TMTB Morning Wrap

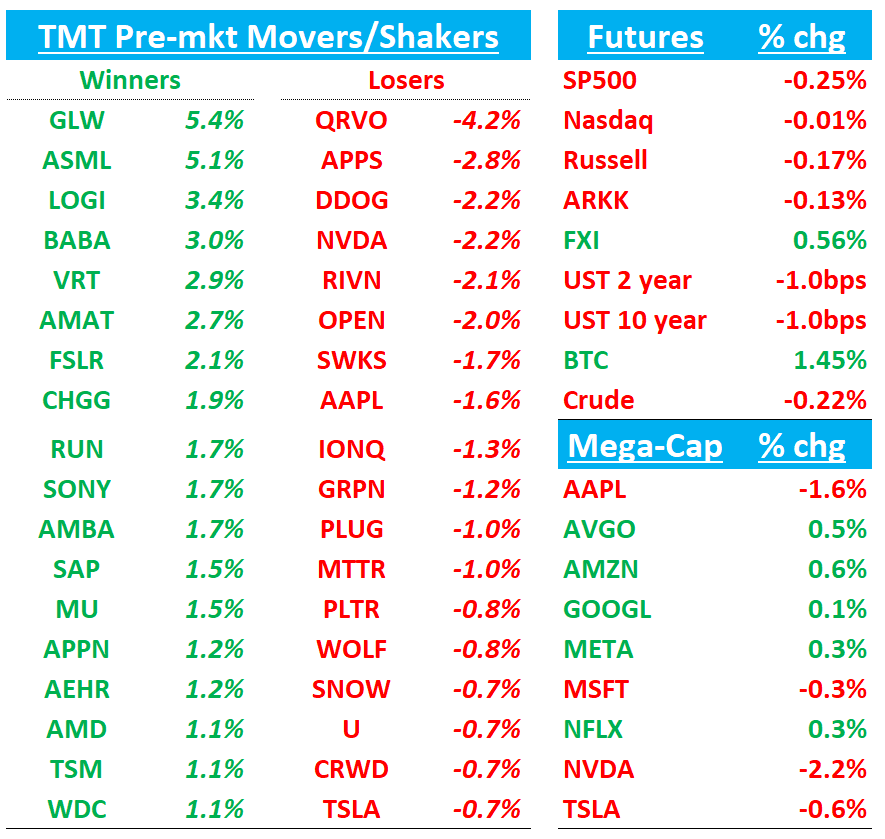

QQQ flattish ahead of Fed today. Yields slightly down; BTC +1%. We’ll hit up some research then ASML, QRVO, FFIV, GLW, TMUS earnings round-ups. Let’s get straight to it…

RDDT: Piper says Reddit has added META ad import feature to attract more advertisers, program in Beta

The new feature lets advertisers import campaigns directly from META’s ad manager, making it easier to shift ad spending to RDDT’s platform. With only several thousand advertisers on RDDT and 10M on META, one can see the potential here…Piper out saying the update is a potential driver for advertiser growth. By streamlining ad imports, Piper notes Reddit is making a strategic push to compete in the digital ad market, where Meta dominates. Piper thinks RDDT could potentially add tens or even 100s of thousands of self serve SMB advertisers. 25-50k advertisers translates to $100-$250M in incremental revs assuming $4-5k spend per customer and would amount to 9-22% revenue boost.

AAPL: Oppenheimer downgrades to Hold from Buy

Oppenheimer downgrades AAPL to Perform, reducing FY26 EPS forecast to $7.95, below Street's $8.23, based on two key iPhone headwinds. First, they see mounting competitive pressure in Greater China. Second, they note Apple's current lack of compelling AI and generative intelligence features that could drive device upgrades. Given soft iPhone sales since September and current valuation levels, Oppenheimer believes AAPL shares will struggle to outperform.

DDOG: Datadog cut to Hold at Stifel on margin headwinds, full valuation and points to potentially lower revenue from OpenAI

Stifel says OpenAI has also been able to optimize its Datadog usage even though checks suggest that it will renew the contract for another year. Stifel thinks the net result of this is OpenAI optimization along with traditional pricing compression upon renewals and potential for year end churn and Oppenheimer expects the company’s AWS growth linkage to continue to compress in Q4. Stifel also warns that the company is heading for headwinds to revenue growth and margin expansion in FY25 while the stock is trading at a "full valuation" of 13.5-times on enterprise value to expected forward revenue basis. Datadog has also had a strong performance since its Q3 results, posing a "less than favorable" risk-reward in the coming quarters, the firm tells investors in a research note.

