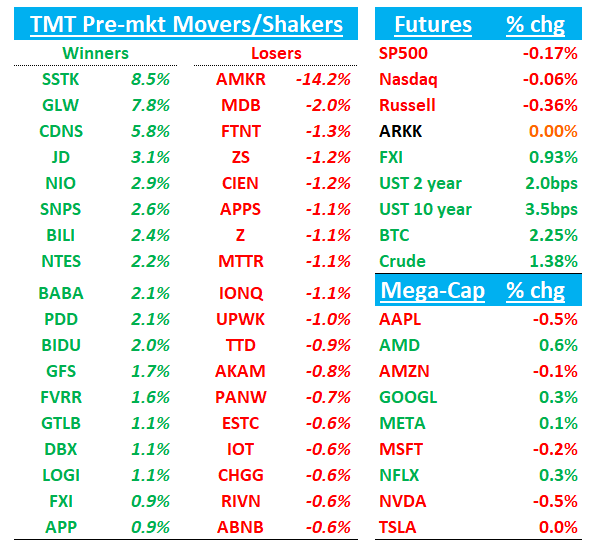

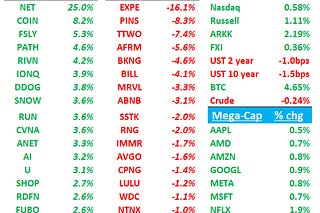

Good morning. QQQs flattish, yields ticking up 2-3bps across the curve and 10 year testing 4.3%; China +1.6% as reports of more stimulus swirl. BTC +2.6% gaining momentum and over $71k for first time since June. Big night of earnings ahead with AMD, GOOGL, SNAP, RDDT, and V on the docket among others.

We’ll hit up earnings recaps first (PYPL, GLW, CHKP, CDNS, FFIV) then dive into some research/news/3p from this morning. Let’s get to it.

PYPL -3%: Looks mixed with slight rev miss, better EPS (1.20 vs bogeys of 1.10); transaction margin $ and branded TPV better, but subdued Q4 guide and lack of go-forward narrative has stock selling off

Transaction margin $ beat at 8% y/y vs 4% y/y on 50bps TPV beat (branded held at 6% vs expects at 5%).

TPV +9% in line with street

TE rate dropped -2bps y/y (unbranded TPV slowed by 8ppt) and lower txn/credit losses.

EPS beat handedly 1.20 vs buyside expects of 1.10

Investors not as excited about the Q4 guide:

FY TM$ raised to MSD growth but even assuming 6% implies Q4 slows to 400bps to 3.5% y/y.

Q4 TPV guide to LSD vs street at 5.5% on slower Braintree TPV and Q4 EPS slightly below.

FY EPS raised to high teens vs low to mid teens prior.

Bulls will say print was fine and mgmt typically guides conservative and new initiatives will begin to ramp up at some point in 2025 while stock still only trading at 15x ‘26 P/E.

Bears will extrapolate weaker Q4 guide to 2025. In our preview we wrote why the go-forward narrative wasn’t great and likely why stock not being defended here as we head into next year:

As investors look forward TPV growth will likely come under more scrutiny while major ‘24 drivers won’t recur (Braintree pricing, float income flipping to a headwind, lower y/y transaction losses).

New product announcements (Adyen, Fastlane, etc.) won’t likely contribute much until 2H’2025 at the earliest.

Overall, we think quarter was ok and guide is conservative, but still think stock unexciting for us right now given lack of go-forward catalysts/narrative (although we do get an investor day in Feb 2025).

Q3 Results:

- ADJ EPS $1.20 vs. $0.98 y/y, EST $1.07

- Total payment volume $422.64B, +9% y/y, EST $421.64B

- Transaction margin dollars $3.65B

- Payment transactions 6.63B, +5.7% y/y, EST 6.83B

- Active customer accounts 432M, +0.9% y/y, EST 429.42M

- Net revenue $7.85B, +5.8% y/y, EST $7.88B

- Transaction revenue $7.07B, +6.2% y/y, EST $7.13B

- Other value added services revenue $780M, +2.1% y/y, EST $746.9M

- US net revenue $4.52B, +6.1% y/y, EST $4.43B

- International net revenue $3.33B, +5.3% y/y, EST $3.44B

- ADJ operating income $1.48B, EST $1.38B

- ADJ operating margin 18.8% vs. 16.9% y/y, EST 18.6%

GLW +8%: Results look good as co upped Q4 guide

GLW also outlined Display expectations for next year, which is mostly in line with the Street but better than feared given concerns around Yen (The company noted that Display net income is expected to be $900-950m for CY25). All segments beat with Optical driving biggest upside with 55% y/y growth in enterprise portion after GLW said would only be >40% y/y at their investor event in Sept

