Why you shouldn't join Y Combinator

为什么不该加入 Y Combinator

Or why YC is good for the economy but bad for your economy

或者,为什么 YC 对经济有利,但对你的经济不利?

YC seems like a reasonable proposition. They give you some money to help you start your business, and they promise you access to a community of people that can help you along the way. In exchange, they only ask for a small amount of equity. Doesn’t sound that bad, no?

YC 似乎是一个合理的提议。他们会给你一些钱来帮助你创业,并承诺你可以进入一个可以在创业过程中帮助你的社区。作为交换,他们只要求少量股权。听起来还不错,不是吗?

But by the end of this post I will convince you that it’s actually a terrible idea.

但在这篇文章的最后,我会让你相信,这其实是个糟糕的主意。

ERGODICITY ERGODICITY(ERGODITY)

First, you have to understand a very important concept: in some systems, what’s best for a group is not necessarily what’s best for the individuals who make up the group. In other words, the total wealth of a group of people could be increasing, while almost everyone making up that group could be seeing their wealth diminish. When this happens, we say we have a non-ergodic system. If the system was ergodic, what’s happening to the collective would also translate to all individuals.

首先,你必须明白一个非常重要的概念:在某些系统中,对一个群体最有利的事情并不一定对组成该群体的个人最有利。换句话说,一个群体的总财富可能在增加,而组成这个群体的几乎每个人的财富可能在减少。如果出现这种情况,我们就可以说这是一个非遍历系统。如果系统是遍历的,那么集体发生的事情也会转化为所有个人的事情。

Silicon Valley is a non-ergodic industry (like Hollywood, book publishing, the music industry, and even your country’s economy unless you’re under full-blown communism.) A non-ergodic system is not necessarily bad, but if you’re not cognizant of the system you’re in, you’re going to be played like a fiddle. Those who benefit from the collective will take advantage of you, while you (as the individual) lose out. This is what YC will try to do to you. In fact, this is what YC has to do; otherwise it won’t survive. Let me explain.

硅谷是一个非啮合产业(就像好莱坞、图书出版业、音乐产业,甚至你的国家经济,除非你处于全面的共产主义之下。)非啮合系统并不一定是坏事,但如果你对所处的系统缺乏认识,你就会像小提琴一样被玩弄于股掌之间。那些从集体中获益的人会利用你,而你(作为个人)则会损失惨重。这就是 YC 会试图对你做的事。事实上,这也是 YC 必须做的,否则它将无法生存。让我来解释一下。

LOOKING FOR TREASURE 寻宝

Imagine you’re told there’s a bunch of hidden treasures within a 100 acre area. What’s the best strategy for finding some of these treasures?

想象一下,有人告诉你在 100 英亩的区域内有许多隐藏的宝藏。寻找这些宝藏的最佳策略是什么?

One way is to pick a spot, and dedicate your entire life digging as far down as possible on that one spot. You might reason that the deeper the treasure, the bigger the loot. You don’t want to settle for a measly small treasure box. You want the full chest of diamonds buried near the end of the earth’s crust. This is your shot at glory.

一种方法是选定一个地点,用毕生精力在这个地点尽可能深地挖掘。你可能会想,宝藏越深,战利品就越大。你不想满足于一个小宝箱。你想要的是埋藏在地壳尽头的满满一箱钻石。这是你获得荣耀的机会。

Another way is to use a search method employed by search and rescue teams. You divide the area into small squares, and do a “reasonable search” in each one. You use probabilities and some common sense to help guide you how deep to dig, and then you move to the next square. If you encounter undisturbed compacted dirt, chances are there’s no treasure beneath. If you run into bedrock, it’s almost certain there’s nothing below. So you use that information and move on. Your goal is to search the entire area where there’s probable treasure as quickly as possible. Ideally within your lifetime.

