Global Markets – Weekly Review

全球市场——每周回顾

Best Week for Stocks in 18 Months: What's Next & Updated Plan.

18 个月以来股票表现最好的一周:下一步是什么以及更新的计划。

“Keep your face always toward the sunshine — and shadows will fall behind you.” — Walt Whitman

“永远面向阳光——阴影就会落在你身后。”——沃尔特·惠特曼

“Opportunities are like sunrises. If you wait too long, you will miss them.” — William Arthur Ward

机遇就像日出。如果你等待太久,你就会错过。——威廉·亚瑟·沃德

110+ Charts & Commentary on all major Markets — for your weekend reading.

110+ 所有主要市场的图表和评论 — 供您周末阅读。

KEY TOPICS COVERED 涵盖的关键主题

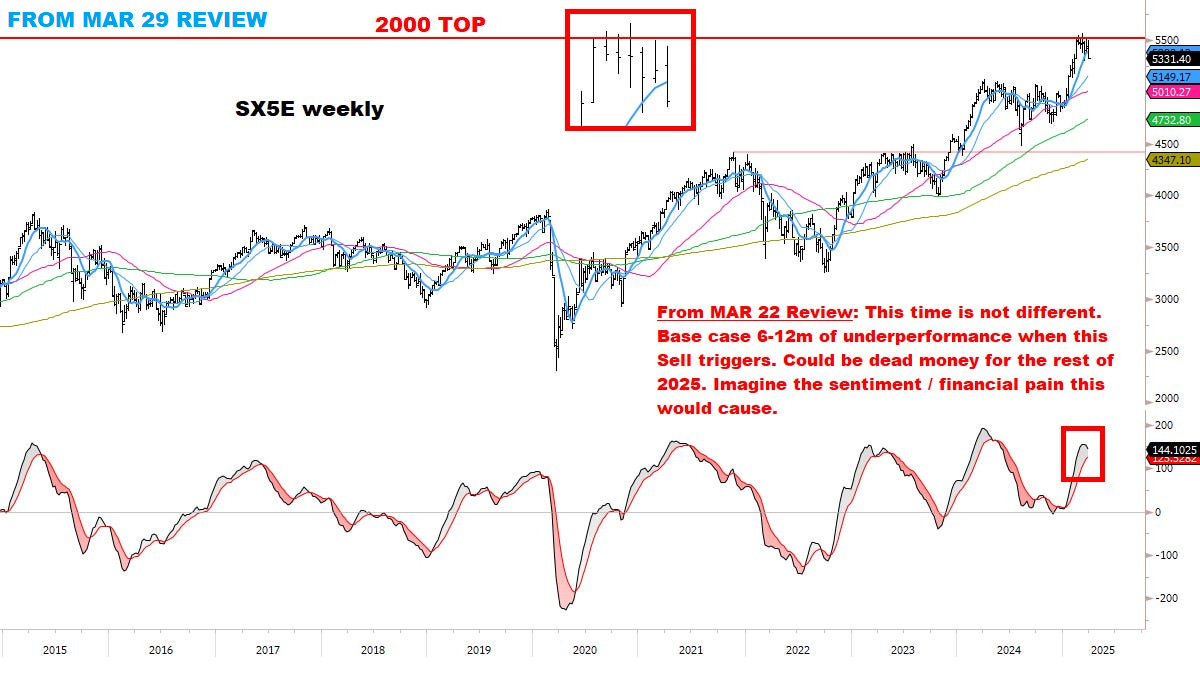

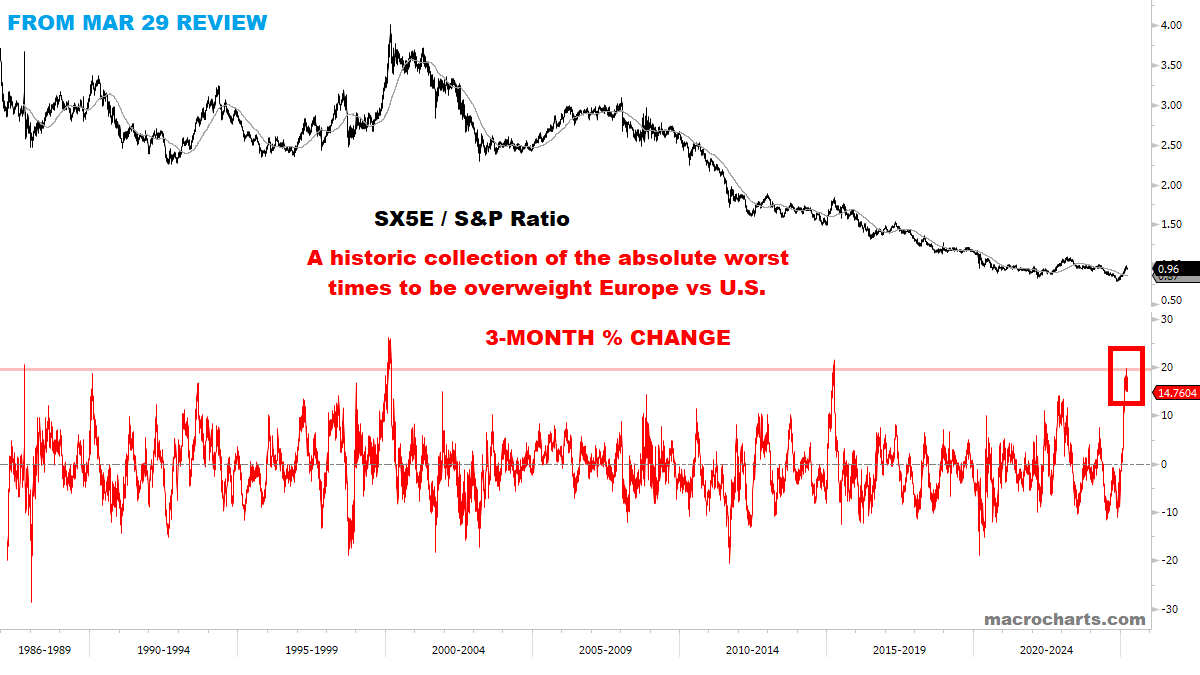

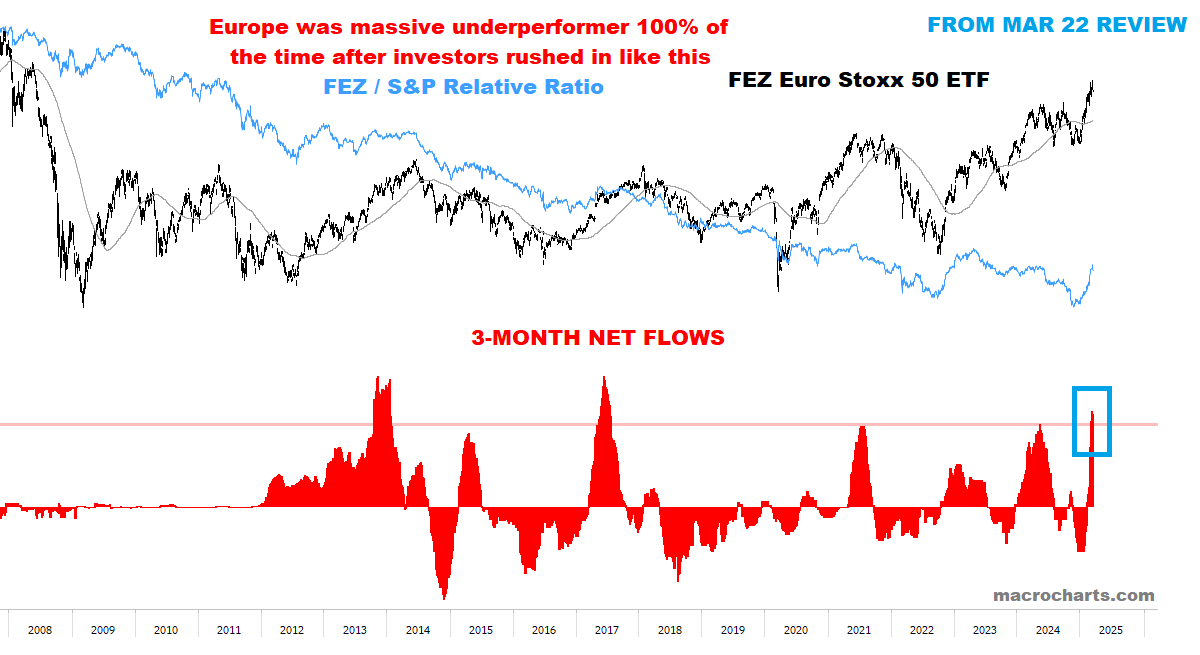

The best week for Stocks since November 2023 — and a week of lasting significance. Onwards and upwards.

这是自 2023 年 11 月以来股市表现最好的一周,也是意义深远的一周。 继续前进,不断进步。A perfect sequence from beginning to end: following and updating our plan for next week & rest of April and Q2.