Q4 Guide:

EPS: 53-57c vs street at 52c

Revenue: $3.75B vs street at $3.65B

Q3 Results

- Core EPS $0.54 vs. $0.45 y/y, EST $0.52

- Core sales $3.73B, +7.9% y/y, EST $3.71B

- Display Technologies net sales $1.02B, +4.4% y/y, EST $1B

- Optical Communications net sales $1.25B, +36% y/y, EST $1.17B

- Specialty Materials net sales $548M, -2.7% y/y, EST $559.2M

- Environmental Technologies net sales $382M, -15% y/y, EST $417.6M

- Life Sciences net sales $244M, +6.1% y/y, EST $248M

- All Other net sales $298M, -8.9% y/y, EST $333.2M

From the PR:

Our outperformance was led by Optical Communications, with 36% year-over-year sales growth – and 55% sales growth in the Enterprise portion of the segment, driven by continued strong adoption of our new optical connectivity products for generative AI. We also demonstrated progress on the powerful incremental profit and cash flow embedded in our ‘Springboard’ plan – we saw significant operating margin expansion and generated $553 million of adjusted free cash flow.”

CHKP -7%: Weaker Q3 as billings miss and sub rev growth decels

Focus mainly on the billings miss given more positive sentiment on CHKP going into the print. Billings came in at 6% vs street at 8% expects closer to high single digits/10%, despite comp being 4 ppts easier

ST billings only 5% vs street at 9% and, and a decel from 7% despite comp being 6 ppts easier.

Total Revs only inline with street

Sub revs missed at 11.5% vs street at 12.5% and a decel from 14% last q and 15% in Q1

The one bright spot is product growth at 4% vs street at 2%

This stock had been a bit of a crowded long going into the print given CHKP is in the middle of a product cycle and checks had been good going in, so this will put a dent in bull’s thesis.

CDNS +6% as Rev beat and guide better than feared

Investor sentiment was generally cautious heading into the print (stock dn 23% from highs) so the better Q3 being looked at favorable as Revs beat by 3% and EPS came in at 1.64 vs street at 1.45 on better OPMs (45% vs street at 41.6%).

CDNS maintained FY24 revenue guidance at midpoint implying confidence in hw acceleration and China to get better. This somewhat de-risks Q4 in that guidance now requires 26% growth vs 29% before. EPS FY24 guide goes up by 3c. Mgmt expects dd growth in FY24 and GenAI continuing to be main driving force of growth. Backlog declined q/q but CFO said Q4’24 hw pipeline strongest Q4 during his tenure at the company.

Other key pts: SD&A saw >40% y/y rev growth helped by auto and aerospace while IP seg grew >50% y/y/Verification +20% y/y helping offset weaker trends in custom and digital.

Bulls will say this print supports view that 2024 exit growth sustainable in 2025 and that Q4 guide is de-risked as 1) hw product cycle should last through ‘25; 2) IP is getting better and 3) China weakness in ‘24 sets up an easy comp for next year

Q3 Results:

- ADJ EPS $1.64 vs. $1.26 y/y, EST $1.45

- Revenue $1.22B, +19% y/y, EST $1.18B

- Product and maintenance revenue $1.10B, +14% y/y, EST $1.1B

- Services revenue $115.1M vs. $57.3M y/y, EST $85.8M

- ADJ operating margin 45% vs. 41% y/y, EST 41.5%

- ADJ net income $450.2M, +31% y/y, EST $397.5M

FY 2024 Revenue GUIDE $4.61bn - $4.65bn vs. St est $4.628bn (Previous guidance $4.60-$4.66bn)

FY2024 Non GAAP Op Mgn GUIDE 42% to 43% vs Street est. 42.5% (Previous guide 41.7%-43.3%)

FY 2024 EPS GUIDE $5.87-$5.93 vs.street est. $5.89 (Previous guidance $5.77-$5.97)

