MicroStockHub/iStock via Getty Images

MicroStockHub/iStock 透過 Getty Images

IPOs can be tricky.

首次公開募股可能會很棘手。

Buying a company that just went public comes with risks, as available data tends to be limited – at least compared to companies that have been public for many years.

購買剛上市的公司存在風險,因為可用的數據往往有限——至少與已上市多年公司的數據相比。

Nonetheless, sometimes an IPO is so important that it deserves attention. One of them is the initial public offering of Lineage, Inc. (NASDAQ:LINE), the world’s biggest cold storage REIT.

儘管如此,有時候首次公開募股(IPO)是如此重要,以至於值得關注。其中之一是 Lineage, Inc.(NASDAQ: LINE)的首次公開募股,這是全球最大的冷藏倉儲不動產投資信託基金(REIT)。

Last month, the Wall Street Journal went with the title “Why a Cold-Storage Company Just Delivered the Year’s Hottest IPO.” The reason I’m bringing this up is because the paper started by focusing on a very important topic: supply chain resilience.

上個月,《華爾街日報》以「為什麼一家冷藏公司剛剛推出了今年最熱門的首次公開募股」為標題。我提到這一點是因為該報紙首先聚焦於一個非常重要的主題:供應鏈韌性。

Since the start of civilization, supply chains have been critical when it comes to survival and prosperity. The pandemic was a ‘great’ example of this, as it showed what the results are of sudden disruptions. Although the worst was avoided in 2020/2021, things could have gotten a lot worse.

自文明開始以來,供應鏈在生存和繁榮方面一直至關重要。疫情就是一個「偉大」的例子,因為它顯示了突發中斷的後果。儘管在 2020/2021 年避免了最糟糕的情況,但情況本可以變得更糟。

Going back to The Wall Street Journal article, the case was made that Lineage is mission-critical. Although these exact words were not used, the article explained that Lineage is a logistics operator most of us depend on daily – often without knowing it.

回到《華爾街日報》的文章中,提出了 Lineage 是關鍵任務的觀點。雖然沒有使用這些確切的詞語,但文章解釋了 Lineage 是一家我們大多數人每天依賴的物流運營商——往往是在不知情的情況下。

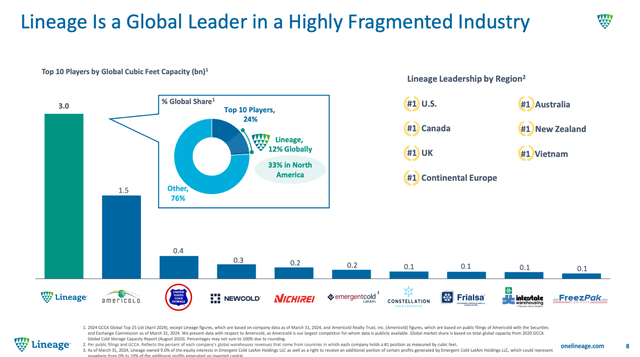

Not only is Lineage so large that its IPO was the largest IPO of the year, but it is also a giant in its industry, as no competitor comes close to its size.

Lineage 不僅規模龐大,其首次公開募股(IPO)更是今年最大的 IPO,且在其行業中也是一個巨頭,因為沒有任何競爭對手能與其規模相提並論。

In the highly fragmented cold storage industry, the company has a 12% market share with a 2 billion cubic feet capacity – twice the capacity of Americold (COLD), which has been a public company since 2018.

在高度分散的冷藏行業中,該公司擁有 12%的市場份額,容量達 20 億立方英尺,是美國冷藏(COLD)容量的兩倍,而美國冷藏自 2018 年以來已成為上市公司。

Lineage Inc. 血統公司

So, to keep this intro from getting too long, in the second part of this article, we’ll discuss the newest addition to the public REIT space and assess how attractive the LINE ticker is for investors.

因此,為了避免這段引言過於冗長,在本文的第二部分,我們將討論公共 REIT 領域最新的成員,並評估 LINE 股票對投資者的吸引力。

What To Make of the Cold Storage Giant?

冷藏巨頭該如何看待?

