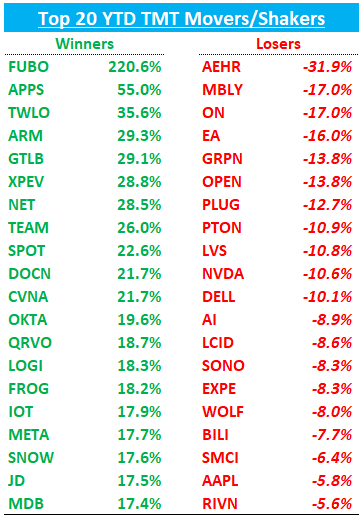

That was quite a first month in the markets! Despite all the choppiness, a yield scare, and a Chinese LLM entering the game, the QQQs are still up 2% for the year. As we suspected, 2025 has brought with it more turbulence in the overall index, but we continue to think the macro environment remains supportive for stocks - plenty of names up 15%+ so far in the year…

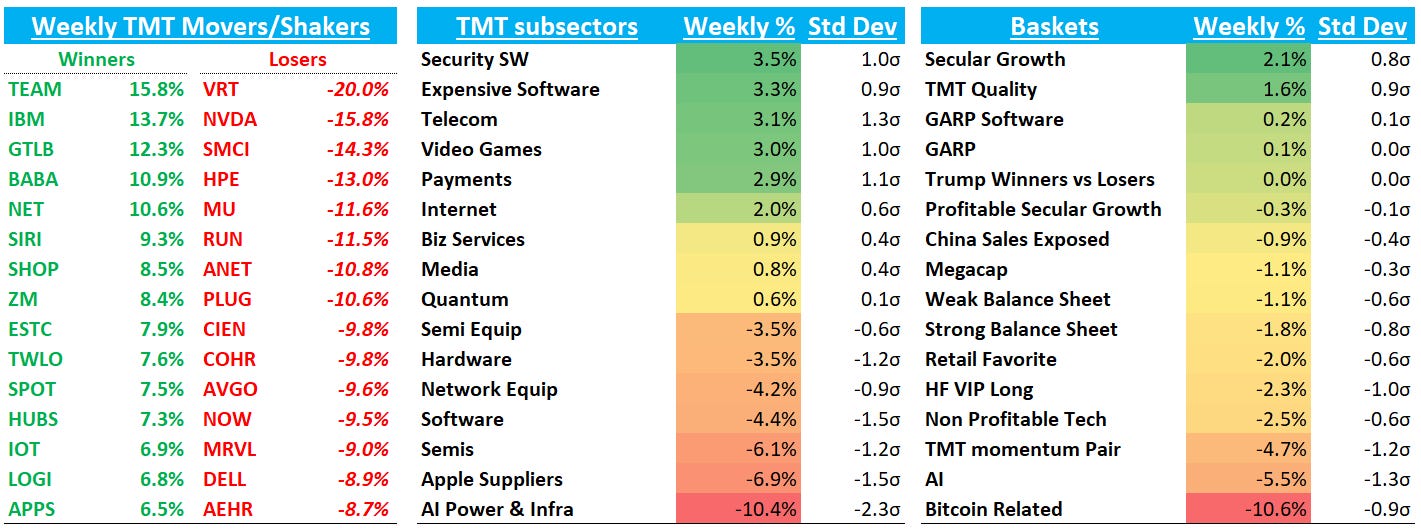

Idiosyncratic stories and beats/misses are being both rewarded and punished - this week we saw that on the long side with CLS and TEAM and on the short side with EA and NOW. While 2024 was an ideal backdrop for momentum—rates were in a sweet spot, sentiment was euphoric, and multiple expansion was rampant — we think 2025 will continue to be a good backdrop for stock picking (with a continued long bias).

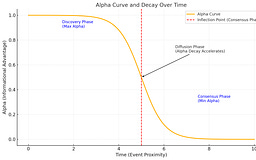

We’ve been writing about the increasing dispersion in AI semis that started near the middle of last year. In 2023/early 2024, everything AI went up. As the AI supercycle has matured from infancy to childhood, investors have become increasingly selective about what to buy, which means winners are getting bid up more heavily (just check out CLS px action this week). This makes for a more discriminatory stock picking environment and a trend we think will continue.

