Subscribe for Investment Insights. Stay Ahead.

订阅投资洞察,保持领先。

Investment market and industry insights delivered to you in real-time.

实时为您提供投资市场和行业洞察。

China’s strategic reserves of critical minerals, including copper and nickel, are estimated to be more than 35% to 133% of the country’s annual demand. This substantial stockpiling has raised concerns across the West — with bipartisan calls for the US to do the same.

中国的关键矿物战略储备,包括铜和镍,估计超过该国年需求的 35%至 133%。这一大规模的囤积引发了西方的担忧——美国两党呼吁采取同样的措施。

The challenge is that global supply chains are already under pressure with increasing demands for critical minerals from data centers, net-zero targets, and military production.

挑战在于,全球供应链已经面临压力,数据中心、净零目标和军事生产对关键矿物的需求不断增加。

Can the USA match China with its own critical mineral stockpile?

美国能否与中国匹敌,拥有自己的关键矿产储备?

China 中国

The official size and strategy of China’s national commodity stockpiles are state secrets — run by China’s National Food and Strategic Reserves Administration (or, State Reserve Bureau) — but is reported to stock aluminum, antimony, cadmium, cobalt, gallium, germanium, indium, molybdenum, rare earth elements, tantalum, tin, tungsten, and zirconium.

中国国家商品储备的官方规模和战略是国家机密,由中国国家粮食和战略储备局(或称国家储备局)管理,但据报道储备铝、锑、镉、钴、镓、锗、铟、钼、稀土元素、钽、锡、钨和锆。

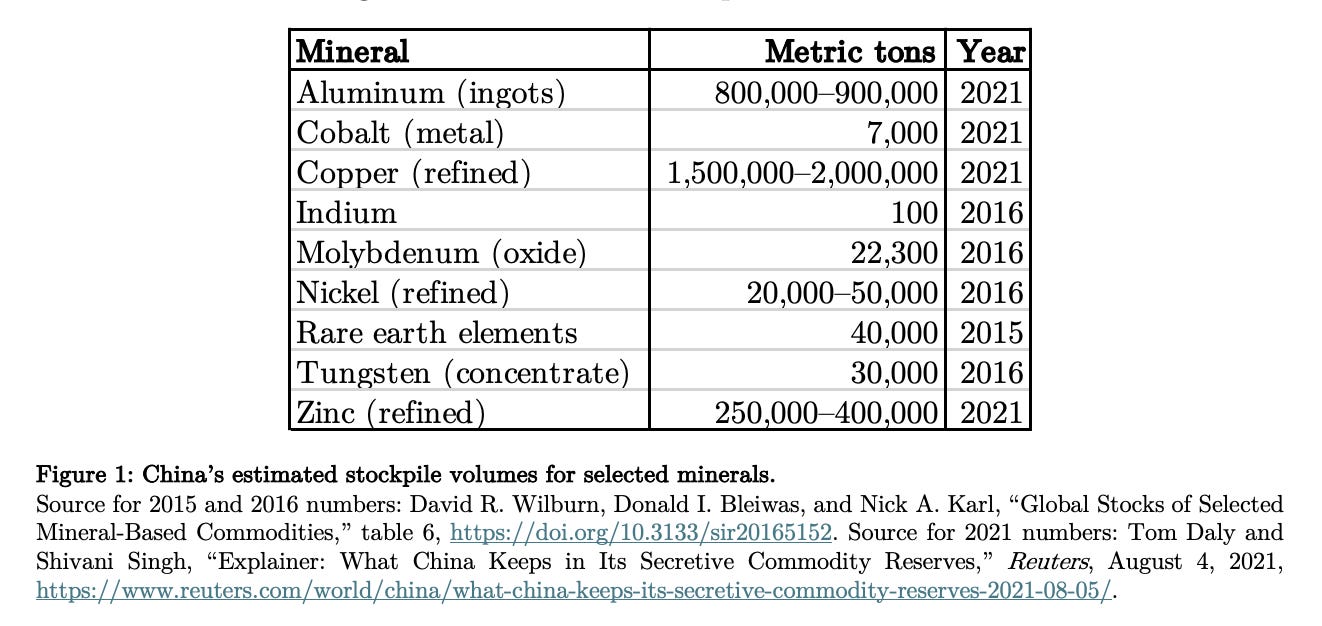

Analysis in 2021 suggested China’s stockpiles included:

2021 年的分析表明,中国的库存包括:

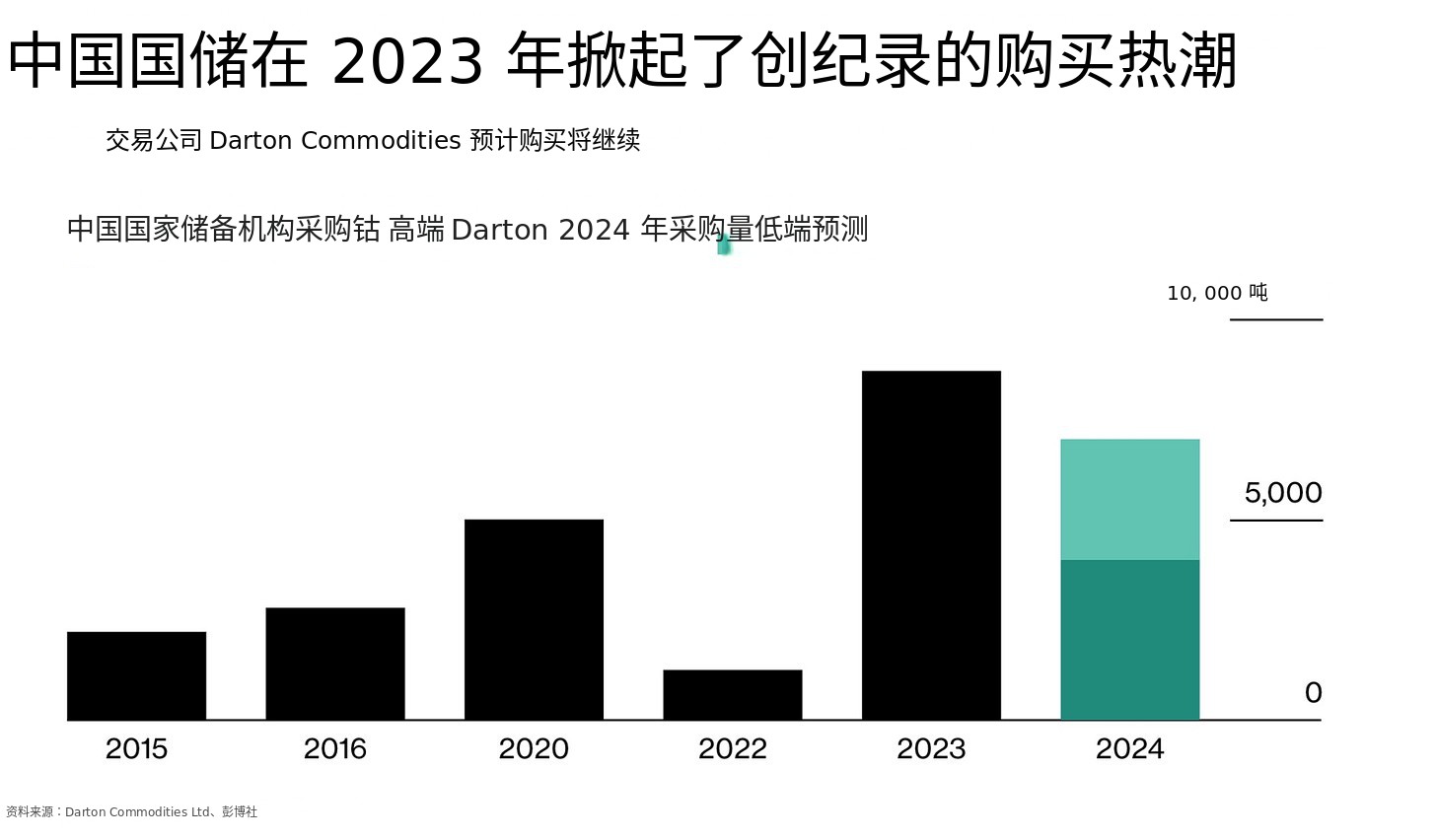

But, since then, the State Reserve Bureau has been spending significant amount more in 2023-2024

但是,从那时起,国家储备局在 2023-2024 年花费了更多的资金

- for example, purchasing a total of more than 15,000 tons of cobalt. Reuters and Bloomberg report the National Food and Strategic Reserves Administration was preparing to buy a record 15,000 tonnes of cobalt from local Chinese producers over 2024 for domestic stockpiles

例如,购买总计超过 15,000 吨的钴。路透社和彭博社报道,国家粮食和物资储备局正在准备在 2024 年从中国本地生产商那里购买创纪录的 15,000 吨钴,以用于国内储备。