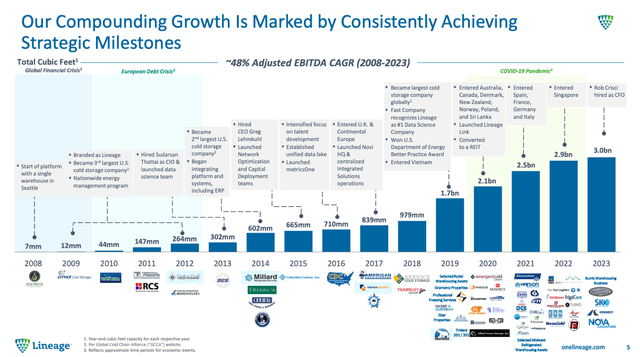

One of the many things that make Lineage interesting is the fact that this industry leader is a rather young company. As reported by The Wall Street Journal, the company was founded in 2008 by two former Morgan Stanley investment bankers, Adam Forste and Kevin Marchetti. It took them less than two decades to build a cold storage empire.

Lineage 之所以引人注目,部分原因在於這家行業領導者是一家相對年輕的公司。根據《華爾街日報》的報導,該公司於 2008 年由兩位前摩根士丹利投資銀行家亞當·福斯特和凱文·馬爾基提創立。他們花了不到二十年的時間就建立了一個冷藏帝國。

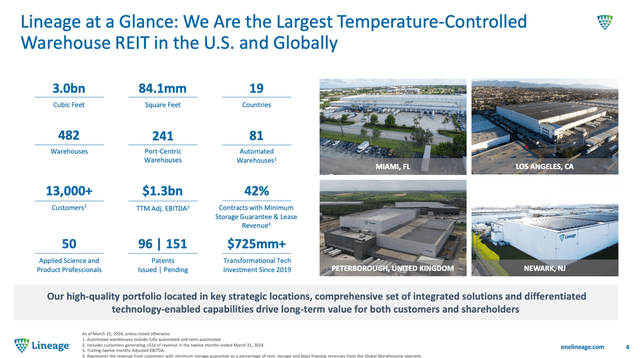

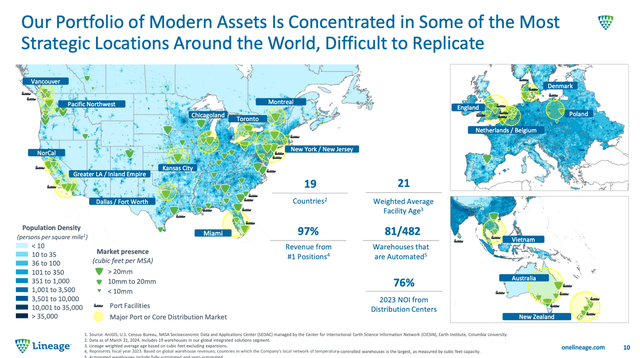

When the company went public – 16 years after being founded – it owned 482 warehouses in 19 countries that serve more than 13 thousand customers - 81 of these warehouses are either fully automated or semi-automated.

當公司上市時——在成立 16 年後——它擁有 482 個倉庫,遍布 19 個國家,服務超過 13,000 名客戶,其中 81 個倉庫是完全自動化或半自動化的。

Even better, more than 40% of the company’s contracts include minimum storage guarantees and leasing revenue, which considerably lowers the risks for the company. It’s comparable to a midstream company that owns pipelines for oil and gas. In many cases, customers are paying for the right to use these assets, regardless of whether they use them.

更好的是,該公司的合同中有超過 40%包含最低存儲保證和租賃收入,這大大降低了公司的風險。這可與擁有石油和天然氣管道的中游公司相提並論。在許多情況下,客戶支付的是使用這些資產的權利,無論他們是否實際使用。

Lineage Inc. 血統公司

The secret of its expansion is M&A. In a highly fragmented industry where most warehouses are operated by family-owned businesses, the company has made 116 acquisitions since 2008 – on average, that’s more than seven deals every year.

