KanawatTH/iStock via Getty Images

It was an interesting year for interest rates in the United States, one in which we got more evidence of the limited power that central banks have to alter the trajectory of market interest rates. We started 2024 with the consensus wisdom that rates would drop during the year, driven by expectations of rate cuts from the Fed. The Fed did keep its end of the bargain, cutting the Fed Funds rate three times during the course of 2024, but the bond markets did not stick with the script, and market interest rates rose during the course of the year. In this post, I will begin by looking at movements in treasury rates, across maturities, during 2024, and the resultant shifts in yield curves. I will follow up by examining changes in corporate bond rates, across the default ratings spectrum, trying to get a measure of how the price of risk in bond markets changed during 2024.

對於美國的利率來說,這是一個有趣的年份,我們得到了更多證據表明央行在改變市場利率軌跡方面的能力有限。我們在 2024 年初開始時,共識是利率將在年內下降,這是由於對美聯儲降息的預期驅動的。美聯儲確實履行了其承諾,但債券市場並未按照劇本走。在這篇文章中,我將首先看看 2024 年期間不同期限的國債利率的變動,以及由此產生的收益率曲線的變化。我將通過檢查不同違約評級範圍內的公司債券利率變化,來衡量 2024 年債券市場中風險價格的變化。

Treasury Rates in 2024

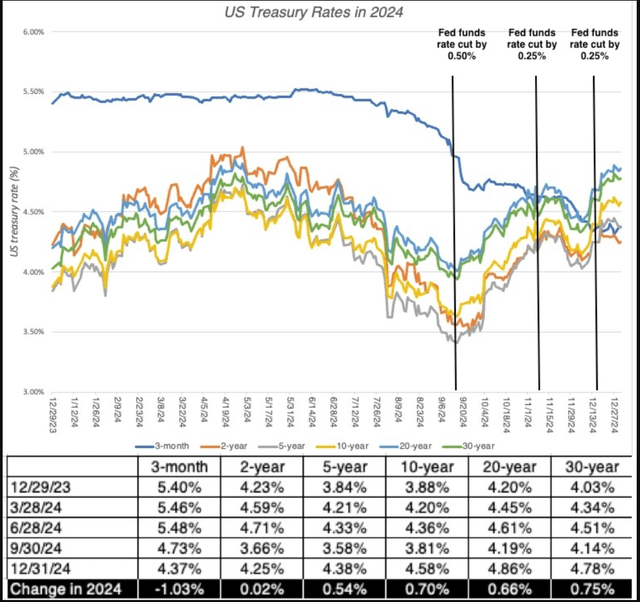

Coming into 2024, interest rates had taken a rollicking ride, surging in 2022, as inflation made its come back, before settling in 2023. At the start of 2024, the ten-year treasury rate stood at 3.88%, unchanged from its level a year prior, but the 3-month treasury bill rate had climbed to 5.40%. In the chart below, we look at the movement of treasury rates (across maturities) during the course of 2024:

進入 2024 年,利率經歷了一段動盪的旅程,在 2022 年因通脹回升而飆升,然後在 2023 年趨於穩定。2024 年初,十年期國債利率為 3.88%,與一年前的水平相同,但三個月期國庫券利率已攀升至 5.40%。在下圖中,我們看看 2024 年期間不同期限的國債利率的變動:

During the course of 2024, long-term treasury rates climbed in the first half of the year, and dropped in the third quarter, before reversing course and increasing in the fourth quarter, with the 10-year rate ending the year at 4.58%, 0.70% higher than at the start of the year. The 3-month treasury barely budged in the first half of 2024, declined in the third quarter, and diverged from long-term rates and continued its decline in the last quarter, to end the year at 4.37%, down 1.03% from the start of the year. I have highlighted the three Fed rate actions, all cuts to the Fed Funds rate, on the chart, and while I will come back to this later in this post, market rates rose after all three.

在 2024 年期間,長期國債利率在上半年攀升,第三季度下降,然後在第四季度逆轉並上升,十年期利率在年底達到 4.58%,比年初高出 0.70%。三個月期國庫券在 2024 年上半年幾乎沒有變動,第三季度下降,並在最後一個季度與長期利率分道揚鑣,繼續下降,年底達到 4.37%,比年初下降了 1.03%。我在圖表中標出了美聯儲的三次利率行動,都是對聯邦基金利率的降息,雖然我稍後會回到這一點,但市場利率在這三次行動後都上升了。

The divergence between short-term and long-term rates played out in the yield curve, which started 2024, with a downward slope, but flattened out over the course of the year:

短期和長期利率的分歧在收益率曲線上表現出來,收益率曲線在 2024 年初呈下降趨勢,但在年內趨於平緩:

Writing last year about the yield curve, which was then downward sloping, I argued that notwithstanding prognostications of doom, it was a poor prediction of recessions. This year, my caution would be to not read too much, at least in terms of forecasted economic growth, into the flattening or even mildly upward sloping yield curve.

