ET

2025 年 1 月 2 日东部时间上午 5:30

插图:托马斯·R·莱克莱特/华尔街日报,iStock

Businesses are bracing for another year of geopolitical uncertainty, with large question marks looming over President-elect Donald Trump’s foreign policy strategy and broader global tumult, despite some executives’ optimism about the year ahead.

企业们正准备迎接又一个地缘政治不确定性的一年,尽管一些高管对未来一年持乐观态度,但关于当选总统唐纳德·特朗普的外交政策战略和更广泛的全球动荡仍然存在很大的疑问。

Geopolitical concerns remain top of mind amid general global uncertainty and, in particular, a continued reordering of the U.S.-China relationship.

地缘政治担忧在全球普遍不确定性中仍然是首要关注,特别是美中关系的持续重组。

Multiple governments around the world saw turmoil in a single week, Goldman Sachs Chief Financial Officer Denis Coleman told attendees at a conference last month, citing France, Syria and South Korea. “To say that there is geopolitical instability in the world would be a gross understatement,” he said.

高盛首席财务官丹尼斯·科尔曼上个月在一次会议上告诉与会者,全球多个政府在一周内经历了动荡,提到了法国、叙利亚和韩国。“说世界上存在地缘政治不稳定将是一个严重的低估,”他说。

The costs of doing business globally have come to a 10-year peak as deglobalization and so-called friend-shoring gain momentum, according to an analysis released in November by Verisk Maplecroft, a consulting firm.

根据咨询公司 Verisk Maplecroft 在 11 月发布的分析,全球商业成本已达到 10 年来的最高点,因为去全球化和所谓的“友岸外包”势头增强。

“In recent years, businesses have been blindsided by a cascade of disruptions—the pandemic, renewed conflicts in Europe and the Middle East, surging populism, intense competition for green minerals and escalating protectionism—which have forced a fundamental reset of longstanding strategies,” said Reema Bhattacharya, Verisk Maplecroft’s head of Asia research.

“近年来,企业被一系列干扰所冲击——疫情、欧洲和中东的冲突重燃、民粹主义上升、对绿色矿产的激烈竞争以及日益加剧的保护主义——这迫使长期以来的战略进行根本性的重置,”Verisk Maplecroft 亚太研究负责人 Reema Bhattacharya 说道。

法国总统埃马纽埃尔·马克龙的政府在 12 月初垮台。照片:文森特·伊索尔/祖玛新闻

“The old playbook, focused on market size, costs and efficiency, has been upended. Now, geopolitics is the driving force,” Bhattacharya said.

“以市场规模、成本和效率为重点的旧剧本已经被颠覆。现在,地缘政治是推动力,”巴塔查里亚说。

The evolving U.S.-China relationship has seen a number of businesses caught in the crossfire, including TikTok, now facing an imminent ban stateside, and e-commerce giants such as Shein and Temu, which have been frequent targets for U.S. officials.

不断发展的美中关系使许多企业陷入了交火之中,包括面临美国即将禁令的 TikTok,以及经常成为美国官员目标的电子商务巨头 Shein 和 Temu。

China for its part has ratcheted up pressure on U.S. diligence and audit firms, targeted chip giant Nvidia with an antimonopoly investigation and launched a probe into Calvin Klein owner PVH.

中国方面加大了对美国尽职调查和审计公司的压力,针对芯片巨头英伟达展开了反垄断调查,并对卡尔文·克莱因的拥有者 PVH 展开了调查。

Big worries 大担忧

Household-name companies aren’t the only ones feeling the geopolitical pressure. Nearly two-thirds of about 900 executives surveyed by consulting firm McKinsey & Co. for a report released last month flagged geopolitical instability as a top risk to global growth. Forty-nine percent said changes in trade policy were a major risk.

家喻户晓的公司并不是唯一感受到地缘政治压力的公司。咨询公司麦肯锡(McKinsey & Co.)对约 900 名高管进行的调查显示,近三分之二的受访者将地缘政治不稳定视为全球增长的主要风险。49%的人表示贸易政策的变化是一个重大风险。

The U.S.-China relationship dominates corporate concerns, in part because toughness on China is a rare area of bipartisan consensus in Washington.

