TMTB Morning Wrap

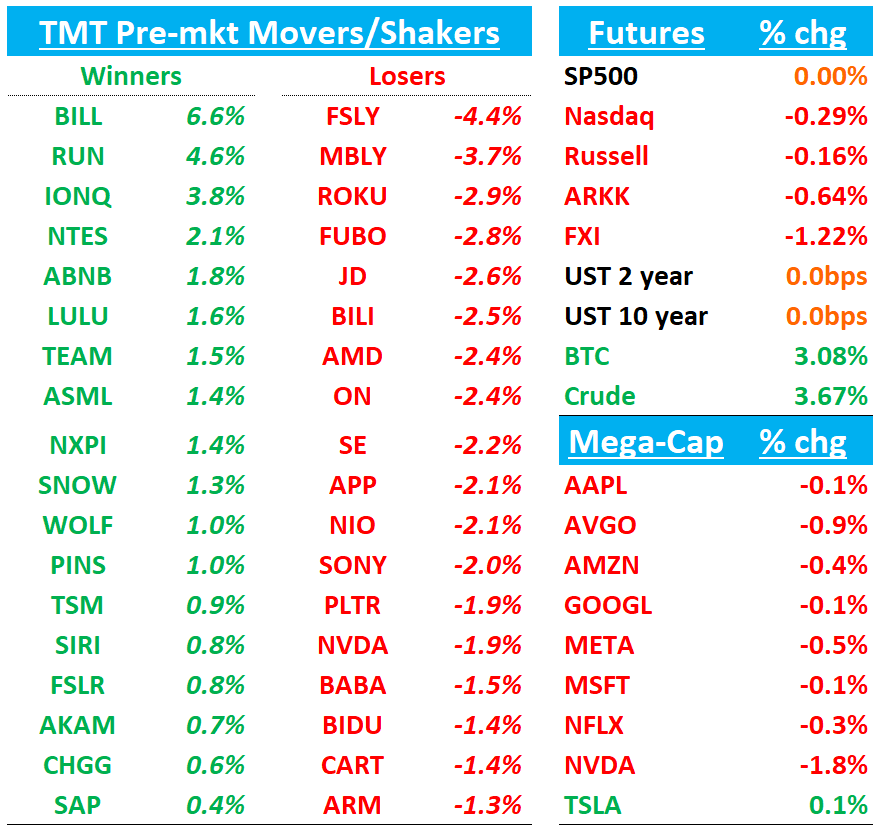

Good morning. QQQs -25bps as we get jobs report in a few minutes.. BTC +3%; Oil +3.5%. yields hovering near flat. Supreme court set to hear arguments today on TikTok ban. Jobs report in a few minutes main focus today…Let’s get to it…

TSMC Sales Beat Estimates in Boost for AI’s Outlook in 2025

58% y/y is an accel from 34% in Nov and 29% in Oct . +1% m/m is much better than typical seasonality of -7% for Dec so co likely to be 2% above street when they report next week

Taiwan Semiconductor Manufacturing Co.’s quarterly sales topped estimates, reinforcing investor hopes that the torrid pace of AI hardware spending will extend into 2025.

The go-to chipmaker for Nvidia Corp. and Apple Inc. reported a 39% rise in October-December revenue to NT$868.5 billion ($26.3 billion), based on calculations off monthly disclosures. That compares with an average estimate of NT$854.7 billion.

Growth accelerated for TSMC in December, capping 34% revenue growth for 2024. That compares with TSMC’s official target of a 30% annual rise, though that outlook was expressed in US dollar terms. The world’s largest maker of advanced chips has been one of the biggest beneficiaries of a global race to develop artificial intelligence.

NVDA - 2%: Nvidia Slams Biden for Trying to ‘Preempt’ Trump With Policy

Nvidia Corp. criticized new chip export restrictions that are expected to be announced soon, saying the White House was trying to undercut the incoming Trump administration by imposing last-minute rules.

The looming changes, which Bloomberg News reported on Wednesday, would cap the sale of US artificial intelligence chips on both a country and company basis — a move that would more tightly limit exports to most of the world. It’s part of a yearslong US effort to keep the latest technology away from China and Russia.

3P Roundup:

UPST: Hearing Yip saying acceleration in Dec loan volume, Q4 finished well above street

ABNB: Hearing Yip saying U.S. Dec nights accelerated vs Nov

CHWY: 3p Data continues to point to slight beat in sales and net adds

AMD: GS downgrades to Neutral

Goldman's Hari downgrades AMD to Neutral from Buy, lowering target to $129 from $175. While positive on AMD's Intel market share gains, concerns include Arm-based CPU competition and accelerated computing pressures. These may impact revenue growth vs peers and increase spending needs. Stock likely range-bound until growth/margin confidence returns, says GS.

