Monty Rakusen/DigitalVision via Getty Images

Investment Thesis 投資論點

Axon Enterprise (NASDAQ:AXON) is one of the most interesting players in the field of technology for law enforcement agencies, which has managed to build a sustainable ecosystem of products. The company is taking advantage of the growing demand for digitalization in the police, and the transition to a subscription model has made the business more predictable and increased margins. It's just that axon is currently trading immediately after deletion, both with the source data and with competitors. Investors clearly have high expectations for future growth in the quotes, but there are several factors that may hold back the dynamics in the short term. Among them are antitrust companies, a possible merger of the state and Motorola Corporation. That is why, despite the long—term potential, the risk-return ratio at the current level does not look optimal, and buying stocks now is not the best idea. The optimal scenario is to wait for their correction.

Axon Enterprise(納斯達克:AXON)是執法機構技術領域中最有趣的參與者之一,成功建立了可持續的產品生態系統。公司正在利用警察數字化需求的增長,轉向訂閱模式使業務更具可預測性並提高了利潤率。只是 Axon 目前正在刪除後立即交易,無論是與源數據還是與競爭對手。投資者顯然對未來股價增長有很高的期望,但有幾個因素可能在短期內抑制動態。其中包括反壟斷公司、可能的州與摩托羅拉公司的合併。這就是為什麼儘管有長期潛力,但當前水平的風險回報比看起來並不理想,現在購買股票並不是最好的主意。最佳方案是等待其修正。

That is why I am assigning the company a "hold" rating and with a fair price of $458 per share, which is about 34% lower than the current value. I would consider buying Axon shares only if the price drops to the range of $450-$460.

這就是為什麼我給予公司「持有」評級,公平價格為每股 458 美元,比當前價值低約 34%。我只有在價格降至 450-460 美元範圍內時才會考慮購買 Axon 股票。

Introduction 介紹

Founded by Rick Smith in 1993 as a manufacturer of TASER stun guns, Axon is now an entire ecosystem of solutions for the police. Its arsenal includes body cameras, cloud—based evidence management software, and even tactical drones. The key point in development was 2017, when Axon rebranded and shifted its focus from hardware production to integrated digital solutions. Since then, the company has steadily strengthened its position: the purchase of VieVu in 2018 helped strengthen the chest camera segment, and the launch of TASER 10 and Axon Body 4 in 2023 only confirmed its technological leadership. Axon continues to grow at a high pace - in 2024, its annual recurring revenue exceeded $1 billion for the first time, and its contract portfolio reached $10.1 billion. The steady revenue growth of more than 25% per year confirms the high demand for its technologies.

Axon 由 Rick Smith 於 1993 年創立,最初是一家 TASER 電擊槍製造商,現在是警察解決方案的整個生態系統。其產品包括隨身相機、基於雲的證據管理軟件,甚至戰術無人機。發展的關鍵點是 2017 年,當時 Axon 進行了品牌重塑,並將其重點從硬件生產轉向集成數字解決方案。從那時起,公司穩步加強了其地位:2018 年收購 VieVu 幫助加強了胸相機領域,2023 年推出 TASER 10 和 Axon Body 4 僅確認了其技術領導地位。Axon 繼續以高速增長——2024 年,其年度經常性收入首次超過 10 億美元,合同組合達到 101 億美元。每年超過 25%的穩健收入增長證明了對其技術的高需求。

Business model 商業模式

Axon's business is built on three key areas: hardware devices, software, and cloud services. TASER remains the backbone of the business, improving performance and increasing application efficiency with each new model. The latest TASER 10 has received an increased range and increased magazine capacity, and civilian versions are complemented by training through VR simulations. However, the main growth driver today is the Axon Body wearable cameras and Axon Fleet patrol systems, which are increasingly integrated into the digital evidence ecosystem. The Axon Body 4 has received support for live-streaming and instant synchronization with cloud services, while the Fleet 3 is equipped with an automatic license plate recognition system. All of this is combined into Axon Evidence, the largest digital data storage and analysis platform. Here, the company has gone beyond simple file storage: Axon offers services for automated reporting (Axon Records), patrol coordination (Axon Response), and integration with urban video surveillance systems (Fusus).