去年我寫到當時呈下降趨勢的收益率曲線時,我認為儘管有末日預言,但它對經濟衰退的預測能力很差。今年,我的建議是不要過多解讀收益率曲線的平緩甚至輕微上升,至少在預測經濟增長方面。

The increase in long-term treasury rates during the course of the year was bad news for treasury bond investors, and the increase in the 10-year treasury bond rate during the course of the year translated into an annual return of -1.64% for 2024:

年內長期國債利率的上升對國債投資者來說是個壞消息,十年期國債利率在年內的上升導致 2024 年的年回報率為-1.64%:

With the inflation of 2.75% in 2024 factored in, the real return on the 10-year bond is -4.27%. With the 20-year and 30-year bonds, the losses become larger, as time value works its magic. It is one reason that I argue that any discussion of risk-free rates that does not mention a time horizon is devoid of a key element. Even assuming away default risk, a ten-year treasury is not risk-free, with a one-time horizon, and a 3-month treasury is definitely not risk-free, if you have a 10-year time horizon.

考慮到 2024 年 2.75%的通脹率,十年期債券的實際回報率為-4.27%。對於 20 年期和 30 年期債券,隨著時間價值的發揮,損失變得更大。這是我認為任何不提及時間範圍的無風險利率討論都缺乏關鍵要素的原因之一。即使假設沒有違約風險,十年期國債在一次性時間範圍內並不是無風險的,而三個月期國庫券在十年期時間範圍內絕對不是無風險的。

The Drivers of Interest Rates

Over the last two decades, for better or worse, we (as investors, consumers and even economics) seem to have come to accept as a truism the notion that central banks set interest rates. Thus, the answer to questions about past interest rate movements (the low rates between 2008 and 2021, the spike in rates in 2022) as well as to where interest rates will go in the future has been to look to central banking smoke signals and guidance. In this section, I will argue that the interest rates ultimately are driven by macro fundamentals, and that the power of central banks comes from preferential access to data about these fundamentals, their capacity to alter those fundamentals (in good and bad ways) and the credibility that they have to stay the course.

在過去二十年裡,無論好壞,我們(作為投資者、消費者甚至經濟學家)似乎已經接受了一個不言而喻的觀念,即央行設定利率。因此,關於過去利率變動(2008 年至 2021 年的低利率,2022 年的利率飆升)以及未來利率走向的問題的答案,一直是看央行的煙霧信號和指引。在本節中,我將論述利率最終是由宏觀基本面驅動的,而央行的力量來自於對這些基本面的數據的優先訪問權、改變這些基本面的能力(無論好壞)以及他們堅持到底的信譽。

Inflation, Real Growth and Intrinsic Risk-Free Rates

通脹、實際增長和內在無風險利率

It is worth noting at the outset that interest rates on borrowing pre-date central banks (the Fed came into being in 1913, whereas bond markets trace their history back to the 1600s), and that lenders and borrowers set rates based upon fundamentals that relate specifically to what the former need to earn to cover expected inflation and default risk, while earning a rate of return for deferring current consumption (a real interest rate). If you set the abstractions aside, and remove default risk from consideration (because the borrower is default-free), a risk-free interest rate in nominal terms can be viewed, in its simplified form, as the sum of the expected inflation rate and an expected real interest rate:

值得注意的是,借貸利率早於央行出現(美聯儲成立於 1913 年,而債券市場的歷史可以追溯到 1600 年代),貸款人和借款人根據與前者需要賺取以覆蓋成本相關的基本面來設定利率,同時賺取利潤。如果你把抽象概念放在一邊,並排除違約風險(因為借款人無違約風險),名義上的無風險利率可以簡化為預期通脹率和預期實際利率的總和:

Nominal interest rate = Expected inflation + Expected real interest rate

名義利率 = 預期通脹率 + 預期實際利率

This equation, titled the Fisher Equation, is often part of an introductory economics class, and is often quickly forgotten as you get introduced to more complex (and seemingly powerful) monetary economics lessons. That is a pity, since so much of misunderstanding of interest rates stems from forgetting this equation. I use this equation to derive what I call an "intrinsic risk-free rate", with two simplifying assumptions:

這個方程式,通常被稱為,通常是經濟學入門課程的一部分,並且在介紹更複雜(看似更強大)的貨幣經濟學課程時往往很快被遺忘。這是一個遺憾,因為對利率的誤解很大程度上源於忘記了這個方程式。我用這個方程式推導出我所謂的“內在無風險利率”,並做了兩個簡化的假設:

- Expected inflation: I use the current year's inflation rate as a proxy for expected inflation. Clearly, this is simplistic, since you can have unusual events during a year that cause inflation in that year to spike. (In an alternate calculation, I use an average inflation rate over the last ten years as the expected inflation rate.)

