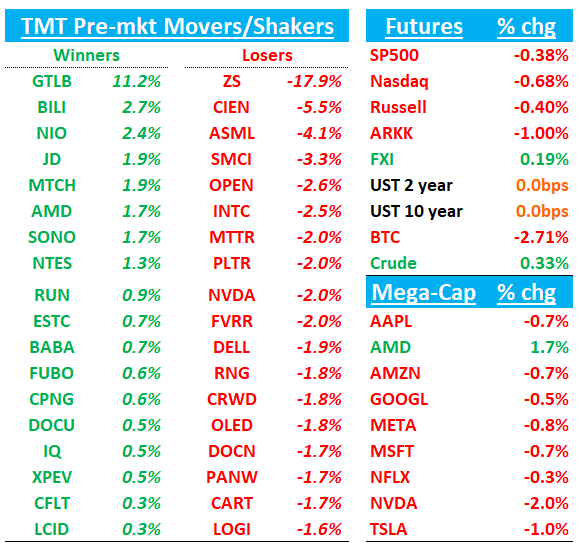

Good morning. QQQs -70bps down again as NVDA falling on DOJ subpoena. Yields flat/BTC -3% / China +15bps…Citi TMT Conf starts today (schedule here)…We’ll hit news/research first then GTLB/ZS/CIEN recaps…Let’s get to it

NVDA: Nvidia Gets DOJ Subpoena in Escalating Antitrust Probe

The US Justice Department sent subpoenas to Nvidia Corp. and other companies as it seeks evidence that the chipmaker violated antitrust laws, an escalation of its investigation into the dominant provider of AI processors.

The DOJ, which had previously delivered questionnaires to companies, is now sending legally binding requests that oblige recipients to provide information, according to people familiar with the investigation. That takes the government a step closer to launching a formal complaint.

GOOGL: A few pieces of mixed news this morning

ISI out with a note detailing their survey of 1k+ consumers and noted that GOOGL’s share as preferred search engine has declined from 80% to 74% from June to August as ChatGPT share has increased from 1% to 8%, although ISI notes that the slippage is concentrated in more general information searches as GOOGL’s selection share has remained consistent in 5 out of the 7 leading commercial searches.

Cleveland downticks on Q3 saying moderation in retail/cpg, ROI pressure and less brand spend (including softer back to school) caused them to lower #s to be in line with street, although they do note optimism for a bounce back in Q4

Semianalysis has an article talking about OpenAI’s “ambitious plan to beat GOOGL’s infrastructure

3p Roundup:

CVNA: Hearing Msci + Yip saying revs accelerated to high 30s y/y growth in the latest week

AMD: Clev positive saying DC revs improving on TAM and AMD share gains and better Mi300 feedback while ex-AI biz also improving

(Also AMD: ex-NVDA’s Keith Strier joined AMD as Sr. VP of Global AI; most recently served as VP of worldwide AI initiatives at Nvidia, w/ responsibility for expanding commercial engagements w/ foreign govt’s_

ABNB: Airbnb cut to Hold at Argus on slowing room nights growth

⁃ Growing competition, soft domestic demand, fewer extended visits, and increased marketing spending aimed at broadening Airbnbs geographic footprint are likely to harm near-term earnings.

⁃ Argus thinks prospects for slowing growth and the shares lofty forward multiple make for a less attractive risk/reward profile.

⁃ Over the long term, Argus expects ABNB to post high-teens revenue and earnings growth, as the company offers new services and as travel increases in developed markets.

ASML: ASML downgraded to Neutral from Buy at UBS

The company's lithography intensity is plateauing in both logic and memory and artificial intelligence demand is an insufficient offset, the analyst tells investors in a research note. The firm believes the investor narrative will begin to shift beyond this to 2026 and 2027 and sees downside risk to consensus estimates

Also ASML: per local press (Eindhovens Dagblad), ASML is facing a disappointing inflow of orders; article notes suppliers in the Eindhoven region will face lower activity for the time being due to the company postponing current orders – link

BKNG: Downgraded to hold at Jefferies

Jefferies top down industry model suggests growth will moderate further over the next 3 years from 11%/6% in 23/24 to 4.5$ /3.5% in 25/26, noting the slowdown is primarily driven by a normalization of demand trends. Jefferies sees BKNG stock upside capped by risk of downside to room nights and are also concerned that a currently elevated booking window could reverse in ‘25, creating a near-term headwind to room night growth. In addition, Jefferies notes slower growth in room nights and intensifying competition in alterative accommodations could pressure margin estimates.

