TMTB Morning Wrap

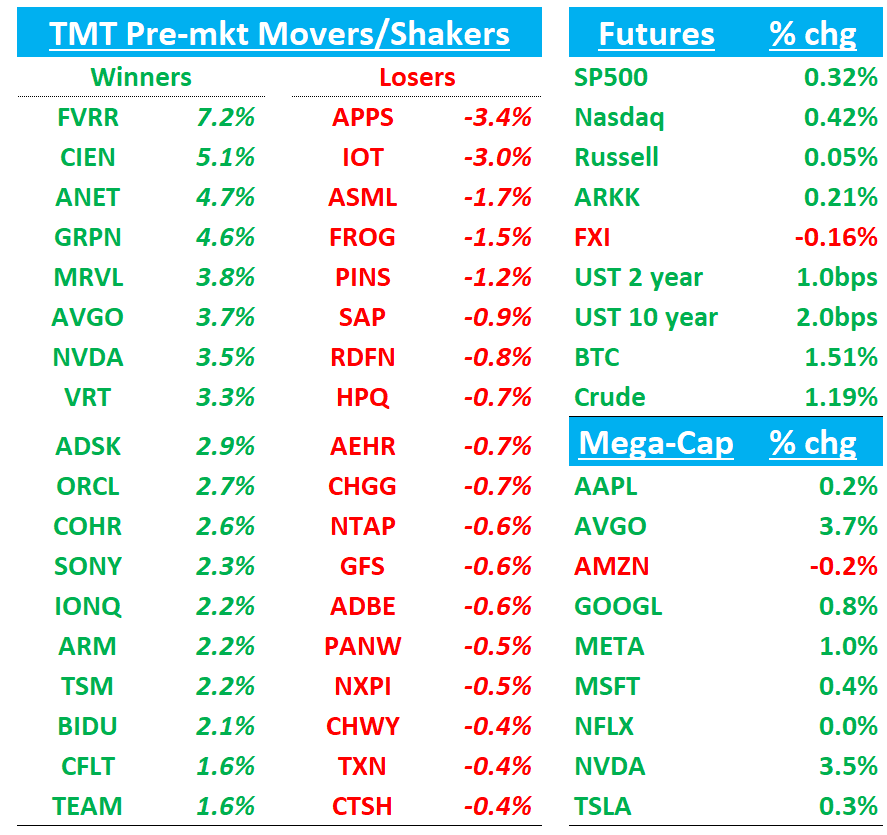

QQQ +40bps trying to gain some traction this morning follow yesterday’s massacre as some AI levered capex names bouncing early as sell-side out generally defending: NVDA +3%; ORCL +2%; MRVL +4%; CIEN +5%; ANET +5%; AVGO +3.7%.

Trump out talking Tariffs again: President Donald Trump said he wants to impose across-the-board tariffs that are “much bigger” than 2.5%, the latest in a string of signals that he’s preparing widespread levies to reshape US supply chains.

Altman says more compute (no surprise):

Yields up 1-2bps across the curve. BTC +1.5%; China flat.

Let’s get to it…

MSFT/Tiktok: Trump says Microsoft is in talks to acquire TikTok - Reuters

Software: Bernstein and Wells Fargo, among others comment on Deepseek’s positive impact on sw

TMTB: We turned positive on AI-agentic sw back in the November, but the Deepseek development is a welcome surprise. While this is unlikely to move #s near-term, we think this is a boon to both investors sentiment (likely to see flows from AI levered capex into the space) and also ability for sw providers to drive costs down, increase adoption of AI products faster, as well increasing amounts of data being driven through pipes is beneficial for cloud consumption players. As we wrote this weekend, our sense is that macro backdrop is still favorable for owning stocks so investors shifting $’s into sw from semis makes sense to us. Our favorites include NOW, CRM, SAP, TEAM, and HUBS. TWLO and MSFT also stands to benefit.

Bernstein Highlights Deepseek’s Potential to Accelerate AI Adoption and Boost Infrastructure Software Vendors. Bernstein says the infrastructure layer is likely beneficiaries of increased demand, specifically highlighting CFLT in data infrastructure, Okta for identity management, DDOG in observability, TWLO for communications, NET for browser delivery, and NOW’s potential in consumption-priced service desk platforms. The firm points out that these infrastructure vendors have faced challenges from slow enterprise AI adoption, lagging behind hyperscaler growth as projects remain in proof-of-concept phases due to cost-benefit uncertainties and budget constraints. However, Bernstein suggests Deepseek's pressure on model costs could both increase viable project numbers and accelerate production deployment, ultimately benefiting the entire software consumption infrastructure ecosystem above the hyperscaler level.

