TMTB EOD WRAP

QQQs -22bps. Fed overall seemed to be a non-event. VK covered it well, as always:

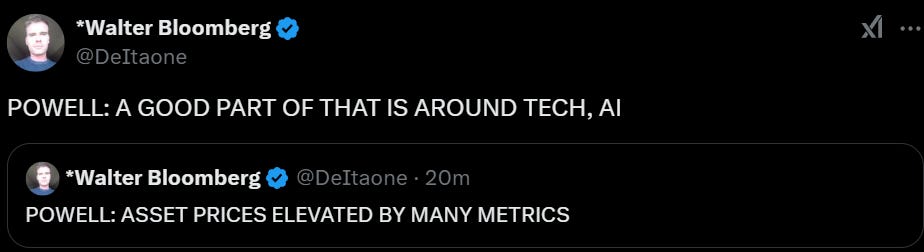

The 2pmET statement contained a hawkish language change around inflation in that it omitted the line “inflation has made progress toward the committee’s 2% objective”. However, Powell’s press conf. remarks were dovish, and he basically said that the statement adjustment should not be interpreted as a hawkish shift. During the press conf., Powell acknowledged that inflation has eased significantly over the last two years, moving much closer to the 2% goal (although remains “somewhat elevated”). Meanwhile, inflation expectations “remain well anchored”. More specifically, it was noted that the most recent inflation data has been encouraging, and it is expected that further disinflationary progress will occur (OER/housing inflation now seems to be drifting lower at a fairly steady clip).

As long as nothing changes current fed trajectory of easing (45-50bps cuts expected this year) and yields remain subdued, we think it will continue to be a supportive macro environment for equities. But macro releases will continue to play an outsized role in potentially changing that and next on the docket is PCE on Friday and NFP next week.

No shortage of excitement as we get META, TSLA, MSFT, and NOW after the close so there will be tea leaves for every sector. For semis what matters most is how Zuck and Nadella frame capex spending, with most paying more attn to how Nadella sounds. Also his commentary might affect sw as well if he repeats his BG2 comments on app layer value vs collapsing SaaS apps.

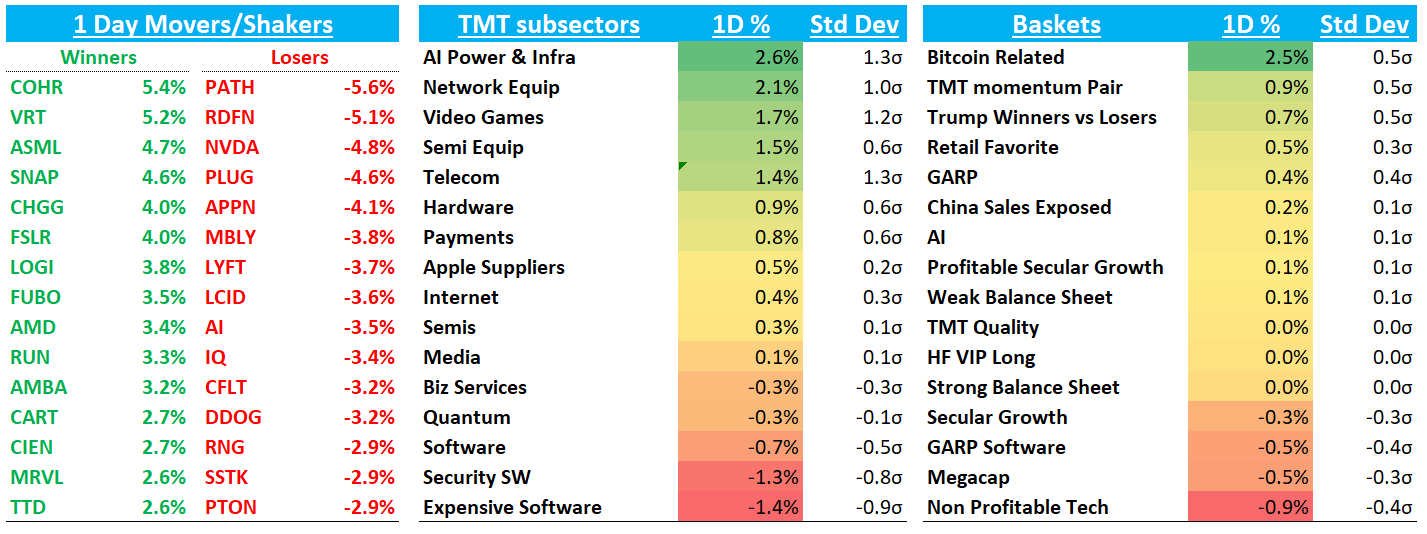

Sw the laggard today while AI Power & Infra rallied. BTC +4.4% getting back to $105k

We’ll make it a fairly quick one today given post-close fireworks. Key movers:

NVDA -5% giving back some gains from yesterday as Trump officials Discuss Tightening Curbs on Nvidia (NVDA) China Sales - Bloomberg…althuogh stock was already down 5% before that news came out.

MRVL +2.7% some nice outperformance vs AVGO -40bps and NVDA

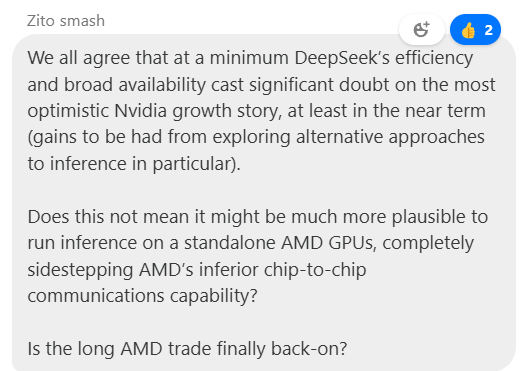

AMD +3.4% nice outperformer. Intg comment in TMTB chat from a reader

UBER -2% / LYFT - 4%: TheVerge saying Waymo will roll out to 10 new cities in 2025, which seems to be a bit of an uptick vs. what Sundar said at Dealbook in Dec. We’ll see what Elon says tonight

RDDT +5% on a pretty bullish Piper note this morning noting they’re rolling out system to easier ramp META advertisers (see morning note for more details)

RBLX +2.5% continues to rock

DDOG -4% on Stifel’s downgrade saying OpenAI likely optimizing usage, which could affect Q1 and FY25 revs

ASTS -10%/GSAT -21%/MDA CN -20% - All 3 down on news that AAPL has been secretly working with SpaceX and TMUS to add support for the Starlink network in its latest iPhone software.

BABA +1.5% following through following their model announcement yesterday.

AAPL +35bps shaking off oppenheimer dg

RIVN -2% on Bernstein neg initiation

COIN +4% as Mizuho ugs to buy and on the back of BTC strength; HOOD +4%

Earnings: QRVO +1.3% despite lower guide; FFIV +10% on good #s + excitement around AI; ASML +4.5% on better bookings

Dario, CEO of Anthropic posted some good thoughts on DeepSeek here, even defending NVDA explicitly: