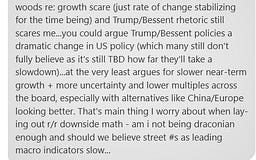

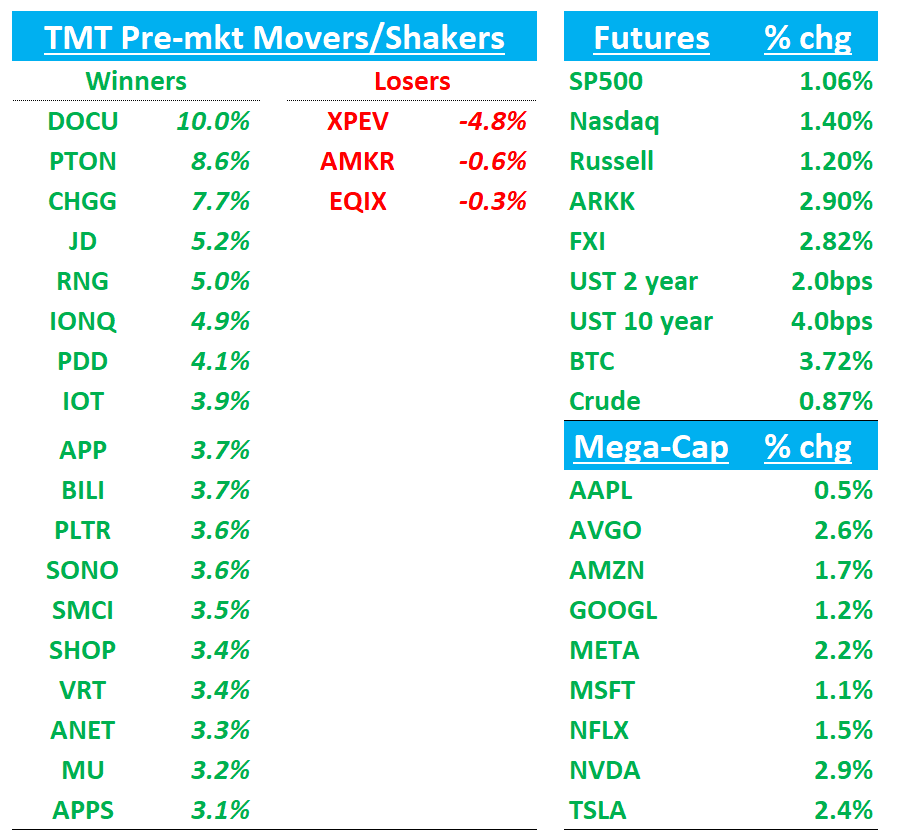

QQQs +1.4% — market bouncing today as yesterday price action began more seriously trading a recession scenario, feeling partly capitulatory near-term. Not much red on my screen pre-market. Yields up 2-4bps across the curve. BTC +4%. China +3%.

QQQs +1.4% — 市场今天反弹,因为昨天的价格走势开始更认真地交易衰退情景,短期内感觉有些屈服。我的屏幕上盘前没有太多红色。收益率在整个曲线上上涨 2-4 个基点。BTC +4%。中国 +3%。

Let’s dive straight in…

让我们直接进入主题……

MU: Warren Lau at Alethia upgrades MU

MU:Warren Lau 在 Alethia 上调 MU 评级

Alethia upgrades on improving memory demand-supply dynamics and Micron potentially becoming a key HBM supplier to NVIDIA and hyperscalers. Alethia notes DRAM ASP in Q2 2025 will likely exceed expectations due to solid AI server demand, robust Chinese mobile sales from subsidies, and accelerated PC shipments ahead of potential tariffs. If demand persists through H2 2025, DRAM prices could rebound starting Q3. For NAND, Alethia expects supply-demand to improve in H2 2025 following industry production cuts from Q1 2025. lethia says Micron may benefit from American manufacturing policies as it emerges as a vital HBM supplier. Alethia's research shows Micron doubling TSV capacity in FY26 and accelerating 12Hi HBM conversion by mid-2025. With successful execution, Micron could become the second-largest HBM supplier by 2026 with 25-30% share, worth $15bn (3x YoY) in FY26.

