100+ Charts & Commentary on all major Markets — for your weekend reading.

“Don’t start the week without it”

First half in the books:

Stocks & Bitcoin went “Higher For Longer”.

Everything else was noise.

Happy Independence Day to all our subscribers.

KEY TOPICS COVERED

In today’s report:

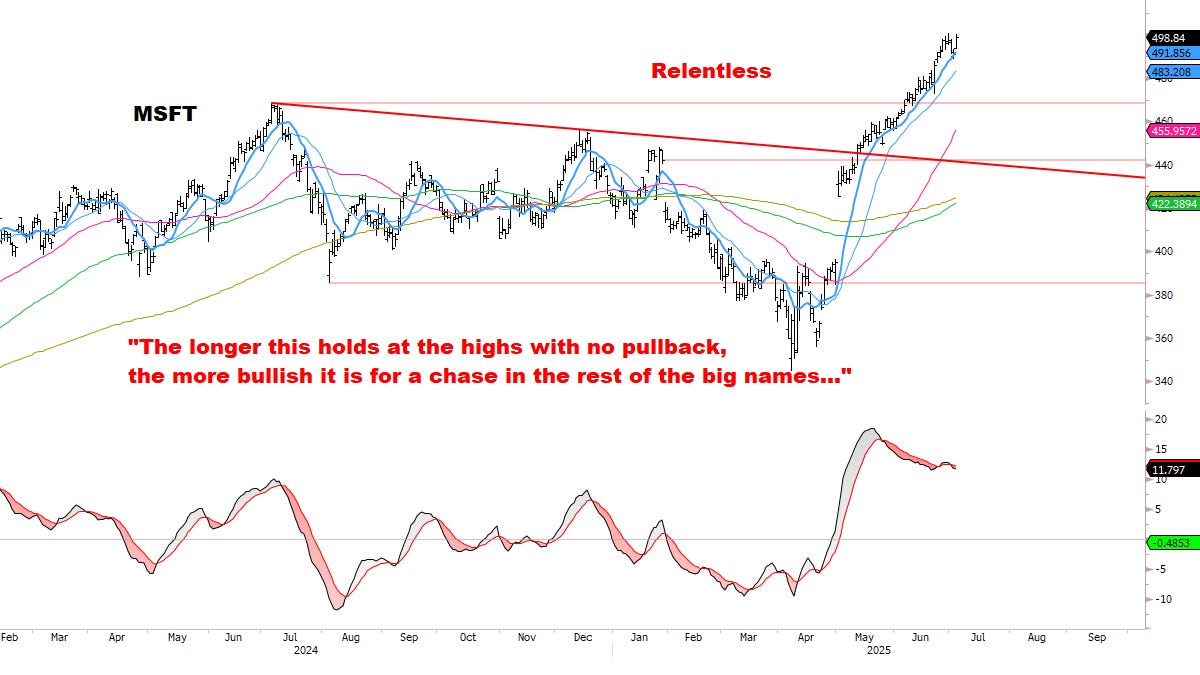

STOCKS: Melt-up = still the ultimate contrarian call. There may be no turning back now.

All Core Watchlist names still leading — now up nearly +50% on average.

Special Update continued: Tracking topping signals (Subscribers only).

Updated scans & targets: assessing (1) model signals, (2) market behavior, (3) individual stocks.

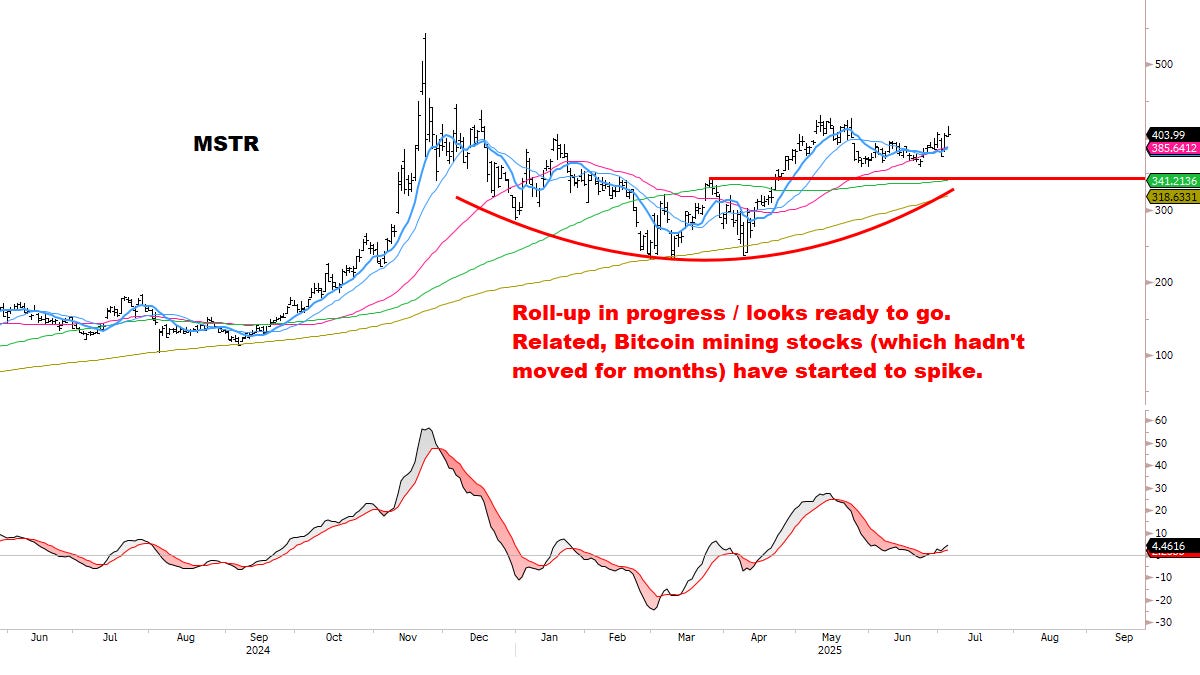

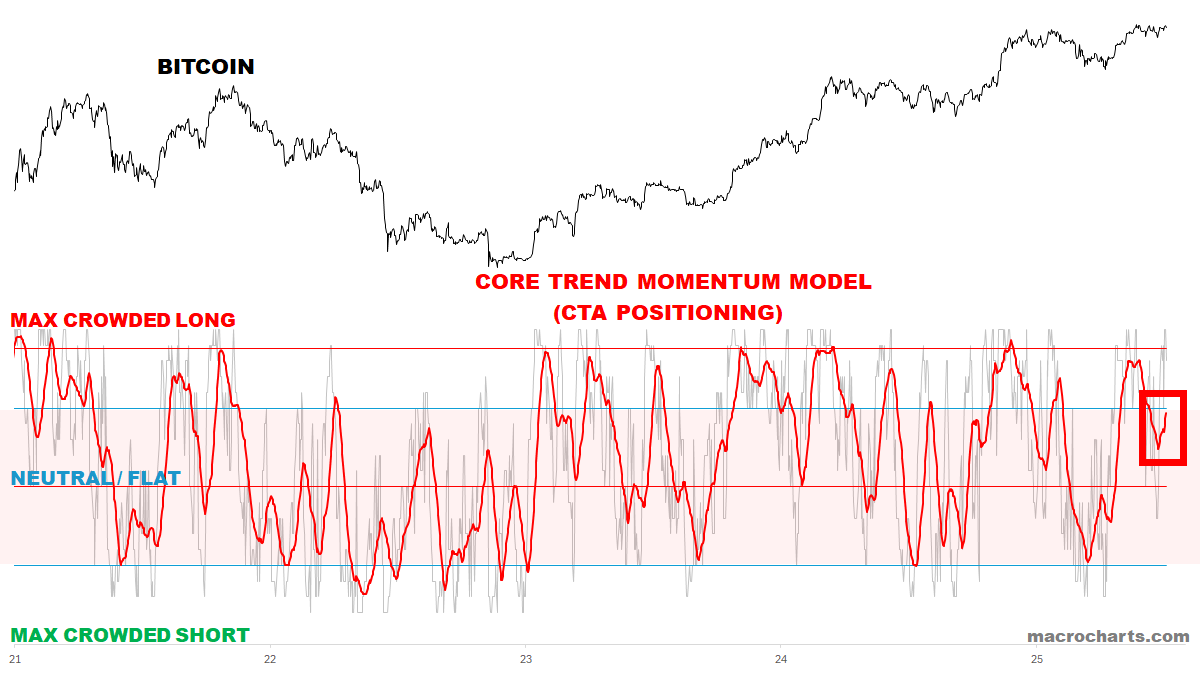

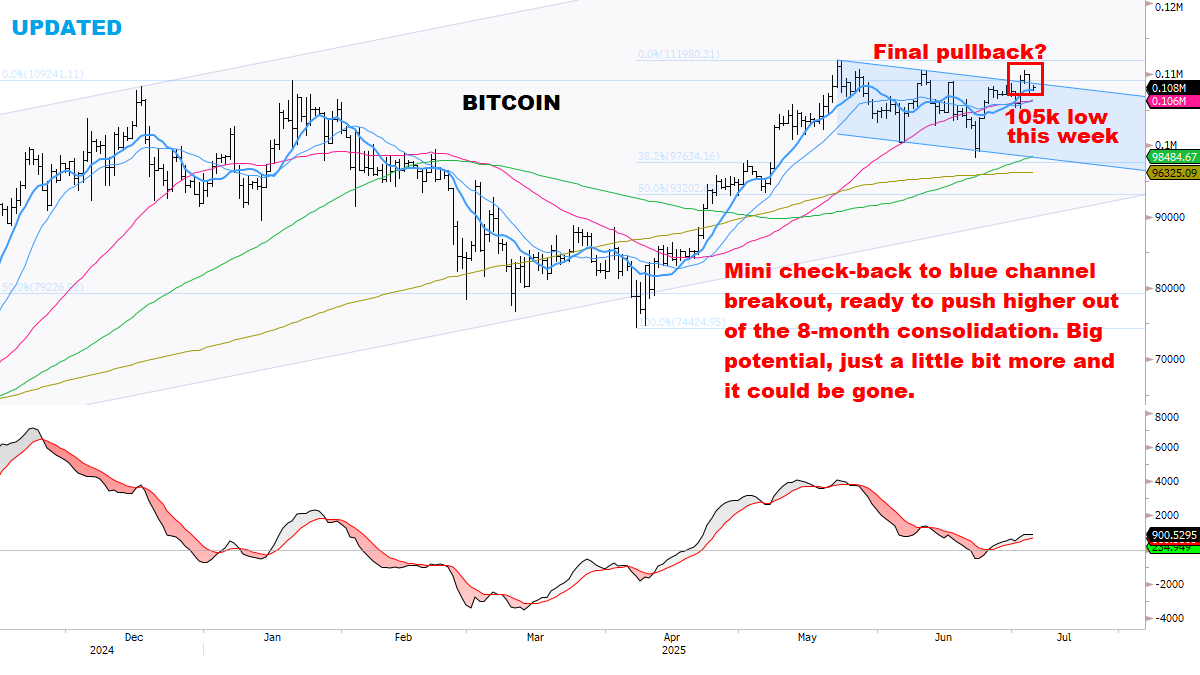

BITCOIN: Big Beautiful.

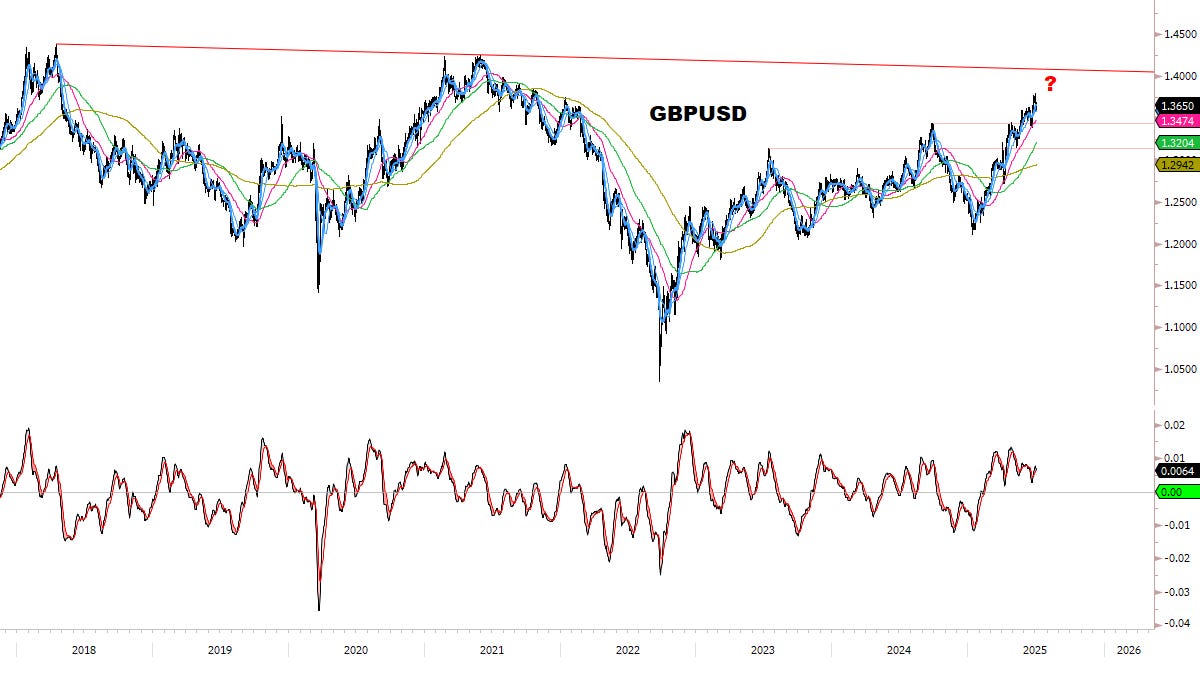

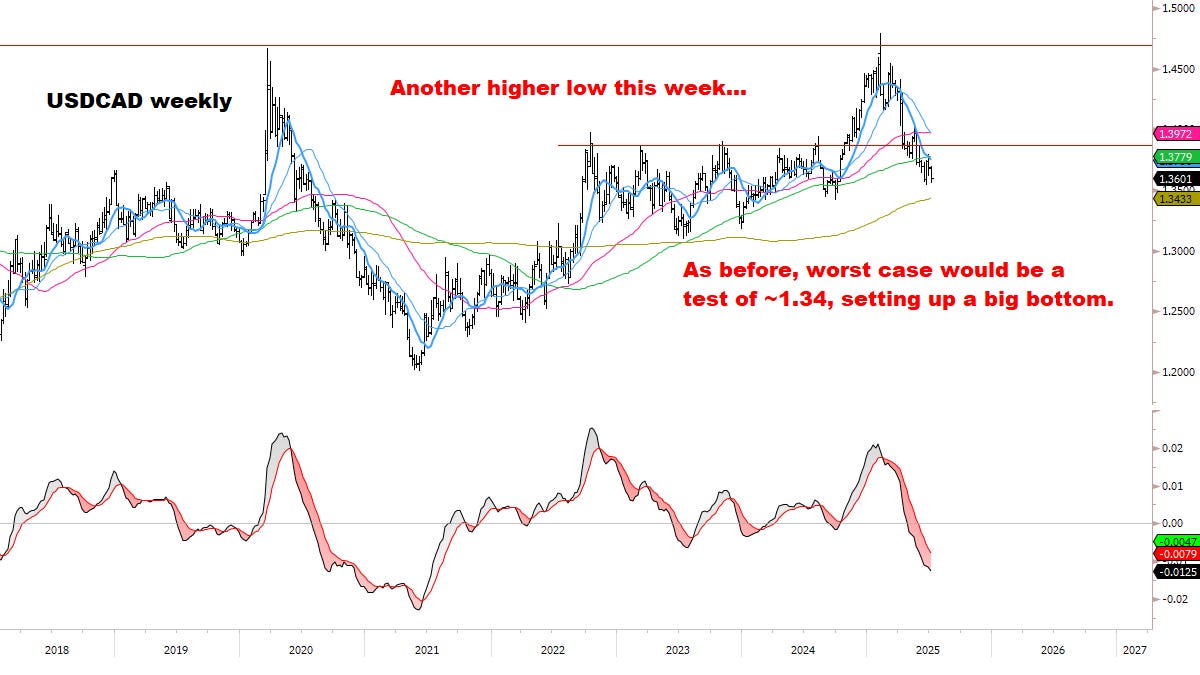

FX: The Buck stops here…?

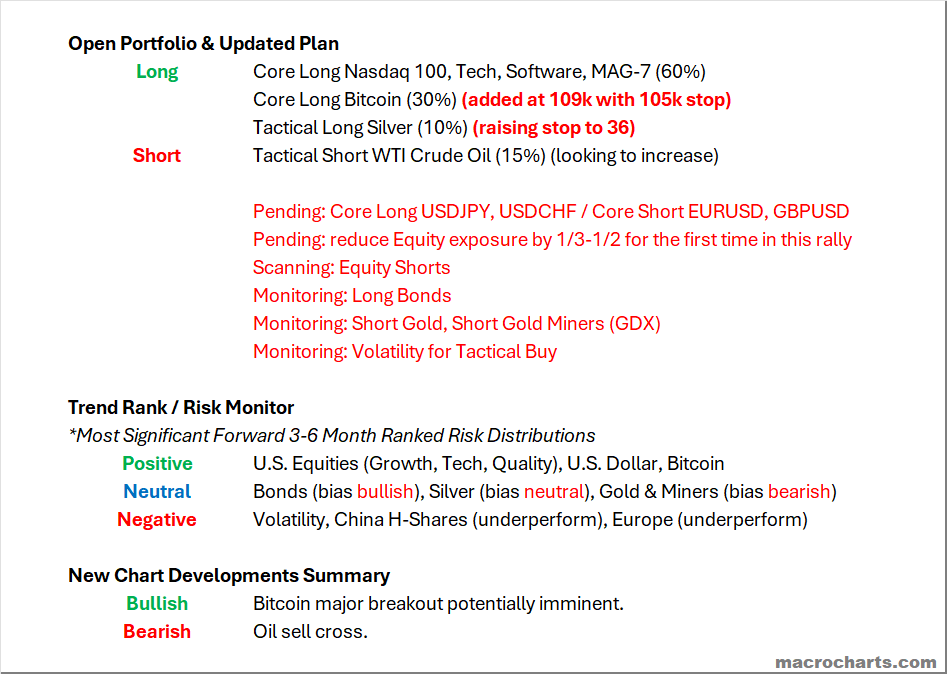

Open Portfolio & Updated Plan

It’s GO TIME:

Taking BTC exposure up with tight stop on this tranche. Potentially a classic breakout setup. We’ll see what the market decides — likely soon.

Emphasizing: keeping an open mind could be the difference between a great summer and an average one. It’s a strong year and I intend to keep pushing — eyes on the next big move.

CORE MODELS & DATA

STOCKS

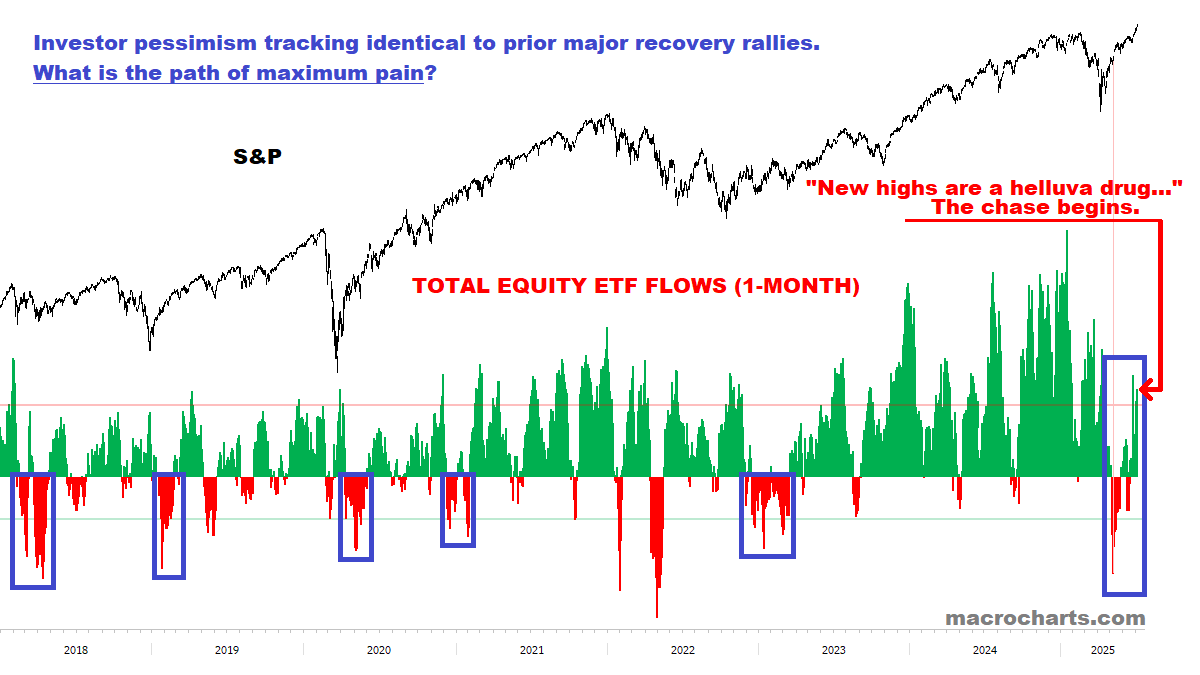

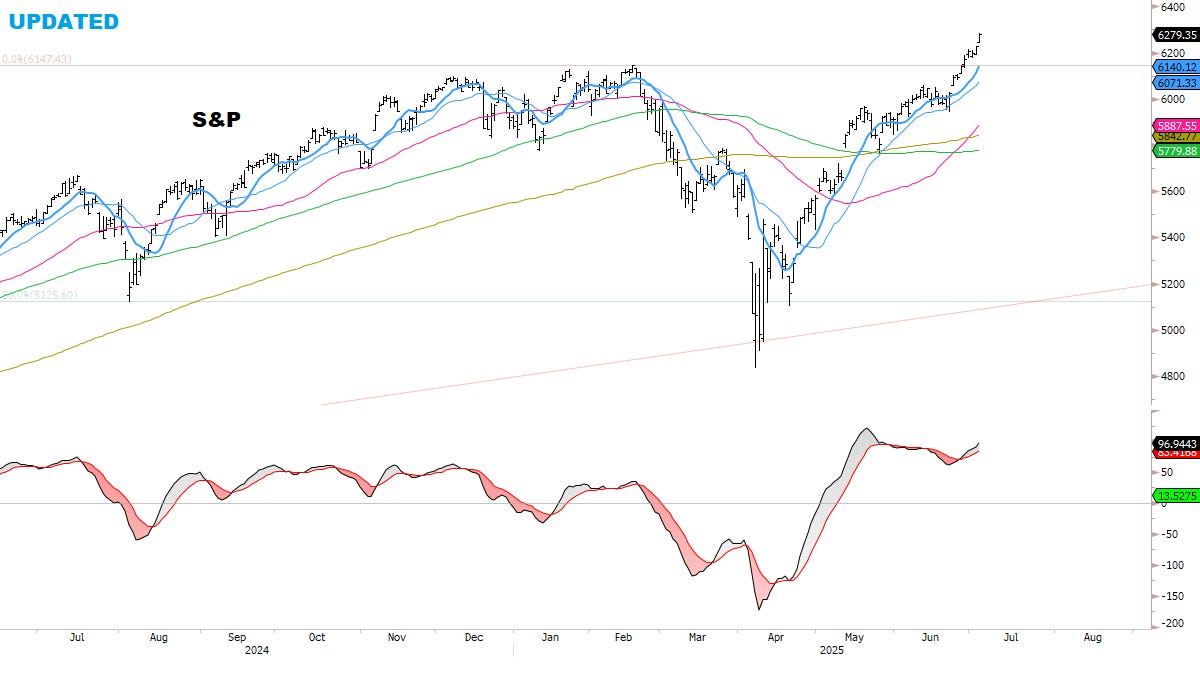

Investors continue to follow the historical script — the chase is ON.

Base case: flows should accelerate.

From May 24: If history is a guide, the path of maximum pain is for the market to grind higher over time, leaving sellers behind. Pullbacks could be limited in scope.

*This framework continues to be validated by the indexes.

Institutions are starting to Buy as stocks break new highs (*data will be updated next week due to holiday):

SPECIAL UPDATE: HOW HIGH CAN STOCKS GO?

A Melt-Up developing (continued):

“Stocks breaking to new highs with a LOT of money still massively underinvested… Our core scenario looks underway — and ready to accelerate.”

Remember what I wrote in April: “at the April 7 bottom, some well-known bulls were publicly apologizing for their view. At the next top of importance, we could see ‘mea culpas’ from some well-known bears. Such is the nature of the stock market.”

