China’s Capital Inflow Jumps in September as Firms Shift to Yuan

中国的资本流入在九月份激增,企业转向人民币

- China’s FX settlement balance saw a surplus in September

中国的外汇结算余额在九月份出现了盈余 - Sustainability of flows hinge on USD path, stimulus measures

流动性可持续性取决于美元走势和刺激措施

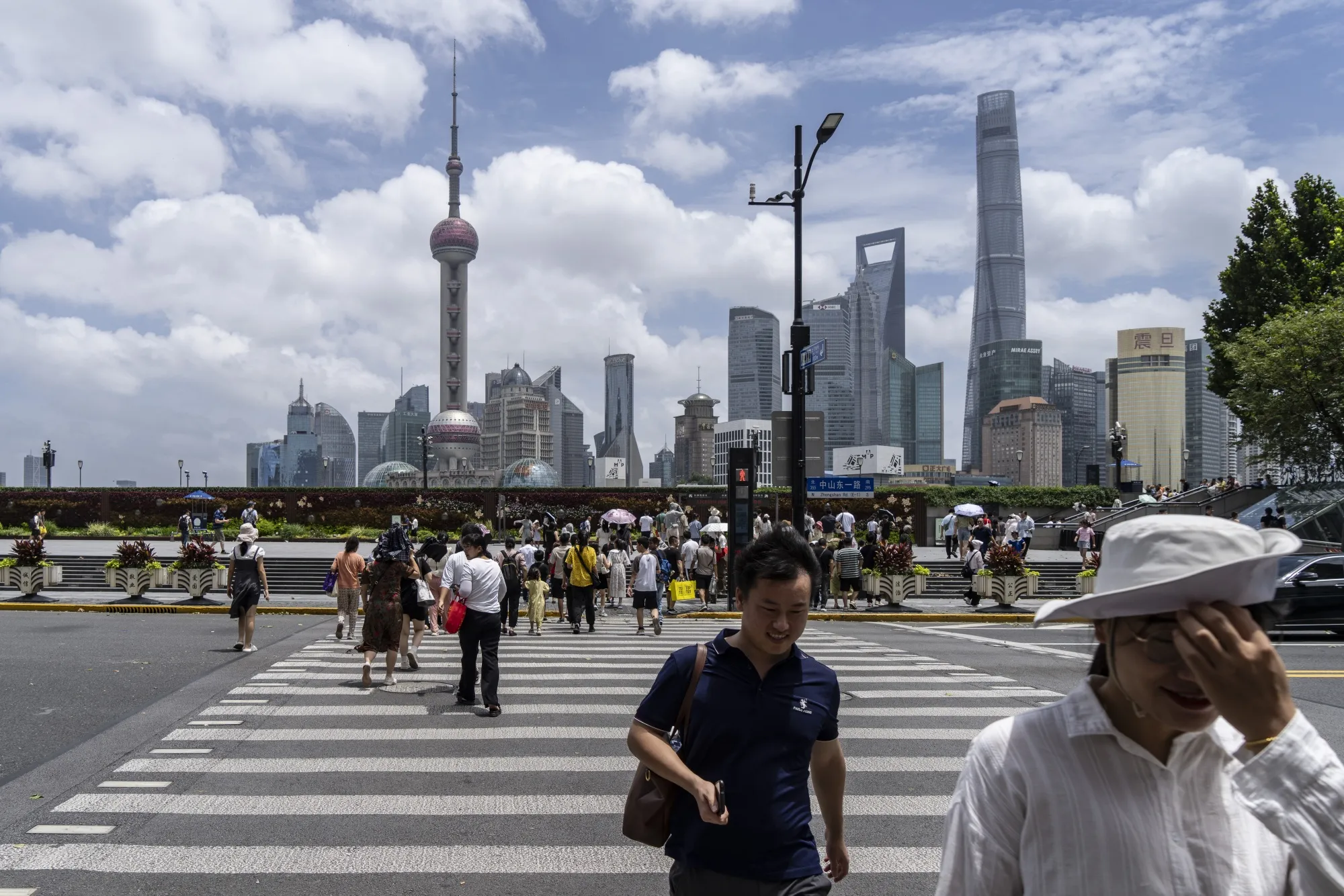

The yuan has weakened 1.8% this month versus the dollar in offshore trading.