美中关系主导了企业的关注,部分原因是对中国采取强硬态度在华盛顿是一个罕见的两党共识领域。

Following a pattern established in the first Trump administration, the departing Biden administration has steadily ratcheted up restrictions on trade, including on semiconductors used in AI and in other key sectors, out of concern over both national security and unfair competition with U.S. workers.

在第一届特朗普政府建立的模式之后,离任的拜登政府逐步加大了对贸易的限制,包括对用于人工智能和其他关键行业的半导体,出于对国家安全和与美国工人之间不公平竞争的担忧。

China has responded with its own countermeasures, many of which make it harder to do business in the country. The degree to which the U.S. and Chinese economies are intertwined can make it difficult for companies to grapple with trade controls and restrictions, said Eric Sandberg-Zakian, chair of the trade controls enforcement practice group at law firm Covington & Burling.

中国已采取了自己的反制措施,其中许多措施使得在该国开展业务变得更加困难。美国和中国经济的相互交织程度可能使公司在应对贸易管制和限制时面临困难,科文顿与伯灵律师事务所贸易管制执法实践小组主席埃里克·桑德伯格-扎基安表示。

“China presents the greatest compliance risk for companies,” Sandberg-Zakian said. “We are seeing corporations invest an incredible amount of time and energy in undertaking due diligence regarding parties in China.”

“沙德伯格-扎基安说:‘中国对公司来说是最大的合规风险。我们看到企业在对中国相关方进行尽职调查方面投入了大量的时间和精力。’”

The incoming Trump administration includes a number of China hawks, including his pick for secretary of state, U.S. Sen. Marco Rubio of Florida, who was behind a law banning most imports from the Xinjiang region over forced labor concerns.

即将上任的特朗普政府包括一些对中国持强硬态度的人士,其中包括他提名的国务卿人选、佛罗里达州参议员马尔科·鲁比奥,他支持一项法律,禁止大多数来自新疆地区的进口,原因是对强迫劳动的担忧。

GOP lawmakers also have proposed legislation that would revoke China’s normal trade status and dramatically raise tariffs on Chinese goods.