SMCI: Previous bull Barclays downgrades SMCI

TheFly:

The analyst cites the company's "poor" gross margin in the June quarter and the annual filing delay "that evidenced several fundamental risks" for the downgrade. The risks include weak orifical intelligence server gross margin, customer erosion, uncertainty on GB200 orders and margins, and a lack of visibility on internal controls and governance, the analyst tells investors in a research note. As such, Barclays is taking a more cautious view on the shares.

MSFT/ADBE: WFS adds to Signature picks list

Altman Infrastructure Plan Aims to Spend Tens of Billions in US

OpenAI Chief Executive Officer Sam Altman’s plans for a massive buildout of the machinery and systems needed for artificial intelligence are coming into clearer focus, beginning with an effort in US states slated to costs tens of billions of dollars, according to a person familiar with the matter.

Altman had spent the early part of the year seeking the US government’s blessing for the project, which aims to form a coalition of global investors to fund the costly physical infrastructure needed to support rapid AI development, Bloomberg reported in February. Now, Altman and his team are working on several details that haven’t previously been reported, including the plan to first target US states.

APH: Amphenol downgraded to Neutral from Buy at BofA

BAMLs checks suggest that certain issues with GB200-based systems could result in a design change that could lower the addressable market for Amphenol and could significantly impact the company's content in Nvidia (NVDA) GB200 NVL36- and NVL72-based configurations, the analyst tells investors. BAML notes the changes are primarily to address some of the system overheating issues and notes one possible solution is to lower the performance and in such a case the flyover cables (produced by APH) could be replaced by a PCB.

AAPL: Apple price target raised to $236 from $190 at UBS

TheFly:

UBS raised the firm's price target on Apple to $236 from $190 and keeps a Neutral rating on the shares. The firm's analysis of Apple's App Store suggests August revenue grew 12% year-over-year, a modest uptick from the 11% growth in July despite a 200 basis point harder compare. However, on a currency neutral basis, August was up 12.4% year-over-year, in-line with July at 12.4% despite a modestly more difficult comp in August, the analyst tells investors in a research note. UBS says that going forward, the months of September through December are tough App Store comps. It believes the App Store is unlikely to contribute upside to its 13.0% forecast in September, Apple's September quarter Services guide of double digit growth, and the consensus estimate of 13.1%.

ADBE: Barclays previews the Q positively

Barclays points out three reasons why they like ADBE into 2H24 and F25:

Barclays estimates $460 million (upside to $475-$480M) in new Digital Media ARR, with Creative Cloud returning to year-over-year growth after overcoming pricing headwinds.

Barclays expects Firefly's growth to accelerate, driven by a new, more credit-intensive video tool coming before the end of 2024, potential partnerships with other AI models (like Sora), and increased clarity on Firefly's monetization.

Digital Experience gross margins recently surpassed 70%, expanding over 400 basis points in two years. This could support over 50 basis points of annual EBIT margin growth, along with revenue growth and share buybacks, contributing to 10-15% EPS growth.

TTD: BofA sees 'robust' growth for Trade Desk, starts with a Buy

As a leading, independent demand-side platform, or DSP, that has strategically positioned itself within the growing connected TV, or CTV, and Retail Media ad markets, Trade Desk is poised to benefit from anticipated robust growth over the next several years, the analyst tells investors. BAML believes “TTD's combination of attractive top line growth, high margins, compelling unit economics (~80% GMs) and long runway for growth warrants a premium valuation.” Over the next 3 years, BAML project revenues grow at a ~23% revenue CAGR and an EBITDA CAGR of ~27%

Alibaba to let rival Tencent's payment app into its 'walled garden'

HONG KONG -- The once formidable garden walls dividing China's biggest tech companies are set to get even lower as Alibaba plans to make rival Tencent's payment app available on Taobao and Tmall, the largest e-commerce platforms in China by market share.

