PwC Is Struggling in China With an Exodus of Clients and Staff

- More than 30 Chinese companies dropped PwC as auditor in 2024

- Some senior PwC China partners are trying to join rival firms

PricewaterhouseCoopers LLP’s regulatory troubles in China have caused an exodus of clients and led some of its accountants to seek out jobs at rivals, casting doubt over the firm’s prospects in the world’s second-largest economy.

Since March, more than 30 publicly listed companies based in mainland China have dropped PwC as their auditor, according to stock-exchange filings. The client losses picked up after property developer China Evergrande Group was accused by Chinese authorities of vastly overstating its revenue and profits, and PwC came under scrutiny for its role in the misstatements. China is weighing a record fine on the accounting firm and may suspend some of its local operations, Bloomberg News has reported.

The threat of regulatory penalties has also unnerved PwC China staffers, according to people familiar with the matter who asked not to be identified discussing private information. While it’s not known how many individuals have left, partners at other major international and domestic accounting firms have received dozens of job inquiries from their peers at PwC, the people said.

The actions of PwC’s clients and employees show how the global firm’s franchise in China is already suffering even before regulators impose penalties on it. Some Chinese companies are in talks with other accounting firms and are waiting to first find out the outcome of regulators’ probe, before deciding whether to switch from PwC to other auditors.

PwC’s onshore arm, PricewaterhouseCoopers Zhong Tian LLP, had 291 partners and more than 1,700 accountants in mainland China at the end of last year, according to regulatory filings. PwC this week appointed Shanghai-based Daniel Li, a longtime partner, as its new Asia Pacific and China chair. Li is the first Chinese national to hold that position, and replaced Raymund Chao, who retired at the end of June.

PwC Zhong Tian was the top earner among accounting firms in mainland China, with 7.9 billion yuan ($1.1 billion) in revenue in 2022, according to the Chinese Institute of Certified Public Accountants. That year, PwC audited roughly 400 companies whose shares are listed in Shanghai, Shenzhen, Hong Kong or New York.

Auditor Replacements

Among the 36 China-based listed companies that have dropped PwC, 26 have appointed new auditors. About two-thirds of those companies went with either Ernst & Young LLP, Deloitte & Touche LLP or KPMG LLP. They included Tsingtao Brewery Co., state-owned China Cinda Asset Management Co., and China Merchants Bank Co.

Eight companies opted for Chinese auditing firms, helping to further increase the market share of local players. Of the 12 largest accounting firms in China — which comprise the Big Four and homegrown players — domestic firms earned 51% of the group’s total revenue in 2022, up from 44% in 2012, official data shows.

