逾越节晚餐,斯特赖特公司生产数百万片无酵饼

Where it came from, what it all means, and why it still matters.

它来自哪里,它意味着什么,以及为什么它仍然很重要。

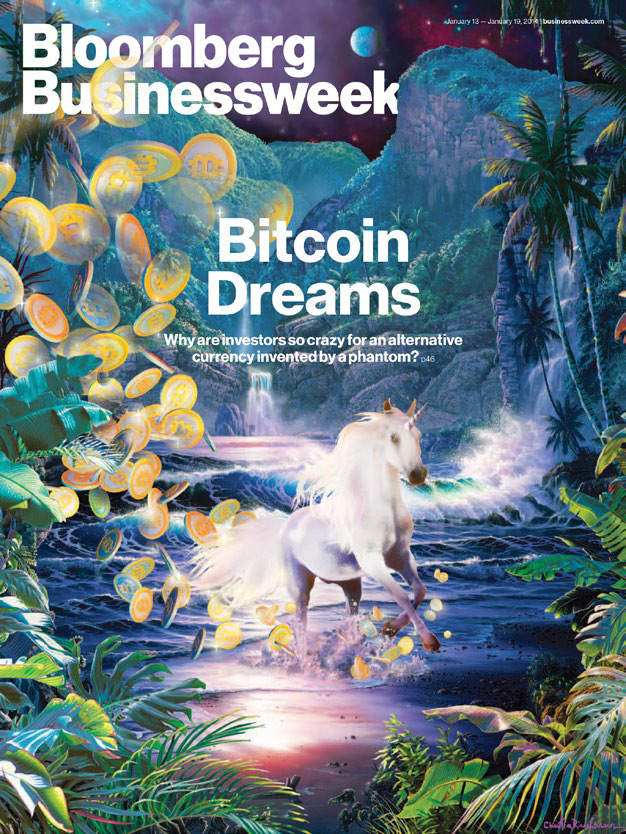

There was a moment not so long ago when I thought, “What if I’ve had this crypto thing all wrong?” I’m a doubting normie who, if I’m being honest, hasn’t always understood this alternate universe that’s been percolating and expanding for more than a decade now. If you’re a disciple, this new dimension is the future. If you’re a skeptic, this upside-down world is just a modern Ponzi scheme that’s going to end badly—and the recent “crypto winter” is evidence of its long-overdue ending. But crypto has dug itself into finance, into technology, and into our heads. And if crypto isn’t going away, we’d better attempt to understand it. Which is why we asked the finest finance writer around, Matt Levine of Bloomberg Opinion, to write a cover-to-cover issue of Bloomberg Businessweek, something a single author has done only one other time in the magazine’s 93-year history (“What Is Code?,” by Paul Ford). What follows is his brilliant explanation of what this maddening, often absurd, and always fascinating technology means, and where it might go. —Joel Weber, Editor, Bloomberg Businessweek

还记得不久前的一刻,我想:“如果我一直误解了加密货币这一切?”我是一个怀疑的普通人,老实说,我并不总是理解这个已经存在了十多年的另一个宇宙。如果你是一个信徒,这个新维度就是未来。如果你是一个怀疑者,这个颠倒的世界只是一个现代庞氏骗局,最近的“加密货币寒冬”是它即将结束的证据。但是,加密货币已经渗透到金融、技术和我们的思想中。如果加密货币不会消失,我们最好尝试理解它。这也是为什么我们邀请了 Bloomberg Opinion 的顶尖金融作家 Matt Levine 撰写了 Bloomberg Businessweek 的封面故事,这是该杂志 93 年历史中仅有的第二次由单一作者完成的(第一次是 Paul Ford 的“What Is Code?”)。以下是他对这个让人困惑、常常荒谬却总是迷人的技术的精彩解释,以及它可能的发展方向。—Joel Weber,Bloomberg Businessweek 编辑

MODERN LIFE CONSISTS IN LARGE PART OF ENTRIES IN DATABASES.

现代生活很大程度上是由数据库中的条目所组成的。

If you have money, what you have is an entry in your bank’s database saying how much money you have. If you have a share of stock, what you have is generally an entry on a list—kept by the company or, more likely, some central intermediary1—of who owns stock.