另一种方法是使用搜救队使用的搜索方法。您将区域划分为一个个小方格,在每个方格内进行 "合理搜索"。你要利用概率和一些常识来帮助指导你挖多深,然后再进入下一个方格。如果你遇到的是未经扰动的夯实泥土,那么下面很可能没有宝藏。如果遇到基岩,几乎可以肯定下面什么也没有。因此,您要利用这些信息继续前进。你的目标是尽快搜索整个可能有宝藏的区域。最好是在有生之年。

I’m sure you agree with me that the first way is a dumb strategy. Almost every digger employing this strategy will die treasure-less. But actually, it’s only dumb for that individual treasure hunter. For a gold mining company, this is the optimal strategy. The company only needs one miner to hit jackpot, and all the other miners can die penniless. If the cost of sacrificing an individual treasure hunter is low, the most optimal strategy is to get tens of thousands of treasure hunters, allocate hundreds of them per acre, and make them dig all the way down to the earth’s core. The treasure hunting economy would grow much bigger than if all the individual treasure hunters were optimizing for their own self-interest.

我相信你也同意我的观点,第一种方法是一种愚蠢的策略。几乎所有采用这种策略的挖掘者都会无宝而死。但实际上,这只是对寻宝者个人而言是愚蠢的。对于一家金矿公司来说,这才是最佳策略。公司只需要一个矿工中头奖,其他矿工都可以身无分文地死去。如果牺牲单个寻宝者的成本很低,那么最理想的策略就是找来数以万计的寻宝者,每英亩分配数百人,让他们一直挖到地心。寻宝经济的规模将比所有寻宝者都为自身利益而优化的情况要大得多。

So, digging in one spot is a dumb strategy for the economy of the individual, but a very wise strategy for the collective economy of all individuals.

因此,在一个地方挖洞对个人经济来说是一种愚蠢的策略,但对所有个人的集体经济来说却是一种非常明智的策略。

This is what happens in a non-ergodic system. We often hear politicians claim that the GDP is growing, but all the gains are going to the 1%. This is the same thing. The wealth of a country could be growing, but almost all the citizens could be getting poorer. There’s nothing inconsistent with this. The average is simply being dragged up by the freak outliers.

这就是在非啮合系统中发生的情况。我们经常听到政客们声称国内生产总值在增长,但所有收益都流向了那 1%的人。这也是同样的道理。一个国家的财富可能在增长,但几乎所有公民都可能变得更穷。这并不矛盾。平均值只是被离群的怪胎拖高了而已。

The same thing happens in venture capital. The owners of the portfolio maximize their returns when the system is non-ergodic, because while the individual treasure hunter has one lifetime to strike gold, the VC portfolio has access to thousands of lifetimes: those of all the treasure hunters.

风险投资也是如此。当系统是非啮合的时候,投资组合的所有者就能获得最大回报,因为单个寻宝者只有一生的时间来淘金,而风险投资组合却有数千年的时间:所有寻宝者的一生。

PLANE CRASH 飞机失事

YC will proudly tell you that you are more likely to end up with a billion dollar business if you join them. That may be true. What they’re more reluctant to tell you is that only about 50 companies met that expectation out of the 4,000 or so that went through their program. That’s 1.25%. To be fair, that’s actually quite impressive, but let’s say you have the stamina and willpower to go through YC three times in your lifetime. You’d need approximately 26 lifetimes to hit the jackpot! Aha! See the problem now?

YC 会自豪地告诉你,如果你加入他们,你更有可能最终拥有十亿美元的生意。这可能是真的。但他们更不愿意告诉你的是,在通过他们项目的 4000 多家公司中,只有约 50 家公司达到了这一预期。也就是 1.25%。平心而论,这个数字其实很可观,但假设你有足够的耐力和毅力在一生中通过三次 YC。你大概需要 26 辈子才能中大奖!啊哈看到问题所在了吗?

I don’t know about you, but I want to be successful in this lifetime. I can't afford to rely on 26 lifetimes. But maybe you think you’re special. You’re not like those 3,950 dummies who failed. Maybe you are in fact special, but I wouldn’t rely too much on that. Business is much more random than it seems. If business was predictable, YC wouldn't have a measly 1.25% success rate, or thereabouts.

我不知道你怎么想,但我想在这一生中获得成功。我不能依靠 26 辈子。但也许你觉得自己很特别。你不像那 3950 个失败的傻瓜。也许你确实很特别,但我不会过分依赖这一点。商业的随机性比表面看起来要大得多。如果生意是可以预测的,YC 就不会只有 1.25% 左右的成功率。

You might think that those who failed might still have gotten something. Maybe. But failure is a very expensive way to learn those things. You don’t need to crash a plane to learn how to fly one. And whatever lessons are learned from going through YC are probably not very useful anyway, but more on that later.