Wells Fargo notes DeepSeek's R1 model is demonstrating performance comparable to OpenAI's o1 but at significantly reduced costs, driving concerns around AI infrastructure economics. However, WF sees this as advantageous for Microsoft given its infrastructure positioning and views the lower entry barriers as beneficial for application software companies. The firm points out that application-layer vendors are successfully utilizing a combination of first-party, third-party, and open-source self-hosted models, positioning them to capitalize on foundation model advances like DeepSeek. Wells Fargo highlights that as model effectiveness improves and compute costs decline, value is increasingly shifting to the application layer, where the real differentiators are data assets, system integrations, and customer relationships. They specifically identify NOW, CRM, TEAM, HUBS as companies well-positioned to benefit from these trends.

CIEN: JPM upgrades to Buy, raises PT to $88 from $84; Notter at Jefferies defends

JPMorgan sees an attractive entry point for Ciena amid exaggerated AI-related selloff triggered by DeepSeek's efficiency claims. They highlight three key drivers: telecom capex recovery post-2024 inventory issues, increased MOFN provider investments in datacenter connectivity, and attractive valuation at 19x CY26 earnings. JPM raises their December 2025 target to $88 (from $84), projecting FY25/26 growth at the high end of 8-11%. While cautious on optical sector valuations broadly, JPMorgan ranks their preferences as COHR, LUMN, then CIEN, noting stronger growth potential in optical components versus systems providers. Despite potential hyperscaler capex scrutiny creating near-term cyclicality, they expect limited fundamental impact on Ciena given continued cloud provider capex growth, telecom recovery, and MOFN investments.

Notter at Jefferies also comments saying GPU utilization has dropped significantly from ~70% (2021-2022) to ~40% currently, representing networking's largest dollar value challenge. However, DeepSeek's efficiency improvements could enable previously cost-prohibitive applications, increasing overall compute demand. Notter views Ciena's selloff as excessive since improved AI economics should drive more data center traffic.

SAP: Solid Q with OP and FCF ahead; inline cloud bookings. Solid FY25 guide

Current cloud backlog growth 29% c/c, steady q/q despite 2 ppts tougher comps.

Total cloud backlog +40%

Q4 EBIT beat by 8% - OPM 26% vs street at 24.3, +270bps y/y

Q4 cloud GM 73.4%, +120bps y/y

CY24 FCF of 4.1B vs street at 3.9B

For FY25, SAP updated its targets as follows:

1) operating profit (including SBC) of €10.3-10.6 cc (+26%-30%), up from €10.2b previously; implied ebit 5% above street

2) Cloud revenue of €21.6-21.9 cc (+26%-28%), up from over €21.5b previously;

3) Cloud and Software revenue of €33.1-33.6b cc (+11-13%); and

4) unchanged FCF guidance of ~€8.0b cc..Now includes €700m of restructuring cash out (previously €500m) but also a €200m benefit from the definition change (which excludes interest income and expenses and includes proceeds from the sale of intangible assets and PP&E)

Key pts:

Nearly 50% of cloud biz included Business AI.

Mgmt noted that lower-cost LLMs like Deepseek will benefit up-stack apps like sw as it drives TCO lower and makes it easier to build value creation inside the process and data layers.

In Mid Feb SAP will launch new offering around data/AI which can support data orchestration of structured + unstructured data and SAP + non-SAP data, which new AI agents and Joule Copilots will be able to access to help drive end-to-end AI automation

Mgmt reiterated its confidence in driving growth acceleration through FY27 alongside margin expansion.

Deal momentum strengthening via larger transformation contracts, cross-selling and new customer wins

3P Roundup:

CVNA: Hearing Units decel’d to 40% from high 50s last week.

AFRM: M-sci raising Q2 #s on stronger Dec GMV data

AMD: Melius downgrades to Hold from Buy; PT to $12 from $160 citing Increased Pressure on Profit Pools

Melius says they should have downgraded AMD post 40%+ Q1’24 performance, emphasizing this dg isn't DeepSeek-related and noting they have already cut January's GPU estimates. Their concern focuses on AMD's long-term x86 position, citing Nvidia's Arm-based CPU push in accelerated PCs and potential server market share erosion from both custom CPUs and Nvidia, despite Turin's current success. They've cut estimates below consensus and lowered their 2-year target to $129 from $160.

AVGO: DeepSeek will create 'faster unlock' of chip demand, says JPMorgan

JPMorgan's Sur sees DeepSeek's efficiency gains accelerating AI inference adoption and boosting demand for high-performance AI semiconductors. Despite investor concerns about AI semiconductor spending following DeepSeek R1's launch, Sur expects continued cloud and hyperscaler expansion to benefit custom ASIC suppliers Broadcom and Marvell due to their cost and power advantages. JPMorgan maintains Overweight ratings on Broadcom, Marvell, and Nvidia, emphasizing that innovation drives new opportunities rather than limiting them.

