TMTB EOD Wrap

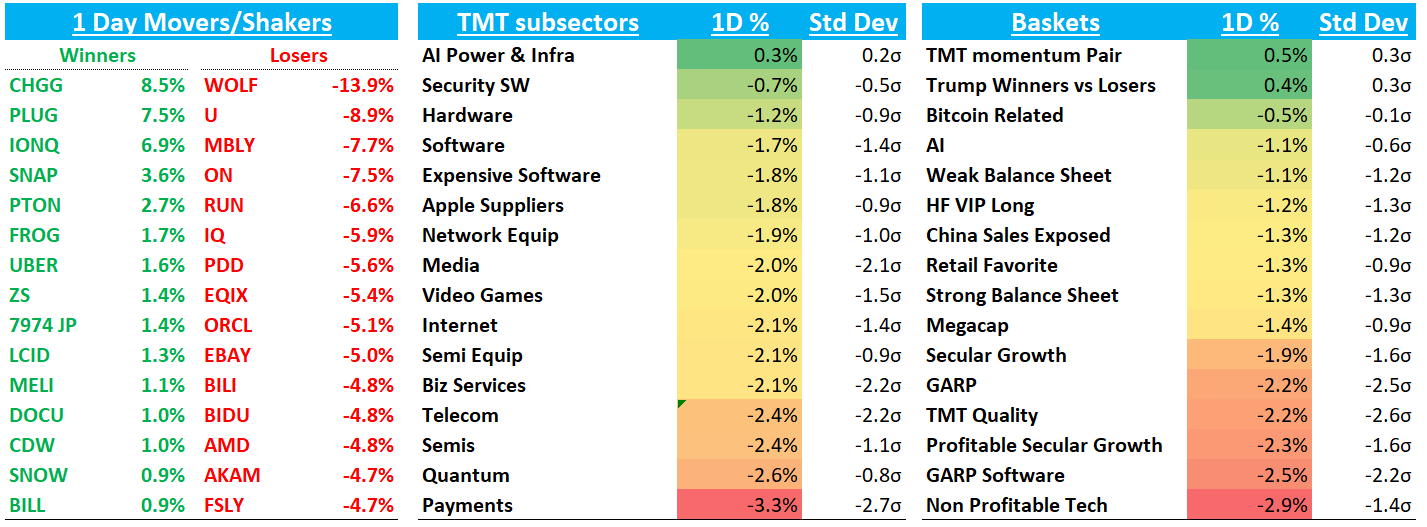

QQQs - 1.6% following a hot jobs report and a big jump in Michigan inflation expectations. Yields spiked 12bps while 10 year was up 8bp to 4.76% while fed expectations now sit at just 28bps worth of easing (down from 40bps). Oil +3.6%. BTC held in relatively well +3%. All eyes now shift to CPI on Wednesday of next week and then Megacap earnings following that, where focus has shifted to fx impact and comp’ing a leap year (see NFLX -4% as JPM cut #s).

Still not seeing great price action from stocks although would characterize today as “mediocre” rather than downright bad. Things like SNOW and TSM were up on good news and you have DKNG rallying once bad news priced in and out of the way, but PINS and TEAM both down on upgrades and UPST/ABNB down on what I thought were pretty solid 3p updates (although CHWY fared better).

Supreme court arguments didn’t seem to have gone too well for Tiktok, helping META +1%, SNAP +3.5%. Key points from hearing: TikTok lawyer emphasized First Amendment rights, but justices focused on ownership concerns rather than speech rights. Lawyer's questionable analogies and weak national security arguments were poorly received. Bloomberg reported Supreme Court likely to uphold ban. Timeline now is January 19 disposal deadline, with Trump taking office January 20. Ban would temporarily affect app updates assuming Trump extends disposal deadline to mid-April. While Oracle, and other private players have showed interest, resolution could also be through US IPO or shareholder carve-out. At this point, legal path to block bill appears increasingly difficult given judicial response.

