Hungary and China Are Fellow Travelers in a $10,000 Electric Car

Viktor Orbán is learning how to bring affordable EVs to the European Union. Democracies can meet the challenge, too.

Building a burgeoning green technology supply chain.

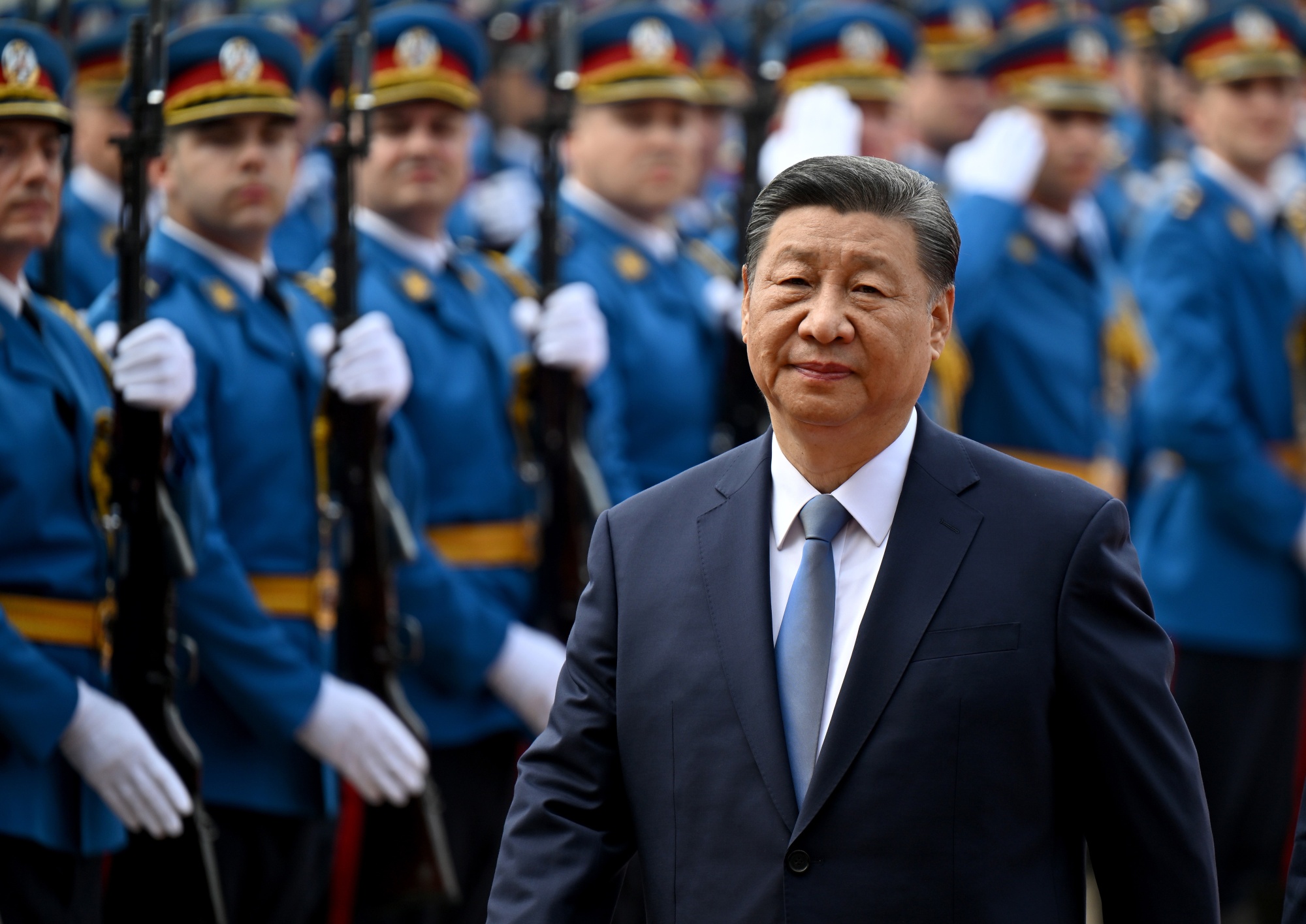

Photographer: Valeria Mongelli/BloombergIf you listen to Chinese President Xi Jinping and Hungarian Prime Minister Viktor Orbán, you might think that cheap electric cars and authoritarianism are joined at the hip. It’s up to rich democracies to prove them wrong.

Xi is visiting Hungary on the last day of his trip to Europe. In doing so, he’s returning a compliment Budapest has paid Beijing in recent years, copying China’s developmentalist model and disdain for democracy to build a burgeoning green technology supply chain in the heart of the European Union.