Alethia 因内存供需动态改善以及美光可能成为 NVIDIA 和超大规模数据中心的关键 HBM 供应商而上调评级。Alethia 指出,2025 年第二季度的 DRAM 平均售价可能会超出预期,这得益于强劲的 AI 服务器需求、来自补贴的中国手机销售强劲,以及在潜在关税前加速的 PC 出货量。如果需求在 2025 年下半年持续,DRAM 价格可能会在第三季度开始反弹。对于 NAND,Alethia 预计在 2025 年下半年供需将改善,原因是行业在 2025 年第一季度的减产。Alethia 表示,美光可能会受益于美国制造政策,因为它正在成为一个重要的 HBM 供应商。Alethia 的研究显示,美光在 2026 财年将 TSV 产能翻倍,并在 2025 年中期加速 12Hi HBM 的转换。如果执行成功,美光到 2026 年可能成为第二大 HBM 供应商,市场份额为 25-30%,在 2026 财年价值 150 亿美元(同比增长 3 倍)。

Earnings quick hits: 收益快讯:

DOCU +11%: Solid Q4 (6% billings beat) driven by early renewal and strength from IAM and self-service in the SMB segment + solid FY26 outlook (subs revs and billings ahead at 6-8% vs street at 6%) but total rev and op mgn below street…No macro weakness seen to date.

DOCU +11%:第四季度表现稳健(账单超出预期 6%),得益于提前续约以及中小企业领域 IAM 和自助服务的强劲表现 + FY26 前景稳健(订阅收入和账单增长 6-8%,而市场预期为 6%),但总收入和运营利润率低于市场预期……迄今未见宏观经济疲软。

Karl at UBS pushes back on results: “early contract renewals and longer billings duration explained much of the billings beat, the 1Q/Apr revs and billings growth guide of 5% would be at/near historical lows and the initial FY26 revs guide was light. Moreover, the guide for 29% non-GAAP OMs fell a point below our 30% estimate and is slightly below FY25 margins.”

瑞士银行的卡尔对业绩表示反对:“早期合同续签和更长的账单周期解释了大部分账单超出预期,1Q/4 月的收入和账单增长指引为 5%,将处于/接近历史低点,初步的 FY26 收入指引较低。此外,29%的非 GAAP 运营利润指引比我们 30%的估计低了一个百分点,略低于 FY25 的利润率。”

Jefferies tech spec J. Favuzza: “still unanswered from our seats was around the Subscription revenue guidance of ~5.7% y/y at the midpoint with IAM overall going to LDD. Which would imply core business much weaker…conservative or cannibalistic was the question we got numerous times.”

Jefferies 技术分析师 J. Favuzza:“我们席位上仍未得到答案的是关于订阅收入指引的约 5.7%年增长率的中点,IAM 整体将达到 LDD。这意味着核心业务要弱得多……我们多次被问到的问题是保守还是自相残杀。”

SMTC +13.7% following a better than feared guide & 4Q beat

SMTC +13.7%,因指引好于预期及第四季度业绩超出预期

GOGO +13% on Q4 beat and FY25 guide above

GOGO +13% 因第四季度业绩超预期和 2025 财年指引上调

RBRK +18% strong Q4 revs with FY’26 revs and EPS above street. Guiding F26 subs ARR $1.35-1.36b/+24% (St $1.31/+24%) and FCF $45-65m (St $32m). Key quote on macro (h/t Jefferies):

RBRK +18% 强劲的第四季度收入,FY’26 收入和每股收益超出市场预期。指导 F26 订阅年收入 $1.35-1.36b/+24%(市场 $1.31/+24%)和自由现金流 $45-65m(市场 $32m)。关于宏观的关键引用(致敬 Jefferies):

