Charday Penn/E+ via Getty Images

Thesis Recap 論點回顧

StoneX (NASDAQ:SNEX) continues to perform as a long-term compounding machine, delivering consistent ROEs at or above their stated target of around 15%. Since my last article, the stock has appreciated by around 20%, proving my thesis so far to be correct. At a current FWD P/E ratio of 12x, the stock is not super expensive and still has a long runway to grow by using technology to reach clients globally. I reiterate a buy rating and expect this long-term compounding track record to continue, so investors should remain bullish on StoneX.

StoneX(NASDAQ: SNEX)繼續作為一臺長期複利機器表現出色,提供一致的 ROE,達到或超過其約 15%的目標。自從我上一篇文章以來,該股已上漲約 20%,證明我的論點至今是正確的。目前的預期市盈率為 12 倍,該股並不超級昂貴,並且仍有很長的增長跑道,通過使用技術來觸及全球客戶。我重申買入評級,並預計這種長期複利記錄將繼續,因此投資者應對 StoneX 保持看漲。

Exceptional Profitability Continues

持續的卓越盈利能力

StoneX continues to be a profit machine, highlighting how volatility in the markets benefits StoneX's business. For FY 2024, management shows solid EPS growth and ROEs in their conference call transcript,

StoneX 繼續作為一臺盈利機器,突顯市場波動如何使 StoneX 的業務受益。對於 2024 財年,管理層在他們的電話會議記錄中展示了穩固的每股收益增長和 ROE,

The fourth quarter of fiscal 2024 was a record result for us, with net income of $76.7 million and diluted earnings per share of $2.30 versus the comparative period a year ago, we were up 51% in net income and 48% in EPS. And as compared to the immediately preceding quarter, these measures were up 24% and 23% respectively.

2024 財年第四季度是我們的創紀錄業績,淨收入為 7670 萬美元,稀釋後每股收益為 2.30 美元,與去年同期相比,淨收入增長了 51%,每股收益增長了 48%。與前一季度相比,這些指標分別增長了 24%和 23%。This represented an 18.5% ROE on stated book and a 19.4% ROE on tangible book value, despite a 21% increase in book value over the last year and a 60% increase over the last two years. We had record operating revenues of $920.1 million, up 18% versus the prior year.

這代表了 18.5%的賬面 ROE 和 19.4%的有形賬面 ROE,儘管賬面價值在過去一年增長了 21%,在過去兩年增長了 60%。我們創下了 9.201 億美元的營業收入,比去年同期增長了 18%。

I believe this long-term compounding growth machine is still working fine as the return on equity almost reaches 20% while the book value grows well into the double-digits. I see this as evidence that StoneX can benefit from bull markets, arguably performing better due to more trading activity and an optimistic market outlook. The recent quarter tells me that net income is still a beneficiary of both market volatility and a high degree of operating leverage.

我相信這臺長期複利增長機器仍然運作良好,因為股本回報率幾乎達到 20%,而賬面價值也以兩位數增長。我認為這是 StoneX 可以從牛市中受益的證據,由於更多的交易活動和樂觀的市場前景,表現可能更好。最近的季度告訴我,淨收入仍然是市場波動和高運營槓桿的受益者。

It's also nice to see that the high-performing institutional segment has continued to show a positive degree of operating leverage, which means a percent increase in revenue leading to a higher percentage increase in earnings. For instance, in the transcript,

也很高興看到高績效的機構部門繼續顯示出積極的運營槓桿,這意味著收入每增加 1%,收益就會以更高的百分比增長。例如,在電話會議記錄中,

As I noted earlier, Institutional segment had a record quarter in both operating revenues and segment income with increases over the prior year of 30% and 41% respectively, in particular driven by increases in equity market making, derivatives and interest income. On a sequential basis, operating revenues were up 9% and segment income was up 24%.