Rogan / Zuck 3 hour episode now uploaded - link here and a summary here

Let’s get to the recap…

Internet

SNAP +3.6% / META +1% helped by poor Tiktok showing

NFLX -4.2% as JPM cut #s on fx and lowered PT

EBAY -5% giving back some gains from Wednesday as sell-side estimates for GMV impact from META putting EBAY listings on marketplace not as big as initially speculated and still some skepticism on what exactly rollout will look like. Stock now only +4% since announcement (we think deserves more than that). Some skittishness from investors in getting in front of Q4 report given fx headwinds and concerns EBAY to embed some margin compression in their initial ‘25 guide.

ROKU -4.6% as Moffett downgraded to Hold

SHOP -4% after being down 8% at one point - Yip was out saying GMV tracking inline to slightly above street

Other large cap: AMZN -1.5%; GOOGL -1%

UBER +1.6% as Waymo CEO didn’t say anthing incremental at CES on Wed night (link)

PINS -70bps on a Monness Crespi upgrade which didn’t have much juice

Semis

TSM +60bps after reporting 58% y/y December numbers, an accel from 34% in Nov and 29% in Oct and +1% m/m much better than typical Dec seasonality of -7%.

NVDA -3% as Biden outlined new rules imposing tougher restrictions on AI chip exports. NVDA VP Finkle: 'We would encourage President Biden to not preempt incoming President Trump by enacting a policy that will only harm the US economy, set America back, and play into the hands of US adversaries ... This last-minute Biden administration policy would be a legacy that will be criticized by US industry and the global community'. Anytime a company comes out defending so hard makes me think the potential impact is not insignificant. MS out also saying they think CFO sounded hedged on near-term upside, sounding enthusiastic for BW but also highlighting complexities in the ramp and MS thinks bigger beats coming in 2H. Stock closed well below the $140 level we were watching.

AMD - 4.8% on Biden rules and GS downgrade

Other AI names mixed: MU flat; ANET -1%; AVGO -2%; MRVL -3%

Software

TEAM -90bps despite BMO upgrade

SNOW +90bps on Barclays upgrade

DOCU +1% as they sounded good on BAML bus tour…key points: IAM potential to expand contract values significantly ($2-5M ACV vs current $300K+). Core e-signature market still shows growth runway, with major clients at only 30% penetration. New offerings include data extraction from agreement repository and no-code workflow tool Maestro for system integration. Efficiency improvements through self-service expansion should enable more new logo focus. Management plans to continue FCF-funded share buybacks.

BILL +90bps on GS upgrade

CRM -3% - Benioff was on Logan Barlett podcast (link here)..key points: expects CRM to be first in sw to deliver $1b in agentic rev, “hopefully short-term” and said CRM maybe not hire anybody in engineering this year given incredible productivity gains

APP -3% despite positive initiation at Benchmark

Elsewhere:

AAPL -2.4% after Ming-Chi Kuo warned that the iPhone maker will "encounter more challenging hurdles in 2025, including nearly stagnant iPhone growth." Based on the analyst's latest industry research, he argues 2025 iPhone shipments may fall 8%-10% below consensus, Kuo stated in a Medium post earlier today. There is "no evidence" of Apple Intelligence driving hardware upgrades or service revenue. Barclays was also out saying AAPL earnings report to be “mixed at best” given choppy iPhone recovery and Zuck was on Rogan talking trash: “'They haven’t really invented anything great in a while—Steve Jobs invented the iPhone, and now they're just kind of sitting on it 20 years later... Apple’s basically squeezing people with a 30% tax on developers and making it tough for other devices to connect. If Apple removed all their random rules, we’d make twice as much profit—and that’s just us. It’s wild'

TSLA flat as they launched new model Y in China

DKNG +3% continues to perform well after FLUT neg pre announcement

Fintech weak: COIN -50bps/HOOD -1.8% held in ok given BTC strength…UPST -2.5% outperformed AFRM -5.8% on a better Yip update as they said Dec loan growth accel’d…SQ/PYPL -5%