“In terms of tariffs and macro, we continue to see a very strong secular demand for our product, because cyber don't care about market cycles, cyber don't care about what is happening in terms of the public market, because on a down market, the customers get more worried about protecting their business, and they want to ensure

“在关税和宏观方面,我们继续看到对我们产品的强劲长期需求,因为网络安全不关心市场周期,网络安全不关心公共市场发生的事情,因为在市场下行时,客户会更加担心保护他们的业务,他们希望确保”

·TTAN: JPM: “FY26 guide landed ahead of consensus on revenue and OI throughout the range: revenue $895-905mm (St $884mm) or +17% vs 2024 +26%, and the FY26 Operating Income guide is $48-53mm (St $39mm).”

·TTAN: JPM: “FY26 指引在收入和营业收入方面超出市场共识:收入 $895-905mm(St $884mm)或比 2024 年增长 17%,比 2024 年增长 26%,FY26 营业收入指引为 $48-53mm(St $39mm)。”

Third-Party Data Roundup:

第三方数据汇总:

GOOGL: Yipit saying GOOGL search decelerated in last 2 weeks, tracking 2-3pps below street

GOOGL:Yipit 表示 GOOGL 搜索在过去两周内减速,跟踪低于市场预期 2-3 个百分点

CVNA: Similar to what we have heard from Yipit, M-sci saying retail volumes tracking well ahead of street

CVNA:与我们从 Yipit 听到的类似,M-sci 表示零售销量远超市场预期

XYZ: M-sci saying seller growth has slowed in Feb, tracking below street. Cash APP trends mixed…also XYZ: Block's Square Financial Services receives FDIC approval to offer consumer loan product Cash App Borrow

XYZ: M-sci 表示卖方增长在 2 月放缓,低于市场预期。现金应用趋势参差不齐……同时,XYZ: Block 的 Square 金融服务获得 FDIC 批准,提供消费贷款产品 Cash App Borrow。

AMZN: Yipit saying NA retail tracking 1ppt above while int’l retail tracking 2ppts below street

AMZN: Yipit 表示北美零售跟踪比预期高出 1 个百分点,而国际零售跟踪比市场预期低 2 个百分点

META: Edgewater says META outperforming peers on rising RoAS but feedback around softening cons disc increase in last couple of weeks (first time they’ve called out macro in their checks)

META:Edgewater 表示 META 在提高 RoAS 方面表现优于同行,但在过去几周中,关于消费品需求减弱的反馈有所增加(这是他们首次在检查中提到宏观经济因素)

ZM: M-sci saying top line accel in feb driven by strength in enterprise

ZM: M-sci 表示 2 月份的收入增长加速是由于企业部门的强劲表现

NVDA: Hon-Hai — worse iPhone / better AI

NVDA: 鸿海 — 更糟的 iPhone / 更好的 AI

Hon Hai Precision Industry Co. posted a surprise earnings fall after weak Chinese iPhone sales eroded margins, though the Nvidia Corp. supplier forecast a doubling in AI-related revenue this quarter.

鸿海精密工业股份有限公司因中国 iPhone 销售疲软侵蚀了利润,意外发布了盈利下滑的消息,尽管这家 Nvidia Corp.的供应商预测本季度与 AI 相关的收入将翻倍。The Taiwanese company’s net income plunged 13% to NT$46.3 billion ($1.4 billion), far short of analysts’ estimates for a 2.3% gain. Hon Hai, one of Nvidia’s most important server assemblers, expects revenue to rise in 2025, though it didn’t specify the extent of gains.