預期通脹率:我使用當年的通脹率作為預期通脹率的代理。顯然,這過於簡單,因為一年中可能會發生異常事件,導致該年的通脹率飆升。(在另一種計算中,我使用過去十年的平均通脹率作為預期通脹率。) - Expected real interest rate: In the last two decades, we have been able to observe a real interest rate, at least in the US, using inflation-protected treasury bonds (OTCPK:TIPS). Since I am trying to estimate an intrinsic real interest rate, I use the growth rate in real GDP as my proxy for the real interest rate. That is clearly a stretch when it comes to year-to-year movements, but in the long term, the two should converge.

預期實際利率:在過去二十年裡,我們至少可以在美國觀察到實際利率,使用通脹保護國債(OTCPK:TIPS)。由於我試圖估計內在實際利率,我使用實際 GDP 增長率作為實際利率的代理。這在年度變動方面顯然是一個延伸,但從長期來看,兩者應該趨於一致。

With those simplistic proxies in place, my intrinsic risk-free rate can be computed as follows:

有了這些簡化的代理,我的內在無風險利率可以計算如下:

Intrinsic risk-free rate = Inflation rate in period t + Real GDP growth rate in period t

內在無風險利率 = 時期 t 的通脹率 + 時期 t 的實際 GDP 增長率

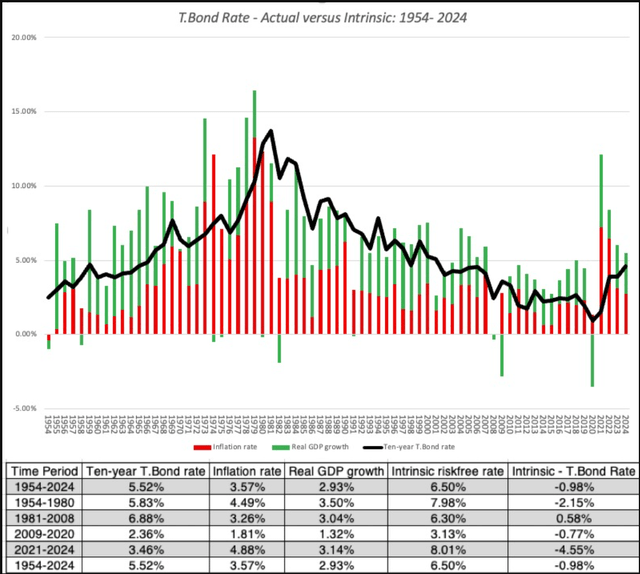

In the chart below, I compare my estimates of the intrinsic risk-free rate to the observed ten-year treasury bond rate each year:

在下圖中,我將我估計的內在無風險利率與每年觀察到的十年期國債利率進行比較:

While the match is not perfect, the link between the two is undeniable, and the intrinsic risk-free rate calculations yield results that help counter the stories about how it is the Fed that kept rates low between 2008 and 2021, and caused them to spike in 2022.

雖然匹配並不完美,但兩者之間的聯繫是不可否認的,內在無風險利率的計算結果有助於反駁關於美聯儲在 2008 年至 2021 年間保持低利率並在 2022 年導致利率飆升的說法。

- While it is true that the Fed became more active (in terms of bond buying, in their quantitative easing phase) in the bond market in the last decade, the low treasury rates between 2009 and 2020 were driven primarily by low inflation and anemic real growth. Put simply, with or without the Fed, rates would have been low during the period.

雖然美聯儲在過去十年中在債券市場上變得更加活躍(在量化寬鬆階段進行債券購買),但簡單來說,無論有沒有美聯儲,利率在這一時期都會很低。 - In 2022, the rise in rates was almost entirely driven by rising inflation expectations, with the Fed racing to keep up with that market sentiment. In fact, since 2022, it is the market that seems to be leading the Fed, not the other way around.

在 2022 年,隨著美聯儲努力跟上市場情緒,事實上,自 2022 年以來,似乎是市場在引導美聯儲,而不是相反。

Entering 2025, the gap between intrinsic and treasury rates has narrowed, as the market consensus settles in on expectations that inflation will stay about the Fed-targeted 2% and that economic activity will be boosted by tax cuts and a business-friendly administration.