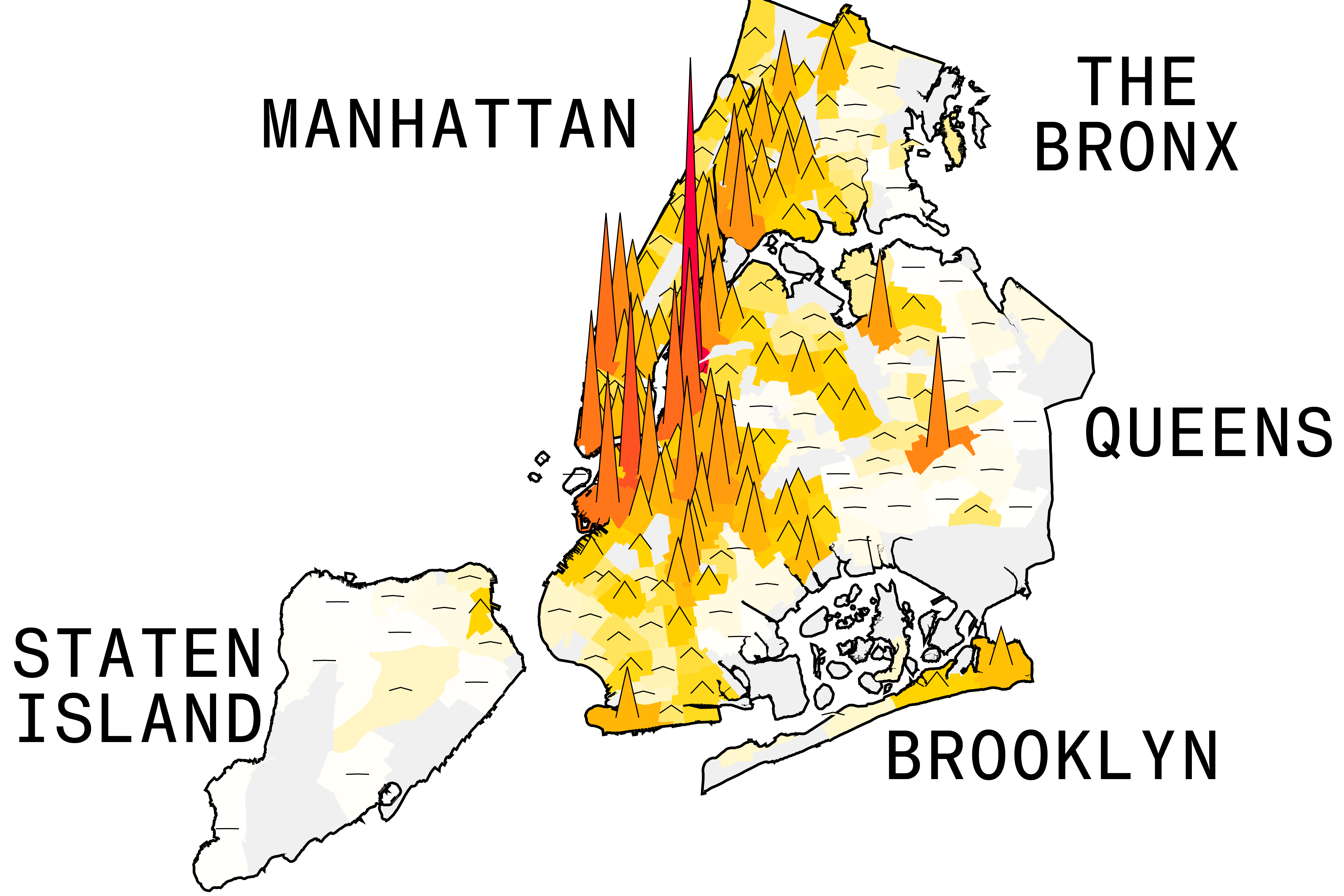

Listed Clientele

Number of publicly traded Chinese companies audited by the Big Four accounting firms, by exchange venue

Source: The Chinese Institute of Certified Public Accountants

Note: Data is from 2022

Taking on PwC’s former clients and reviewing their results could be costly and time consuming. “New auditors might have to check everything from scratch,” said Lu Yeung, a Bloomberg Intelligence analyst. He added that companies switching auditors would also draw more scrutiny, so only those that are confident about their financials would choose to go with other Big Four accounting firms.

Senior PwC partners that are looking to join rivals, meanwhile, would be expected to bring on clients and help generate revenue in order to be part of the bonus pool at other accounting firms. Some senior partners could have non-compete clauses in their contracts that would limit what they can do within a year of leaving PwC. The accounting firm’s salaried workers and junior accountants would have more flexibility to leave on shorter notice if they find jobs at other firms.

PwC’s marquee Chinese clients include technology giants Tencent Holdings Ltd., Alibaba Group Holding Ltd., Meituan and Xiaomi Corp. — which all still use its services. The firm also audits many consumer companies and property developers, though it has been reducing its exposure to China’s real estate sector.

Regulatory Probe

Regulators have been examining PwC’s role in the alleged Evergrande fraud, and China is poised to impose a record fine of at least 1 billion yuan on the firm, Bloomberg reported earlier, citing people familiar with the matter.

PwC hasn’t commented publicly on the regulatory probe. A spokesperson for the accounting firm declined to comment for this article.

A fine of that magnitude would exceed the previous record fine for an accounting firm, the 212 million yuan handed out to Deloitte in 2023. Last year, the regulator suspended the operations of Deloitte’s Beijing office for three months as a penalty for the auditing work it did for disgraced bad-debt manager China Huarong Asset Management Co.

Big Four Auditors in China

PwC was the top earner among China's leading 100 auditors

Source: The Chinese Institute of Certified Public Accountants

The Chinese companies that recently dropped PwC paid more than 800 million yuan in total fees to their auditors last year, according to calculations by Bloomberg News based on disclosures in the companies’ annual reports.

The client losses include state-owned giants China Life Insurance Co., China Telecom Corp. and PetroChina Co.

Beijing-based PetroChina had said in March that it was planning to reappoint PwC and its onshore arm as its international and domestic auditors for 2024. It canceled that proposal in late May, saying the decision was “in view of recent matters in relation to the audit industry which require further verification,” and after conversations with PwC. The oil and gas company, which is listed in Hong Kong as well as Shanghai, has yet to appoint a new auditor.

Bank of China Ltd., a major state-owned bank, had also earlier planned on re-engaging PwC and Zhong Tian as its external auditors for this year. The state-owned lender has opted to engage PwC for an interim review at a fee of 35 million yuan — about a third of what it was planning to pay them for the full year, while it looks for another external auditor. Bank of China said it made the decision after “taking into account market conditions, and and the bank’s business development needs, and based on the principle of prudence.”

“In the chaotic consequences in this kind of situation, you don’t really gain that much by continuing to use an auditor whose reputation may be severely damaged,” said Pingyang Gao, an accounting and law professor at HKU Business School.

— With assistance from Trista Xinyi Luo, Kiuyan Wong, and Amanda Wang