TMTB Morning Wrap

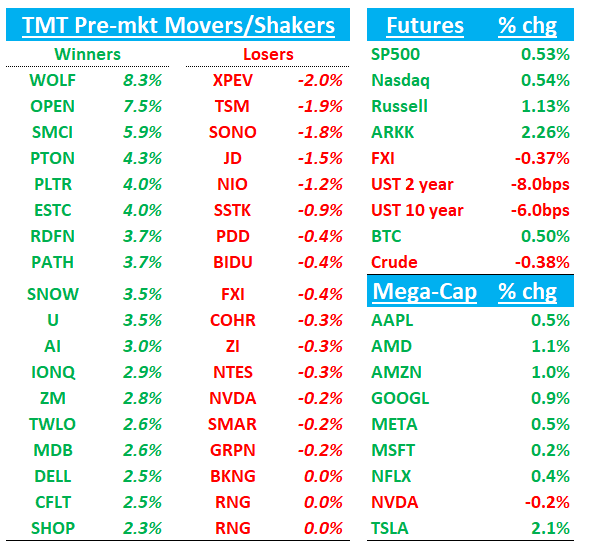

Good morning QQQs +50bps as market liked the Bessent pick for Treasury, who is seen as more market friendly and less punitive on tariffs (see Bloomberg article here…does that help semis today?). Odds of a fed cut continue to hover in the 50-55% range. DXY is sliding 50bps. BTC +40bps hovering around $97k. China -40bps. Treasuries bid with yields down 6-8bps across the curve. We’ll see if trend of mega-caps underperforming continues today. Lots to get to so let’s get straight to it:

AMZN/NVDA: Amazon’s Moonshot Plan to Rival NVDA in AI Chips

Not sure if this is why NVDA underperforming this morning (not a ton new in the article) but don’t see much else out there on it after stock was down 3% on Friday. The article talks about AMZN’s effort to build out a rival chip despite NVDA still maintaining a strong moat bc of their sw.

Demand for Amazon’s AI chips was slow at first, meaning customers could get access to them immediately rather than waiting weeks for big batches of Nvidia hardware. Japanese firms looking to quickly join the generative AI revolution took advantage of the situation. Electronics maker Ricoh Co., for example, got help converting large language models trained on English-language data to Japanese.

Demand has since picked up, according to Gadi Hutt, an early Annapurna employee who works with companies using Amazon chips. “I don’t have any excess capacity of Trainium sitting around waiting for customers,” he says. “It’s all being used.”

Software/ESTC/SNOW: Wedbush gets bullish software sector ad upgrades ESTC and SNOW to buy. Also raises PT on PLTR and CRM

Wedbush says it’s software time to shine in the sun of the AI trade as its poised for AI-driven growth as enterprise use cases expand. 2025 marks expected shift to broader enterprise AI consumption, with widespread LLM model launches. Generative AI adoption likely to catalyze significant software industry transformation, representing key opportunity in fourth Industrial Revolution.

SNOW receives an upgrade from Wedbush to Buy with a $190 target as it exits its optimization phase, showing improved product revenue momentum and strong positioning for AI use cases over the next 12-18 months.

Wedbush upgrades ESTC moves to Outperform ($135 target) as it capitalizes on enterprise AI demand through platform consolidation and accelerated migration programs from legacy vendors.

Wedbush raises PLTR’s PT increases to $75, reflecting heightened confidence in the AIP strategy and expected AI adoption acceleration across enterprises. The firm sees Palantir's comprehensive product suite driving unprecedented demand as AI use cases expand.

Wedbush raises CRM’s target rises to $375 as customer feedback indicates growing traction across their portfolio, with AI solutions driving transformational demand. Recent checks suggest customers are finding expanded use cases for CRM's entire platform while the company advances into its next growth phase leveraging AI capabilities.

Wedbush notes all these upgrades underscore the broader theme of enterprise AI adoption moving from experimental to implementation phase, with these platforms well-positioned to capture growing demand.