進入 2025 年,內在利率和國債利率之間的差距已經縮小,市場共識認為通脹將保持在美聯儲目標的 2%左右,並且經濟活動將受到減稅和親商政府的推動。

The Fed Effect 聯邦儲備效應

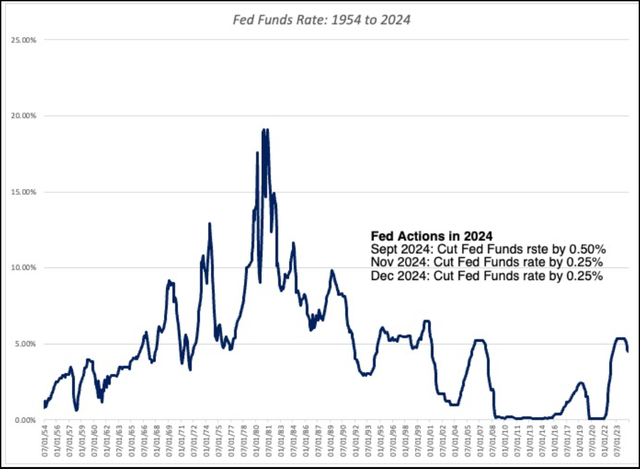

I am not suggesting that central banks don't matter or that they do not affect interest rates because that would be an overreach, but the questions that I would like to address are about how much of an impact central banks have, and through what channels. To the first question of how much of an impact, I started by looking at the one rate that the Fed does control, the Fed Funds rate, an overnight interbank borrowing rate that nevertheless has resonance for the rest of the market. To get a measure of how the Fed Funds rate has evolved over time, take a look at what the rate has done between 1954 and 2024:

我並不是在暗示中央銀行不重要或它們不會影響利率,因為那樣說會過於誇大,但我想探討的問題是中央銀行的影響有多大,以及通過哪些渠道產生影響。對於第一個問題,即影響有多大,我首先查看了聯準會確實控制的一個利率——聯邦基金利率,這是一個隔夜銀行間借貸利率,但對市場其他部分仍有影響。要了解聯邦基金利率隨時間的變化,請看 1954 年至 2024 年間該利率的走勢:

As you can see, the Fed Funds were effectively zero for a long stretch in the last decade, but has clearly spiked in the last two years. If the Fed sets rates story is right, changes in these rates should cause market set rates to change in the aftermath, and in the graph below, I look at monthly movements in the Fed Funds rate and two treasury rates - the 3-month T.Bill rate and the 10-year T.Bond rate

如你所見,聯邦基金利率在過去十年的大部分時間裡實際上為零,但在過去兩年中明顯飆升。如果聯準會設定利率的說法是正確的,這些利率的變化應該會導致市場利率在之後發生變化。在下圖中,我查看了聯邦基金利率和兩種國債利率——3 個月期國庫券利率和 10 年期國債利率的月度變動。.

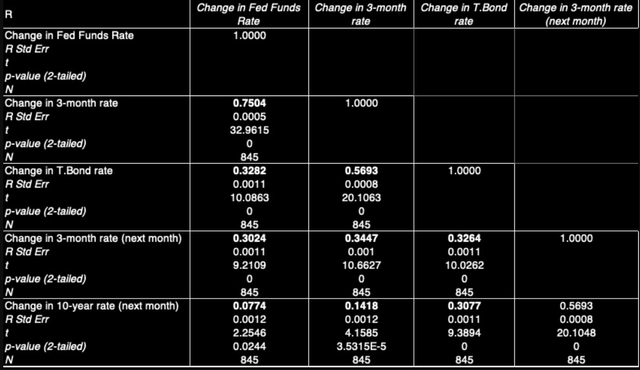

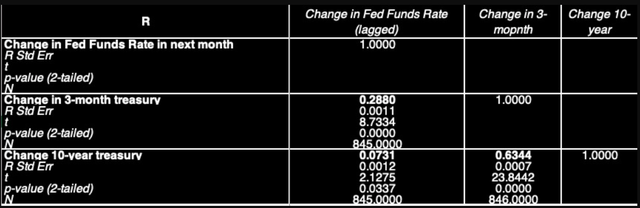

The good news for the "Fed did it" story is that the Fed rates and treasury rates clearly move in unison, but all this chart shows is that Fed Funds rate move with treasury rates contemporaneously, with no clear indication of whether market rates lead to Fed Funds rates changing, or vice versa. To look at whether the Fed funds leads the rest of the market, I look at the correlation between changes in the Fed Funds rate and changes in treasury rates in subsequent months.

對於「聯準會做到了」這一說法來說,好消息是聯準會利率和國債利率,但這張圖表只顯示了聯邦基金利率與國債利率同時變動,並沒有明確的跡象表明是市場利率導致聯邦基金利率變化,還是相反。為了查看聯邦基金利率是否引領市場其他部分,我查看了聯邦基金利率變化與後續幾個月國債利率變化之間的相關性。

As you can see from this table, the effects of changes in the Fed Funds rate on short-term treasuries is positive, and statistically significant, but the relationship between the Fed Funds rate and 10-year treasuries is only 0.08, and barely meets the statistical significance test. In summary, if there is a case to be made that Fed actions move rates, it is far stronger at the short end of the treasury spectrum than at the long end, and with substantial noise in predictive effects. Just as an add-on, I reversed the process and looked to see if the change in treasury rates is a good predictor of change in the Fed Funds rate and obtained correlations that look very similar.