共和党立法者还提议立法,撤销中国的正常贸易地位,并大幅提高对中国商品的关税。

美中关系主导企业关注。照片:tingshu wang/路透社

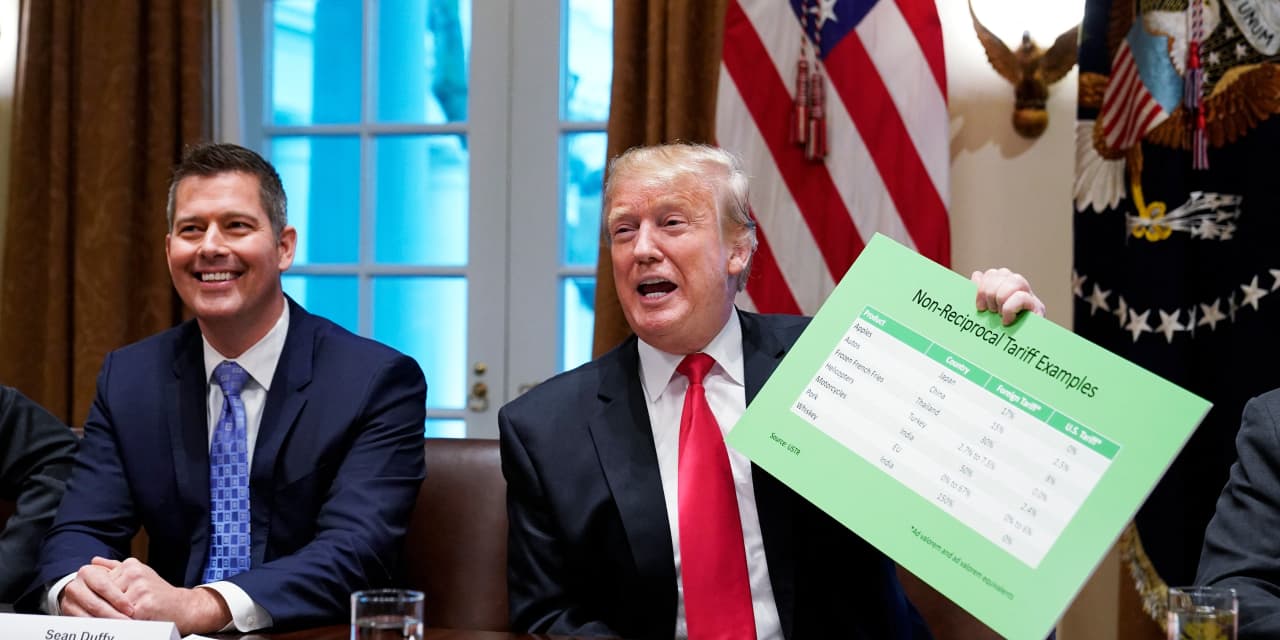

Tariffs are the biggest risk to the 2025 growth outlook, analysts at investment research firm Morningstar said last month, adding that they expect a meaningful tariff increase on China, though with the caveat that there is uncertainty around the prediction. Trump has also threatened tariffs on Canada and Mexico.

分析公司晨星的分析师上个月表示,关税是 2025 年增长前景最大的风险,并补充说他们预计对中国会有显著的关税增加,但有一个前提是这一预测存在不确定性。特朗普还威胁对加拿大和墨西哥征收关税。

Some industries see the reset in the U.S. government as a chance to press for their favored policies. The domestic textile industry has concerns about tariffs on Canada and Mexico, but supports ending trade provisions that favor China, said Kim Glas, head of the National Council of Textile Organizations. Textiles and apparel have been a major focus for the Biden administration but also for Republicans in Congress.

一些行业将美国政府的重置视为推动其偏好政策的机会。国家纺织组织委员会主席金·格拉斯表示,国内纺织行业对加拿大和墨西哥的关税表示担忧,但支持结束有利于中国的贸易条款。纺织品和服装一直是拜登政府以及国会共和党的主要关注点。

“There is always a lot of hope when you not only have a new administration, but a changing Congress,” Glas said. “We look forward to working with everybody on both sides of the aisle.”

“当你不仅有一个新的政府,而且国会也在变化时,总是充满希望,”格拉斯说。“我们期待与两党所有人合作。”

Wild cards 外卡

The past few weeks have seen the fall of longtime Syrian ruler Bashar al-Assad, the historic collapse of France’s government and the brief institution of martial law in normally stable South Korea.

过去几周,长期统治叙利亚的巴沙尔·阿萨德的垮台、法国政府的历史性崩溃以及通常稳定的韩国短暂实施戒严法。

The conflict in Ukraine also has taken on an increasingly international character, with the involvement of Iranian technology and North Korean soldiers.

乌克兰的冲突也越来越具有国际性质,涉及伊朗技术和朝鲜士兵的参与。

一名男子站在被推翻的叙利亚总统巴沙尔·阿萨德的肖像旁。照片:萨米尔·阿尔-杜米/法新社/盖蒂图片社

“I don’t think anyone has a playbook at this point in time,” said David K. Young, president of the Committee for Economic Development, the public policy center of the Conference Board. “Nothing happens in isolation. Everything’s interconnected…We’re living in a heightened geopolitical environment.”

“我认为在这个时候没有人有应对方案,”经济发展委员会主席大卫·K·杨说,该委员会是会议委员会的公共政策中心。“没有任何事情是孤立发生的。一切都是相互关联的……我们生活在一个高度地缘政治的环境中。”

Despite those headwinds, company board members reported having more confidence in business conditions than they had at the outset of 2024, with a notable bump occurring after the election, according to a survey conducted in November and December by Diligent Institute, which provides corporate leadership training.

尽管面临这些逆风,公司董事会成员报告称对商业环境的信心比 2024 年初时更强,根据 Diligent Institute 在 11 月和 12 月进行的一项调查显示,选举后信心显著提升,该机构提供企业领导力培训。

But 52% said they thought geopolitical conflict had the highest chance of being the next history-altering event.