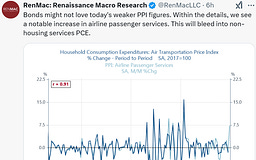

We continue to think the macro environment remains favorable for owning stocks (all those NVDA $’s need to go somewhere…) Macro prints / yields will continue to stay front of mind and we remain on our toes, but our feeling continues to be that the market wants to continue to go up; which means inline-ish prints/releases will continue to strengthen the current goldilocks narrative: subdued inflation, steady econ growth, fed easing cycle near the end but still intact, new biz friendly administration helping drive deregulation/increased biz + consumer sentiment, oil close to $70, and an AI supercycle that is still intact (yes, despite all the Deepseek noise). We saw that this week with a slightly more dovish fed and an inline PCE driving stocks higher (Trump’s tariffs notwithstanding). That last part - Trump’s tariffs - throws a bit of a wild card into the mix. Good politico article on that front:

But there’s a practical limit to Trump’s unpredictability because he needs tariffs to do more than strong-arm other countries. He needs them to provide some hard-number cash for the treasury.

The administration is serious about using duties as a way to raise revenue as Republicans look to extend and expand tax cuts, Trump allies tell me. So they are working to develop a framework for achieving that — one that goes well beyond one-off threats.

In other words, against the backdrop of chaos used for any purpose, there will also likely be some kind of universal tariff — predictability by Trump standards.

That adds a bit of uncertainty but sw and internet are generally insulated, while we think AI semis have more top of mind issues driving those stocks. Other semis and consumer facing product stocks like AAPL, LOGI, DELL have more to lose.

A few charts we liked from this week:

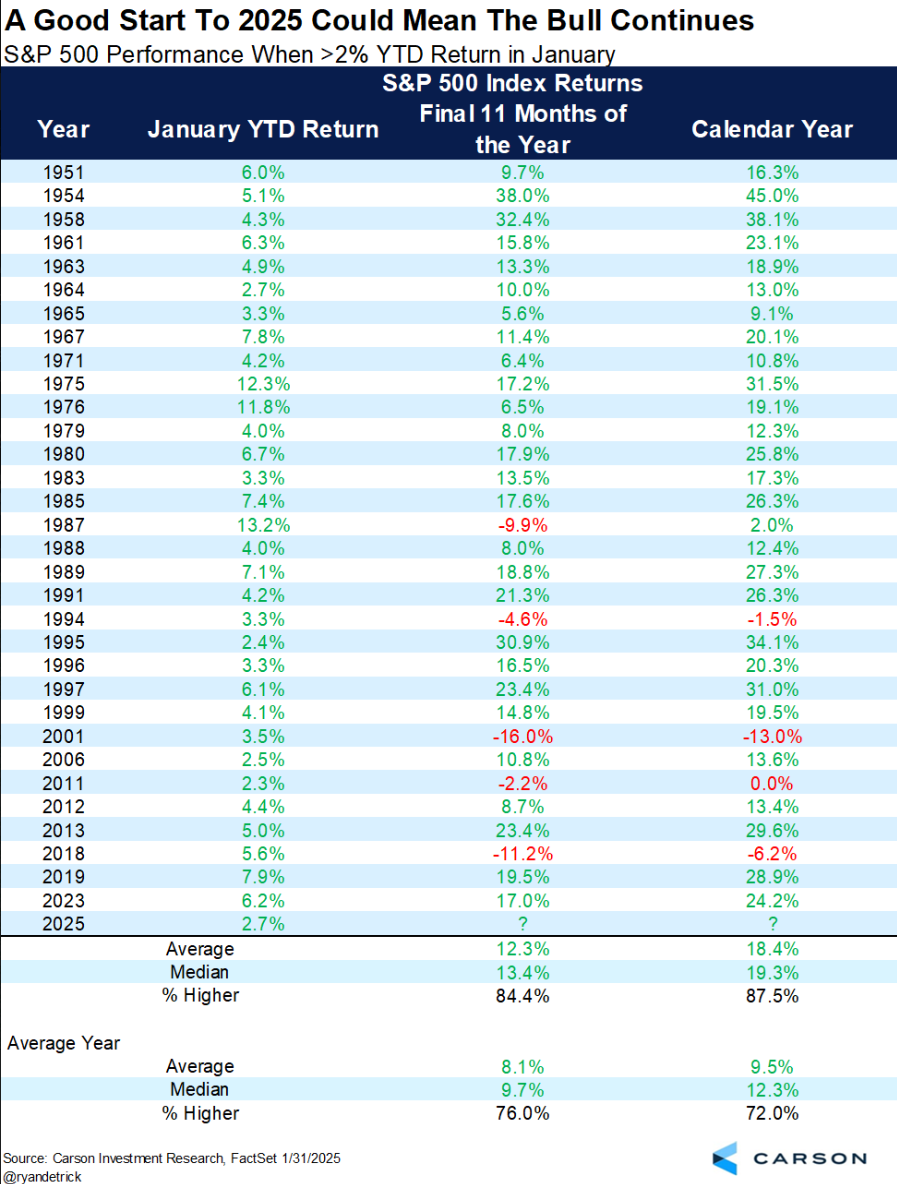

A good January tends to be good for the year:

Seasonality strong through Mid-February:

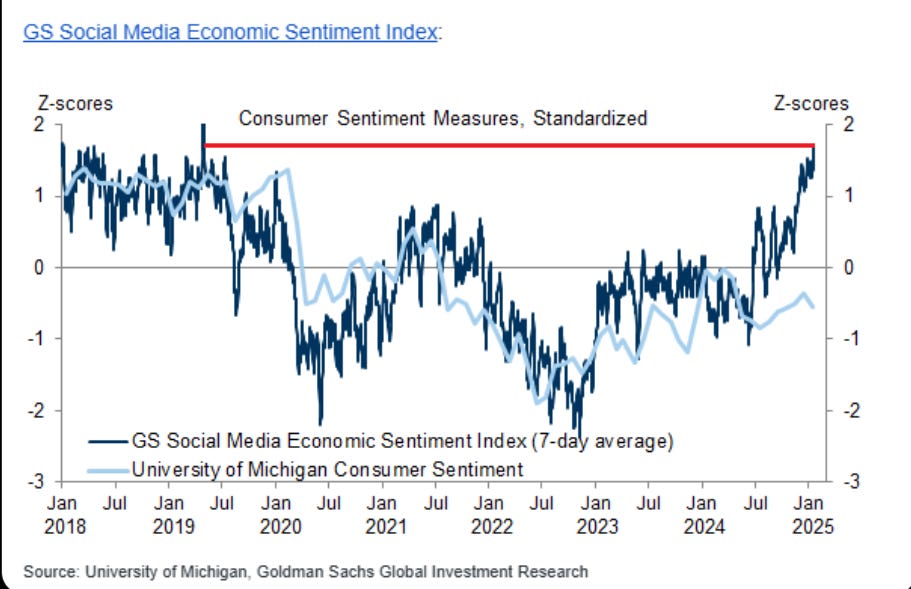

Sentiment a bit stretched (but an outright negative in our view especially coming off subdued levels):

Moving on to Tech where we had a week I don’t think any of us will forget any time soon….

A few thoughts from this week:

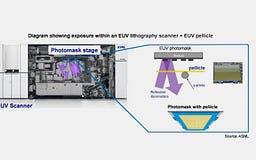

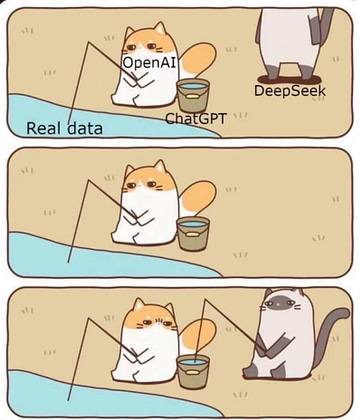

Deepseek and what it means for compute /AI levered semis: after Monday’s freakout and a week filled with plenty of takes, we began to see a clearer narrative emerge and a dispersion in stock performance. Overall, I think by the end of the week most investors were convinced 1) increased model competition 2) lower inference costs 3) and a narrative that now has more nationalistic undertones (U.S. vs. China) will all lead to more compute. We liked this analogy to foundries Semianalysis made yesterday that would mean training compute will remain robust:

What we think will happen is an even faster version of leading edge fab dynamics. Rushing to the newest capability means continued pricing power (see ChatGPT Pro) and lagging capabilities means much lower pricing that mostly accrues to the infrastructure that serves the tokens.