FFIV: Better than Expected Q4 and FY25 reacceleration driven by software renewals

Revs beat by 2% and product revs beat by 6.6%, up 10% y/y driven by strong sw growth +19% y/y and improving systems demand. Co guided to reaccelerating rev growth in FY25 up 4-5% weighted toward FY25 driven by sw growth given FFIV has good visibility thanks to renewal basee containing the FY19 and FY22 cohorts (sw expected to grow HSD and Systems MSD)

Key takeaways from the call: 1) Software growth outlook: Management expects acceleration in H2'25 driven by strong renewal rates, Healthy expansion activity, Robust new business pipeline 2) Systems business recovery: Projecting mid-single-digit growth for FY25, gaining market share and benefiting from refresh cycle momentum; 3) AI opportunity: Seeing demand across both hardware and software offerings, several early customer wins secured. No AI upside included in FY25 guidance 4) Federal business stability: No disruption from Carahsoft relationship (10% of Q4FY23 revenue) as U.S. government bookings meeting expectations

Bulls will say the above points all sound good, especially AI opportunity and reacceleration in total revs driven by high margin/high visibility sw. Stock still only 15x fwd P/E.

Bears will say certain growth areas not showing growth needed for a re-rating as security revs flat y/y and ARR of core SaaS and managed serves was up only ~5%. Seems like bulls have it for now.

GUIDANCE: Q1

- Guides revenue $705M to $725M, EST $703.1M

- Guides ADJ EPS $3.29 to $3.41, EST $3.37

RESULTS: Q4

- Net revenue $746.7M, +5.6% y/y, EST $730.7M

- Net service revenue $388.4M, +1.8% y/y, EST $393.9M

- Net product revenues $358.3M, +10% y/y, EST $337.3M

- ADJ EPS $3.67 vs. $3.50 y/y, EST $3.46

- ADJ net income $217M, +3.8% y/y, EST $203.7M

Research/News

3P Roundup

UBER: Hearing 3p saying Q4 tracking slight above street

BKNG: Hearing M-sci positive on Q4 volumes

AMZN: Hearing slight downtick at Yip in weekly retail data

CVNA: Hearing 3p saying units accel’d to 70% in latest week

TTD: New Street downgrades TTD to Sell on more harder post-election comps as we head into 2025

New Street understands the rally in TTD as smaller walled gardens continue giving TTD more access to their premium inventory and the company's top competitor, GOOGL’s DV 360, continues to give share according to all of the firm's recent industry conversations. New Street continues to believe TTD is best-in-class for vision, strategy and execution. However, New Street says the key challenge is 2025 as street estimates imply implies about 30% core spend growth excluding political, up from 19% in 2024. NS believes that core spend growth can accelerate in 2025, just not to the level that consensus implies, arguing that 2025 consensus is not properly reflecting the difficult comps that will follow the U.S. election.

WFS Initiates TTD (Buy, $150 PT) APP (Buy, $200 PT), U(Hold, $20 PT)

On APP, WFS notes they see similarities between APP’s market position in mobile games and Google in programmatic, after purchasing DoubleClick in 2008. As a result, WFS expects APP to continue capturing share and beating revenue estimates in the $34B sector. WFS believes the mobile game user acquisition market is large enough for APP to compound 20-30% software revenue growth through 2027.

On TTD, WFS sees multiple factors benefiting the co, particularly AMZN accelerating shift of advertising spend to connected TV, new partnerships ramping and Google distracted with regulatory woes. Wells is looking past the stock's elevated valuatio" in light of positive industry trends and estimates which are above street. Wells also believes introducing ads on Prime Video accelerated connected TV industry growth, benefiting Trade Desk, which goes against what some on the buyside are thihnking.

On U, Wells thinks the company's new management has made strides in turning it around, by trimming the portfolio and rectifying the runtime fee issue. However, Wells notes that fixing Unity Ads requires even better execution and sees a lack of compelling r/r.

WMT/AMZN: Walmart slashes Walmart Plus subscription price by half ahead of holidays

Walmart (WMT.N), opens new tab said on Monday it would offer its membership service, Walmart Plus, at a 50% discount ahead of the holiday season, as the retailer attempts to close the gap with rival Amazon.com's (AMZN.O), opens new tab Prime subscription service.

As part of these early deals, Walmart is offering a one-year Walmart Plus membership for $49, down from its regular $98, from Monday through Dec. 2.