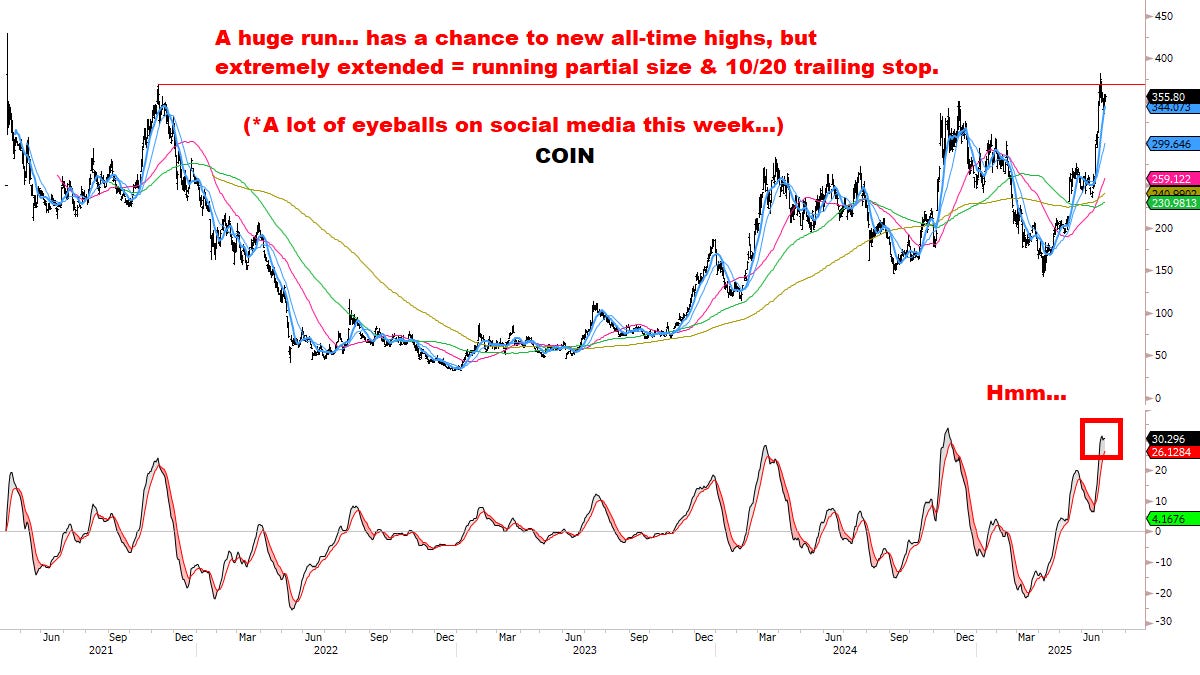

Scanning social media again this week, the usual pundits are still openly skeptical of the rally.

This is not how tops are made.

Additionally:

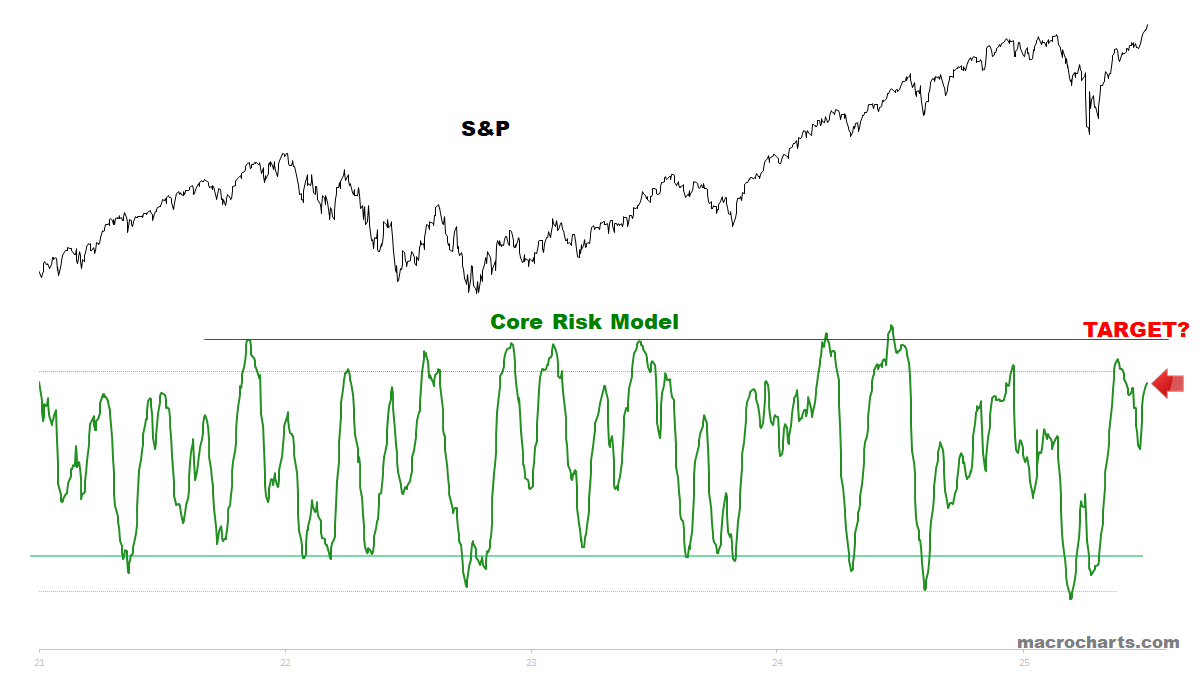

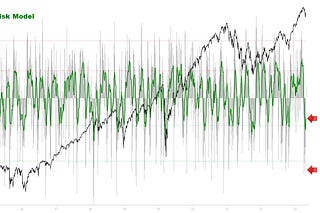

Core Risk Models have room to get overbought — *especially if a melt-up is underway.

When THIS reaches topping range and turns down, I’ll raise cash / look to put on Tactical hedges. Not before.

When the time comes, we’ll be sharing this and other signals with Subscribers only. No public sites or social media.

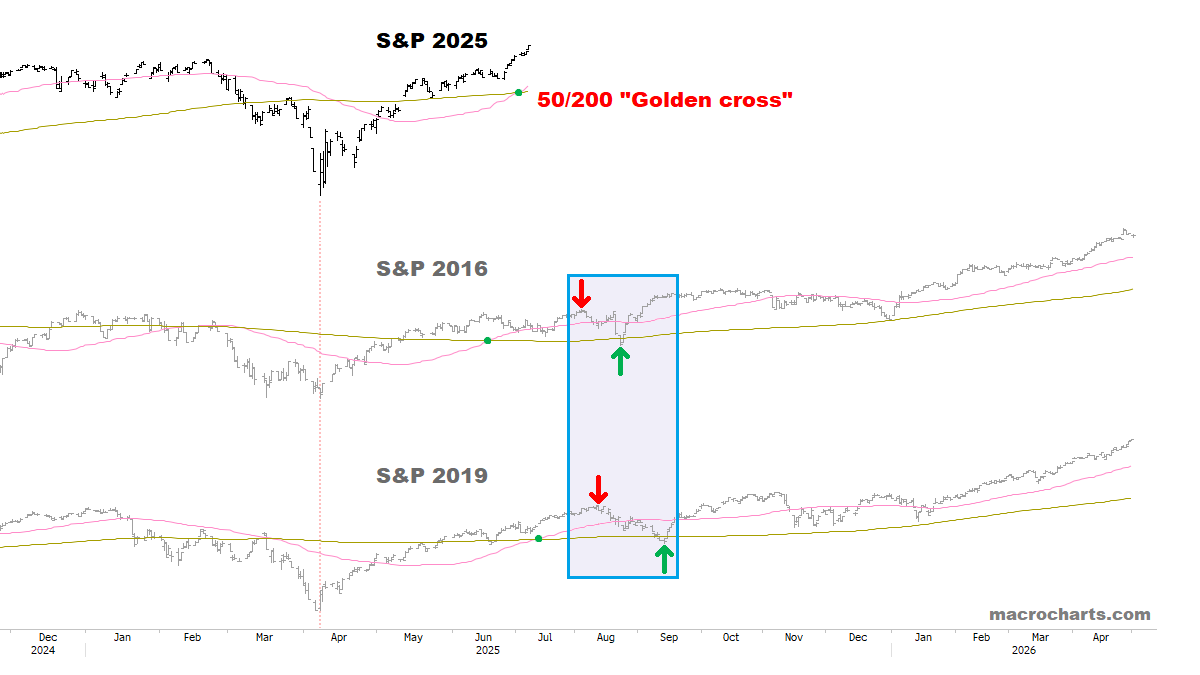

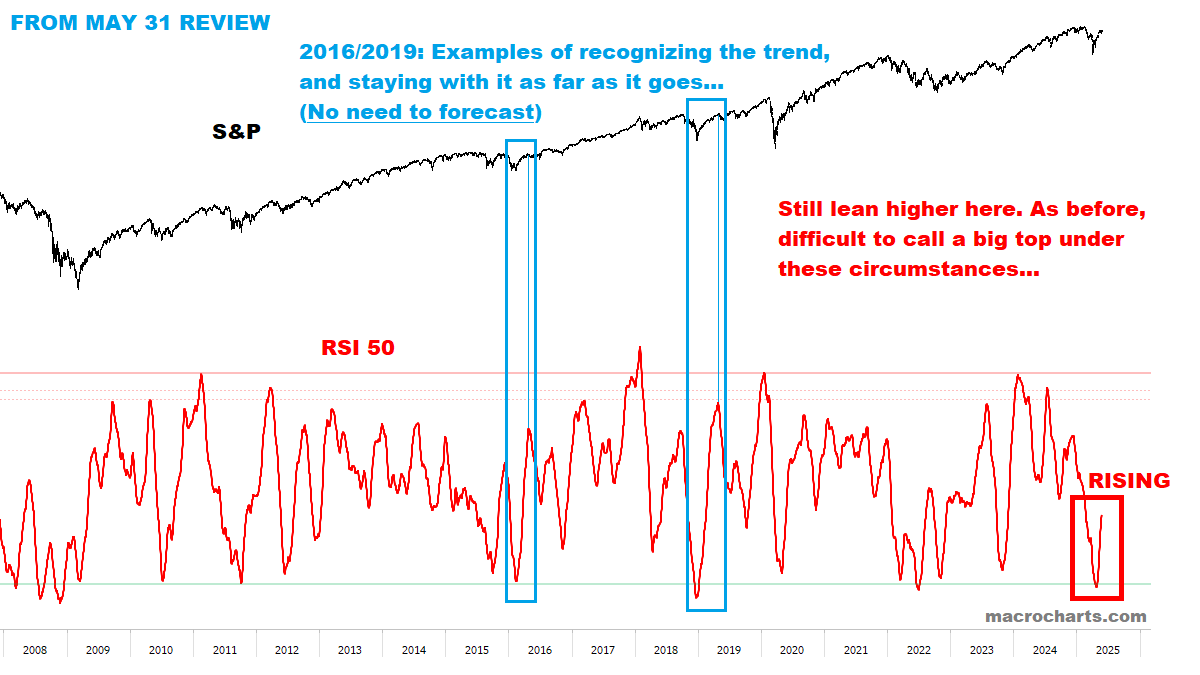

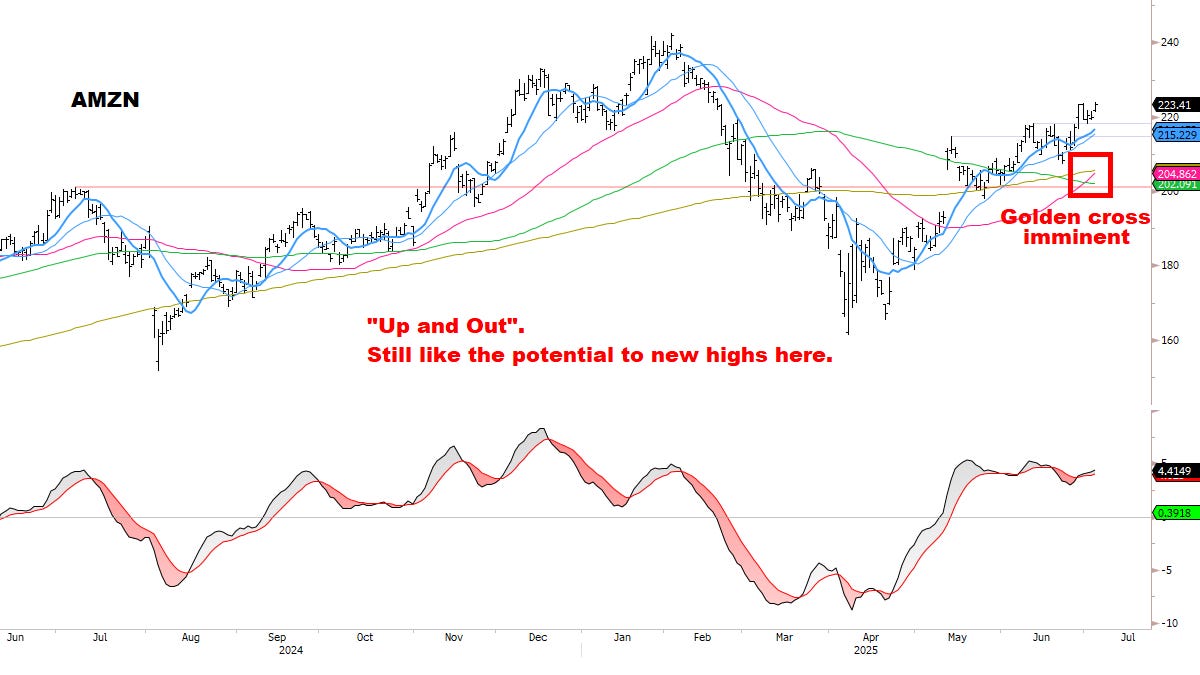

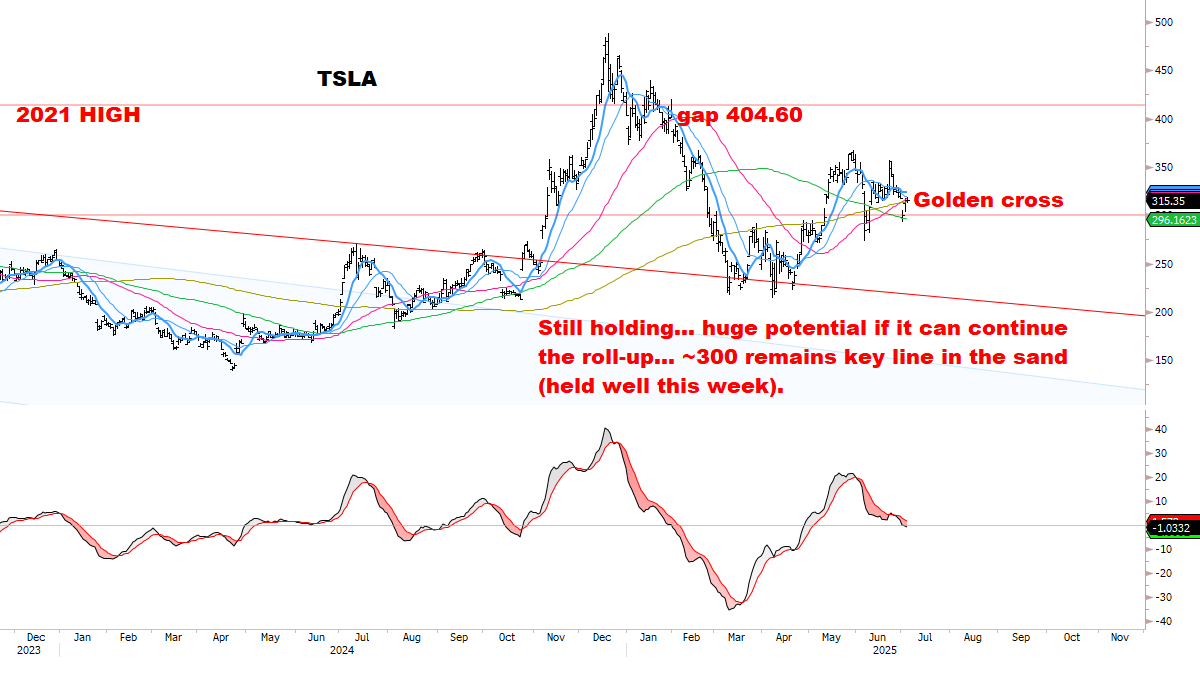

We continue to track this closely for an ideal top into late summer — note “Golden cross” has triggered in line with prior recovery rallies:

As discussed May 24:

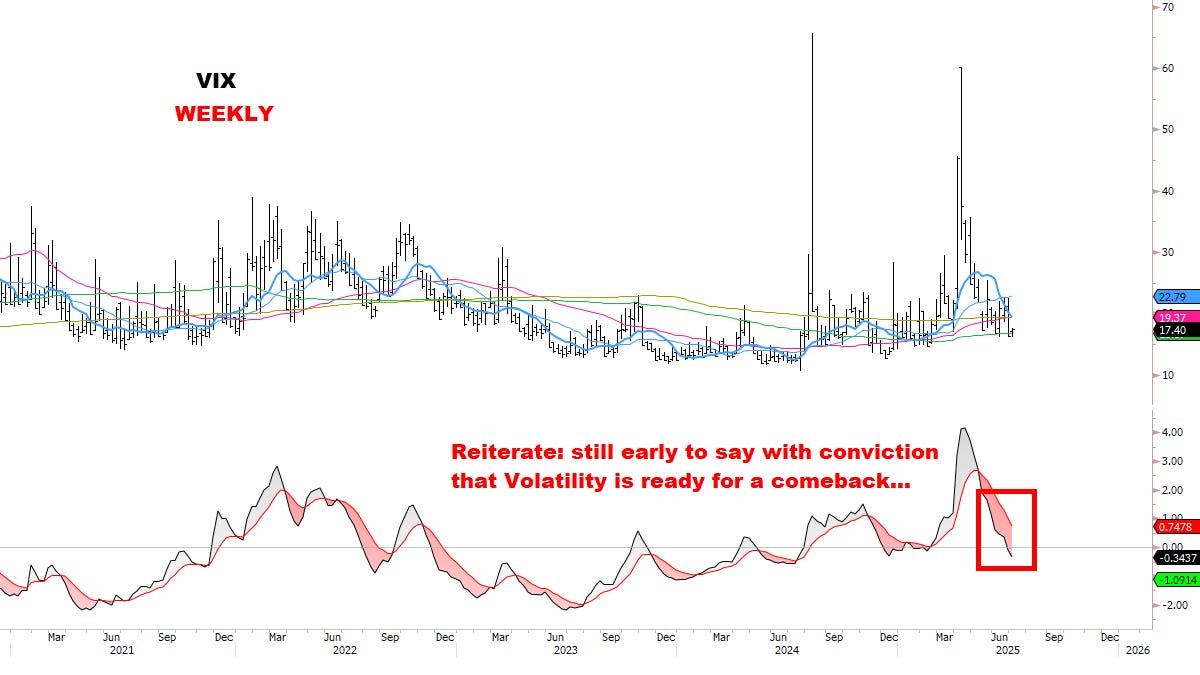

“If the sequence continues, dips should remain shallow for the next few weeks, with the market in a slight upward bias. Overall, a *perfect environment* for stock-picking. *Also: not yet an optimal setup to Short Indexes or buy Volatility.”

*This framework continues to be validated by the market.

As always: an open mind could be the difference between a great summer and an average one. It’s a strong year and I intend to keep pushing — eyes open to the next big move.