“On the path of Chinese-style modernization and development, we see Hungary as a traveling companion,” Xi wrote in an op-ed in Magyar Nemzet, the newspaper of the ruling Fidesz party.

Since 2019, first South Korean and then Chinese lithium-ion battery companies have flocked to Eastern Europe, taking advantage of low costs, access to the EU’s single market, and proximity to existing car factories in southern Germany and Slovakia.

Punching Above Its Weight

China is far and away the biggest battery producer. But Hungary is at number four.

Source: BloombergNEF

Note: Data is in gigawatt-hours of annual production capacity.

Hungary alone has received about €20 billion ($21 billion) in electric vehicle investments. Factories run by Samsung SDI Co., SK On Co., and Contemporary Amperex Technology Co. have made the country of 10 million people the fourth-largest producer of lithium-ion cells after China, South Korea, and the US. BYD Co., vying with Tesla Inc. for the crown of world’s biggest EV producer, has chosen it as the location for its first European plant.

Most remarkable of all, in a world where a coming flood of cheap Chinese clean technology is being treated as an existential threat justifying tariffs, investigations, and bans, Hungary is competing on cost. If you want to be able to buy a $10,000 electric car like BYD’s Seagull outside of China, that’s going to be essential.

The average lithium-ion battery pack produced in Hungary right now comes to about $105.7 per kilowatt-hour, according to a BloombergNEF cost model. That’s only a sliver above $104.5/kWh from Chinese plants, and likely well below it after accounting for the sum a European purchaser would have to spend on transport. By contrast, Canada, Germany, the UK and US are all north of $120/kWh.

Pile 'em High

Hungary's battery prices are the only ones in the rich world that compete with China

Source: BloombergNEF

Note: Data is in dollars per kilowatt-hour.

The cost edge is crucial because some 40% of what you’re paying for when buying an electric vehicle is the battery pack. If European and US carmakers want to be able to compete with Chinese rivals on price as well as trade restrictions, they’re going to have to learn from what Hungary has done to make its power cells so cheap.

What’s the trick? The key insight is something Elon Musk recognized a decade ago in announcing the site that has become synonymous with colossal battery plants, Gigafactory One in Nevada. Mass production cuts costs by operating at epic magnitudes. If your new factory covers less than 100 hectares (247 acres) — roughly a third the size of New York’s Central Park — it’s not going to pass muster.

To play in that game, you need cheap land and excellent connections to electricity, water, and transport networks. It’s not easy to find such sites in the richer countries of Western Europe and North America, where permitting and red tape means it can take $1.7 million and several years to build (or even fail to build) a San Francisco public toilet. Giant new chemicals plants are rarely popular with the neighbors, including in Hungary. Protests, regulations, and exhaustive environmental impact reviews can prevent green technology from getting built for years, or even decades.

A cheap workforce is even more decisive. About 80% of the additional cost for batteries made in Germany over Hungary is the labor expense, according to BloombergNEF’s data. Orbán’s failure to close the income gap with Western Europe gives Hungary a potent cost advantage.

Kraftwerk

Hungary's cost advantage over Germany is mostly about land, labor, and power

Source: BloombergNEF

Note: Data is in dollars per kilowatt-hour in battery pack cost.

The last element is cash. Hungary’s 9% corporate tax rate is the lowest in Europe, and Orbán has also been able to use EU funds earmarked for regional development and energy transition to provide sweeteners and encourage foreign manufacturers to set up shop.

This policy mix is almost identical to what’s driven China’s industrial development for two decades. For all the rhetoric about predatory overcapacity and lavish state subsidies, the core innovation in China’s model is the Special Economic Zone: a designated region where the government provides investors with cheap land, labor, infrastructure, and modest tax breaks, and then lets them get on with things.

If Europe and North America are serious about decarbonization, they can repeat that pattern without any of the authoritarianism so precious to Xi and Orbán. Land and labor costs are also pretty low in Poland, Mexico, Romania and Bulgaria. Governments are free to offer tax and investment incentives for green technology, and should be doing so wherever possible.

Get a supply chain going, moreover, and you can establish the sort of industrial cluster that’s sprouting up now in Hungary, and develop the kind of process innovations that make China such a formidable competitor.

That’s a much more hopeful future than one where rich countries fall short on decarbonization and drift ever closer to conflict because tariffs and trade wars are cutting them off from cheap Chinese technology. On a planet heading for net zero, there is more than enough green investment needed to ensure that every part of the world gets its share.

More From Bloomberg Opinion:

- After Macron and Xi's Honeymoon, the Cognac Hangover: Lionel Laurent

- China’s EV and Solar Boom Is a Capitalist Win for Communism: David Fickling

- Making Sense of China’s Magical 5.3% Growth: Shuli Ren

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.