從這張表中可以看出,聯邦基金利率變化對短期國債的影響是正向的,並且具有統計顯著性,但聯邦基金利率與 10 年期國債之間的關係僅為 0.08,勉強達到統計顯著性測試。總的來說,如果要證明聯準會的行動會影響利率,。作為補充,我反轉了這個過程,查看了國債利率的變化是否能夠很好地預測聯邦基金利率的變化,並獲得了看起來非常相似的相關性。

In short, the evidence is just as strong for the hypothesis that market interest rates lead the Fed to act, as they are for "Fed as a leader" hypothesis. 簡而言之,。

As to why the Fed's actions affect market interest rates, it has less to do with the level of the Fed Funds rate and more to do with the market reads into the Fed's actions. Ultimately, a central bank's effect on market interest rates stems from three factors:

至於為什麼聯準會的行動會影響市場利率,這與聯邦基金利率的水平關係不大,而更多與市場對聯準會行動的解讀有關。最終,中央銀行對市場利率的影響來自三個因素:

- Information: It is true that the Fed collects substantial data on consumer and business behavior that it can use to make more reasoned judgments about where inflation and real growth are headed than the rest of the market, and its actions often are viewed as a signal of that information. Thus, an unexpected increase in the Fed Funds rate may signal that the Fed sees higher inflation than the market perceives at the moment, and a big drop in the Fed Funds rates may indicate that it sees the economy weakening at a time when the market may be unaware.

信息:確實,聯準會收集了大量關於消費者和企業行為的數據,這些數據可以用來做出比市場其他部分更合理的判斷,關於通脹和實際增長的方向,其行動通常被視為這些信息的信號。因此,聯邦基金利率的意外上升可能表明聯準會看到的通脹高於市場目前的感知,而聯邦基金利率的大幅下降可能表明聯準會認為經濟正在走弱,而市場可能尚未意識到這一點。 - Central bank credibility: Implicit in the signaling argument is the belief that the central bank is serious in its intent to keep inflation in check, and that it has enough independence from the government to be able to act accordingly. A central bank that is viewed as a tool for the government will very quickly lose its capacity to affect interest rates, since the market will tend to assume other motives (than fighting inflation) for rate cuts or raises. In fact, a central bank that lowers rates, in the face of high and rising inflation because it is the politically expedient thing to do may find that market interest move up in response, rather than down.

中央銀行的可信度:信號論中隱含的信念是中央銀行是可信的,並且它必須能夠相應地行動。被視為政府工具的中央銀行將很快失去影響利率的能力,因為市場往往會假設其他動機(而不是對抗通脹)來進行降息或升息。事實上,面對高且不斷上升的通脹,中央銀行因為政治上的權宜之計而降息,可能會發現市場利率反而上升,而不是下降。 - Interest rate level: If the primary mechanism for central banks signaling intent remains the Fed Funds rate (or its equivalent in other markets), with rate rises indicating that the economy/inflation is overheating and rate cuts suggesting the opposite, there is an inherent problem that central banks face, if interest rates fall towards zero. The signaling becomes one-sided, i.e., rates can be raised to put the economy in check, but there is not much room to cut rates. This, of course, is exactly what the Japanese central bank has faced for three decades, and European and US banks in the last decade, reducing their signal power.

利率水平:如果中央銀行傳達意圖的主要機制仍然是聯邦基金利率(或其他市場中的等價物),利率上升表明經濟/通脹過熱,而降息則表明相反的情況,那麼中央銀行面臨的一個固有問題是,如果利率趨近於零,信號傳遞就會變得單向,即可以通過提高利率來控制經濟,但降息的空間不大。這正是日本中央銀行在過去三十年中所面臨的情況,以及歐洲和美國銀行在過去十年中所面臨的情況,這削弱了它們的信號傳遞能力。

The most credible central banks in history, from the Bundesbank in Deutsche Mark Germany to the Fed, after the Volcker years, earned their credibility by sticking with their choices, even in the face of economic disruption and political pushback. That said, in both these instances, central bankers chose to stay in the background, and let their actions speak for themselves. Since 2008, central bankers, perhaps egged on by investors and governments, have become more visible, more active and, in my view, more arrogant, and that, in a strange way, has made their actions less consequential. Put simply, the more the investing world revolves around FOMC meetings and the smoke signals that come out of them, the less these meetings matter to markets.