其擴張的秘密在於併購。在一個高度分散的行業中,大多數倉庫由家族企業經營,自 2008 年以來,該公司已進行了 116 項併購——平均每年超過七筆交易。

As we can see below, most of these deals were made after 2018.

如我們在下方所見,這些交易大多是在 2018 年之後達成的。

Lineage Inc. 血統公司

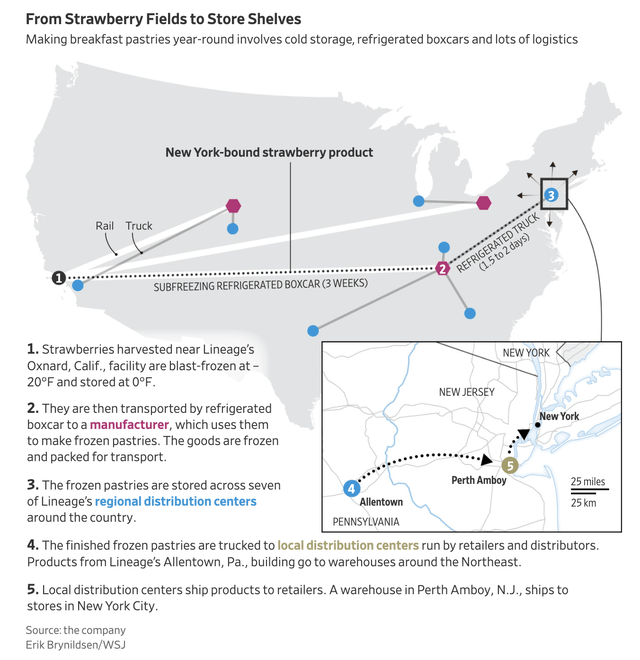

With that said, The Wall Street Journal used the map below, which is a great example of the importance of cold storage in the modern supply chain. The example shows the strawberry supply chain, which includes harvest, storage, transportation, processing, storage, and distribution to retailers.

《華爾街日報》使用了下面的地圖,這是一個展示現代供應鏈中冷藏儲存重要性的絕佳範例。這個範例顯示了草莓供應鏈,包括收穫、儲存、運輸、加工、儲存和分配給零售商。

The Wall Street Journal 華爾街日報

Needless to say, this applies to more or less every single product in your fridge and freezer – even if you’re not American, as Lineage has significant overseas exposure, including West Europe and Asia Pacific.

不必多說,這幾乎適用於你冰箱和冷凍庫中的每一種產品——即使你不是美國人,因為 Lineage 在海外市場的曝光率相當高,包括西歐和亞太地區。

Lineage Inc. 血統公司

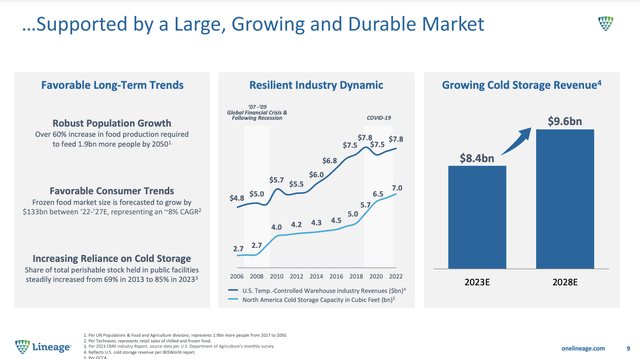

Because of secular growth trends, the industry is expected to see almost $10 billion in revenue by 2028, 14% more compared to 2023. Although this may seem like a slow increase for an industry with secular tailwinds, we need to be aware that the post-COVID period came with some challenges.

由於世俗增長趨勢,預計到 2028 年,該行業的收入將接近 100 億美元,比 2023 年增長 14%。儘管對於一個擁有世俗順風的行業來說,這似乎是一個緩慢的增長,但我們需要意識到,後疫情時期帶來了一些挑戰。

Lineage Inc. 血統公司

As we can see in the chart above, after booming demand during the pandemic, demand has come down. Meanwhile, cold storage capacity increased, which created an unfavorable environment.

