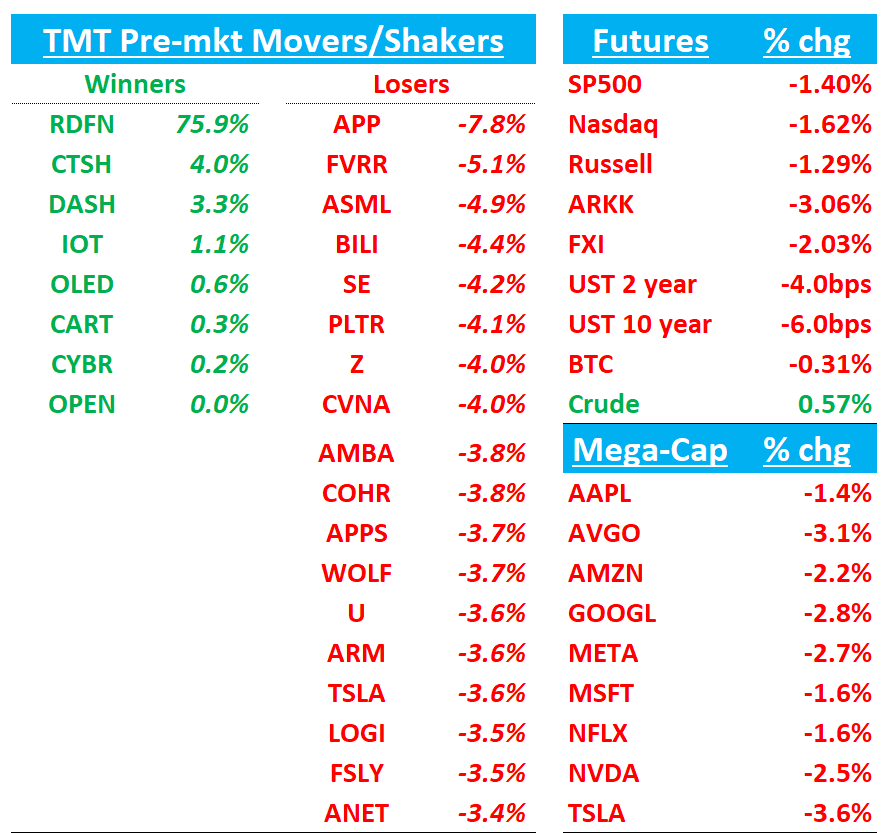

TSMC: Feb sales +43% y/y / -11% m/m

台积电:2 月销售额同比增长 43%/环比下降 11%

J. Favuzza at Jefferies provides context:

Jefferies 的 J. Favuzza 提供了背景信息:

Compares to a 25% y/y increase in February over the last 5-years, and a (15%) sequential decline. So, on the whole, better than historical February seasonality.

与过去五年 2 月份同比增长 25%相比,以及环比下降 15%相比,整体上优于历史 2 月份的季节性表现。Revenue for the first 2 months of this year is now tracking to +39% y/y and is currently at NT$553B.

今年前两个月的收入目前同比增长+39%,达到 5530 亿新台币。TSMC guided to NT$820B-846B based on NT$32.8 spot. Applying normal 5-year March seasonality of +11% m/m gets TSMC to finish Q1 above the midpoint of their quarterly guide.

台积电基于 32.8 新台币现汇价,指引为 8200 亿至 8460 亿新台币。应用通常的五年三月季节性增长+11%月环比,台积电第一季度业绩有望超过其季度指引中点。

TSLA: UBS reduces target to $225 from $259, citing “decreased deliveries and promotional activities impacting margins”

TSLA: 瑞银将目标价从 259 美元下调至 225 美元,理由是“交付量减少和促销活动影响利润率”

UBS notes they're lowering Q1 2025 delivery forecast to 367k from 437k, 13% below consensus, citing evidence of slower current run-rate despite potential end-quarter push. Analyst points to UBS Evidence Lab data showing short Model 3/Y delivery times in key markets, indicating softer demand. UBS projects auto gross margin ex-credits at 10.3% vs previous quarter's 13.6% and year-ago's 16.4%, significantly below 13.5% consensus. The analyst attributes margin pressure to both TSLA's mentioned production changeovers and their forecast of reduced deliveries with increased promotional activity. UBS revises Q1 EPS to $0.37, 28% below consensus.