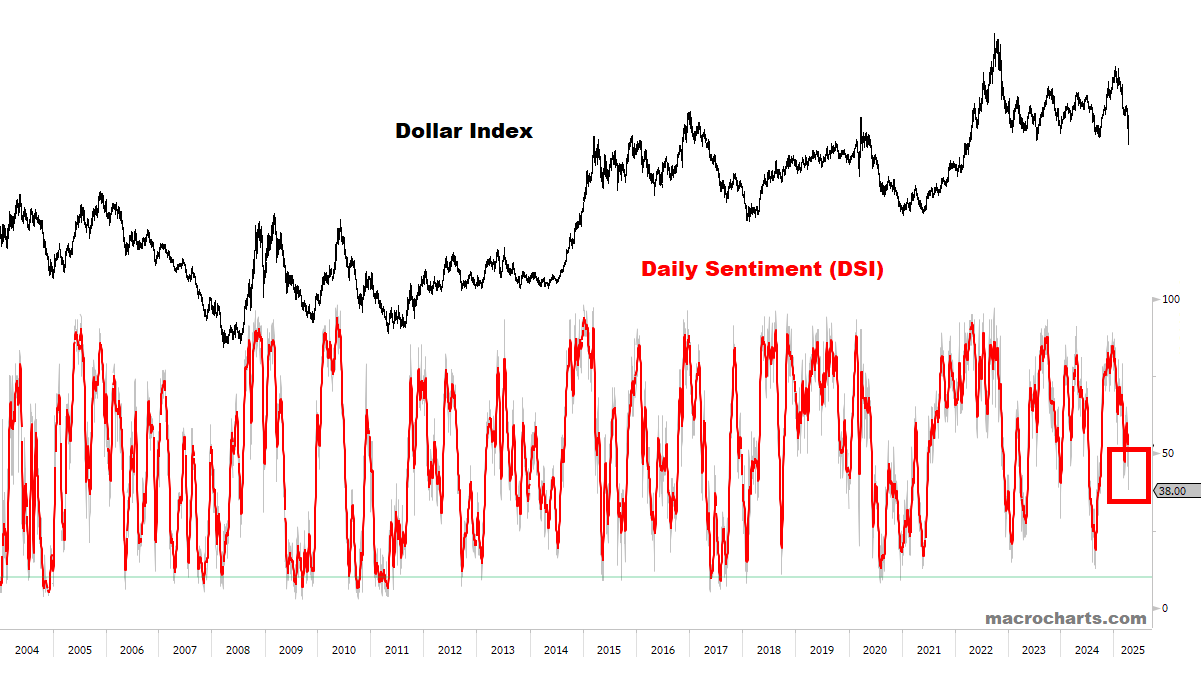

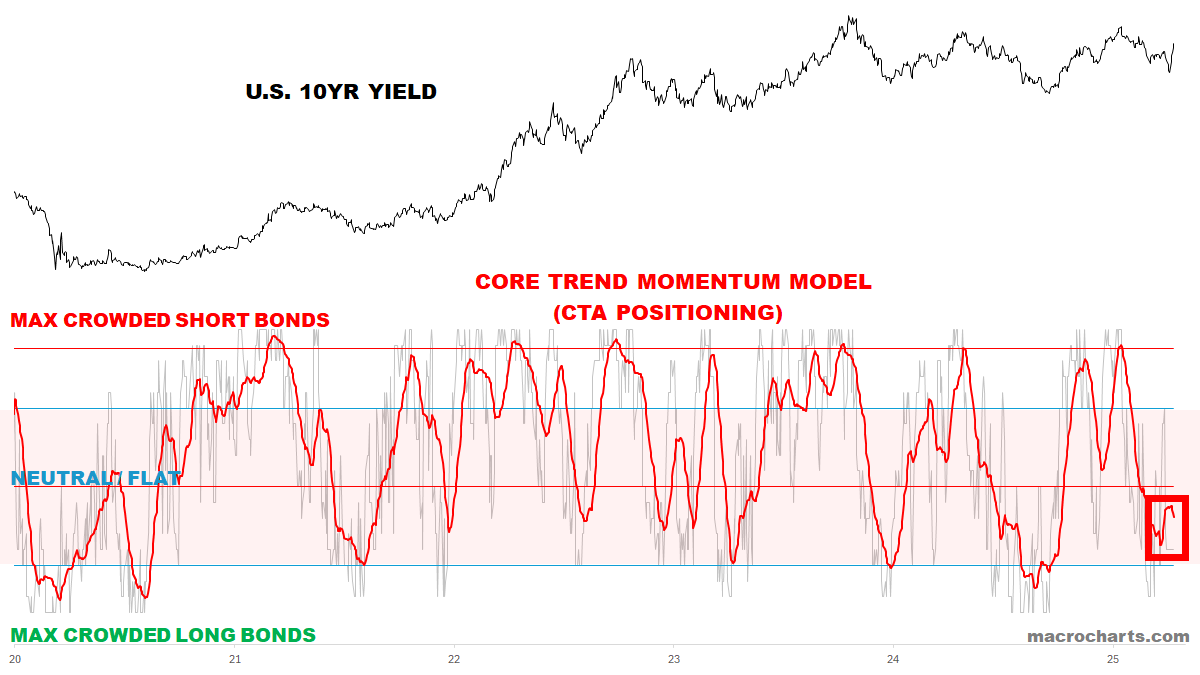

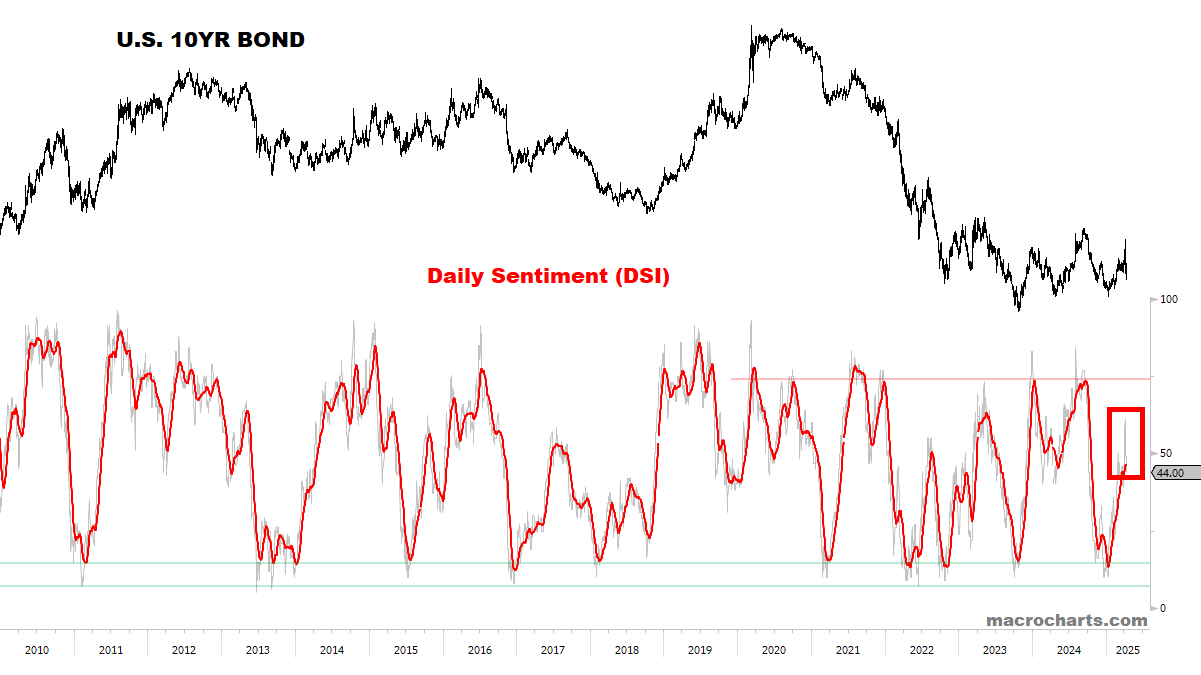

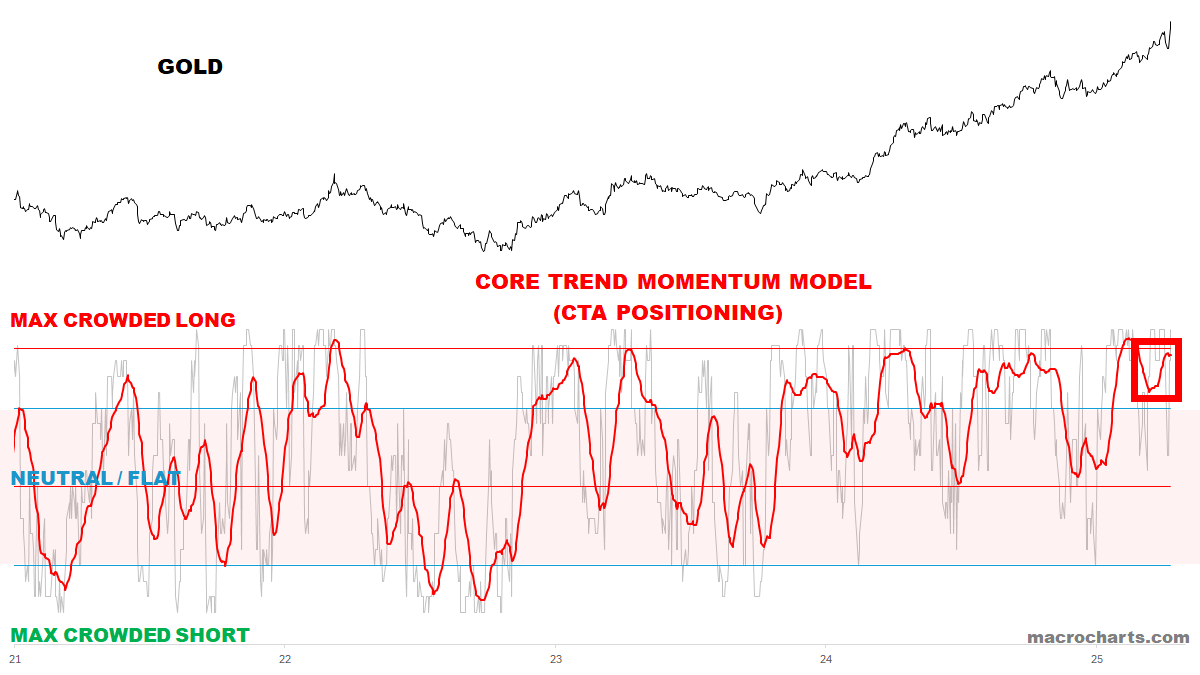

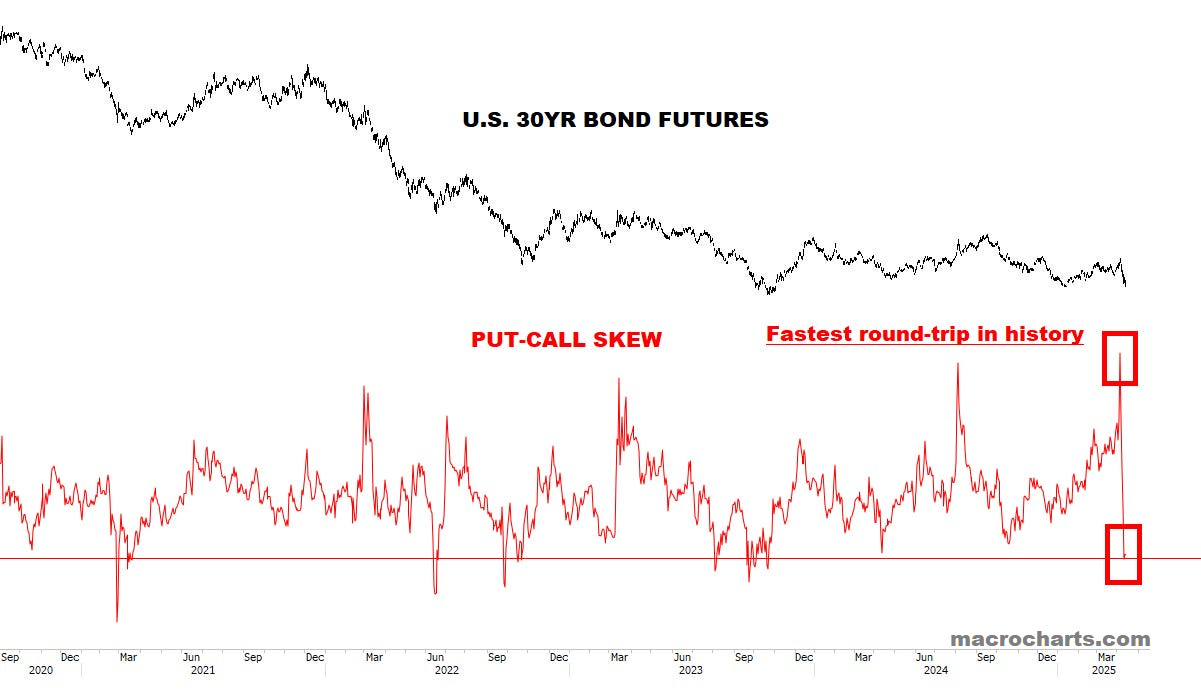

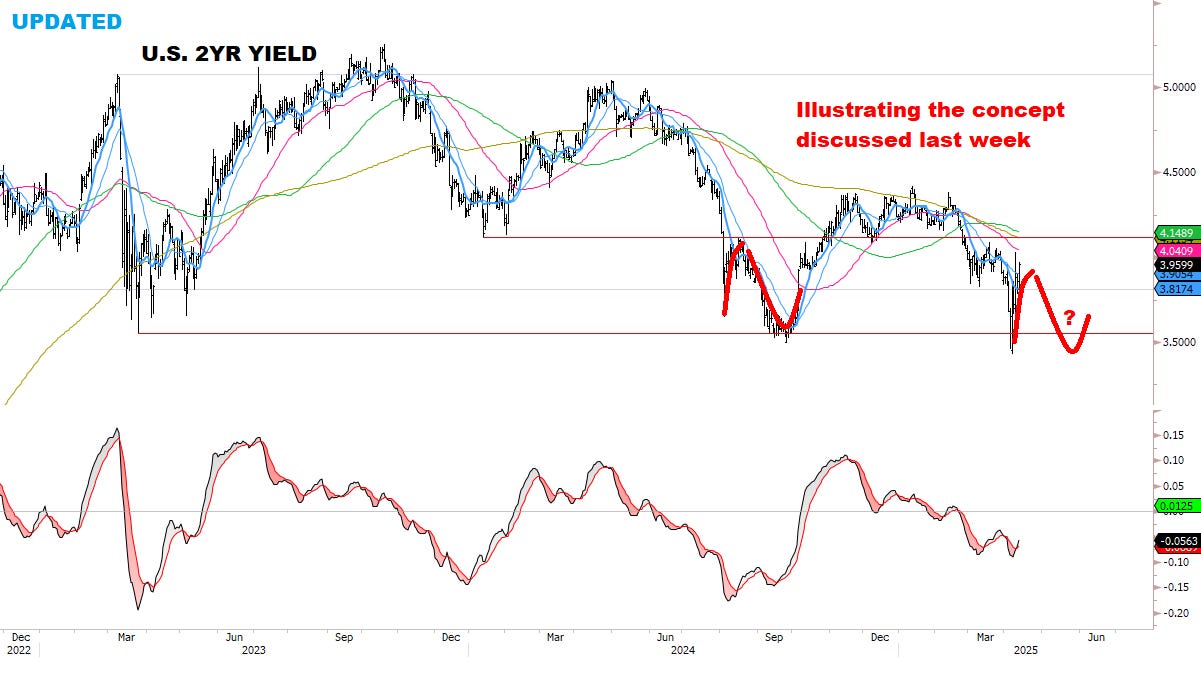

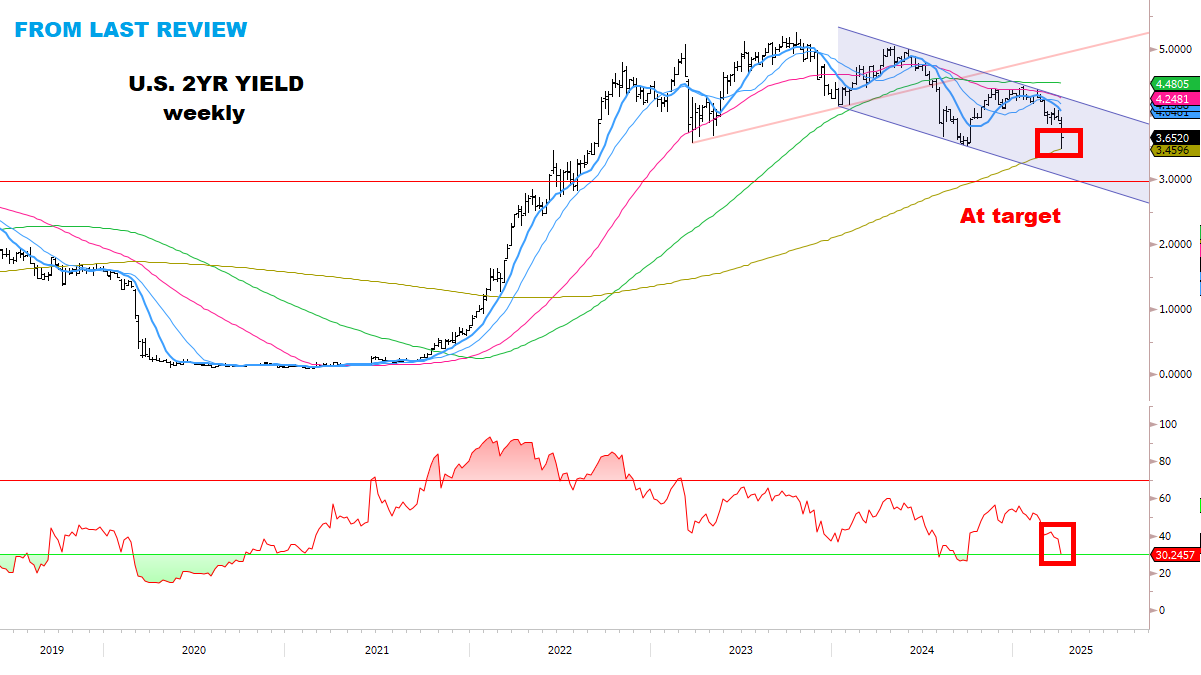

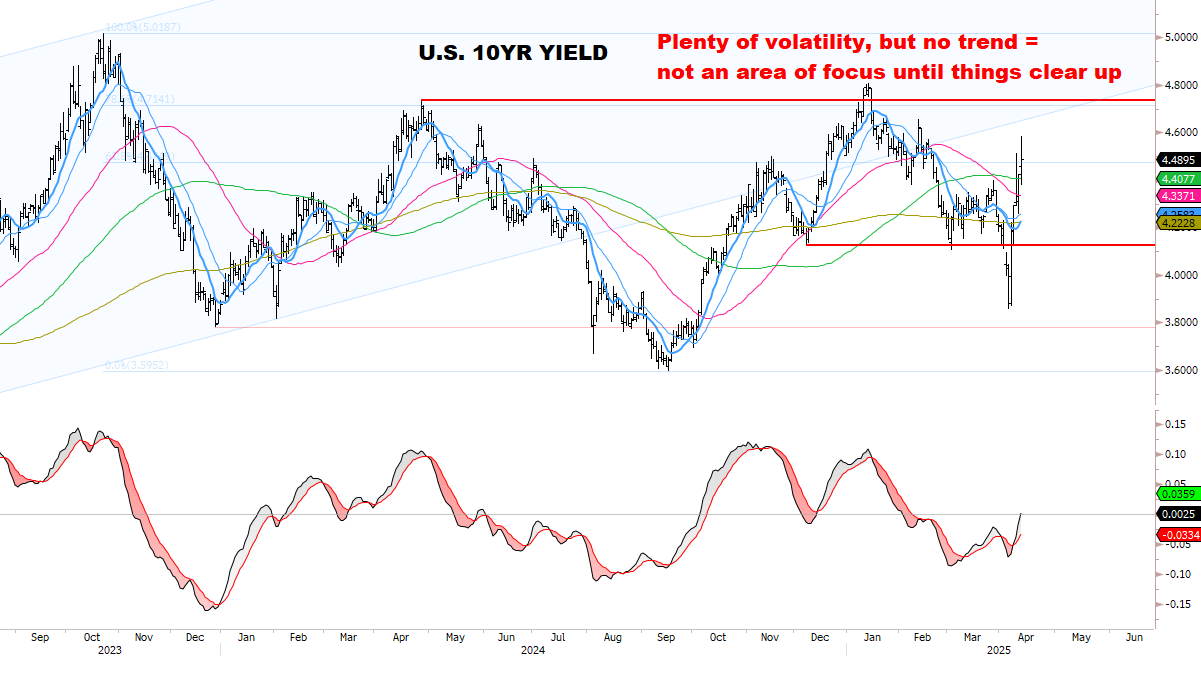

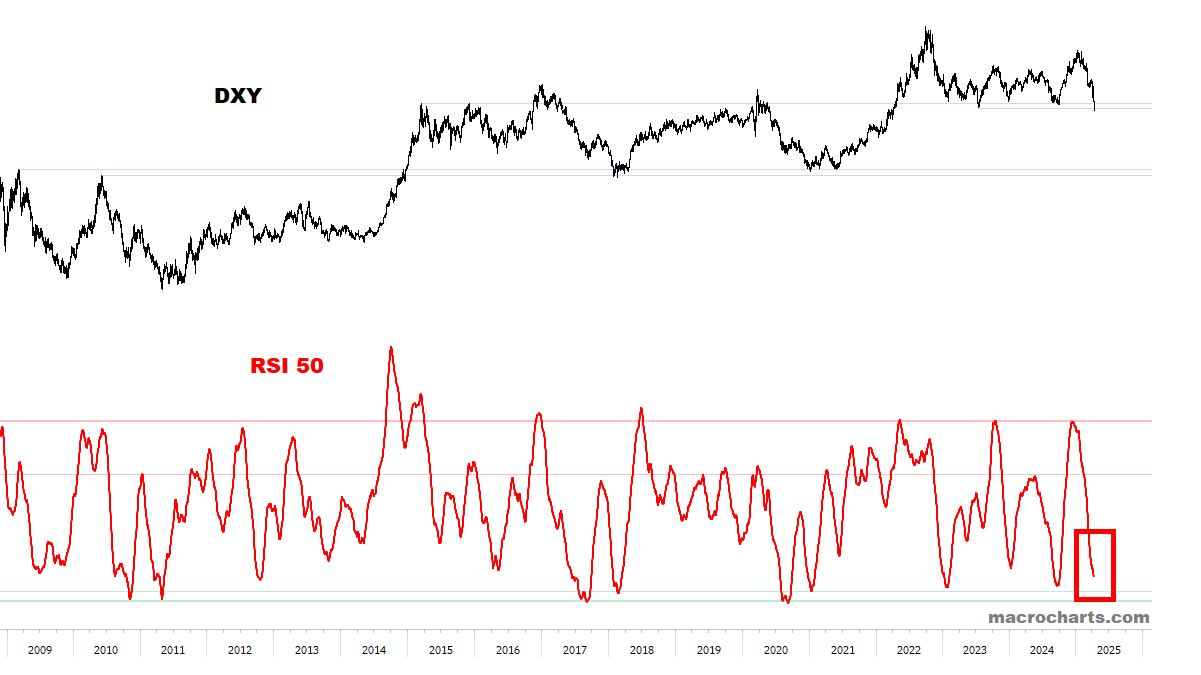

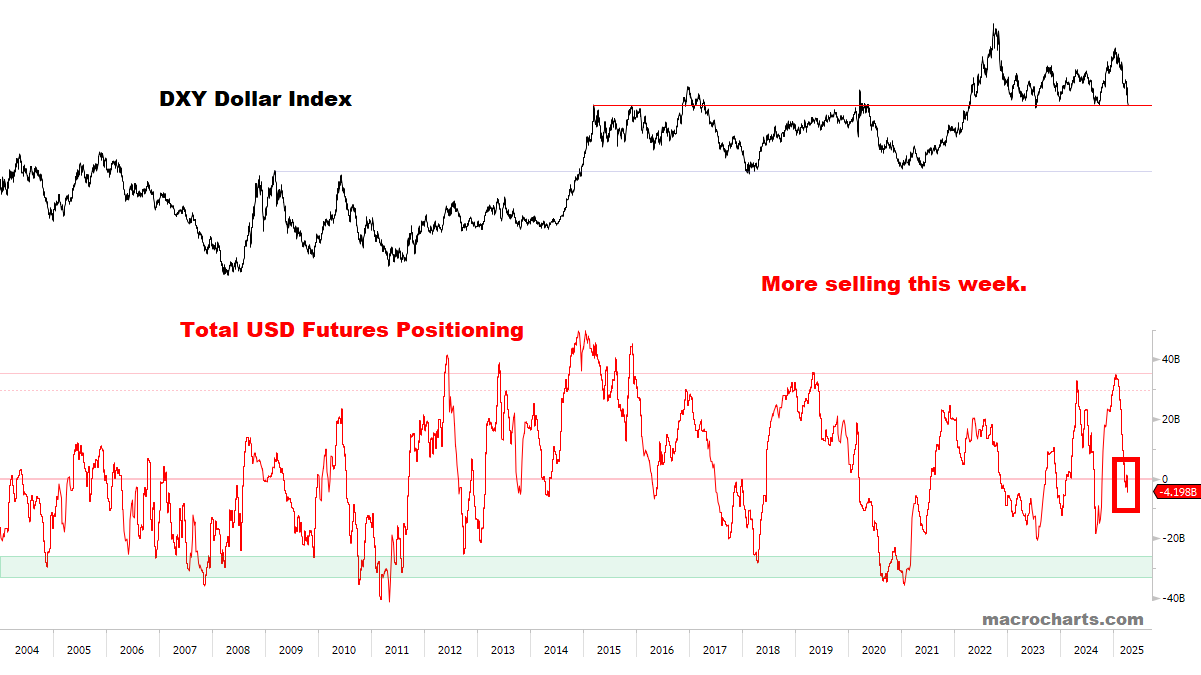

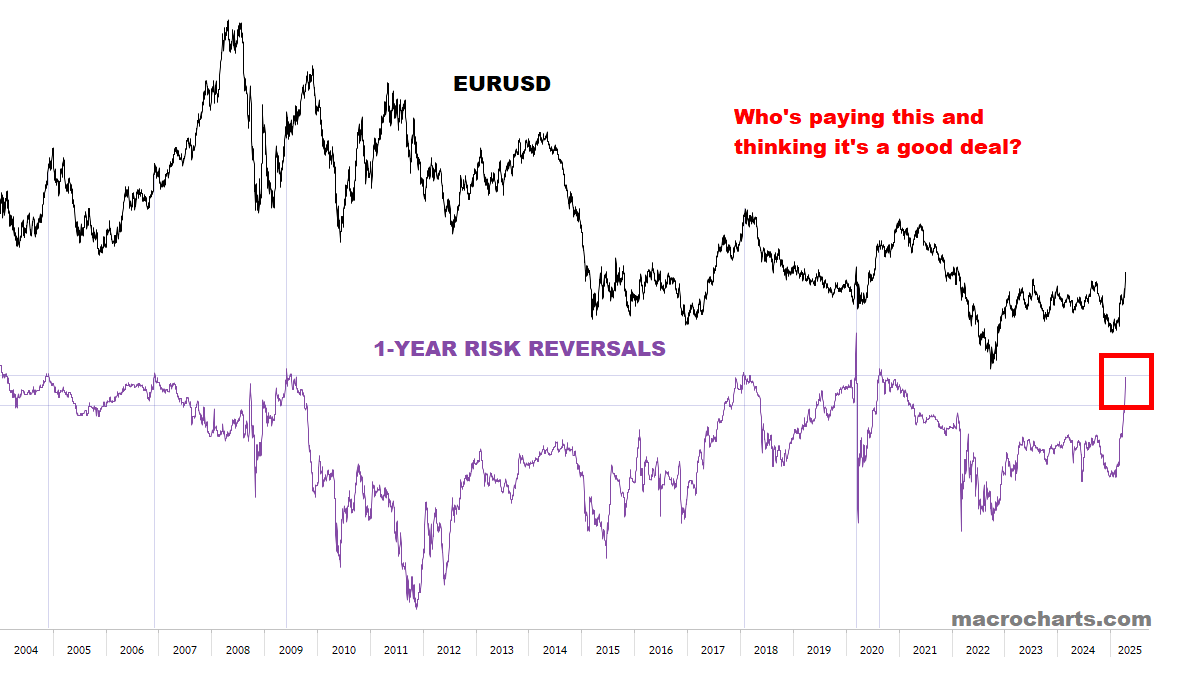

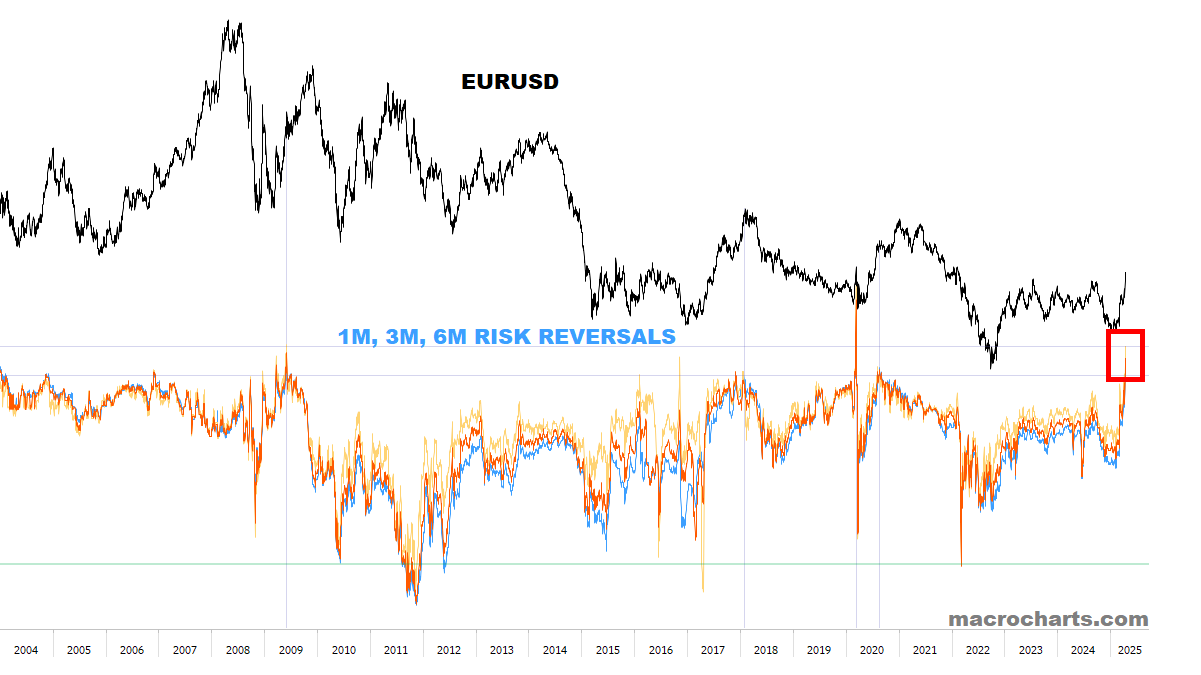

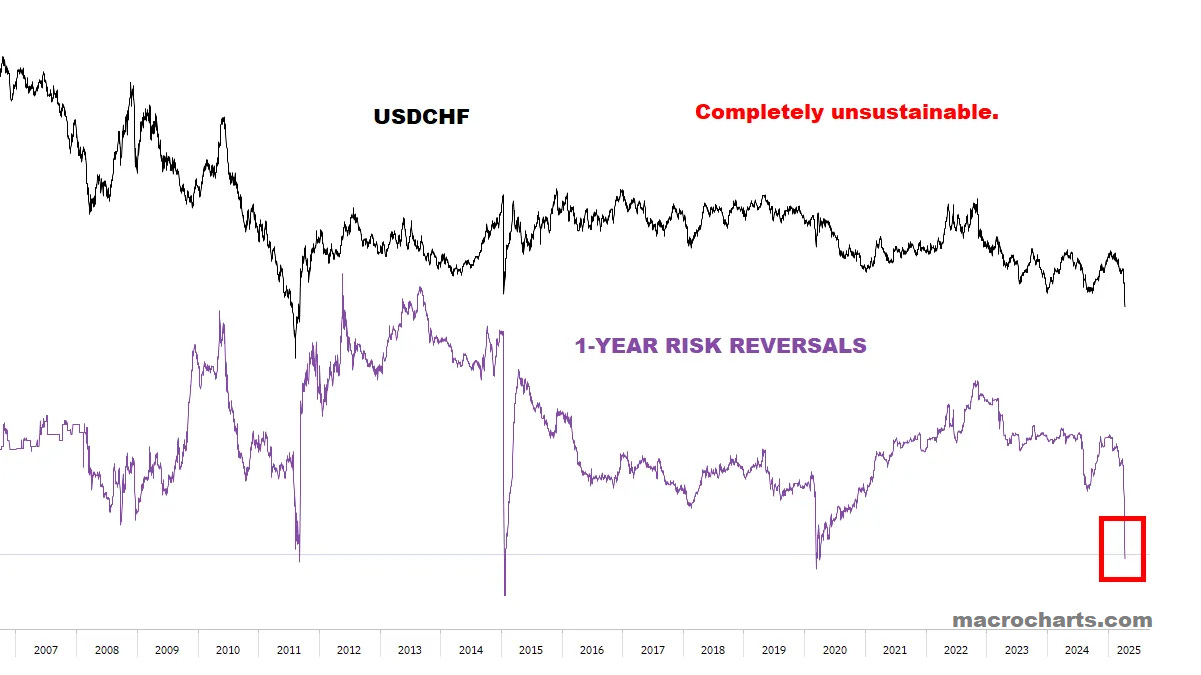

从头到尾的完美顺序: 跟踪和更新我们下周、四月剩余时间和第二季度的计划。Important update: Bonds & the Dollar (and updated Macro framework).

重要更新:债券和美元 (以及更新的宏观框架)。*Actionable* & Comprehensive Analysis of Key Market Signals.

*可操作*且全面的关键市场信号分析。Complete list of Buy/Sell setups we’re watching.

我们正在关注的买入/卖出设置的完整列表。Detailed Charts & Commentary: Core Models, Global Equities & Sectors, Volatility, Rates & Credit, Currencies, Commodities, Bitcoin.