这家台湾公司的净收入下降了 13%,降至 463 亿新台币(14 亿美元),远低于分析师对 2.3%增长的预期。鸿海,Nvidia 最重要的服务器组装商之一,预计 2025 年收入将增长,但并未具体说明增长幅度。

XYZ: Block poised to grow gross profit by 15% over next two years, says BTIG

XYZ:BTIG 表示,区块有望在未来两年内实现 15%的毛利润增长

BTIG's Andrew Harte maintains a Buy rating and $110 price target on Block, highlighting the company's recent FDIC approval for Cash App Borrow consumer loans. Harte notes this development exemplifies the operational flexibility that Square Financial Services (SFS) provides to Block. According to Harte's research, the company is positioned to increase its gross profit by approximately 15% over the coming two years while significantly expanding operating margins as it strengthens relationships with both Cash App users and Square merchants.

BTIG 的 Andrew Harte 维持对 Block 的买入评级和 110 美元的目标价,强调该公司最近获得 FDIC 批准的 Cash App Borrow 消费者贷款。Harte 指出,这一发展体现了 Square Financial Services (SFS)为 Block 提供的运营灵活性。根据 Harte 的研究,该公司预计在未来两年内其毛利润将增加约 15%,同时在加强与 Cash App 用户和 Square 商户的关系的过程中显著扩大运营利润率。

TSLA: Wells cuts Tesla target on 'shocking' European sales drop

TSLA:Wells 因“令人震惊”的欧洲销售下滑下调特斯拉目标价

Wells Fargo's Colin Langan has reduced his price target on Tesla from $135 to $130 while maintaining an Underweight rating on the stock. Langan indicates that "shocking" European sales performance year-to-date has finally drawn attention to Tesla's fundamental business issues. The analyst highlights that Tesla's overall sales are down 16% year-to-date, with European Union sales specifically plummeting 45% in January. Langan warns of additional risks to Tesla's volumes, pricing, and profit margins. "Investors are beginning to recognize that the fundamentals offer little excitement," Langan explains in his research note. Wells Fargo believes Tesla's dramatic European sales decline likely triggered the recent correction in share price, as it raises the possibility of another year without growth. The firm also mentions that recent protests and vandalism "further compound concerns" about Tesla's outlook.

富国银行的科林·兰根已将特斯拉的目标股价从 135 美元下调至 130 美元,同时维持对该股票的减持评级。兰根指出,年初至今“令人震惊”的欧洲销售表现终于引起了人们对特斯拉基本商业问题的关注。分析师强调,特斯拉的整体销售年初至今下降了 16%,而欧盟的销售在 1 月份特别暴跌了 45%。兰根警告特斯拉的销量、定价和利润率面临额外风险。“投资者开始意识到基本面几乎没有令人兴奋的地方,”兰根在他的研究报告中解释道。富国银行认为,特斯拉在欧洲销售的剧烈下降可能引发了近期股价的修正,因为这提高了又一年没有增长的可能性。该公司还提到,最近的抗议和破坏行为“进一步加剧了”对特斯拉前景的担忧。

TSLA: Tesla plans production of lower-cost Model Y in Shanghai, Reuters reports

TSLA:特斯拉计划在上海生产更低成本的 Model Y,路透社报道

Reuters: 路透社:

TSLA will make a lower-cost version of its best-selling Model Y in Shanghai, three people with knowledge of the matter said, aiming to regain ground lost during a price war in its second-largest market.

特斯拉将在上海推出其畅销车型 Model Y 的低成本版本,三位知情人士表示,旨在重新夺回在其第二大市场价格战中失去的市场份额。The U.S. electric vehicle maker is developing the model under a project codenamed "E41" and will build it using existing production lines, the people said. Mass production will begin at its biggest factory by output in 2026, said two of the people.

美国电动车制造商正在开发一个代号为“E41”的车型,并将利用现有生产线进行生产,这些人表示。两位知情人士表示,量产将在其产量最大的工厂于 2026 年开始。

ORCL/TikTok: Oracle Is Leading Contender to Help Run TikTok in New Deal

ORCL/TikTok:甲骨文是帮助运营 TikTok 的新交易中的主要竞争者

Oracle has emerged as a leading contender to help run TikTok as part of a deal President Donald Trump is orchestrating to satisfy last year’s divest-or-ban law, say investors, bankers and former executives familiar with the Chinese tech giant. ByteDance management prefers Oracle, while President Trump has also indicated his support for Oracle playing a key role.