UBS 指出,他们将 2025 年第一季度交付量预测从 437k 下调至 367k,比市场共识低 13%,理由是尽管季度末可能有推动,但当前运行速度放缓的证据。分析师引用 UBS Evidence Lab 数据,显示关键市场中 Model 3/Y 的交付时间缩短,表明需求疲软。UBS 预计汽车毛利率(不包括积分)为 10.3%,低于上一季度的 13.6%和去年同期的 16.4%,显著低于 13.5%的市场共识。分析师将利润率压力归因于 TSLA 提到的生产转换以及他们预测的交付量减少和促销活动增加。UBS 将第一季度每股收益(EPS)修正为 0.37 美元,比市场共识低 28%。

Redburn maintains Sell saying “stalled volumes and inventory strain”

Redburn 维持卖出评级,称“销量停滞和库存压力”

Redburn-Atlantic notes they anticipate "another year of stalled volumes" due to lack of new vehicle launches on the horizon. The analyst highlights concerning registration data suggesting ongoing demand challenges. Redburn-Atlantic expects cash flow pressure from rising inventories as refreshed Model Y deliveries begin this month. The analyst points to potential U.S. tariffs on Mexican imports as an additional cost concern. Redburn-Atlantic has reduced their FY25 EPS forecast by 5%, citing flat growth expectations combined with continued incentives. The analyst warns of increasing disappointment risk ahead of Tesla's early April delivery report and Q1 results. Redburn-Atlantic indicates they've lowered delivery expectations based on February vehicle registration data and elevated inventory levels related to the Model Y production transition.

Redburn-Atlantic 指出,由于缺乏即将推出的新车型,他们预计“销量将再一年停滞不前”。分析师强调了令人担忧的注册数据,表明需求持续面临挑战。随着本月开始交付更新版 Model Y,Redburn-Atlantic 预计库存上升将带来现金流压力。分析师还指出,美国对墨西哥进口产品可能征收的关税是另一个成本担忧。Redburn-Atlantic 已将 2025 财年每股收益(EPS)预测下调 5%,理由是增长预期持平且激励措施持续。分析师警告称,在特斯拉 4 月初交付报告和第一季度业绩发布前,失望风险正在增加。Redburn-Atlantic 表示,基于 2 月份车辆注册数据和与 Model Y 生产转型相关的高库存水平,他们已下调了交付预期。

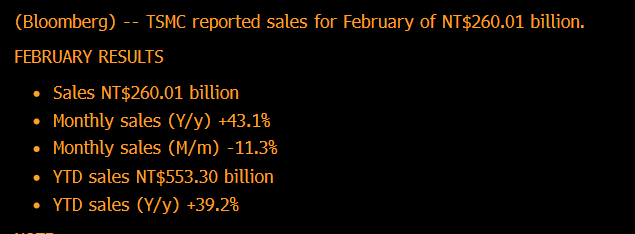

Tesla Is Flailing in China and BYD’s Rapid Rise Is to Blame

特斯拉在中国举步维艰,比亚迪的迅速崛起难辞其咎

Tesla Inc.’s business in China is trending as though its best days in the world’s biggest electric vehicle market may be behind it.

特斯拉公司在中国市场的业务趋势表明,它在这个全球最大电动汽车市场的最佳日子可能已经过去。Elon Musk’s automaker has been backsliding in China for the past five consecutive months on a year-on-year basis, according to data from the country’s Passenger Car Association. Tesla’s shipments plunged 49% in February from a year earlier to just 30,688 vehicles, the lowest monthly figure since way back in July 2022, when it shipped just 28,217 EVs — and that was in the middle of Covid.