详细图表和评论:核心模型、全球股票和行业、波动性、利率和信贷、货币、商品、比特币。

Open Positions & Market Dashboard

未平仓头寸和市场仪表板

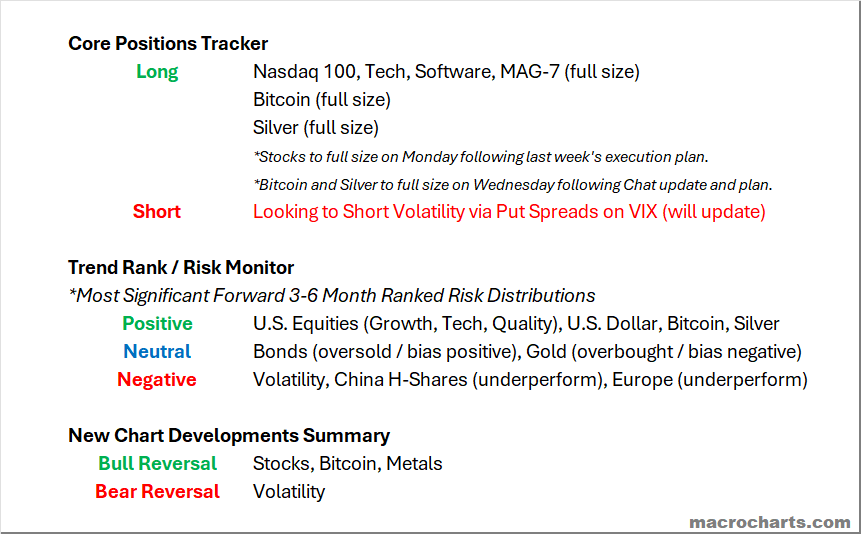

Core Positions Tracker: Portfolio changes communicated in real-time via Posts & Substack Subscriber Chat. All changes planned ahead of market conditions, and include (1) reasoning, (2) chart context, (3) entry/stop levels, and (4) price projections.

核心仓位追踪器:投资组合变动可通过帖子和 Substack 订阅聊天实时沟通。所有变动均根据市场行情提前规划,包括 (1) 推理、(2) 图表背景、(3) 入场/止损位以及 (4) 价格预测。

Trend Rank / Risk Monitor: Model-driven system which includes Positioning, Sentiment, and Momentum to generate forward 3-6 month ranked risk distributions. These can become Core Positions if/when Trends are confirmed.

趋势排名/风险监测:模型驱动的系统,包含仓位、情绪和动量,用于生成未来3-6个月的排名风险分布。如果趋势得到确认,这些可以成为核心仓位。

New Chart Developments Summary: Notable chart patterns of the week, developing potential key inflection or acceleration points.