Axon 的業務建立在三個關鍵領域:硬件設備、軟件和雲服務。TASER 仍然是業務的支柱,每個新模型都提高了性能和應用效率。最新的 TASER 10 增加了射程和彈匣容量,民用版本通過 VR 模擬進行培訓。然而,今天的主要增長動力是 Axon Body 可穿戴相機和 Axon Fleet 巡邏系統,這些系統越來越多地集成到數字證據生態系統中。Axon Body 4 支持實時流媒體和與雲服務的即時同步,而 Fleet 3 配備了自動車牌識別系統。所有這些都結合到 Axon Evidence 中,這是最大的數字數據存儲和分析平台。在這裡,公司已經超越了簡單的文件存儲:Axon 提供自動報告(Axon Records)、巡邏協調(Axon Response)和與城市視頻監控系統(Fusus)集成的服務。

All these solutions work according to a subscription model, creating predictable cash flows. The Officer Safety Plan (OSP) package allows police departments to gain full access to the Axon ecosystem – from cameras and TASER to cloud solutions – for a fixed fee. This makes the company's revenues more stable and its customers more loyal. By 2024, 61% of revenue is accounted for by the Software & Sensors segment, and this trend will only intensify. Axon is also expanding the ecosystem with AI, analytics, drones, and tactical solutions. Artificial intelligence is already being implemented for automatic video analysis and object recognition, as well as for police situation centers.

所有這些解決方案都按照訂閱模式運行,創造了可預測的現金流。警官安全計劃(OSP)套餐允許警察部門以固定費用獲得對 Axon 生態系統的完全訪問——從相機和 TASER 到雲解決方案。這使得公司的收入更加穩定,客戶更加忠誠。到 2024 年,61%的收入來自軟件和傳感器部門,這一趨勢只會加劇。Axon 還在擴展生態系統,包括人工智能、分析、無人機和戰術解決方案。人工智能已經被用於自動視頻分析和對象識別,以及警察情況中心。

Development strategy 發展戰略

Axon Enterprise has set an ambitious goal to reduce the number of fatal incidents involving police and citizens by 50% by 2033, and relies on three key areas for this: technology, training, and data analysis. The company is actively developing TASER 10 and unmanned systems, expanding the range and reducing the need for firearms. VR training helps police officers better cope with stressful situations, and analytical initiatives, including a National Incident Database, allow them to evaluate the effectiveness of new technologies and adapt strategies. In addition, Axon aims to strengthen its position in the field of robotics, expand the incident management platform and integrate AI to automate analytics and reporting, while remaining within the framework of the concept of "AI to help people, not instead of them." The company's management demonstrates the ability to implement ambitious plans: over the past five years, Axon has steadily grown by more than 25% annually, and the strategy has received support from government agencies and society. However, there are risks, including dependence on government budgets, possible regulatory restrictions, and growing competition, especially from major players such as Motorola Solutions. In addition, international expansion takes time, as purchases in different countries are regulated by complex bureaucratic procedures. Nevertheless, Axon's strategic approach is not just technological dominance, but a comprehensive transformation of the approach to public safety, which makes the company a key player in this niche for many years to come.

Axon Enterprise 設定了一個雄心勃勃的目標,即到 2033 年將涉及警察和公民的致命事件減少 50%,並依賴於三個關鍵領域:技術、培訓和數據分析。公司正在積極開發 TASER 10 和無人系統,擴大範圍並減少對槍支的需求。VR 培訓幫助警察更好地應對壓力情況,分析計劃(包括國家事件數據庫)允許他們評估新技術的有效性並調整策略。此外,Axon 旨在加強其在機器人領域的地位,擴展事件管理平台並集成人工智能以自動化分析和報告,同時保持在「人工智能幫助人,而不是取代人」的概念框架內。公司管理層展示了實施雄心勃勃計劃的能力:在過去五年中,Axon 每年穩步增長超過 25%,該戰略得到了政府機構和社會的支持。然而,存在風險,包括對政府預算的依賴、可能的監管限制和日益增長的競爭,特別是來自摩托羅拉解決方案等主要參與者。此外,國際擴展需要時間,因為不同國家的購買受到複雜的官僚程序監管。儘管如此,Axon 的戰略方法不僅僅是技術主導,而是公共安全方法的全面轉型,這使得公司在未來許多年成為這一領域的關鍵參與者。