根据中国乘用车协会的数据,埃隆·马斯克的汽车制造商在中国的销量已连续五个月同比下滑。特斯拉 2 月份的出货量同比骤降 49%,仅为 30,688 辆,这是自 2022 年 7 月以来的最低月度数据,当时该公司仅出货了 28,217 辆电动汽车——而那还是在新冠疫情高峰期。

U: Wells Fargo cuts U PT to $22 from $27 as “industry checks leave them less optimistic on Vector”

U: 富国银行将 U 目标价从 27 美元下调至 22 美元,原因是“行业调查显示他们对 Vector 的乐观情绪降低”

Wells Fargo notes industry checks on Unity's new "Vector" user acquisition platform have left them "less optimistic" about near-term benefits. The firm understands Vector will release end of Q1 with Q2 implementation completion, featuring daily updates (vs previous 60-day model) and improved ML. However, Wells Fargo's checks suggest Vector will likely stabilize business but not drive meaningful growth, with MMP fees reduction limiting revenue upside. The analyst indicates SDKs already provide similar device data as Vector, questioning meaningful incrementality. Wells Fargo points to continuing decline in Unity's mediation share offsetting potential Vector benefits. The firm reduces FY25/26 Grow revenue estimates by 2%/3% while remaining more constructive on the Engine business, maintaining Equal Weight with 9x Create & 15x Grow 2026 EBITDA multiple.

富国银行指出,对 Unity 新推出的“Vector”用户获取平台进行的行业检查让他们对近期效益“不那么乐观”。该公司了解到,Vector 将于第一季度末发布,并在第二季度完成实施,特点是每日更新(相较于之前的 60 天模式)和改进的机器学习功能。然而,富国银行的检查表明,Vector 可能稳定业务但不会推动显著增长,MMP 费用的减少限制了收入上升空间。分析师指出,SDK 已经提供了与 Vector 类似的设备数据,质疑其带来的实质性增量。富国银行指出,Unity 中介份额的持续下降抵消了 Vector 的潜在好处。该公司将 FY25/26 的 Grow 收入预测下调 2%/3%,同时对引擎业务保持更为积极的态度,维持 Equal Weight 评级,基于 9 倍 Create 和 15 倍 Grow 的 2026 年 EBITDA 倍数。

DOCU: JPMorgan upgrades DocuSignt to Neutral on 'subtle' trend improvement

DOCU: 摩根大通将 DocuSign 评级上调至中性,因趋势出现“微妙”改善

JPMorgan upgraded DocuSign to Neutral from Underweight, raising the price target to $75 from $70. The analyst notes shares have "remained stagnant" for three years between $50-$110, currently trading mid-range, and have fallen 25% since early December's fiscal Q3 earnings. The firm considers DocuSign's valuation "reasonably fair" with "modest improvements emerging" in business trends following post-pandemic adjustments. JPMorgan now sees balanced risk/reward and potential for DocuSign to maintain stabilization or improve growth rates "as it develops a strategy for sustainable double-digit growth."

摩根大通将 DocuSign 的评级从“减持”上调至“中性”,并将目标价从 70 美元上调至 75 美元。分析师指出,该股三年来在 50 至 110 美元之间“一直停滞不前”,目前处于中位区间交易,自 12 月初的第三财季财报公布以来已下跌 25%。该公司认为,随着疫情后调整,业务趋势出现“适度改善”,DocuSign 的估值“相对合理”。摩根大通现在认为,随着 DocuSign 制定可持续两位数增长的战略,其风险/回报趋于平衡,并有可能保持稳定或提高增长率。

AAPL: Citi removes 'positive catalyst watch' on Apple shares

AAPL: 花旗取消对苹果股票的“积极催化剂观察”

Citi analyst Atif Malik removed the "90-day positive catalyst watch" on Apple shares while maintaining a Buy rating with a $275 price target. The removal stems from a delay in the "highly anticipated" Siri upgrade within the iOS 18.4 update expected in April. The analyst notes Apple shares have risen 1% while the S&P 500 declined 4% since late January. Citi reduced its iPhone unit estimates for 2025 and 2026 to 232M and 244M respectively, reflecting the Siri upgrade delay. The firm argues that while Apple Intelligence value varies by user, an enhanced Siri would have accelerated iPhone replacements this year. Nevertheless, Citi believes Apple continues to make progress introducing Apple Intelligence features in China.