新图表发展摘要:本周值得注意的图表模式,正在发展潜在的关键拐点或加速点。

CORE MODELS & DATA 核心模型和数据

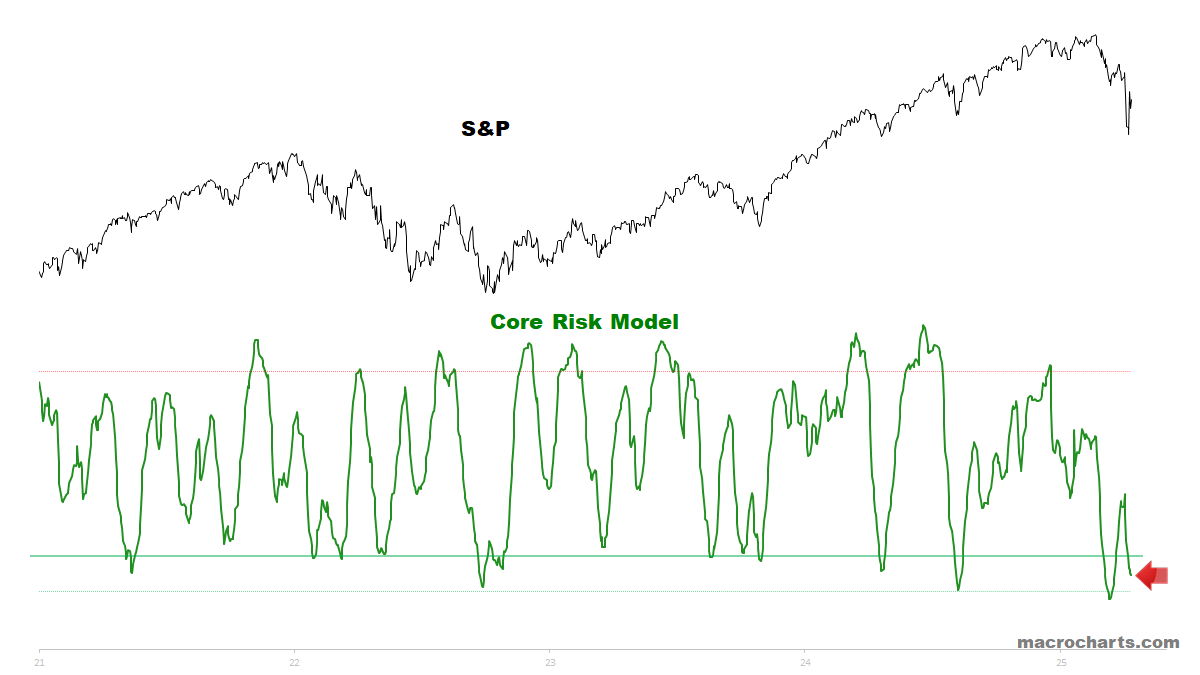

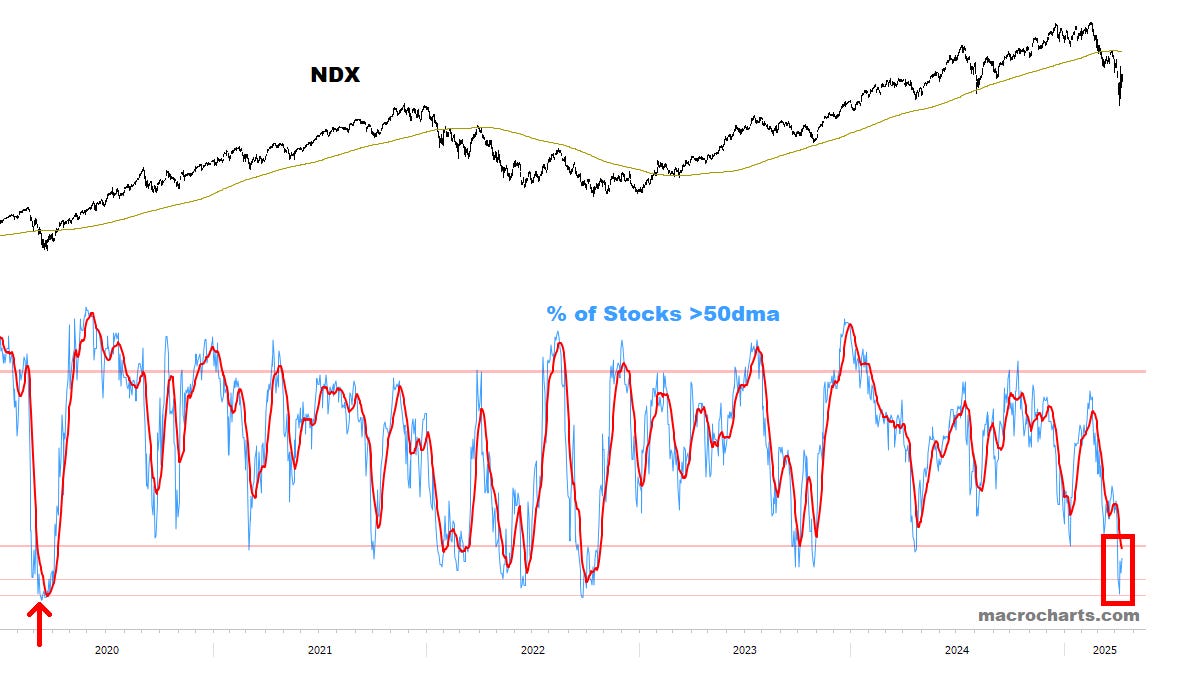

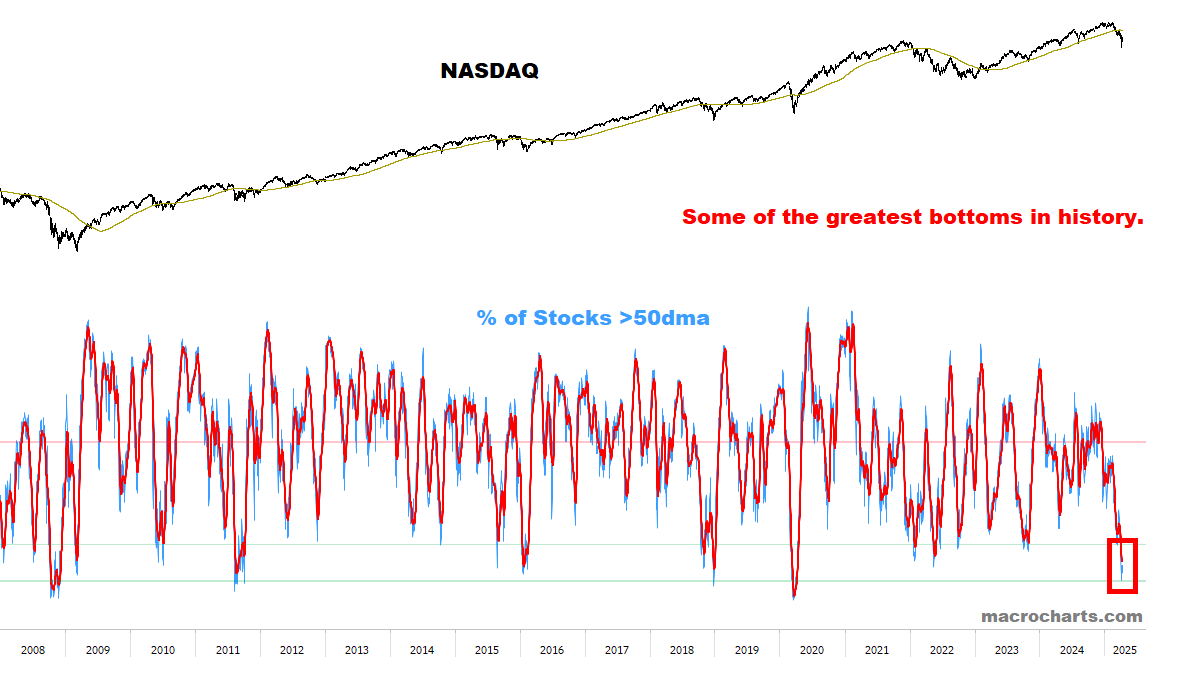

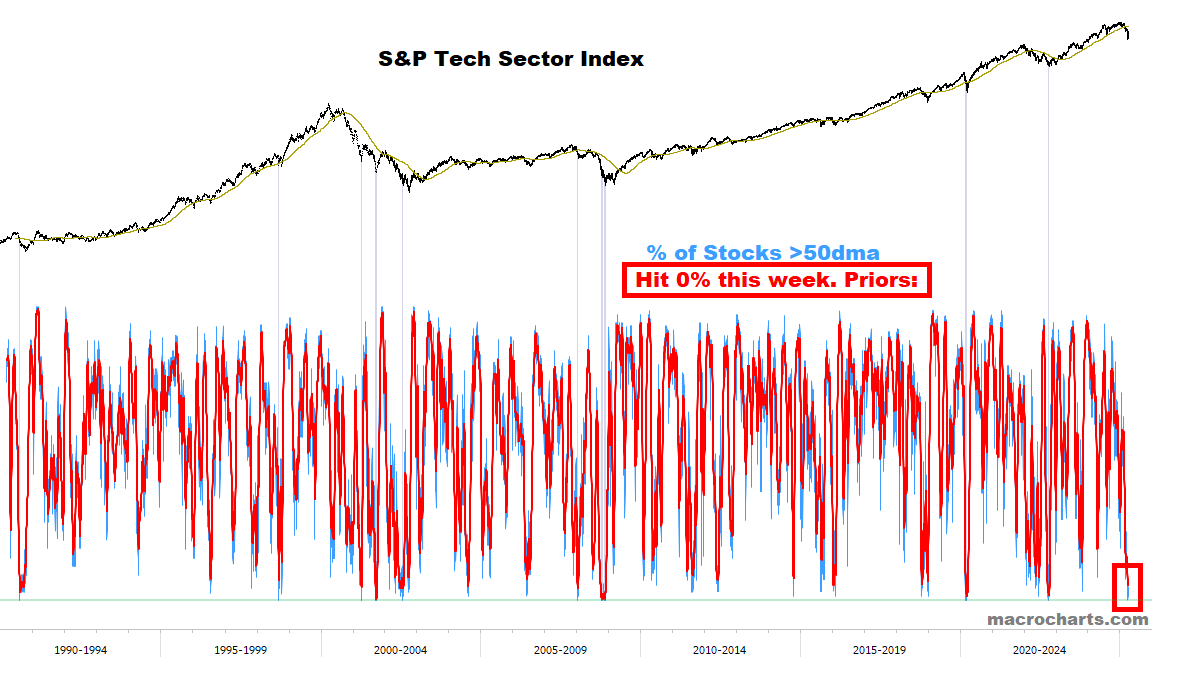

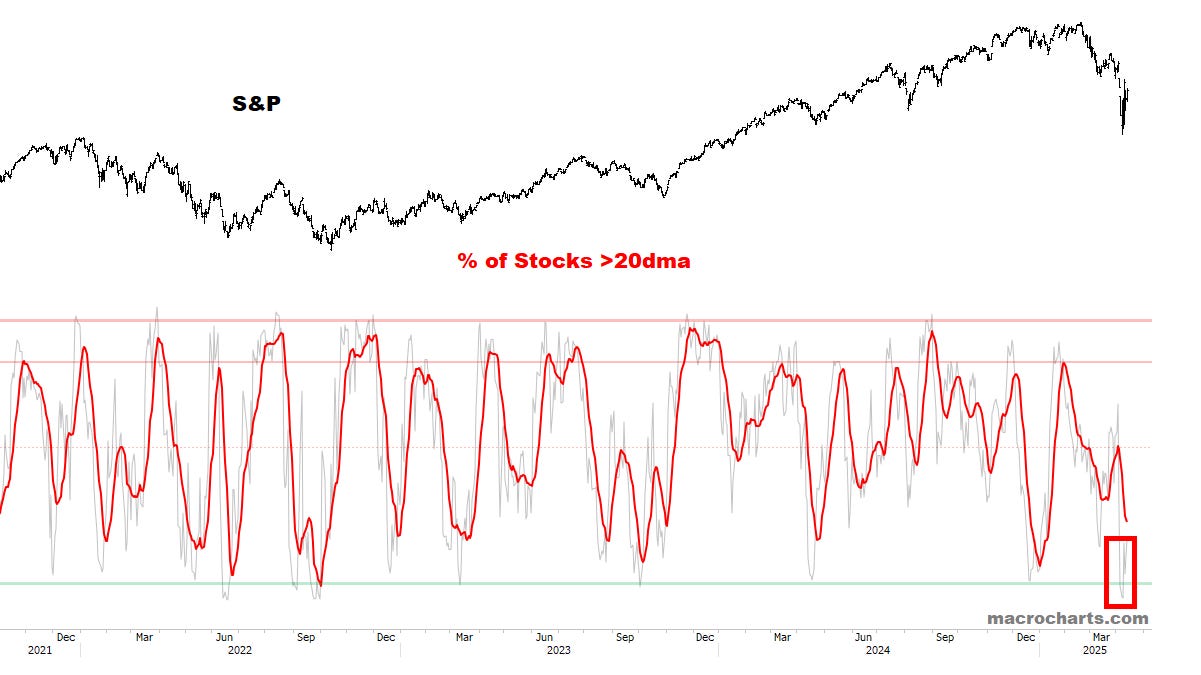

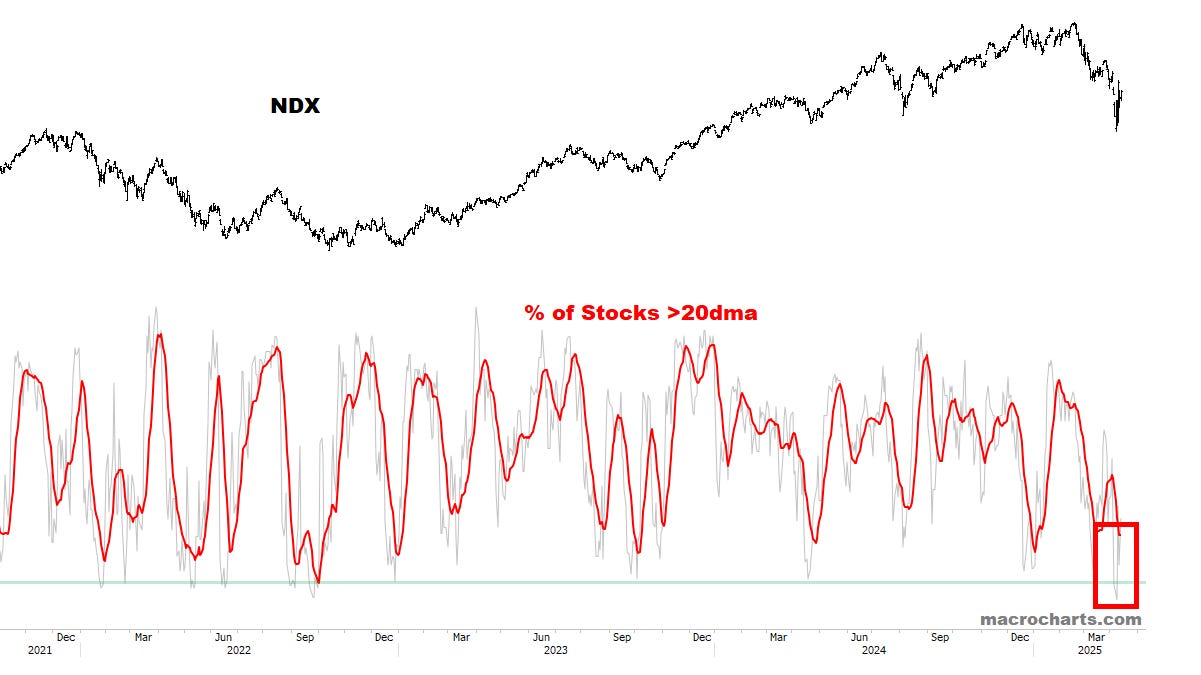

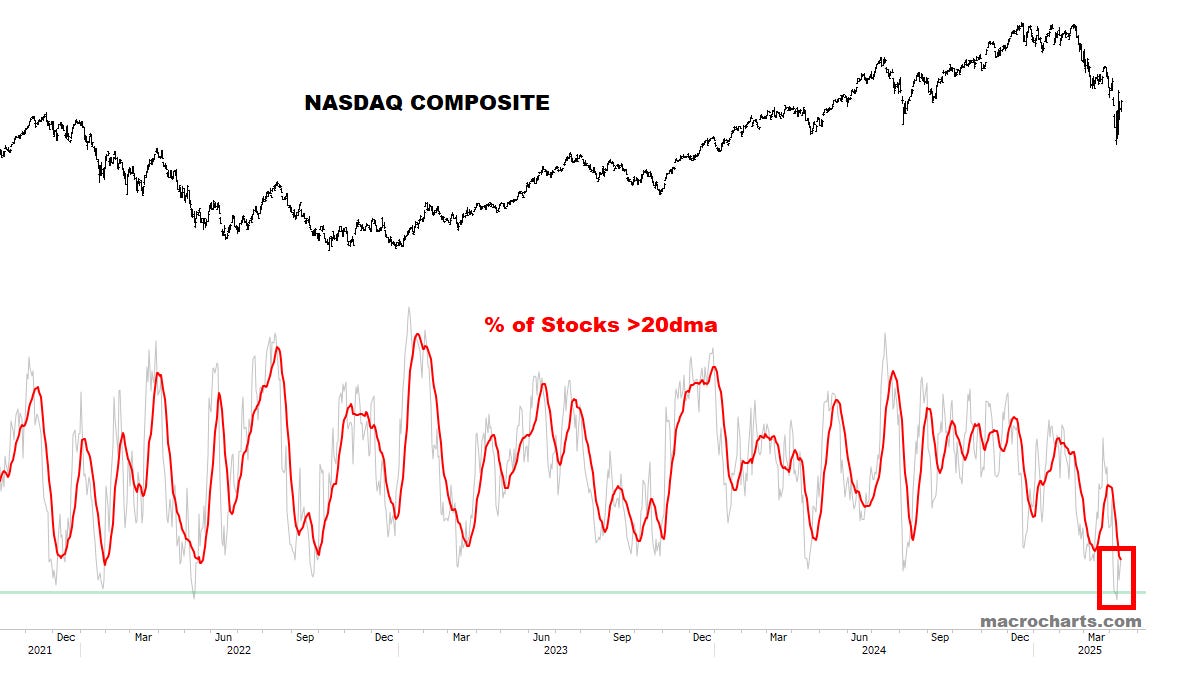

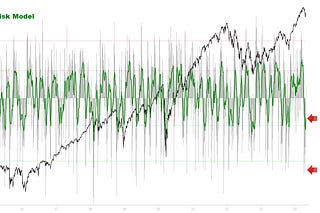