Competitors 競爭對手

Axon Enterprise operates at the intersection of several fast-growing segments of public safety technology, encompassing non-lethal weapons, wearable video cameras, and cloud-based evidence management platforms. Collectively, these markets are estimated at tens of billions of dollars, with digital solutions developing most dynamically. According to Spherical Insights, by 2033, the global digital evidence management market could exceed $23.25 billion, growing by 11.9% annually. The United States remains the largest market, generating up to half of global demand. Axon holds dominant positions in several niches: It practically monopolizes the TASER stun gun market, and remains a leader in the segment of wearable cameras and cloud solutions, creating a comprehensive ecosystem for the police. "device + Software + analytics". But the competition is intensifying. In the field of cameras and video systems, the largest competitor is Motorola Solutions, which is actively absorbing competitors and developing its own video analytics platform. There are also smaller players in the market, such as Digital Ally, Getac and Reveal Media, but their scale is not comparable to Axon. In the software field, the company competes with both Motorola and Microsoft Azure cloud platforms, as well as with IT giants including Oracle, OpenText and Genetec, which offer record management and analytics solutions. The competition is even higher in the segment of cloud services and CAD/RMS systems: Axon is expanding the integration of its cameras, drones and analytics into unified incident management, but players such as Mark43, Tyler Technologies and CentralSquare are strong here, and many large cities prefer to develop custom solutions. Due to the early start and deep integration into law enforcement agencies, the company retains its leadership, but the increasing competition, especially from large IT corporations capable of offering alternative integrated solutions, is becoming a serious challenge.

Axon Enterprise 在幾個快速增長的公共安全技術領域中運營,涵蓋非致命武器、可穿戴視頻相機和基於雲的證據管理平台。總體而言,這些市場估計價值數十億美元,數字解決方案發展最為動態。根據 Spherical Insights 的數據,到 2033 年,全球數字證據管理市場可能超過 232.5 億美元,每年增長 11.9%。美國仍然是最大的市場,佔全球需求的一半。Axon 在幾個領域佔據主導地位:它幾乎壟斷了 TASER 電擊槍市場,並在可穿戴相機和雲解決方案領域保持領先地位,為警察創建了全面的「設備+軟件+分析」生態系統。但競爭正在加劇。在相機和視頻系統領域,最大的競爭對手是摩托羅拉解決方案,它正在積極吸收競爭對手並開發自己的視頻分析平台。市場上還有一些較小的參與者,如 Digital Ally、Getac 和 Reveal Media,但它們的規模無法與 Axon 相比。在軟件領域,公司與摩托羅拉和微軟 Azure 雲平台競爭,還與包括 Oracle、OpenText 和 Genetec 在內的 IT 巨頭競爭,這些公司提供記錄管理和分析解決方案。在雲服務和 CAD/RMS 系統領域,競爭更加激烈:Axon 正在擴展其相機、無人機和分析的集成到統一的事件管理中,但 Mark43、Tyler Technologies 和 CentralSquare 等參與者在這裡很強大,許多大城市更喜歡開發定制解決方案。由於早期啟動和深入集成到執法機構中,公司保持了其領導地位,但日益增長的競爭,特別是來自能夠提供替代集成解決方案的大型 IT 公司,正在成為一個嚴峻的挑戰。

The competitive environment in the law enforcement technology industry combines elements of oligopoly and monopolistic competition. In the field of electroshock weapons, Axon is practically a monopolist: TASER remains patented and has no real alternatives. In the segment of wearable cameras and cloud services, the situation is closer to an oligopoly, with Axon and Motorola Solutions leading the way, as well as several smaller companies. The public security industry is currently in a phase of active growth, which is facilitated by the growing public demand for police transparency. However, there are also challenges: the market for wearable cameras and TASER in the United States is close to saturation, which makes international expansion critically important. Political factors, including a possible reduction in police funding, may limit demand.