花旗分析师 Atif Malik 取消了对苹果股票的“90 天积极催化剂观察”,同时维持买入评级,目标价 275 美元。取消的原因是由于 iOS 18.4 更新中“备受期待”的 Siri 升级预计将推迟至 4 月。分析师指出,自 1 月底以来,苹果股价上涨了 1%,而标普 500 指数下跌了 4%。花旗将 2025 年和 2026 年的 iPhone 销量预估分别下调至 2.32 亿部和 2.44 亿部,以反映 Siri 升级的延迟。该机构认为,虽然苹果智能的价值因用户而异,但增强版的 Siri 本应加速今年 iPhone 的换机需求。尽管如此,花旗相信苹果在中国推出苹果智能功能的进展仍在继续。

IOT: Samsara upgraded to Overweight after pullback at Piper Sandler

IOT: Samsara 在 Piper Sandler 回调后上调至增持

Piper Sandler upgraded Samsara to Overweight from Neutral yesterday, while maintaining their $50 price target. The firm points to valuation as the reason for the upgrade, following a 40% decline in shares over the past few weeks and over 20% during the last six months. Piper describes Samsara as a "high-quality, durable" company with growth exceeding 20%, which is capturing additional core fleet market share, expanding upmarket, and has numerous cross-selling possibilities. Piper indicates the stock has "finally reached a more reasonable entry point now that expectations have been recalibrated."

Piper Sandler 昨日将 Samsara 评级从中性上调至增持,同时维持其 50 美元的目标价。该公司将估值作为上调评级的原因,此前该股在过去几周下跌了 40%,在过去六个月下跌了超过 20%。Piper 将 Samsara 描述为一家“高质量、持久”的公司,其增长超过 20%,正在获取更多的核心车队市场份额,向高端市场扩展,并拥有众多交叉销售的可能性。Piper 表示,随着预期被重新调整,该股“终于达到了一个更合理的入场点”。

SNDK: SanDisk initiated with an Outperform at Mizuho

SNDK: SanDisk 在 Mizuho 的初始评级为跑赢大盘

Mizuho analyst Vijay Rakesh began coverage of SanDisk with an Outperform rating and a price target of $60. In a research note to investors, the analyst states that SanDisk holds a leadership position in the client and consumer market with a "dominating" 45% global share, which puts the company in a favorable position for edge artificial intelligence growth. The firm anticipates improving industry conditions with NAND pricing expected to trend upward in the latter half of 2025, as wafer capacity is projected to decrease by 13% compared to the previous year, creating a better supply/demand equilibrium.

Mizuho 分析师 Vijay Rakesh 开始覆盖 SanDisk,给予“跑赢大盘”评级,目标价为 60 美元。在给投资者的研究报告中,该分析师指出,SanDisk 在客户端和消费市场占据领导地位,拥有“主导性”的 45%全球市场份额,这使公司在边缘人工智能增长方面处于有利地位。该公司预计行业状况将有所改善,随着晶圆产能预计比前一年减少 13%,NAND 价格有望在 2025 年下半年呈上升趋势,从而创造更好的供需平衡。

RKT/RDFN: Rocket Companies to acquire Redfin for $12.50 per share (115% premium), or $1.75B