All Taobao and Tmall sellers will soon be given the option to add WeChat Pay to their storefronts to "enhance consumers' shopping experience," Alibaba's Taobao and Tmall Group said in a notice to merchants on Wednesday, without giving a specific date.

Intel manufacturing business suffers setback as Broadcom tests disappoint

Sept 4 (Reuters) - Intel's (INTC.O), opens new tab contract manufacturing business has suffered a setback after tests with chipmaker Broadcom (AVGO.O), opens new tab failed, three sources familiar with the matter told Reuters, dealing a blow to the company's turnaround efforts.

The tests conducted by Broadcom involved sending silicon wafers - the foot-wide discs on which chips are printed - through Intel's most advanced manufacturing process known as 18A, the sources said. Broadcom received the wafers back from Intel last month. After its engineers and executives studied the results, the company concluded the manufacturing process is not yet viable to move to high-volume production.

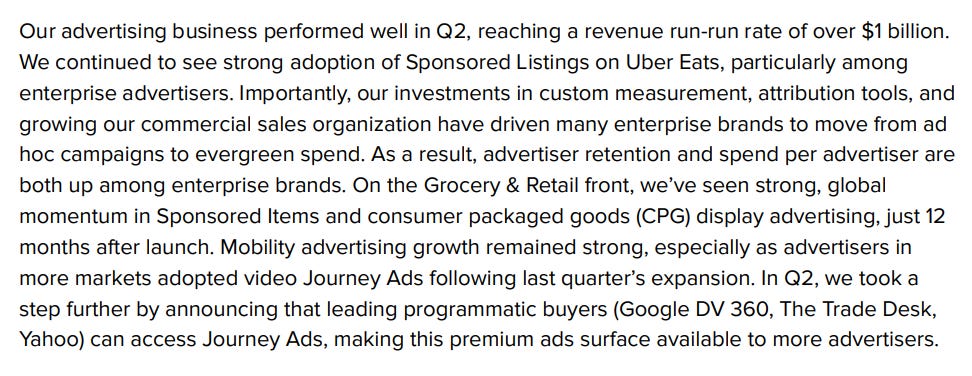

Snap CEO Rallies Workers on Ad Business Amid Stock Drop

Bloomberg:

Snap Inc. Chief Executive Officer Evan Spiegel is trying to rally employees amid a 48% drop in the stock this year, telling them in an internal letter that the company is on pace for record annual revenue and will continue to press forward on augmented reality.

“You may be wondering why, with all of the progress we’ve made in our business over the last year, our share price performance has lagged the overall market,” Spiegel wrote Tuesday in the letter. “The answer is simple: our advertising business is growing slower than our competitors.”

LYFT: Announces restructuring, 1% termination of employees. Reaffirms Q3, FY24 guide

MU: Mizuho raises ests but lowers PT fo $145 from $155

Mizuho takes an update on the HBM market as AI drives accelerated growth for HBM3e and as some major DRAM suppliers lag HBM3e qualifications. Mizuho sees 1) HBM market growing ~6x y/y to ~$25B in 2025E and towards ~$35B by 2026E; 2) HBM3e drive major upside for MU with revs growing 10-20X to $2-5B in C25-26E, alongside SK Hynix as key DRAM suppliers lag HBM supply traction, and 3) Average AI server HBM to content/GPU up 50-100% from 100 GB/GPU in 2023 to potentially as much as ~200 GB/GPU in 2025E, a tailwind for SemiCap and MU.