Core Risk Models are extremely oversold — monitoring a turn UP:

核心风险模型极度超卖——监控上涨:

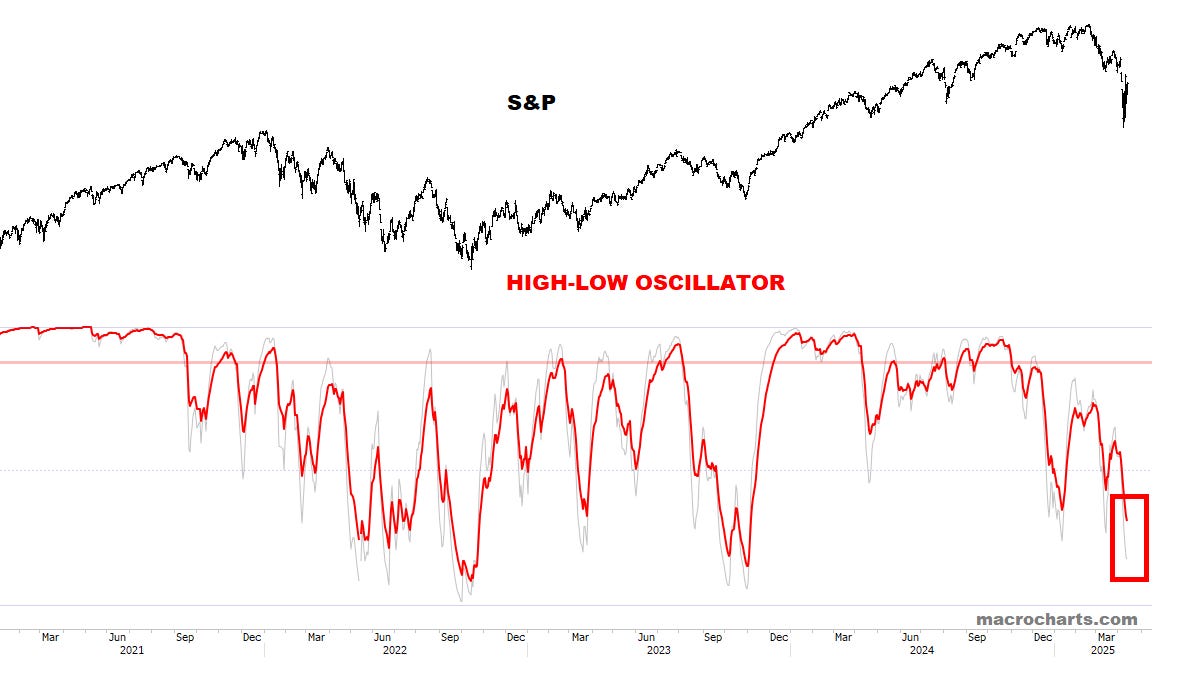

High-Low Oscillators are extremely oversold — including S&P at last.

高低震荡指标极度超卖——包括标准普尔指数。

*ALERT:* *警报:*

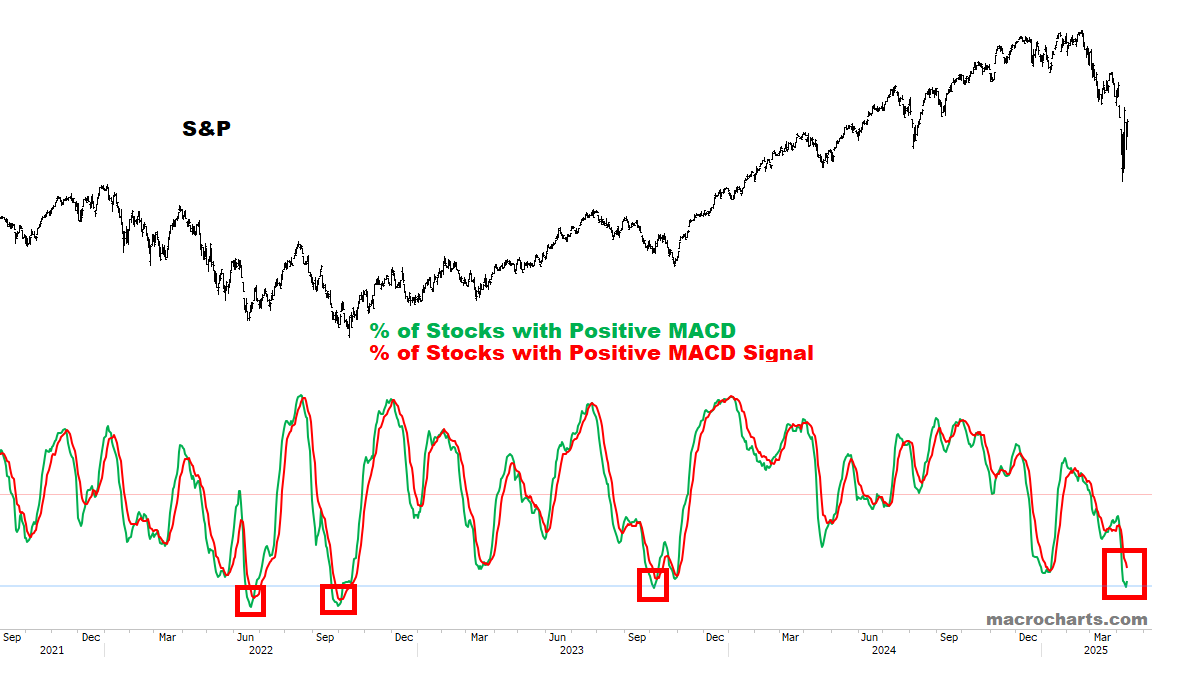

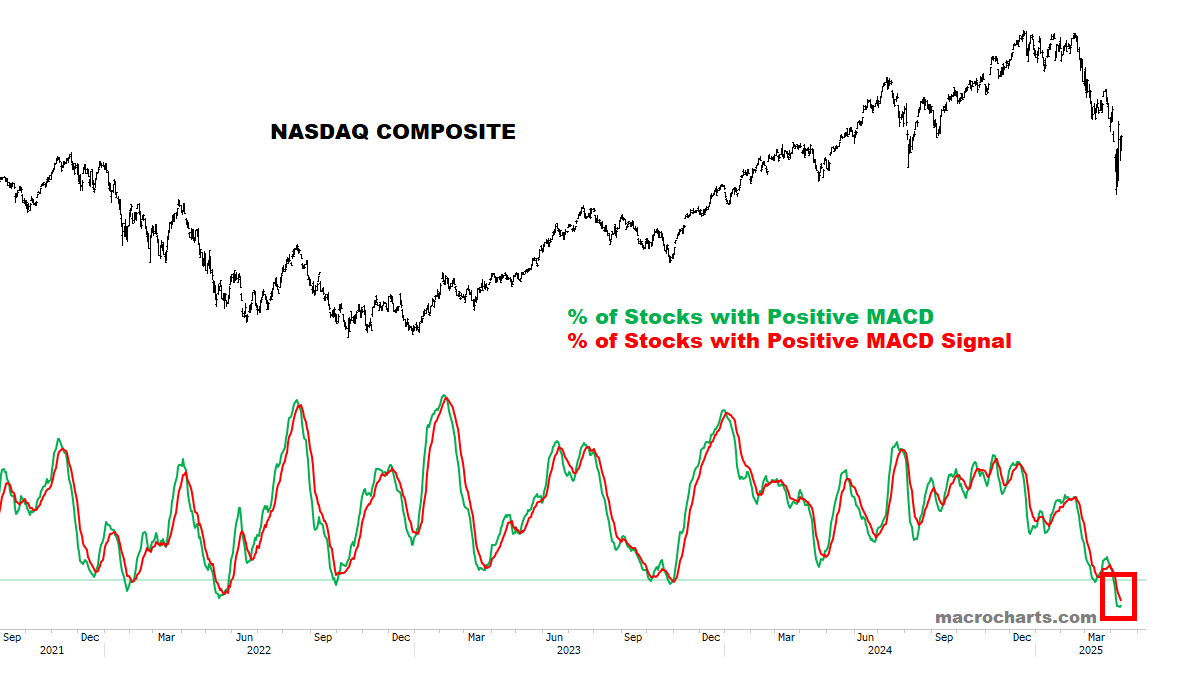

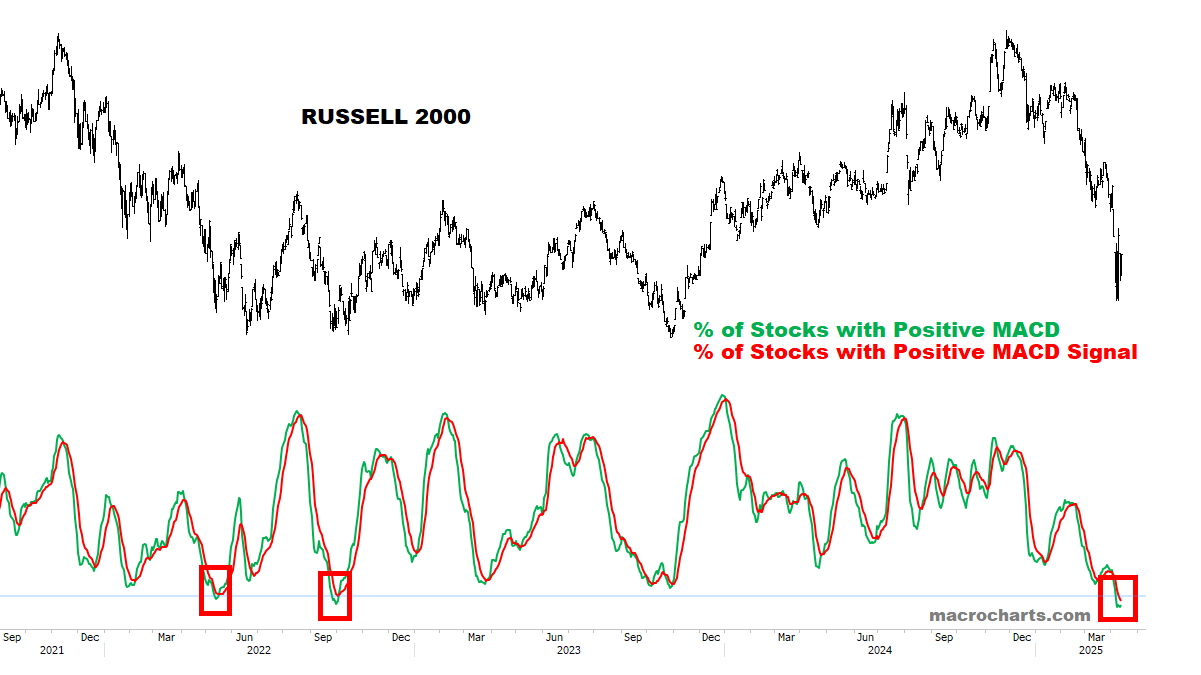

MACD Profiles showing big Bullish potential as well.