RKT/RDFN: Rocket Companies 将以每股 12.50 美元(溢价 115%)或总计 17.5 亿美元的价格收购 Redfin

SMCI: Super Micro re-initiated with a Buy at Rosenblatt

SMCI:罗森布拉特重新给予超微电脑买入评级

Rosenblatt analyst Kevin Cassidy re-initiated coverage of Super Micro with a Buy rating and $60 price target. Super Micro is a leading system server artificial intelligence provider in the cloud, enterprise, and telecom market segments. The firm says the company's AI revenues are now nearly 70% of sales and are accelerating. Rosenblatt views Super Micro's ability to deliver liquid cooling at scale as a competitive advantage, saying liquid cooling at scale has been difficult to deploy given the complexity, expense, and reliability concerns. It points out Super Micro's liquid cooling technology, at scale, can increase rack compute power by over two-times, which is a "disruptive dynamic in a power constrained data center."

Rosenblatt 分析师 Kevin Cassidy 重新开始对 Super Micro 进行覆盖,给予买入评级,目标价为 60 美元。Super Micro 是云、企业和电信市场领域的领先系统服务器人工智能提供商。该公司表示,其 AI 收入现已接近总销售额的 70%,并且正在加速增长。Rosenblatt 认为 Super Micro 大规模提供液冷技术的能力是其竞争优势,指出由于复杂性、成本和可靠性问题,大规模液冷技术一直难以部署。它强调,Super Micro 的液冷技术在大规模应用下可以将机架计算能力提高两倍以上,这在电力受限的数据中心中是一种“颠覆性动态”。

Trump Says Four Bidders in Play for TikTok Deal ‘Soon’

特朗普表示,TikTok 交易的四位竞标者“很快”将参与其中

President Donald Trump said Sunday he was negotiating with four different possible buyers for TikTok’s US business and that a deal for the social video app could come “soon.”

美国总统唐纳德·特朗普周日表示,他正在与四个不同的潜在买家就 TikTok 的美国业务进行谈判,并称这款社交视频应用的交易可能“很快”达成。“We’re dealing with four different groups, and a lot of people want it,” Trump told reporters aboard Air Force One on Sunday. He didn’t specify the contenders nor say which way he was leaning, instead saying “all four are good.”

“我们正在与四个不同的团体打交道,很多人都想要它,”特朗普周日乘坐空军一号时对记者表示。他并未具体说明竞争者,也没有透露自己倾向于哪一方,而是说“所有四个都不错。”ByteDance Ltd.’s TikTok faces a deadline of April 5 to strike a deal for its US operations — or be banned from the country under a bipartisan law passed during the Biden administration. The US is by far its most important market — ByteDance operates a sister service, Douyin, at home in China — and TikTok US was estimated to be worth as much as $50 billion last year.

字节跳动有限公司旗下的 TikTok 面临 4 月 5 日的最后期限,需就其美国业务达成协议——否则将根据拜登政府时期通过的两党法律被禁止进入该国。美国是迄今为止其最重要的市场——字节跳动在中国国内运营着姊妹服务抖音——而 TikTok 美国去年估值高达 500 亿美元。

ServiceNow Nears Deal to Buy AI Assistant Maker Moveworks

ServiceNow 接近达成收购 AI 助手制造商 Moveworks 的交易

Bloomberg: 彭博社:

ServiceNow Inc. is nearing a deal to buy artificial intelligence firm Moveworks, people familiar with the matter said, in what would be its largest acquisition to date.

知情人士透露,ServiceNow Inc.即将达成收购人工智能公司 Moveworks 的交易,这将是其迄今为止最大的一笔收购。The software company is putting the final touches on a deal for Mountain View, California-based Moveworks that could be announced as soon as the coming days, according to the people. The purchase could value Moveworks at close to $3 billion, they said.

知情人士称,这家软件公司正在为总部位于加州山景城的 Moveworks 的交易做最后的收尾工作,该交易最早可能在未来几天内宣布。他们表示,这笔收购对 Moveworks 的估值可能接近 30 亿美元。While discussions are advanced they could still be delayed or falter, the people said, asking not to be identified discussing confidential information. A representative for ServiceNow declined to comment. A spokesperson for Moveworks couldn’t immediately be reached for comment.