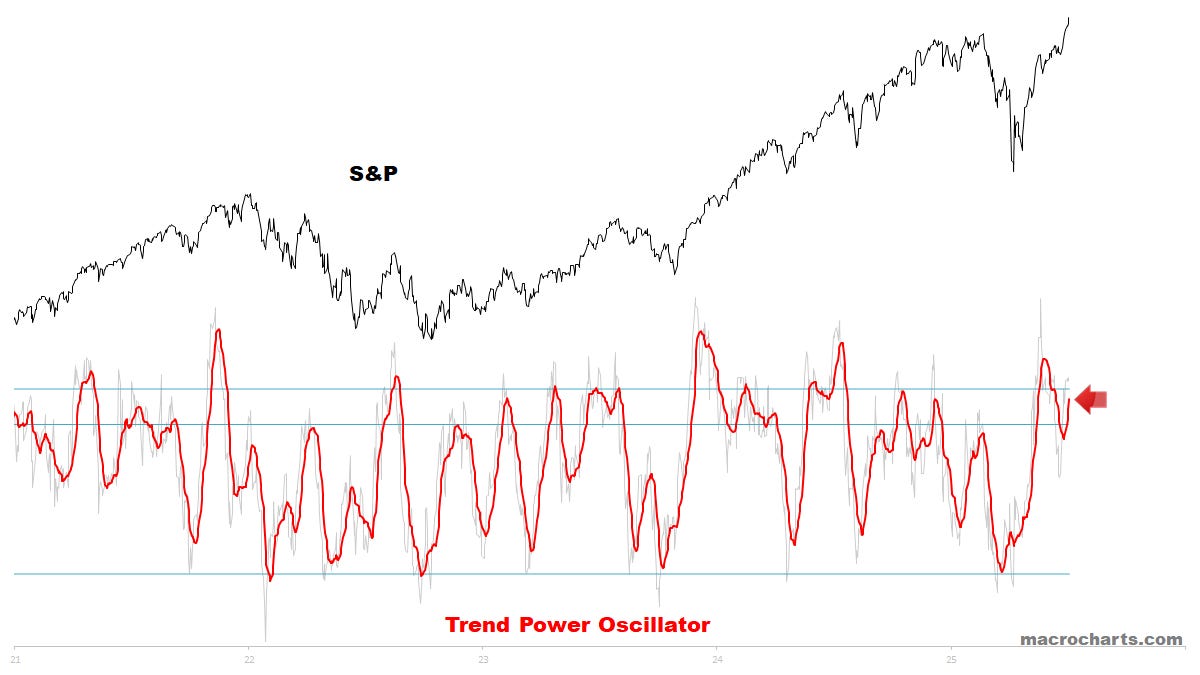

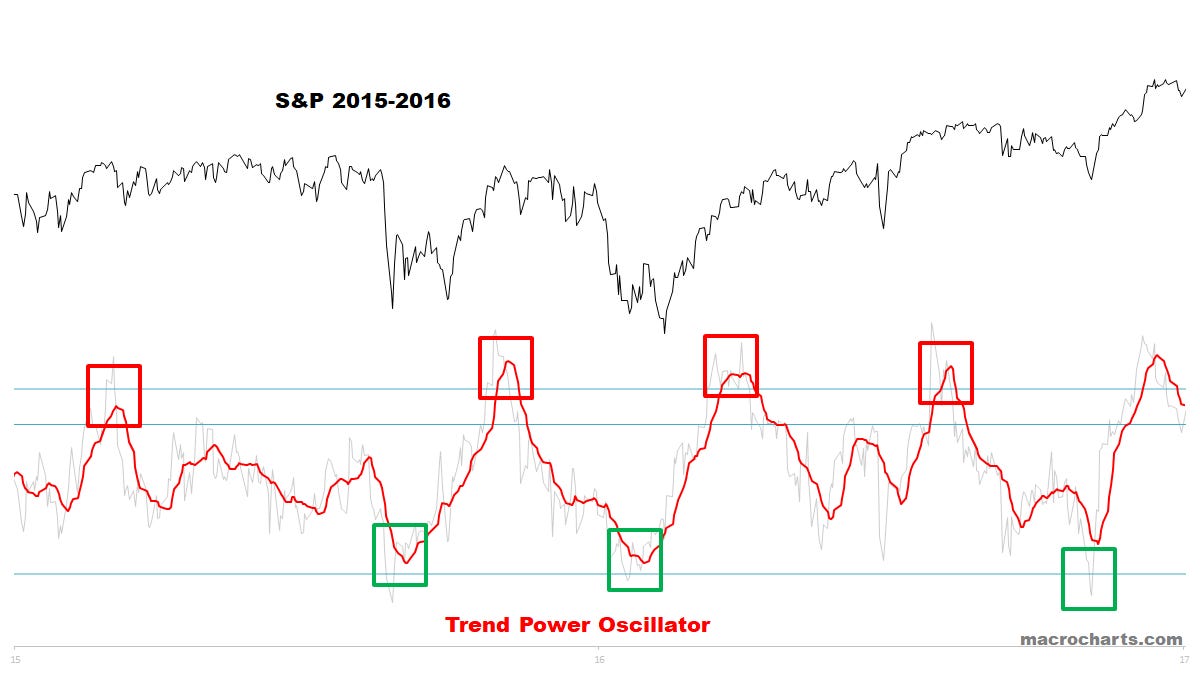

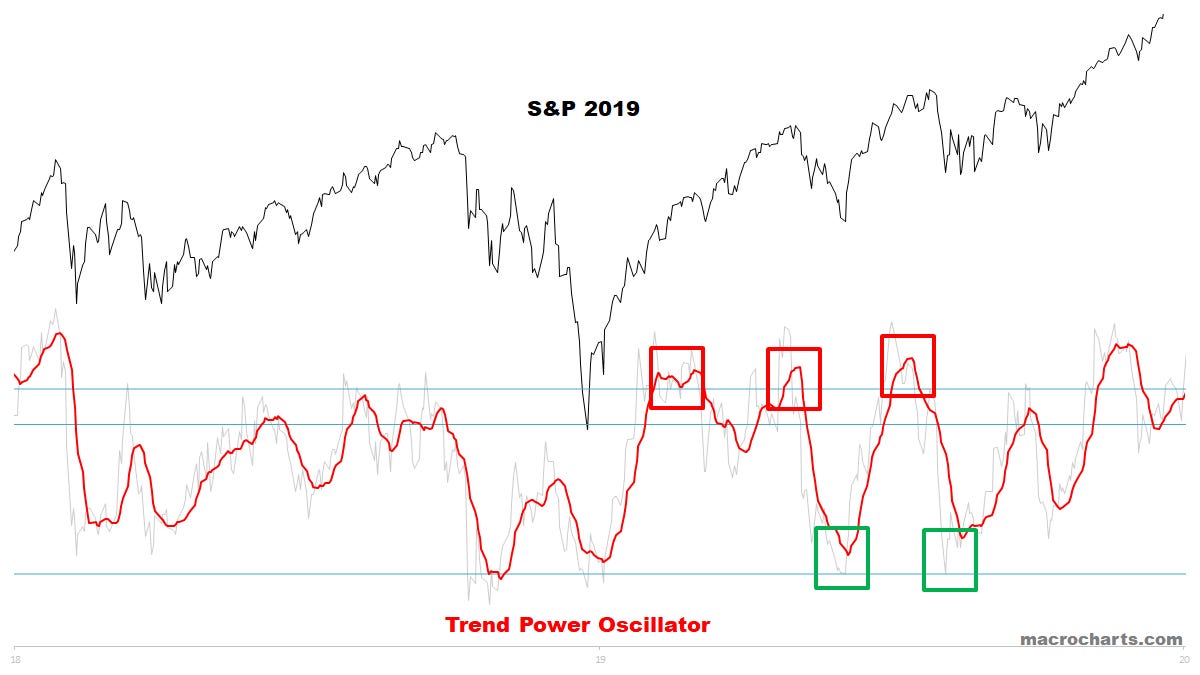

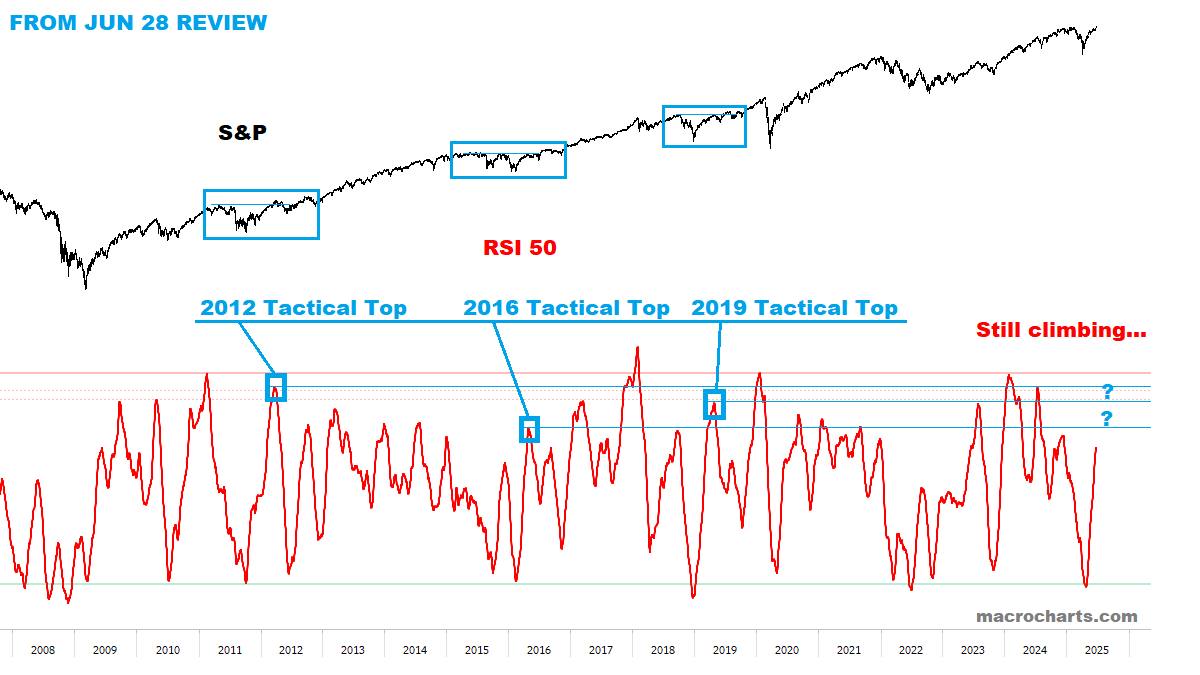

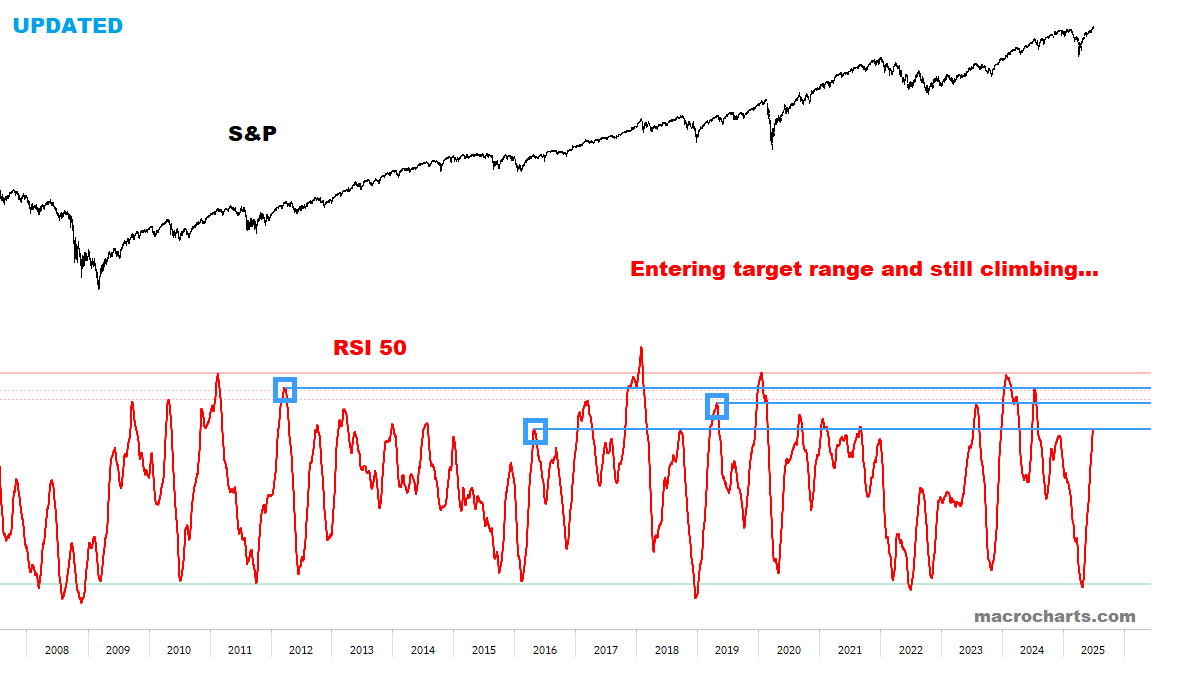

Trend Power Oscillator is moving to overbought — still tracking the 2016/2019 scenario:

When this reaches topping range and turns down, I’ll raise cash / look to put on Tactical hedges. Not before.

When the time comes, we’ll be sharing this and other signals with Subscribers only. No public sites or social media.

Remember:

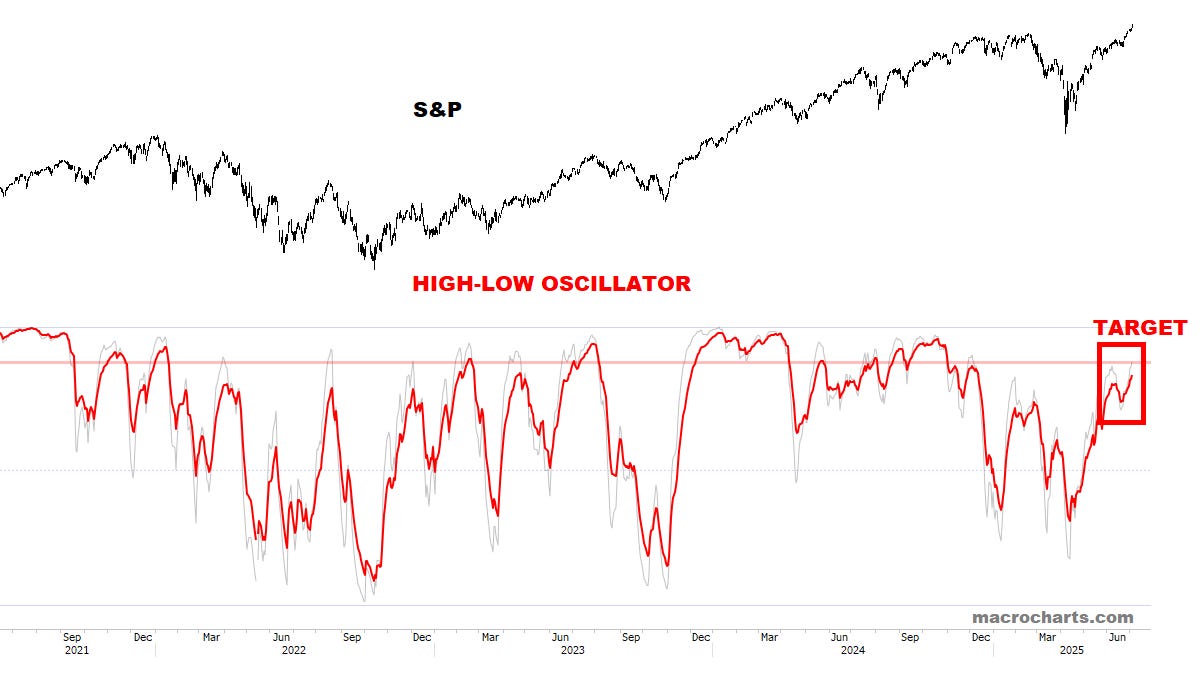

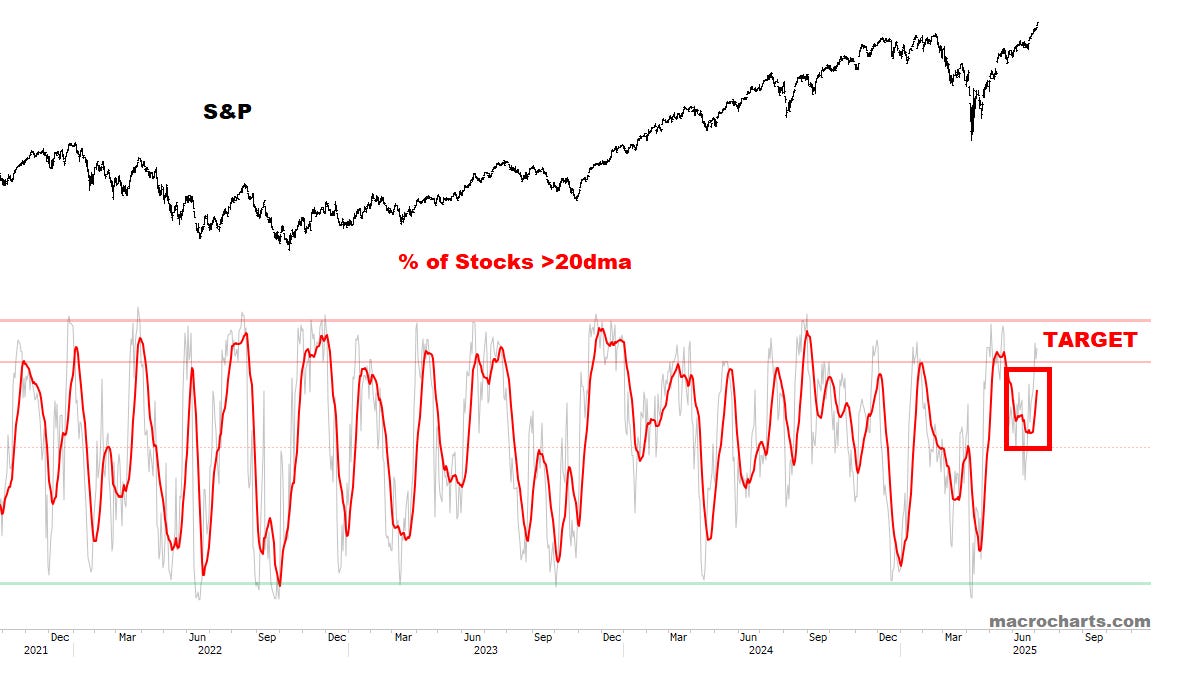

High-Low Oscillator has room to push to target range:

Reiterate: on track for new highs in all key areas, before a bigger correction is seen.

Base case: speculation and more importantly flows should ramp up rapidly as new highs continue to expand. This is now clearly happening.

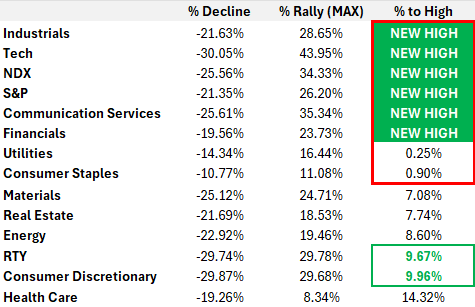

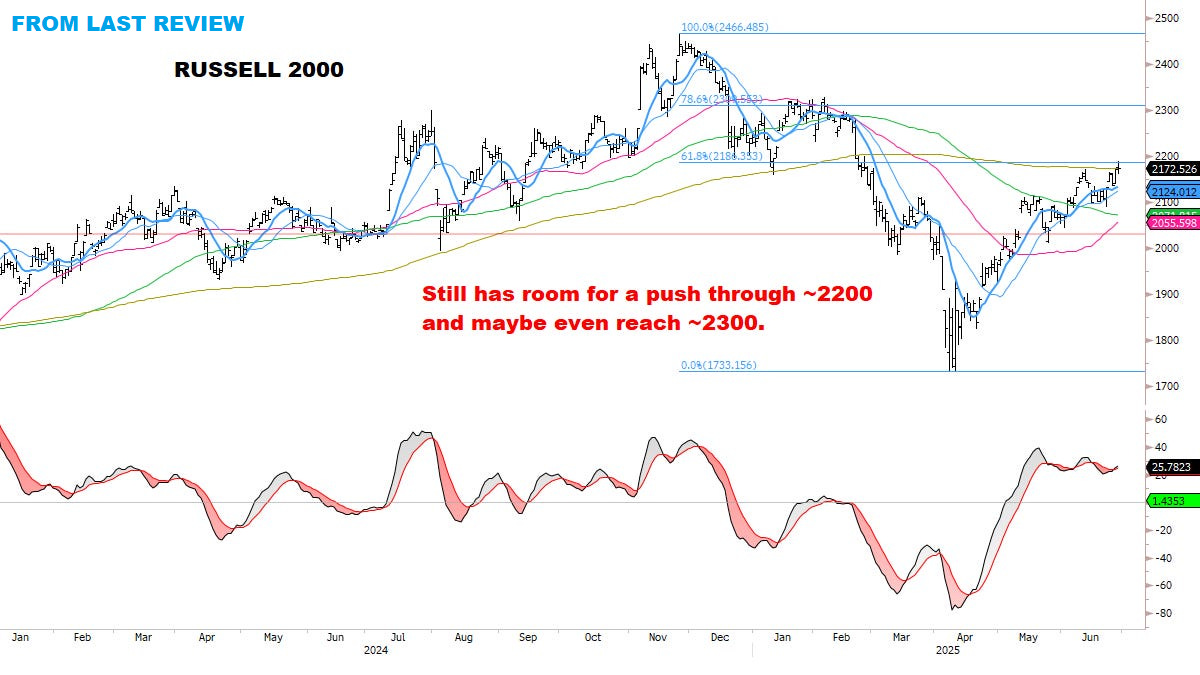

Russell & Consumer Discretionary ran higher this week, joining the rally at a critical moment. They remain in GREEN below, with potential to recover even further (in my view):

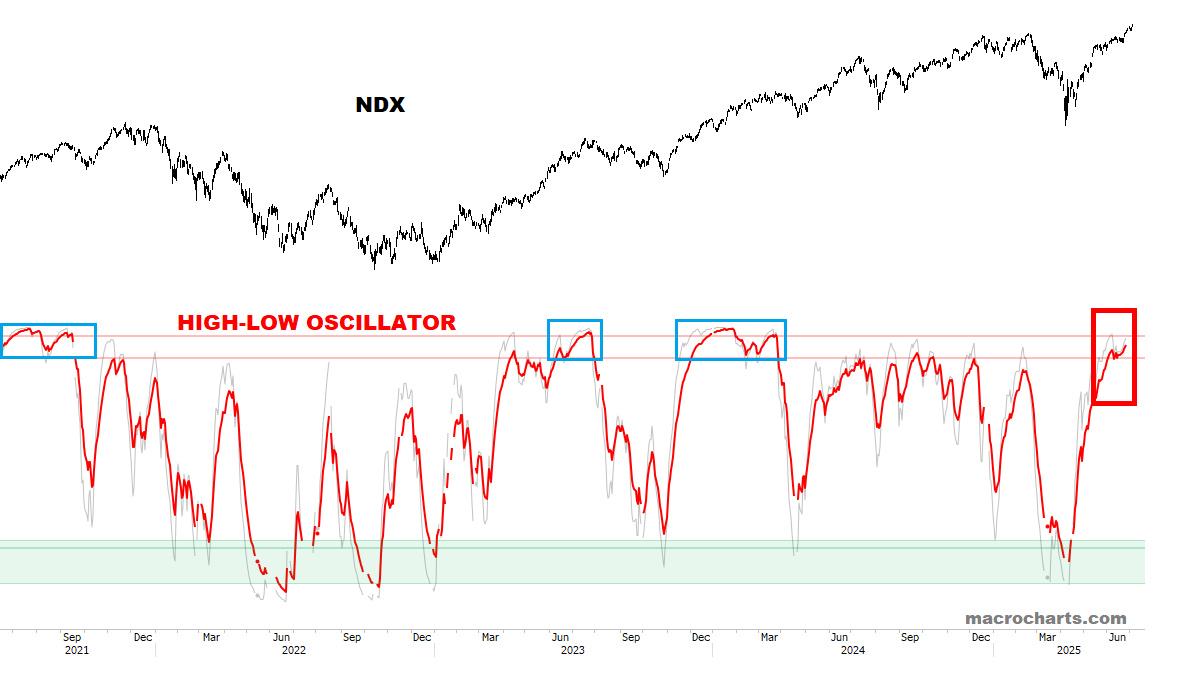

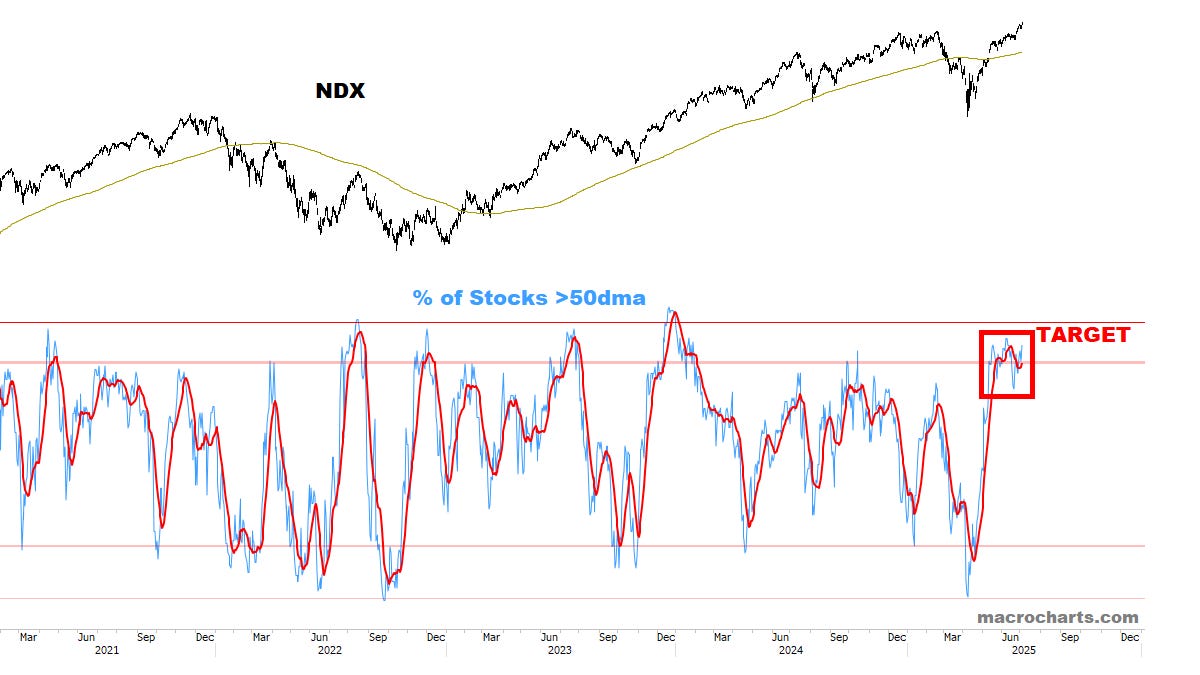

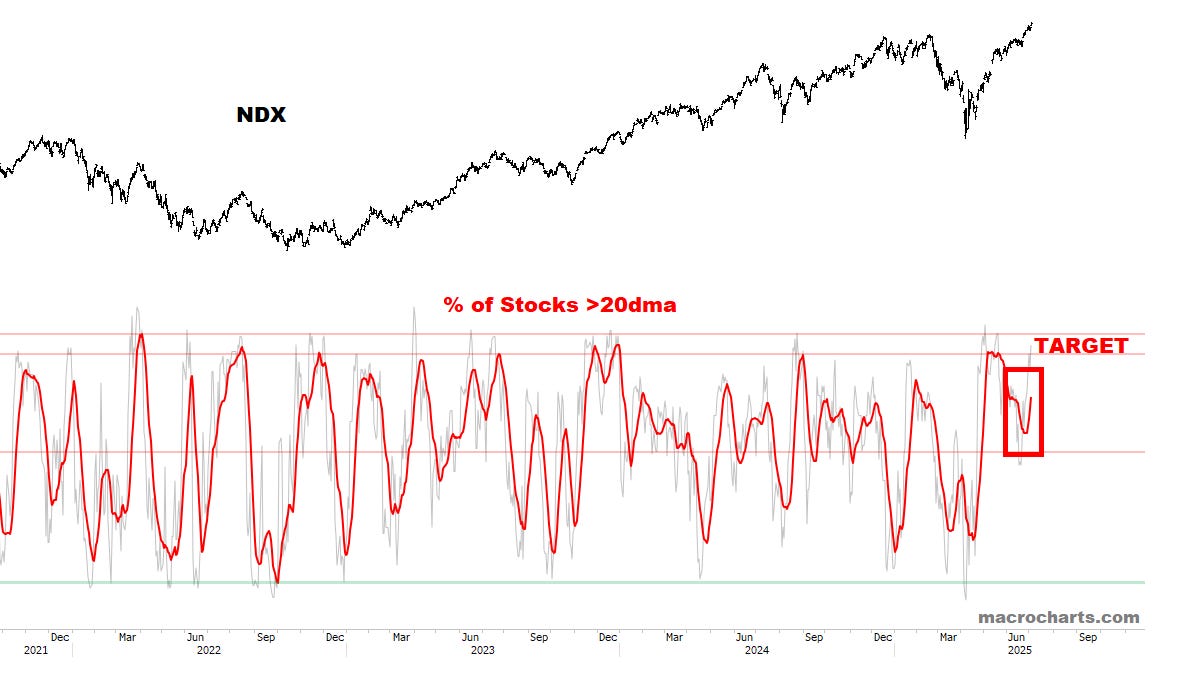

NDX is still showing significant strength — *an important bullish sign:

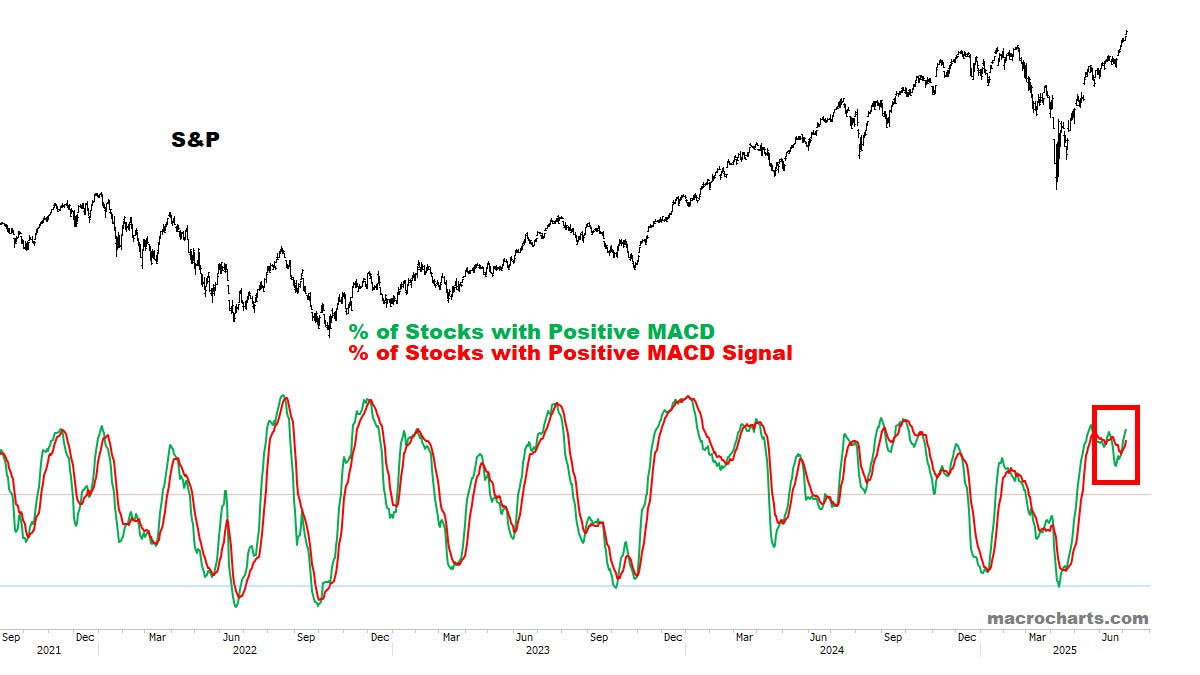

Sell Signals remain dormant — this is Bullish. Watching how it evolves:

MACD Profiles remain in full melt-up mode:

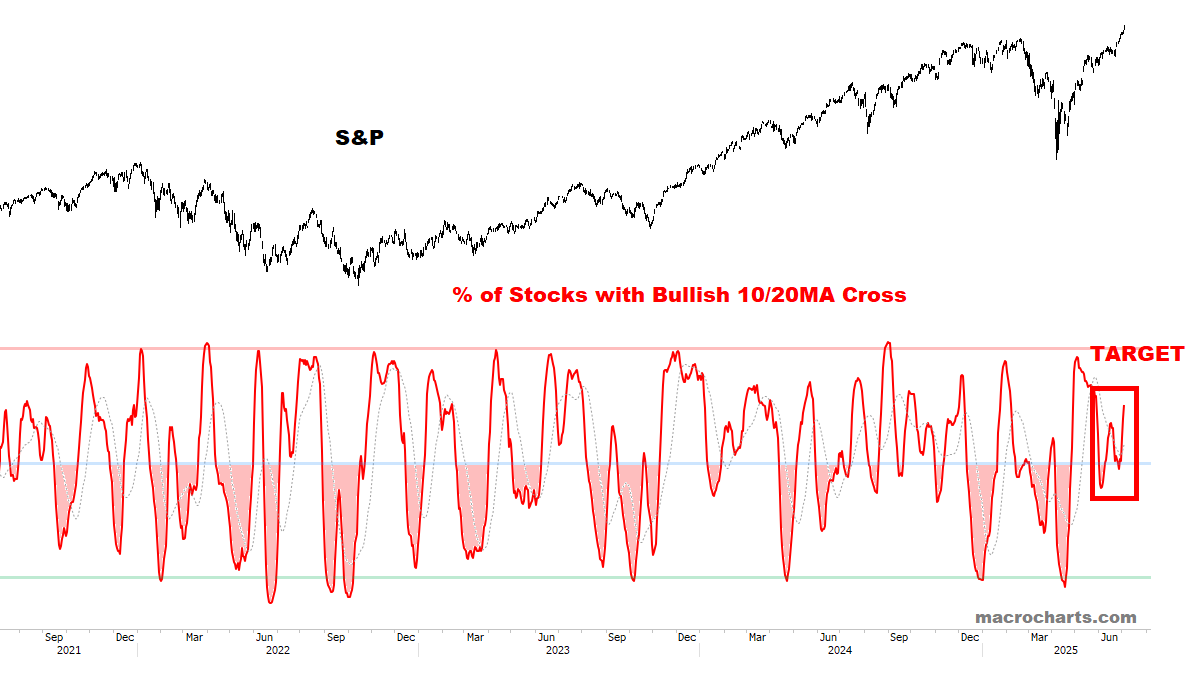

Stocks with a Bullish Cross turned UP last week. This week’s rally extension was “right on schedule” — with room to go even higher:

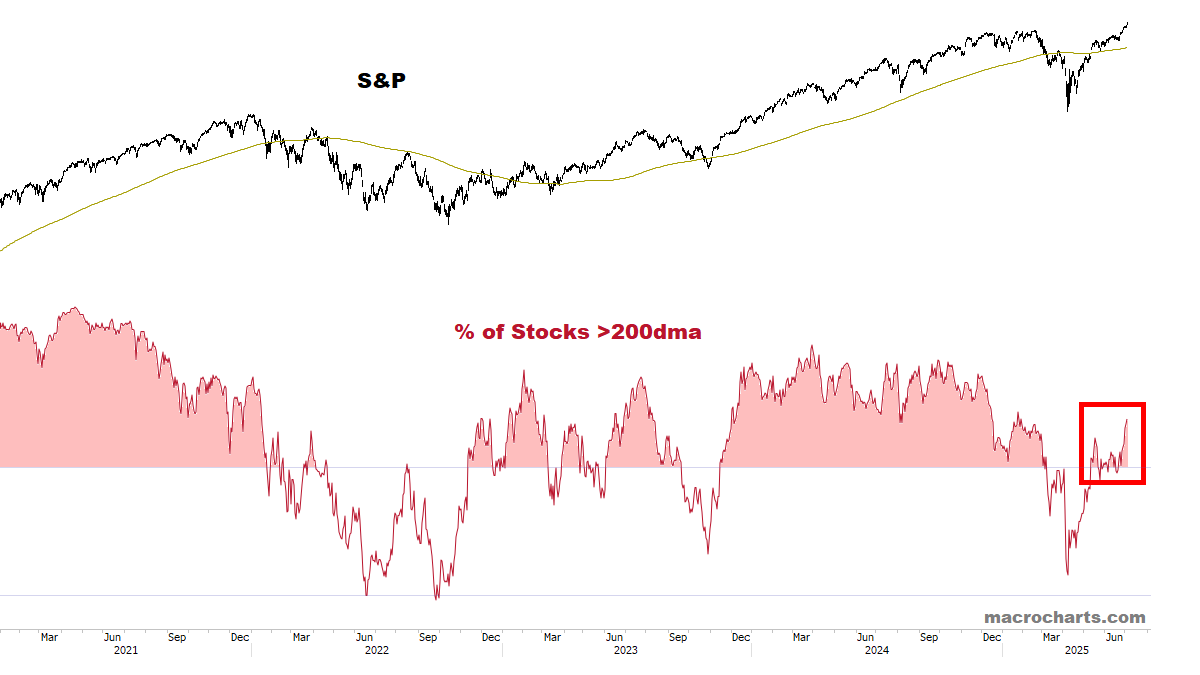

Long-term Breadth expanded healthily this week — Bull Market action:

Intermediate Breadth still has room to get overbought if a melt-up is underway:

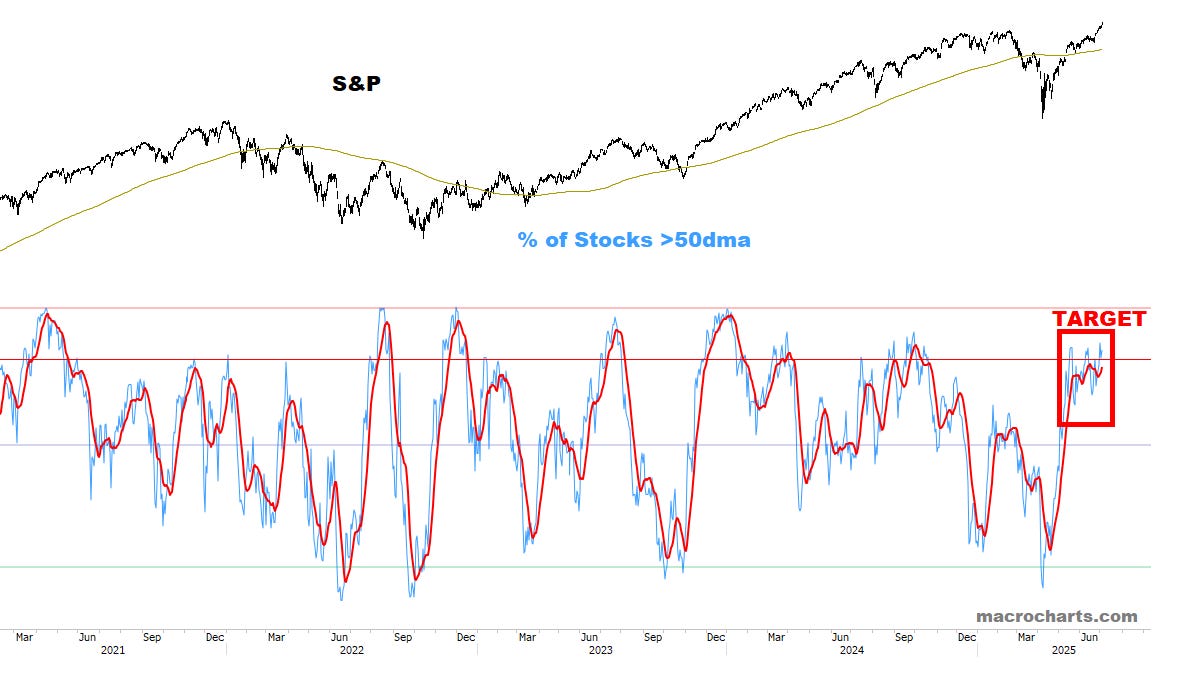

Short-Term Breadth has room to push to target range:

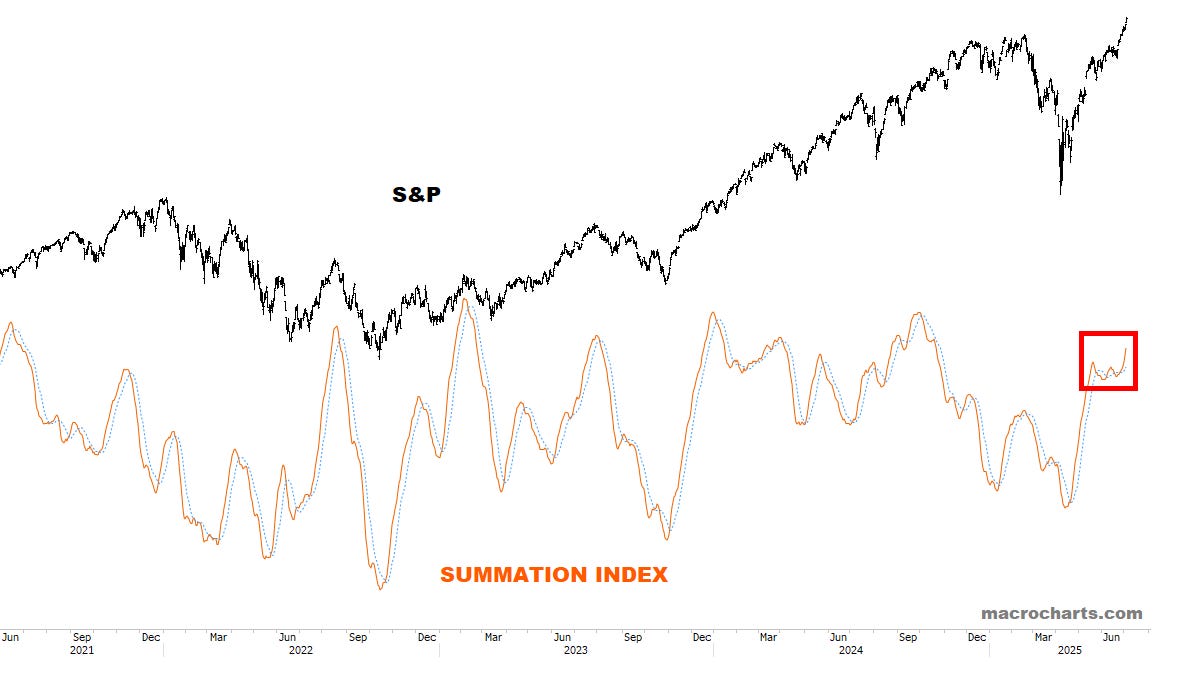

Summation Index continues to display classic melt-up behavior:

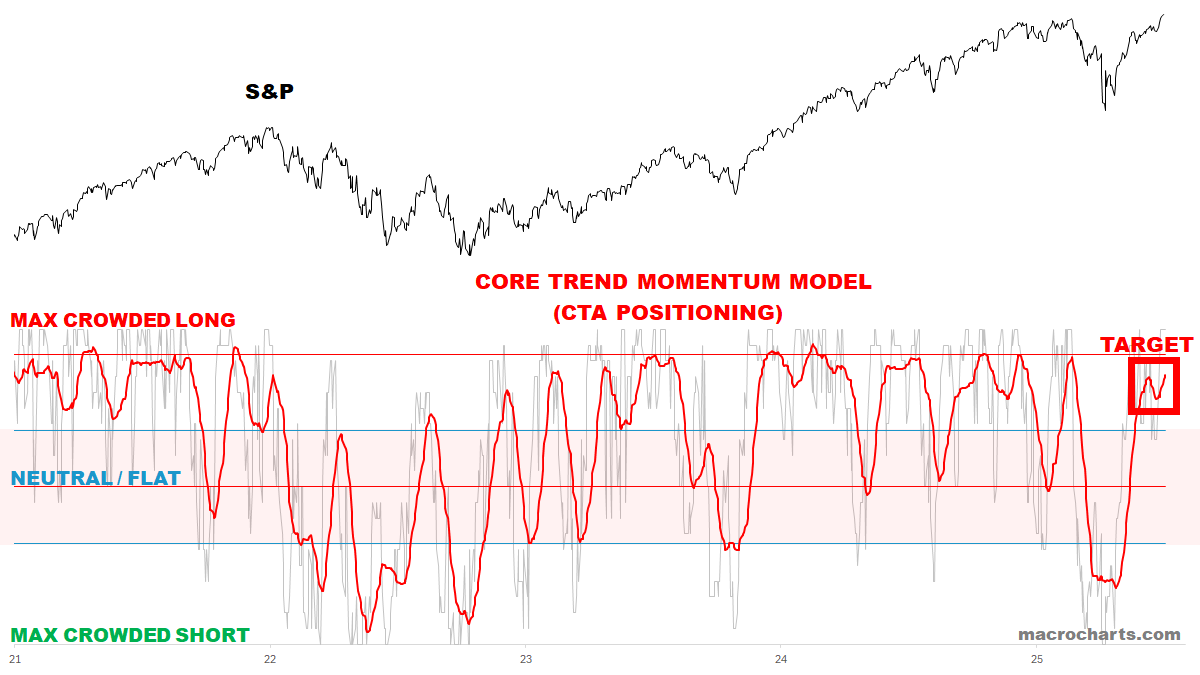

CTA Equity Trend positioning has room to get more extended:

Option Skews have room to get more extended:

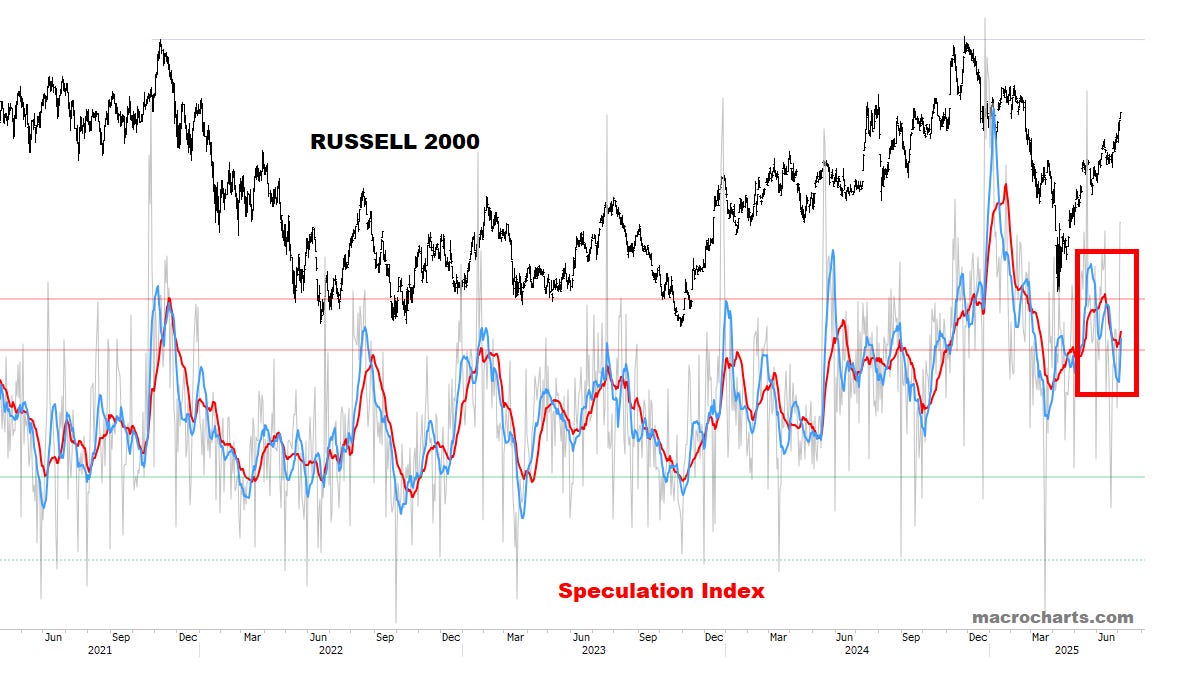

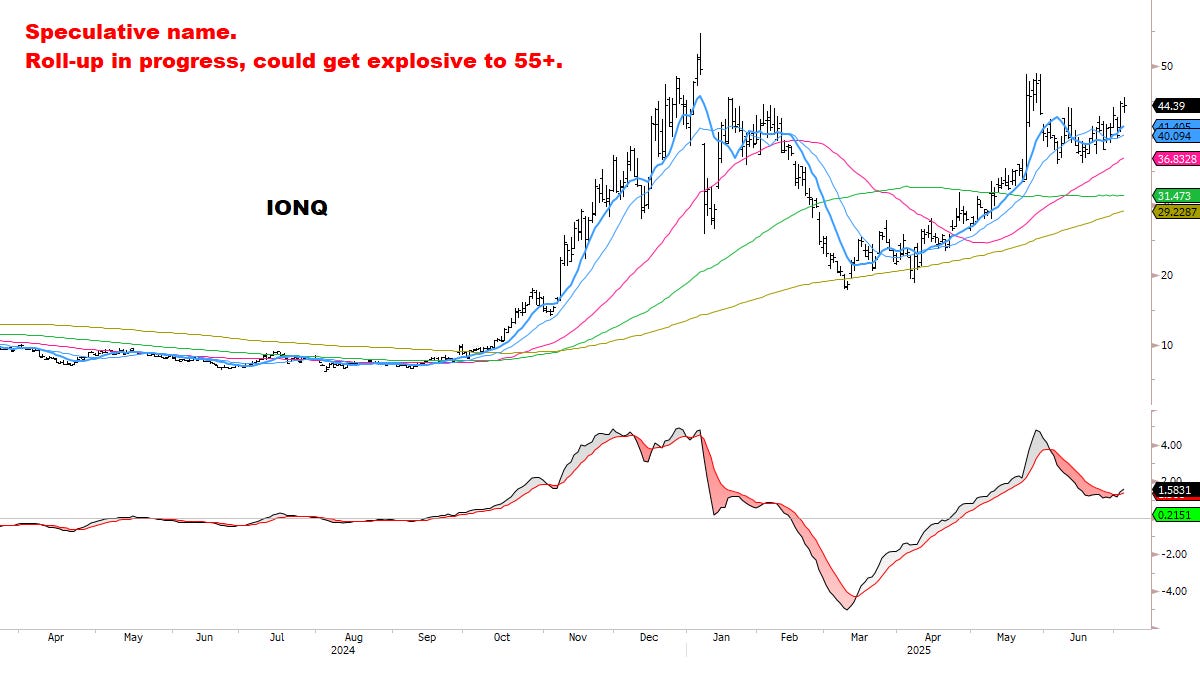

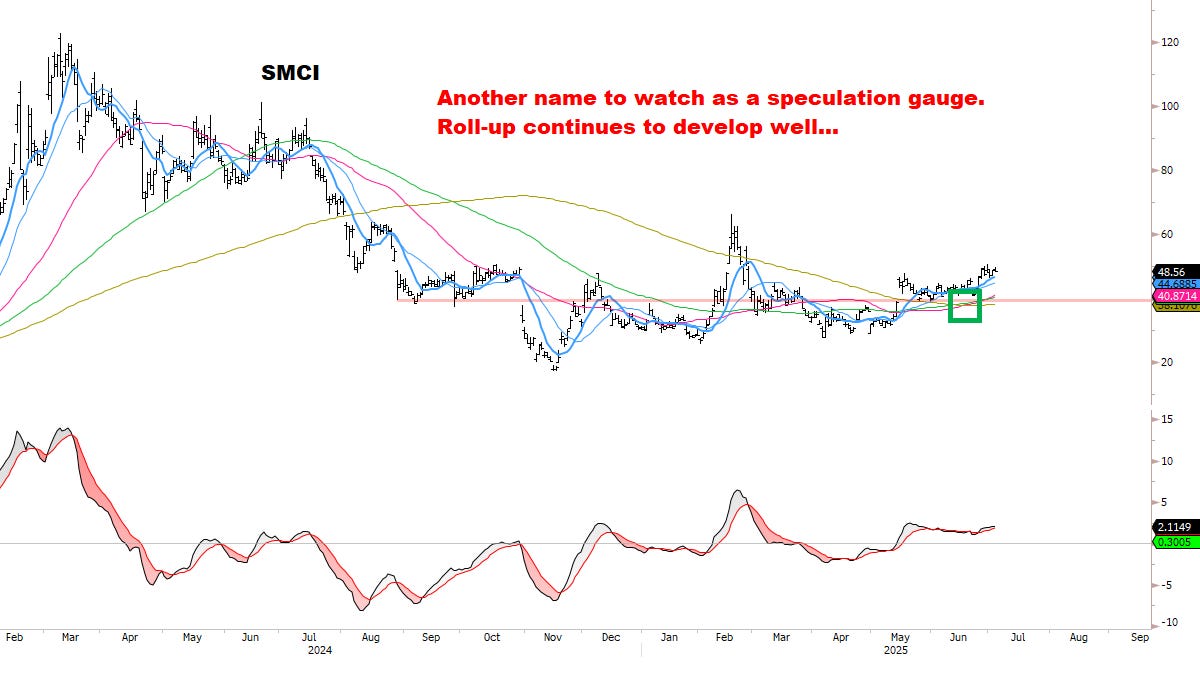

Speculation Index remains a medium-term concern — *although the Russell chart is tactically constructive (as discussed last week and confirmed with this week’s breakout), I remain focused on Large-cap Growth/Tech for now:

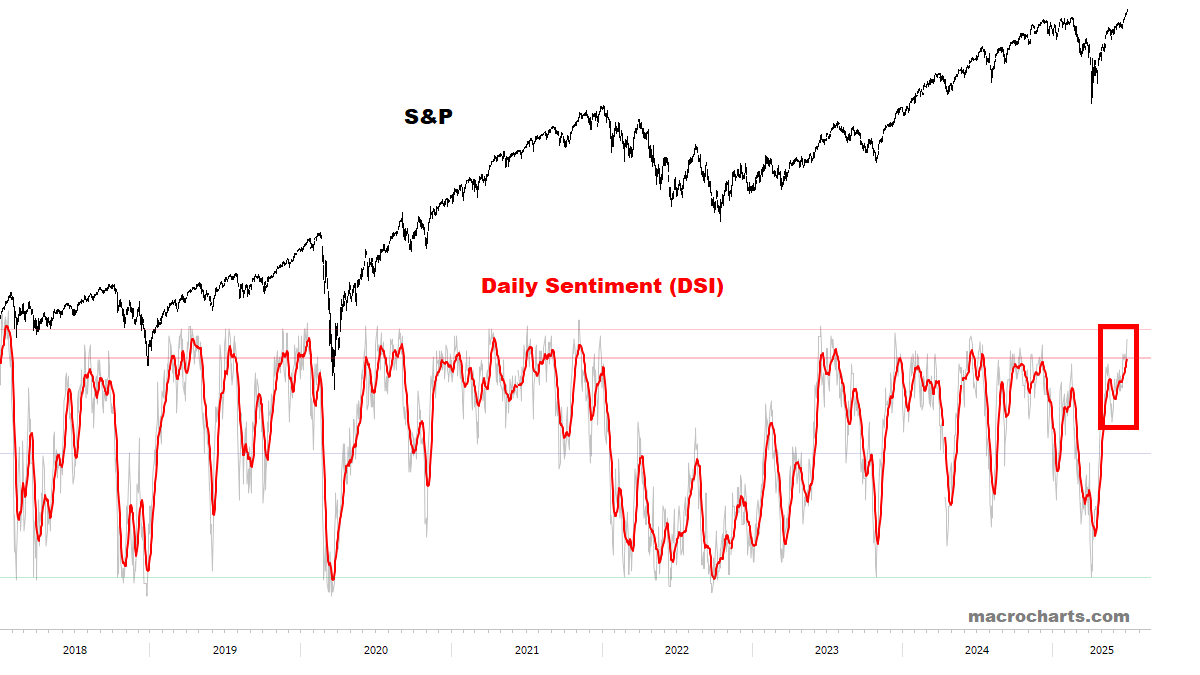

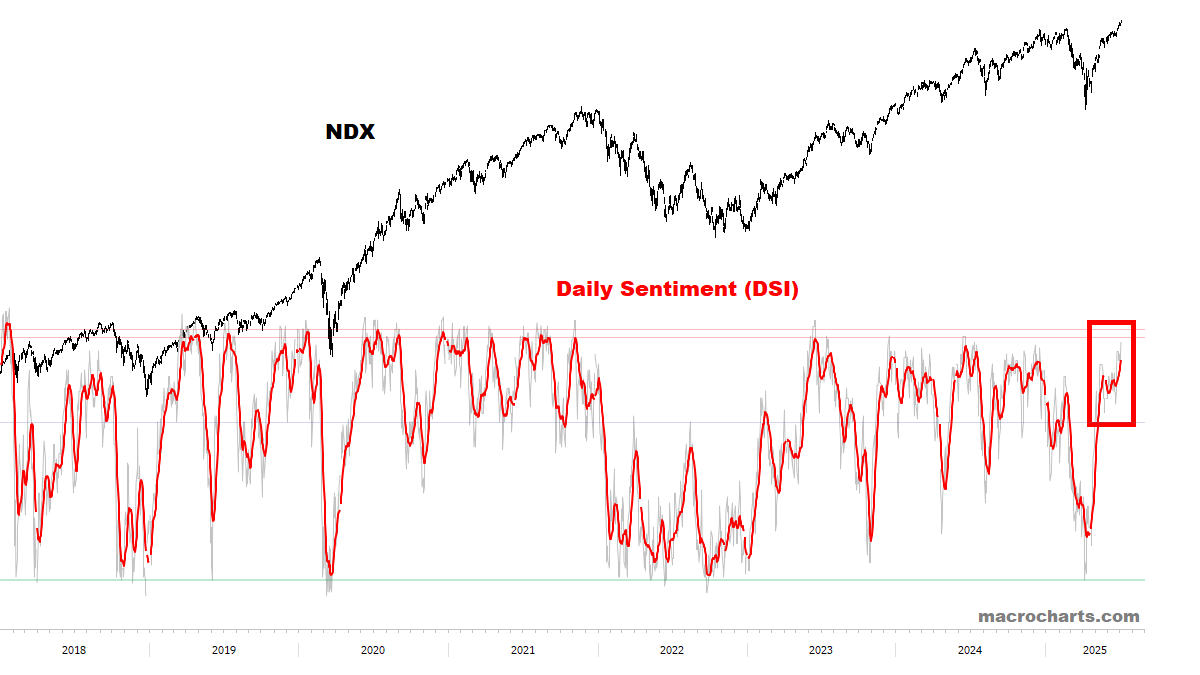

Equity Sentiment can spike higher if a melt-up is unfolding:

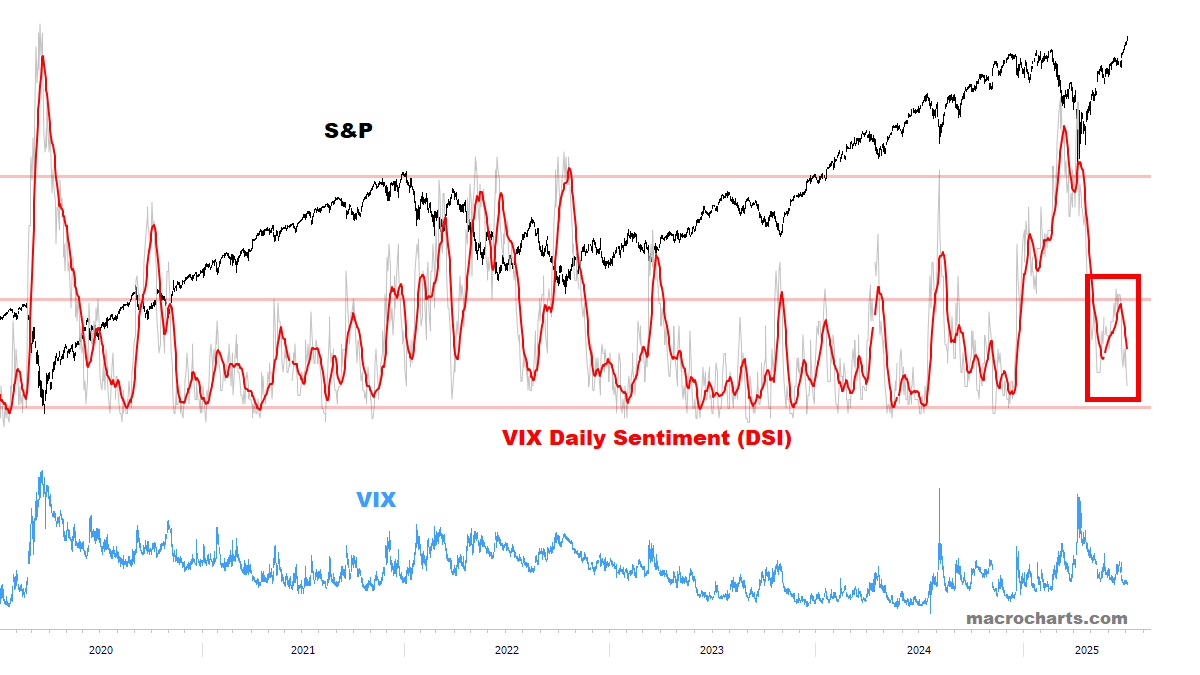

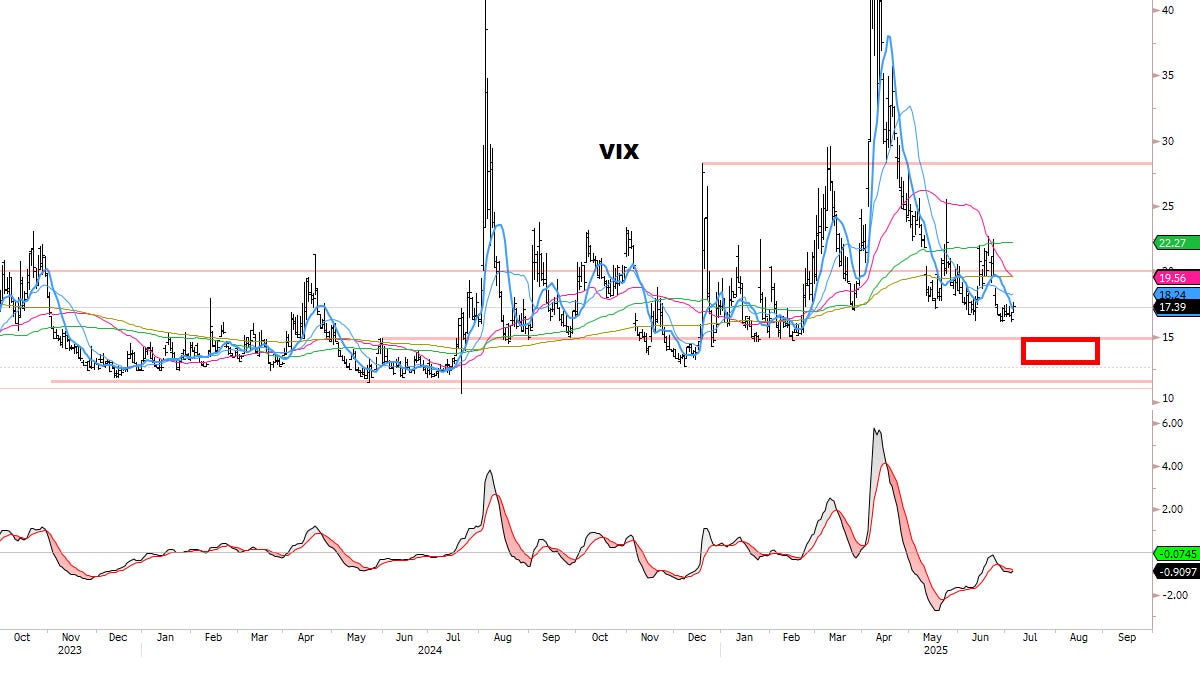

VIX Sentiment is finally on track to our ideal targets (*lower still):

VIX still has room to our lower target range for the summer:

DOLLAR

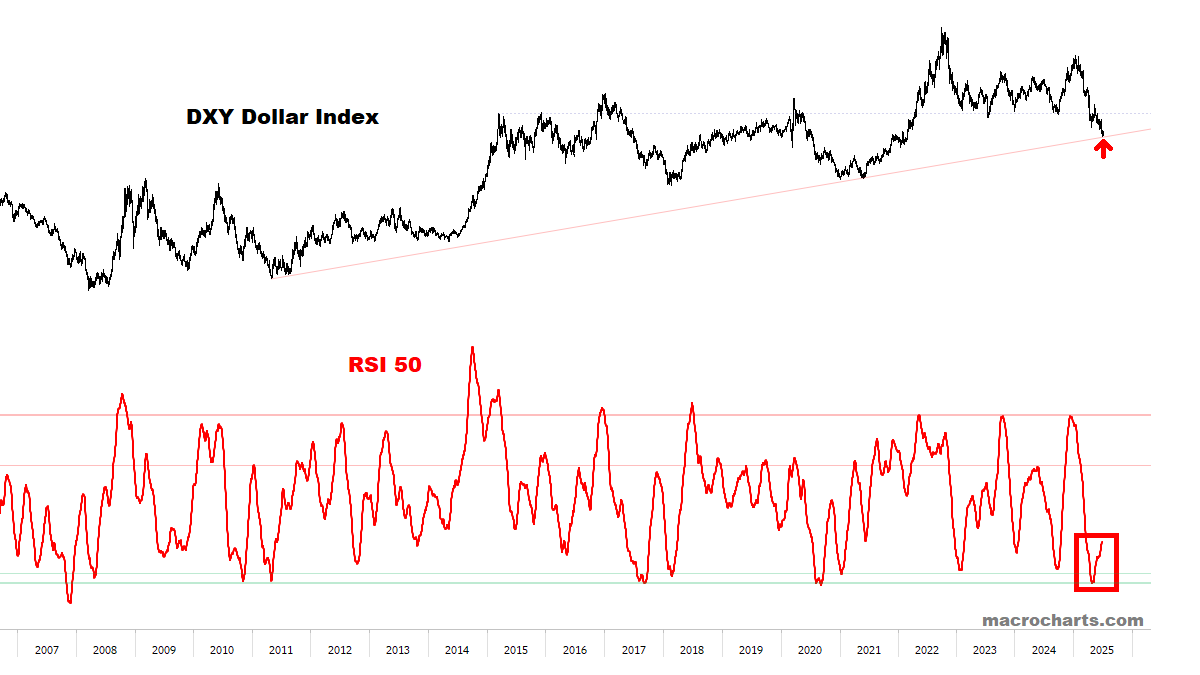

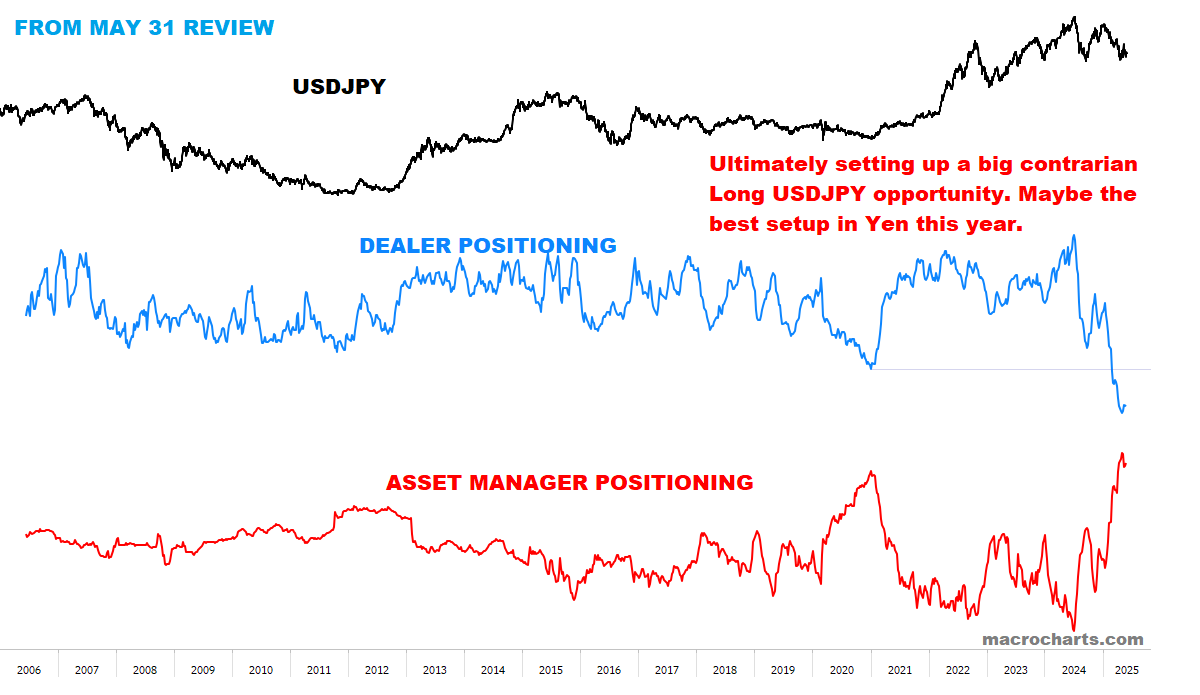

The Buck stops here…?

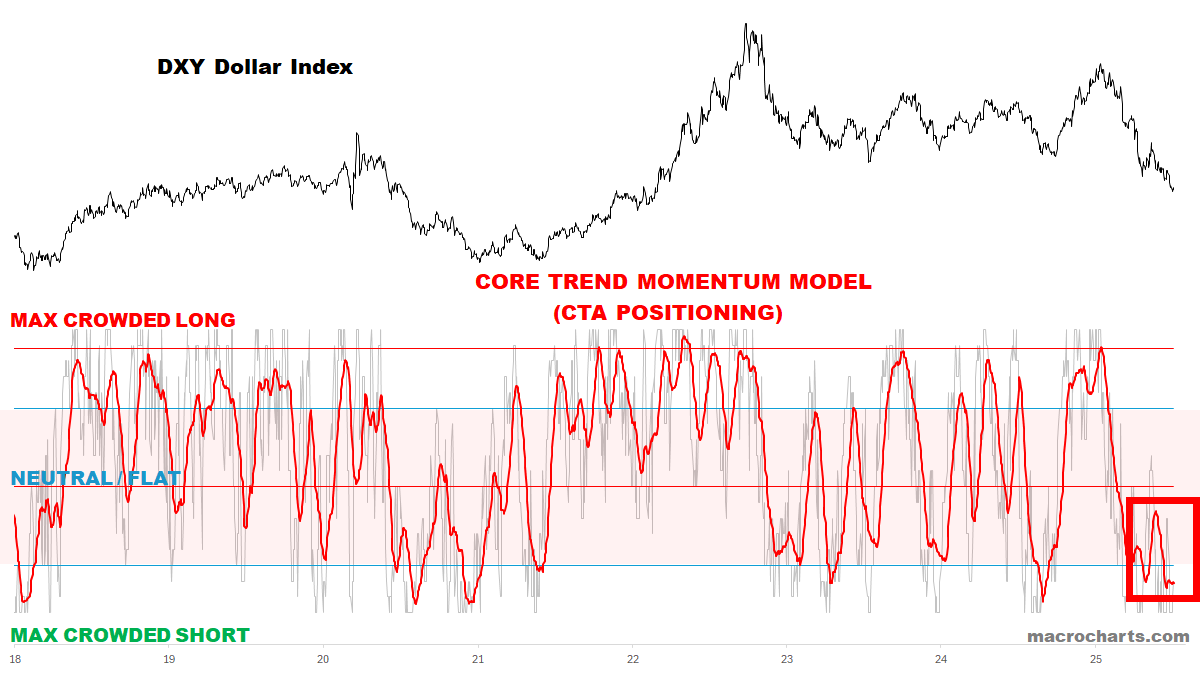

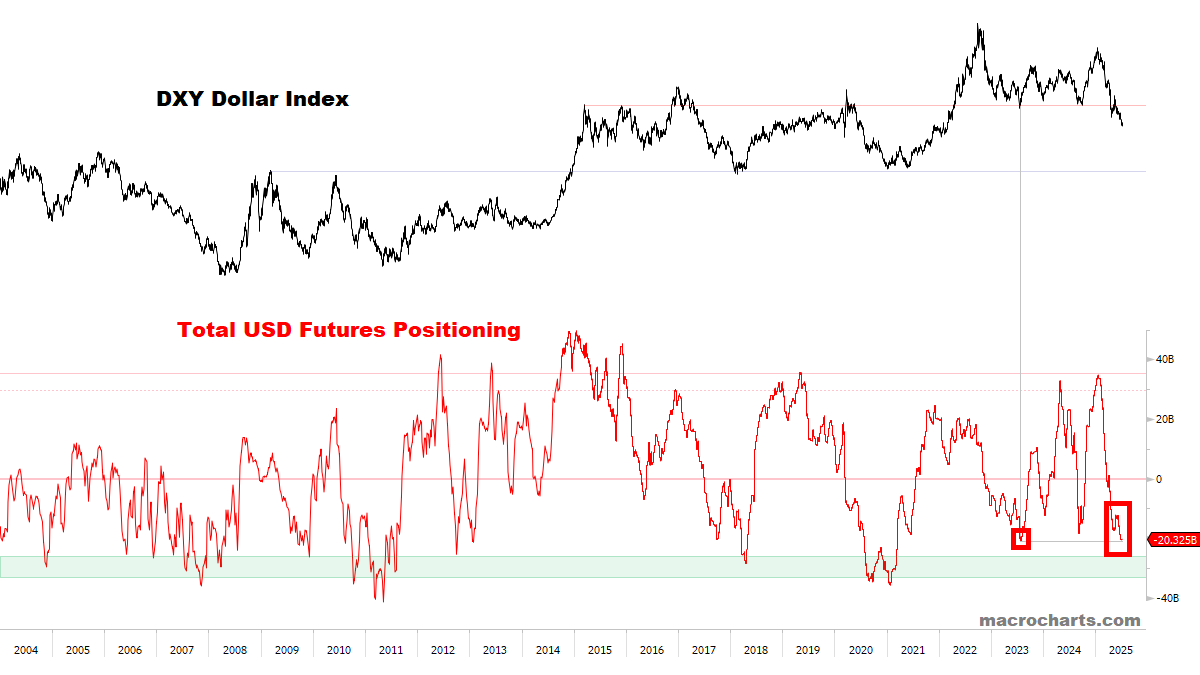

CTA Dollar Trend positioning is in bottoming range — *monitoring for a turn UP*:

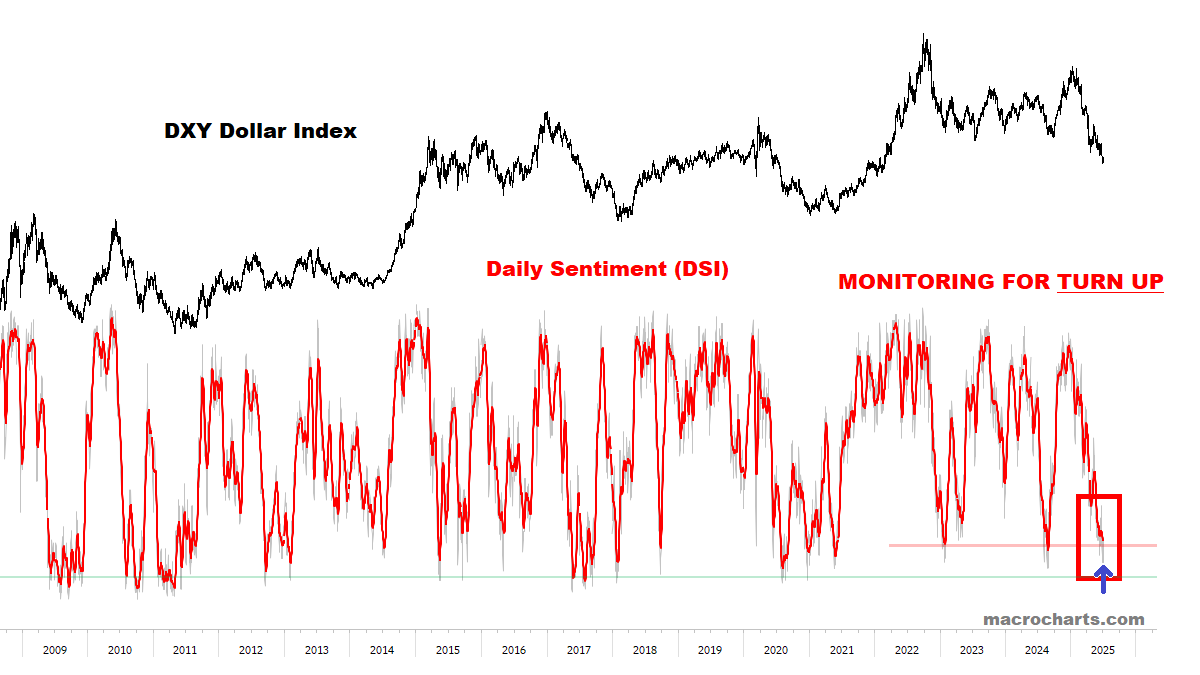

Dollar Sentiment is in full capitulation — *monitoring for a turn UP*:

Dollar Net Short Positioning is tied with the JULY 2023 bottom (*data will be updated next week due to holiday):

Big picture, the Dollar has significant room to recover:

BONDS

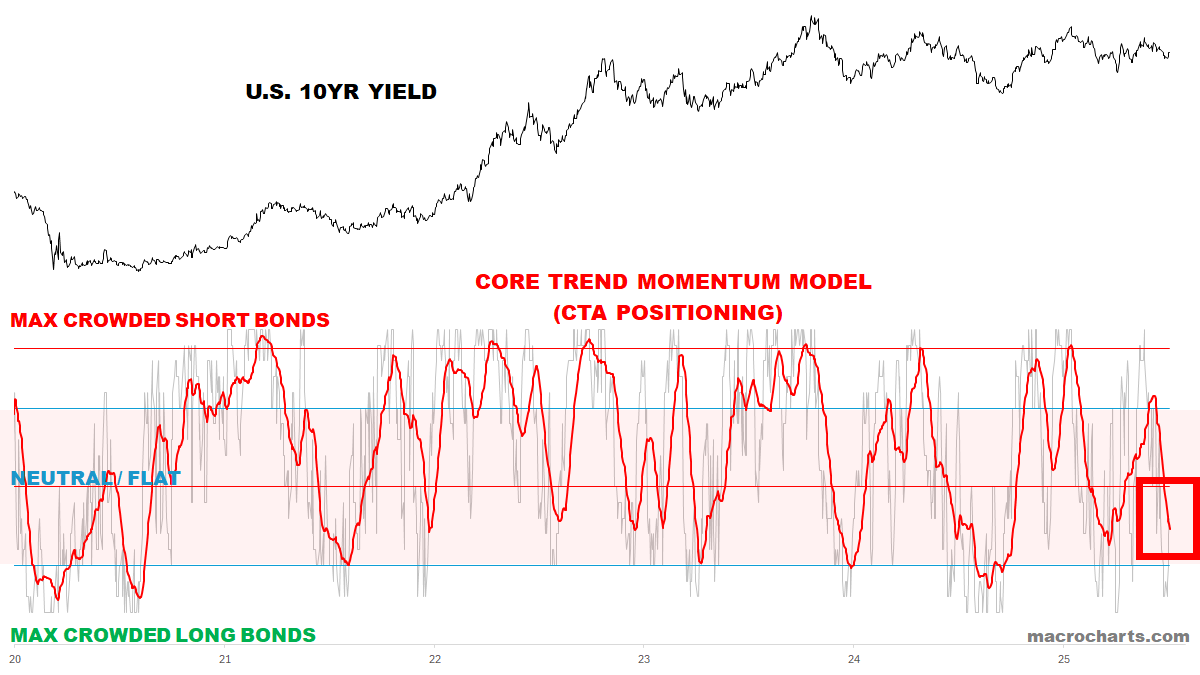

CTA Rates Trend positioning has room to reach the bottoming range:

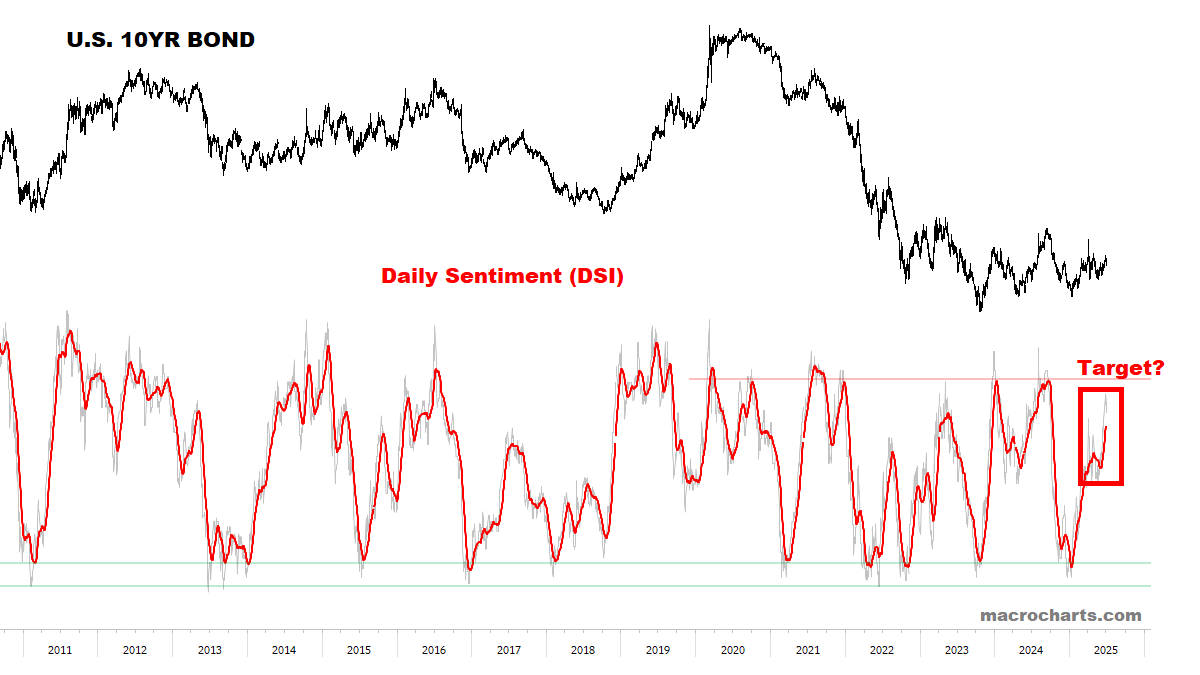

Bond Sentiment is trending higher and could still push to overbought:

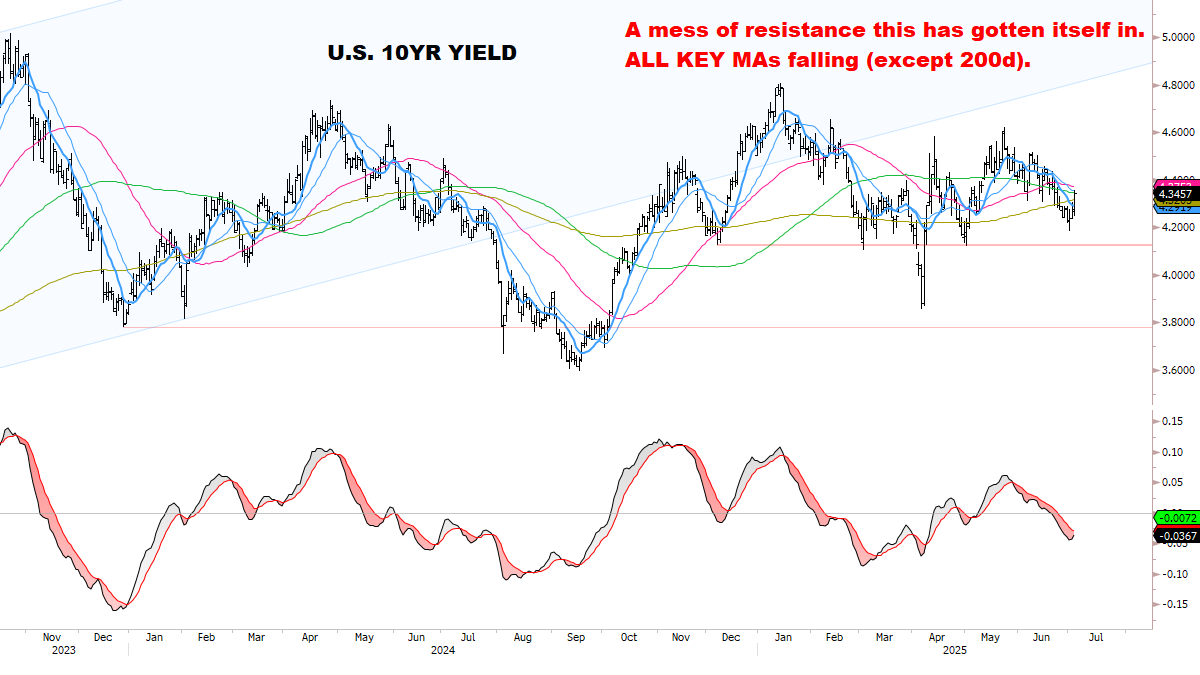

Bond Yields have bounced to ideal resistance and should fail / turn down here.