RIVN: Rivian Automotive initiated with an Underperform at Bernstein with $6.10 PT

Bernstein initiated coverage of Rivian Automotive with an Underperform rating and $6.10 price target. The firm says that while it sees the company succeeding in its plan to reach over 500,000 cars by 2030, "this is not enough to create financial success for shareholders." Rivian will only achieve mid-teens gross margins by the end of the decade, which makes it "challenging to deliver meaningful value to shareholders," the analyst tells investors in a research note. Bernstein expects the company will still burn $14B to reach breakeven. Rivian in post-market trading is down 1% to $12.55.

LYFT/UBER: BAML comments on Waymo announcement yesterday to expand freeway testing

Watch both names ahead of TSLA earnings today….

Waymo has begun employee testing of autonomous freeway rides in LA, as announced on their X platform. This follows their March 2024 CPUC approval for freeway operations in both SF and LA markets. BofA highlights that while a public freeway launch would negatively impact LYFT, market expectations for rollout timing may be too aggressive. They point to SF's gradual deployment - despite having approval for nearly a year, Waymo continues testing and still routes trips to avoid freeways, resulting in significantly longer trip times compared to LYFT (50 minutes versus 30 minutes on sample routes).

FFIV +13%: Strong Q and FY25 guide along with bullish AI commentary

FFIV reported FQ1 revenue / EPS of $766mm / $3.84 vs. expectation of $714mm / $2.35.

Q4 revs +11% y/y beat street by 7%, which is the biggest beat that I can see in Bloomberg’s history - much bigger than average 1-2% beat.

Software +22%, 4% above street; Systems +22 y/y, above street expects of 0% y/y growth

Perpetual revenue grew 2% Y/Y in the quarter and subscription grew 30% to $162M, representing 78% of total software revenue.

For the Full year, FFIV guiding sw revs to grow 7.5% + Systems to grow dd, y/y expansion in OPM and GM, as well as EPS growth of 7.5% at the mid pt, slightly above street.

While AI revenue remains immaterial for F5's FY25, the mgmt said the co is seeing emerging interest across several compelling use cases. The first centers on managing data store performance during RAG (retrieval augmented generation) operations. As customers run inference tasks using RAG, the high volume of data store queries creates bottlenecks and latency issues - a challenge F5's ADC solutions can address by sitting in front of these data stores and optimizing query flow. The second focus area involves securing inference operations through Web Application and API Protection (WAAP), helping customers protect their AI deployments. Finally, F5 is positioning its technology to handle load balancing between GPU clusters within AI factories, ensuring efficient workload distribution across these intensive computing environments. All of these are still small, but mgmt sounded bullish on opportunities.

Bulls will point to all of these, better demand, price increases, potential hw refresh driving software upcycle while Bears will say FY25 is 2H weighted, hardware is tough to predict, and you are paying 20x for high single digit EPS growth.

GLW: Solid Q and guide with 93% growth in enterprise optical which is being driven by AI

Optical #s here will help keep AI Bull story alive. Implementing dd px increases in Display

C1Q revenue/EPS guidance of $3.6b/$0.50 vs. Street at $3.56b/$0.48

Plans to upgrade “springboard” plan at investor event in March

From the PR, ““Ed Schlesinger, executive vice president and chief financial officer, said, “We outperformed in the fourth quarter, driven by strong adoption of our new products for Gen AI, which drove sales growth of 93% year over year in the Enterprise portion of Optical Communications. We also successfully implemented double-digit price increases in Display Technologies to ensure we can maintain stable U.S. dollar net income in a weaker yen environment, and we expect to deliver segment net income of $900 million to $950 million in 2025 and to maintain net income margin of 25%.”

$GLW RESULTS: Q4

- Core EPS $0.57 vs. $0.39 y/y, EST $0.56

- Core sales $3.87B, +18% y/y, EST $3.74B

- Display Technologies net sales $971M, +12% y/y

- Optical Communications net sales $1.37B, +51% y/y

- Specialty Materials net sales $515M, +8.9% y/y

- Environmental Technologies net sales $397M, -7.5% y/y

- Life Sciences net sales $250M, +3.3% y/y

- All Other net sales $373M, +4.8% y/y

ASML: Very strong bookings and better Q1 Guide

All around solid print (see #s below…)

Re: Deepseek, CEO was on CNBC saying “A lower cost of AI could mean more applications. More applications means more demand over time. We that as an opportunity for more chips demand.”

Chinese revenue comprised 27% of total sales and represents just over 20% of pending orders, suggesting ASML's earlier projection of 20% Chinese revenue for 2025 might be too conservative.