執法技術行業的競爭環境結合了寡頭壟斷和壟斷競爭的元素。在電擊武器領域,Axon 幾乎是壟斷者:TASER 仍然受專利保護,沒有真正的替代品。在可穿戴相機和雲服務領域,情況更接近寡頭壟斷,Axon 和摩托羅拉解決方案領先,還有幾家較小的公司。公共安全行業目前處於積極增長的階段,這得益於公眾對警察透明度的需求增長。然而,也存在挑戰:美國的可穿戴相機和 TASER 市場接近飽和,這使得國際擴展至關重要。政治因素,包括可能的警察資金減少,可能會限制需求。

Financials 財務

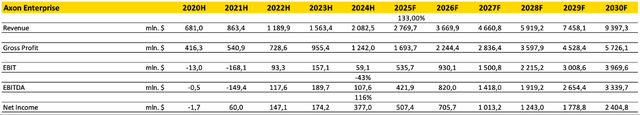

Revenue for 2024 grew by 33% and exceeded $2.1 billion for the first time, marking the third consecutive year of growth above 30%. The rapid growth was driven by an expansion in the share of service revenue: Axon cloud services generated $806 million, an increase of 44% year-on-year.

2024 年收入增長了 33%,首次超過 21 億美元,標誌著連續第三年增長超過 30%。快速增長是由於服務收入份額的擴大:Axon 雲服務產生了 8.06 億美元,同比增長 44%。

Author

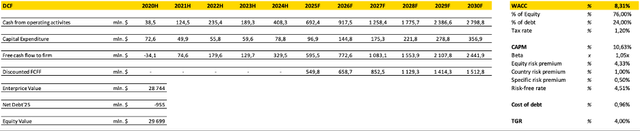

I expect revenue to grow by 33% in 2025 to about $2.77 billion due to sustained demand for Axon Evidence cloud services, continued scaling of the subscription model, and increased international orders, especially in Canada and Europe, where the company's product penetration remains low. The CAGR of total revenue between 2020 and 2024 was 32.24%. According to my forecast, the CAGR in the period from 2025-2030 will slow down to 27.68%. The company's main market is the USA, which accounts for 75% of its total revenue. Most police departments are already equipped with wearable cameras and TASERS, and new contracts require not only time, but also a struggle for budget funding. However, Axon still has a serious trump card – international expansion, which so far brings in only 13% of revenue. This opens up huge prospects, especially considering that the company is not limited to cameras and stun guns, but is actively expanding into new segments. The introduction of AI analytics, the use of drones, and the creation of integrated incident management systems all enable Axon to maintain average annual revenue growth rates above 25%.

我預計 2025 年收入將增長 33%,達到約 27.7 億美元,這是由於對 Axon Evidence 雲服務的持續需求、訂閱模式的持續擴展以及國際訂單的增加,特別是在加拿大和歐洲,這些地區的產品滲透率仍然較低。2020 年至 2024 年總收入的複合年增長率(CAGR)為 32.24%。根據我的預測,2025-2030 年期間的 CAGR 將放緩至 27.68%。公司的主要市場是美國,佔其總收入的 75%。大多數警察部門已經配備了可穿戴相機和 TASER,新合同不僅需要時間,還需要爭取預算資金。然而,Axon 仍然有一個重要的王牌——國際擴展,目前僅帶來 13%的收入。這打開了巨大的前景,特別是考慮到公司不僅限於相機和電擊槍,還積極擴展到新領域。引入人工智能分析、使用無人機和創建集成事件管理系統都使 Axon 能夠保持平均年收入增長率超過 25%。