**Whichever way this resolves, the next move is likely to be a big one.**

From Wednesday’s update: “As discussed in the Weekly Review, would like to see yields bounce a bit in the very near term, which could set up an initial Long position. Watching 2s around 3.88, 10s around 4.35, 30s around 4.90. Last but certainly not least... the 50dma on 30YR Yield is starting to roll down, and has my strong attention.”

2YR closed at 3.8799 vs. my 3.88 level (a perfect hit) — *watching for the next signal*:

10YR closed at 4.3457 vs. my 4.35 level (a perfect hit) — *watching for the next signal*:

30YR closed at 4.86 vs. my 4.90 level— *watching for the next signal*:

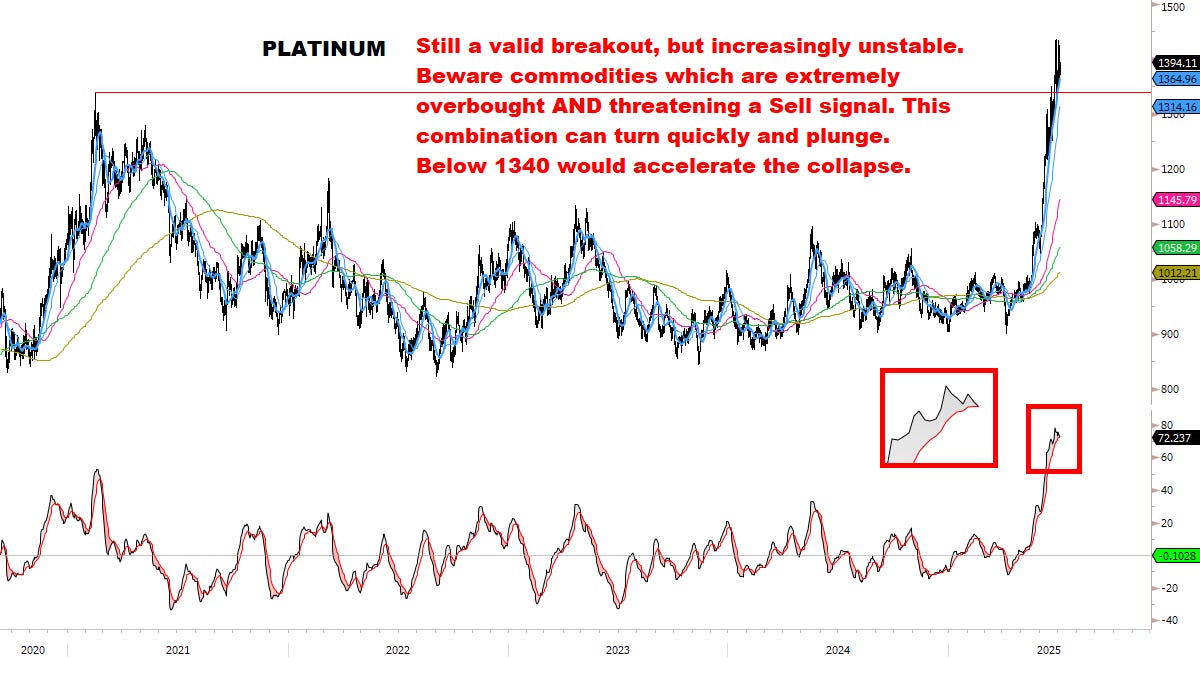

PRECIOUS METALS

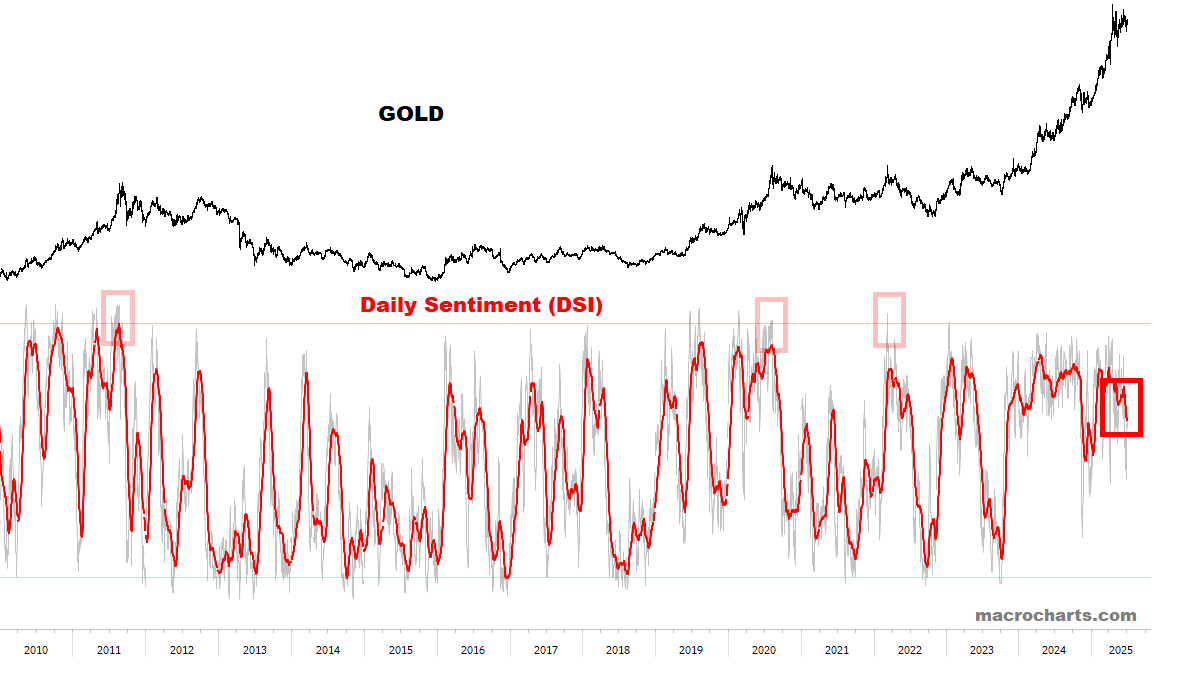

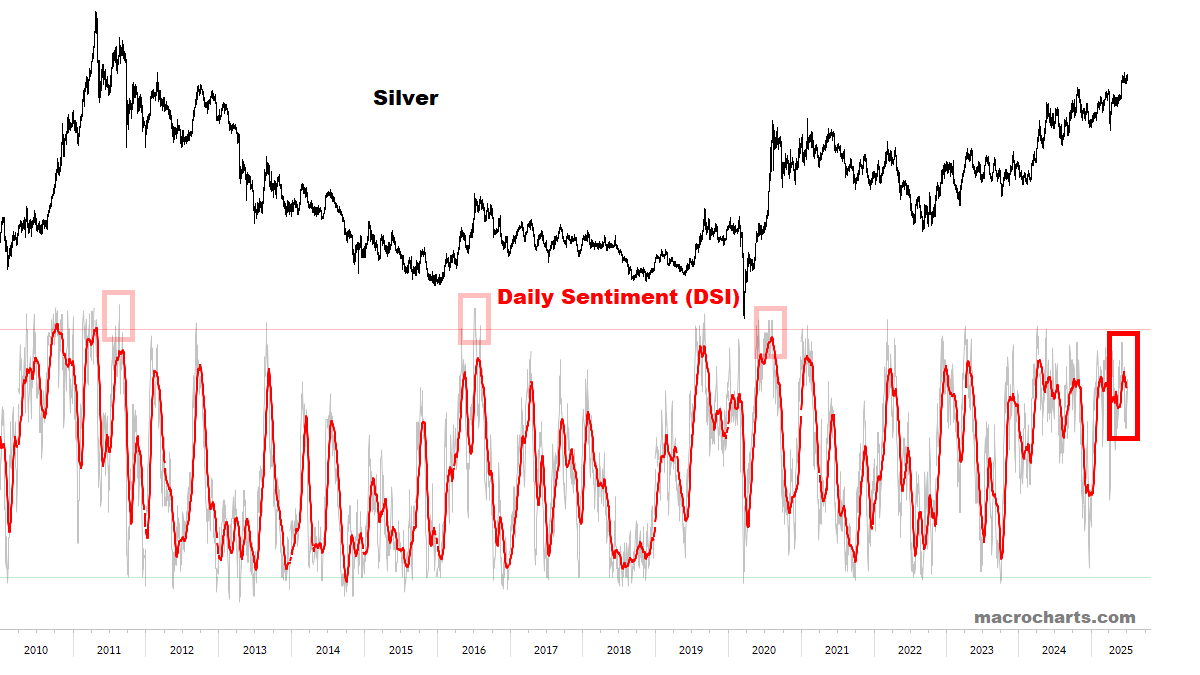

Risking a Top. What do they know?

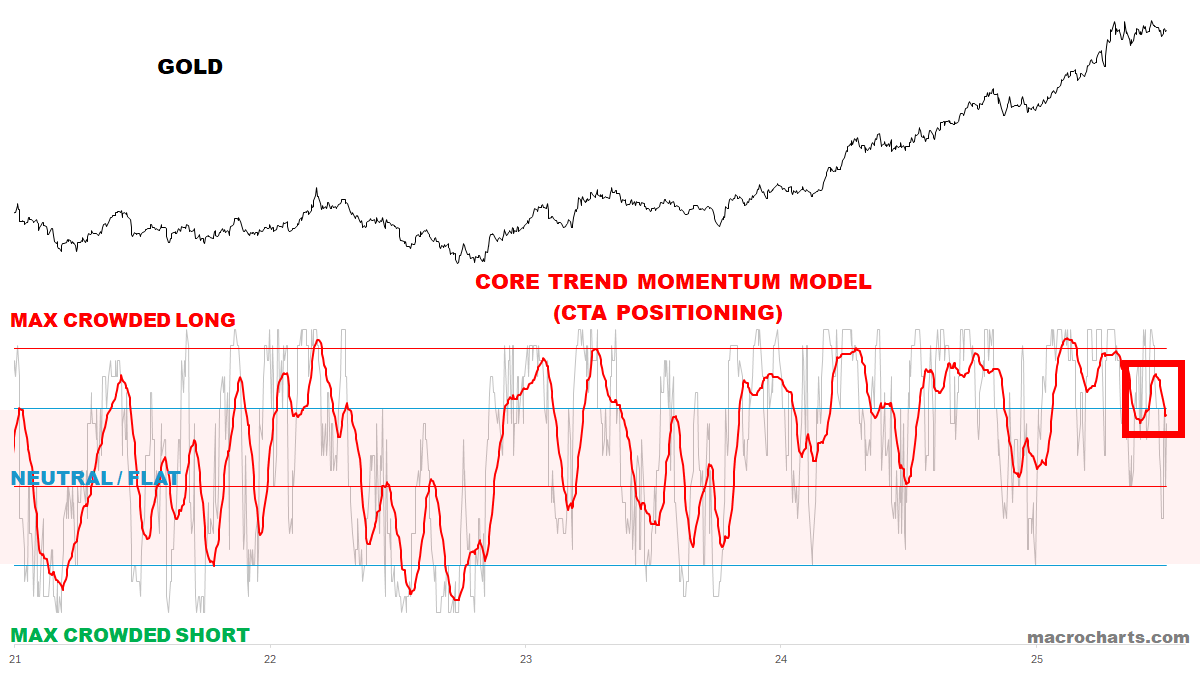

CTA Gold Trend positioning looks vulnerable:

Gold remains on a Weekly Sell — despite the Dollar trading at three-year lows. *What does Gold know?

Precious Metals Sentiment never got extreme but may have turned:

What do Precious Metals know?

Is the Dollar bottoming?

KEY TECHNICAL CHARTS

A QUALITATIVE ASSESSMENT (CONTINUED)

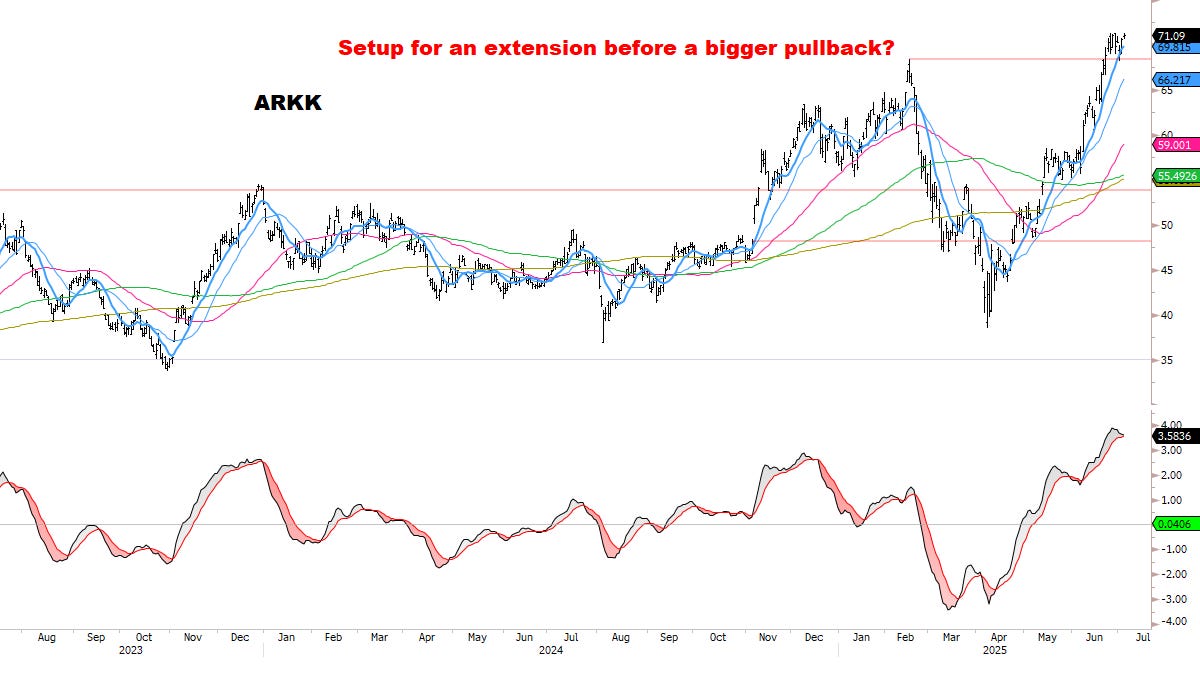

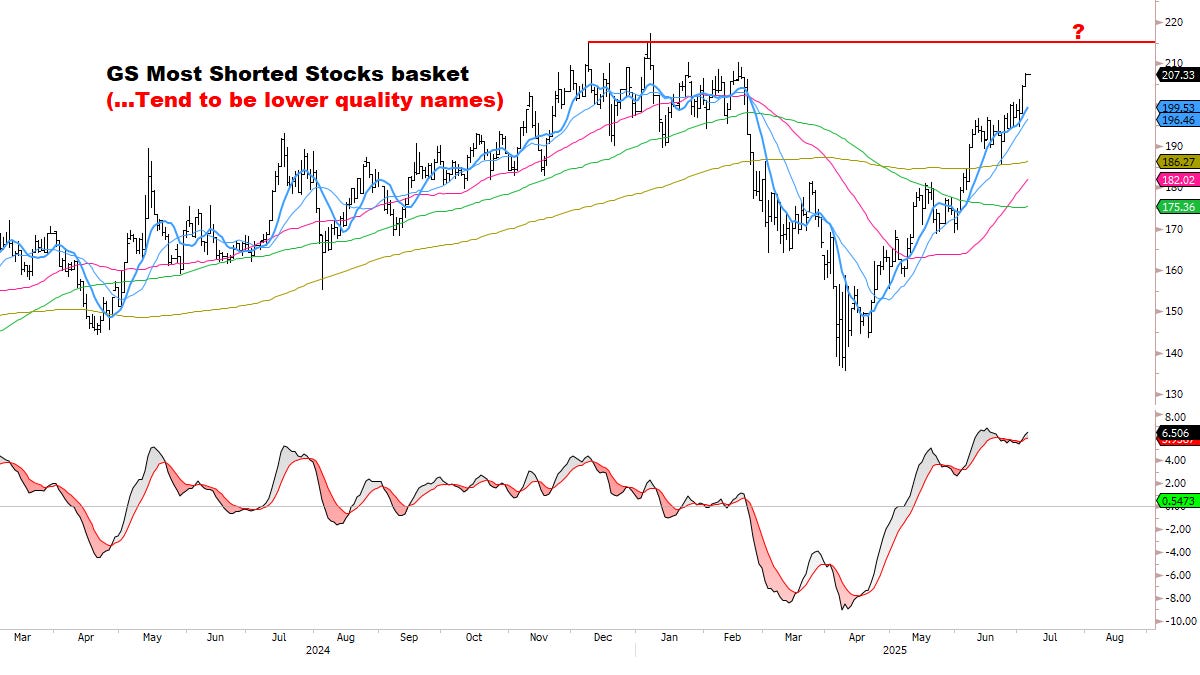

On April 30 in “What’s Next For Stocks?”, I wrote:

Inevitably, at some point in every rally, the wall of worry finally crumbles and even the garbage gets bought.

This extreme risk-seeking behavior is fueled by two forces: performance-chasing, and general FOMO taking over.

Looking around today, quantitatively and qualitatively I don’t think we’re quite there yet. I also think it will be a much different market picture in a few weeks’ time.

Are we there yet? I still don’t think so.

Things could get more extreme:

Let the market run its course:

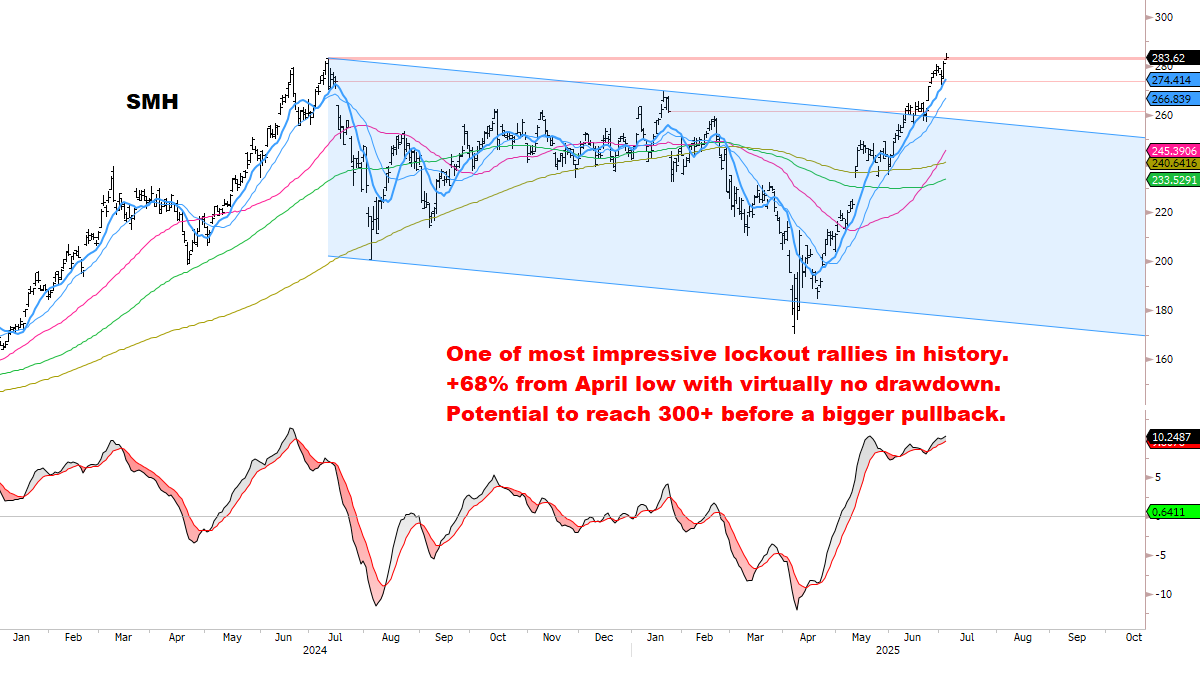

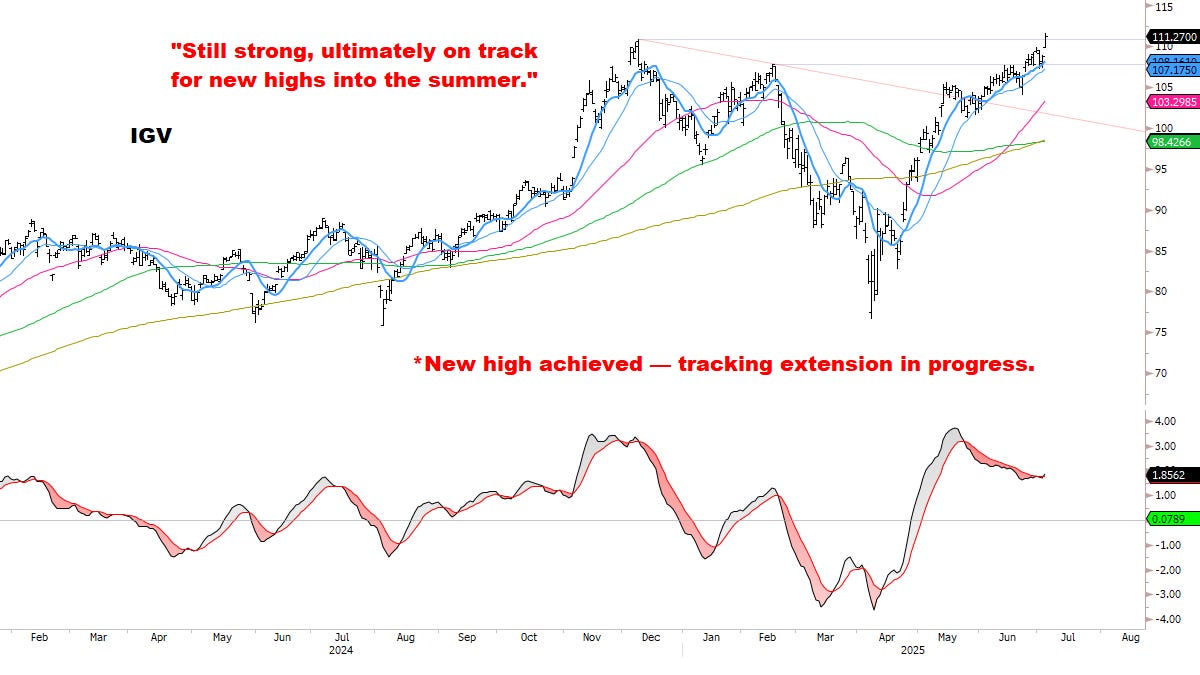

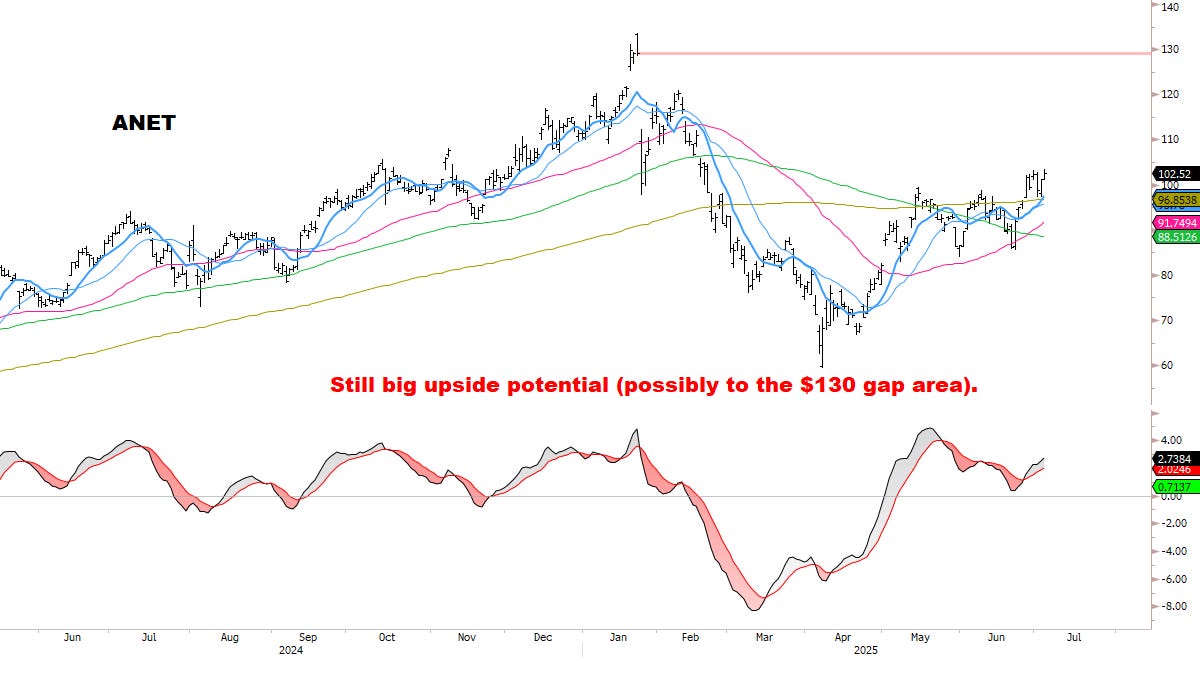

All key Sectors & Groups remain in good chart position: especially the leaders in Semis, Tech, Communication Services, and Software.