…As long as you expand capability to drive new features which can create value on top of these features, then you deserve pricing power. If not – commoditization is the open model market just a generation behind.

What we described to you was a parallel for a hyperdrive version of chip manufacturing as an analogy, the most capital intensive industry known to man. Not a single industry spends more on R&D in the world, and yet the closest realized parallel means this is somehow bad for the chips that support the model companies…

In the beginning it wasn’t clear you could scale transistors smaller and smaller, and when it did become clear, the entire industry focused on scaling CMOS to the smallest possible dimension and built meaningful functions on top. We are in the early stages of putting together multiple CoT models and capabilities together. We are scaling models like we initially scaled transistors, and while that is likely to be a very hectic period in terms of technological progress, this is good for Nvidia.

I like that argument but in terms of training compute, we are still debating issues of scaling laws and whether synthetic data is good enough to train the frontier models on. We think the shortly to be released Grok 3 will give us further clarity on this as it was trained on the massive Colossus cluster of100k H100s.

To me, the more interesting question with less clear of an answer is what’s the timeline on more inferencing compute — that’s to say: how long does it take for Javon’s paradox to play out in a world where we still don’t have any killer AI apps yet outside LLM models? And what does that mean for 1) the trajectory of spend and 2) investor’s confidence in the trajectory of spend?

That was partly answered with the capex guidance and commentary we got from META and MSFT. MSFT guided Q3 and Q4 capex to remain at similar levels from Q2 ($22.6B or >$90B run rate) and expects FY26 capex to grow, albeit at a slower pace than FY25 (~55%) (Nadella described the shift in capex from infra to more “short-lived assets more correlated to revenue growth”, which reads good for GPUs and servers). Zuck sounded bullish on the call saying they will continue to invest “hundreds of billions of dollars” over the long-term saying they are ramping up use of MTIA and will replace GPU servers hitting EOL with MTIA (Good for ASICs). Zuck’s talk of 2025 being a really “intense year” and to “buckle up” really sounds like he is all-in on getting “there” first.

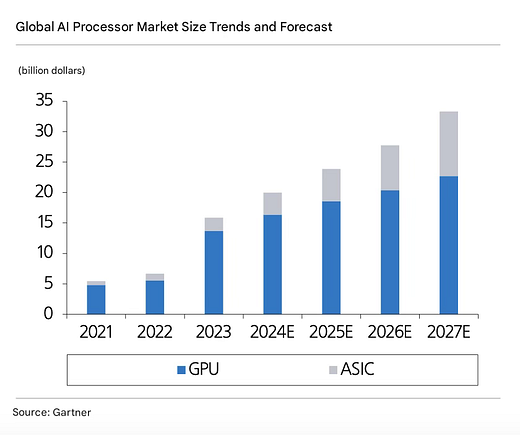

The other interesting question - one that was already raging in full force - to emerge is what this all means for ASICs (MRVL/AVGO, etc.) vs Merchant GPUs (NVDA). Merchant bulls argue that open-source innovation creates a dynamic market where flexibility is crucial. In this environment, companies like NVDA have an advantage because they can rapidly adapt, scale, and allocate resources efficiently. In contrast, ASICs are designed for specific customers and can only be optimized for their particular needs. Merchant bulls also argue that hyperscalers don’t necessarily need to adopt ASICs to improve efficiency if algorithmic advancements continue to reduce inference costs. On the other hand, ASIC bulls will say ASICs are inherently more efficient for inference tasks, which is why hyperscalers are developing their own custom solutions and say that growing software and developer support will drive broader adoption of ASICs over time. META’s talk of increasing focus on MTIA helped support that argument.