- China imported a record high of 1.18 billion tonnes of iron ore in 2023

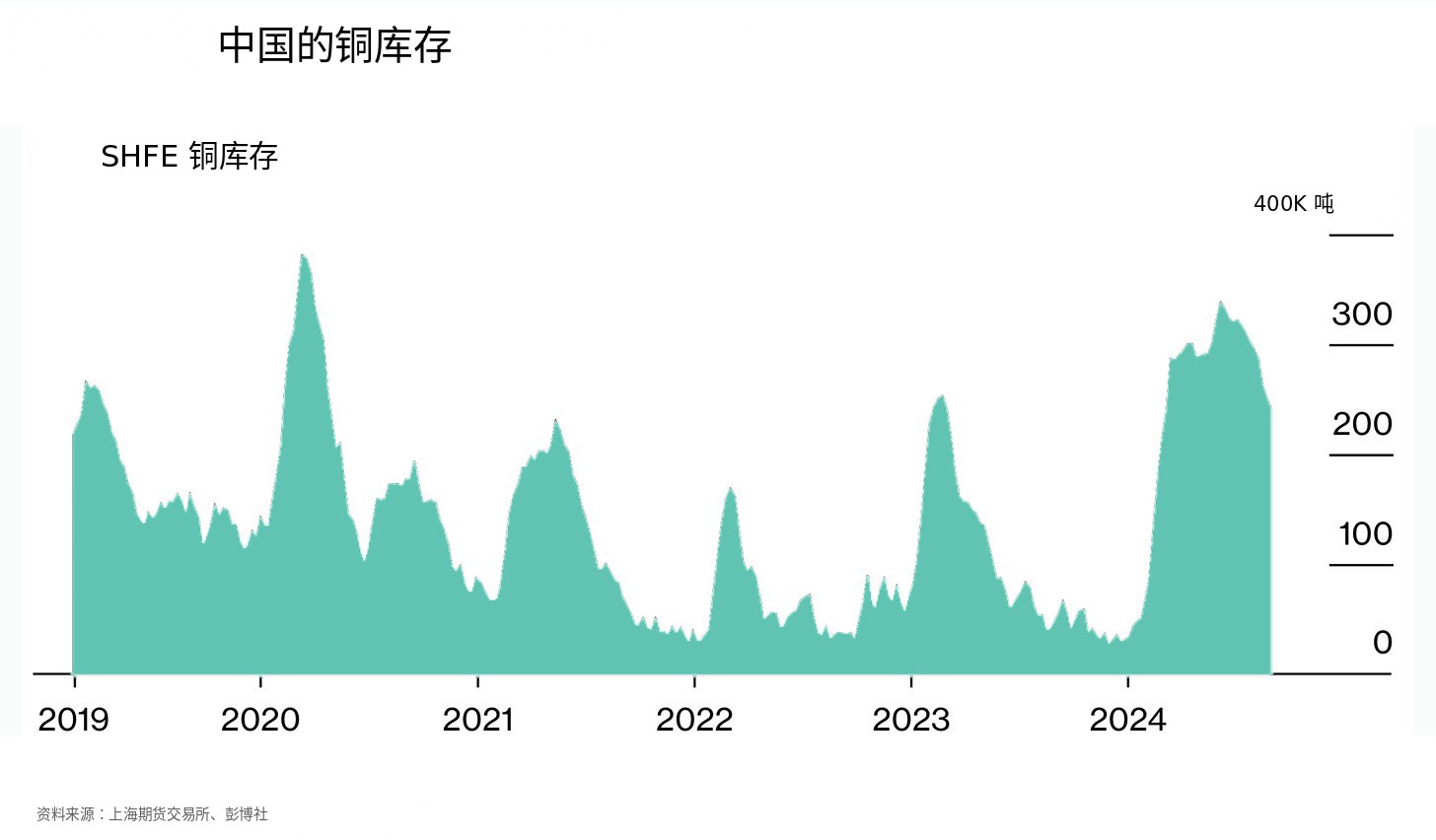

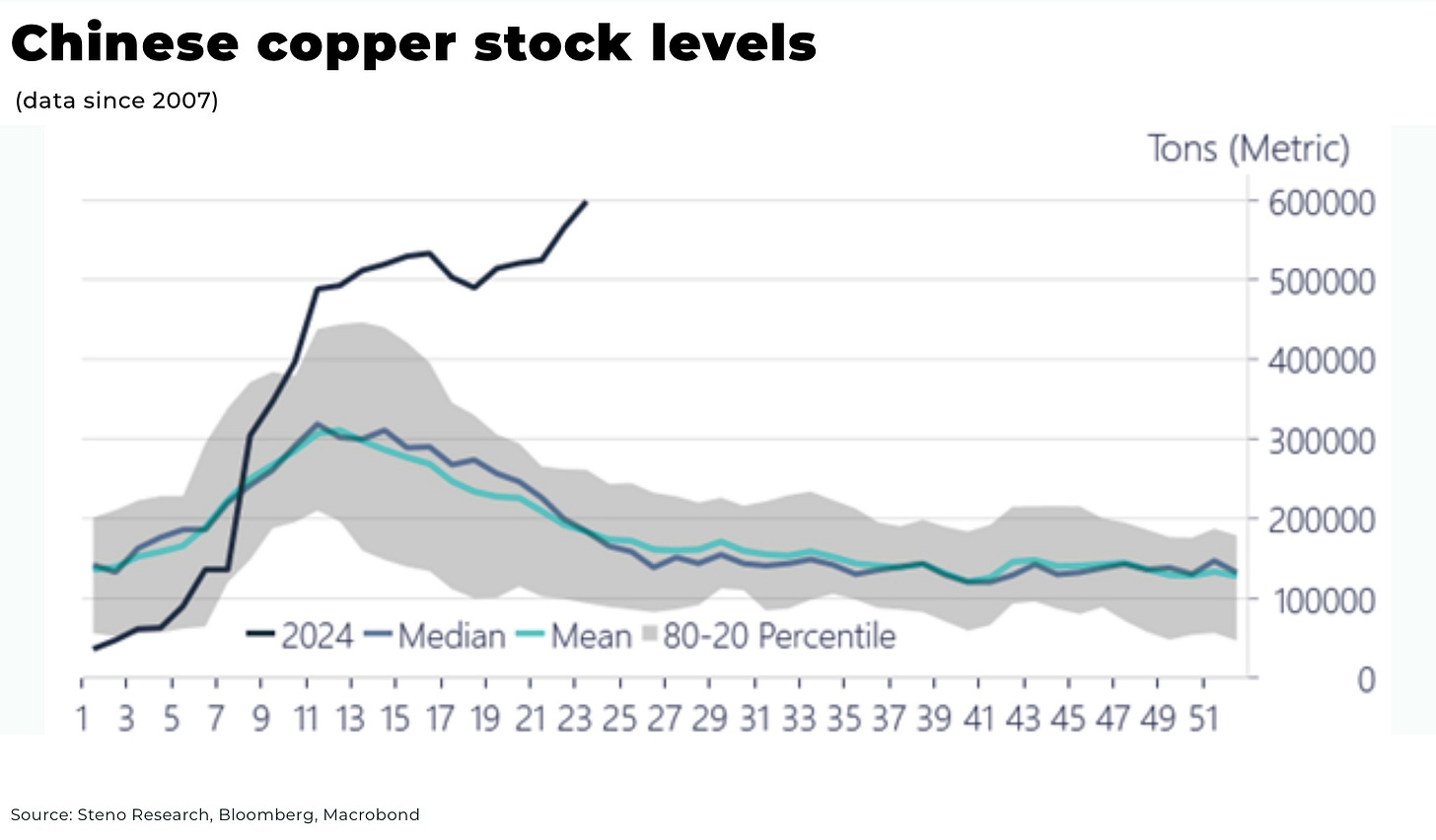

中国在 2023 年进口了创纪录的 11.8 亿吨铁矿石。 - copper inventories have also been increasing, with stockpiles held in Shanghai Futures Exchange warehouses ended in June well above 300,000 tons

