TMTB EOD Wrap

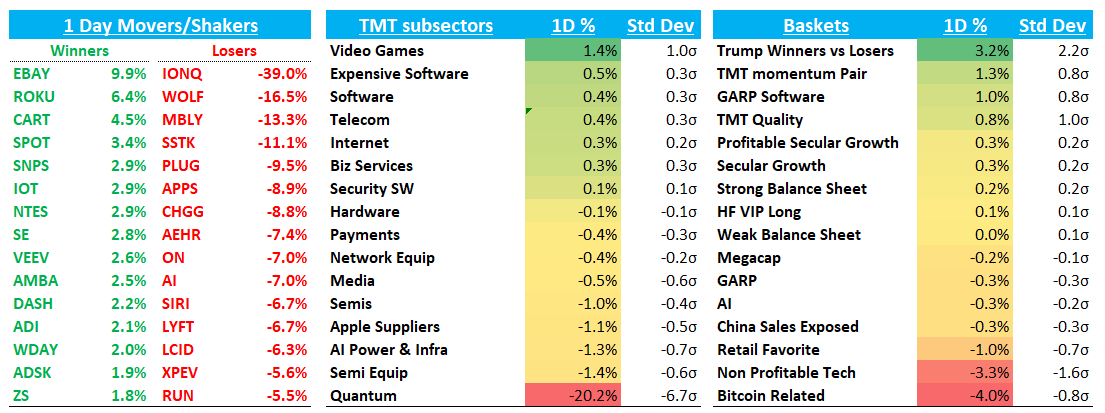

QQQs flat after a volatile session. Treasuries saw some gains as Waller and FOMC minutes weren’t as hawkish as feared and decent 30-year auction in the afternoon helped. Market off tomorrow and we get NFP tomorrow morning. BTC - 2%. Trump winners outperformed Trump losers by 3% after hawkish Tariff comments in early morning. Non-profitable tech -3% helped lower by Quantum debacle.

Post close: Biden to Further limit NVDA, AMD AI Chip exports in Final push…seems a bit incremental than the usual China stuff as they are calling out other countries as well…NVDA - 1% / AMD -1%. Bloomberg:

President Joe Biden’s administration plans one additional round of restrictions on the export of artificial intelligence chips from the likes of Nvidia Corp. just days before leaving office, a final push in his effort to keep advanced technologies out of the hands of China and Russia.

The US wants to curb the sale of AI chips used in data centers on both a country and company basis, with the goal of concentrating AI development in friendly nations and getting businesses around the world to align with American standards, according to people familiar with the matter.

The result would be an expansion of semiconductor caps to most of the world – an attempt to control the spread of AI technology at a time of soaring demand. The regulations, which could be issued as soon as Friday, would create three tiers of chip trade restrictions, said the people, who asked not to be identified because the discussions are private.

Let’s get to it….

Internet

EBAY +10% as META -1% said they would launch a test in Germany, France and the US that will enable buyers to browse listings from eBay on Facebook Marketplace and then complete their transactions on eBay. Reminder, US is 50% of the biz and Germany is the 3rd largest market just after the UK. Would be big positive for EBAY if this would actually go through but still some uncertainty given 1) unclear how exactly roll out would look and 2) META is still appealing EU decision. Still, every $10B in additional GMV is an additional 10% to revs and slightly more to EPS. This would also help the multiple as 1) new avenue of growth and many more eyeballs going to EBAY. One assumes marketplace growing faster than EBAY which could accel growth on a go-forward basis even after initial jump 2) One of the main overhangs on EBAY has been competition from FB Marketplace so this alleviates that.

ROKU +6% as Yip said revs tracking 5% ahead of street

RBLX +1.2% as M-sci raised bookings #s, said Jan off to a strong start and ads doing well too.

GOOGL -80bps initially sold off along with Quantum names

CART +4.5% being added to S&P Midcap 400

SPOT +3.4% as GS raised PT to $550 from $490…Sheridan highlighted key Spotify narratives driving stock performance: global audio platform leadership driving user growth and engagement, sustained margin improvements post-2023 restructuring, and potential 2025 shift toward capital returns ($70M annually/$18M quarterly). Noted recent platform updates enhance creator monetization, expand video capabilities, and strengthen multi-format content strategy.

SNAP -4% as Edgewater had a note with negative checks saying SNAP still struggling to stand out in a competitive ad landscape while advertisers still skeptical on Sponsored snaps. BAML also neg lowering #s on mixed checks. Spiegel canceled tonight’s CES appearance - he lives in LA so could be he wanted to stick around…unclear…

PINS -3% as BAML lowered #sto 10% from 12% (street at 14%) in Q1 on tough Q1 comps That’s roughly where buyside is although I’ve heard as low as high single digits. At this point PINS might as well clear the decks and guide for high single digits - hearing investors interested in buying a cut here

RDDT flat as BAML raised PT to $180 from $99 on better channel checks, raising revs by 3% and EBITDA by 8%

CVNA -70bps despite Citi upgrade

UBER -2% as Waymo presents tonight at CES

NTES +3% on MS upgrade as co expects earnings turnaround driven by strong PC game pipeline, citing Blizzard games' record China performance. Notes Marvel Rivals international launch and potential Q1 FragPunk release as growth catalysts.

Semis

Quantum basket dn 20% with IONQ -40% (and down 50%) at one point after Jensen comments yesterday that Quantum was 30 years out. IONQ now back to *checks chart* where it was in Mid-Dec. Not a bad thing to see pockets of froth come back to earth as animal spirits can reset a bit - definitely extended on that front in mid/late Dec...

MRVL +1.7% led the pack of AI semis

CLS +4% busting through $100

NVDA flat

MU -2% giving some back after last week’s rise as Samsung missed and Jensen sounded positive on Samsung getting qualified with them at some point

AMD on HSBC’s downgrade

TSM -2% as Trump Tariff see-saw continues with him coming out more hawkish yesterday

MBLY - 13% now down 20%+ in a couple days after presenting at CES. J.P. Morgan analyst Samik Chatterjee said the company outlined that there is an "incremental" total addressable market with stricter regulations to achieve a 5-star safety rating in the U.S. and Europe. He added that Mobileye's strategy towards revolutionizing transportation is more akin to TSLA than Waymo's, but the upcoming Chaffeur product is not expected to launch until 2027. And while the company may be feeling more confident about its future roadmap and potential design wins, at this point, Mobileye is only in "advanced stages of engagement," Chatterjee added.

ON -7% - guessing investors didn’t like what they heard at CES meetings as mgmt continues to suggest L-shaper recovery. Not new, and not eaxctly sure what they called out for the drop.

Software

APP flat after a volatile session — mo names were down which weighed on the stock despite Jeff taking ad rev forecasts 10% above street in a pretty bullish note. Also this blog called in a strong sell saying “AppLovin is merely a Russian/Belarusian/Cypriot hellhole of related-party transactions on low-tier mobile games in a declining industry.” Some hyperbole in the post obviously, but if you’re involved, worth sifting through to some points at least worth being mindful of.

PLTR -2.5% / AI -7% likely in sympathy with Quantum names getting punished

PANW -1.5% after another pair of downgrades

HUBS +1% on better checks at Scotia and Barclays

TWLO +1% on Mizuho’s upgrades

ADBE -70bps decent px action on DB’s downgrade

ACN +40bps on Wolfe’s ug

ADSK +2% on Piper’s upgrade

SNOW +1.4% as DB raised PT to $210 from $190

Elsewhere

TSLA flat

COIN -2% / HOOD +60bps as BTC -2%…AFRM -4%

AAPL +20bps