TMTB EOD Wrap

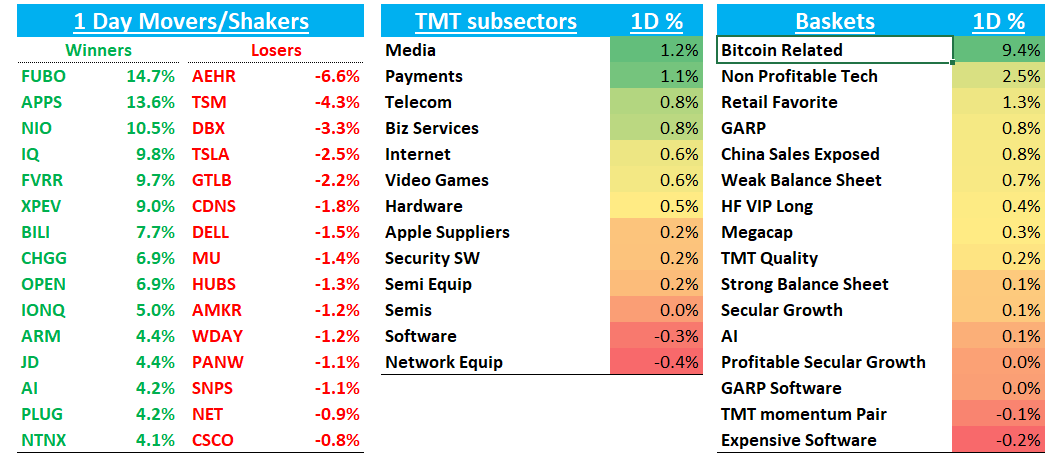

Good afternoon. QQQs finished flat after being up 65bps early morning in the calm before the storm of earnings which will hit us the next few days. One of those days where IWM +1.6% massively outperformed as non-profitable tech caught a bid and TMT momentum stalled. BTC +3% / ARKK +1.5% (despite TSLA - 2.5%). China +1.8%. Treasuries saw some pressure as yields rose 3-4bps across the curve following underwhelming auction results but Fed expects didn’t shift much w market still pricing in 42bps worth of cuts over the final two meetings. Crude down 6% today on the Israel/Iran news over the weekend while US nat gas prices fell 11%.

Let’s get to the TMT recap…

Semis

TSMC - 4.3% as Trump said on Rogan that Taiwan “stole” our chip biz, should pay for protection, and tariffs are a better policy than CHIPS Act Funding.

MU - 1.4% as Asia press reported Samsung passed internal qualification for HVM3E 12-Hi. (link)

NVDA - 70bps: all I saw was Rosenblatt said “we see NVDA Blackwell yields a bit weaker” after the metallization fix and the monolithic die approach in the current cycle

AVGO -60bps as Jefferies slashed nums for 1H’25 although stayed bullish on an accel following that. Biz Insider although had a neg article on customers reactions to price increases at VMW biz.

MRVL +2.2% as Jefferies raised nums sayng they see “a stronger ramp of the Trainium 2 chip to as high as 250k in April 25 with Inferentia 2.5 adding another 1M units in 2025.” This points MRVL’s AI ASIC revenue to be in the $2.5-3B range for CY25 with optical adding another $1.5-2B which all in is $4-5B range for AI vs the >$2.5B guide.

ARM +4.4% - didn’t see anythign here

IONQ +5% continues to rip - shows how scarcity value (Quantum) can play big role in market

ON +1.4% on a relatively in-lineish with buyside expectations print. Seq growth in auto was better than feared similar to TXN led by a stronger China EV market, growth in image sensors and SiC share gains vs IGBT. They did call out extended cyclicality in other businesses which isn’t a surprise given neg industrial datapoints….analog names in sympathy: NXPI +2.7% given highest auto exposure; ADI flat; TXN -50bps.

AI laggard AMD +2.4% caught a bid

WDC +40bps as following a Digitimes before the press piece saying Samsung/others consider NAND output cutback… Recent supply chain sources indicate that the two main NAND flash manufacturers intend to scale back production in the fourth quarter'

Internet

AMZN +30bps as M-sci said int’l and NA retail tracking slightly ahead of street for Q4

GOOGL +90bps as faster money investors generally positioned long for a beat. Several news items: 1) GOOGL quietly testing AI search tool to help advertisers reach new audiences (Adweek) 2) GOOGL aiming to release Gemini 2.0 model in December but it is reportedly not showing the performance gains the team had hoped for (Verge) 3) Google Preps AI That Takes Over Computers (theinformation) 4) Perplexity CEO Aravind Srinivas says the AI search engine now serves 100M queries each *week& up from 250M per month in July (TechCrunch)

SHOP +1% despite a mixed Clev report

NFLX -75bps; META +80bps

RBLX +40bps as Wedbush made it a best idea

PTON +2% as MS said beat is likely

SPOT +1.4% as Wells made it a top pick calling out better GMs and OPMs going forward

LYFT +3.5% as 3p data showing them taking some share from UBER

RDDT +2% on some profit taking in front of the Q as Bernstein called out better checks but kept sell on the name

China strong: BILI +8% as M-sci called out better growth in games; BABA +2.5%; BIDU +3.8%

CVNA +1% as M-sci raised Q4 numbers

W flat on a neg Piper note

Software

Slow news day here…

Large cap mixed: PANW - 1%; NOW - 60bps; ORCL - 60bps; MSFT - 40bps; SAP +1%

CRM +1% as Stifel followed MS in calling out tailwinds from Agents

CRWD +25bps despite new Delta suing them

Cloud names mixed: MDB +1.3%; SNOW +1%; DDOG -20bps

Elsewhere

NTNX +4% as MS upgraded saying potential to capture VMW sare is becoming more concrete, potentially boosting growth by 2-5ppts.

AAPL +86bps as Apple Intelligence released today

TSLA - 2.5% giving some gains back from last week

HOOD +3% after announcing presidential betting available on platform

Other fintech strong as well: COIN +5% on BTC strength; AFRM +3.5%; UPST +3%; SQ +2.5%; PYPL +2.3%