铜库存也在增加,上海期货交易所仓库的库存在六月份结束时超过了 30 万吨

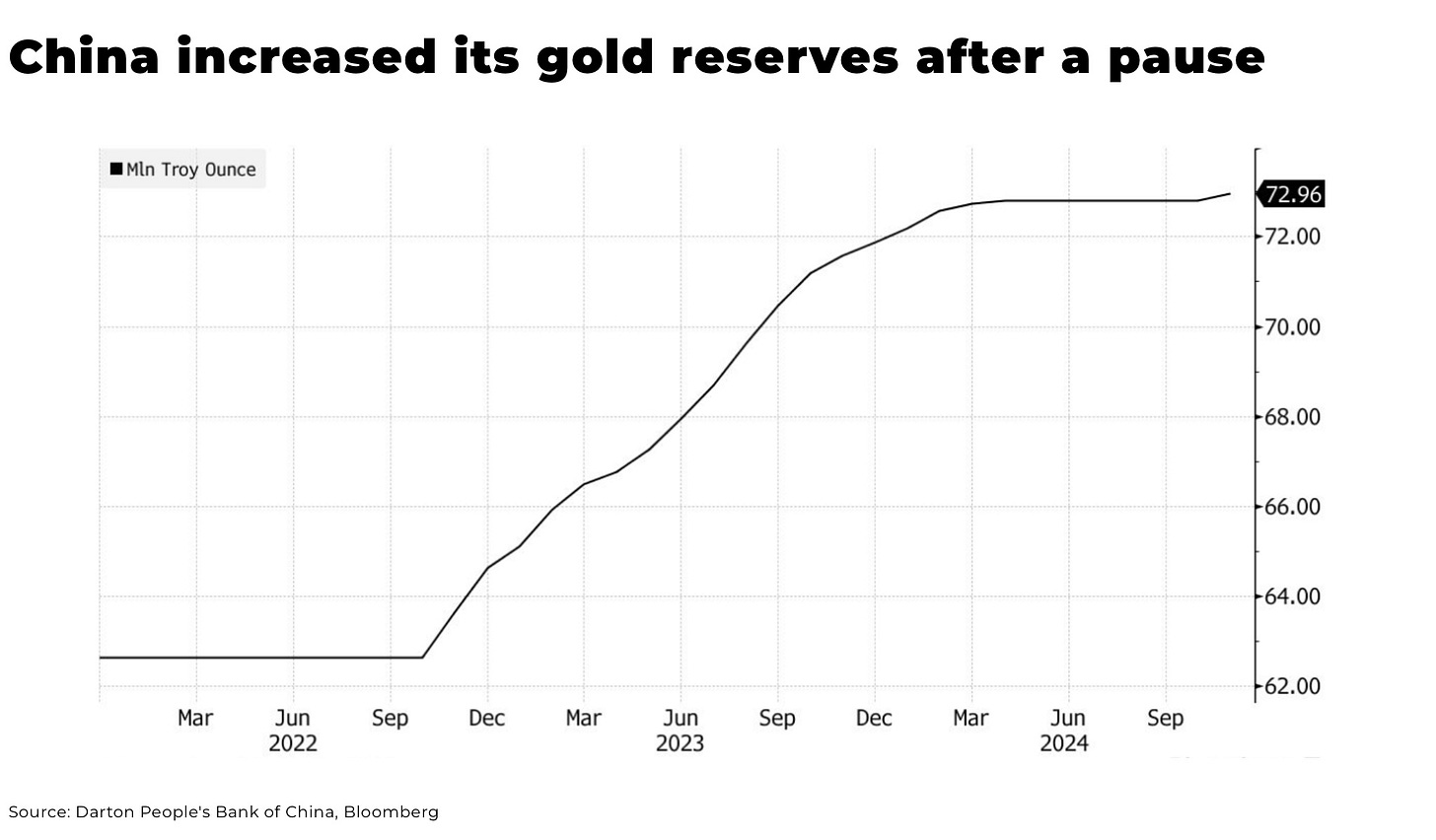

- China’s central bank has been making record purchases of gold, with bullion held by the People’s Bank of China climbing by 160,000 fine troy ounces last month to 72.96 million fine troy ounces, according to official data

中国央行在创纪录地购买黄金,根据官方数据,上个月中国人民银行持有的黄金增加了 160,000 盎司,达到 72.96 百万盎司。

And it’s not just metals, for example, with China reportedly asking state firms to add 60 million barrels of oil to reserves, coal inventories rose to a unprecedented 635 million tons at the end of June, from less than 90 million in late 2021, and China’s construction of grain warehouses has increased the national grain storage capacity to over 700 million tonnes by the end of 2023, an increase of 36% from 2014.

不仅仅是金属,例如,据报道,中国要求国有企业将 6000 万桶石油加入储备,煤炭库存在 6 月底达到了创纪录的 6.35 亿吨,而 2021 年底还不到 9000 万吨,中国的粮仓建设使国家粮食储存能力到 2023 年底超过 7 亿吨,比 2014 年增加了 36%。

Note, these numbers will be highly volatile and are under a great deal of secrecy, so we use them not to give exact specifications, but a general sense of direction.

请注意,这些数字将高度波动,并且受到严格保密,因此我们使用它们不是为了提供确切的规格,而是为了给出一个大致的方向感。

Each commodity is different and there are a variety of reasons for such significant stockpiling, including:

每种商品都是不同的,造成如此大量囤积的原因多种多样,包括:

- the economy is stalling and with output stalling, demand for much of the critical mineral mining infrastructure that China has set up means it can only be put in storage

经济正在停滞,随着产出停滞,对中国建立的许多关键矿产采矿基础设施的需求意味着这些设施只能被储存起来 - national security, including preparation for conflict, for example, over Taiwan

国家安全,包括为冲突做准备,例如,针对台湾的冲突 - preparation for a trade war with potential tariffs from a Trump administation, including a potential devaluation of the Yuan

为特朗普政府可能实施的贸易战做准备,包括人民币可能贬值的潜在关税

We personally think an invasion of Taiwan is unlikely, and China is, instead, preparing for a trade war.

我们个人认为对台湾的入侵不太可能,而中国则在为贸易战做准备。

But, whatever the reason, the outcome is the same: these stockpiles give China significant leverage over both the market and the West.

但是,无论原因是什么,结果都是一样的:这些库存使中国在市场和西方之间拥有了显著的杠杆作用。

Subscribe for Investment Insights. Stay Ahead.

订阅投资洞察,保持领先。

Investment market and industry insights delivered to you in real-time.