Photographer: Lam Yik/Bloomberg人民币在离岸交易中本月对美元贬值了 1.8%。摄影师:林逸/彭博社

Chinese companies rushed to shift money back into their home market last month as US rate cuts reduced returns on dollar assets, leading to the largest monthly capital inflow in about two years.

中国公司上个月急于将资金转回国内市场,因为美国降息降低了美元资产的回报,导致约两年来最大的月度资本流入。

Last month, domestic firms sold the most foreign exchange to banks since December 2021, a sharp reversal from their large purchases of US dollars and other currencies over the past year, official data released Tuesday show. The figures also revealed a rise in foreign currency settlement for goods trade, signaling growing confidence in the yuan’s stability, and record levels of FX sales related to securities investments.

上个月,国内企业向银行出售的外汇量是自 2021 年 12 月以来的最高水平,这与过去一年大量购买美元和其他货币的情况形成了明显反转,官方数据显示。数据显示,商品贸易的外币结算也有所上升,表明对人民币稳定性的信心增强,以及与证券投资相关的外汇销售创下历史新高。

This shift followed the slide in the greenback in recent months, a move than has since reversed amid rising questions about how fast the Federal Reserve will cut rates. The offshore yuan gained additional momentum in late September, briefly surpassing past the 7-per-dollar mark, after the People’s Bank of China announced a series of mesures to support the economy and boost the stock market.

这一变化是在最近几个月美元贬值之后发生的,此后由于人们对美联储降息速度的质疑增加,这一趋势已发生逆转。离岸人民币在九月底获得了额外的动力,短暂突破了每美元 7 元的关口,此前中国人民银行宣布了一系列支持经济和提振股市的措施。

“The data confirmed the mitigation of RMB depreciation risk following the Fed’s pivot, and the RMB rally was supported by actual FX settlement flow,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank. He said that whether the trend continues will depend on the pace of Fed rate cuts, the US election and the extent of China’s stimulus. He said that whether the trend continues will depend on the pace of Fed rate cuts, the US elections and the extent of China’s stimulus.

“数据证实了在美联储转向后人民币贬值风险的缓解,人民币的反弹得到了实际外汇结算流的支持,”瑞穗银行首席亚洲外汇策略师 Ken Cheung 表示。他表示,趋势是否持续将取决于美联储降息的速度、美国选举以及中国刺激政策的力度。他表示,趋势是否持续将取决于美联储降息的速度、美国选举以及中国刺激政策的力度。

That said, the yuan has weakened 1.8% this month versus the greenback in offshore trading, as investors mull prospects of slower Fed rate cuts and uncertainties in the US election. The sharp rally in Chinese stocks also lost some steam in recent weeks amid disappointments over a lack of follow-up policies.

尽管如此,本月人民币在离岸交易中对美元贬值了 1.8%,投资者考虑美联储减息放缓的前景以及美国选举的不确定性。近期中国股市的强劲反弹也因缺乏后续政策而失去了一些动力。

At a briefing Tuesday, China’s FX regulator official highlighted signs of improving sentiment, such as a rising foreign currency settlement ratio and increasing foreign positions in local bonds. Expectations and trading in the forex market remain orderly and rational, said Li Hongyan, deputy chief at the State Administration of Foreign Exchange.

在周二的简报会上,中国外汇监管机构官员强调了情绪改善的迹象,例如外币结算比例上升和外资在本地债券中的持仓增加。国家外汇管理局副局长李洪艳表示,外汇市场的预期和交易保持有序和理性。

“The key is whether its going to last,” said Eddie Cheung, senior emerging markets strategist at Credit Agricole CIB in Hong Kong. “I think the numbers for October will be strong too, but that’ll still only be two months.”

“关键在于这是否会持续,”香港法国农业信贷银行的高级新兴市场策略师 Eddie Cheung 说道。“我认为十月份的数据也会很强,但那仍然只有两个月。”

中国财富基金今年发行创纪录的 290 亿美元债券