GUIDANCE: Q1

- Guides net sales EU7.5B to EU8.0B, EST EU7.25B

- Guides gross margin 52% to 53%, EST 51.2%

F/Y GUIDANCE

- Still sees gross margin 51% to 53%, EST 52.1%

- Still sees net sales EU30B to EU35B, EST EU32.19B

ASML RESULTS: Q4

- Bookings EU7.09B vs. EU2.63B q/q, EST EU3.53B

- Net sales EU9.26B, +24% q/q, EST EU9.02B

- Net system sales EU7.12B, EST EU7.16B

- Net service & field operation sales EU2.15B, EST EU1.86B

- Gross margin 51.7% vs. 50.8% q/q, EST 49.6%

- R&D expenses EU1.12B, EST EU1.1B

- Operating income EU3.36B, EST EU3.09B

- Operating margin 36.2%, EST 34.1%

- Net income EU2.69B, +30% q/q, EST EU2.62B

- Cash and other EU12.74B vs. EU4.99B q/q, EST EU6.17B

- Total lithography systems sold 132 units, EST 121.14

- Net system sales China share 27% vs. 47% q/q

- 2024 YEAR RESULTS

- Dividend per share EU6.40

- Final dividend per share EU1.84

QRVO: Solid Q4 and Q1 guide but Lower 2025 Guide driven by Android brings down stock

Stock was trading +20% at one point in the post-market yesterday, but now -5% as they guided FY’25 (ends March ‘260 to be be flat y/y, with ACF down while HPA and CSG +10-12%.

Android revenue (~$875M FY25) will drop $150-200M annually over FY26-27 as they exit low-margin entry-tier Chinese OEM business and see some Samsung mid-tier decline. This mix shift should boost gross margins long-term and QRVO expects annual GMs to be above 50% beyond FY27 benefiting from exiting lower margin business and cost savings initiatives

Apple (50% of revenue in F3Q) remains their biggest ACG opportunity, with content gains expected in fall launch supporting flat to modest FY26 growth, particularly in Pro/Pro Max models. AAPL March guided better than historical -30% seasonality and flat to modestly up in FY26 with confidence in content gains. Company maintains slight AAPL growth outlook but won't discuss modem mix assumptions - likely conservative given ET chip upside.

TMUS +6% following a clean beat across the board and better than feared FY25 guide

Positioning leaned short from HFs going in so this should be viewed pretty favorable, making it 3rd wireless name with good earnings, cementing wireless as a safe haven of sorts right now.

Beat Postpaid phone net adds of 903K vs cons 857k & Service Rev of $16.93B vs cons $16.76B.

Revs $21.87B vs cons $21.32B, Adj EBITDA $7.9B vs cons $7.83B, and FCF of $4.1B vs cons 3.95B.

Service Revenue also accelerated to 5.5% vs 5.1%

FY25 guidance better with postpaid net ad guide of 5.5M-6M

FY25 FCF better than feared at $17.3B -$18B vs bogeys for $17B

core EBITDA $33.1-33.6b or +5.7% high-end

3P Roundup:

DIS: M-sci raising Q1 net adds on stronger December data and calling out strong premium cruise pricing.

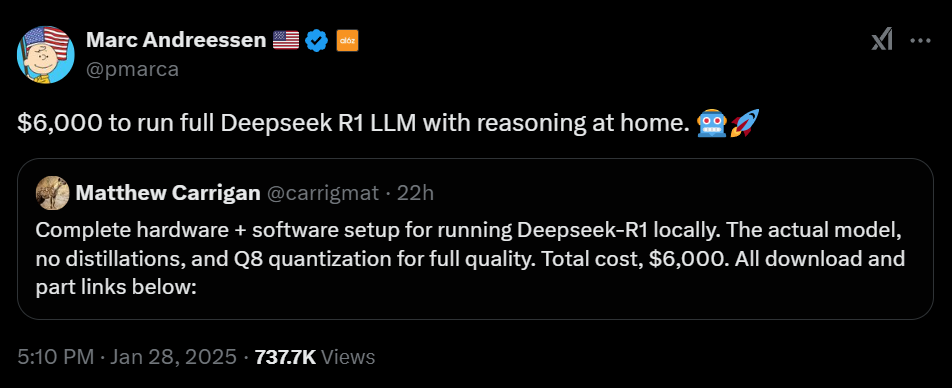

OPENAI ACCUSES CHINA’S DEEPSEEK OF USING ITS MODEL FOR TRAINING – FT

OpenAI has found evidence that Chinese AI startup DeepSeek used its proprietary models to train its own open-source model, according to the Financial Times. The company says it detected signs of "distillation"—a technique where developers use outputs from larger models to improve smaller ones, allowing them to achieve similar results at a lower cost. OpenAI declined to provide further details but emphasized that its terms prohibit copying its services or using outputs to develop competing models.