实时为您提供投资市场和行业洞察。

The West 西方

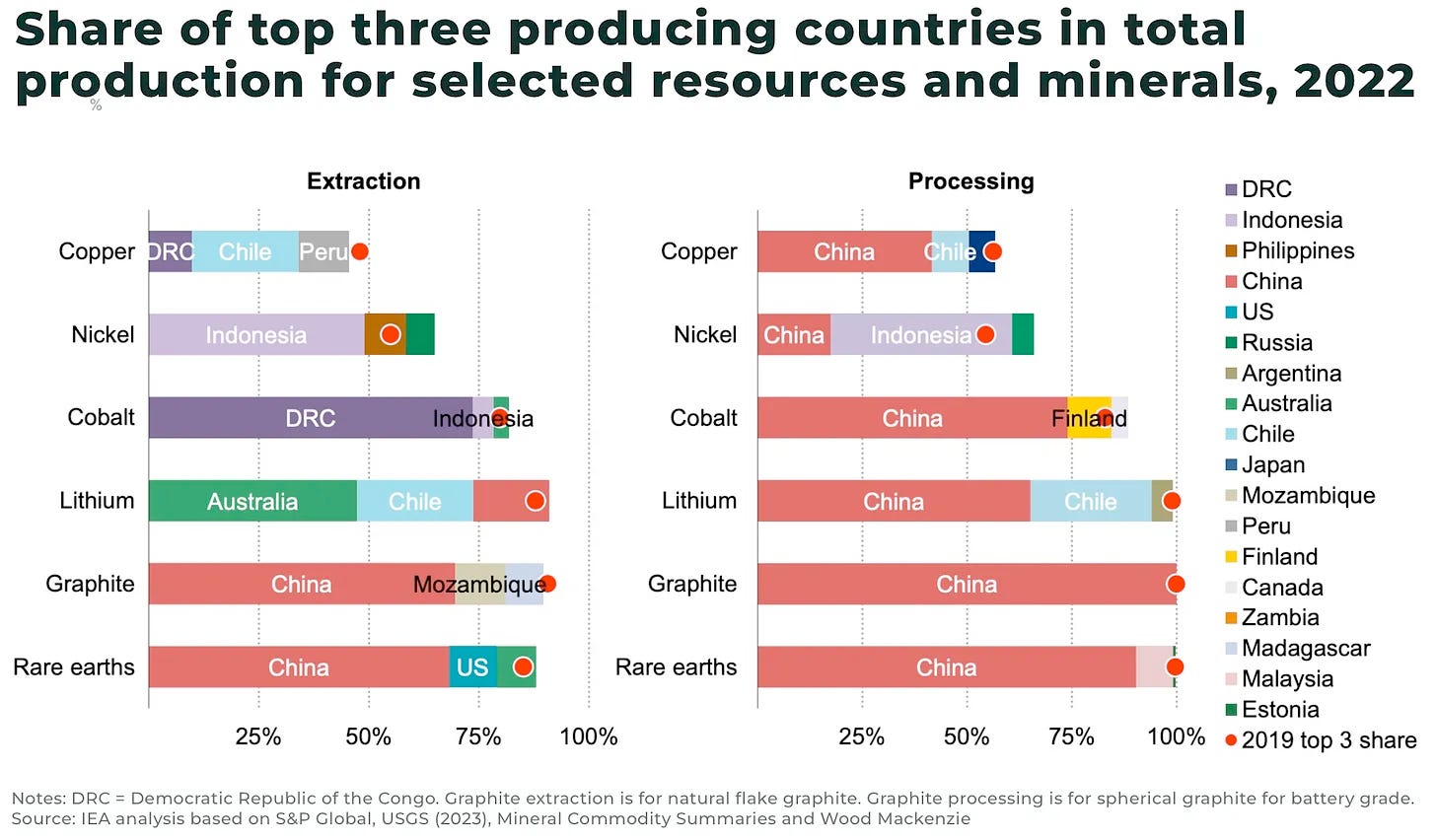

“Over the past several decades, China has cornered the market for processing and refining of key critical minerals, leaving the US and our allies and partners vulnerable to supply chain shocks and undermining economic and national security”

“在过去几十年中,中国在关键矿产的加工和精炼市场上占据了主导地位,使美国及其盟友和合作伙伴面临供应链冲击的脆弱局面,削弱了经济和国家安全。”— the White House said in a statement, Biden-Harris Administration Takes Further Action to Strengthen and Secure Critical Mineral Supply Chains

— 白宫在一份声明中表示,拜登-哈里斯政府采取进一步行动以加强和保障关键矿产供应链

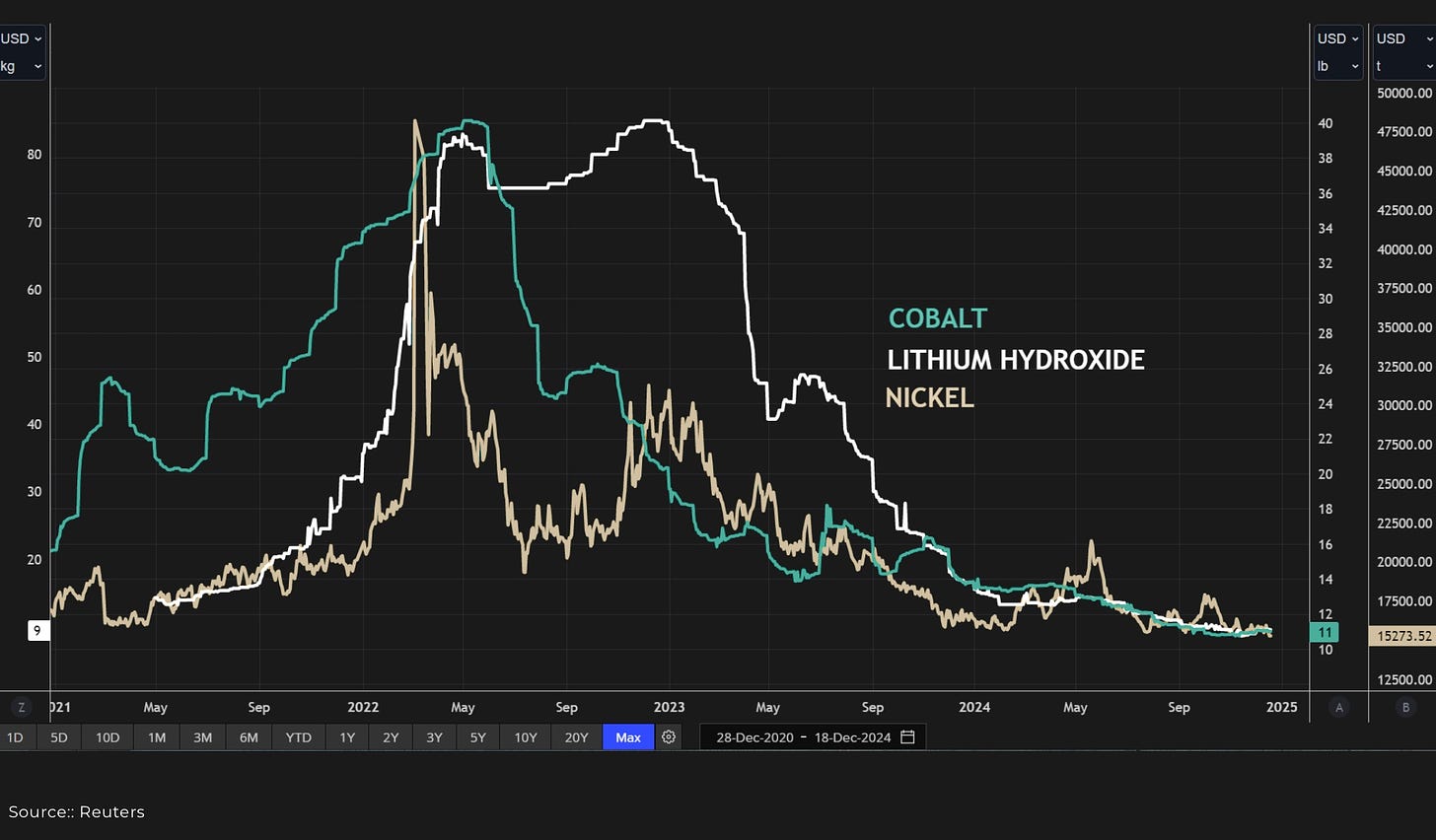

Concerns over US dependency on Chinese supply of critical minerals have been realised with export bans of germanium and gallium, as well as flooding of the market with cheap nickel by Indonesia to take out competition.

对美国依赖中国关键矿物供应的担忧已通过德国 ium 和镓的出口禁令得以体现,同时印度尼西亚通过向市场大量投放廉价镍来消除竞争。

In her election campaign, Kamala Harris proposed a national stockpile critical minerals.

在她的选举活动中,卡马拉·哈里斯提议建立国家关键矿物储备。

The proposed reserve would target minerals with high volatility, low US domestic production, and Chinese import dependence, such as cobalt, graphite, and rare earth elements. This would be similar to how the US Strategic Petroleum Reserve (SPR) is used.

提议的储备将针对波动性高、美国国内生产低以及对中国进口依赖的矿物,如钴、石墨和稀土元素。这将类似于美国战略石油储备(SPR)的使用方式。

We suggest this is not a partisan issue, and that the idea builds on existing administration’s work — Trump in 2020 asked Congress for US$1.5 billion over 10 years to create a new national stockpile of US-mined uranium — and, so, is likely to continue.