To me, the merchant argument makes more sense long-term, but what does the trajectory look like for the stocks? Near-term we think the narrative is clearer for ASICs like MRVL + AVGO. First, there is the not so tiny issue of export controls which NVDA is far more greatly exposed to than MRVL or AVGO. Second, we are in a much different part of the lifecycle in ASIC spend (infancy) vs NVDA spend (childhood). Hyperscalers are still just ramping up spend on ASICs, which means less of a focus on the near-term trajectory - we saw how AVGO reacted in December when it talked up its long-term guidance despite near-term #s being more murky. Third and related, NVDA faces questions of Blackwell ramp issues which adds even more uncertainty to the picture. That’s not to say we’re negative on NVDA - it’s hard to be when we think r/r skews positively: 25x street CY25 EPS is only about 10% down from here. 25x is near the bottom of the range where stock has traded since 2016:

Software and shift to Agentic AI pricing - Does 1 + 1 really = 3? Here’s NOW’s CEO - a great salesman - give his best pitch this week:

Now, we are also enabling elements of consumption-based pricing as AI agents become a potent value driver for the enterprise. While we could have launched an additional SKU and offered AI agents as an add-on to drive more immediate revenue growth, our strategy prioritizes accelerating adoption. So by foregoing upfront incremental new subscriptions, we are enabling faster penetration into our customer base and monetizing the hockey stick of usage over time. As the agents become increasingly productive, they will drive the consumption pricing meter, and that, of course, will be in addition to the seat-based licensing foundation. You'll get both. It's the Goldilocks model where you get it both ways. You get the same revenue and predictability you've been used to. But now we have a hockey stick formation that can turn into a sensational growth shoot for the company..Tthere are millions of technical jobs that go unfilled year-after-year. With Agentic AI agents, you can now fill those jobs and at the same time improve human productivity and the productivity curve of these businesses in a dramatic way

We thought Jack Atherton from JPM had some good thoughts on the topic this week:

I don’t think anyone is calling a structural change to the narrative and most can sympathize with the view that ServiceNow shouldn’t be punished for accelerating to a new normal on pricing. The shift from licensing to SaaS, kicking off in the early 2000s was a painful one for the on-prem businesses… but there was a very clear light at the end of the tunnel for those that managed it. This is a different dynamic, we’re moving from a highly visible, recurring model to a more cyclical, less visible model. Why? 1) because Software companies are trying to cannibalize themselves via Agentic solutions which replace workers and blow up the seat-based model without big price increases, and 2) on the hope of ultimately generating net new revenue as Software inferencing accelerates. ServiceNow can only do this first because it has the most advanced agentic solutions and it doesn’t have a CSP to directly monetize it over MSFT/Azure… others will need to follow suit and I’ll guess they have a much trickier time navigating it.

(To be clear: we don’t think NOW was down because of the pricing model shift, but instead bc ofweaker cRPO #s and guide on a stock that was priced for beats/perfection).

However, Jack raises a good point here and one I hadn’t fully digested: the AI Agentic shift is one that moves software from a highly predictable recurring model to a less cyclical less visible model. Some of our best longs early in our career were going long sw companies that were undergoing the opposite shift to a more predictable model - from license to SaaS (ADBE/ADSK). Investors love highly predictable revs and reward those stocks with higher multiples; the opposite is true as well.

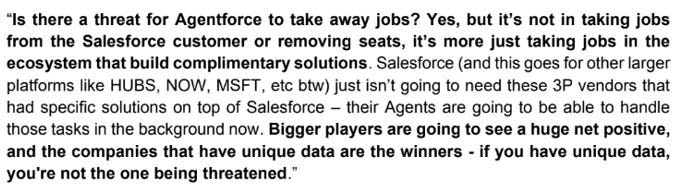

We are bullish AI Agentic software, but there’s a reason we have been calling it a “Golden 3 to 6 to 9 month window.” That reason being: we think there’s a window where the initial ramp up of AI agentic revs will be additive both to #s and sentiment. We think that window is now, but at some point down the read - 6 or 9 months or a year or longer, the narrative is likely to shift to fears around 1) seat cannibalization 2) companies taking a DIY approach to Gen AI as models get better and make it easier to build DIY solutions and 3) what Nadella recently talked about on the BG2 podcast of SaaS being CRUD.

For now, we still like CRM, HUBS, TEAM, GTLB and NOW (although we think the latter needs some digestion).