MACD 曲线也显示出巨大的看涨潜力。

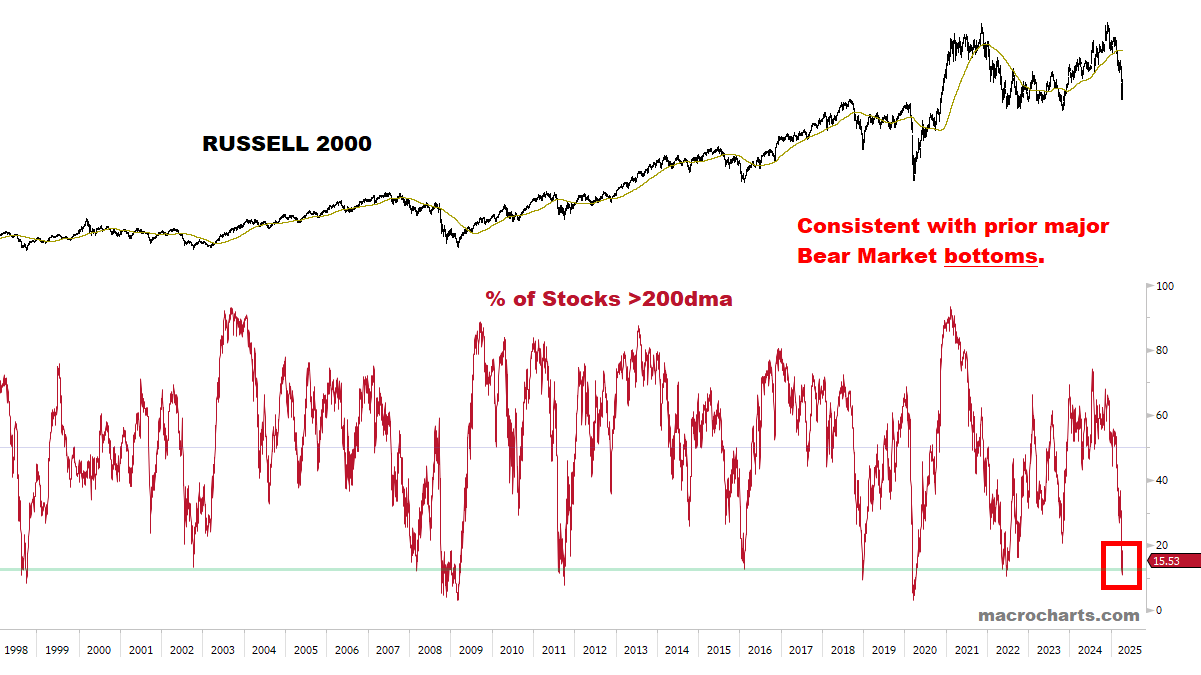

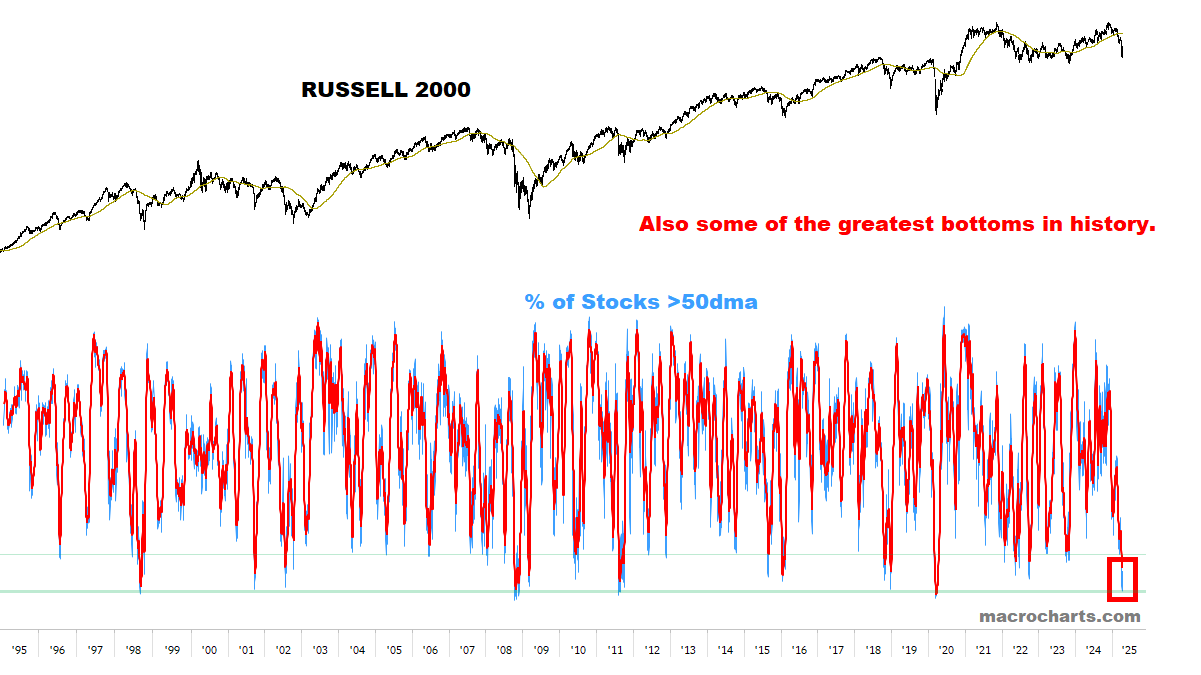

Russell Long-Term Breadth is at levels of prior Bear Market bottoms.

罗素长期广度指数目前处于之前熊市底部的水平。

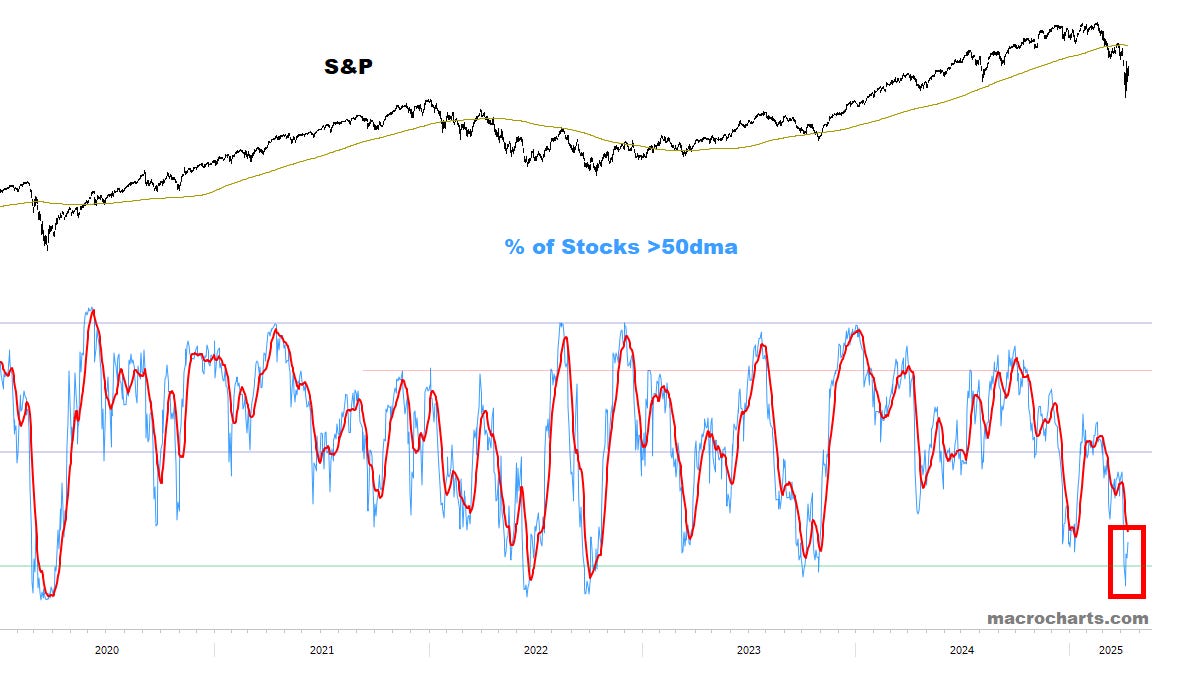

Intermediate-Term Breadth is ticking up from extreme oversold — historically a very Bullish development.

中期广度正在从极度超卖状态回升——从历史上看,这是一个非常看涨的发展。

*ALERT:* *警报:*

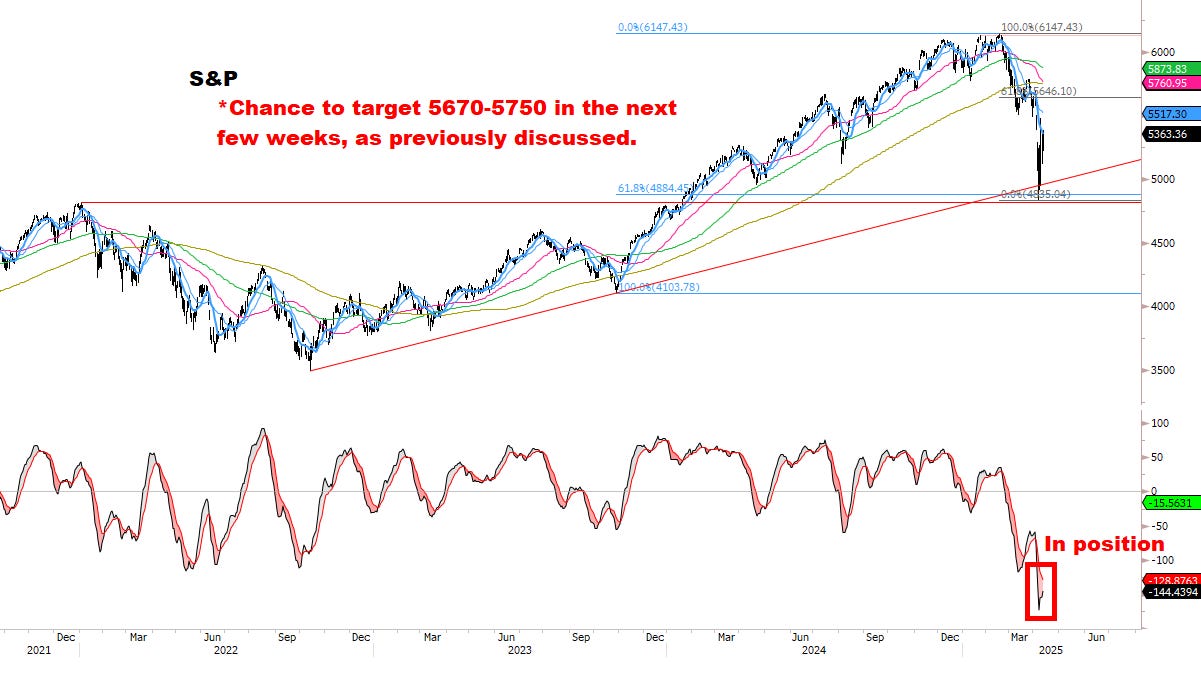

S&P Short-Term Breadth is turning up from extreme oversold. From last week: “These are extremely rare conditions likely to produce an immediate reaction next week.” So far, the response has been textbook.

标普短期广度指数正从极度超卖状态回升。上周曾写道:“这些情况极其罕见,很可能在下周立即引发反应。” 到目前为止,市场反应非常典型。

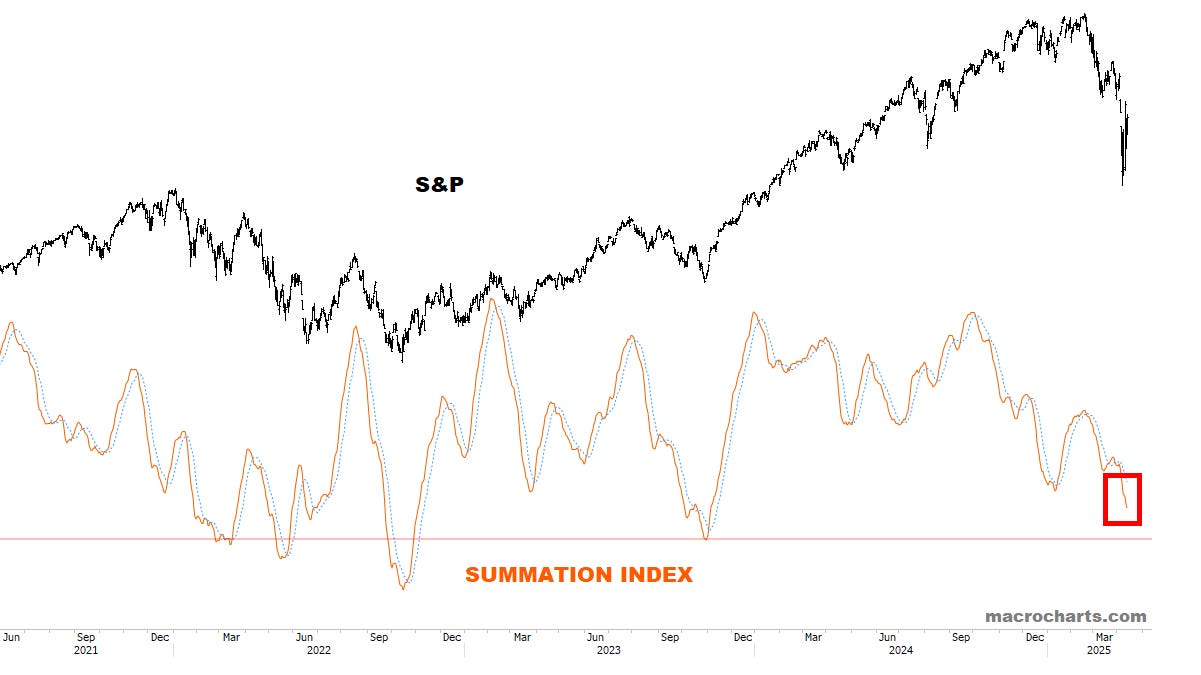

Summation Index remains on a Sell, monitoring if it can stabilize and turn up next week. *Looks like it will lag relative to others.

总结指数仍处于卖出状态,观察其下周能否企稳并回升。*看起来它会相对其他指数有所滞后。

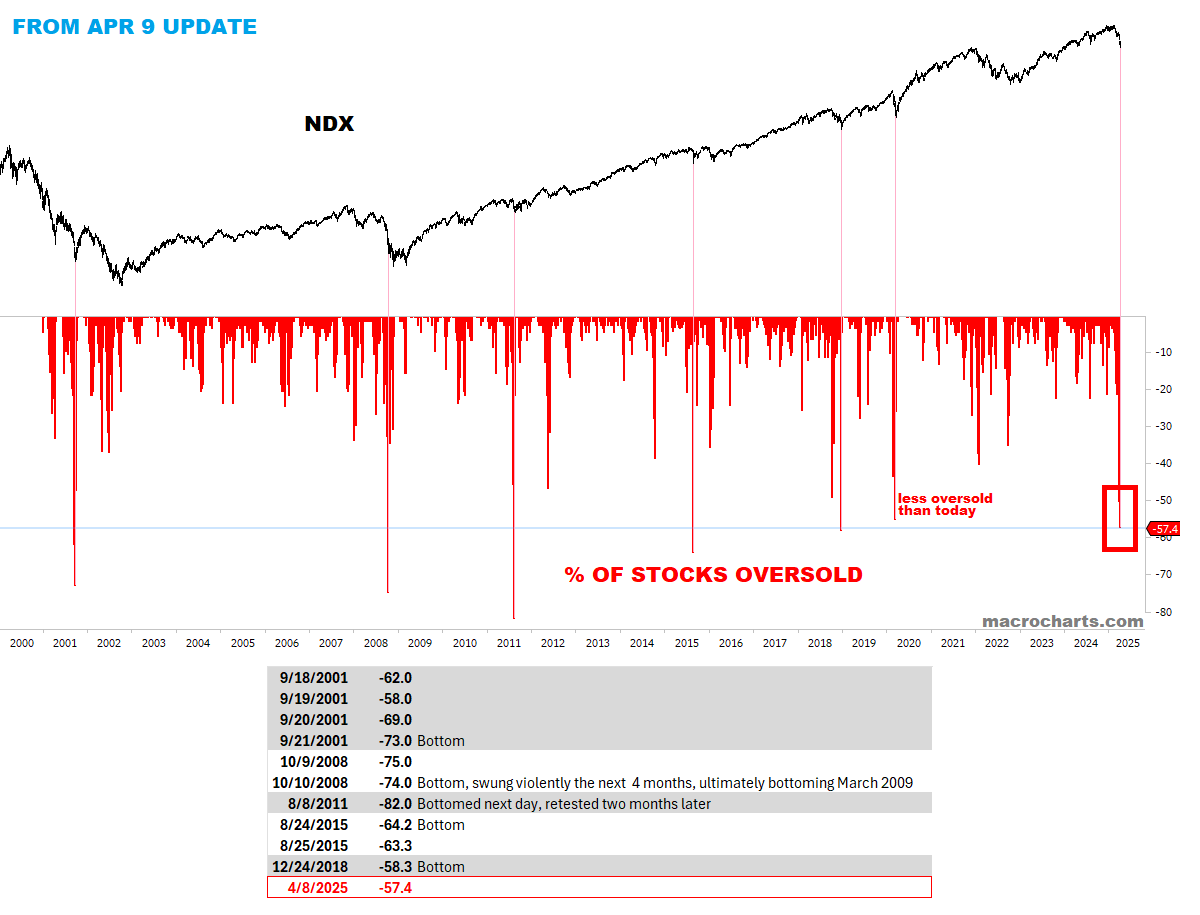

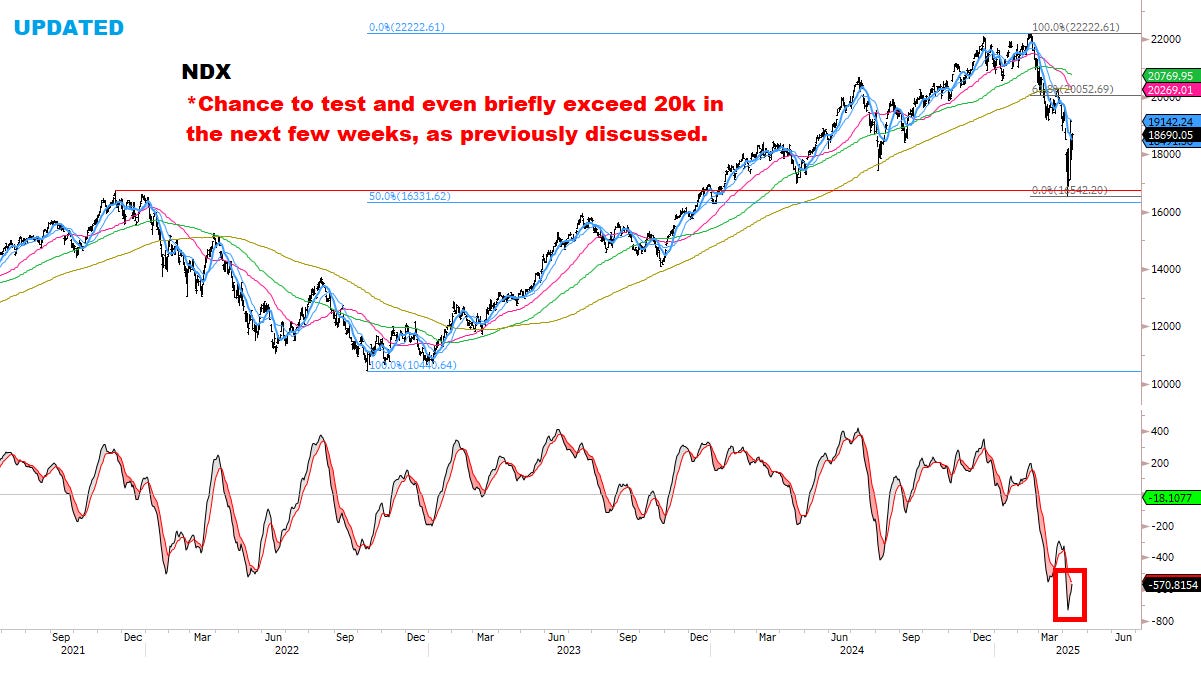

On Tuesday, NDX reached 57% oversold — the 11th most oversold day in data history. The setup was for an immediate bottom to form, as discussed then.