我们认为这不是一个党派问题,这个想法建立在现有政府的工作基础上——特朗普在 2020 年要求国会拨款 15 亿美元,用于在 10 年内创建一个新的美国矿产铀国家储备——因此,这个计划很可能会继续进行。

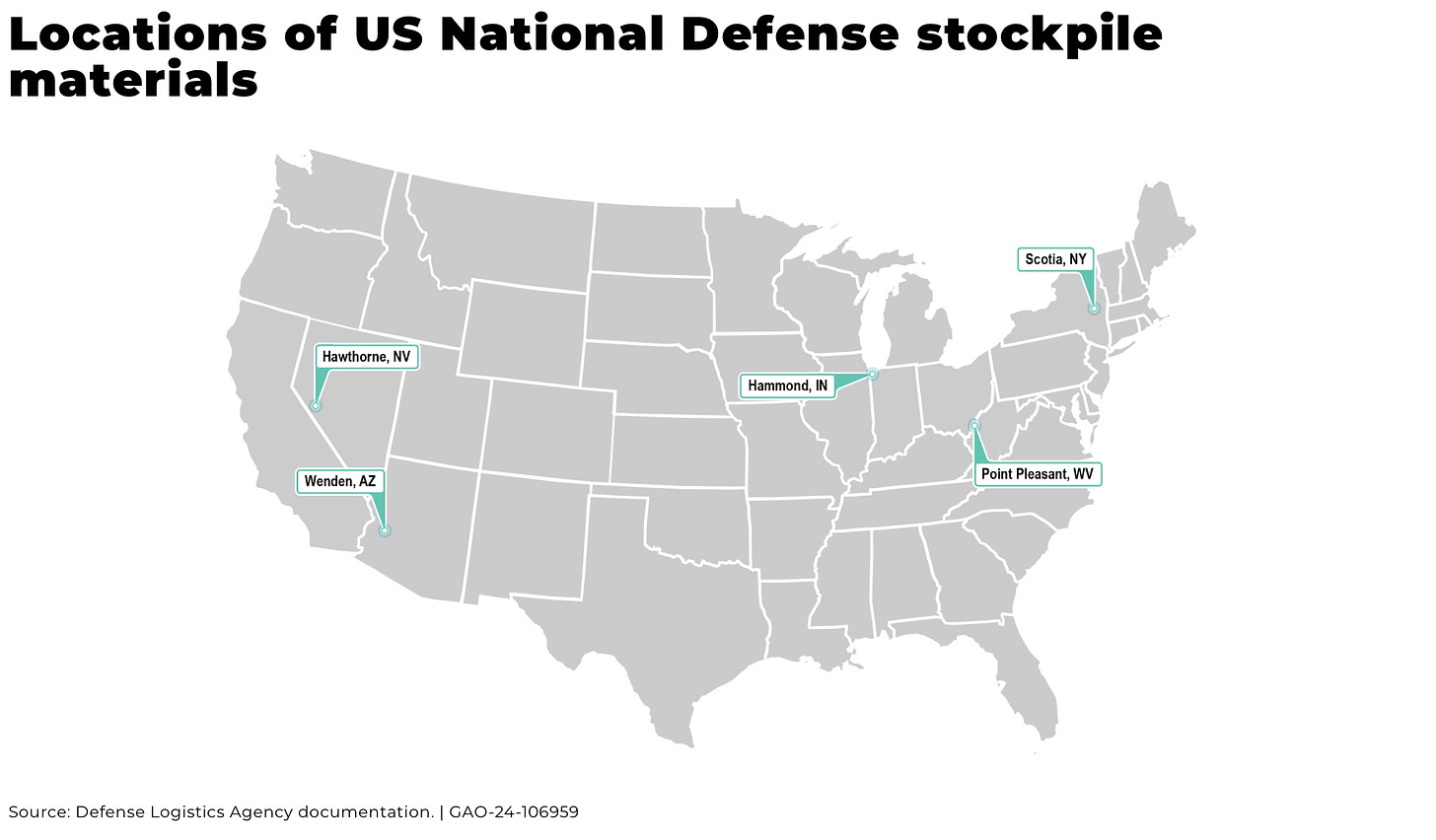

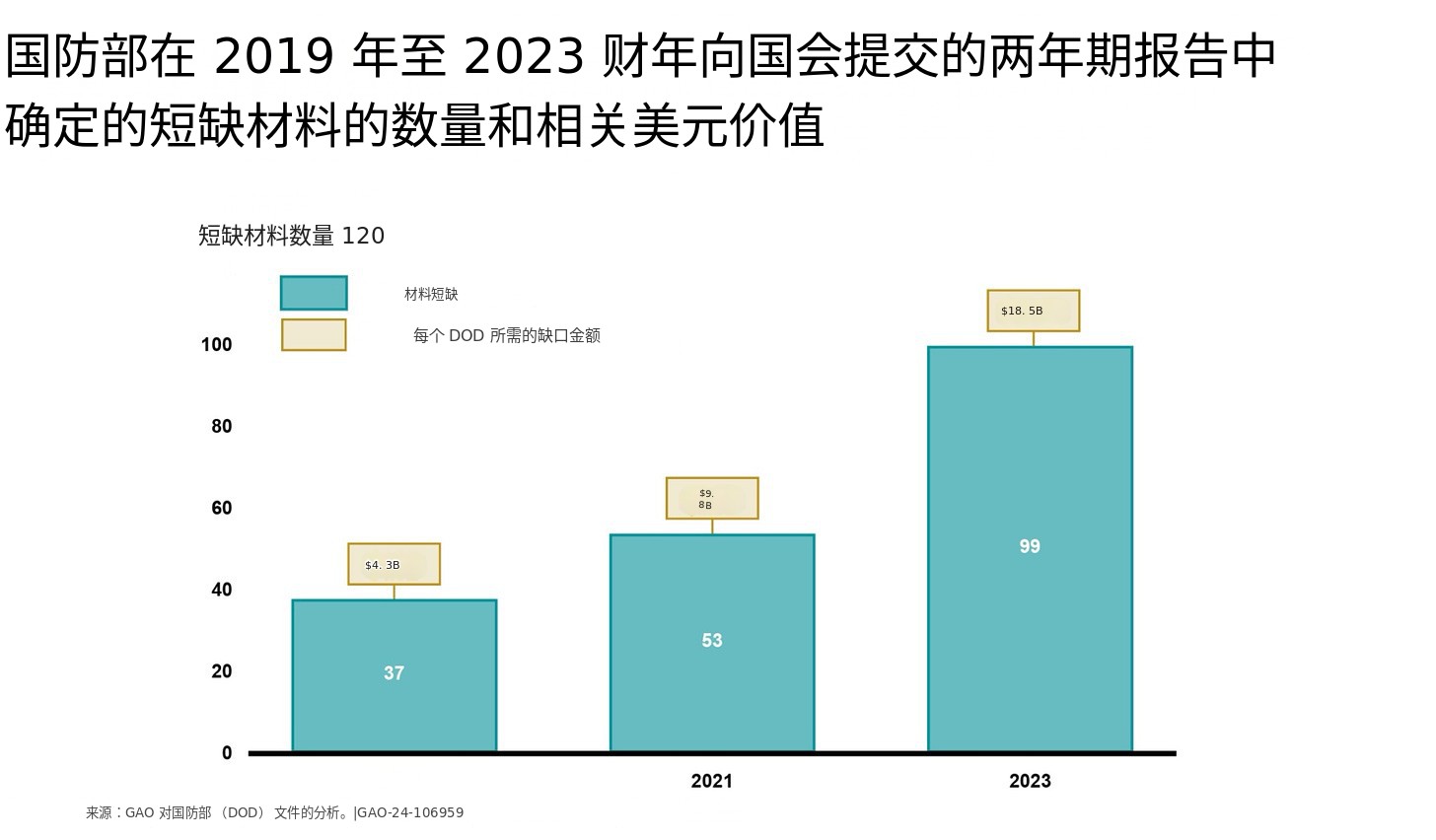

The US does already have an official National Defense Stockpile to be used in emergencies but after decades of neglect, Congress found it “deficient” in 2023.

美国确实已经拥有一个官方的国家防御储备,以备紧急情况使用,但经过数十年的忽视,国会在 2023 年发现其“不足”。

As of March 2023, the National Defense Stockpile contains US$1.3 billion in total assets, including US$912.3 million of stockpiled material.

截至 2023 年 3 月,国家防御储备总资产为 13 亿美元,其中包括 9.123 亿美元的储备物资。

Per estimates, as of April 2023, the current inventory mitigates less than half of estimated strategic and critical materials shortfalls for military requirements; less than 10% of essential civilian demand shortfalls; and approximately 6% of total net shortfalls in “base case” national emergency scenarios. The vast majority of the US$13.5 billion gap between current stockpile assets and current stockpile requirements would support non defense critical infrastructure demand in the event of an attack on the US