So far, fears of smaller companies taking a DIY approach to Gen AI are real, but feedback from enterprises so far are they want support in tapping into Gen AI’s potential.

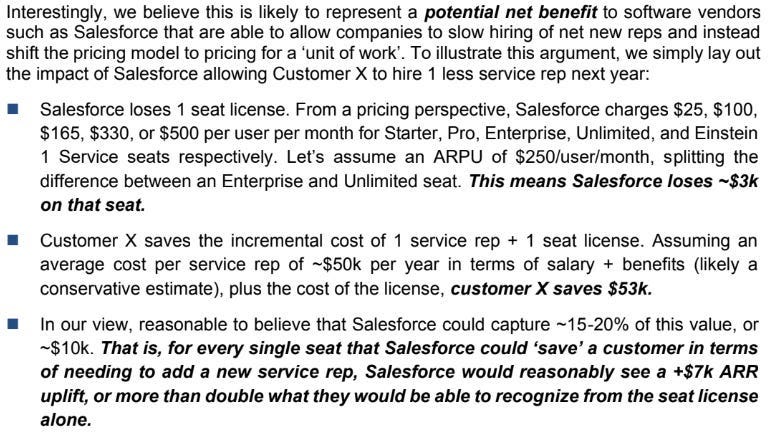

Some of the early ROI #s from some of these tools like CRM’s Agentforce are big — this will make it more clear that companies that aren’t implementing tools to increase productivity, etc. are at risk of falling behind, which means budgets are more likely to be loosened quicker. ISI also laid out some math on ROI in their November note on CRM:

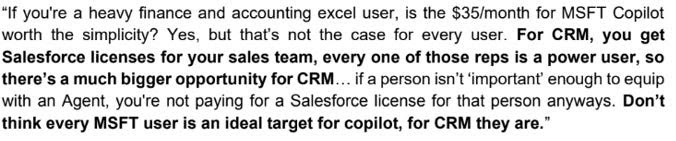

We are particularly bullish on CRM’s AI Agent offering for a couple reasons 1) because they target “power users” (members of the sales team where ROI is easily measured). Check out this feedback from a CRM customer

2) Because they have tons of data:

because Agentforce has a lot of synergies with other parts of CRM’s business like Data Cloud which will help inflect the rest of the biz sooner.

In addition, CRM has 1) the most palatable valuation than any of the other stocks and 2) easier comps going forward. A good check on CRM’s Agentforce here.

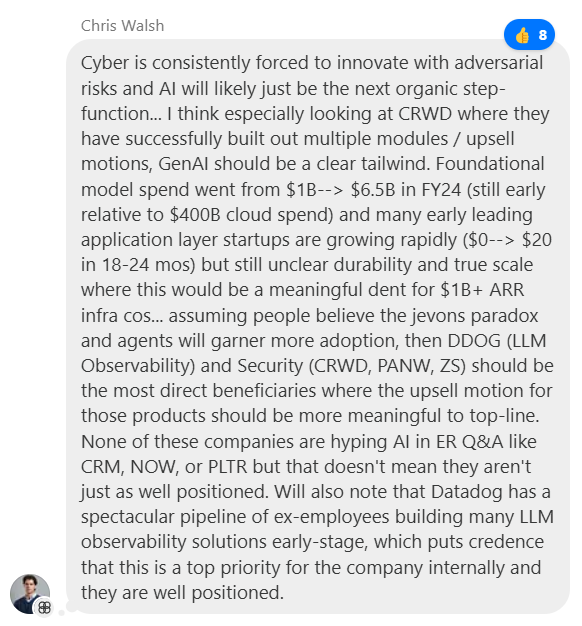

What other stocks do lower inference costs benefit? We liked this take from our reader Chris on TMTB Chat, calling out cyber and DDOG (we also think SNOW is helped):