TEAM: BMO upgrades to Buy from Hold

BMO Capital upgraded Atlassian to Outperform from Market Perform with a price target of $292, up from $255. BMO says its confidence has increased that Atlassian can sustain 20% year-over-year growth through a combination of factors, after passing the very difficult March compares. BMO notes given the current free cash flow valuation relative to revenue growth multiple, if Atlassian sustains 20% type of revenue growth, the shares will push higher.

SNOW: Barclays upgrades to Buy

Barclays upgraded Snowflake to Overweight from Equal Weight with an unchanged price target of $190. The new management team is addressing the evolving artificial intelligence data landscape better, and investors should see more evidence in terms of new product momentum this year, says Barclays. Barclays sees a better setup for fiscal 2026, saying Snowflake is coming into the year with an accelerated velocity of new products, many of which address newer AI trends, that is now mature and generally available and will now contribute meaningful growth.

TMTB: Raimo downgraded SNOW at the beginning of 2024, which was a great call. Reversing that call now…

ROKU: MoffettNathanson downgrades Roku to Sell, says market 'too optimistic'

MoffettNathanson downgrades Roku to Sell ($55 target), arguing market optimism is excessive. Questions acquisition speculation as driver of stock rise, noting lack of credible buyers. Prior Neutral rating was based on platform margin outlook, which firm now doubts.

PINS: Monness Crespit upgrades to buy on platform transformation

Analyst Brian White upgraded Pinterest to Buy from Neutral, setting a $40 target. He cites Pinterest's strong 2024 execution in growing advertiser support, enhancing user experience, and expanding ad partnerships. Despite these improvements and a $2B buyback program, the stock missed 2024's tech rally as investors chased AI stocks. White suggests this disconnect between Pinterest's lagging stock price and improved profitability has created an attractive valuation opportunity.

BILL: GS Upgrades to Buy

Goldman Sachs lifted Bill to Buy from Neutral, raising the target to $104 from $96. The bank had downgraded Bill earlier due to accelerated investments amid economic uncertainty. However, GS thinks several factors have shifted in co’s favor and they now have improved visibility into re-accelerating topline trends and ultimately profitabiility.

EBAY: UBS says Onus remains on eBay to convert Facebook Marketplace users to buyers / MS also comments on META/EBAY partnership

UBS analyst Madhukar maintains Neutral on eBay ($66 target) following Facebook Marketplace's test of eBay listing syndication. While this expands eBay's reach to Facebook's 8x larger user base, success depends on converting these users to "enthusiast buyers." For Meta, this could improve merchandise selection, shopping experience, and user engagement.

Morgan Stanley's Feather (Overweight, $70 target) sees Meta-eBay partnership as potentially beneficial for both: eBay gains distribution while Meta improves Marketplace monetization. Analysis suggests 0%-9% potential EBIT increase for eBay, though uncertainties remain.

AAPL: Apple earnings report to be 'mixed at best,' says Barclays

Barclays maintains Underweight on Apple ($184 target), noting 2024's performance was driven by multiple expansion despite weak iPhone 16 launch and regulatory risks. For 2025, expects mixed Q4 earnings, choppy iPhone recovery, Google TAC uncertainty, App Store regulatory pressures, and China exposure concerns for both sales and supply chain.

SQ: Block announces ticker symbol change to XYZ

Block, Inc. announced that it will be changing its ticker symbols from "SQ" and "SQ2" to "XYZ". This is in connection with the company's earlier name change to "Block" and its ecosystem of brands including Cash App, Square, Afterpay and TIDAL. The change will be implemented across the company's dual listings on the New York Stock Exchange and the Australian Securities Exchange. Effective January 21, 2025, the company's Class A common stock will trade on the NYSE under the new symbol "XYZ". Effective January 22, 2025, the company's ticker code on the ASX will also change to "XYZ".

RUN: UBS upgrades to Buy

UBS upgrades Sunrun to Buy from Neutral ($17 target, up from $14), citing attractive valuation at near all-time low multiples. Notes doubled California market share to 22% and projects 15% residential solar market growth in 2025. Key catalyst: March renewable tax credit decision, with credit expiry revisions more likely than full repeal.

