Good afternoon - getting this one out early as won’t be around after the close. QQQs +30bps crossing over into the green after a choppy morning, but as has been the case over the last two weeks, the story under the surface tells a more complete picture. IWM +1.8% outperforming as small/mid caps catch a bid.

First the macro: yields are climbing slightly as we got some better claims data this morning. BTC +3% getting close to that $100k which seems to be acting like a magnet. China -80bps.

In tech, software is +2% while semis are +1% despite NVDA -1% at the time of writing. Software keeps getting confirming datapoints and earnings that support our view that this trade will keep on working into 2025 in what we called the “6-9 month golden era of software” this past weekend. Today it was SNOW’s stellar print that is driving names upward. SNOW +32% shows you how important it is to move your feet in the aftermarket as stock was indicated <+15% for about 30 minutes yesterday. Cloud consumption names are ripping this morning with MDB +16%; CFLT +6%; ESTC +5%; DDOG +7%. After a little digestion over the last week post the graveyard Doji we called out, we are hitting new highs:

Strength across the board in sw and even PANW crossed from red to green showing the difference in strength in sw vs semis (NVDA crossed green to red). Other particularly strong names today: FRSH +6%; CRM +5%; TEAM +4% all of which benefit from AI Agents theme. Large caps doing well ORCL +2.6%; NOW +2.4% although poor MSFT -20bps still struggling to catch a bid.

In internet, GOOGL -6% after DOJ announced it needs to sell Chrome taking down other large caps (AAPL flat on the news). AMZN -3% move seems large and didn’t see any news today other than some on the edges +ve 3p on AWS - maybe some follow through from yesterday’s article that they won’t be raising FBA fees this year and maybe some more regulatory fears. META -1% possibly getting hit by PDD’s tepid results. NFLX +2.6% shaking off large cap woes and continues to be a monster passing through $900 like a knife through hot butter. RDDT +11% (didn’t see anything here). RBLX -4% as 3p data tracking below street for Q4. SE +2% on better M-sci 3p data this morning.

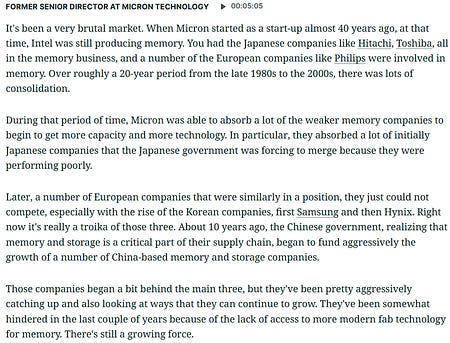

In semis, some names ex-NVDA that have been lagging getting a bid like MU 4% this morning (we still like r/r there). Would be good for the indexes if semis can get back on stronger footing. SMCI +15% benefitting from Jensen call out. Other AI names mixed: MRVL +3%; AVGO +1%; AMD -15bps/ARM -30bps lagging. VRT +5% continues to break out as does CLS +6%. DELL +4% taking NVDA results/blackwell commentary well.

In fintech, weirdly COIN -4%/HOOD -1.3% lagging BTC but SQ +2.3% and AFRM/UPST +5%. WIX +4% more follow through after beating yesterday.

Still early out there - let’s see what rest of the day holds…