投资者、银行家和熟悉这家中国科技巨头的前高管表示,甲骨文已成为帮助运营 TikTok 的主要竞争者,这是唐纳德·特朗普总统正在策划的一项交易,以满足去年的剥离或禁令法。字节跳动管理层更倾向于甲骨文,而特朗普总统也表示支持甲骨文发挥关键作用。At the same time, though, ByteDance’s leaders want to retain a hands-on role with TikTok’s operations in any deal, even if U.S. companies end up owning a piece of TikTok U.S., the people say. That stance could undercut hopes of several U.S. bidders interested in buying control of TikTok, including a consortium led by billionaire Frank McCourt with Reddit cofounder Alexis Ohanian.

与此同时,字节跳动的领导者希望在任何交易中继续对 TikTok 的运营保持直接参与,即使美国公司最终拥有 TikTok U.S.的一部分,这些人表示。这一立场可能会削弱几家有意收购 TikTok 控制权的美国竞标者的希望,包括由亿万富翁 Frank McCourt 和 Reddit 联合创始人 Alexis Ohanian 领导的财团。According to investors familiar with ByteDance’s thinking, the Chinese company is hoping Trump will approve a deal based on the contours of Project Texas, a multibillion-dollar initiative set up between TikTok and Oracle in the past couple of years in which TikTok stores U.S. user data on Oracle servers and lets Oracle review the source codes of the algorithm dictating what users see on the app. ByteDance’s preference could draw criticism that it would leave control of TikTok still in Chinese hands, undercutting the point of the law

根据熟悉字节跳动思维的投资者,中文公司希望特朗普批准一项基于“德克萨斯项目”轮廓的交易,该项目是过去几年间在 TikTok 和 Oracle 之间建立的一项数十亿美元的倡议,TikTok 将美国用户数据存储在 Oracle 服务器上,并允许 Oracle 审查决定用户在应用上看到内容的算法源代码。字节跳动的偏好可能会引发批评,认为这将使 TikTok 的控制权仍然掌握在中国手中,从而削弱法律的初衷。“The precise form of a TikTok deal remains hazy. While a new entity, partly owned by U.S. companies, is likely to be formed to oversee TikTok U.S., it’s unclear what that entity would house. For instance, it’s not known whether the entity would handle advertising, sales and engineering for TikTok in addition to controlling U.S. user data or the algorithm, the most valuable asset within TikTok. One person involved with a potential bidder said it remains unclear what is actually for sale in the TikTok deal, and their understanding of that has changed multiple times after conversations with White House officials.

TikTok 交易的具体形式仍然模糊不清。虽然可能会成立一个由美国公司部分拥有的新实体来监督 TikTok 美国,但尚不清楚该实体将包含什么。例如,目前尚不清楚该实体是否会处理 TikTok 的广告、销售和工程,除了控制美国用户数据或算法,这是 TikTok 中最有价值的资产。一位参与潜在竞标者的人士表示,目前仍不清楚 TikTok 交易中实际出售的内容是什么,并且在与白宫官员的对话后,他们对这一点的理解已经多次变化。

lutnick on tiktok: Trump doesn't like to ask for extensions…Trump will aim to do in timeframe he has

lutnick 在 TikTok 上:特朗普不喜欢请求延期……特朗普会在他拥有的时间框架内完成

AAOI +58% after disclosing an agreement with Amazon.com to issue warrants to purchase up to 7.9M shrs

