travelism/E+ via Getty Images

Kuaishou Technology (OTCPK:KUASF) reported a largely in-line Q4 quarter and in-line 1Q25 guidance. The quarterly earnings call largely centered around KS’s investment in its Kling AI model, but the overall narrative of decelerating advertising growth due to reliance on e-commerce and declining live-streaming due to macro headwinds remains.

快手科技(場外交易代碼:KUASF)公布基本符合預期的第四季業績及 2025 年第一季財測。財報電話會議聚焦 Kling AI 模型投資,但廣告增長因電商依賴而放緩、直播業務受宏觀逆風衝擊的整體敘事未變。

While we acknowledge that KS has made respectable inroads in AI and that visual generation AI is clearly a relevant sector in media, we continue to believe that AI's impact on KS remains in its early days and that its impact on revenue reacceleration remains proof of concept.

我們認可快手在 AI 領域取得顯著進展,視覺生成 AI 確屬媒體產業關鍵賽道,但仍認為 AI 對快手的營收重振效應尚處早期階段,其商業化影響力仍需驗證。

Our thesis on KS is that its core business in live-streaming could see ongoing revenue challenges as viewers pull back on discretionary spending, while online marketing and other services could see revenue deceleration due to the deceleration in e-commerce GMV. Furthermore, KS has been investing in user acquisitions and merchant retention, which could further pressure the margin outlook. Without a material macro recovery, the current narrative is unlikely to change as much of the company’s revenue growth depends on e-commerce, which drives its internal advertising revenue and other services that account for around half of its total revenue. (See: Kuaishou: E-Commerce Deceleration And Macro Headwinds Spell Growth Dilemma).

我們的核心觀點是:隨著觀眾縮減非必需消費,快手直播業務將持續面臨營收壓力;而電商 GMV 增速放緩將拖累線上營銷等服務收入。加之用戶獲取與商家留存投入可能進一步壓縮利潤空間。在缺乏實質性宏觀復甦下,當前困境難有轉機——公司過半營收依賴電商導流的內部廣告與配套服務(參見《快手:電商失速與宏觀逆風下的增長困境》)。

We recommend investors avoid KS and stick with higher-quality e-commerce plays. Within this sector, we like PDD given its global growth potential in Temu (see: PDD Holdings: Reset Expectations, Seize Growth Amid Challenges) and JD given its exposure to electronics and home appliances segments, which, we believe, will continue to benefit from China’s ongoing subsidy campaign to drive consumption (see:JD.com: Upgrading To Buy On Government Subsidy Tailwinds Driving Growth).

建議投資者避開快手,轉向更高品質的電商標的。我們看好拼多多旗下 Temu 的全球增長潛力(參見《拼多多:重設預期,逆勢把握增長機遇》),以及京東在 3C 家電領域的佈局將持續受惠中國消費補貼政策(參見《京東:升級至買入評級,政策紅利驅動增長》)。

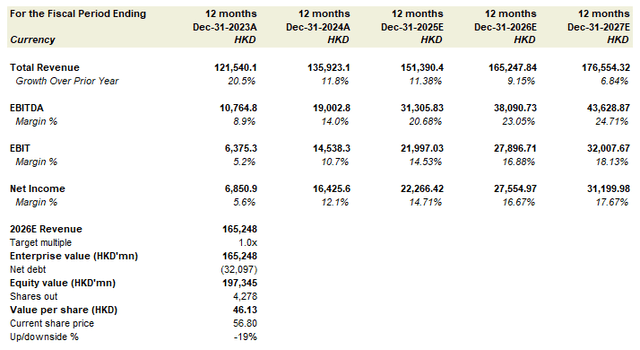

We value KS at 1x forward revenue multiple, implying a 19% downside from the current level given the decelerating macro as we head into 2025.

基於 2025 年宏觀增速放緩預期,我們按 1 倍前瞻市銷率對快手估值,隱含當前股價 19%下行空間。

Core business paints a diverging narrative

KS’s core business continues to paint a diverging trend in which solid online marketing is offset by weakness in online streaming.

