TMTB Morning Wrap

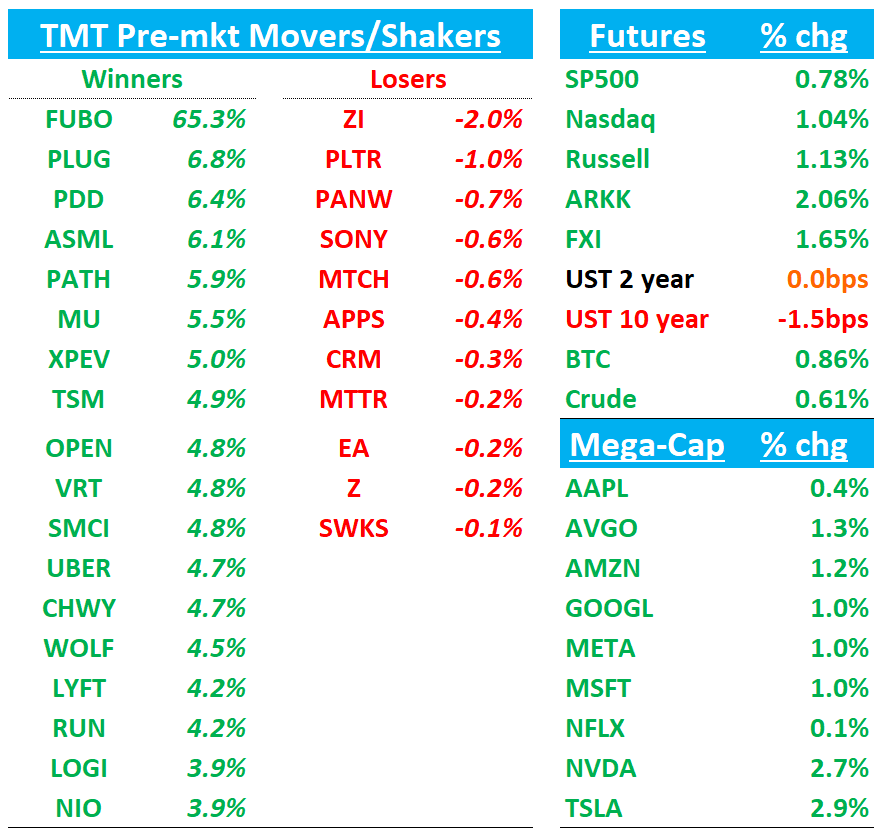

QQQs +1% as semis are ripping on the first day of CES, Altman getting bulled up on AGI, and news that Trump tariffs less onerous as well as some positive HonHai #s.

Busy week ahead…

CES: Jensen has the main keynote on Monday at 9:30pm est.(link) Sell-siders will be hosting meetings with most semi companies (First one - JPM has fireside chat with MRVL CEO a 9am est. and NVDA CFO at 11am est on Tuesday) NVDA Investor Q&A with Jensen at 3:30est on Tuesday. Also have SNAP’s CEO Evan Spiegel at 7:05est on Tuesday. Investors also expecting to hear some sort of ad-tier MAU update at CES from NFLX this week (last was 70M in Nov 24 up from 40M in May). 90M would be a good number. Waymo Co-Co keynote on Wednesday evening (watch UBER/LYFT)

Also get several sell-side software bus tours this week: JPM, BAML, Jefferies, ISI which should give us some color on how Dec finished up.

Friday we get DOJ and Tiktok presenting oral arguments to the Supreme Court. On macro front, we get NFP on Friday as well.

BTC +1%; yields flat to down; China +1%. Small thematic stocks (robotics, space, drones, etc. ) on the move again this morning (just check out ARBE +85% on an NVDA partnership).

Lot’s to get to so let’s dive in…

Trump Team Mulls Narrowing Universal Tariffs, Post Reports

Aides to President-elect Donald Trump are considering a tariff plan that would apply to all countries but be limited to specific critical imports, the Washington Post reported, citing three people familiar with the discussions who it didn’t identify.

If implemented, the plan would mark a significant narrowing of the universal tariffs of 10% to 20% that Trump had proposed during his campaign, a move economists expect to drive up consumer prices and distort patterns of global trade.

GS was out Friday mid day talking about Q1 better seasonal only down 2% vs st down 7% good

MSFT: Had a blog post noting $80B in AI spend for FY25. UBS confirmed with IR this was just annualizing $20B Q1 #, and not updated guidance.