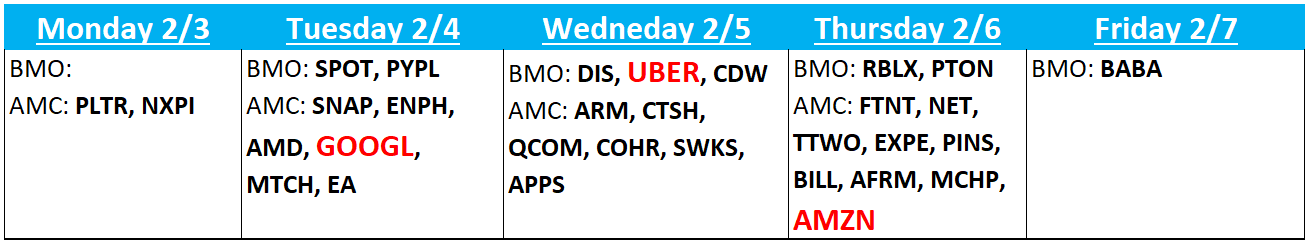

Earnings Previews

Before we get to GOOGL and AMZN, I want to comment on META px action post-print. With stock having rallied into the print, it being most crowded in internet, much higher opex guide and a roughly inline Q1 guide, I would have thought the stock would have been down ~2ppts. However, stock was quickly bought up, which I think is an important tea leaf for this week’s earnings: mainly, as investors shift to “cleaner” AI beneficiaries in internet, they’re likely to be more forgiving on things they would normally nitpick at and “inline”ish will be seen as good enough. With the large 3 - META, AMZN, and GOOGL - all trading at very reasonable valuations, there is plenty of room for multiple expansion as the narrative/sentiment shifts away from AI levered capex to ROI beneficiaries.

GOOGL (Tuesday AMC)

5.7% implied move vs 4.8% average =

+8% YTD; +17% since last earnings; stock at ATHs

Long-term Positioning: 6 out of 10

Short-term Positioning: 7.5 out of 10

GOOGL px action has been surprisingly (to us) strong given Q1 3p data so far has been tracking 3-4ppts below street for search. We think a large part of that is the shift in sentiment that begun to occur late last year. We wrote about it in early January:

GOOGL is a little more complicated. We’ve used GOOGL as a trading stock over the last 2 years: we’ve taken advantage of high quality set ups when sentiment is washed out and AI fears at their peak, at the same time search revs are tracking above street. Our view has been that as long as search is tracking above street, bears face an uphill battle proving that AI secular/structural fears are real. And the opposite is true as well: when search is in line to lower, it’s easier for AI headlines to hit the stock. However, we’ve sensed a shift in the driving narrative of GOOGL over the last couple months: Optimism around AVs and Waymo and the co. shipping a variety of AI products in Dec along with having big hits such as NotebookLM have investors feeling less concerned about AI risks even at a time when we’ve seen slight share shifts in the direction of ChatGPT. The market is also increasingly focused on long-tail technology trends such as drones, robotics, and Quantum all of which GOOGL has exposure to in their Other Bets division. One could argue Youtube will also be a big beneficiary from AI content creation (see FT interview with YT chief here)

With Trump’s win, the regulatory environment also shifted in favor of GOOGL. There’s a reason why Sundar was all smiles at Trump’s inauguration. META’s Q4 looked very healthy and unlike them, GOOGL doesn’t guide Q1, which helps the setup as Q4 data and checks looked pretty healthy for GOOGL. We also got news this week that GOOGL issued ‘voluntary exit’ program for Android, Chrome, and Pixel employees. Investors took this as a positive sign for margins going forward.

The Platforms & Devices team is offering a voluntary exit program that provides US-based Googlers working on this team the ability to voluntarily leave the company with a severance package. This comes after we brought two large organizations together last year. There’s tremendous momentum on this team and with so much important work ahead, we want everyone to be deeply committed to our mission and focused on building great products, with speed and efficiency.

Overall, I’m not quite sure what to do with the stock. Price action has been surprisingly strong, valuation is v reasonable, co is likely to continue to deliver on margins but Q1 search tracking below street worries me.