The company's EBITDA was $107 million in 2024, showing a 45% drop in YoY due to a significant increase in operating expenses, including increased investment in R&D, staff expansion to scale the cloud platform, and integration costs of recently acquired companies such as Fusus and Sky-Hero. The EBITDA margin for the reporting period fell by 7% to 5.17%. I expect that in 2025 the company will be able to restore marginality to 10%. Why? There are several factors at once. Firstly, the integration process of Fusus and Sky-Hero is finally coming to an end, which means that additional costs for IT infrastructure and adaptation of new teams will be spent. Secondly, subscription services are starting to play an increasingly important role - Axon Evidence and Axon Fleet are becoming real drivers of stable cash flow, which has a positive impact on operating profitability. Another important point is to reduce employee compensation costs. In 2024, the company spent heavily on options and bonuses, but in 2025 these expenses should return to normal. It is also worth paying attention to the improvement of the supply chain: new contracts with suppliers will allow Axon to reduce the cost of manufacturing hardware products such as TASER and wearable cameras, and this will automatically give a boost to profitability. Taken together, all these factors form a scenario in which the company's EBITDA margin will be able to return to 10% next year.

公司 2024 年的 EBITDA 為 1.07 億美元,同比下降 45%,這是由於運營費用的大幅增加,包括增加研發投資、擴展員工以擴展雲平台以及最近收購公司(如 Fusus 和 Sky-Hero)的整合成本。報告期的 EBITDA 利潤率下降了 7%至 5.17%。我預計 2025 年公司將能夠將利潤率恢復到 10%。為什麼?有幾個因素。首先,Fusus 和 Sky-Hero 的整合過程終於接近尾聲,這意味著 IT 基礎設施和新團隊適應的額外成本將被花費。其次,訂閱服務開始發揮越來越重要的作用——Axon Evidence 和 Axon Fleet 正在成為穩定現金流的真正驅動力,這對運營盈利能力有積極影響。另一個重要點是降低員工補償成本。2024 年,公司在期權和獎金上花費了大量資金,但 2025 年這些費用應該會恢復正常。還值得關注供應鏈的改善:與供應商的新合同將使 Axon 能夠降低 TASER 和可穿戴相機等硬件產品的製造成本,這將自動提高盈利能力。總的來說,所有這些因素形成了一個情景,即公司的 EBITDA 利潤率將能夠在明年恢復到 10%。

Author

Net profit for the year increased by 116% YoY and amounted to $377 million. The current profit has become a record for the company. The net profit margin was 18.10%, and the return on equity (ROE) was 19.14%.

年度淨利潤同比增長 116%,達到 3.77 億美元。當前利潤成為公司的記錄。淨利潤率為 18.10%,股本回報率(ROE)為 19.14%。

Author

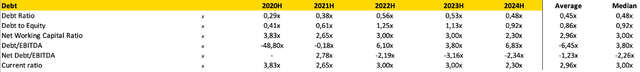

At the end of 2024, Axon demonstrates a steady level of debt burden with positive dynamics of key ratios. Net Debt/EBITDA improved to -2.34x versus -3.16x in 2023, indicating a significant cash balance in excess of debt obligations and increased financial flexibility of the company. The current Ratio decreased to 2.30x (compared to 3.00x in 2023), which remains a comfortable level of liquidity to cover short-term liabilities, but indicates a decrease in available current assets.

截至 2024 年底,Axon 展示了穩定的債務負擔水平,關鍵比率呈積極動態。淨債務/EBITDA 改善至-2.34 倍,而 2023 年為-3.16 倍,表明現金餘額顯著超過債務義務,並增加了公司的財務靈活性。流動比率下降至 2.30 倍(相比 2023 年的 3.00 倍),這仍然是覆蓋短期負債的舒適流動性水平,但表明可用流動資產減少。

In 2024, AXON increased capital expenditures by 32% due to investments in new product development, expansion of the Axon Evidence cloud infrastructure, scaling up production of TASER 10 and Axon Body 4, as well as integration of recently acquired technologies, including Sky-Hero drones and the Fusus platform for situational centers. As for capital expenditures in 2025, management expects high investment activity to continue, but with moderate growth dynamics. In the long term, I expect investments to remain at 3.5–5% of revenue.