3p Roundup:

AMZN: Yip AWS downticks in latest week but note it’s skewed by Christmas Day falling on a weekday. Q ended up ~20% vs street at 19%.

PINS: Edgewater out positive saying Performance+ driving improved CTRs/CPCs

TSLA: New Street upgrades to Buy

New Street upgrades Tesla to Buy ($460 PT) from Neutral. Expects auto growth reacceleration from lower-cost models, stable margins as cost reductions match price cuts. FSD progress strengthens outlook for partial unsupervised/robotaxi test fleets this year. Though full deployment timeline remains lengthy, firm sees $4.7T market cap potential by 2030 if robotaxi dominance achieved. Views risk/reward as favorable.

HonHai/AAPL/NVDA: HonHai +2% after better Dec rev but weaker Q1 guide

Hon Hai's Q4 revenue beat at NT$2.13tn (+2% vs Street). Hon Hai's December revenue showed strong Y/Y growth in Smart Consumer Electronics, primarily from Apple pull-in demand. Q4 revenue was flat Y/Y (vs expectations of +1-2% iPhone growth). Cloud/Networking declined QoQ during Hopper-Blackwell transition. Q1 guidance weaker at -30% QoQ (vs Street -20%), possibly bc of lower H1'25 GB200 shipments due to supply chain issues.

CHWY: Mizuho upgrades to Buy

Follows Wolfe’s upgrade on Friday…

Not a ton in the upgrade, but PT raised to $42 from $24 and makes it a top pick over and within consumer internet. The firm says Chewy "checks several boxes" on its 2025 "thematic list" of automation, retail media, and secular growth, noting the pet category will return to steady growth and the company's internal initiatives will further take hold, the analyst tells investors in a research note. Mizuho notes the pet category is beginning to recover into 2025 yielding a return to net active customer growth for Chewy and a subsequent sales reacceleration.

MDB: Gugg upgrades to Buy on accelerating Atlas growth

Gugg upgrades MongoDB to Buy (from Neutral) with $300 PT (22% upside), implying 10.1x EV/NTM and 9.3x EV/FY26 revenue multiples. Despite 30% stock decline since Q3 earnings (vs IGV -6%), firm believes bearish concerns are overstated. Bears cite Atlas consumption deceleration, Enterprise Advanced growth headwinds/Atlas cannibalization risk, margin pressure from investments, and CFO/COO departure. However, Gugg sees stable Atlas consumption, with Q3 New ARR showing modest acceleration vs Q2 (2-year stack). Channel checks indicate Q4 consumption uptick. Projects FY26 Atlas growth at 29% (vs FY25 +27%, or -1pt ex-unused commits). Firm supports management's Enterprise Advanced investment strategy for hybrid environments (core + AI workloads), expecting sustainable low-teens growth and expanded TAM and anticipates FY26 revenue guidance starting near 15%, consistent with past two years.

FTNT: Piper Sandler upgrades Buy on firewall refresh in 2025

Piper Sandler upgraded Fortinet to Overweight (from Neutral), raising PT to $120 (from $100). Channel partner and CIO surveys indicate firewall cycle uptick in 2025, with early refresh signals. Firm sees Fortinet as top pick for this product acceleration trend.

CRM: Gugg downgrades to Sell, negative on Agentforce

Gugg downgrades CRM to Sell from Neutral with a $247 price target. Gugg notes CRM has rallied about 30% in the four months since it introduced Agentforce in late August, but does not believe that Salesforce will meaningfully monetize Agentforce unless it acquires several assets that "have been doing, over the past decade, what Agentforce aspires to do." Gugg notes CRM’s status as a system of record "gives it staying power, but in our view doesn't give it any advantage in providing AI solutions that require dynamic data with rich context.”

UBER: Uber announces $1.5B accelerated share repurchase program (1.5% of market cap)

Uber announced that it has entered into an accelerated share repurchase agreement with Bank of America to repurchase $1.5B of shares of Uber common stock, as part of its previously announced $7B share repurchase authorization. Under the ASR agreement, on January 6, Uber will pay $1.5B to the dealer and expects to receive an initial delivery of 18,578,727 shares of Uber common stock, representing approximately 80% of the shares of Uber common stock it expects to repurchase under the ASR agreement. The total number of shares to be repurchased by Uber pursuant to the ASR agreement will be based on the volume-weighted average price of Uber common stock on specified dates during the term of the ASR agreement, less a discount, and subject to customary adjustments pursuant to the terms and conditions of the ASR agreement.