Difficult to build a top while these leading areas continue to carry the market AND are moving in synch.

Uptrends remain intact, with no bearish reversals in any major Index.

VIX and Credit Spreads continue trending DOWN.

Max pain scenario remains: low-volatility summer grind to new highs (now in full force).

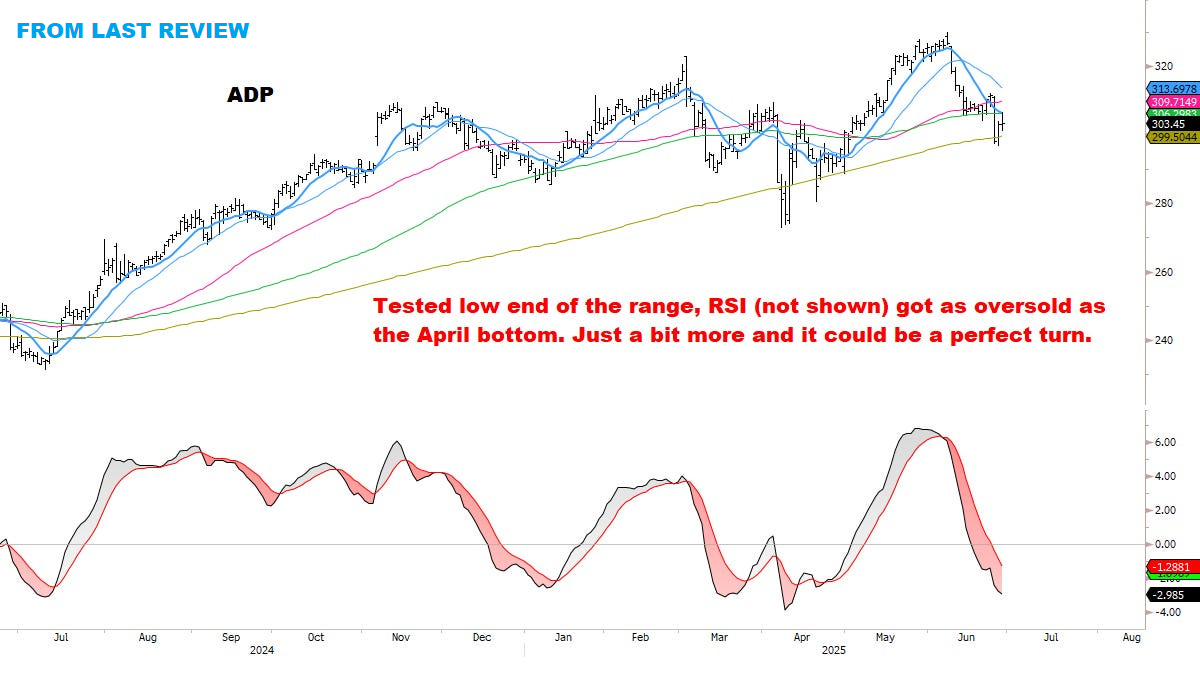

Updated Stocks Scan:

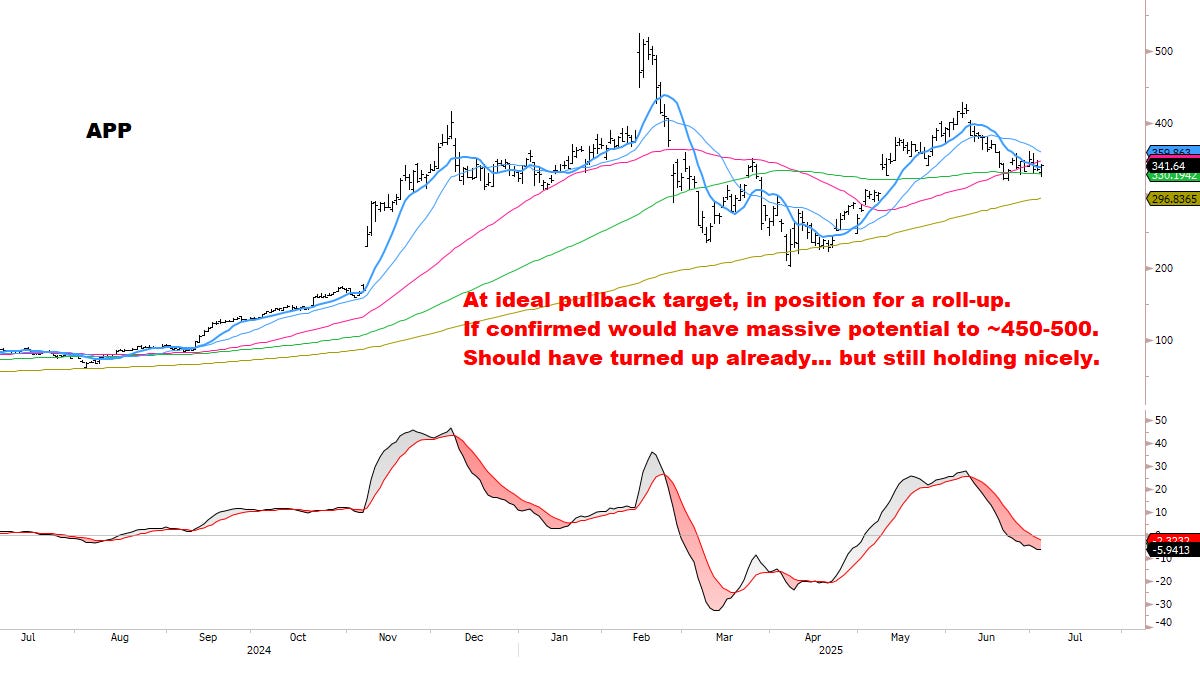

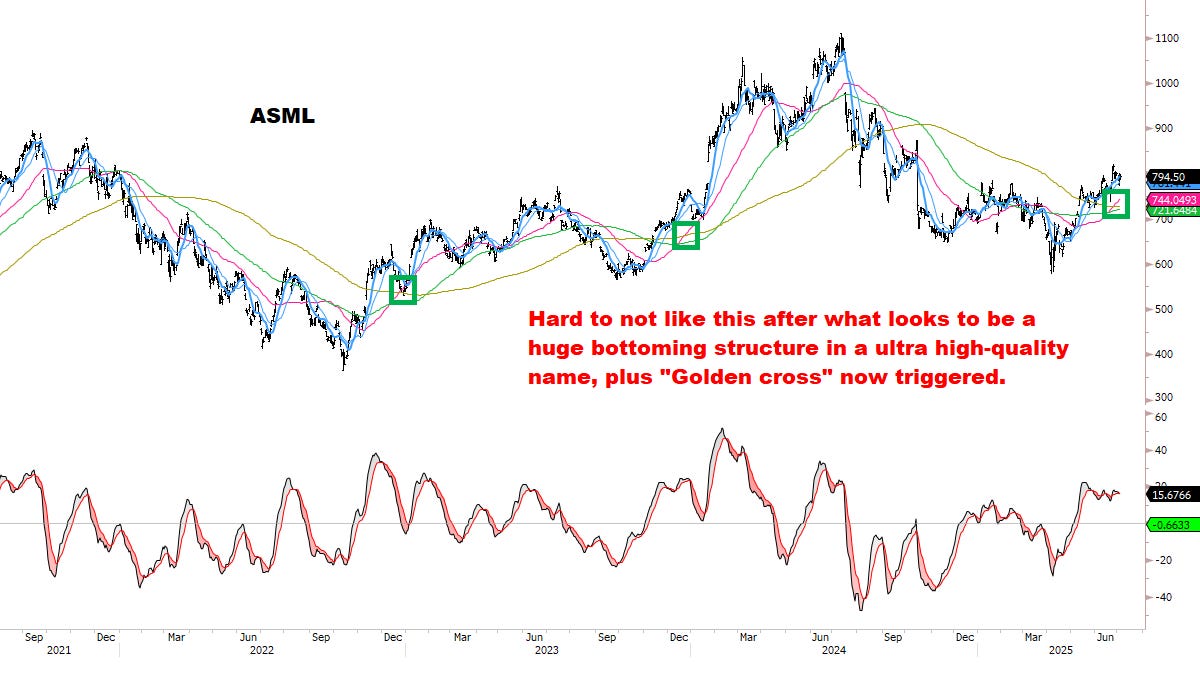

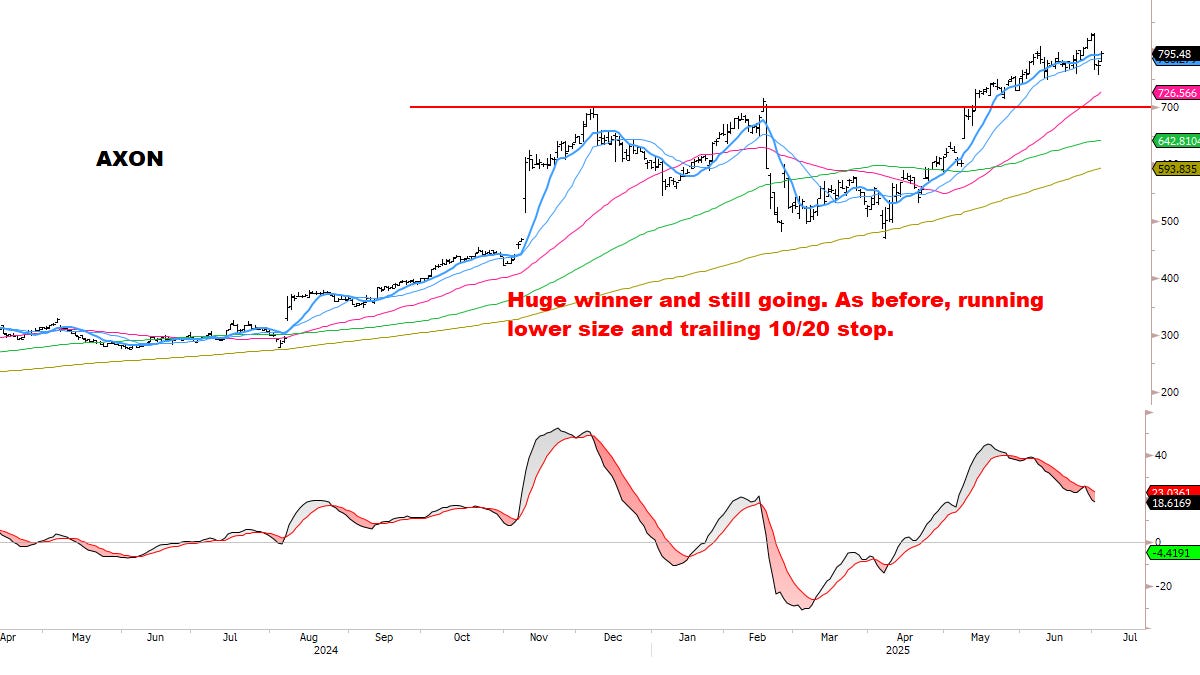

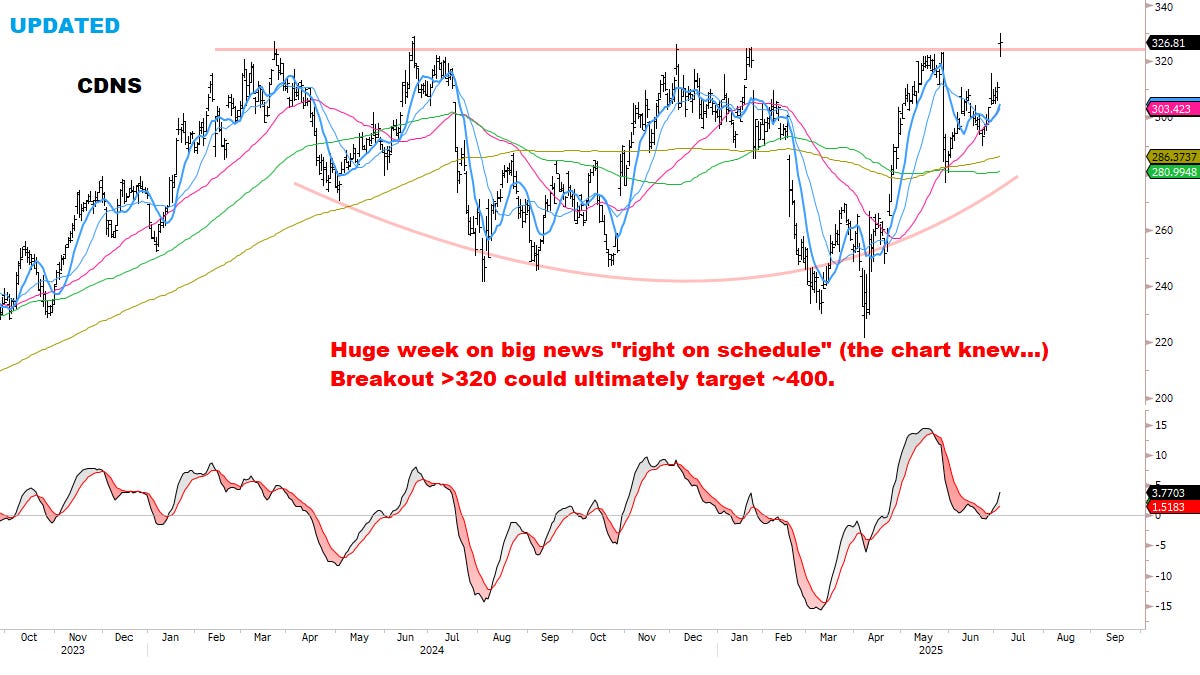

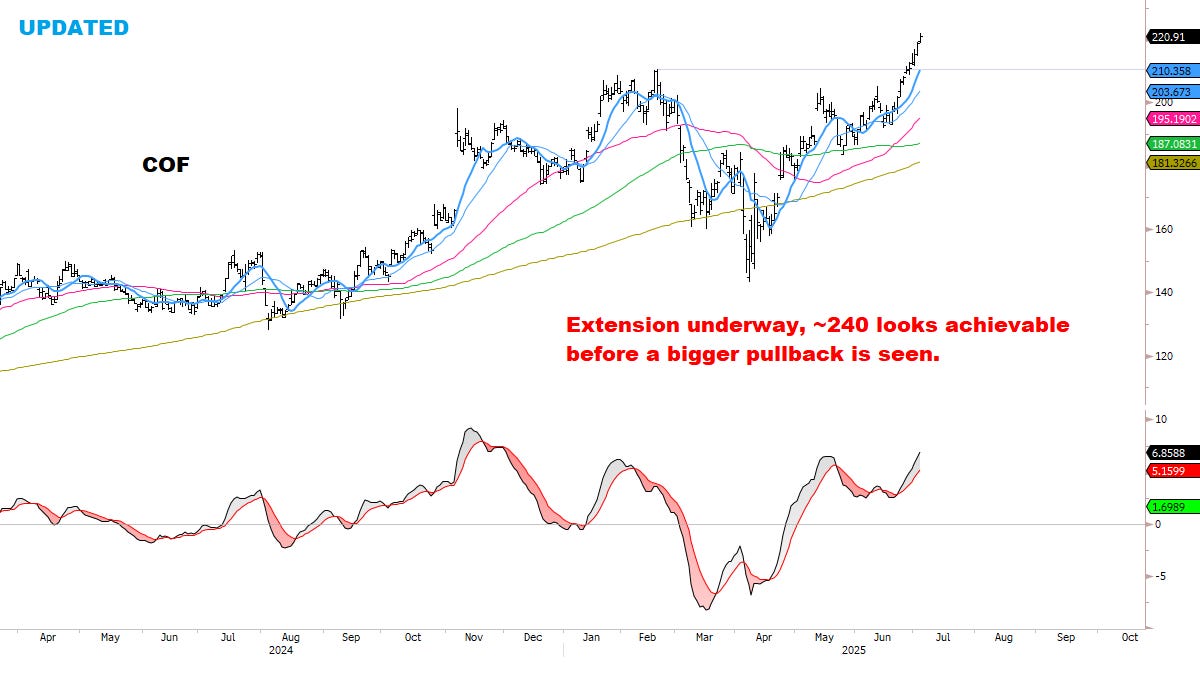

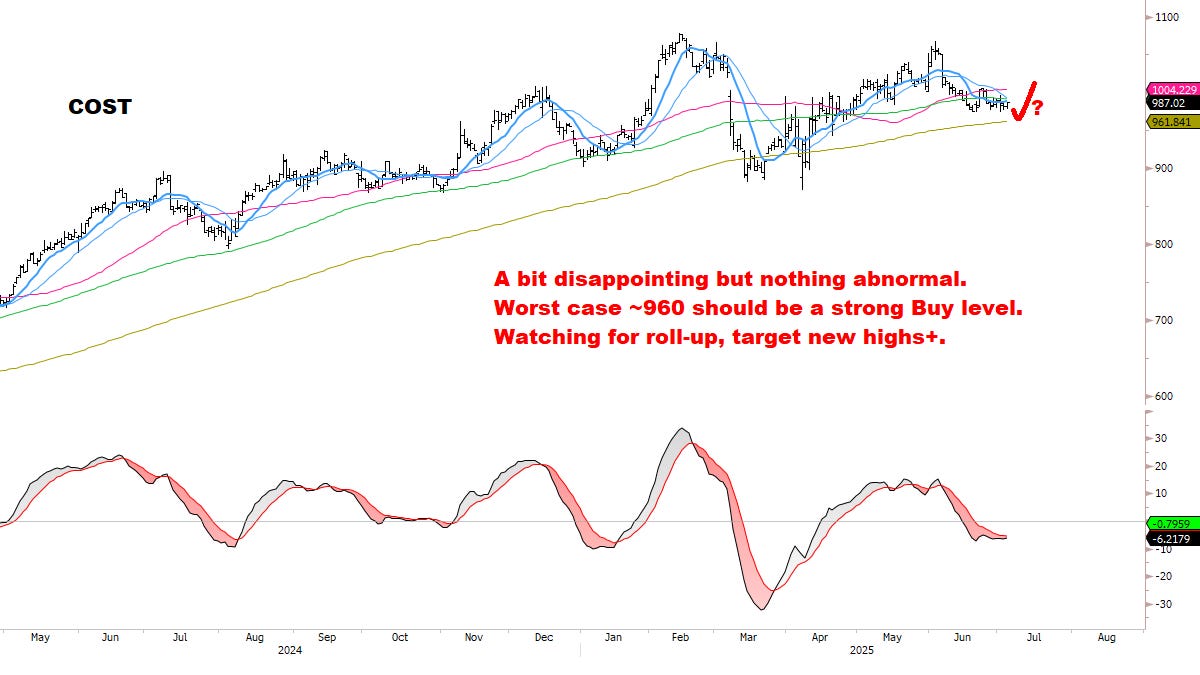

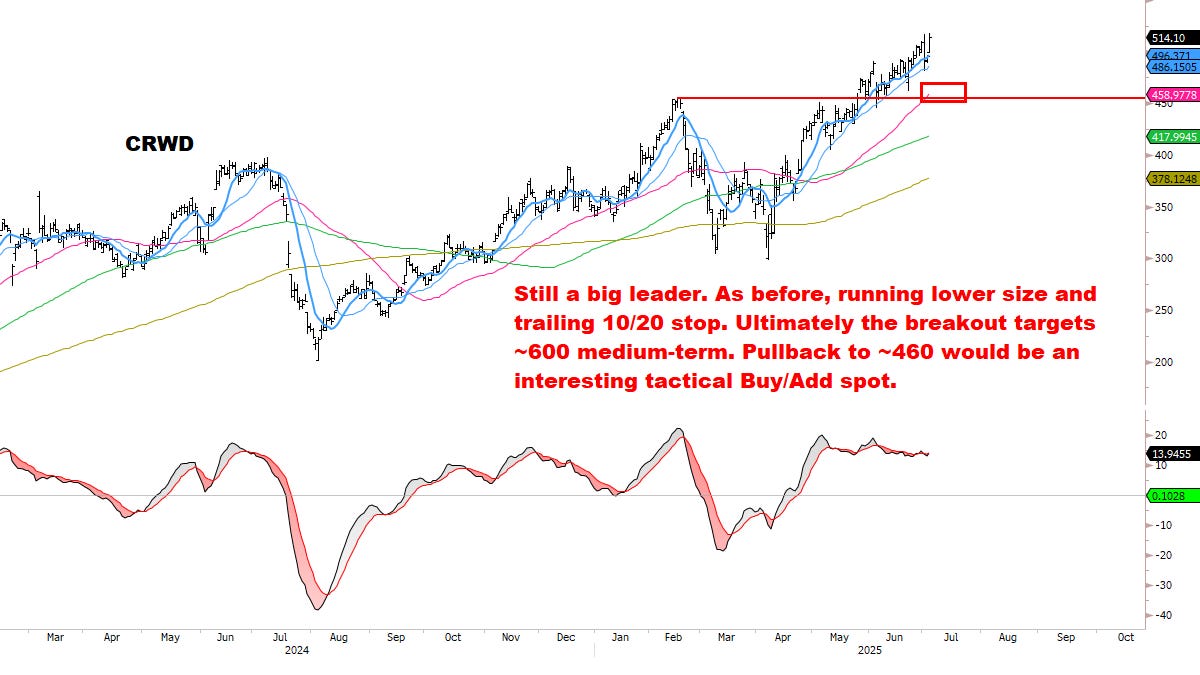

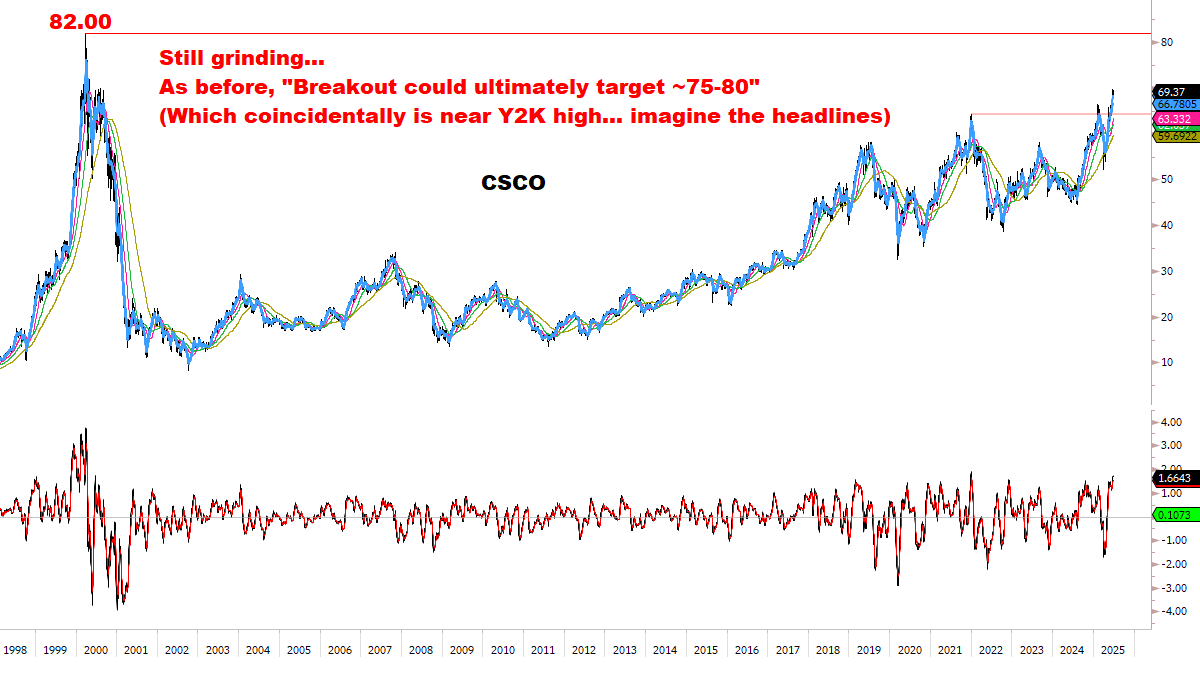

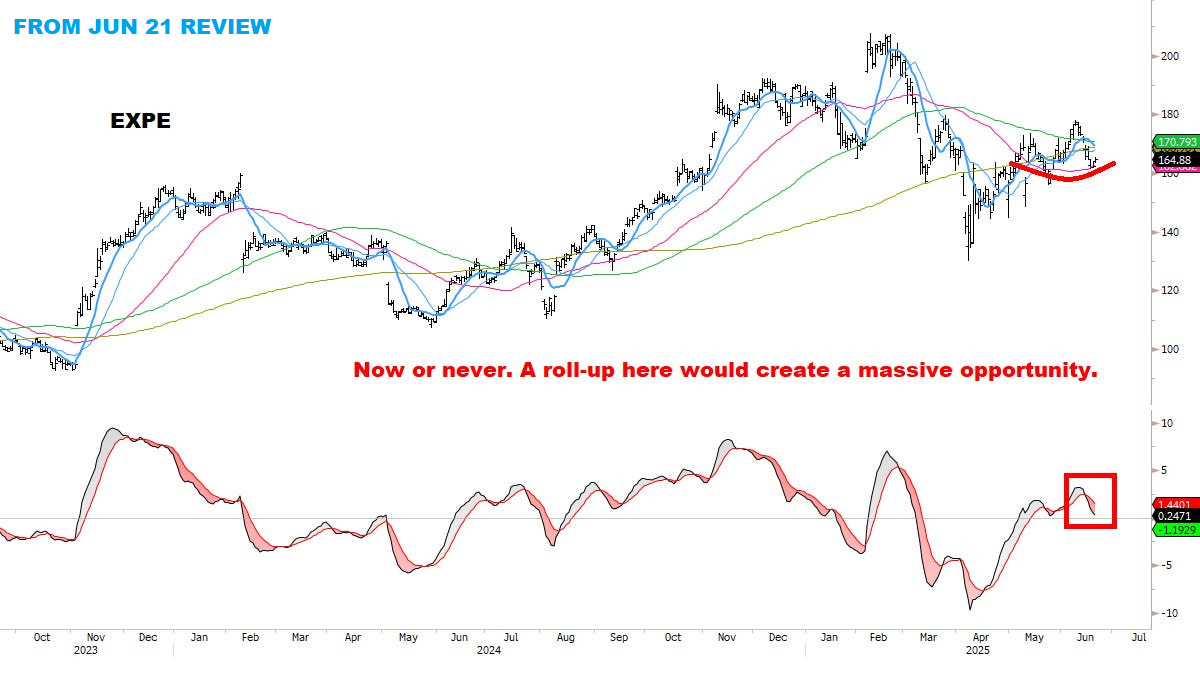

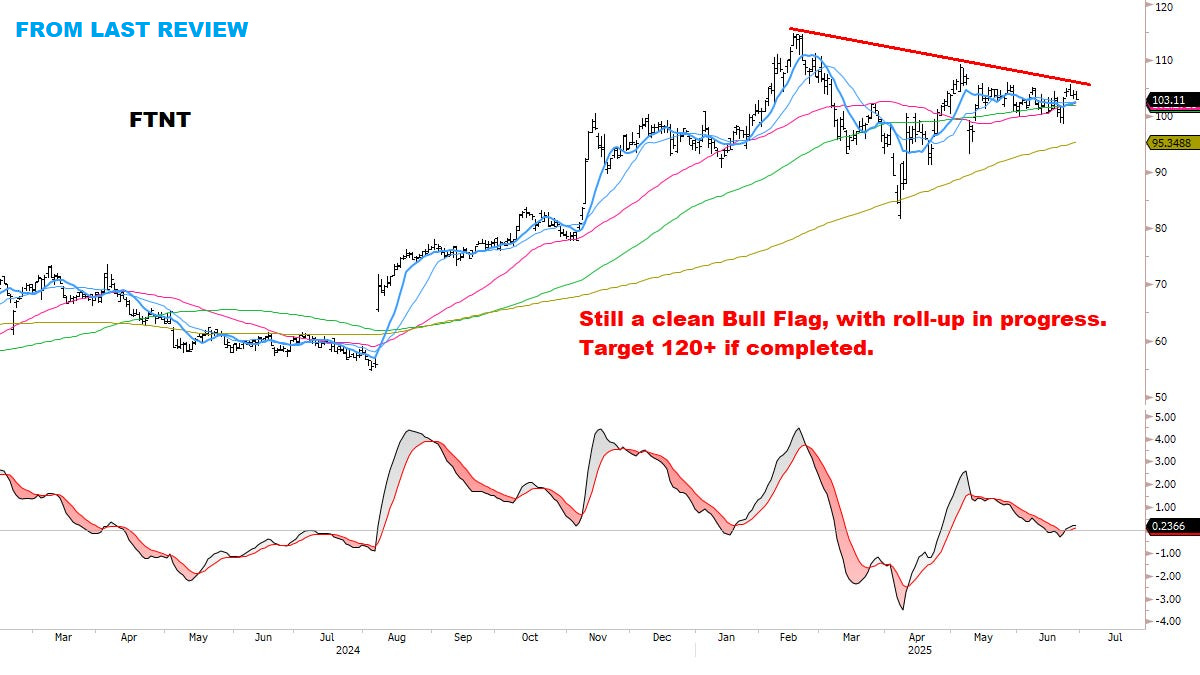

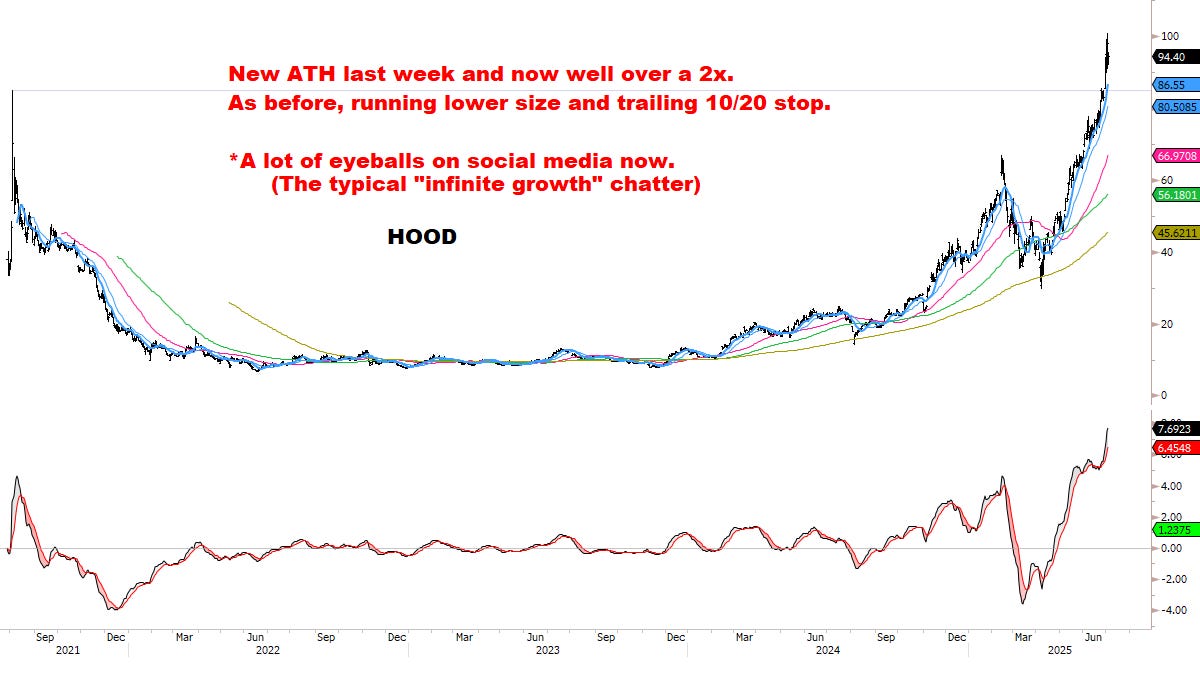

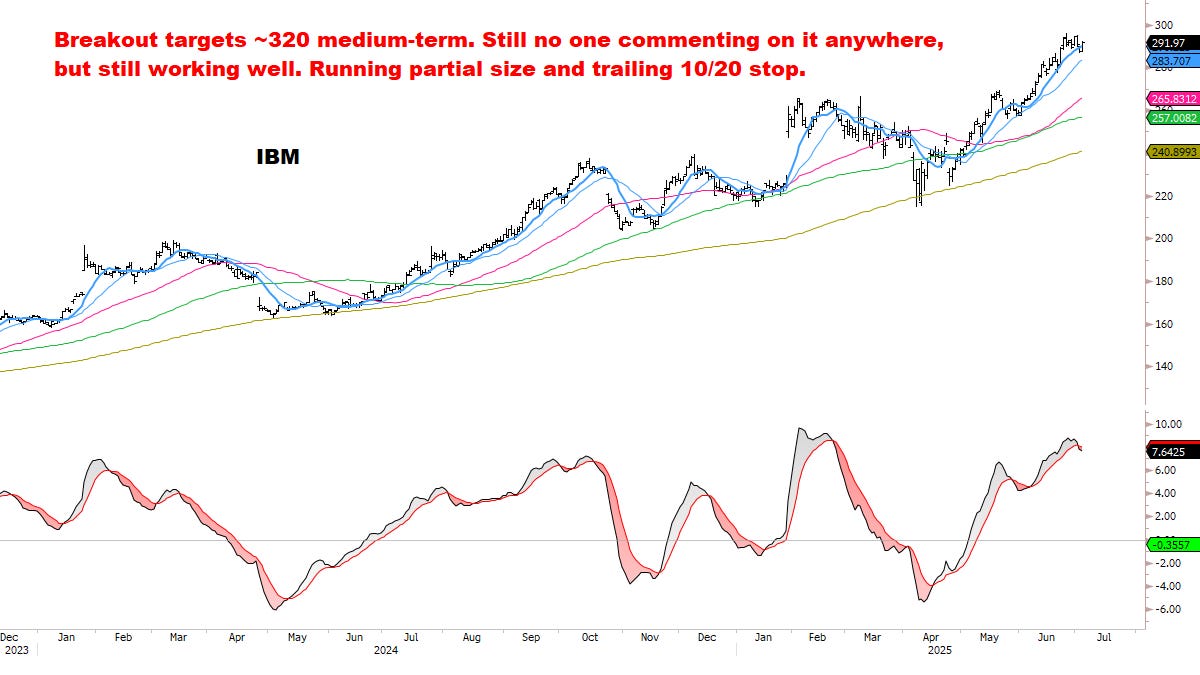

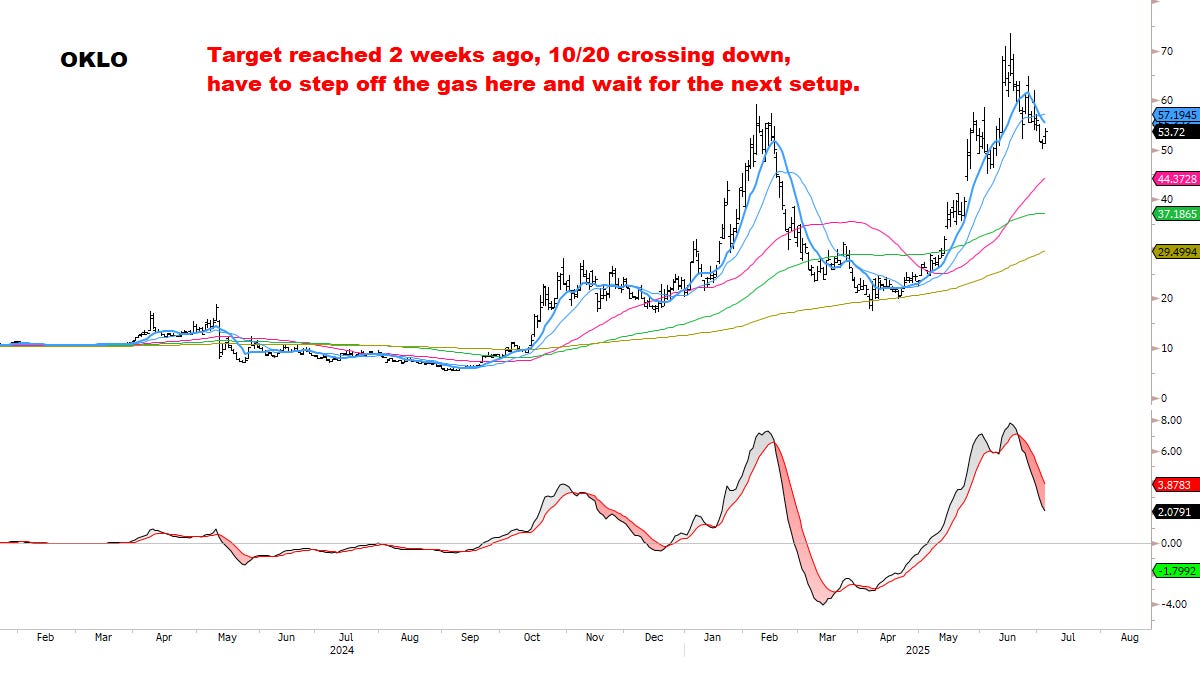

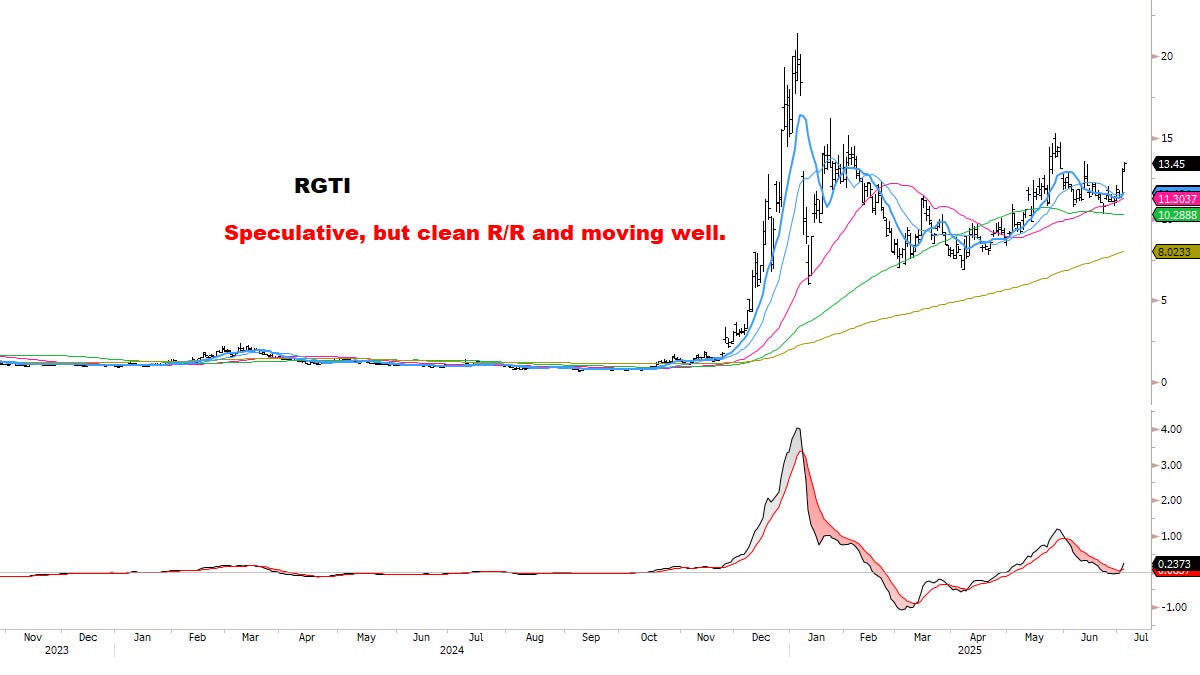

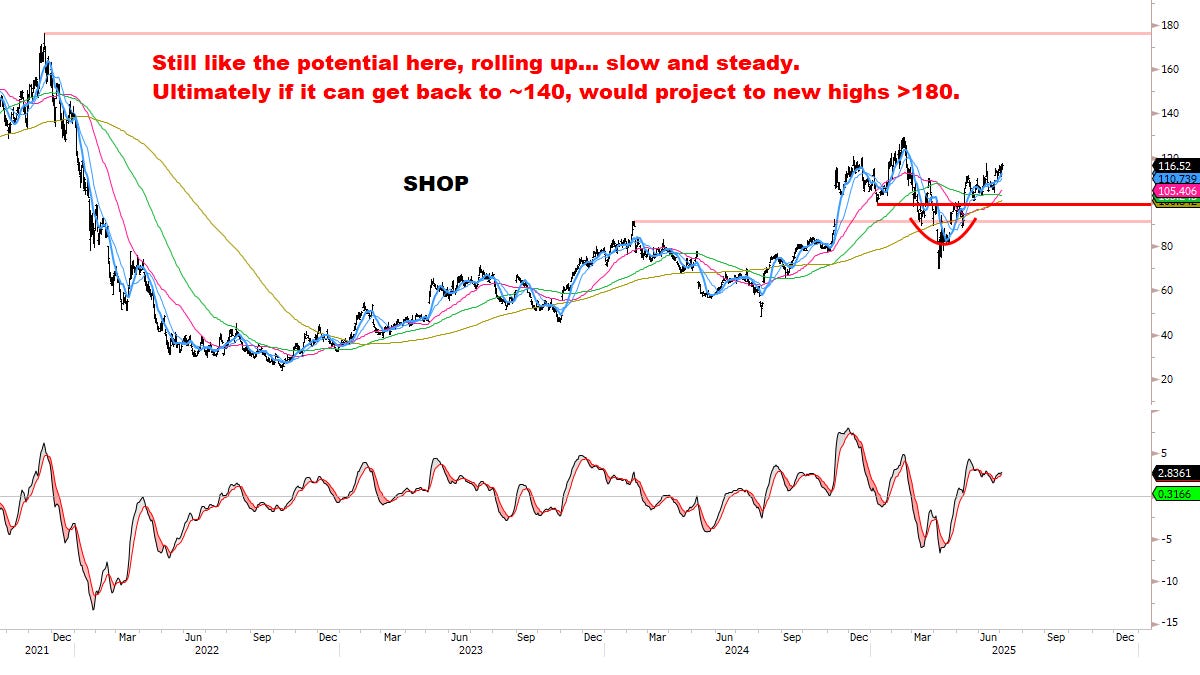

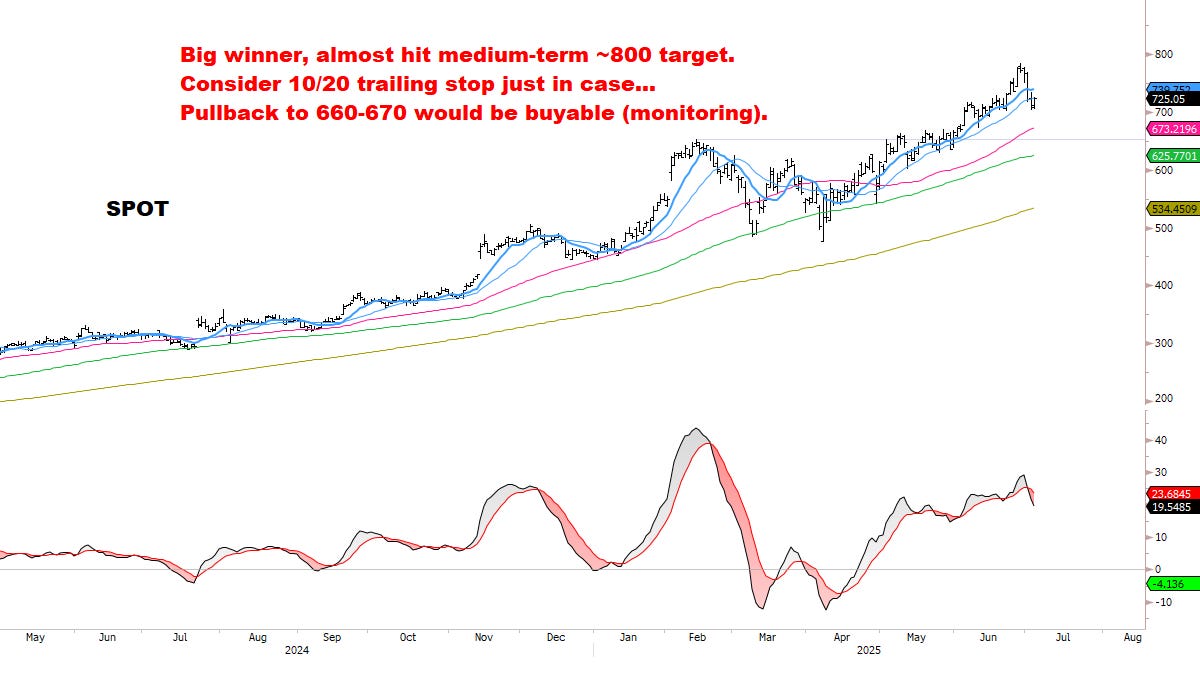

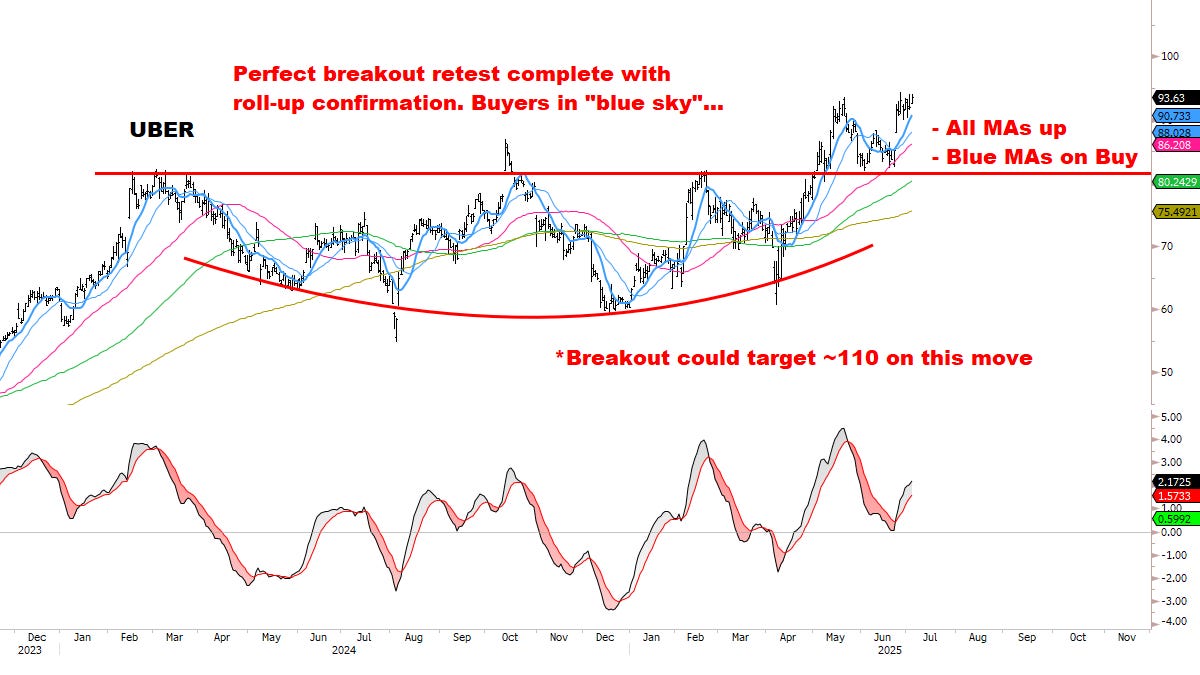

Through the end of June 2025, the average stock in our Core Watchlist is up +45%, with several names near/over 2x — a strong outperformance relative to the market.

As before, focused on: Stocks meeting strict criteria for (1) relative strength, (2) improving momentum, (3) defined risk. Building on this list as signals develop.