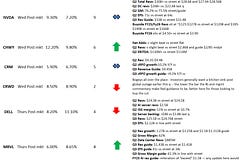

CIEN: Q3 looks ok so far with rev and eps beat…focus on the Q4 guide coming up…

CIEN RESULTS: Q3

- ADJ EPS $0.35 vs. $0.59 y/y, EST $0.26

- Revenue $942.3M, -12% y/y, EST $928.2M

- Networking platforms revenue $699.5M, -17% y/y, EST $691.3M

- Routing and switching revenue $92.7M, -27% y/y, EST $120.2M

- Platform software and services revenue $83.2M, +5.4% y/y, EST $86.7M

- Blue Planet Automation software and services revenue $25.8M, +97% y/y, EST $14.8M

- Global Services revenue $133.8M, +3.5% y/y, EST $137.1M

- Maintenance support and training revenue $74.4M, +2.1% y/y, EST $77.9M

- Installation and deployment revenue $46.5M, -0.6% y/y, EST $46.1M

- Consulting and network design revenue $12.9M, +34% y/y, EST $12.1M

GTLB: Solid report with rev beat,FY guide raise more than magnitude of beat, and accelerating RPO/cRPO

Rev growth beat by 3.5% and raised FY more than the beat.

RPO +51% and cRPO +42% vs 20% last q

Seven of the top ten deals were Ultimate driven, as was the majority (65%) of new ARR in the $100k+ ARR cohort

On the AI front mgmt. noted that …“So we really expect AI to start contributing to the model in FY 2026 and beyond.”

GTLB 2025 F/Y GUIDANCE

- Guides revenue $742.0M to $744.0M, saw $733.0M to $737.0M, EST $735.7M

GUIDANCE: Q3

- Guides revenue $187.0M to $188.0M, EST $187.7M

RESULTS: Q2

- Revenue $182.6M, EST $177.2M

- ADJ EPS $0.15, EST $0.10

- ADJ gross margin 91%

ZS: Ok #s but FY25 billings guide below street and buyside expectations

The midpoint of ZS's initial FY25 outlook calls for billings of $3,122.5MM / +19.0% y/y in line withstreet at $3,122MM / +20.0% y/y but below buyside expectations of 20%+. In its opinion, the biggest concern coming out of the earnings call

While the q was good, the big gripe among investors from the call was was commentary which implies billings growth of only 13% in 1H'F25 before improving to 23% in 2H'F25 as new sales representatives ramp in productivity.

ZS 2025 F/Y GUIDANCE

- Guides ADJ EPS $2.81 to $2.87, EST $3.36

- Guides calculated billings $3.11B to $3.14B, EST $3.12B

GUIDANCE: Q1

- Guides revenue $604M to $606M, EST $604.8M

RESULTS: Q4

- ADJ EPS $0.88 vs. $0.64 y/y, EST $0.70

- Revenue $592.9M, +30% y/y, EST $568.5M

- Deferred revenue $1.89B, +32% y/y, EST $1.9B

- Deferred revenue +32%

- Calculated billings $910.8M, +27% y/y, EST $892.7M

Other News:

China: China Weighs Cutting Mortgage Rates in Two Steps to Shield Banks..China is considering cutting interest rates on as much as $5.3 trillion of mortgages in two steps to lower borrowing costs for millions of families while mitigating the profit squeeze on its banking system. Financial regulators have proposed reducing rates on outstanding mortgages nationwide by a total of about 80 basis points, part of a package that includes an accelerated timeline for when mortgages become eligible for refinancing - Bloomberg

CPNG: Upgraded to Buy at CLSA

China eComm: Regulators call for investigation of Shein, Temu, citing reports of 'deadly baby products' – USA Today

DIS: DirecTV Says Disney Blackout Has No Easy Resolution, Even With NFL Season Starting – Variety

INTC: Intel’s Money Woes Throw Biden Team’s Chip Strategy Into Turmoil – Bloomberg

MU/Hynix: SK Hynix to start mass producing HBM3E 12-layer chips this month – Reuters

NVDA: Trendforce expects H200 to dominate Nvidia’s shipments from 2Q24 thanks to order pull-in demand from CSP and OEM customers – link

QCOM: Microsoft Rolled Out AI PCs That Can’t Play Top Games—and There’s No Quick Fix…Qualcomm-Arm processor chips have compatibility problems with ‘Fortnite’ and other titles – WSJ

QCOM: CNBC reported Qualcomm launched its Snapdragon X Plus 8-core processor as it looks to ramp up its push into the AI-PC space