歷史上最可信的中央銀行,從德國馬克時期的德國聯邦銀行到沃爾克時代之後的聯準會,都是通過堅持自己的選擇來贏得可信度,即使面對經濟動盪和政治壓力。話雖如此,在這兩種情況下,中央銀行家都選擇保持低調,讓行動自己說話。自 2008 年以來,中央銀行家們,或許受到投資者和政府的推動,變得更加顯眼、更加活躍,並且在我看來更加傲慢,這在某種奇怪的方式上使他們的行動變得不再那麼重要。簡單來說,投資世界越是圍繞 FOMC 會議及其釋放的信號轉動,這些會議對市場的影響就越小。

Forecasting Rates 預測利率

I am wary of Fed watchers and interest rate savants, who claim to be able to sense movements in rates before they happen, for two reasons. First, their track records are so awful that they make soothsayers and tarot card readers look good. Second, unlike a company's earnings or risk, where you can claim to have a differential advantage in estimating it, it is unclear to me what any expert, no matter how credentialed, can bring to the table that gives them an edge in forecasting interest rates. In my valuations, this skepticism about interest rate forecasting plays out in an assumption where I do not try to second guess the bond market and replace current treasury bond rates with fanciful estimates of normalized or forecasted rates. If you look back at my S&P 500 valuation in my second data post for this year, you will see that I left the treasury bond rate at 4.58% (its level at the start of 2025) unchanged through time.

我對聯邦觀察者和利率專家持懷疑態度,他們聲稱能夠在利率變動發生之前感知到這些變動,原因有兩個。首先,他們讓占卜師和塔羅牌讀者看起來很厲害。其次,與公司的收益或風險不同,在這些方面你可以聲稱在估計上有差異優勢,但我不清楚任何專家,無論多麼有資歷,能帶來什麼優勢來預測利率。在我的估值中,這種對利率預測的懷疑體現在一個假設中,即我不試圖猜測債券市場,並用對正常化或預測利率的幻想估計來取代當前的國債利率。如果你回顧我今年第二篇數據文章中的標普 500 估值,你會看到我將國債利率保持在 4.58%(2025 年初的水平)不變。

If you feel the urge to play interest forecaster, I do think that it is good practice to make sure that your views on the direction of interest rates are consistent with the views of inflation and growth you are building into your cash flows. If you buy into my thesis that it is changes in expected inflation and real growth that causes rates to change in interest rates, any forecast of interest rates has been backed up by a story about changing inflation or real growth. Thus, if you forecast that the ten-year treasury rate will rise to 6% over the next two years, you have to follow through and explain whether rising inflation or higher real growth (or both) that is triggering this surge, since that diagnosis have different consequences for value. Higher interest rates driven by higher inflation will generally have neutral effects on value, for companies with pricing power, and negative effects for companies that do not. Higher interest rates precipitated by stronger real growth is more likely to be neutral for the market, since higher earnings (from the stronger economy) can offset the higher rates. The most empty forecasts of interest rates are the ones where the forecaster's only reason for predicting higher or lower rates is central banks, and I am afraid that the discussion of interest rates has become vacuous over the last two decades, as the delusion that the Fed sets interest rates becomes deeply engrained.

如果你有興趣扮演利率預測者,我確實認為確保你對利率方向的看法與你對通脹和增長的看法一致是很好的做法。如果你接受我的論點,即預期通脹和實際增長的變化導致利率變化,那麼任何利率預測都應該有通脹或實際增長變化的故事支持。因此,如果你預測十年期國債利率將在未來兩年內上升到 6%,你必須進一步解釋是通脹上升還是實際增長更高(或兩者兼有)引發了這一激增,因為這種診斷對價值有不同的影響。對於有定價能力的公司來說,較高的利率通常對價值有中性影響,而對於沒有定價能力的公司來說則有負面影響。較高的利率對市場來說更可能是中性的,因為較高的收益(來自更強勁的經濟)可以抵消較高的利率。最空洞的利率預測是那些預測者唯一預測利率上升或下降的原因是中央銀行,我擔心過去二十年來利率討論變得空洞,因為聯邦儲備設定利率的錯覺已經深入人心。

Corporate Bond Rates in 2024

The corporate bond market gets less attention than the treasury bond market, partly because rates in that market are very much driven by what happens in the treasury market. Last year, as the treasury bond rate rose from 3.88% to 4.58%, it should come as no surprise that corporate bond rates rose as well, but there is information in the rate differences between the two markets. That rate difference, of course, is the default spread, and it will vary across different corporate bonds, based almost entirely on perceived default risk.

公司債券市場受到的關注比國債市場少,部分原因是該市場的利率很大程度上受國債市場的影響。去年,隨著國債利率從 3.88%上升到 4.58%,公司債券利率也上升並不令人驚訝,但兩個市場之間的利率差異中蘊含著信息。當然,這種利率差異就是違約利差,它會根據不同的公司債券而變化,幾乎完全基於感知的違約風險。

Default spread = Corporate bond rate - Treasury bond rate on bond of equal maturity