如上圖所示,在疫情期間需求激增後,需求已經下降。與此同時,冷藏容量增加,這造成了不利的環境。

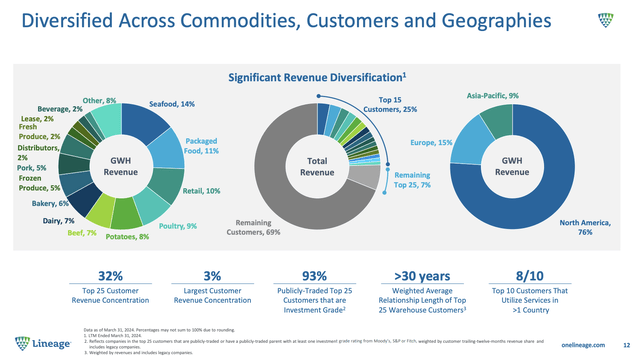

In this case, it helps that the company has a highly favorable customer base. Its largest customer accounts for just 3% of its revenue. Its largest 25 customers account for almost a third of its revenue. This lowers concentration risks.

在這種情況下,該公司擁有一個非常有利的客戶基礎是有幫助的。其最大客戶僅佔其收入的 3%。其前 25 大客戶幾乎佔其收入的三分之一。這降低了集中風險。

On top of that, the company has multi-decade relationships with customers.

此外,該公司與客戶之間有著數十年的合作關係。

Lineage Inc. 血統公司

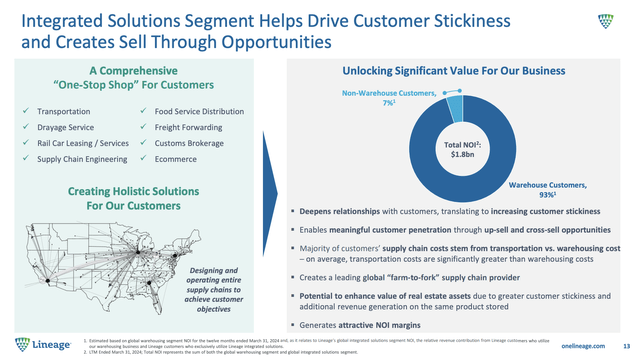

Based on this context, Lineage is more than just an owner of cold storage, as it operates two business segments:

根據這個背景,Lineage 不僅僅是一家冷藏存儲的擁有者,還運營著兩個業務部門:

- Global warehousing. This segment covers its buildings.

全球倉儲。此部分涵蓋其建築物。 - Global integrated solutions. This segment includes supply chain services.

全球綜合解決方案。此部分包括供應鏈服務。

Essentially, Lineage has become a one-stop shop for its customers, as it offers transportation, drayage services, rail car leasing, supply chain engineering, freight forwarding, e-commerce, brokerage, and more.

本質上,Lineage 已經成為其客戶的一站式服務中心,提供運輸、拖運服務、鐵路車輛租賃、供應鏈工程、貨運代理、電子商務、經紀服務等多種服務。

This deepens relationships with customers, massively improves up-sell opportunities (if you lease the warehousing, you’ll likely opt for some services as well) and makes the company a mission-critical “farm-to-fork” supply chain player.

這加深了與客戶的關係,大幅提升了追加銷售的機會(如果您租用倉儲,您可能也會選擇一些服務),並使公司成為一個關鍵的“從農場到餐桌”的供應鏈參與者。

Lineage Inc. 血統公司

This is what an automated facility looks like (robots packing and unpacking shelves):

這就是自動化設施的樣子(機器人正在打包和拆包貨架):

Lineage Inc. 血統公司

Automation does not just sound good, but it could help cut costs significantly. The typical North American cold storage warehouse spends 69% of its costs on operating costs. Real estate costs (mortgage, rent, or lease) usually account for 31% of total costs.

自動化不僅聽起來不錯,還能顯著降低成本。典型的北美冷藏倉庫將 69%的成本用於運營成本。房地產成本(抵押貸款、租金或租約)通常佔總成本的 31%。

Of its operating costs, 51% is spent on labor, followed by electricity (14%) and repairs (13%).