ALAB: Northland upgrades to to Outperform after 28% tumble

Northland upgraded Astera Labs (ALAB) to Outperform from Market Perform with a $120 price target after shares in the company fell 28% on Monday as Chinese artificial-intelligence startup DeepSeek's low-cost approach reignited concerns that big U.S. companies have poured too much money into developing AI. However, the firm does not expect hyperscalers to cut capital expenditure forecasts when they report earnings in the comings days, which it believes should act as a catalyst for Astera, the analyst tells investors.

JNPR -7% - hearing CapForum article on HPE acq doing the rounds

META: Citi says Deepseek should lead to greater GenAI product cadence and potentially faster ROI

Citi sees DeepSeek's R1 model's low training costs ($6M) and competitive performance as accelerating GenAI development and ROI. They emphasize R1's open-source approach benefits the broader AI ecosystem, including Llama, Gemini, and OpenAI. Following Meta's $60-65B CapEx guidance for the year, Citi believes model efficiency gains could boost engagement through new features like Search, Agents, and Enterprise. They'll watch Meta's Q4 earnings for insights on how these efficiencies might impact product development and CapEx plans.

AFRM: MS previews the quarter positively, raising #s

Morgan Stanley expects strong GMV results driven by Amazon (23% of GMV) and Shopify (15%) performance during BFCM, plus December's non-store sales acceleration to 10.2%. New merchant partnerships and fully lapped Amazon 36% APRs suggest room for continued beats. Delinquencies (30+ DQs) at 3.0% in December show 9bps monthly improvement in both 2023-A/B deals, positive given credit expansion and UK launch. GMV growth likely sustainable until DQs exceed 3.5%. MS notes recent funding deals ($4bn Sixth Street, $500mm Prudential, $750mm Liberty Mutual) demonstrate strong private credit demand. While funding constraints unlikely for 4-5 years, Morgan Stanley expects Affirm to pursue ILC license under Trump administration, enabling better deposit economics versus current Cross River revenue share.

VRT: Melius downgrades four 'capex thematic' stocks as AI momentum trade stalls

Melius Research downgraded VRT, ETN, JCI, and TT all to Hold from Buy. While "not concerned" about earnings results for any of the four in 2025, "or even '26 for that matter," the firm is concerned about the multiple that investors will be willing to apply to those results as the emergence of DeepSeek raises the risk that this AI capex "arms race has peaked," the analyst tells investors. While the "violent market reaction yesterday helps discount a lot of this risk," the firm does not see an easy outperformance pathway for these stocks from here, adding that "if nothing else, the positive capex revisions part of the spend cycle seems to have peaked."

Trump Renews Universal Tariff Threat to ‘Protect Our Country’

President Donald Trump said he wants to impose across-the-board tariffs that are “much bigger” than 2.5%, the latest in a string of signals that he’s preparing widespread levies to reshape US supply chains.

“I have it in my mind what it’s going to be but I won’t be setting it yet, but it’ll be enough to protect our country,” Trump told reporters Monday night.

Asked about a report that incoming Treasury Secretary Scott Bessent favored starting with a global rate of 2.5%, Trump said he didn’t think Bessent supported that and wouldn’t favor it himself. He said he wanted a rate “much bigger” than 2.5%.

MSFT: Jefferies says DeepSeek part of 'ongoing evolution, not revolution'

Jefferies sees DeepSeek as evolutionary rather than revolutionary, viewing the MSFT selloff as excessive. They expect improved AI efficiency to accelerate software adoption, backing MSFT and AMZN for enterprise exposure, META and GOOGL for consumer, and SNOW as a data/AI play. Jefferies highlights DT and DDOG benefiting from broader AI adoption in observability. Jefferies considers Oracle's 14% decline an overreaction, emphasizing that core AI demand persists and DeepSeek's inference efficiency gains represent a continuation of existing trends rather than a dramatic shift.

ADSK: Autodesk upgraded to Outperform from Neutral at Mizuho

Mizuho upgraded Autodesk to Outperform, raising target to $400 from $280. Panigrahi sees $10B revenue by FY29 (13% 5-year CAGR, up from 11%) with $15 FCF per share and 400bps margin expansion. They boosted FY26/27 revenue and EPS estimates 4%/6% and 5%/6% above consensus. The $400 target reflects 36x FCF estimate discounted at 11.5%.

Key drivers: new transaction model enabling better upsell/cross-sell with lower costs, reduced distributor commissions, margin focus through headcount cuts and opex control, and improving construction/design spend. Channel checks and macro trends support their bullish view.

BABA, Gen AI: Alibaba’s Qwen released a new family of AI models, Qwen2.5-VL, similar to the model powering OpenAI’s recently launched Operator