2024 年,AXON 增加了 32%的資本支出,這是由於投資於新產品開發、擴展 Axon Evidence 雲基礎設施、擴大 TASER 10 和 Axon Body 4 的生產以及最近收購技術(包括 Sky-Hero 無人機和 Fusus 平台)的整合。至於 2025 年的資本支出,管理層預計高投資活動將繼續,但增長動態適中。長期來看,我預計投資將保持在收入的 3.5-5%。

In 2025, I expect free cash flow (FCF) to grow to $595.5 mdr, which is associated with an increase in operating cash flow due to the restoration of marginality and effective cost management, as well as the stabilization of capital investments after their reduction in 2024. In the long term, I predict that the free cash flow CAGR in 2025-2030 will be about 29.78%, driven by expected revenue growth, improved operating profitability, optimized personnel costs, and balanced investments in business development.

我預計 2025 年自由現金流(FCF)將增長至 5.955 億美元,這與由於利潤率恢復和有效成本管理以及 2024 年資本投資減少後的穩定化而增加的運營現金流有關。長期來看,我預測 2025-2030 年自由現金流的複合年增長率(CAGR)約為 29.78%,這是由於預期的收入增長、運營盈利能力的提高、人員成本的優化以及業務發展的平衡投資。

Thus, Axon demonstrates a high-quality financial position with high business growth rates and margins.

因此,Axon 展示了高質量的財務狀況,具有高業務增長率和利潤率。

Valuation 估值

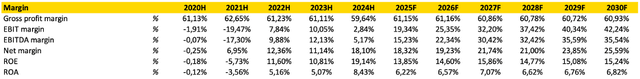

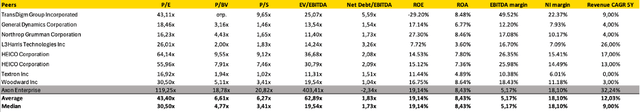

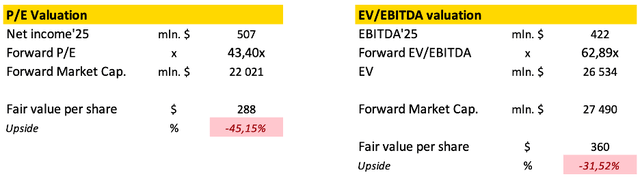

The main disadvantage of Axon is its valuation - I believe that the company's shares are very overvalued. At the moment, the company is trading at a significant premium to its historical averages in terms of P/E multipliers (the premium is 14%) and EV/EBITDA (the discount is 118%).

Axon 的主要缺點是其估值——我認為該公司的股票被嚴重高估了。目前,該公司的市盈率(P/E)乘數相對於其歷史平均水平有顯著的溢價(溢價為 14%),而企業價值/息稅折舊攤銷前利潤(EV/EBITDA)則有 118%的折價。

Author

Compared to its competitors, the company is also super overvalued in terms of multipliers: the P/E revaluation is 2.7 times higher than the median among competitors, and AXON's EV/EBITDA is 6.5 times higher than the market average. For comparison, I took key competitors or companies relatively similar to it: Woodward, HEICO Corporation, Textron, L3Harris Technologies, TransDigm Group and others.

與競爭對手相比,該公司在乘數方面也被嚴重高估:市盈率重估比競爭對手的中位數高出 2.7 倍,而 AXON 的 EV/EBITDA 比市場平均水平高出 6.5 倍。作為比較,我選取了其主要競爭對手或相對類似的公司:Woodward、HEICO Corporation、Textron、L3Harris Technologies、TransDigm Group 等。

My thesis is that the company is highly overvalued due to investors' overly optimistic view of the company's shares. Yes, the company has great prospects in the future and I believe in the growth and development of its business, but I'm definitely not ready to buy it at this price.