正如我之前提到的,機構部門在營業收入和部門收入方面都創下了季度紀錄,分別比去年同期增長了 30%和 41%,特別是受股票做市、衍生品和利息收入增長的推動。按季度計算,營業收入增長了 9%,部門收入增長了 24%。

The institutional segment continues to be the main driver of growth, witnessing higher percentage increase in segment income over operating revenues. To me, this means that some of StoneX's growth is valuable as it leads to much higher earnings due to a large proportion of fixed costs. I think going into 2025 the momentum brought by the institutional segment will continue, as market outlooks suggest that these investors will continue to be optimistic and will trade more accordingly.

機構部門繼續成為增長的主要驅動力,部門收入的增長百分比高於營業收入。對我來說,這意味著 StoneX 的一些增長是有價值的,因為它由於固定成本比例較大而導致更高的收益。我認為進入 2025 年,機構部門帶來的勢頭將繼續,因為市場前景表明這些投資者將繼續保持樂觀並進行更多的交易。

In conclusion, I think StoneX performed exceptionally well for the last quarter of 2024 and reasonably strong for the FY 2024. The numbers tell me that Institutional and Retail took the spotlight for the year, suggesting increased investor appetite and interest in the markets. StoneX remains resilient and a long-term compounding machine, with a track record of growing "operating revenue and market capitalization at nearly 30% CAGR for the last 21 years" likely to continue.

總之,我認為 StoneX 在 2024 年最後一個季度表現非常出色,並且在 2024 財年表現相當強勁。數字告訴我,機構和零售部門在一年中成為焦點,表明投資者對市場的興趣和胃口增加。StoneX 仍然具有韌性,是一臺長期複利機器,其“過去 21 年營業收入和市值以近 30%的複合年增長率增長”的記錄可能會繼續。

Using Technology To Go Global

利用技術走向全球

A major theme that I noticed management discuss in the latest earnings call is using technology to digitize many of their offerings. This is especially true for their self-directed retail segment, which has seen "operating revenues up 13% and a 6% increase in segment income" in the latest quarter.

我注意到管理層在最新的財報電話會議中討論的一個主要主題是利用技術來數字化他們的許多產品。這尤其適用於他們的自主零售部門,該部門在最新季度中“營業收入增長了 13%,部門收入增長了 6%”。

I think StoneX is ready to capitalize on investing in the right technologies to profit from the ongoing digitization of our markets. For instance, management talks about new initiatives in their earnings call,

我認為 StoneX 已經準備好投資於正確的技術,以從我們市場的持續數字化中獲利。例如,管理層在他們的財報電話會議中談到了新的舉措,

As we continue down this digitization journey, not only will we be able to scale, but we should see significant operating leverage, as already evidenced in what we have now renamed our self-directed retail segment, which we believe will serve to dramatically increase margins over time and allow StoneX to increasingly exhibit characteristics of a Fintech-style company.

隨著我們繼續進行這趟數字化之旅,我們不僅能夠擴展規模,還應該看到顯著的運營槓桿,正如我們現在重新命名的自主零售部門所證明的那樣,我們相信這將隨著時間的推移顯著提高利潤率,並使 StoneX 越來越多地表現出金融科技風格公司的特徵。As I mentioned earlier, we are looking to take our retail digital platform and expand its capabilities to include all of the StoneX products and capabilities. Together with our proven digital marketing team, this will allow us to expand our addressable market for all of the StoneX products globally.

正如我之前提到的,我們正在考慮將我們的零售數字平台擴展到包括所有 StoneX 產品和功能。與我們經過驗證的數字營銷團隊一起,這將使我們能夠在全球範圍內擴展所有 StoneX 產品的可觸及市場。

StoneX looks prepared to transition into what they call more of a "fintech-style company", which to me suggests they are ready to invest in digital technologies to become more of a global company. Some of their new tech investments include adding new digital trading products and entering the crypto space. With numerous acquisitions made in the past few years, I think StoneX's digital transformation is making their products efficient and more accessible globally, contributing to more potential EPS growth for shareholders.

