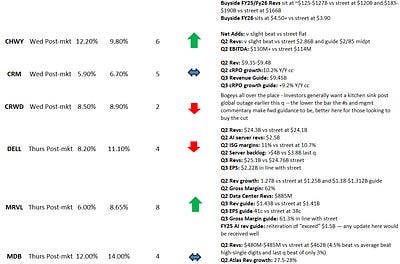

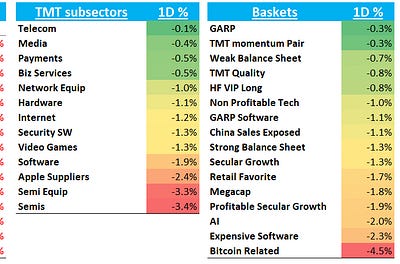

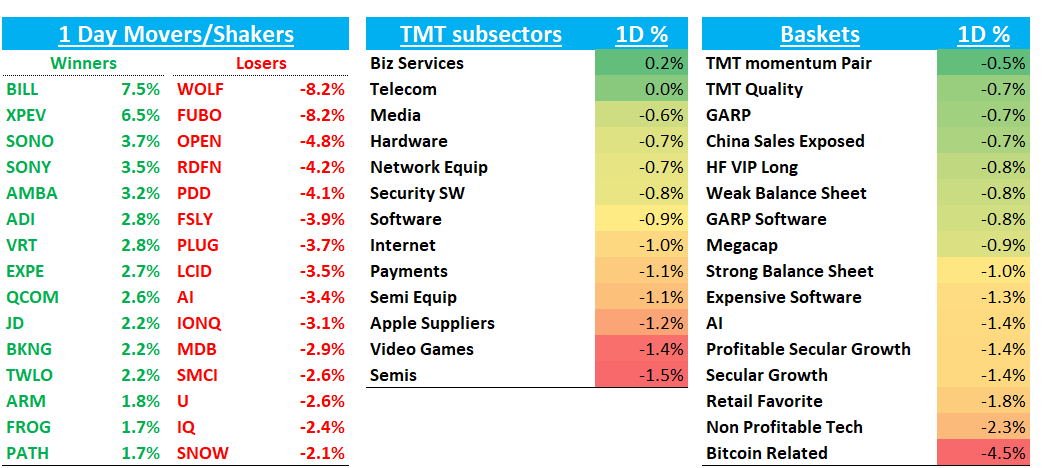

A little early today as we have some big prints after the close. QQQs - 1% as Semis -1.3% underperformed led by SMCI’s -20% after delaying 10-k filling. In terms of factors, unprofitable tech underperformed while large cap and TMT mo outperformed. We’ll have some quick earnings takes after the close…see you then…

Semis

SMCI -20% following through on yesterday’s Hindenburg report after they delayed their 10-k filing. Stock now at $450 after being above $1,200 at one point earlier this year. WFS lowered target to $375 from $650 citing increase uncertainty and concern over rev recognition. ISI out saying SMCI concerns may help DELL -50bps and HPE gain AI server share

Other AI semis generally weak ahead of NVDA -1.5%: ARM - 4%; MU - 3%; AMD - 2.5%; AVGO - 2%. TSM -50bps fared the best

AMBA +11% after their beat and raise citing growth stemming from multiple waves of new CV product ramps (CV5, CV7, and CV3 families) for both IoT and Automotive, with all new products coming with higher ASPs

INTC - 2% after more neg press of board member leaving

Analog mixed: TXN - 1%; MCHP - 1.5%; ON -1.5%; NXPI - 2%

Internet

CHWY +10% after solid results with EBITDA posting nice upside and sequential improvement in active customers.

AMZN -1.5%: slight downtick in 3p retail NA sales this week, tracking 1ppts below street

PDD - 7% continues to hit new lows; Other China names weak: BIDU -3%; BAB - 2%; JD - 2%

Housing names weak: OPEN - 11%; RDFN -7%; Z -1.3%

META - 20bps fared the best out of large cap with GOOGL - 1% and NFLX - 1.8%

W - 3% despite Mizuho talking up their in-store openings

Software

CRM -2% after more mixed sell-side checks ahead of the print

Large cap mixed: ORCL - 50bps; NOW - 2%; MSFT - 80bps

Cloud names weak: SNOW - 3.5% closing at new lows; DDOG - 2%; CFLT - 2.5%; MDB - 2%

Elsewhere

OpenAI in talks for funding round valuing it above $1B - WSJ

Fintech weak as BTC - 4%: COIN - 3%; HOOD - 5%; UPST - 5%; AFRm - 4%; PYPl - 1.7%; SQ - 3%

AAPL -20bps fared better

PARA +2%

TSLA - 2% despite some decent weekly yipit data