知情人士表示,虽然讨论已经深入,但仍可能被推迟或陷入僵局,他们要求不具名讨论机密信息。ServiceNow 的代表拒绝置评。Moveworks 的发言人暂时无法联系到以发表评论。Created in 2016, Moveworks provides companies with AI assistants to deal with employee requests. Its technology is used by companies including Unilever Plc, GitHub Inc. and Broadcom Inc., according to its website. Moveworks has received backing from investors including Kleiner Perkins, Lightspeed Venture Partners and Bain Capital Ventures. The company was valued at $2.1 billion in a 2021 funding round.

Moveworks 成立于 2016 年,为企业提供 AI 助手以处理员工请求。据其官网显示,联合利华(Unilever Plc)、GitHub Inc.和博通(Broadcom Inc.)等公司均采用了其技术。Moveworks 已获得包括 Kleiner Perkins、Lightspeed Venture Partners 和 Bain Capital Ventures 在内的投资者支持。在 2021 年的一轮融资中,该公司估值达到 21 亿美元。

New DOJ proposal still calls for Google to divest Chrome, but allows for AI investments

新司法部提案仍要求谷歌剥离 Chrome,但允许进行 AI 投资

The US Department of Justice is still calling for Google to sell its web browser Chrome, according to a Friday court filing.

根据周五的法庭文件,美国司法部仍要求谷歌出售其网络浏览器 Chrome。The DOJ first proposed that Google should sell Chrome last year, under then-President Joe Biden, and it seems to be sticking with that plan under the second Trump administration. The department is, however, no longer calling for the company to divest all its investments in artificial intelligence, including the billions Google has poured into Anthropic.

去年,在时任总统乔·拜登的领导下,美国司法部首次提出谷歌应出售 Chrome,而在特朗普第二任政府下,这一计划似乎仍在继续。然而,司法部不再要求谷歌剥离其在人工智能领域的所有投资,包括谷歌向 Anthropic 投入的数十亿美元。“Google’s illegal conduct has created an economic goliath, one that wreaks havoc over the marketplace to ensure that — no matter what occurs — Google always wins,” the DOJ said in a filing signed by Omeed Assefi, its current acting attorney general for antitrust. (Trump’s nominee to lead antitrust for the DOJ still awaits confirmation.)

司法部在由现任反垄断代理总检察长 Omeed Assefi 签署的文件中表示:“谷歌的非法行为已造就了一个经济巨兽,它肆意破坏市场秩序,以确保无论发生什么,谷歌总能胜出。”(特朗普提名的司法部反垄断负责人仍在等待确认。)

DKNG: Benchmark defends saying despite concerns about a deceleration in handle growth during Q4 2024, Q1 2025 has shown a strong re-acceleration, particularly in NBA betting volume

DKNG:Benchmark 为观点辩护称,尽管担心 2024 年第四季度投注额增长放缓,但 2025 年第一季度已显示出强劲的重新加速,特别是在 NBA 投注量方面

Management attributes this to an increase in NBA viewership and broader engagement in sports following the U.S. election cycle.The Super Bowl was a key event, driving exceptional customer acquisition and handle growth, and March Madness is expected to further sustain momentum. Hold rate improvements have exceeded expectations, largely driven by a shift in bet mix Same Game Parlays have experienced a 500-600 bps YoY increase in contribution, particularly within the NFL and NBA, where player centric betting is more prevalent.Live betting now accounts for approximately 50% of total betting volume at DraftKing's, a figure that continues to trend upward