StoneX 看起來已經準備好轉型為他們所說的更像“金融科技風格的公司”,這對我來說表明他們已經準備好投資於數字技術,以成為一家更具全球性的公司。他們的一些新技術投資包括增加新的數字交易產品和進入加密貨幣領域。在過去幾年中進行了多次收購,我認為 StoneX 的數字化轉型正在使他們的產品在全球範圍內更高效和更易於訪問,為股東帶來更多的潛在每股收益增長。

I think the good thing about using technology to embrace the digitization of our markets is that this will likely enhance the positive impact of the degree of operating leverage. Thus, I think EPS can continue to grow as StoneX enters new markets and enhances their trading platforms, leveraging their technology to reach new clients everywhere. Upgrading their offerings digitally may contribute to more customer value and higher switching costs, making StoneX's long-term digital bets potentially very profitable for shareholders.

我認為利用技術來擁抱我們市場的數字化的好處是,這可能會增強運營槓桿的積極影響。因此,我認為隨著 StoneX 進入新市場並增強他們的交易平台,利用他們的技術觸及全球新客戶,每股收益可以繼續增長。數字化升級他們的產品可能會帶來更多的客戶價值和更高的轉換成本,使 StoneX 的長期數字賭注對股東來說可能非常有利可圖。

In sum, the recent earnings call transcript suggest to me that this compounding machine still has room to grow. I expect earnings to continue to grow at a double-digit rate, as well as returns on equity to remain at least 15% for the foreseeable future. StoneX's technology investments look to be promising in bringing in new clients globally while improving their profit margins.

總之,最近的財報電話會議記錄表明,這臺複利機器仍有增長空間。我預計收益將繼續以兩位數的速度增長,並且在可預見的未來,股本回報率將保持在至少 15%。StoneX 的技術投資看起來很有希望在全球範圍內吸引新客戶,同時提高他們的利潤率。

Valuation - Still A Compounding Machine

估值 - 仍然是一臺複利機器

As I mentioned before in previous articles, I don't have a price target for this stock in the fears of missing out on future potential compounding gains. For a long-term compounder like StoneX, I think investors should remain bullish as long as the business continues to compound book value and EPS growth at an attractive rate. This name is best to be bought and held, so long as the fundamentals remain intact, in my opinion.

正如我之前在之前的文章中提到的,我沒有為這隻股票設定價格目標,因為擔心錯過未來的潛在複利收益。對於像 StoneX 這樣的長期複利者,我認為只要業務繼續以有吸引力的速度複利賬面價值和每股收益增長,投資者就應該保持看漲。在我看來,只要基本面保持不變,這隻股票最好買入並持有。

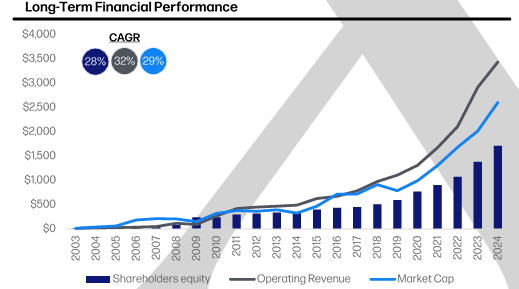

A look at this chart in their investor presentation suggests it was wrong to sell this stock at any point in its history. This is why I think a price target is potentially not suitable as it misses the long-term story that StoneX can provide.

查看他們投資者演示中的這張圖表表明,在歷史上的任何時候賣出這隻股票都是錯誤的。這就是為什麼我認為價格目標可能不合適,因為它錯過了 StoneX 可以提供的長期故事。

Investor presentation

When investors talk about the power of compounding, I think StoneX is a defining example of how it works. At any point in this stock's history, investors should have simply held on as the business worked to provide around 30% CAGR in both book value and operating revenue. So long as this continues, the stock should follow this compounding machine, so investors should not be afraid to hold on at the current P/E of 12x.

當投資者談到複利的力量時,我認為 StoneX 是一個定義性的例子。在這隻股票的歷史上的任何時候,投資者都應該簡單地持有,因為業務努力提供約 30%的賬面價值和營業收入的複合年增長率。只要這種情況繼續下去,股票應該跟隨這臺複利機器,因此投資者不應該害怕在目前的 12 倍市盈率下持有。

Risks 風險

Of course, past compounding success is no guarantee of future performance. Investors may face potential risks coming from more regulated scrutiny in markets which decrease trading activity, or a bear market wrecking markets which leads to lesser demand for some of StoneX's products and services. I would argue StoneX performs very well in bull markets but weaker in bear markets, so the compounding track record may be interrupted in the future.