周二,NDX 的超卖程度达到 57%,创下数据历史上第 11 次超卖纪录。正如当时讨论的那样,这预示着市场将立即触底。

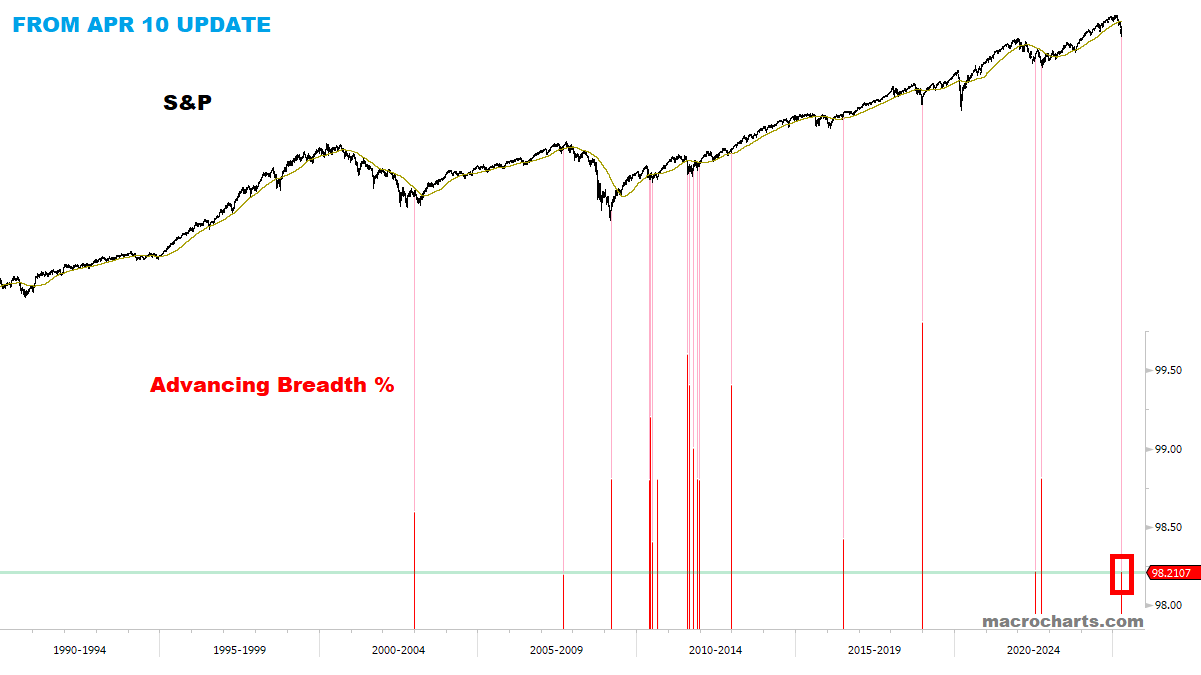

Following that signal, almost every S&P Stock closed higher Wednesday — the strongest reading since October 4, 2022.

遵循这一信号,几乎所有标准普尔股票在周三收盘时都上涨——这是自 2022 年 10 月 4 日以来的最强读数。

In the last 35 years (data history), which includes some major declines, Stocks never went into a Bear Market after registering this level of strength. Not even in 2008.

过去35年(数据历史)中,包括一些大幅下跌,股市在达到如此强劲的水平后从未进入熊市。即使是2008年也没有。Virtually every time, Stocks exited a Bear Market. We made a clear contrarian case for this week and so far the market has strongly confirmed our view — watching for more follow-through, and continuing to follow our plan.

几乎每次股市都会走出熊市。 本周我们明确提出了反向投资策略,到目前为止,市场也强烈证实了我们的观点——关注后续走势,并继续执行我们的计划。(Even in 2007, when Stocks eventually transitioned into a major Bear Market, they first ran to new highs again. The equivalent would be S&P back to 6200 by summer, and then rolling over. This may not seem likely here, but then again, no one is prepared for it either.)

(即使在 2007 年,当股市最终进入大熊市时,它们也是先上涨至新高。相当于标准普尔指数在夏季回升至 6200 点,然后回落。这在这里似乎不太可能,但话又说回来,也没有人为此做好准备。)

TREND & SENTIMENT: Equities

趋势与情绪:股票

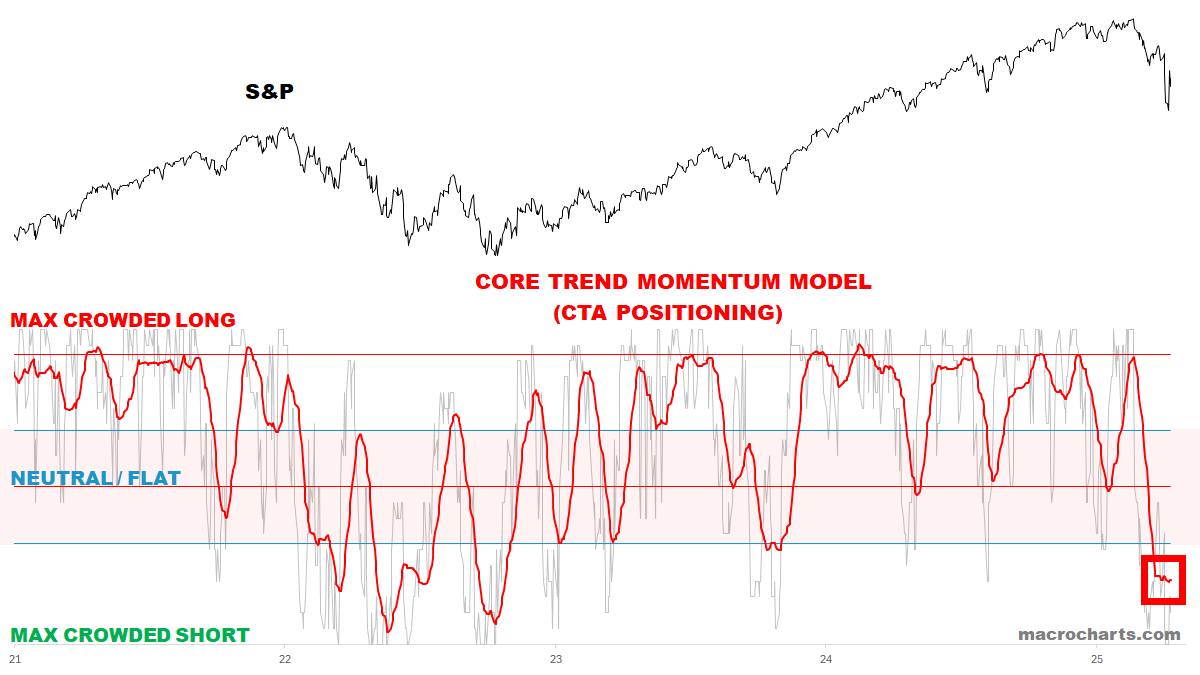

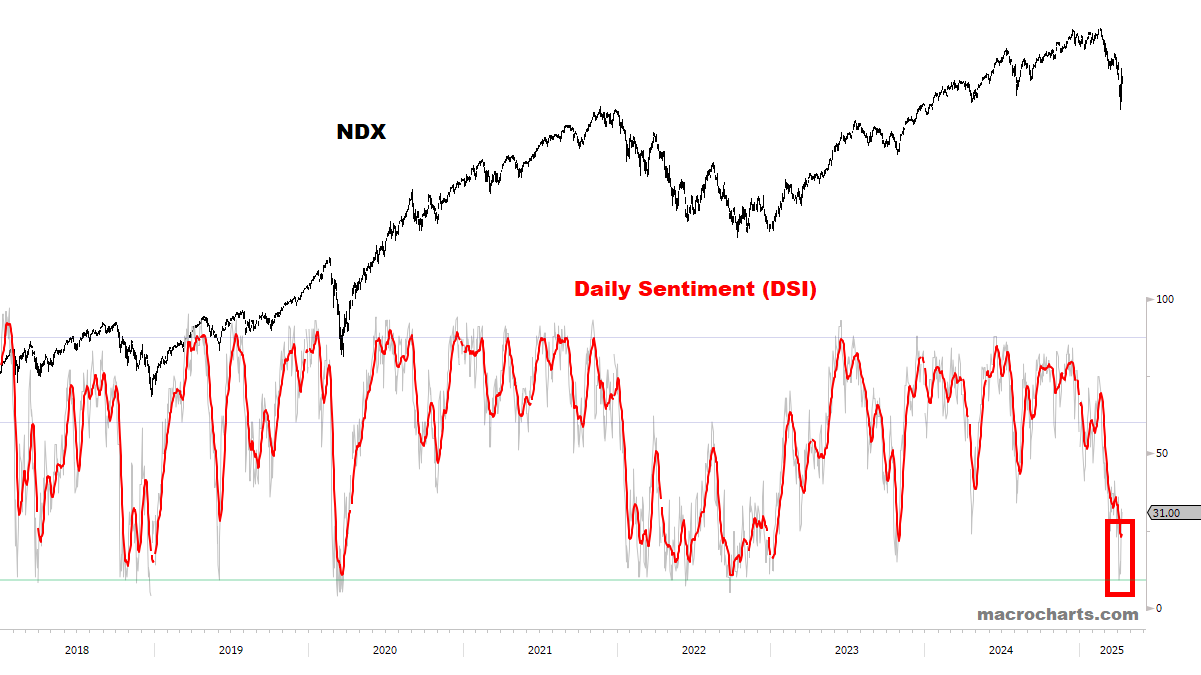

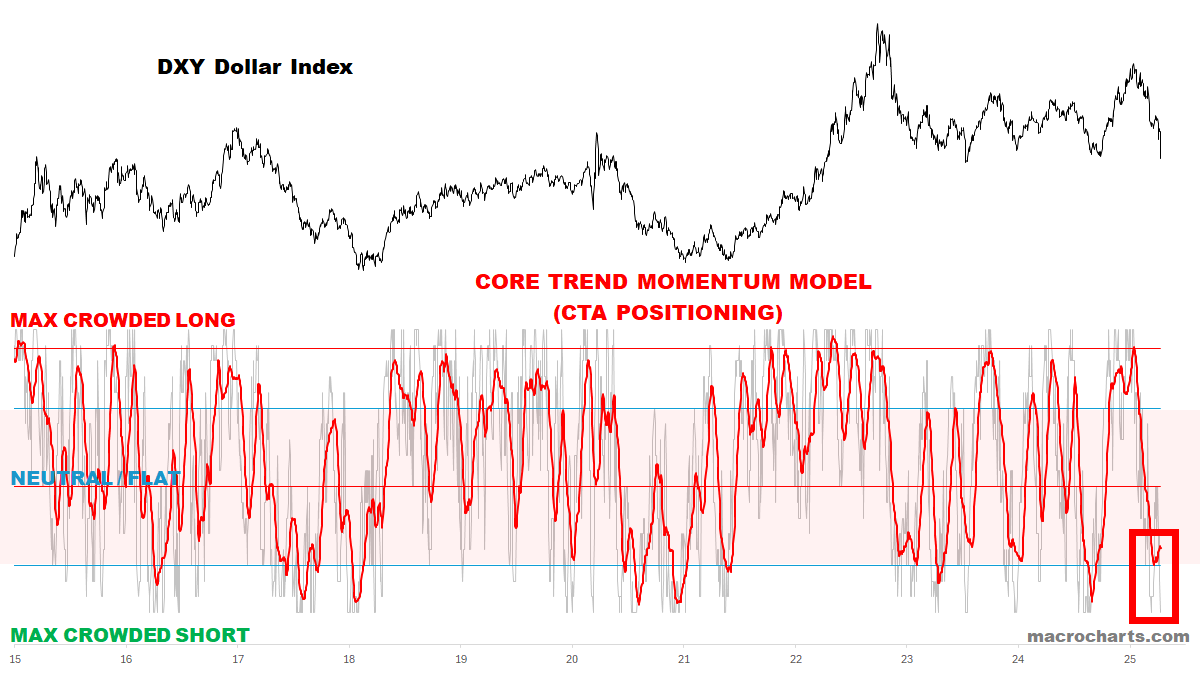

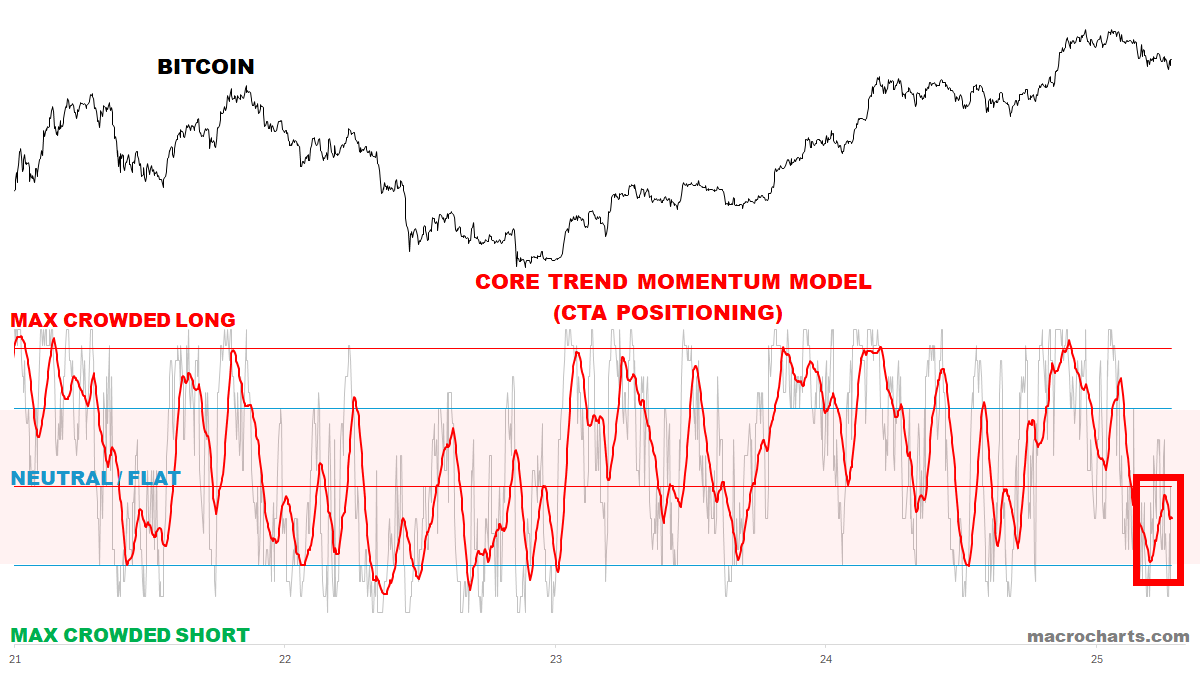

CTA Equity Positioning remains at the lowest since the October 2022 Bear Market bottom.