你可能会想,那些失败的人可能还是有所收获的。也许吧。但失败是学习这些东西的一种非常昂贵的方式。你不需要通过坠机来学习如何驾驶飞机。而且,无论从 YC 中吸取了什么教训,可能都不会有什么用处,这一点稍后再谈。

PIVOTS ARE STUPID 支点是愚蠢的

One of the bad learnings you get from YC is that there’s a formula for success, and it looks like this: First you do some brainstorming. Then you come up with a good idea that can scale to a billion dollars (otherwise what’s the point of getting out of bed in the morning?) Then you work hard until you find “product-market-fit.” And then if the noises from investors indicate you won’t be getting a next round of funding, you start looking for a “pivot.”

从 YC 学到的一个不好的经验是,成功有一个公式,看起来是这样的:首先,你要进行头脑风暴。然后,你要想出一个能达到十亿美元规模的好点子(否则早上起床还有什么意义?然后,如果投资者的声音表明你无法获得下一轮融资,你就开始寻找 "支点"。

This so-called formula is nonsense. First, good ideas rarely come to us from a brainstorming session. They come from wandering about with an open mind until we stumble on an opportunity worth pursuing. Most of your ideas will be bad ideas, because unfortunately you’re not a genius visionary. So the best way to find good ideas is to have many ideas, try them out, take what works, and throw away the rest. But this is not what YC wants you to do. YC wants you to pick an idea that has market pull (or the potential for it), and to then dig a hole in the same spot until you reach the boiling magma. Because what if you stop digging just before you strike gold? When you’re cheap and expendable, that’s not an optimal strategy for the YC fund. You must go all in. Diversification is for your YC overlords, not for you.

这个所谓的公式是无稽之谈。首先,好点子很少来自头脑风暴会议。好点子来自于以开放的心态四处游荡,直到偶然发现一个值得追寻的机会。你的大多数想法都是馊主意,因为很不幸,你并不是一个有远见的天才。因此,找到好点子的最好办法就是有很多点子,尝试它们,取其精华,去其糟粕。但这不是 YC 希望你做的。YC 希望你选择一个有市场吸引力(或有潜力)的想法,然后在同一个地方挖洞,直到挖到沸腾的岩浆为止。因为如果你在挖到金子之前就停止了挖掘,那该怎么办?当你的成本很低,消耗很大时,这就不是 YC 基金的最佳策略了。你必须全力以赴。分散投资是为你们的 YC 霸主准备的,不是为你们准备的。

If you reach the magma layer and you still have nothing, then you’d be encouraged to pivot. But that’s not how you find business opportunities in the real world. You can’t just say I’m going to pivot, and suddenly a good opportunity lands on your lap from heaven. You get good ideas by embracing randomness for a long time, until something looks like it has a fighting chance of paying off. The pivot idea you were forced to come up with is extremely unlikely to be one. Your imagination is overrated. The YC execs didn’t imagine Stripe or Dropbox or AirBnb. Random things come to them during demo days. The YC folks are smart because they know their imagination is limited. And so should you. You can’t just pivot a business idea. And if you’re going to cherry pick some pivot that worked out of the thousands attempted, you should stop reading now. Just go join YC.

如果到了岩浆层,你还是一无所获,那就鼓励你转向。但在现实世界中,你并不是这样寻找商机的。你不能只说我要转向,然后一个好机会就突然从天而降。要想得到好点子,你必须长期接受随机性,直到某个点子看起来有机会获得成功。你被迫想出的支点点子是极不可能的。你的想象力被高估了。YC 的高管们并没有想象过 Stripe、Dropbox 或 AirBnb。在演示日期间,他们会随机想到一些东西。YC 的员工很聪明,因为他们知道自己的想象力有限。你也应该如此。你不能随意改变一个商业创意。如果你想从成千上万的尝试中挑出一些成功的支点,那你现在就别看了。加入 YC 吧。

The second bad lesson from YC is the focus on the upside. But if there’s any formula for success in business, it’s to focus relentlessly on staying in the game rather than on hitting it big. Focus on the downside, and let the upside take care of itself. To thrive, you must first survive. To win the race, you must finish the race. And so on. But this is in tension with what YC wants you to do. They want you to dig deep to the middle of the earth, and if you don’t come back alive, tough luck. You were a brave soldier, but now it’s time for them to focus on the other 999 soldiers. YC is still alive, but you’re not.