AAOI 在披露与 Amazon.com 达成协议以发行购买高达 790 万股的认股权证后上涨 58%

INTC: Inside the Mind of Intel’s New CEO: ‘Disrupt and Leapfrog’ - WSJ

INTC:英特尔新任首席执行官的思维:‘颠覆与跨越’ - 华尔街日报

TMUS: T-Mobile downgraded to Neutral from Buy at Citi

TMUS:T-Mobile 在花旗被下调至中性评级,之前为买入评级

Citi downgraded T-Mobile to Neutral from Buy with an unchanged price target of $268. T-Mobile continues to generate favorable growth relative to the category and its competitors, but the stock's valuation has stayed elevated, the analyst tells investors in a research note. Citi does not see "any immediate accelerators to quickly reduce T-Mobile's premium." However, the risk that wireless competition may elevate further and increase costs is not good for category multiples, especially for the premium at which T-Mobile trades, the firm adds.

花旗将 T-Mobile 的评级从买入下调至中性,目标价维持在 268 美元不变。分析师在研究报告中告诉投资者,T-Mobile 相对于行业和竞争对手仍然保持良好的增长,但该股票的估值仍然较高。花旗认为“没有任何立即的推动因素可以迅速降低 T-Mobile 的溢价。”然而,分析师补充道,无线竞争可能进一步加剧并增加成本的风险,对行业倍数并不利,尤其是 T-Mobile 的交易溢价。

PTON: Canaccord upgrades Peloton to Buy, sees 'turning point'

PTON:Canaccord 将 Peloton 评级上调至买入,认为出现“转折点”

Canaccord has elevated Peloton's rating from Hold to Buy while maintaining their $10 price target after transferring coverage. Canaccord notes that Peloton stands as the definitive leader in the connected fitness space, a market they invested in early and where they've built a loyal 6M member base generating a high-margin recurring revenue stream. The analyst projects that the company's revenue will turn positive in fiscal 2026 as management implements new revenue strategies, with subscription growth following in fiscal 2027 through the introduction of complementary products. Canaccord believes Peloton "has reached an inflection point in its development where significant upside potential exists from current price levels."

Canaccord 已将 Peloton 的评级从持有上调至买入,同时在转移覆盖后维持其 10 美元的目标价。Canaccord 指出,Peloton 在连接健身领域中是绝对的领导者,这是他们早期投资的市场,并在此建立了一个忠实的 600 万会员基础,产生了高利润的经常性收入流。分析师预测,随着管理层实施新的收入策略,该公司的收入将在 2026 财年转为正值,订阅增长将在 2027 财年通过引入互补产品实现。Canaccord 认为,Peloton“已经达到了其发展的拐点,从当前价格水平存在显著的上行潜力。”

ASML: remains best European idea in 2025 at TDCowen

ASML:在 2025 年仍然是 TDCowen 最佳欧洲投资理念

ASML remains TDCowen's best European idea in 2025 given its best-in-class litho portfolio that addresses critical challenges in foundry/logic, and increasingly future DRAM scaling. Valuation is currently attractive relative to peers trading at a near 5Y low premium of ~1.5x (avg. of 2.1x). Bookings momentum in C1H25 critical to CY26 outlook, nevertheless, the LT structural litho story is still intact.

ASML 仍然是 TDCowen 在 2025 年最好的欧洲投资理念,考虑到其在光刻领域的最佳产品组合,能够应对代工/逻辑领域的关键挑战,以及未来 DRAM 扩展的日益重要性。相对于同行,目前的估值具有吸引力,交易接近 5 年低溢价约 1.5 倍(平均为 2.1 倍)。C1H25 的订单势头对 CY26 的前景至关重要,尽管如此,长期结构光刻的故事仍然完好无损。

AMD: Mizuho lowers AMD PT to $120 from $150 and NVDA to $168 from $175

AMD:瑞穗将 AMD 目标价从$150 下调至$120,将 NVDA 目标价从$175 下调至$168

Mizuho hosted an industry call focused on Gen AI/Agentic, and CSP CAPEX trends from new models. Key takeaways: 1) MMLU benchmarks show parameter scaling still important in Pre-Training Foundation models and could drive GPU demand, but potential plateau in 2-3Y, 2) AI also moving to Inference/reinforcement learning (IF/RL) with new Qwen/DS R1/GeminiR2/Manus though requires ~10% GPU load vs pre-training - but IF/RL workloads could grow SIGNIFICANTLY driving bigger GPU ramps, 3) Mizuho notes China Ascend 910a/c at 50% lower cost, unstable but improving performance, though H20 STRONG, and 4) Mizuho also cites TARIFFS exposure risk as ~28% of US Servers made in Mexico.