MSTR: Mizuho intiaties at Buy, $515 PT

According to Mizuho , MSTR’s core strategy revolves around leveraging debt and equity financing to accumulate bitcoin, with the specific goal of increasing bitcoin holdings on a per-share basis. The firm currently trades at approximately 75% premium to its underlying bitcoin holdings, which enables accretive capital raising through convertible bonds and equity issuance. While acknowledging bitcoin lacks intrinsic value, Mizuho sees price appreciation supported by three key factors: expanding global adoption, decreasing supply growth rate, and a supportive political landscape. They think BTC price growth at 25-30% CAGR through year-end 2027 (projecting MSTR ownership of 783K bitcoins), a 9x multiple on treasury operations (discounted 50-60% versus S&P 500 due to elevated risk profile), and a modest 1-2x multiple assigned to their legacy software business.

MNDY: JPM opens positive catalyst watch, PT $350

JPM sees positive setup for Monday.com's earnings based on multiple indicators. Channel feedback shows U.S. enterprise demand rebounded after September slowdown, while SMB environment remains stable with recent uptick. European trends improved late Q4 despite early weakness. JPM expects 2025 growth guidance around 24% constant currency (23%+ USD), above buy-side expectations of low 20s%. Bottom-up analysis suggests high 20s% ARR growth potential, with ~10-12% from non-CWM products. With stock off highs and trading at ~1.5x growth-adjusted FCF multiple (vs software peers at ~3x), JPM views current levels as attractive entry point.

COIN: Mizuho upgrades Coinbase to Neutral on correlation to bitcoin price

Mizuho upgraded COIN to Neutral from Underperform with a price target of $290, up from $250. The firm's analysis of bitcoin adoption growth points to further upside in bitcoin price over the medium-term. Bitcoin price and Coinbase shares are highly correlated, the analyst tells investors in a research note. In addition, stablecoins are increasingly seen as a "disruptive force" in payments and U.S. dollar coin's market capitalization is on an upward trajectory, contends Mizuho. The firm points out stablecoin revenue is 20% of Coinbase's mix. The company's Q4 and January volume trends are also pacing well ahead of expectations, according to the analyst. However, Coinbase shares are more expensive than Robinhood (HOOD), and its retail take rates "remain rich," which could lead to price compression over time, Mizuho says, explaining why it didn't upgrade the stock to Outperform. Further, the more friendly regulatory environment under President Trump and the presence of bitcoin exchange traded funds may increase Coinbase's competition, the firm notes.

TSLA: Tesla likely to disclose 2025 vehicle growth outlook, says Cantor Fitzgerald

Cantor Fitzgerald analyst Andres Sheppard expects Tesla to disclose its vehicle growth outlook for 2025, along with the company's target for its Energy Generation and Storage business segment, on today's earnings call, with the analyst noting that the call will mark Elon Musk's first earnings call since President Trump's Inauguration. Musk may also disclose additional information on Tesla's Robotaxi segment, and more specifically, its plans to launch via unsupervised full-self diving in Texas and California this year, as well as a more specific timeline for the introduction of Tesla's lower-priced vehicle, the analyst tells investors in a research note. Cantor has a Neutral rating and $365 price target on Tesla shares.

META: KEYB rases PT to $750 from $700

The market has digested DeepSeek's innovations, and KEYB believes its first take from its weekly still holds: the commoditization of foundation models is a positive for lowering unit costs and spurring product innovation. Overweight rated Meta stands as the clear beneficiary in KEYB's sector as cost efficiencies/ longer useful lives, an app development and user acquisition cycle, and more gradual CAPEX ramps create an upward bias to its/Street 2026E revenue, EPS, and FCF. Sector Weight-rated Duolingo strikes US as the best positioned SMID cap due to the Max AI story, product development expertise, and potential for modest unit costs, although KEYB wrestles with how much of this is priced into shares ($DUOL trades at 42.4x 2026E EV/EBITDA)

Other News:

AAPL: Apple and SpaceX Link Up to Support Starlink Satellite Network on iPhones – Bloomberg

Advantest: Nvidia Partner Advantest Shrugs Off DeepSeek and Lifts Outlook– Bloomberg

AVGO, SYNA: Synaptics signed a definitive licensing agreement w/ Broadcom to accelerate its Edge AI strategy; includes Wi-Fi 8, ultra-wideband (UWB), Wi-Fi 7, advanced Bluetooth, and next-gen GPS/GNSS products and tech for IoT & Android ecosystem

DeepSeek: U.S. Navy bans use of DeepSeek due to ‘security and ethical concerns’ – CNBC

GOOGL: out intraday yesterday….Waymo begins testing robotaxis on LA freeways – TechCrunch

HPE/JNPR: HPE, Juniper Met With Trump DOJ on Fate of $14 Billion Deal – Bloomberg