快手核心業務呈現線上營銷穩健與直播疲弱的背離走勢。

Online marketing revenue growth of 13% y/y was driven by single-digit eCPM growth. Marketing spending from commercialized short plays increased by three times, and UAX, KS’s automated ad placement product, contributed to 55% of total external marketing. For closed-loop marketing, merchants using an omni-platform marketing solution and smart hosting contributed to 55% of the ad spend. Overall merchant spending increased by 30% y/y in the quarter due to improving ad performance.

線上營銷收入年增 13%由個位數 eCPM 增長驅動。短劇商業化營銷支出增長三倍,自動化廣告投放產品 UAX 佔外部營銷收入 55%。閉環營銷中,採用全渠道解決方案與智能託管的商家貢獻 55%廣告支出。因廣告效果提升,季度商家總支出年增 30%。

KS continues to be highly reliant on e-commerce, in which GMV increased by 14% y/y, with the number of MAUs up 10% y/y to 143mn, representing a penetration rate of 19.5%. New user acquisition from Southern China was successful during the Double 11 Festival, and the number of monthly active merchants was up 25% y/y. Most notably, short video e-commerce GMV was up 50% y/y, while pan-shelf-based e-commerce GMV contributed to 30% of total e-commerce GMV.

快手仍高度依賴電商業務,GMV 年增 14%,月活用戶達 1.43 億(年增 10%),滲透率 19.5%。雙十一期間華南地區新用戶獲取成功,月活商家數年增 25%。值得注意的是,短視頻電商 GMV 年增 50%,泛貨架電商貢獻總 GMV 的 30%。

On the other hand, live-streaming continues to be pressured due to China’s soft backdrop in which viewers remain sensitive to discretionary spending. Live-streaming revenue continues to decline on a y/y basis while KS continues to attract a large number of talent agencies and streamers to drive content creation and encourage viewer spending.

另一方面,由於中國經濟環境疲軟,觀眾對非必要支出仍持謹慎態度,直播業務持續承壓。直播收入同比持續下滑,而快手仍持續吸引大量經紀公司與主播加入,以推動內容創作並刺激觀眾消費。

For 2025, we expect KS’s e-commerce GMV to grow in the low double-digit percentage driven by an increase in merchant onboarding and incremental user growth as consumers continue to trade down to value as KS’s live-streaming e-commerce products largely focus on value-for-money products.

我們預期 2025 年快手電商 GMV 將以低雙位數百分比增長,主要驅動因素在於商家入駐數量增加及用戶規模持續擴張。由於消費者持續轉向高性價比商品,而快手直播電商產品主要聚焦於高 CP 值商品,這將進一步帶動業績成長。

AI impact remains in its early days

KS has made significant investments in its Kling AI model, and we expect this investment to continue as Chinese internet companies drive the proliferation of AI applications.

快手已對其 Kling AI 模型進行重大投資,我們預期隨著中國互聯網企業推動 AI 應用普及,這項投資將持續增加。

KS introduced its latest Kling AI 1.5 Pro which is one of the two largest video models in the world. In 4Q24, the Kling AI app saw accelerated growth and achieved cumulative revenue of over RMB100 million as of February 2025. The adoption of Kling has increased user activity, improved ad performance, and enhanced the efficiency of the business ecosystem. One notable area that saw good progress is in live-streaming, in which virtual digital human solutions and AIGC short-video marketing increased daily spending in Q4.

快手推出最新一代 Kling AI 1.5 Pro 模型,躋身全球兩大頂級視頻模型之列。2024 年第四季度,Kling AI 應用程式加速成長,截至 2025 年 2 月累計營收突破 1 億元人民幣。該技術的應用顯著提升用戶活躍度、廣告轉化效果及商業生態效率,其中直播電商領域表現尤為突出,虛擬數位人解決方案與 AIGC 短影音行銷推動第四季度日均消費額持續增長。

Although these are positive updates, we caution that we are still in the early days of video-generative AI and that its revenue impact on KS remains a proof of concept. While Kling has its positives, there are also a number of negatives as indicated by user feedback.