瑞穗举办了一场行业电话会议,重点讨论了生成 AI/代理和新模型的 CSP 资本支出趋势。主要要点:1)MMLU 基准显示,参数扩展在预训练基础模型中仍然重要,可能推动 GPU 需求,但在 2-3 年内可能会达到平台期;2)AI 也在向推理/强化学习(IF/RL)转变,新的 Qwen/DS R1/GeminiR2/Manus 虽然需要约 10%的 GPU 负载与预训练相比,但 IF/RL 工作负载可能会显著增长,推动更大的 GPU 需求;3)瑞穗指出,中国 Ascend 910a/c 的成本降低了 50%,性能不稳定但在改善,尽管 H20 表现强劲;4)瑞穗还提到关税风险,约 28%的美国服务器是在墨西哥制造的。

TEAM Remains Overweight rated and $365 PT; KEYB is buying the dip @ KEYB

团队维持超配评级,目标价为$365;KEYB 正在逢低买入@ KEYB

As software stocks have experienced a pullback and multiple compression due to concerns around tariffs and broader geopolitical/macro tensions, KEYB conducted a review of its coverage list and recently engaged with investor relations to identify compelling opportunities created by market dislocations. With TEAM shares having declined 25% month-to-date (compared to $IGV's 9% drop) and currently trading at a low-30s next twelve months FCF multiple, KEYB perceives an attractive risk/reward profile for a sustainable Rule of 40+ company with several upcoming catalysts, along with some visibility into a potential valuation floor if macroeconomic conditions worsen.

由于软件股票因关税和更广泛的地缘政治/宏观紧张局势而经历了回调和多重压缩,KEYB 对其覆盖名单进行了审查,并最近与投资者关系进行了接触,以识别市场错位所创造的有吸引力的机会。随着 TEAM 股票本月迄今下跌了 25%(相比之下,$IGV 下跌了 9%),并且目前以低 30 倍的未来十二个月自由现金流倍数交易,KEYB 认为对于一家可持续的 40+规则公司来说,具有吸引人的风险/回报特征,并且有几个即将到来的催化剂,同时在宏观经济条件恶化的情况下,对潜在估值底部有一定的可见性。

AAPL: Wedbush Defends after recent weakness

AAPL:Wedbush 在近期疲软后进行辩护

Wedbush sees Apple facing bearish pressure amid AI feature delays, tech weakness, and China tariff concerns. Wedbush notes investors are focused on AI development timing crucial for iPhone 16 upgrades. Despite temporary setbacks, Wedbush maintains OUTPERFORM rating and $325 target, believing Apple will reach new highs in 2025 during its AI cycle. Wedbush's worst-case shifts only 10M iPhones (~4%) from FY25 to FY26, still projecting 225-230M units growing to 245-250M. Wedbush estimates $10B in annual AI Services revenue by 2027 and highlights three overlooked dynamics: 1) 2B+ iOS device installed base with 300M in upgrade window, 2) $2T valuation Services business, and 3) 20% of global population accessing AI through Apple devices soon.