从 YC 身上学到的第二个坏毛病是只关注上升空间。但是,如果说商业成功有什么秘诀的话,那就是坚持不懈地专注于不被淘汰,而不是一鸣惊人。关注下行趋势,让上行趋势自生自灭。要想茁壮成长,首先必须生存。要赢得比赛,就必须完成比赛。以此类推。但这与 YC 希望你做的事情相矛盾。他们希望你深入地底,如果你不能活着回来,那就运气不好了。你是一名勇敢的士兵,但现在他们应该把注意力放在其他 999 名士兵身上。YC还活着,但你不行了。

Don’t be a dummy. Don’t be a bet in somebody else’s portfolio.

不要做傻瓜。不要在别人的投资组合中下注。

BUT YOU JUST WANT TO SELL YOUR COURSE!!!

但你只想卖你的课程!!!

Ahahaha, you caught me! It’s true. I do have something to sell you. I run a community for small-time entrepreneurs who are satisfied with reliably attainable mediocre success. The YC folks feel sorry for our joy with mediocrity while they’re out there changing the world. And we reciprocate the emotion.

啊哈哈,被你发现了!是真的 It's true.我确实有东西要卖给你。我为那些满足于可望而不可即的平庸成功的小企业家们运营着一个社区。YC 的人们为我们的平庸感到遗憾,而他们却在外面改变着世界。我们也回报了这种情感。

So yes, I am promoting something that goes against everything YC stands for. But if you think YC is not also selling you something, I have a bridge to sell you. But maybe I’m being a bit too harsh. Because what is it that YC is selling you exactly?

所以,是的,我在推销与 YC 所代表的一切背道而驰的东西。但是,如果你认为 YC 不是在向你推销东西,那我就有一座桥要卖给你。不过,也许我说得有点过分了。因为 YC 到底在向你推销什么?

Me, I charge you a one-time payment of $245, and you get access to my community, which includes live workshops, recorded classes, a group chat, and a few other things. It’s very clear what I’m doing. I ask for some money in exchange for access, and those who give me the money get access. Even my 6 year old kid understands it.

而我,我向你一次性收取 245 美元,你就可以进入我的社区,包括现场研讨会、录制课程、群聊和其他一些活动。我的目的很明确。我需要一些钱来换取访问权,给我钱的人就能访问。连我 6 岁的孩子都明白这一点。

But YC is not asking you for money. They actually give you money! It looks like you’re the one selling to them. You’re technically selling them a piece of your business, no?

但 YC 并没有向你要钱。他们实际上是在给你钱!看起来是你卖给他们的。严格来说,你是在向他们出售你的一部分业务,不是吗?

No, no, no, hold on. The easiest way to see what YC is selling is to look at military recruitment. The military sells the narrative that serving your country is a noble endeavor. You’ll get a shot at glory, and at the very least you gain some important life skills. You’ll also get paid enough to feed yourself and cover your basic needs, but barely. The military wants to recruit expendable soldiers who will go out to the battlefield risking their lives and limb for the collective, while the generals with all the medals sit in an air conditioned room giving orders.

不,不,不,等等。要想知道 YC 在推销什么,最简单的方法就是看看军队招募。军队推销的说法是,为国效力是一项崇高的事业。你将获得荣耀的机会,至少还能学到一些重要的生活技能。你还能得到足够的报酬来养活自己,满足基本需求,但也只是勉强维持。军方希望招募可消耗的士兵,让他们冒着生命危险为集体奔赴战场,而那些挂满勋章的将军们则坐在空调房里发号施令。

YC is no different. It wants to recruit wide-eyed young founders to pick a spot on the treasure map and dig all the way down through the earth’s crust. Most of them will spend years or decades digging, and all they end up with it is a ramen lifestyle. Usually bunched up with 4 roommates in a damp San Francisco basement living on take-out ramen noodles every single day. But hey, they’re young. They’ll have time to do adult things later, like starting family or making decent money. And at the very least, they’ll gain some important life lessons and make some good connections.