我的論點是,由於投資者對該公司股票的過於樂觀看法,該公司被嚴重高估。是的,該公司未來有很好的前景,我相信其業務的增長和發展,但我絕對不願意以這個價格購買。

Author

In my forecast of the target price, I use three estimation methods: DCF (weight in the estimate – 34%), target value of P/E and target value of EV/EBITDA with weights (weights in the estimate of 33%). In the basic DCF valuation scenario, I assume a growth rate of 4% in the terminal period (which is very optimistic, but even with a 4% TGR, the company remains overvalued) and a weighted average cost of capital of 8.31%.

在我的目標價格預測中,我使用了三種估值方法:DCF(估值中的權重為 34%)、目標市盈率和目標 EV/EBITDA(估值中的權重為 33%)。在基本的 DCF 估值情景中,我假設終端期的增長率為 4%(這非常樂觀,但即使有 4%的終端增長率,該公司仍然被高估),加權平均資本成本為 8.31%。

Author

The target P/E multiplier for 2025 is 43.40x, and EV/EBITDA is 62.89x (I took the average for peers).

2025 年的目標市盈率乘數為 43.40 倍,EV/EBITDA 為 62.89 倍(我採用了同行的平均值)。

Author

According to my calculations, the final fair valuation of Axon shares is $458 per share, which is 34% lower than the current price. I would only consider purchasing Axon shares if the price drops to the $450-$460 range.

根據我的計算,Axon 股票的最終公平估值為每股 458 美元,比當前價格低 34%。我只有在價格跌至 450-460 美元範圍內時才會考慮購買 Axon 股票。

Key risks and growth drivers for Axon

Axon 的主要風險和增長驅動因素

Axon Enterprise, despite being a leader in its field, is facing challenges that could affect its business and, consequently, its stock price. One of the key risks is regulatory pressure. Antitrust investigations and possible litigation threaten the company's business model. If the authorities force Axon to change its strategy and split the sale of hardware and software, this could undermine the current level of monetization and reduce margins. Another factor is dependence on government financing. Police budgets are formed by the state, and possible cuts in spending on law enforcement agencies may limit demand for the company's solutions. There have already been discussions in the United States about the “defund the police” initiative, which could theoretically hit orders for Axon products. Against this background, Motorola Solutions continues to strengthen its position by offering alternative integrated solutions to law enforcement agencies, and if its offerings become more competitive in terms of price and functionality, Axon may lose some of its contracts. Do not forget about technological risks – the pace of digitalization is high, and if Axon's innovative developments, such as drones, AI analytics or cloud services, do not meet expectations or are delayed in release, the company may lose ground to more dynamic players. In addition, Axon's international expansion is progressing slowly: bureaucratic barriers, competition with local players, and various regulatory requirements may slow down the process of entering new markets.

Axon Enterprise 儘管是其領域的領導者,但正面臨可能影響其業務並進而影響其股價的挑戰。其中一個關鍵風險是監管壓力。反壟斷調查和可能的訴訟威脅著該公司的商業模式。如果當局迫使 Axon 改變其策略並分拆硬件和軟件的銷售,這可能會削弱當前的貨幣化水平並降低利潤率。另一個因素是對政府資金的依賴。警察預算由國家制定,執法機構可能的支出削減可能會限制對該公司解決方案的需求。美國已經有過關於“削減警察資金”倡議的討論,這理論上可能會影響 Axon 產品的訂單。在這種背景下,Motorola Solutions 繼續加強其地位,為執法機構提供替代的集成解決方案,如果其產品在價格和功能上變得更有競爭力,Axon 可能會失去部分合同。不要忘記技術風險——數字化的步伐很快,如果 Axon 的創新開發(如無人機、AI 分析或雲服務)未能達到預期或延遲發布,該公司可能會輸給更具活力的競爭對手。此外,Axon 的國際擴展進展緩慢:官僚障礙、與本地玩家的競爭以及各種監管要求可能會減緩進入新市場的進程。