NFLX: Netflix price target lowered to $1,000 from $1,010 at JPMorgan on fx headwinds

JPMorgan maintains Overweight on Netflix, lowers target to $1,000 from $1,010. Positive pre-Q4 earnings but reduced 2025 estimates due to currency impact. Notes 27% stock rise post-Q3, recent 7% drop on forex concerns. Sees currency headwinds as well understood by investors.

NXPI: NXP Semiconductors upgraded to Buy from Neutral at Goldman Sachs

Goldman upgrades NXP to Buy from Neutral ($257 target, down from $260). Despite limited auto/industrial visibility, expects no estimate cuts around Q4 earnings. Views auto downturn in late stages with 2025 recovery likely. Cites NXP's strategic positioning for automotive semiconductor market share gains long-term.

APP: AppLovin initiated with a Buy at Benchmark

Benchmark analyst Mark Zgutowicz initiated coverage of AppLovin with a Buy rating and $375 price target. AppLovin provides an AI-powered advertisement platform for optimizing user acquisition, engagement, and monetization, alongside managing a diverse portfolio of mobile apps, says Benchmark, who sees continued advancements in its AXON AI technology as a key catalyst. Bencharmark notes expanding into new verticals such as e-commerce and connected TV, as well as "substantial growth" within its core advertising business in mobile gaming, present significant revenue growth and profitability expansion opportunities.

TSLA launched a new version of the Model Y, its best-selling car, in China on Friday, as the new Model Y is priced from 263,500 yuan ($35,900),5.4% more expensive than the previous version in China - link

META/AMZN/RDDT/PINS - Citi incrementally positive on ad names following CES.

Citi reports positive online advertising outlook following CES meetings, maintaining 14% YoY US growth forecast for 2025 despite potential policy uncertainty. Highlights include GenAI driving efficiency gains, CTV momentum, evolving search spend, retail media expansion, and live shopping adoption. Analysis increased firm's confidence in Meta, Amazon, Reddit, The Trade Desk, and Criteo.

MRVL: Citi raises PT to $136 following CEs meetings

Citi met with Marvell COO Koopmans and IR VP Saran at CES. Firm confirms confidence in AI sales growth sustainability through 2026 (particularly AWS) and Marvell's $43B custom ASIC market projection vs Broadcom's $60-90B. Marvell expects AI sales to reach $8B+ by 2028, with Microsoft ramping late 2026 and AWS maintaining growth. Company's conservative ASIC TAM likely to be updated in June, driven by higher cloud spending and ASIC adoption. Citi raises target to $136, applying 35x P/E on CY26 estimates.

W - to exit German market immediately

Wayfair Inc - Germany restructuring to impact approximately 730 employees

Wayfair Inc - expects charges of $102M to $111M

Wayfair Inc - cost savings to be reinvested in core initiatives and international markets - SEC filing

NOW: Stifel reiterates buy as early checks point to consistent q and solid 1H25 pipeline

Stifel reports strong ServiceNow enterprise activity based on SI contacts, expecting cRPO upside of 23% YoY (vs 21.5% guidance). Notes healthy large deals, workflow demand, and Pro+ customer growth (around 1k total). Projects Q1 2025 cRPO guidance of 21-22% with normal seasonality, sees potential upside to 20.5% FY25 estimate given strong H1 outlook and renewal cohort.

Elon Musk agrees that we’ve exhausted AI training data

“We’ve now exhausted basically the cumulative sum of human knowledge … in AI training,” Musk said during a livestreamed conversation with Stagwell chairman Mark Penn on X late Wednesday. “That happened basically last year.”

Other news:

AAPL: Apple’s pricey iPhones out of China’s new subsidy scheme as ceiling capped at US$818 – SCMP

AMZN: Amazon Explores News Push Following Brian Williams Election Special– Variety

ARM: SoftBank’s Chip Designer Arm Considers Acquiring Ampere Computing – Bloomberg

DIS: post market Wed said it’s ad-supported MAUs have reached 157M globally (112M in the US)

Robotics: per TrendForce, global robotics LLM market (incl. AI training and AIGC solutions) will exceed US$100bn in 2028, with a CAGR of 48.2% from 2025 to 2028 – Commercial Times

TikTok: Agencies Are Spending More on TikTok Ads This Year Despite US Ban Uncertainty - AdWeek

TSM: reportedly may face challenges in taking orders from China due to the potential expansion of US process technology control, from current 7nm to 16nm – Economic Daily

UNIT: announces launch of fiber securitization notes offering