YC 也不例外。它想招募眼界开阔的年轻创始人,让他们在藏宝图上选中一个点,然后通过地壳一路向下挖掘。他们中的大多数人将花费数年或数十年的时间去挖掘,但最终却只能过着拉面的生活。他们通常和 4 个室友挤在旧金山一间潮湿的地下室里,每天靠外卖拉面度日。但是,他们还年轻。他们以后会有时间做一些成人的事情,比如成家立业或赚体面的钱。最起码,他们还能学到一些重要的人生道理,结交一些好朋友。

Think about this for a second: The most successful business owners are typically in their 40s and 50s. Why is YC full of 22 year olds? Why aren’t the 40 year old entrepreneurs taking up this incredible deal that YC is offering? YC will tell you it’s because only the 22 year old kids can be true visionaries. BULL. SHIT. You’re not a visionary. All those 4,000 kids who went into YC also thought they were visionaries, and where are they now? They’re all in the startup cemetery, except for a dozen or so who despite the low odds managed to flip 10 heads in a row. The biggest indicator YC is a bad deal is that only people who are easily duped take up these deals.

请想一想:最成功的企业主通常都是四五十岁的人。为什么 YC 挤满了 22 岁的年轻人?为什么 40 岁的创业者不接受 YC 提供的这笔不可思议的交易?YC 会告诉你,因为只有 22 岁的孩子才能成为真正有远见的人。胡说八道。胡说八道。你不是有远见的人。所有那些进入 YC 的 4000 个孩子也都认为自己是有远见的人,他们现在在哪里?他们都在创业公司的墓地里,只有十几个人,尽管赔率很低,但还是连续翻了 10 个跟头。YC是一桩糟糕的交易,其最大的标志就是只有那些容易上当受骗的人才会接受这些交易。

UNLEARNING IS HARD 解套难

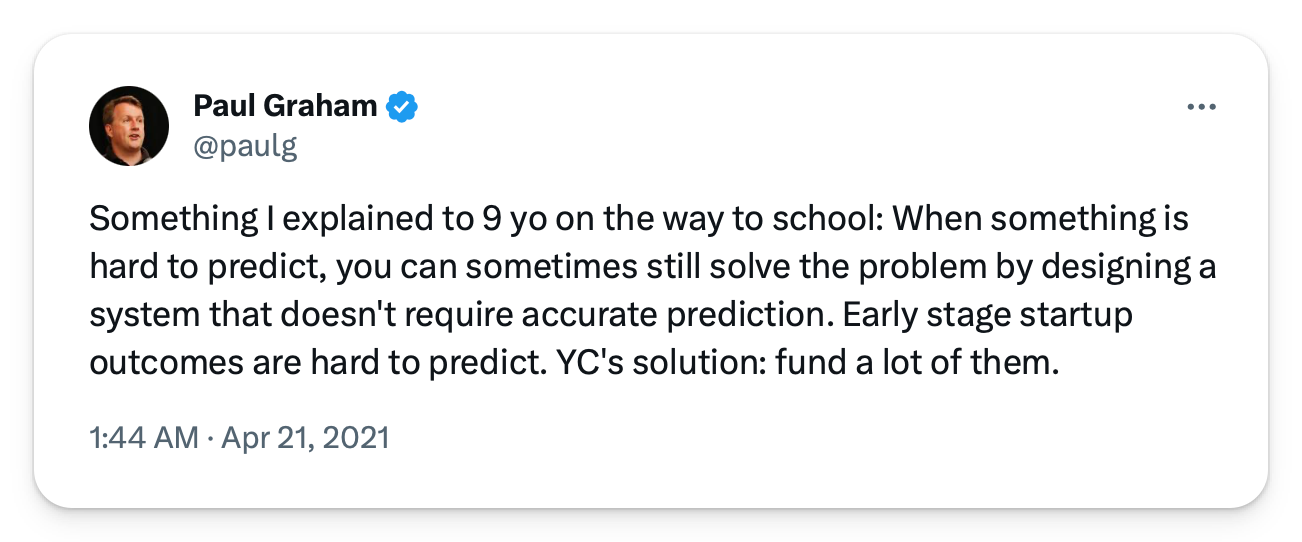

The best thing I learned about business is to avoid trying to predict what will work and what won’t. YC knows this. That's why they only make small bets in thousands of businesses. But YC will try to teach you the exact opposite.