Nevertheless, despite the existing challenges, Axon has a number of powerful growth drivers that allow the company not only to maintain leadership, but also to scale the business confidently. One of the key factors is the steady growth in demand for transparency technologies and digital solutions for law enforcement agencies. The mandatory use of wearable cameras is becoming the standard in many countries, which guarantees high demand for Axon equipment and cloud services. The subscription model, which provides predictable cash flows, is also gaining momentum. Axon is gradually transforming from an equipment manufacturer into a provider of high-margin SaaS solutions, which significantly strengthens financial stability. The company's technological leadership is another strategic asset. Axon does not just sell devices, but creates a digital ecosystem that includes AI analytics, drones, the Axon Evidence cloud platform, and automated incident management systems. These are not just products, they are infrastructure solutions that are already deeply integrated into US law enforcement agencies, which means that changing suppliers becomes difficult and expensive for customers. International markets still account for a small portion of Axon's revenue (85% is in the United States), but global demand for such technologies is just beginning to grow. Europe, Canada, Australia and the Middle East are promising destinations where the company is already concluding its first major contracts. In addition, Axon is actively expanding its presence in related segments: tactical drones, VR training and analytical systems for incident management centers are new areas that can take business to the next level. In the long term, the company remains one of the key players in the security industry, with steady financial flows and a technological advantage.

然而,儘管存在這些挑戰,Axon 擁有一些強大的增長驅動因素,使該公司不僅能夠保持領導地位,還能自信地擴展業務。其中一個關鍵因素是對透明技術和執法機構數字解決方案的穩定需求增長。強制使用穿戴式攝像頭正在成為許多國家的標準,這保證了對 Axon 設備和雲服務的高需求。訂閱模式提供了可預測的現金流,也正在獲得動力。Axon 正逐漸從設備製造商轉變為高利潤 SaaS 解決方案的提供商,這顯著增強了財務穩定性。該公司的技術領導地位是另一個戰略資產。Axon 不僅銷售設備,還創建了一個數字生態系統,包括 AI 分析、無人機、Axon Evidence 雲平台和自動化事件管理系統。這些不僅僅是產品,它們是已經深深融入美國執法機構的基礎設施解決方案,這意味著更換供應商對客戶來說變得困難且昂貴。國際市場仍然只佔 Axon 收入的一小部分(85%在美國),但全球對此類技術的需求才剛剛開始增長。歐洲、加拿大、澳大利亞和中東是有前景的市場,該公司已經在這些地區簽訂了首批重大合同。此外,Axon 正在積極擴展其在相關領域的業務:戰術無人機、VR 培訓和事件管理中心的分析系統是可能將業務提升到新水平的新領域。從長遠來看,該公司仍然是安全行業的關鍵參與者之一,擁有穩定的財務流和技術優勢。

Conclusion 結論

Axon Enterprise confidently holds the leadership in the segment of technologies for law enforcement agencies, consistently transforming its business model from selling hardware solutions to an ecosystem approach with a subscription model and cloud services. Overall, Axon is showing steady growth and continues to strengthen its influence in the security industry, but the high valuation of the stock and a number of potential risks require a balanced approach from investors.

Axon Enterprise 在執法機構技術領域自信地保持領導地位,持續將其業務模式從銷售硬件解決方案轉變為具有訂閱模式和雲服務的生態系統方法。總體而言,Axon 顯示出穩定的增長,並繼續加強其在安全行業的影響力,但股票的高估值和一些潛在風險要求投資者採取平衡的方法。

Comments (3)

看起來在當前價格水平找到了支撐。即使市場因關稅消息下跌,即使有可轉換債券,價格也沒有變化。

很棒的分析。我真的很喜歡 AXON,但你必須時刻注意潛在風險。目前 AXON 是一家擁有特殊護城河的優秀公司,但每個護城河都可能被破壞或損害。在當前水平,它可能是一個買入機會,但風險較高。我同意你在 450 時買入的觀點,但不確定我們是否能達到這個目標。只有在他們失敗的情況下...不確定這是否會(很快)發生。因此,股價可能會在未來幾個季度和幾年內繼續上漲...直到某個事件可能導致下跌。