如果你有钱,你拥有的其实是你银行数据库中的一条记录,表明你拥有多少钱。如果你拥有股票,一般来说,你拥有的就是一份名单上的记录——由公司或更可能是某个中央中介机构保存的——记录谁拥有股票。

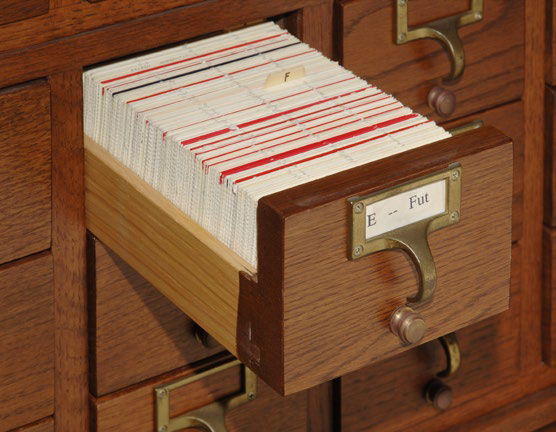

If you own a house, things are slightly different. There’s a house involved. But your ownership of that house is probably written down in some database; in the US this often means there’s a record of you buying the house—your title—in a filing cabinet in the basement of some county clerk’s office. (It’s not a very good database.) In many ways the important thing here is the house: You have a key to the front door; your stuff is there; your neighbors will be unsurprised to see you leaving the house in the morning and would be surprised to see someone else coming back in. But in many other ways the important thing is the entry in the database. A bank will want to make sure you have the title before giving you a mortgage; a buyer will want to do the proper procedures to that record before paying you for the house. The key will not suffice.

如果你拥有房产,情况略有不同。这里涉及到房产本身。但是,你对该房产的所有权可能被记录在某个数据库中;在美国,这通常意味着你购买房产的记录——房产所有权证书——被存放在某个县政府办公室地下室的文件柜中。(这不是一个非常好的数据库。)在很多方面,重要的是房产本身:你拥有前门的钥匙;你的东西都在那里;你的邻居不会对你早上离开房产感到惊讶,也不会对其他人回来感到惊讶。但是在其他很多方面,重要的是数据库中的记录。银行在给你贷款之前会确保你拥有所有权证书;买家在支付房产款项之前也会对该记录进行适当的处理。钥匙是不够的。

Lots of other stuff. Much of modern life occurs online. It’s not quite true that your social life and your career and your reputation consist of entries in the databases of Meta Platforms and Google and Microsoft, but it’s not quite false, either.

还有许多其他事情。现代生活的大部分发生在网上。你的人际关系、职业生涯和名誉不完全是由 Meta Platforms、Google 和 Microsoft 的数据库条目所组成的,但也不能说完全不是这样。

Some of this stuff has to do with computers. It’s far more convenient for the money to be computer entries than sacks of gold or even paper bills. Some of it is deeper than that, though. What could it mean to own a house? One possibility is the state of nature: Owning a house means 1) you’re in the house, and 2) if someone else tries to move in, you’re bigger than them, so you can kick them out. But if they’re bigger than you, now they own the house.

有些事情与计算机有关。将钱存在计算机 entries 中比装在金袋或纸币中方便多了。然而有些事情比这更深刻。拥有一个房子是什么意思?一种可能性是自然状态:拥有一个房子意味着 1) 你在房子里,2) 如果其他人试图搬进来,你比他们强大,所以你可以把他们赶出去。但如果他们比你强大,现在他们就拥有了房子。

Another possibility is what you might think of as a village. Owning a house means you live there and your neighbors all know you live there, and if someone else tries to move in, then you and your neighbors combined are bigger than them. Homeownership is mediated socially by a high-trust network of peers.

另一种可能性是,你可能会认为它是一个村庄。拥有房产意味着你居住在那里,你的邻居都知道你居住在那里,如果有人尝试搬进来,那么你和你的邻居加起来比他们更强大。房产所有权是通过一个高信任的同伴网络在社会上得到调节的。

A third possibility is what you might think of as a government. Owning a house means the government thinks you own the house, and if someone else tries to move in, then the government will kick them out.2 Homeownership is mediated socially by a government. The database is a way for the government to keep track. You don’t have to trust any particular person; you have to trust the rule of law.

第三种可能性是政府。拥有房产意味着政府认为你拥有这所房产,如果其他人尝试搬进来,那么政府就会将他们赶出去。房产所有权是由政府在社会层面上调节的。数据库是政府跟踪房产所有权的一种方式。你不需要信任特定的个人,而是需要信任法治。

Money is a bit like that, too. Sacks of gold are a fairly straightforward form of it, but they’re heavy. A system in which your trusted banker holds on to your sacks for you and writes you letters of credit, and you can draw on those letters at branches of the bank run by your banker’s cousin—that’s pretty good, though it relies on trust between you and the banker, as well as the banker and the banker’s cousin. A system of impersonal banking in which the tellers are strangers and you probably use an ATM anyway requires trust in the system, trust that the banks are constrained by government regulation or reputation or market forces and so will behave properly.

