TMTB EOD Wrap

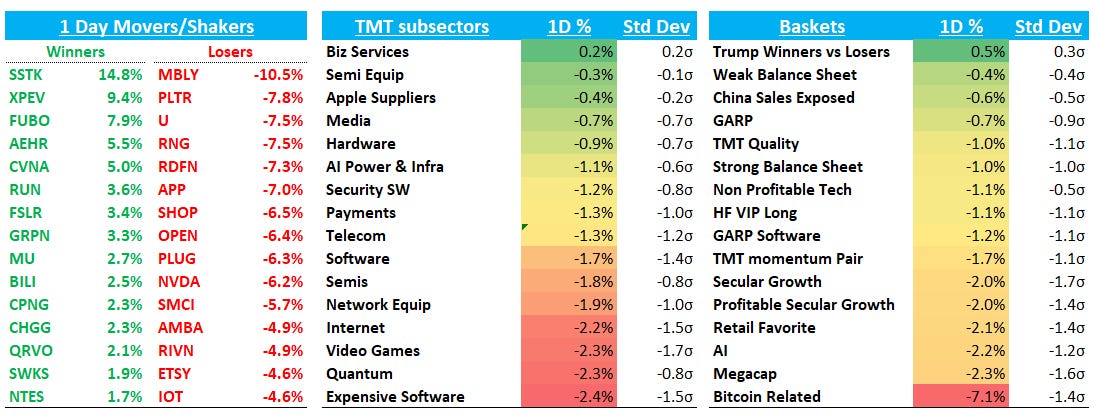

QQQs - 2% and now close to flat on the year. BTC - 5%; China - 1%. Oil +1% Market sold off as hotter econ data exacerbated worries of unsustainable fiscal policy and yields rose 3-6bps across the curve.