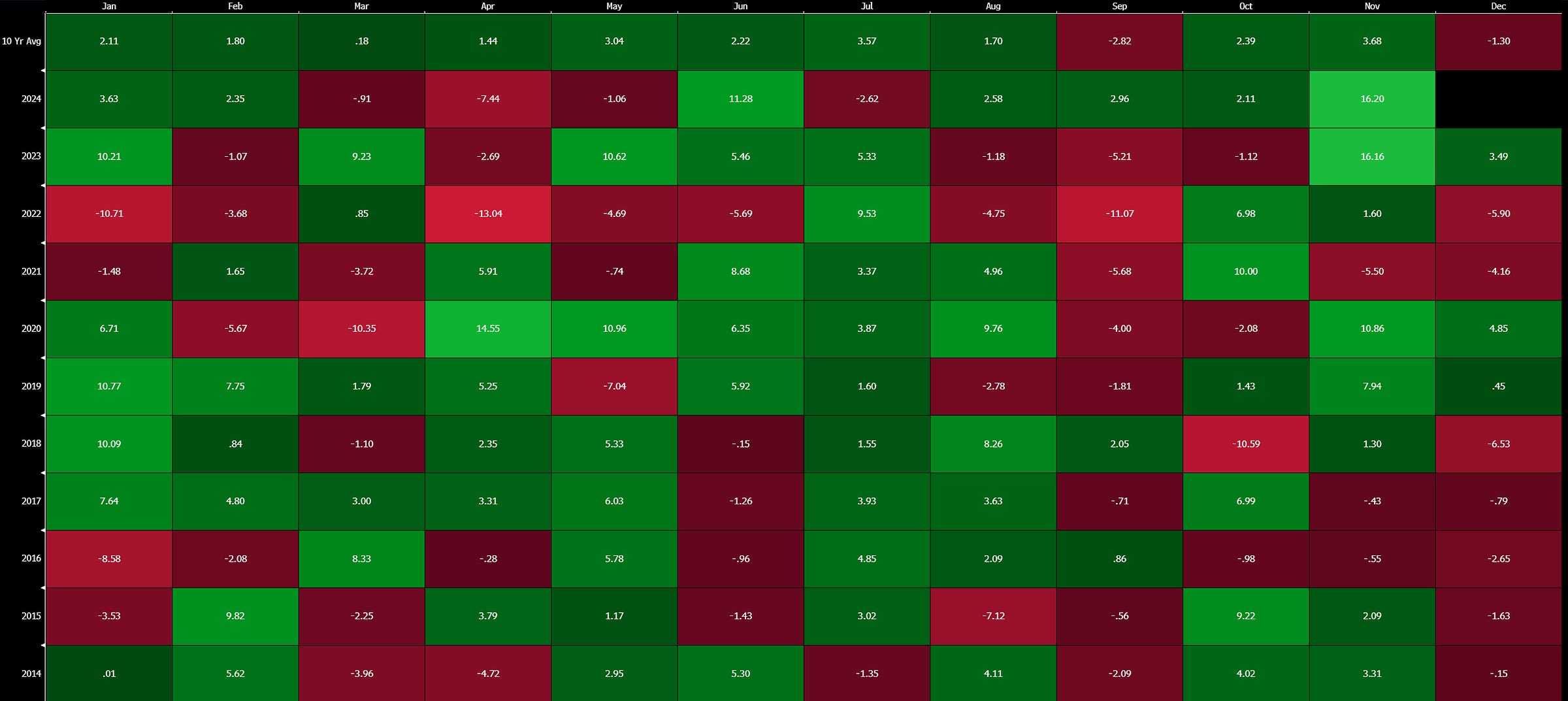

TMTB: We’ve been writing about our bullishness on sw as we head into ‘25, but would note near-term sentiment getting a bit frothy and Dec is historically 2nd weakest month for sw performance (Nov the best). Just something we are watching here…

AAPL: MS’ global smartphone survey highlights iPhone upgrades

Interesting results from MS survey today talking up potential for upgrade cycle — remains to be seen if some hold off until ‘26 given delay in Siri improvements until then….

MS’ latest survey confirms improving iPhone upgrade rates, with Apple Intelligence emerging as a key catalyst. Broader availability is seen as critical to unlocking global pent-up demand, saying results support a multi-year thesis for strong iPhone upgrade momentum. MS notes near-term upgrade intentions have exceeded expectations year-over-year, though MSCO maintains its FY25 iPhone shipment forecast of 230M units for now. MS notes. China has shifted from a headwind to a growth driver for FY25, with iPhone upgrade rates up +5pts Y/Y and a net switching rate increase of +24pts Y/Y to 6%, while Huawei's switching rate fell -34pts Y/Y to 15%. Interestingly, MS notes Apple Intelligence is already among the top five drivers for iPhone upgrades as half of iPhone owners delaying upgrades cited the delayed rollout of Apple Intelligence as a factor, indicating pent-up demand for 2H25 and 2026. MS also notes prospective iPhone owners are willing to pay ~$9/month for unlimited access to Apple Intelligence, suggesting $7-14B upside in Services revenue by FY27.

SQ: Block downgraded to Market Perform from Outperform at BMO Capital

BMO downgrades Block to Market Perform from Outperform (PT $100 from $94), citing limited gross profit upside after 22% post-Q3 rally. Analyst sees risk to Cash App growth and questions sustainability of "Rule-of-40" 2026 target given headcount constraints, suggesting 2025-26 beat/raise cycle may be challenging to maintain and reminding investors 30% of SQ’s net income goes towards immunizing SBC.