钱也有点像这样。金币袋是一种非常直接的形式,但它们很重。有一个系统,你信任的银行家为你保管金币袋,并为你开具信用函,你可以在银行家的堂弟开设的银行分行上提取这些信用函——这非常好,只是它依赖你和银行家之间的信任,以及银行家和银行家的堂弟之间的信任。在一个匿名银行系统中,出纳员是陌生人,你可能使用自动柜员机,无论如何都需要信任系统,信任银行受到政府监管、声誉或市场力量的约束,因此会行为得当。

Saying that modern life is lived in databases means, most of all, that modern life involves a lot of trust.

现代生活是在数据库中度过的,这最重要的一点是,现代生活需要大量的信任。

WE TRUST THE KEEPERS OF THE DATABASES.

我们信任数据库的守护者。

Sometimes this is because we know them and consider them to be trustworthy. More often it means we have an abstract sense of trust in the broader system, the system of laws and databases and trust itself. We assume that we can trust the systems we use, because doing so makes life much easier than not trusting them and because that assumption mostly works out. It’s a towering and underappreciated achievement of modernity that we mostly do trust the database-keepers,

有时候这是因为我们认识他们,并认为他们是值得信任的。更多时候,这意味着我们对更广泛的系统拥有抽象的信任感,即法律、数据库和信任体系本身。我们假设我们可以信任我们使用的系统,因为这样做使生活变得比不信任他们更容易,同时这种假设通常也能奏效。这是现代社会一个高耸且被低估的成就,即我们大多数时候都信任数据库的管理者。

and that they mostly are trustworthy.

他们大多数是值得信任的。

But we don’t always trust them, and they’re not always trustworthy.

但是我们并不总是信任他们,他们也并不总是值得信任的。

Sometimes they just aren’t. There are banks you can’t trust to hold your money for you and places where you can’t trust the rule of law to regulate them. There are governments you can’t trust not to seize your money from the banks, or falsify election results, or change the property registry and take your house. There are social media companies you can’t trust not to freeze your account arbitrarily. Most people in the US, most days, live in a high-trust world, where it’s easy and reasonable to trust that the intermediaries who run the databases that shape our lives will behave properly. But not everyone everywhere lives like that.

有时候它们不可信任。有些银行不可信任,无法确保它们为你保管钱款;有些地方法律规则不可靠,无法监管它们。有些政府不可信任,不会从银行中没收你的钱款、篡改选举结果、更改房产登记册并夺走你的房子。有些社交媒体公司不可信任,随意冻结你的账户。美国的大多数人在大多数日子里生活在一个高信任度的世界中,在这里很容易相信那些管理我们生活数据库的中间机构会行为得当。但并不是每个人在每个地方都生活得如此。

Even in the US, trust can be fragile. The 2008 financial crisis caused huge and lasting damage to a lot of people’s trust in the banking system. People trusted banks to do nice, safe, socially productive things, and it turned out they were doing wild, risky things that caused an economic crisis. After that it became harder for many people to trust banks to hold their savings.

即使在美国,信任也可能非常脆弱。2008 年的金融危机对许多人对银行系统的信任造成了巨大和持久的损害。人们原本信任银行会做些良好、安全、有社会效益的事情,但结果发现它们却在做些疯狂、冒险的事情,导致经济危机。从那以后,许多人更难以信任银行来存放自己的储蓄。

Also, though, you might have a philosophical objection to trust. Even if your bank has an absolutely unblemished record of keeping track of your money, that might not be good enough for you. Your bank is, to you, a black box. “How do I know you’ll give me my money back?” you could ask the bank. And the bank will say things like “Here are our audited financial statements” and “We are regulated by the Federal Reserve and insured by the Federal Deposit Insurance Corp.” and “We have never not given back anyone’s money.” And you’ll say, “Yes, yes, that’s all fine, but how do I know?” You don’t. Trust is built into the system, a prerequisite. You might want proof.3

此外,你可能会对信任持有哲学上的反对意见。即使你的银行有着绝对无瑕的记录,始终如一地管理你的钱财,这对你来说也许仍然不够。你眼中的银行是一个黑箱。“你如何确保把我的钱退还给我?”你可能会问银行。银行会说类似的话,如“这里是我们的审计财务报表”、“我们受到联邦储备局的监管和联邦存款保险公司的保险”、“我们从未不退还任何人的钱财”。你会说,“是的,是的,这一切都很好,但我如何知道?”你不知道。信任是系统中固有的前提。你可能想要证据。