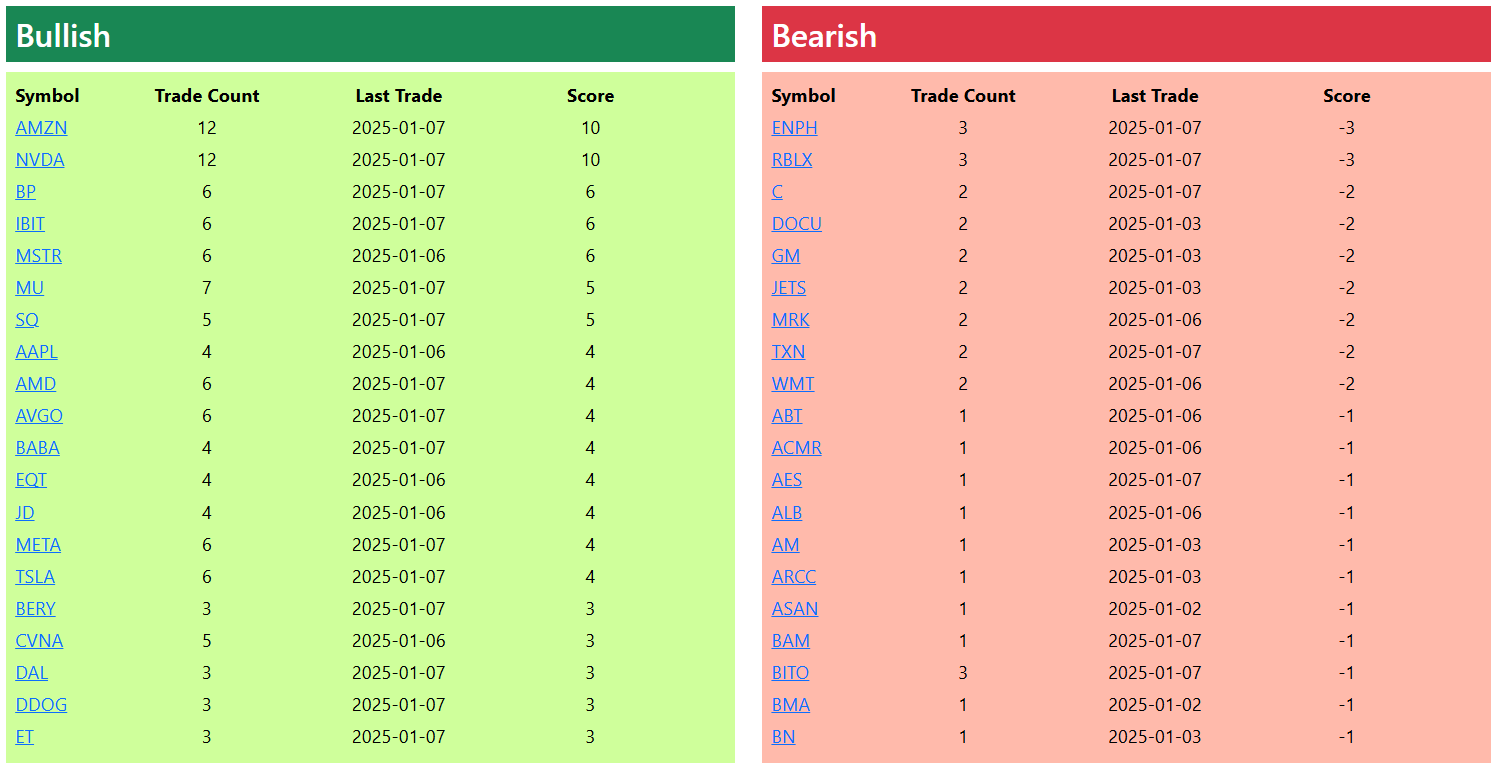

Readers who have been a here a while know that I like to look at individual price action in names as tea leaves for where the broader market is going. One question we like to ask is: Are stocks going up/down on good/bad news? Are moves outsized in one direction? We view morning news items as mini-earnings and reactions to those items are important as a barometer for where the market wants to head near-term. Other things we look at: are stocks holding onto earnings gaps or following through; are stocks hitting new highs then falling below those highs, etc. We also like to look at market leaders for potential shifts in momentum.

With that being said, there are an increasing amount of worrisome tea leaves for us that are influencing our near-term view on the market. A few I have seen in recent days:

The leaders of the mo rally post Trump election are now rolling over. Take a look at TSLA, APP, PLTR — 3 of the most impt mo leaders - which are now below ST moving averages. TSLA broke above all time highs and now is decidedly below that. Whereas we saw outsized moves in the positive direction in late 2024, now we are seeing things like APP -7% on BAML’s call out this morning. And PLTR now down 10%+ following MS neg note yesterday. These stocks were like teflon from Nov through late Dec and that shine has worn off, which is likely a sign animal spirits are cooling

SW price action is horrendous. CRM has failed to hold the earnings gap. TEAM and SNOW were down 3% on upgrades this morning. MDB and ADBE are following through to the downside afer misses. Leaders like NOW are failing at ST moving average resistance. No bueno

NFLX has failed to rally on several pieces of good news starting in late dec: positive 3p data; good xmas/squid game numbers and a great golden globe showing.

NVDA is one important one I’m watching and one could argue px action today was outsized to the downside on sell the news. In terms of short-term for the market, I really want to see it hold the 10d at $140, which was also the previous high in June. If it does, would get me more comfortable things will stabilize

AAPL is another stock that had been like Teflon but now is finally going down on neg checks/neg news.

BTC - a good measure of risk appetite - has now failed at $100k twice and is sitting right at 10d/20d. COIN and MSTR - both leaders in the crypto rally - are exhibiting worrisome px action. COIN is now below previous highs in march after breaking above in Nov. MSTR is dn 35% from highs.

AVGO price action to start the year…

AMZN lower highs; GOOGL/META double tops with RSI neg divergence…travel names rolling over to start year

On the flip side, several frothy areas like Quantum, space, robotics etc all still looking ok. And we all know what MU has done over the last couple of weeks. And CVNA has bounced back nicely after Hindenberg report. EBAY up on good 3p data today - so some things still acting fine.

Still — there is enough evidence on the back of rising yields/slightly more hawkish Fed where I rather be closer to a neutral stance rather than aggressively pressing the accelerator at the moment. As always, things could change quickly, but have to go with what the px action in front of our face is telling us.

Let’s get to the recap…

Internet

EBAY +20bps as Yipit upticked on their data saying q4 ended inline to slightly above street

CHWY -4% as Yipit data weakened and BC selling a 7M block

W - 6% as M-sci said y/y share trends have declined in Q4 and customer growth has worsened q/q

CVNA +5% as RBC upgraded to buy and JPM said lending fears are overblown

UBER -50bps outperformed on announcement with NVDA although seemed like nothing-burger to me. Waymo CEO presenting at CES on Wednesday evening - will be interest how stock reacts now that it’s up 10% from bottom.

ROKU -3% after being up 5-6% as perma-bull Needham made it their top pick for 2025

ETSY -5% as 3p data continues to show a big miss for Q4

Semis

NVDA -6% despite Colette sounding good at CES

Other AI names weak: AMD - 1.4%; VRT - 3%; ANET - 3%; AVGo -3%; MRVL -2.6%

MU +3% now up close to $20 post earnings disaster as sentiment has down almost a complete 180. Some saying stock up on NVDA RTX announcement but that’s seem like a big deal me - just think continued follow through from last few days

MBLY -11% giving back some strength from early in the year.

Software

APP -7% as BAML said in-app purchases tracking -4% vs street at +2%. U-8% in sympathy

PLTR -7.5% follow through from MS note yesterday and likely in sympathy with other mo stock APP being down

TEAM -2.8% despite Truist upgrade

SNOW -3.5% despite Wells Fargo upgrade

DDOG -3% on Truist downgrade

NET flat as Wells named top pick for 2025 on stronger spend environment and several market transitions within security

Elsewhere

TSLA -4% on BAML’s downgrade saying most optionality is priced in

DELL -2.6% despite UBS naming a top pick

Fintech weak on BTC weakness: COIN -9%; HOOD -6% (despite JPM ug); SQ - 6%. Other fintech weak as well: PYPL -2%; AFRM -6.5%; UPST - 6%

DIS +30bps on Redburn’s upgrade