This move highlights Walmart's efforts to compete with Amazon Prime, which costs $139 per year and has over six times more subscribers. According to Consumer Intelligence Research Partners, Amazon Prime has 180 million U.S. subscribers, while eMarketer estimates Walmart Plus will reach 32 million by the end of this year.

AAPL: Citi says Apple Intelligence software release to impact iPhone sales

TheFly:

Citi believes a prolonged Apple Intelligence software release likely impacts typical iPhone sales seasonality this year. The firm models September and December quarter iPhone sales 2% and 3% below the Street, respectively, on delay of Apple Intelligence software features to spring of next year. That said, Citi still believes in a "strong" 9% year-over-year iPhone 17 unit driven upgrade cycle next year once Apple Intelligence software is fully released. It maintains a Buy rating on the shares with a $255 price target.

META: BAML comments on META search engine announcement, saying a sentiment neg for GOOGL

BofA's Justin Post comments on The Information's report that Meta is developing a web-scanning search engine to provide conversational responses about news and current events through its Meta AI chatbot. While Meta's AI developments were anticipated, Post suggests the increasing reports of potential search competition create "negative sentiment" around Alphabet and Google search. However, the analyst believes Meta faces significant disadvantages in data collection and web crawling capabilities compared to Google, given Meta AI's currently limited user base. While acknowledging the possibility that some internet traffic could shift away from Google Search (which holds 90% global market share), Post suggests Google should emphasize its new AI Overview features and any associated search query growth to address mounting concerns about market share erosion.

ROKU: Roku price target raised to $65 from $60 at Morgan Stanley as they preview the q

MS notes ROKU shares have climbed approximately 35% post-Q2 results, attributing this gain to market optimism around advertising strength and new growth initiatives, which many believe could drive better-than-expected performance and accelerated growth heading into 2025. However, Swinburne suggests this positive sentiment may be "too early" and believes investors are underestimating competitive pressures in the space.

FTNT: Cantor assumes coverage at neutral with PT to $88 up from $65 on improving fundamentals

Cantor notes recent checks highlight improvement in partner sell-through in Q324 relative to Q224, with several partners noting a material bounce-back in growth from 1H24, in addition to channel inventory stocking that sounds broader relative to Q224. Just over half of the partners Cantor spoke to (9 of 17) noted success in closing SASE deals. In addition, Cantor hears of increased channel-incentive activity, including take-out campaigns focused on the company's superior price/performance and TCO, in addition to channel incentives for longer-term contracts. Partner pipeline expectations are also growing, with partner growth assumptions for FY25 in the low double-digit range versus high single digits previously.

Chinese EV Stocks Jump as Government Expected to Boost Purchases

Chinese electric-vehicle stocks rallied in Hong Kong after state media reported on government measures to support the sector’s development.

Central-government agencies will increase purchases of new-energy vehicles, state media Xinhua News Agency reported Tuesday, citing a government guideline dated Sept. 27 that said EVs should be no less than 30% of new vehicles purchased annually in principle.

It also stated that the purchase price per vehicle should not be above 180,000 yuan ($25,200), and recommended measures like construction of charging infrastructure to make EV usage easier.

FSLR: First Solar upgraded to Buy at Janney Montgomery Scott ahead of earnings

The stock has declined approximately 32% from its mid-June peak of $300, reflecting market concerns about delayed projects, AD/CVD tariff decisions, and election-related uncertainties. Given the current valuation, Milligan sees a "significantly better risk-reward balance." The analyst suggests clarity should emerge post-election and notes that a Trump victory could heighten focus on tariffs, which they believe would positively impact long-term pricing assumptions.

Other News:

AAPL: Apple Ships $6 Billion of iPhones From India in Big China Shift – Bloomberg

Global Semis: Japan to offer multi-year financial support for semiconductor industry; NHK reports that the Ministry of Economy, Trade and Industry is considering a new framework that provides financial support to Japanese chipmakers for multiple years, w/ a bill expected to be submitted as early as next year

Global Semis: U.S. finalizes China tech investment ban targeting AI, chips – Nikkei Asia

RPD: Exclusive: Cybersecurity firm Rapid7 fields buyout interest, sources say – Reuters

Semis/Hard Tech: US lawmakers urge review of China threat from silicon photonics technology – Reuters