但 52%的人表示,他们认为地缘政治冲突是下一个改变历史事件的可能性最高的因素。

In the wake of the pandemic, when a host of businesses belatedly realized the fragility of their supply chains, and Russia’s 2022 invasion of Ukraine, which drove many large multinationals into divestitures, many businesses have worked to bolster their geopolitical risk function.

在疫情之后,当许多企业迟迟意识到其供应链的脆弱性,以及俄罗斯在 2022 年入侵乌克兰导致许多大型跨国公司进行剥离时,许多企业努力加强其地缘政治风险职能。

Newsletter Sign-up 新闻通讯注册

WSJ | Risk and Compliance Journal

华尔街日报 | 风险与合规期刊

Our Morning Risk Report features insights and news on governance, risk and compliance.

我们的晨间风险报告提供关于治理、风险和合规的见解和新闻。

Scenario analysis around possible geopolitical issues has become a must for many businesses. About three-quarters of chief executives say they have at least significant visibility into the geopolitical risks they face, according to a survey by accounting firm Ernst & Young, including 30% who say they have full visibility into the geopolitical risks they face.

围绕可能的地缘政治问题进行情景分析已成为许多企业的必需品。根据会计师事务所安永的一项调查,约四分之三的首席执行官表示,他们对面临的地缘政治风险至少有显著的了解,其中 30%的人表示他们对面临的地缘政治风险有全面的了解。

Organizations also must increasingly grapple with complicated, global interconnectedness, said Lindsay Newman, a London-based political analyst formerly with think tank Chatham House and the Eurasia Group, a consulting firm. Attacks by Yemeni rebels spurred on by the Israel-Hamas conflict, for example, caused global supply-chain disruptions.

组织还必须越来越多地应对复杂的全球互联性,伦敦的政治分析师林赛·纽曼(Lindsay Newman)表示,她曾在智库查塔姆研究所和咨询公司欧亚集团工作。例如,受到以色列-哈马斯冲突激励的也门叛军的攻击导致了全球供应链的中断。

“We now know that there can be shocks in one part of the world that can travel the whole world,” said Newman. “[Businesses] need to also understand what’s happening at the regional level and at the global level, and how those different dynamics are interconnected.”

“我们现在知道,世界某个地方的冲击可以传播到整个世界,”纽曼说。“[企业]还需要了解区域层面和全球层面发生的事情,以及这些不同动态是如何相互关联的。”

Write to Richard Vanderford at Richard.Vanderford@wsj.com

写信给理查德·范德福德,邮箱地址是 Richard.Vanderford@wsj.com

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Pillar Two Survey: Global Tax and Finance Leaders See Cost, Disruption Impacts

第二支柱调查:全球税务和金融领袖看到成本和干扰影响

Top of mind are the cost of compliance and new strategic concerns, from M&A to site selection

合规成本和新的战略关注点,如并购和选址,成为首要考虑

合规成本和新的战略关注点,如并购和选址,成为首要考虑

Converged Security: Uniting Physical, Cyber, Ops Technology to Secure the Enterprise

融合安全:将物理、安全、运营技术结合起来以保护企业

Separating cyber and physical security could leave enterprises highly fragmented with vulnerable assets and disparate or duplicative technologies, limiting efforts for cost optimization

将网络安全与物理安全分开可能会使企业高度分散,导致资产脆弱以及技术分散或重复,从而限制成本优化的努力

将网络安全与物理安全分开可能会使企业高度分散,导致资产脆弱以及技术分散或重复,从而限制成本优化的努力

Expansion-Stage Financing: Market Trends and Creative Exit Strategies

扩张阶段融资:市场趋势与创新退出策略

Exit financing for expansion-stage companies has slowed considerably since its frenetic peak in 2021, which may motivate some companies to choose a more creative alternative

扩张阶段公司的退出融资自 2021 年疯狂高峰以来显著放缓,这可能促使一些公司选择更具创意的替代方案

扩张阶段公司的退出融资自 2021 年疯狂高峰以来显著放缓,这可能促使一些公司选择更具创意的替代方案

Content from our Sponsor: Deloitte

来自我们赞助商的内容:德勤

来自我们赞助商的内容:德勤