根据估计,截至 2023 年 4 月,目前的库存仅能缓解不到一半的军事需求所需的战略和关键材料短缺;不到 10%的基本民用需求短缺;以及在“基本情况”国家紧急情况中大约 6%的总净短缺。当前库存资产与当前库存需求之间的 135 亿美元差距绝大部分将用于支持在美国遭受攻击时的非国防关键基础设施需求。

In December 2023, the US House Select Committee on the Chinese Communist Party called for the creation of a Resilient Resource Reserve to insulate American producers from price volatility and China’s weaponization of its dominance in critical mineral supply chains. This included spending US$1 billion to build out its stockpile of critical minerals as a “buffer.”

2023 年 12 月,美国众议院中国共产党特别委员会呼吁建立一个韧性资源储备,以保护美国生产者免受价格波动和中国在关键矿产供应链中武器化其主导地位的影响。这包括花费 10 亿美元来扩大关键矿产的储备,作为一种“缓冲”。

The reserve is envisioned as a physical stockpile that can meet US military demands in a major conflict, influence domestic mineral prices to incentivize expanded US production, as well as act as a buffer, both financially and physically, in case of any supply crisis.

该储备被设想为一个实物库存,能够满足美国军方在重大冲突中的需求,影响国内矿产价格以激励美国生产的扩大,并在任何供应危机发生时,充当财务和物理上的缓冲。

The seriousness with which the issue is being taken was highlighted when the US looked into buying cobalt for defence stockpiles last year, with the possibility of the Defense Logistics Agency purchasing more in the future.