我在经营中学到的最好的东西就是不要试图预测什么会成功,什么不会成功。YC 深谙此道。这就是为什么他们只在成千上万的企业中下小注。但 YC 会试图教你完全相反的东西。

Business is a lot more random than it seems. You can’t treat it like a predictable project. You need to treat it like a financial investment. Instead of investing your money, you’re investing your time and energy, which is as scarce and as precious as money (if not more). Tell me, how do you invest your money? Do you pick one amazing stock and put all your life savings on it? Of course not. You understand that finance is uncertain. What’s good today might not be good tomorrow. There are hidden risks everywhere. And even if your stock pick doesn’t go bust, the biggest gains are likely to happen elsewhere and you won’t benefit from them if you’re only exposed to one piece of equity.

商业的随机性比表面看起来要大得多。你不能把它当作一个可预测的项目。你需要像对待金融投资一样对待它。与其说你在投资你的钱,不如说你在投资你的时间和精力,而时间和精力与金钱一样稀缺和珍贵(如果不是更珍贵的话)。告诉我,你如何投资你的钱?你会选择一只神奇的股票,然后把毕生积蓄都压在上面吗?当然不是。你知道金融是不确定的。今天好的,明天可能就不好了。风险无处不在。即使你选中的股票没有破发,最大的收益也可能发生在其他地方,如果你只持有一只股票,就无法从中获益。

YC teaches you to try to be a visionary. When you fail… Oopsie! Tough luck. The fund benefits from the non-ergodic nature of the system, but you’re out years of your time. But that’s not even the worst of it. You would have been taught things that not only won’t work in the real world of business, but are counterproductive. You will have to unlearn almost everything.

YC 教会你努力成为一个有远见的人。当你失败时......哎呀!运气不好。基金从系统的非啮合性中获益,但你却失去了多年的时间。但这还不是最糟糕的。你所学到的东西在现实商业世界中不仅行不通,反而会适得其反。你必须重新学习几乎所有的东西。

If you want to succeed in the real world (and within this lifetime), you need to try many small things, experiment, tinker, and build a portfolio of multiple income streams. You need to treat your time the same way you treat your brokerage account. You basically need to become a VC, but for your own ideas. To make the system ergodic, you must un-leverage yourself from going all in on one thing, and get access to many diverse income streams. The same way it’s wise to invest in a broad ETF, you should be doing the same things with your projects. YC will teach you to do the opposite, but you’ll have to unlearn all of it. And unfortunately unlearning is much harder than learning.

如果你想在现实世界中(以及在有生之年)取得成功,你需要尝试许多小事情,进行实验、修补,并建立一个多种收入来源的投资组合。你需要像对待你的经纪账户一样对待你的时间。从根本上说,你需要成为一个风险投资人,但投资的是你自己的想法。为了使系统符合人体工程学,你必须放弃对一件事的全情投入,获得多种多样的收入来源。就像投资广泛的 ETF 是明智之举一样,你也应该在你的项目上做同样的事情。YC 会教你反其道而行之,但你必须重新学习这一切。不幸的是,解除学习要比学习难得多。

The arguments against what you're saying remind me a lot of the arguments against self-publishing on Amazon, etc. years ago.

反对你所说的论点让我想起了多年前反对在亚马逊等网站上自助出版的论点。

Trad pub authors (and the industry itself) lambasted self-published authors on every topic from quality to them not publishing 'real' books, but it slowly dawned on everybody that self-publishing was not only possible, but easier and more profitable with more upside for a broader spectrum of writers. And the gatekeepers (the industry that hoarded and controlled the profits and distribution) were left scrambling to adjust. Weirdly, many still believe they need 'permission' from agents and trad pub houses to publish 'real' books.

传统出版商(以及出版业本身)从质量到不出版 "真正 "的书等各个方面抨击自助出版的作者,但大家慢慢发现,自助出版不仅是可能的,而且更容易、更有利可图,对更广泛的作家来说有更大的发展空间。而守门人(囤积并控制利润和发行的行业)则不得不争相调整。奇怪的是,许多人仍然认为他们需要得到代理商和传统出版社的 "许可 "才能出版 "真正 "的书籍。

Loved how you broke down the VC funding model, makes so much sense this way. Glad I’m following the small bets pathways to having a business

我很喜欢你对风险投资模式的分析,这种方式非常有意义。我很高兴我正在遵循小赌怡情的创业之路