Bogeys:

Q4 Total Rev Growth – 12.5% vs street at 12%

Q4 Google Search Rev Growth – 11.5-12% vs street at 11%

Q4 YouTube Rev Growth – 12% vs street at 11%

Q4 Cloud Rev Growth – 33-34% vs street at 32%

FY25 capex: ~$65B vs street at $58B

AMZN (Thursday AMC)

%6 implied move vs 6.4% average =

+8% YTD; +22% since last earnings; stock at ATHs

Long-term Positioning: 9 out of 10

Short-term Positioning: 9 out of 10

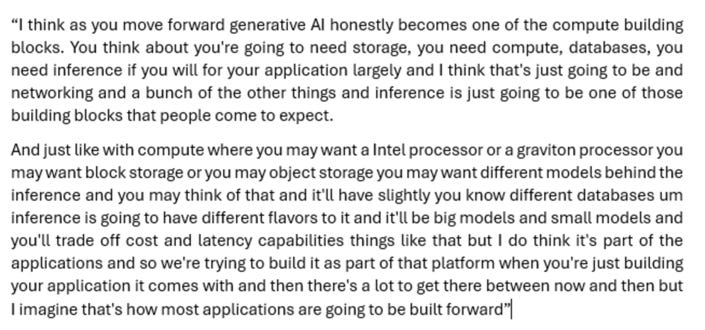

In early December, we wrote about the positive burgeoning shift in AMZN’s narrative from “AI loser” to potential “AI leader.” We think this week’s Deepseek news only helped cement that narrative; as a reminder our main takeaway for AMZN’s AWS strategy coming out of re:invent in Dec was “predicated on the idea that AI becomes a commodity, not something eternally special.” Here’s AWS CEO Garman back in August, sounding prescient as ever:

This shift is important for several reasons. First, despite expanding retail margins, AMZN’s multiple has been held back by worries AWS had been falling behind Azure and not ready for primetime AI. Now, we think both are moving in the right direction, a powerful combo that can allow AMZN to potentially re-rate back to the 20-30x EBITDA multiple it used to trade at pre 2021:

It’s also important as Azure is now dealing with “execution issues.” For the first two years of GenAI, Azure was seen as the market leader given their partnership with OpenAI and accelerating Azure growth. Now, we not only have a shift internally at AMZN, but their main competitor dealing with “execution issues” and lack of acceleration. Both combined are powerful in terms of cementing a change in narrative/perception, which in turn affects the multiple. What would drive home the point? An AWS print > 20%. It’s unclear if we get that as 3p showing <20% in Q4 and no accel in Q1 so far. But that would be right tail upside case.

Ok, back to the main bull case: expanding retail margins driven by ads, improving cost to serve (robotics, densifying inbound, packaging, int’l, etc.), AVOD, a greater focus on efficiency (Ad growth, and HC reductions. We think this quarter helps in that regard.

In terms of 3p data, Q4 NA retail finished 2.5ppts above the street and Q1 NA retail is tracking 3ppts above street. According to Yipit, international also finished Q4 3ppts ahead of street.

Yip is estimating Q4 AWS at 19.8% while M-sci is slightly lower - street is at 19.1% and buyside closer to 19.5%, which is where the bogey has settled at. According to Yip, Q1 is only tracking <19%, inline with street.

All-in all we don’t have a great call on the q, but AMZN remains one of our favorite compounders along with META and our view is you need to stay involved in earnings prints for a name like this, especially when price action is skewing positive.

Our 1-2 year view: We’d like to see AWS begin to accelerate into mid 20s to really give juice to the stock and get us closer to our bull case. Our base case assumes 18x $170B+ in EBITDA in ‘25 (5% upside to street), which would be $285 stock or 20%+ upside. We believe that if AWS can accelerate to 25%+ at the same time retail margins are expanding, the stock can go back to trading at 25x — 25x $200B ‘26 EBITDA would be $470, close to a 2x from here.

Bogeys:

Q4 Rev Growth – $188-$189B vs street at $187.3

Q4 GAAP EBIT – $20.5B vs. street at 18.8B

Q4 AWS Revs/Growth – 19.5%

Q1 Rev Guide – 10%, $158.5B midpoint vs street at $158.7B

Q1 GAAP EBIT Guide – $18-19B vs street at 18.2B

Q1 AWS Revs/Growth – 19% vs street at 18.8%

We’ll have our earnings cheat sheet with some one-liners out on Monday. Have a great weekend!

If you enjoyed reading TMTB Weekly, please recommend us to a friend, colleague or on X (@heartbreakout) - reader recs are the main way we grow. Thank you!