该问题的严重性在于,美国去年曾考虑购买钴用于国防储备,国防后勤局未来可能会购买更多。

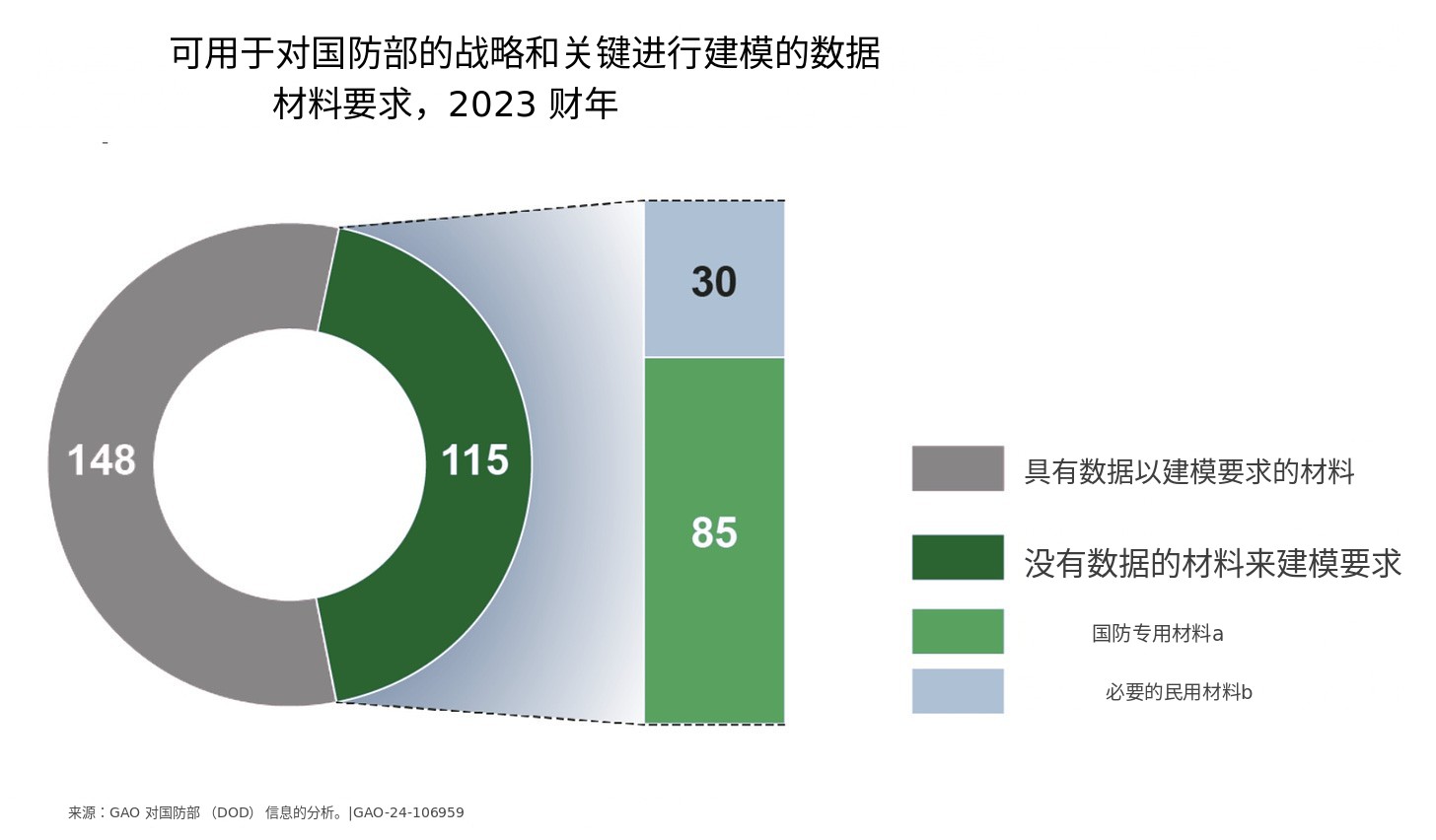

The Department of Defence has developed a process for identifying strategic and critical material requirements However, the Department of Defence did not have the data needed to do so for 115 of the 263 materials — or about 44% — it wanted to model in fiscal year 2023.

国防部已制定了一项识别战略和关键材料需求的流程。然而,国防部并没有所需的数据来对其在 2023 财年希望建模的 263 种材料中的 115 种(约占 44%)进行分析。

And it’s not just the US, for example:

不仅仅是美国,例如:

- Canada’s government will buy stockpiled rare earth materials from Vital Metals Ltd. in a deal that prevents the company from selling its production to a Chinese buyer

加拿大政府将从 Vital Metals Ltd.购买储备的稀土材料,此项交易阻止该公司将其生产出售给中国买家。 - The South Korea government has started to build up a national stockpile of lithium reserves through the state-owned Korea Mine Rehabilitation & Mineral Resources Corp (KOMIR), Fastmarkets was told on Tuesday May 21

韩国政府已通过国有的韩国矿山复兴与矿产资源公司(KOMIR)开始建立国家锂储备。Fastmarkets 在 5 月 21 日星期二获悉 - Most of Europe does not even have a critical mineral stockpile

大多数欧洲国家甚至没有关键矿产的储备

Subscribe for Investment Insights. Stay Ahead.

订阅投资洞察,保持领先。

Investment market and industry insights delivered to you in real-time.

实时为您提供投资市场和行业洞察。

Other initiatives 其他倡议

The IEA is also developing a new Critical Minerals Security Programme, modelled after its oil security mechanism. Key aspects of the programme include:

国际能源署(IEA)还在开发一项新的关键矿产安全计划,该计划以其石油安全机制为模型。该计划的关键方面包括:

- the programme would serve as a “safety net” for critical mineral supply chains

该计划将作为关键矿产供应链的“安全网” - collaboration between 31 governments

31 个政府之间的合作 - draws lessons from the IEA’s oil security mechanism, which requires member countries to hold 90 days of oil stocks

借鉴国际能源署(IEA)的石油安全机制,该机制要求成员国储备 90 天的石油库存

Further details of the programme are expected to be announced in the coming year.

该计划的进一步细节预计将在明年公布。

Market implications 市场影响

Stockpiles have a significant impact on the market – both upsides and downsides:

库存对市场有显著影响——无论是正面还是负面

Demand and price stability: the creation of a US national stockpile, coupled with China’s ongoing stockpiling efforts, could lead to a sustained increase in demand for critical minerals, including a floor for prices, offering miners offtake and buyer-of-last-resort agreements, which could encourage new investment across the industry

需求和价格稳定:美国国家储备的建立,加上中国持续的囤积努力,可能会导致对关键矿物的需求持续增加,包括价格的底线,为矿工提供购买协议和最后买家协议,这可能会鼓励整个行业的新投资

Global critical mineral alliances: as the US seeks to build critical mineral supply chains with allies, we are likely to see increased international cooperation across the mining sector. This could lead to new joint ventures, technology transfers, and trade agreements focused on critical minerals

全球关键矿产联盟:随着美国寻求与盟友建立关键矿产供应链,我们可能会看到矿业领域国际合作的增加。这可能导致新的合资企业、技术转让以及专注于关键矿产的贸易协议。

Decentalization and market diversification: the push for diversified supply chains could benefit junior miners and exploration companies operating in geopolitically stable regions outside of China’s sphere of influence. This could lead to a more robust, globally distributed mining sector.

去中心化和市场多样化:推动多元化供应链可能会使在地缘政治稳定的地区、位于中国影响力之外的初级矿业公司和勘探公司受益。这可能会导致一个更强大、全球分布的矿业部门。

But, it could also lead to overcapacity risks and market distortions if not carefully managed, with sudden large purchases or sales from national stockpiles potentially creating price volatility.

但如果管理不当,这也可能导致产能过剩风险和市场扭曲,国家储备的突然大规模采购或销售可能会造成价格波动。

A race to secure and control critical minerals could also exacerbate geopolitical tensions, with trade disputes, resource nationalism and export restrictions leading to global supply chain disruption and threats to national security.

争夺和控制关键矿产的竞赛可能加剧地缘政治紧张局势,贸易争端、资源民族主义和出口限制将导致全球供应链中断和国家安全威胁。

Conclusion 结论

A US national stockpile is essential as a buffer in any national emergency, and low prices across many critical minerals, such as nickel, offers a perfect opportunity for governments to buy.

美国国家储备在任何国家紧急情况下都是至关重要的缓冲,而镍等许多关键矿物的低价格为各国政府提供了一个绝佳的购买机会。

However, although stockpiles are set up to alleviate pressures on supply, any decision by major economies like China and the US to build substantial stockpiles of critical minerals are likely to exacerbate existing supply chain pressures.

然而,尽管建立库存是为了缓解供应压力,但中国和美国等主要经济体如果决定大规模储备关键矿产,可能会加剧现有的供应链压力。

And the faster the US wants to stockpile, the higher the pressure on supply.

美国越想快速储备,供应压力就越大。

Already demand is expected to exceed supply across a range of critical minerals due to net zero targets, defence expansion, and the surge of data centers for artificial intelligence.

由于净零目标、国防扩张以及人工智能数据中心的激增,预计一系列关键矿物的需求将超过供应。

Increased stockpiling efforts may compound existing pressures, heightening the risk of short-term price volatility and market destabilization.

增加的囤积努力可能加剧现有压力,提高短期价格波动和市场不稳定的风险。

Subscribe for Investment Insights. Stay Ahead.

订阅投资洞察,保持领先。

Investment market and industry insights delivered to you in real-time.

实时为您提供投资市场和行业洞察。