UBER: Uber added to Best Ideas List at Wedbush

Wedbush adds Uber to Best Ideas List, noting attractive valuation at 12.9x 2026 EBITDA despite AV concerns. Firm sees unwarranted discount given mid-teens revenue growth and 30%+ annual EBITDA growth outlook over the next two years. While AV industry evolution remains uncertain, expects Uber to partner with AV leaders. Near-term AV risk minimal due to limited availability, scaling challenges, and operating costs and capex constraints. Maintains Outperform, $86 PT.

UBER: How Uber and Lyft Are Gearing Up for the Robotaxi Revolution

UBER and LYFT gave up on big plans to develop their own driverless taxis years ago. Now, they are revamping their businesses to accommodate competitors who may have figured it out.

The ride-hailing leaders are preparing to bring driverless taxis to your door with new app features that allow customers to use their phones to open trunks and honk horns. They are building infrastructure to maintain the high-tech taxis and training human support staff to handle riders without drivers.

ZI: ZoomInfo downgraded to Underweight from Neutral at Piper Sandler

Piper Sandler cut ZoomInfo to Underweight (from Neutral), lowering PT to $10 (from $11). Firm cites extended turnaround timeline due to aggressive competitive pricing, with limited catalysts until revenue grows beyond current $1.2B level. For 2025, Piper favors large, strategic cloud/analytics vendors positioned for AI adoption. Notes potential renewed investment in application/data layers for 2025-26 after three years of slowed growth.

SHOP: Wedbush upgrades to Buy

Wedbush upgrades SHOP to Outperform from Neutral with a price target of $125, up from $115. The firm is more constructive on shares in the near-term given an improving margin outlook following Q3 results and expectations for strong operating income growth in 2025. Shopify remains the dominant e-commerce software platform with a large TAM opportunity, considerable pricing power within its subscription services, and ongoing payments expansion with expected gross payment volume of $225B in 2025, Wedbush says.

W: Wedbush downgrades to Neutral from Buy

Wedbush cuts Wayfair to Neutral ($44 PT from $45), citing slowing market share gains in 2025 without major investment despite sales outperformance. Notes tariff risk given import exposure and price-sensitive customer base, limiting consensus upside and downside risk to margins.

LYFT: Lyft upgraded to Buy at Benchmark despite 'headline risk'

Benchmark upgrades LYFT to Buy from Hold with a $20 price target. While Benchmark acknowledges that both Uber and Lyft are likely to face ongoing pressure from Tesla (and Waymo headlines, the firm says the argument for Lyft from "boils down to a few factors." Benchmark believes Lyft's decision to reduce surge pricing, while sticking with their Price Lock platform expansion, should drive upside to rider metrics and it thinks Lyft is "just getting started" with their expansion via partnerships, both on the traditional and autonomous vehicle fronts, with prior partnerships likely to produce near-term upside to metrics.

TEAM: Oppenheimer raises Atlassian price target to $300, reiterates as a top pick

Oppenheimer raises Atlassian's price target to $300 (from $270) and maintains an Outperform rating, positioning it as a top pick for 2025 given multiple growth catalysts. The firm highlights the evolving enterprise sales strategy under the new CRO's leadership, expecting enhanced go-to-market execution and sales team expansion. Additionally, Oppenheimer sees significant leverage potential from improved product packaging, bundling initiatives, and new product development driving larger deal sizes and expansion opportunities. While maintaining a prudent outlook, the firm anticipates that an improving macro environment could catalyze broader seat expansion across Atlassian's customer base.

GOOGL: Wedbush names Alphabet as a top pick for 2025, raises price target to $220

Wedbush raises Alphabet PT to $220 (from $210), maintaining Outperform and naming it a top 2025 pick. Firm expects search concerns to fade as focus shifts to Cloud growth and margin potential. Notes Q3 Cloud acceleration across core and AI offerings, with AI contribution growth expected in 2025. New CFO may enhance cost optimization, driving potential margin upside. While acknowledging legal risks, firm views structural changes as unlikely.

FUBO +70%; DISNEY IS SAID TO NEAR DEAL TO MERGE HULU + LIVE INTO FUBO

OpenAI: Sam Altman on ChatGPT’s First Two Years, Elon Musk and AI Under Trump - Bloomberg

Good interview with altman. Also in a blog post, he comments on AGI:

Sam Altman blog post tonight

"We are now confident we know how to build AGI as we have traditionally understood it. We believe that, in 2025, we may see the first AI agents “join the workforce” and materially change the output of companies. We continue to believe that iteratively putting great tools in the hands of people leads to great, broadly-distributed outcomes.