儘管這些都是正面的進展,但我們必須謹慎看待,因為影片生成式 AI 仍處於早期階段,其對 KS 營收的影響尚待驗證。雖然 Kling 有其優勢,但根據用戶反饋也顯示出若干不足之處。

We note that there are reports of Kling saw model performance decline when dealing with complex tasks and that the model may struggle to generate creative content. Notably, the model's performance declines when dealing with multi-level scenes and fast transitions in which the generated video may appear fragmented as it struggles to handle complex interactions between multiple characters or objects.

我們注意到有報告指出,Kling 模型在處理複雜任務時性能下降,且該模型可能在生成創意內容方面遇到困難。值得注意的是,當處理多層次場景和快速轉換時,模型的表現會下滑,生成的影片可能因難以處理多個角色或物體間的複雜互動而顯得支離破碎。

There is also the challenge of generation speed and output quality in which the model could see slow output generation when dealing with complex inputs and for video of higher quality the output may lose clarity and details.

此外,還存在生成速度與輸出品質的挑戰,該模型在處理複雜輸入時可能出現輸出生成緩慢的情況,而對於更高品質的影片,輸出可能會失去清晰度和細節。

Current consensus expects Kling to generate RMB500mn in annualized revenue for KS in 2025, which is immaterial given the hype surrounding this product, so clearly, this remains a proof of concept.

當前市場共識預期 Kling 將在 2025 年為 KS 帶來 5 億元人民幣的年化收入,考慮到該產品引發的市場熱度,此數字顯得微不足道,顯然這仍僅處於概念驗證階段。

Valuation implies incremental downside risk

Given KS’s business largely relies on advertising and e-commerce, we feel that it should be valued similarly to that of e-commerce peers such as Alibaba and JD, which share similar growth profiles. Alibaba currently trades at 1.6x forward revenue, while JD currently trades at 0.2x forward revenue. KS’s e-commerce GMV continues to have respectable growth, and a 1x forward revenue multiple seems fair given that it is growing faster than JD but does not have the AI premium that BABA does.

考慮到快手(KS)的業務主要依賴廣告和電子商務,我們認為其估值應與具有相似增長特性的電商同業如阿里巴巴和京東相當。阿里巴巴目前的前瞻市銷率為 1.6 倍,而京東則為 0.2 倍。快手的電商 GMV 持續保持可觀增長,鑑於其增速快於京東但未享有阿里巴巴的 AI 溢價,1 倍前瞻市銷率應屬合理。

At 1x forward revenue, we derive an implied value of HK$46/share, or 19% downside from the current level.

以 1 倍前瞻市銷率計算,我們得出每股隱含價值為 46 港元,較當前股價有 19%的下行空間。

Capital IQ, Astrada Advisors

Given that Chinese equities are entering a technical correction after the recent AI-driven rally and that KS was one of the beneficiaries of the rally, we believe that the shares could also be corrected in the near term along with the broader market. Based on the share price movement, KS’s investment in AI has allowed it to capitalize on the AI rally, but we continue to believe that AI’s impact on KS remains immaterial and that the company should be valued more closely to an advertising or e-commerce company rather than being assigned an AI premium similar to that of Alibaba.

鑒於中國股市在近期 AI 驅動的漲勢後進入技術性修正,且快手是此輪漲勢的受益者之一,我們認為其股價短期內可能隨大盤同步修正。從股價走勢來看,快手對 AI 的投資使其得以把握 AI 熱潮,但我們仍認為 AI 對快手的實質影響有限,其估值應更貼近廣告或電商公司,而非享有與阿里巴巴相似的 AI 溢價。

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

編者註:本文討論的一種或多種證券未在美國主要交易所交易。請注意這些股票的相關風險。

Comments