CTA 股票仓位仍处于 2022 年 10 月熊市触底以来的最低水平。

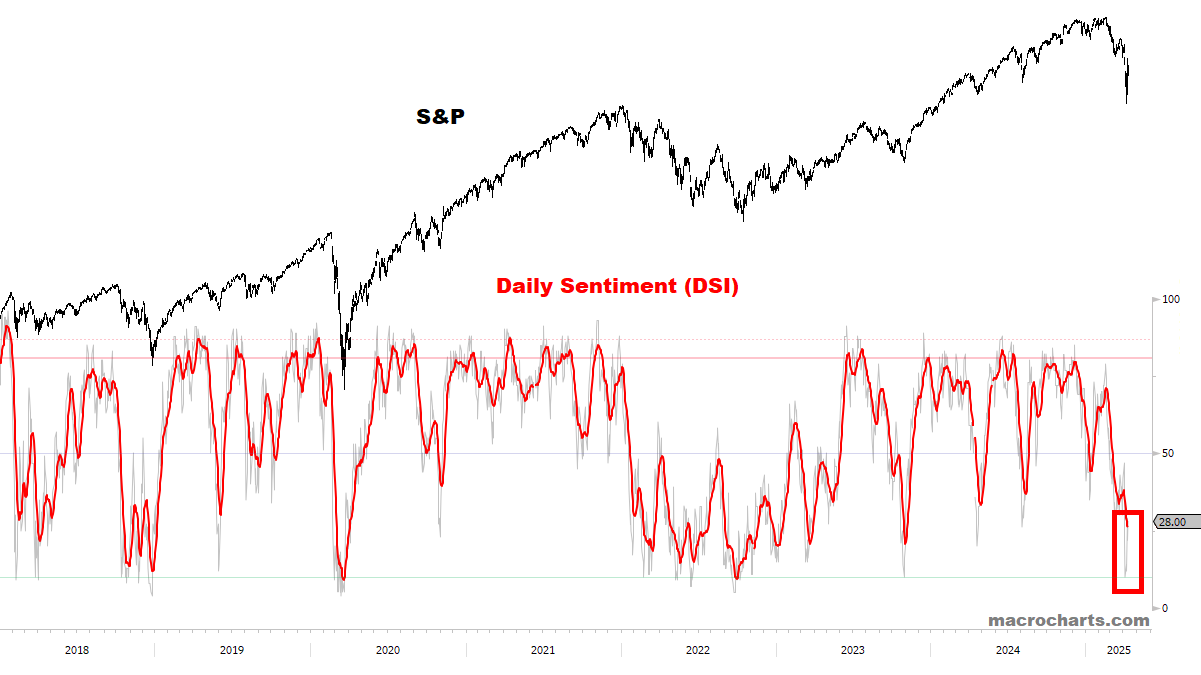

Equity Sentiment is stabilizing after reaching a full capitulation:

股市情绪在全面投降后趋于稳定:

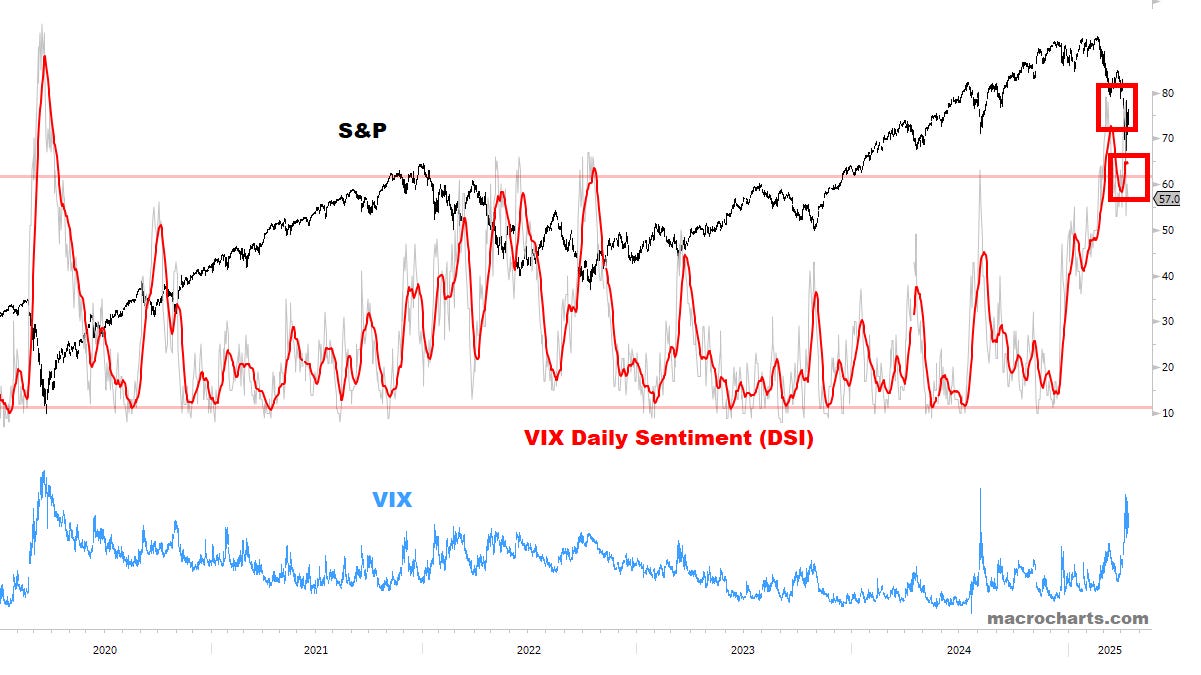

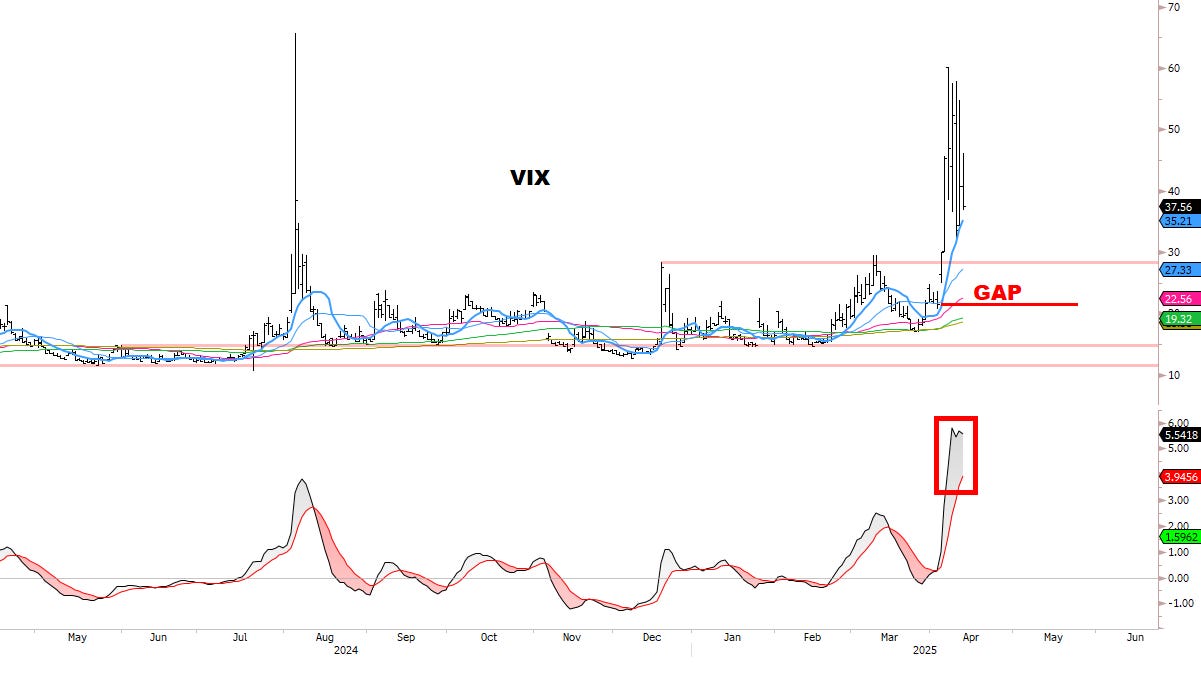

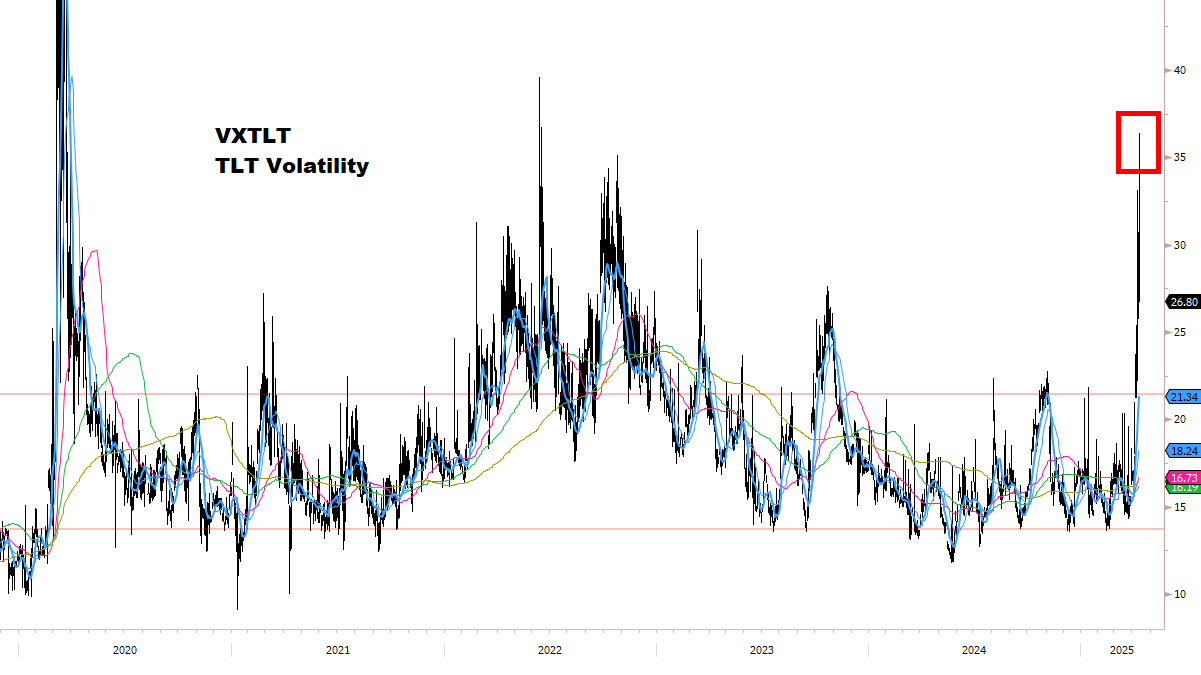

VIX Sentiment is forming a major Top and may have turned DOWN on Friday.

VIX 情绪正在形成一个主要顶部,并可能在周五下跌。

*There’s a chance that Volatility has peaked for the year, and is a multi-month SELL from here.

*波动率有可能已经达到今年的峰值,并且从现在开始将进入数月的卖出阶段。

*Looking to express this through a Short Vol position, and will update on this theme as it sets up an optimal entry. Stay tuned.

*希望通过短线波动率仓位来表达这一点,并将在找到最佳入场点后更新此主题。敬请关注。

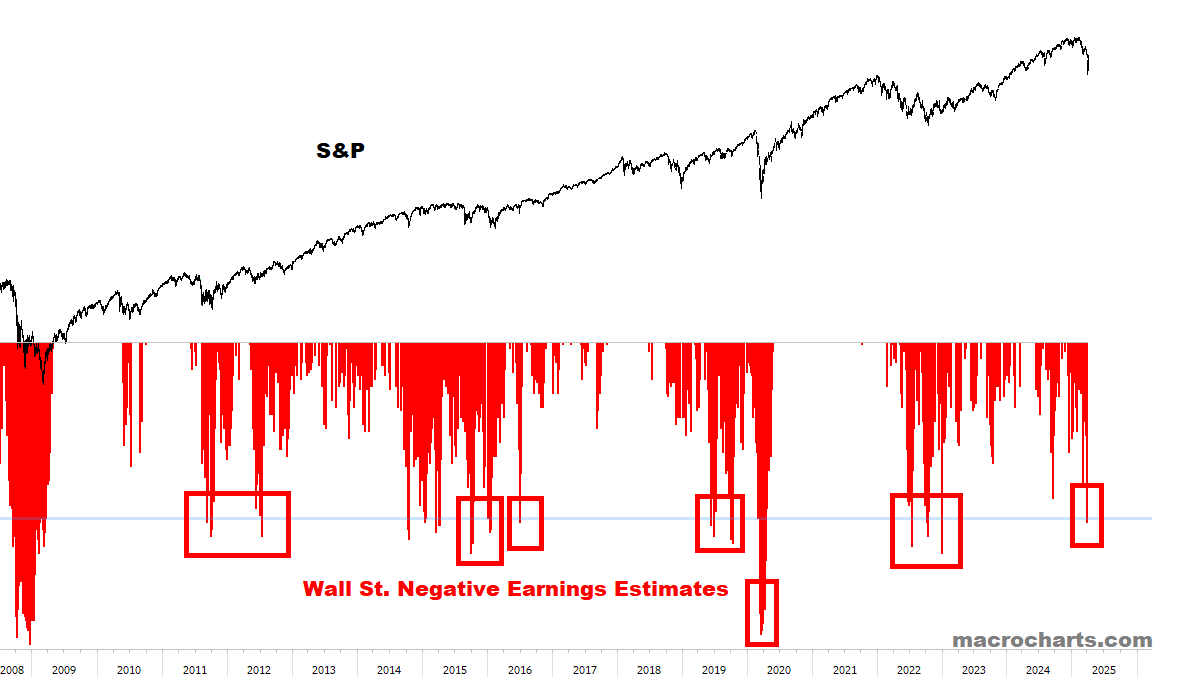

Earnings Estimates are extremely pessimistic.

盈利预测极其悲观。

Current expectations are more consistent with prior bottoms in the market, rather than the beginning of a new Bear phase.

当前的预期与市场之前的底部更加一致,而不是新熊市阶段的开始。For context, the last time at these levels was at the double bottom in 2022 — and others like it. Pessimism is running deep.

就背景而言,上一次达到这种水平是在2022年的双底时期——以及其他类似的时期。悲观情绪正在深入人心。