在其營運成本中,51%用於勞動力,接著是電力(14%)和維修(13%)。

Even better, because of automation, buildings can be larger, as shelves are no longer limited to the capabilities of humans operating forklifts and similar machinery.

更好的是,由於自動化,建築物可以更大,因為貨架不再受限於人類操作叉車和類似機械的能力。

Although I dislike it when business trends are unfavorable for labor (people need to eat), there is no denying that automation is increasingly important. Elevated inflation, rising storage needs, and new capabilities make automation a “no-brainer.”

儘管我不喜歡商業趨勢對勞工不利(人們需要吃飯),但無法否認自動化變得越來越重要。高漲的通脹、上升的儲存需求和新能力使得自動化成為一個“明智之舉”。

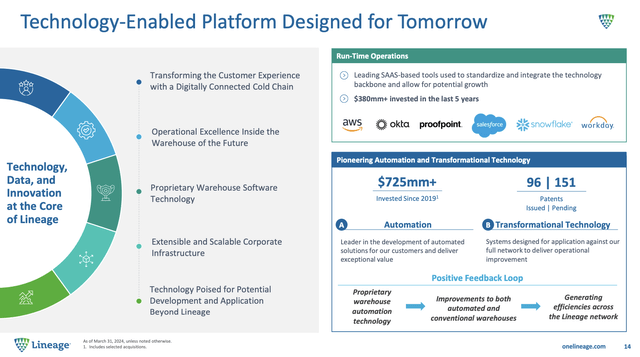

Hence, it helps that Lineage is aggressively expanding in this area, investing hundreds of millions, and implementing advanced tools from America’s largest tech companies.

因此,Lineage 在這個領域積極擴張,投資數億美元,並引入美國最大科技公司的先進工具,這一點是非常有幫助的。

In fact, using the cloud to collect data allowed the company to build proprietary tools that made it possible to grow so quickly. Going forward, this will remain a big benefit.

事實上,利用雲端收集數據使公司能夠建立專有工具,從而實現如此快速的增長。展望未來,這將仍然是一個重要的優勢。

Lineage Inc. 血統公司

It also enjoys a BBB+ credit rating, one step below the A range.

它的信用評級為 BBB+,比 A 級低一步。

So, what does this mean for shareholders?

這對股東意味著什麼?

No Dividend Yet and a Lofty Valuation

尚未派息且估值高昂

LINE does not pay a dividend – yet.

LINE 尚未支付股息。

However, because the company is a REIT, it is obligated to pay a dividend.

然而,由於該公司是一家不動產投資信託基金(REIT),因此有義務支付股息。

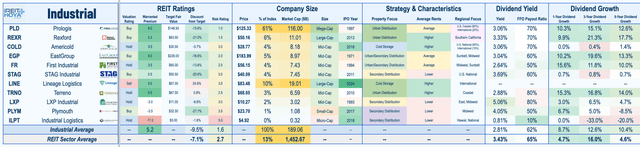

Using our own iREIT®+Hoya data, we see the average industrial REIT has an FFO payout ratio of 62%, in line with the REIT sector average of 65%.

根據我們自己的 iREIT®+Hoya 數據,我們看到平均工業 REIT 的 FFO 派息比率為 62%,與 REIT 行業平均的 65%相符。

iREIT®+Hoya

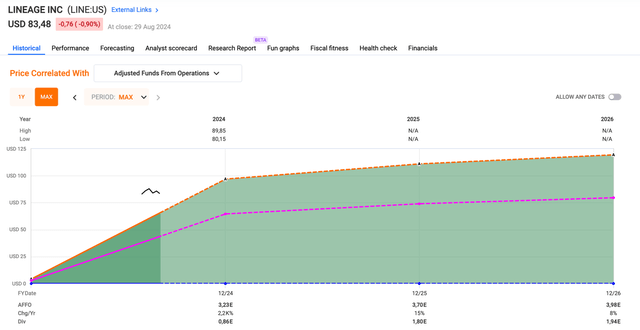

With this in mind, using the FactSet data from the chart below, the company is expected to generate $3.23 in adjusted FFO this year. This would imply a dividend of $2.00 and translate to a yield of 2.4%. This is based on a 62% payout ratio and by NO MEANS a prediction.