PYPL/SQ: CFPB expands oversight to PayPal and Block, says New Street

New Street analyzes CFPB's new oversight rule for non-bank financial services firms, affecting PYPL, SQ, AAPL GOOGL, AMZN, and Zelle. Traditional banks supported the regulation amid tech competition in financial services. New Street notes the rule requires oversight on privacy, fraud complaints, and banking access issues. While "somewhat significant" but not "game-changing" for companies like PayPal, analyst notes significant uncertainty around rule's future under potential Trump administration. Banks' support notwithstanding, New Street says there is a high likelihood of rule modification or elimination under Trump’s new administration.

HOOD: Upgraded at MS to buy with PT up to $55 from $24

Pretty big PT raise on this ug….we agree with all pts here. If you want exposure to crypto and a retail-driven bull market, HOOD is best way to get exposure to both…

MS upgrades Robinhood to Buy citing multiple growth drivers: sustained post-election retail trading, crypto momentum, M&A opportunities, and retail investor sentiment. MS notes recent RIA custody platform acquisition demonstrates execution on wallet share expansion. Despite 100%+ YTD gains, MS notes valuation remains attractive given new initiatives and expected continuation of retail trading strength into 2025.

RBLX: Cowen says Q4 trends deteriorating

Cowen confirms what we’ve been hearing from 3p data so far in Q4…slowing DAU/engagement growth. While we remain positive on RBLX heading into 2025, near-term comps do get harder over the next couple months and the 3p November Bookings comp is the toughest.

Cowen’s analysis reveals concerning Roblox monetization trends, with October showing significant slowdown versus Q3 and further deterioration in November. Cowen notes current top-grossing rankings match or fall below early 2024 lows that preceded Q1 guidance reduction with U.S. iPhone performance hitting year-low seven-day average of 14.86, while Android ranking dropped to #15, worst since pre-pandemic excluding 2021 service outage.

While direct causation remains unclear, Cowen notes Bloomberg's July report and October industry coverage regarding child safety protocols may be influencing parental spending decisions. Cowen thinks the severity of impact from these safety concerns highlights Roblox's continued reliance on young users' spending, rather than successful aging-up of the platform.

META added to favorites list at Raymond James

ARM: Arm initiated with a Buy at UBS

UBS starts Arm with a Buy and $160 target, citing AI driving growth across markets. UBS says the data center opportunity is expanding through broader IP licensing and cloud customer demand for power-optimized CPUs. Even in saturated smartphone market, UBS expects ARM to outgrow the market via higher royalty rates and increasing processor value as a % of phone costs.

MU: Mizuho bullish raises FY26 estimates

Mizuho takes a more bullish view focused around MU’s share gains and rising yields in HGM DRAM for AI, benefitting from Samsungs continued struggles and NVDA’s aggressive ramp of their new BW rack system. Mizuho’s view is that MU is sold out for HBM through CY25, with pricing locked in and potentially up 10% y/y. Mizuho notes MU targets mkt share in HBM in 20-25% range by end CY25, taking to over 10% of their total DRAM bit capacity and estimates MU yields in HB, stable at 65%, noting the next catalyst could be shift to 12 layer HBM with 50% more capacity and HBM4 launching late ‘25 with 30% more capacity.

Also relevant: Nvidia Working as Fast as It Can to Certify Samsung’s AI Memory – Bloomberg

TTD: New Street upgrades to Hold from Sell

New Street upgrades Trade Desk (PT $115 from $85) citing two main factors: lower-than-expected 2024 political ad spending means easier 2025 growth comparisons, and improved competitive positioning as Google Ad Tech DOJ case concludes. Analyst also highlights opportunity in newly announced Ventura TV operating system.

BIDU: Baidu downgraded at Susquehanna amid macro and search headwinds

Susquehanna cuts Baidu to Neutral (from Positive), lowers target to $85 (from $105) due to Q3 weakness from macro challenges and AI search monetization headwinds. Despite attractive valuation, stock likely range-bound until these pressures ease.

NIO: Nio downgraded to Sell from Neutral at Goldman Sachs

Goldman downgrades Nio to Sell (PT $3.90 from $4.80), citing limited new model pipeline, slow Onvo ramp, and intensifying competition entering 2025. GS expects Onvo brand expansion costs to extend operating losses, delaying profitability for the next 3 years. GS sees 24% downside to consensus 2025 non-GAAP estimates.

META: Meta Threads loses ground to Bluesky, FT reports - link

Meta Threads is losing ground to Bluesky in capitalizing the mass departure of users from Elon Musk's X following Donald Trump's election, Hannah Murphy and John Burn-Murdoch of The Financial Times reports. Since election day, app usage of Bluesky in the U.S. and U.K. increased by almost 300% to 3.5M daily users, the Times said, citing research group Similarweb. After election day, Threads is only 1.5 times larger than its rival.