當然,過去的複合成長成功並不能保證未來的表現。投資者可能面臨來自市場更嚴格監管審查的潛在風險,這會減少交易活動,或者熊市破壞市場,導致對 StoneX 某些產品和服務的需求減少。我認為 StoneX 在牛市中表現非常出色,但在熊市中表現較弱,因此未來的複合成長記錄可能會中斷。

The degree of operating leverage is a double-edged sword, as a corresponding decrease in revenues leads to a bigger decline in earnings. So far, it's been working in their favor, but if sales begin to decline due to a tough trading market or new competition, earnings growth may reverse.

營運槓桿的程度是一把雙刃劍,因為相應的收入下降會導致更大的盈利下降。到目前為止,這對他們有利,但如果由於艱難的交易市場或新的競爭導致銷售開始下降,盈利增長可能會逆轉。

Buy StoneXnagement shows solid

買入 StoneX 管理層表現穩健

The compounding story is still intact, with a fair P/E of 12x not excessive considering remarkable growth in profitability and book value. The business is transforming arguably into more of a fintech company, using technology to reach a global audience while simultaneously creating more seamless, end to end services that enhance customer value and keeps them retained long-term. I say let your winners run and remain bullish, rating shares as a buy with no price target due to the unique long-term compounding potential of StoneX.

複合成長的故事仍然完整,考慮到盈利能力和賬面價值的顯著增長,12 倍的合理市盈率並不過分。該業務正在轉型,可以說更像是一家金融科技公司,利用技術觸及全球受眾,同時創造更無縫的端到端服務,提升客戶價值並長期保留他們。我認為應該讓你的贏家繼續奔跑並保持看漲,由於 StoneX 獨特的長期複合成長潛力,將股票評為買入,沒有設定價格目標。

Comments (12)

這支股票已經平穩上漲了一段時間!!!它在 Seeking Alpha 上被評為強力買入#1 評級,並且有強勁的指標...這家金融公司看起來一切都很棒。它沒有得到很多評論或新聞,所以我錯過了什麼...我在過去一年中買賣了幾次,現在正在考慮再次建立新倉位....SA 的朋友們能給我一個不買的好理由嗎?我會感激任何意見...謝謝...繼續加油,讓我們都賺大錢!!JR(別名 JohnnyRocker)

為什麼這支股票在熊市(例如 2022 年)中也如此穩定?@Bargain Buyer

它是基於交易費用的,其傳統基礎(全球主要行業)與新交易支持之間有協同效應。它只是跟隨客戶想要訪問的內容。在此過程中,它吸引了新客戶。非常穩定,甚至有點無聊,但卻是一個複合增長者。

它負責後端運營;無論市場波動方向如何,它們都能獲利,而且它們一直在發展業務線。

謝謝。但交易量何時會放緩?只有在真正低迷的市場中嗎?那時每筆投資都不好。

或者新競爭者可能是一個風險。

閱讀關於 StoneX 的文章很有趣,但我的投資組合中已經有很多優質金融股,所以我不會碰它。如果 FICO 再跌得多一些,可能會考慮加入。

客戶使用他們的服務來對沖,這是一個例子...它們在某種程度上是熊市免疫的...這裡和那裡有一些調整,但這是一支在 2-3 年內會達到 200-300 美元的股票...只要看看 3 年圖表,它是一個美麗的景象..

甚至沒有人知道這支股票的存在..我在想是否會被某個更大的公司收購..

possible by some much bigger firm.. cant do much better than

可能無法比 snex 在過去 10 年或更長時間內做得更好

snex has done over the last 10 years or more

snex 在過去 10 年或更長時間內做得很好

他們需要制定某種資本回報計劃。雖然幾年前在低於 10 倍時回購更具吸引力,但 13 倍仍然不算太貴。任何具有強勁盈利表現的中小型公司都必須進行某種資本回報,以與支撐大型股的被動買盤競爭。

很好的觀點,丹..有點驚訝沒有股息討論或傳言

我的期貨結算所