違約利差 = 公司債券利率 - 相同期限的國債利率

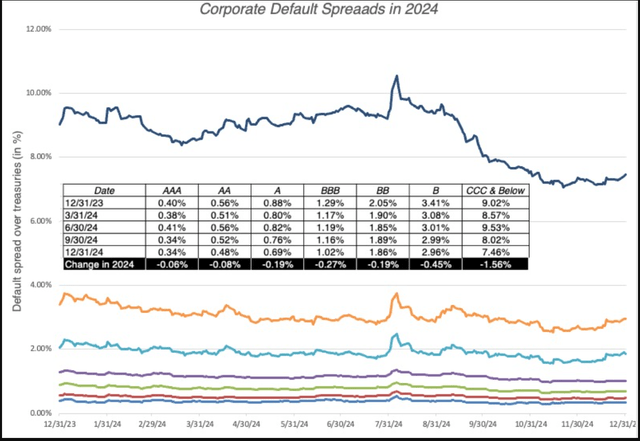

Using bond ratings as measures of default risk, and computing the default spreads for each ratings class, I captured the journey of default spreads during 2024:

使用債券評級作為違約風險的衡量標準,並計算每個評級類別的違約利差,我捕捉到了 2024 年違約利差的變化:

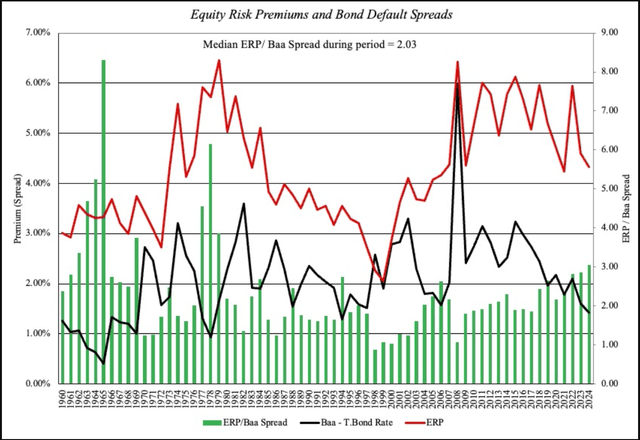

During 2024, default spreads decreased over the course of the year, for all ratings classes, albeit more for the lowest rated bonds. Using a different lexicon, the price of risk in the bond market decreased during the course of the year, and if you relate that back to my second data update, where I computed a price of risk for equity markets (the equity risk premium), you can see the parallels. In fact, in the graph below, I compare the price of risk in both the equity and bond markets across time:

在 2024 年期間,所有評級類別的違約利差在一年中都有所下降,尤其是最低評級的債券。用不同的詞彙來說,債券市場的風險價格在一年中有所下降,如果你將其與我的第二篇數據更新聯繫起來,在那裡我計算了股票市場的風險價格(股票風險溢價),你可以看到相似之處。事實上,在下圖中,我比較了股票和債券市場的風險價格隨時間的變化:

In most years, equity risk premiums and bond default spreads move in the same direction, as was the case in 2024. That should come as little surprise, since the forces that cause investors to spike up premiums (fear) or bid them down (hope and greed) cut across both markets. In fact, looking at the ratio of the equity risk premium to the default spread, you could argue that equity risk premiums are too high, relative to bond default spreads, and that you should see a narrowing of the difference, either with a lower equity premium (higher stock prices) or a higher default spread on bonds.

在大多數年份中,股票風險溢價和債券違約利差朝著相同的方向移動,2024 年就是這樣的情況。這應該不足為奇,因為導致投資者提高溢價(恐懼)或降低溢價(希望和貪婪)的力量在兩個市場中都存在。事實上,看看股票風險溢價與違約利差的比率,你可以認為較低的股票溢價(較高的股票價格)或較高的債券違約利差。

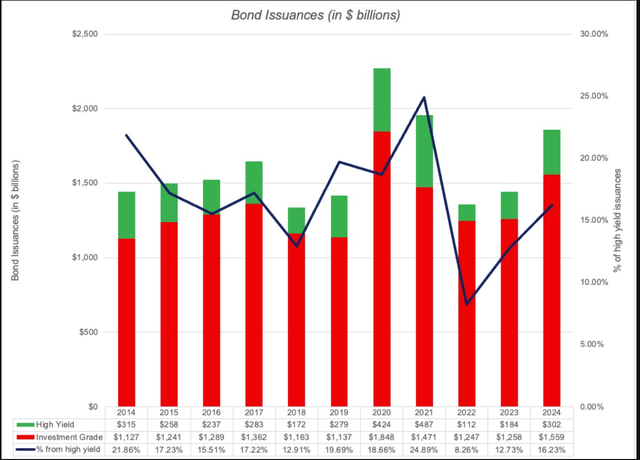

The decline of fear in corporate bond markets can be captured on another dimension as well, which is in bond issuances, especially by companies that face high default risk. In the graph below, I look at corporate bond issuance in 2024, broken down into investment grade (BBB or higher) and high yield (less than BBB).

公司債券市場中恐懼的減少也可以從另一個維度來捕捉,那就是債券發行,尤其是那些面臨高違約風險的公司。在下圖中,我查看了 2024 年的公司債券發行情況,分為投資級(BBB 或更高)和高收益(低於 BBB)。

Note that high-yield issuances which spiked in 2020 and 2021, peak greed years, almost disappeared in 2022. They made a mild comeback in 2023 and that recovery continued in 2024.

請注意,高收益債券發行在 2020 年和 2021 年激增,這是貪婪的高峰年,但在 2022 年幾乎消失了。它們在 2023 年略有回升,並且這種復甦在 2024 年繼續。

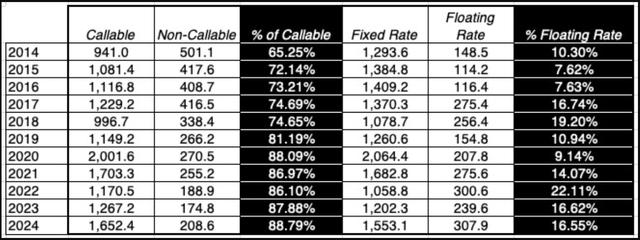

Finally, as companies adjust to a new interest rate environment, where short terms rates are no longer close to zero and long-term rates have moved up significantly from the lows they hit before 2022, there are two other big shifts that have occurred, and the table below captures those shifts:

最後,隨著公司適應新的利率環境,短期利率不再接近零,長期利率從 2022 年之前的低點顯著上升,還發生了另外兩個重大變化,下表捕捉了這些變化:

First, you will note that after a long stretch, where the percent of bonds that were callable declined, they have spiked again. That should come as no surprise, since the option, for a company, to call back a bond is most valuable, when you believe that there is a healthy chance that rates will go down in the future. When corporates could borrow money at 3%, long term, they clearly attached a lower likelihood to a rate decline, but as rates have risen, companies are rediscovering the value of having a calculability option. Second, the percent of bond issuances with floating rate debt has also surged over the last three years, again indicating that when rates are low, companies were inclined to lock them in for the long term with fixed rate issuances, but at the higher rates of today, they are more willing to let those rates float, hoping for lower rates in future years.

首先,你會注意到,在長時間的停滯之後,它們再次激增。這應該不足為奇,因為當你認為未來利率有可能下降時,公司收回債券的選擇權最有價值。當公司可以長期以 3%的利率借款時,他們顯然對利率下降的可能性持較低的看法,但隨著利率上升,公司重新發現了擁有可計算選擇權的價值。其次,在過去三年中,浮動利率債券的發行也激增,這再次表明當利率較低時,公司傾向於通過固定利率發行來長期鎖定利率,但在今天較高的利率下,他們更願意讓這些利率浮動,希望未來幾年利率會下降。

In Conclusion

I spend much of my time in the equity market, valuing companies and assessing risk. I must confess that I find the bond market far less interesting, since so much of the focus is on the downside, and while I am glad that there are other people who care about that, I prefer to operate in a space where there is more uncertainty. That said, though, I dabble in bond markets because what happens in those markets, unlike what happens in Las Vegas, does not stay in bond markets. The spillover effects into equity markets can be substantial, and in some cases, devastating. In my posts looking back at 2022, I noted how a record bad year for bond markets, as both treasury and corporate bonds took a beating for the ages, very quickly found its ways into stocks, dragging the market down. On that count, bond markets had a quiet year in 2024, but they may be overdue for a cleanup.

我大部分時間都在股票市場中度過,評估公司價值和風險。我必須承認,我發現債券市場遠不如股票市場有趣,因為大部分焦點都在下行風險上,雖然我很高興有其他人關心這一點,但我更喜歡在一個有更多不確定性的空間中操作。話雖如此,我還是涉足債券市場,因為這些市場中發生的事情,不像拉斯維加斯發生的事情,不會停留在債券市場中。對股票市場的溢出效應可能是巨大的,在某些情況下甚至是毀滅性的。在我回顧 2022 年的文章中,我注意到債券市場創紀錄的糟糕年份,國債和公司債券都遭受了歷史性的打擊,很快就影響到了股票,拖累了市場。在這方面,債券市場在 2024 年表現平靜,但它們可能已經到了需要清理的時候。

Data Updates for 2025 2025 年數據更新

- Data Update 1 for 2025: The Draw (and Danger) of Data!

2025 年數據更新 1:數據的吸引力(與危險)! - Data Update 2 for 2025: The Party continued for US Equities

2025 年數據更新 2:美國股市派對繼續 - Data Update 3 for 2025: The times they are a'changin'!

2025 年數據更新 3:時代正在改變! - Data Update 4 for 2025: Interest Rates, Inflation and Central Banks!

2025 年數據更新 4:利率、通脹與中央銀行!

Data Links 數據鏈接

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編輯註:本文的摘要點由 Seeking Alpha 編輯選擇。

Comments (1)

我再次從閱讀你的文章中受益,因為我現在理解了信用利差!謝謝