Wedbush 认为,苹果在人工智能功能延迟、科技疲软和中国关税担忧的背景下面临看跌压力。Wedbush 指出,投资者关注人工智能开发的时机,这对 iPhone 16 的升级至关重要。尽管面临暂时的挫折,Wedbush 仍维持“跑赢大盘”评级和 325 美元的目标,认为苹果将在 2025 年其人工智能周期中达到新高。Wedbush 的最坏情况仅将 1000 万部 iPhone(约 4%)从 2025 财年转移到 2026 财年,仍预计出货量为 2.25 亿至 2.3 亿部,增长至 2.45 亿至 2.5 亿部。Wedbush 预计到 2027 年,人工智能服务的年收入将达到 100 亿美元,并强调三个被忽视的动态:1)超过 20 亿的 iOS 设备安装基础,300 百万部在升级窗口内,2)2 万亿美元估值的服务业务,以及 3)全球 20%的人口将很快通过苹果设备访问人工智能。

OTHER NEWS 其他新闻

AAPL: UK, US Hold Talks in Bid to Resolve Apple Encryption Feud – Bloomberg

AAPL:英国、美国就解决苹果加密争端进行会谈 – 彭博社AAPL: Apple’s iPhone 16e Is Outselling iPhone SE But Won’t Reverse China Slide – Bloomberg

AAPL:苹果的 iPhone 16e 销量超过 iPhone SE,但无法扭转中国市场下滑 – 彭博社BIDU, TSLA: Tesla's cooperation w/ Baidu is limited to map navigation – Sina, (h/t BofA)

BIDU, TSLA:特斯拉与百度的合作仅限于地图导航 – 新浪,(h/t BofA)CMCSA: Comcast-owned NBC agrees $3bn deal to broadcast Olympic Games beyond 2032 – FT

CMCSA:康卡斯特旗下的 NBC 同意以 30 亿美元的交易在 2032 年后播出奥运会 - FTCOMP: Compass is in talks to buy Buffett's real-estate brokerage unit, WSJ reports – Reuters

COMP:据《华尔街日报》报道,Compass 正在与巴菲特的房地产经纪公司进行收购谈判,路透社DeepSeek: DeepSeek focuses on research over revenue in contrast to Silicon Valley– FT

DeepSeek:DeepSeek 专注于研究而非收入,这与硅谷形成对比——FTGen AI: AI Companies Embrace Efficient Models That Run on Fewer Chips – Bloomberg

Gen AI:人工智能公司采用高效模型,使用更少的芯片 – 彭博社LYV: a federal judge denied Live Nation's attempt to narrow the DoJ's antitrust case seeking to break off Ticketmaster – Bloomberg

LYV:一名联邦法官拒绝了 Live Nation 缩小美国司法部寻求拆分 Ticketmaster 的反垄断案件的尝试——彭博社NAND: Kioxia anticipates NAND supply to fall short in 2H25 and overall NAND shipments in 2025 will increase by 10-15% as consumer clients resume their NAND purchases – Digitimes

NAND:Kioxia 预计 2025 年下半年 NAND 供应将不足,整体 NAND 出货量将在 2025 年增加 10-15%,因为消费客户恢复其 NAND 采购——DigitimesNVDA: UAE Official to Press US on Ability to Buy More Nvidia AI Chips – Bloomberg

NVDA:阿联酋官员将向美国施压,要求购买更多 Nvidia AI 芯片 – 彭博社OpenAI, SoftBank: SoftBank and OpenAI to build an AI data center in Japan – Nikkei

OpenAI, SoftBank: SoftBank 和 OpenAI 在日本建设人工智能数据中心 – 日本经济新闻STM: Italy set to use veto powers over STMicro governance - Italian press

STM:意大利将对 STMicro 治理行使否决权 - 意大利媒体TSLA, Tariffs: Tesla warns it could face retaliatory tariffs – Reuters

TSLA,关税:特斯拉警告称可能面临报复性关税 – 路透社Video Games: Nintendo Switch 2 Set for Gaming’s Biggest Ever Launch Even at $400-Plus – Bloomberg

视频游戏:任天堂 Switch 2 准备迎接有史以来最大的游戏发布,即使价格超过 400 美元 - 彭博社