PLTR: Palantir price target raised to $75 from $55 at BofA

BAML notes PLTR has demonstrated their ability to digitize enterprises and battlespaces from finances to missile production and the firm sees Palantir as "the enabler and winner in this new era" where efficiency, innovation, safety, and speed are the most valuable assets. BAML notes Software represents 17% of U.S. nonresidential private fixed investments, which thinks PLTR is "poised to dominate" as companies turn to software and AI to grow margins, rather than through scale with fixed assets.

MDB: BAML raises PT to $400 from $350 on better 3p data

BAML looks at Similarweb Web Market Analysis data on engaged visits as a directional indicator for Q3 Atlas revenue to be reported on December 9, and the firm says the data point to improving trends in Q3 and is raising its target on what it calls the "top data platform" ahead of earnings.

Several CRM notes this morning previewing the q…

CRM: Truist raises PT to $380 from $315 at Truist

Truist analyst Terry Tillman raised the firm's price target on Salesforce to $380 from $315 and keeps a Buy rating on the shares. After attending last week's Salesforce's Agentforce World Tour event, Truist is incrementally confident in consistent compounding earnings and cash flow, as an increased innovation cycle and new product catalysts could help positively inflect revenue growth going forward, the analyst tells investors in a research note.

CRM: MS previews the print, tactically cautious

MS notes that while there is excitement around Agentrouce opportunity, the timing of eterprise adoption cycles and inline partner checks suggest modest upside in Q3., but they remain bullish on opportunity into CY25. MS did note partner conversations suggest Agentforce is gaining traction with customer POCs building exiting CY24. and an opportunity for rev contribution in 2H

CRM: Jefferies says gradual improvement per their 30+ partner checks

Thill at Jefferies says demand environment has improved and 71% saw more AI interest post Dreamforce showcasing optimism in the ecosytem. Jefferies expects CRM to meet/exceed CRPO growth of 9% despite facing toughest comp of the year.

RDDT: Reddit price target raised to $160 from $118 at JMP Securities

JMP Securities raised the firm's price target on Reddit to $160 from $118 and keeps an Outperform rating on the shares. The firm came away from its 2024 San Francisco Internet Bus Tour believing the macro is stable, and tells investors in a research note that Reddit has multiple product catalysts near-term, including greater personalization of the service, international ramping with both better local content and machine translation, search improvements, and better advertising and measurement tools.

SAP: Bernstein says Supply chain mgmt could help SAP sustain dd rev growth rate over ‘25-’30

Bernstein highlights that the overall SCM software market is projected to grow at an average annual rate of ~16% between 2024 and 2028, with the SaaS SCM segment expected to expand even faster at 24% annually. Bernstein notes SCM holds strategic importance for SAP, comparable to ERP, as ~77% of the company's revenue comes from manufacturing and consumer industries where supply chains are critical. Bernstein notes that in the rapidly growing SaaS SCM market, SAP has gained 250 basis points of market share over the past five years, reaching ~25% and bernstein remains optimistic about SAP's outlook, citing its strong execution capabilities and robust business foundation as key drivers for growth heading into 2025 and beyond.

APP: AppLovin price target raised to $480 from $260 at Oppenheimer

Opp raises PT after discussions with two experts involved in AppLovin's e-commerce pilot, who reported favorable early impressions and metrics from both agency and direct-to-consumer brand perspectives, noting return on ad spend (ROAS) comparable to META. Oppenheimer anticipates that recent stock performance and accelerating momentum in e-commerce will create multiple positive feedback loops, benefiting APP stock and business momentum into 2025. The firm considers AppLovin a top pick within its coverage.

INTC: US plans to reduce Intel's $8.5 billion federal CHIPS grant below $8 billion

The US government plans to reduce Intel Corp's preliminary $8.5 billion federal chips grant to less than $8 billion, the New York Times reported on Sunday citing unnamed sources. The change took into account a $3 billion contract Intel had been offered to make chips for the Pentagon, the people told the Times.

Other News

AAPL: Indian regulator rejects Apple request to put antitrust report on hold – Reuters

AAPL, GOOGL: Apple, Google Risk UK Probe Over Mobile Browser Dominance – WSJ

China, Semis: Chamber of Commerce sees new US export crackdown on China, email says – Reuters

EVs: EU, China close to agreement over EV import tariffs, leading MEP says – Reuters

Gen AI: CoreWeave targets valuation of over $35 billion in 2025 U.S. IPO, sources say – CNBC

INTC, LSCC: Lattice Is Said to Consider Making Offer for Intel’s Altera Unit - Bloomberg – Bloomberg