考慮到這一點,根據下方圖表中的 FactSet 數據,該公司預計今年將產生 3.23 美元的調整後 FFO。這將意味著每股派息 2.00 美元,並轉化為 2.4%的收益率。這是基於 62%的派息比率,絕對不是預測。

I’m just playing with some numbers here.

我只是在這裡玩弄一些數字。

Speaking of expectations, next year, per-share AFFO is expected to rise by 15%, potentially followed by 8% growth in 2026. These numbers make sense, given falling cold storage construction, increasing pricing power, and the company’s investment in growth.

談到預期,明年每股 AFFO 預計將增長 15%,隨後在 2026 年可能增長 8%。考慮到冷藏建設減少、定價能力增強以及公司對增長的投資,這些數字是合理的。

FAST Graphs 快速圖表

The problem is that LINE isn’t cheap.

問題在於 LINE 並不便宜。

Because the company’s IPO was so desired, there’s not a lot of meat on the bone. Currently, the company trades at 25.5x AFFO. If the stock maintains a 25x multiple, we get a fair stock price of $100, using 2026E per-share AFFO.

由於該公司的首次公開募股受到極大關注,因此可供挖掘的價值並不多。目前,該公司的交易倍數為 25.5 倍的調整後基金運用收益(AFFO)。如果該股票保持 25 倍的倍數,我們可以根據 2026 年預估的每股 AFFO 計算出合理的股價為 100 美元。

This would imply a 20% upside and be based on a rather lofty multiple.

這將意味著 20%的上漲潛力,並且基於相當高的倍數。

As a result, we cannot make the case that LINE is a buy at current levels. However, because we like the business model and the industry, we’ll monitor the stock, as we are interested in buying it at lower prices.

因此,我們無法主張在當前價格水平下購買 LINE。然而,由於我們喜歡這個商業模式和行業,我們將持續關注這支股票,因為我們有興趣在更低的價格時購買。

In Closing 結語

Investing in new public companies like Lineage can be challenging due to limited data and often lofty valuations.

投資於像 Lineage 這樣的新上市公司可能會面臨挑戰,因為數據有限且估值通常偏高。

While Lineage, which has become the world's largest cold storage REIT, has a compelling business model with significant industry advantages, its current valuation leaves little room for upside.

儘管成為全球最大的冷藏房地產投資信託基金的 Lineage 擁有引人注目的商業模式和顯著的行業優勢,但其當前的估值幾乎沒有上漲的空間。

However, the company's impressive growth, mission-critical role in the supply chain, and potential future dividends make it worth keeping on your radar.

然而,該公司的驚人增長、在供應鏈中的關鍵角色以及未來潛在的紅利,使其值得持續關注。

Nonetheless, given the current price, it may be wise to wait for a more attractive entry price before diving in.

然而,考慮到目前的價格,等待一個更具吸引力的進場價格再行動可能是明智的。

Author's Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed to assist in research while providing a forum for second-level thinking.

作者註:布拉德·托馬斯是一位華爾街作家,這意味著他的預測或建議並不總是正確。由於這也適用於他的語法,請原諒您可能會發現的任何錯字。此外,這篇文章是免費的:撰寫並發佈以協助研究,同時提供一個進行二級思考的論壇。

Introducing iREIT® 介紹 iREIT®

Join iREIT® on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. Our iREIT® Tracker provides data on over 250 tickers with our quality scores, buy targets, and trim targets.

今天就加入 iREIT® 在 Alpha,獲取最深入的研究,包括 REITs、mREIT、優先股、BDC、MLP、ETF、建築商和資產管理公司。我們的 iREIT® 追蹤器提供超過 250 個股票代碼的數據,並附有我們的質量評分、買入目標和減持目標。

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

我們最近新增了一個全新的評分追蹤器,名為 iREIT 買入區,幫助會員篩選價值。使用我們的免費兩週試用,您沒有任何損失。

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

這個優惠包括兩週的免費試用以及我的免費書籍。