管理层将此归因于 NBA 观众的增加以及美国选举周期后体育参与度的广泛提升。超级碗是关键事件,推动了客户获取和投注额的增长,而三月疯狂(March Madness)预计将进一步维持这一势头。投注保留率的改善超出了预期,这主要得益于投注组合的变化——同场比赛串关(Same Game Parlays)的贡献率同比增长了 500-600 个基点,尤其是在 NFL 和 NBA 中,以球员为中心的投注更为普遍。在 DraftKings 上,实时投注现已占总投注量的约 50%,这一比例持续呈上升趋势。

T: KEYB remains positive relative to $TMUS/$VZ given T's relative growth/valuation

T: 鉴于 T 的相对增长/估值,KEYB 相对于$TMUS/$VZ 仍保持积极

KEYB hosted AT&T's SVP, Finance and Investor Relations, Brett Feldman, at its ETS conference.Key items of focus for investors were on: 1) recent messaging indicating weakness in Mobility subscriber net adds in January; 2) the plan around Copper decommissioning; and 3) AT&T's Fiber build program. From KEYB's perspective, it thinks investors can anchor on a number of attractive strategic initiatives around the Fiber network build, convergence, and Copper decommissioning that should drive a reasonably healthy financial growth profile on EBITDA and FCF. KEYB is positive on T relative to TMUS/VZ given T's relative growth/valuation, though it remains SW as: 1) it feels the stock has gotten ahead of the fundamentals in the NT; 2) it worries about calls on capital, particularly for Spectrum, that are likely coming, and 3) it sees the overall Wireless space becoming less attractive from a competitive standpoint, with Cable likely becoming more aggressive in the next 12-18 month

KEYB 在其 ETS 会议上邀请了 AT&T 的财务和投资者关系高级副总裁 Brett Feldman 出席。投资者关注的重点包括:1)近期消息显示 1 月份移动用户净增疲软;2)铜网退役计划;3)AT&T 的光纤建设计划。从 KEYB 的角度来看,他们认为投资者可以围绕光纤网络建设、融合以及铜网退役等多项有吸引力的战略举措进行锚定,这些举措应能推动 EBITDA 和自由现金流(FCF)实现相对健康的财务增长。相对于 TMUS 和 VZ,KEYB 对 T 持积极态度,考虑到 T 的相对增长/估值,但仍保持 SW 评级,原因如下:1)认为短期内股价已超越基本面;2)担忧资本需求,尤其是频谱方面的可能支出;3)从竞争角度看,整体无线领域吸引力下降,未来 12-18 个月内有线电视公司可能会更加激进。

OTHER NEWS 其他新闻

AAPL: Apple Delays Siri Upgrade Indefinitely as AI Concerns Escalate – Bloomberg

AAPL: 苹果无限期推迟 Siri 升级,因 AI 担忧加剧 – 彭博社Agencies: Bain and WPP to break up research company Kantar – FT

机构:贝恩与 WPP 将分拆研究公司 Kantar – 英国《金融时报》China, Gen AI: How Alibaba’s new RISC-V chip hits the mark for China’s tech self-sufficiency drive – SCMP

中国,生成式人工智能:阿里巴巴新推出的 RISC-V 芯片如何契合中国科技自立自强战略——《南华早报》CTSH: Activist Mantle Ridge Builds Over $1 Billion Stake in Cognizant– WSJ

CTSH:维权投资者 Mantle Ridge 在 Cognizant 建立超 10 亿美元股份– WSJDeepSeek: U.S. Likely to Ban Chinese App DeepSeek From Government Devices – WSJ

DeepSeek: 美国可能禁止政府设备使用中国应用程序 DeepSeek – WSJAMZN/WMT: How Walmart Built the Biggest Threat Amazon Has Faced – WSJ

AMZN/WMT:沃尔玛如何打造亚马逊面临的最大威胁——《华尔街日报》Foxconn: Foxconn Builds FoxBrain, Its Own AI Model – WSJ

富士康:富士康打造自有 AI 模型 FoxBrain – 华尔街日报STX: Lasers, Magnets and the $40 Billion Fight to Store the World’s Data– link

STX: 激光、磁铁与 400 亿美元的数据存储之战 – 链接