We are beginning to turn our aim beyond that, to superintelligence in the true sense of the word. We love our current products, but we are here for the glorious future. With superintelligence, we can do anything else. Superintelligent tools could massively accelerate scientific discovery and innovation well beyond what we are capable of doing on our own, and in turn massively increase abundance and prosperity.

This sounds like science fiction right now, and somewhat crazy to even talk about it. That’s alright—we’ve been there before and we’re OK with being there again. We’re pretty confident that in the next few years, everyone will see what we see, and that the need to act with great care, while still maximizing broad benefit and empowerment, is so important."

Also: Sam Altman said the co. is losing money on its new $200/mo ChatGPT Pro because people are using it more than expected – TechCrunch

AAPL: UBS remains cautious on sustainability of Apple's App Store growth

UBS analysis shows Apple's App Store revenue grew 13% (13.5% FX-neutral) with currency causing a 50bp drag. December slowed 350bp month-over-month, though December-November comp stayed flat. Q4 saw 15% reported growth (13.3% FX-neutral). UBS notes December showed balanced regional performance (US +12%, ROW +13%) with 5% monthly growth, slightly below seasonal norms due to strong November. UBS remains cautious on maintaining low-to-mid teens growth given muted iPhone demand and stays neutral on the stock.

PYPL: Susq raises PT to $101 from $94

After three consecutive "beat and raise" quarters, Susquehanna analyzes PayPal's TM$ acceleration drivers. Customer balance interest income is the biggest contributor, followed by Branded Checkout, Braintree, Venmo, and favorable credit/transaction losses. Firm projects 2025 TM$ growth slowing to 3% (vs 6.9% in first 9M 2024). Susq’s mid-term outlook remains positive with sustained mid-single-digit TM$ growth potential, supporting high-single-digit revenue growth.

AMKR: Melius downgrades to Hold on fx impact

Melius Research cut Amkor to Hold ($30 PT from $34). While firm sees 2025 upside in hyperscaler capex and enterprise IT spend, expects benefits to concentrate in H2 and extend into 2026. Though AI boom enters "year 3" with tempered euphoria, Melius maintains it's still early. Near-term currency headwinds may pressure Amkor revenue.

TER: Northland upgrades to Buy

Northland upgraded Teradyne to Outperform (from Market Perform, $154 PT) citing benefits from advanced packaging transition in DRAM/compute (2025) and application processors (2026). also noting the co gaining compute market share as CSPs design ASICs and adopt its testing solutions.

SNOW: Piper raises PT to $208 from $185

Piper Sandler raises Snowflake PT to $208 (from $185), maintains Overweight. Sees $1T annual spend potential within 7 years, driven by AI era and digital labor integration. Large strategics with broad distribution positioned to deliver AI features enterprise-wide. Piper expects renewed application/data layer investment in 2025-26 after three years of moderated growth.

ABNB: Airbnb named a top pick for 2025 at Wedbush

Wedbush names Airbnb top 2025 pick, maintaining Outperform ($155 PT). Expects accelerating room night growth against easier comps, driven by expansion market mix shift, take rate gains via monetization and new services, and core-plus growth. Despite margin debates, firm sees limited downside vs reset consensus expectations for 2025.

Other News:

AVGO, MRVL: Why Marvell Will Overtake Broadcom As Nvidia’s AI Challenge – The Information (out Friday morning)

CSCO, Telecom: How Chinese Hackers Graduated From Clumsy Corporate Thieves to Military Weapons - WSJ

Foundry: NVDA & QCOM are reportedly considering using Samsung's 2nm process due to TSM’s high ASP, and Qualcomm is currently testing the Samsung's 2nm process – ijiwei

INTC: Intel’s Problems Are Even Worse Than You’ve Heard – WSJ

Memory, HMB: SK Hynix plans to unveil 16 layer HBM3E sample at CES and SK Chairman Chey is expected to meet up with NVDA Jensen Huang

NVDA: Jensen is reportedly expected to unveil RTX 50 series GPUs, AI computing products, and the latest advancement in automotive/robotics-related technologies at CES 2025 keynote – UDN

OpenAI: in an interview Sam Altman expressed confidence in the co’s progress in artificial general intelligence (AGI) and super intelligence – Bloomberg

Samsung: Samsung Adds Generative AI to World’s Best-Selling TV Lineup – Bloomberg

SK Hynix: Hynix announced it will unveil its 5th gen HBM3E 16-stack prototype at CES 2025; SK Hynix plans to mass-produce the 6th generation HBM (HBM4) in 2H25 – Businesskorea