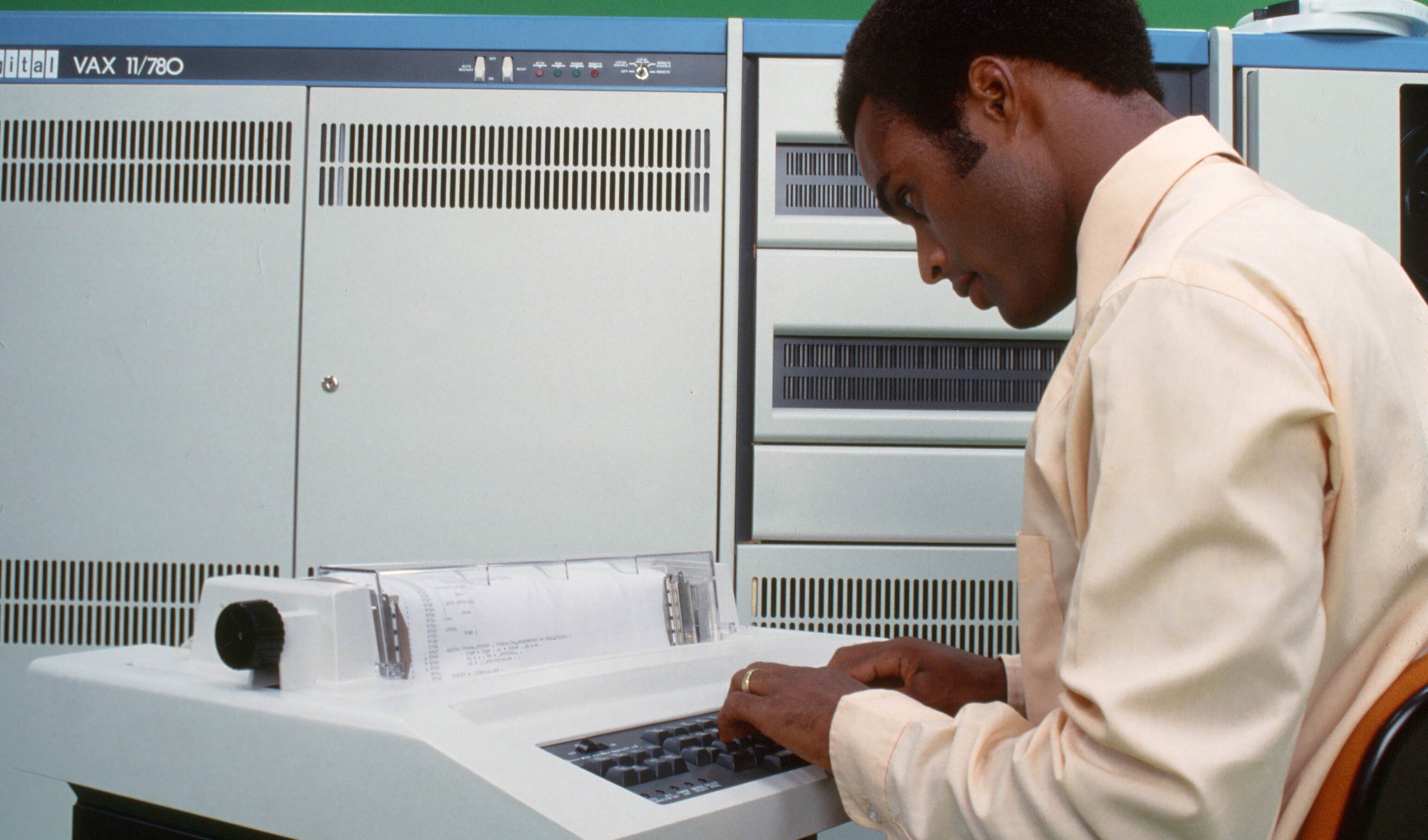

Even if you’re generally cool with trusting the keepers of modern databases, you might have a more technical objection. These databases aren’t always very good. Lots of the banking system is written in a very old computer language called Cobol; in the US people still frequently make payments—electronic transfers between electronic databases of money—by writing paper checks and putting them in the mail. US stock trades take two business days to settle: If I buy stock from you on a Monday, you deliver the stock (and I pay you) on Wednesday. This isn’t because your broker has to put stock certificates in a sack and bring them over to my broker’s office, while my broker puts dollar bills in a sack and brings them over to your broker’s office, but because the actual process is a descendant of that. It’s slow and manual and sometimes gets messed up; lots of stock trades “fail.”

即使你通常信任现代数据库的管理者,你也可能有技术上的异议。这些数据库并不总是很好。银行系统的大部分是用一种非常古老的计算机语言 Cobol 编写的;在美国,人们仍经常通过写纸质支票并邮寄来进行支付——电子数据库之间的电子转账。美国股票交易需要两天的结算期:如果我在星期一从你那里购买股票,你将在星期三交付股票(我付款给你)。这不是因为你的经纪人需要将股票证书装入袋子并带到我的经纪人办公室,而我的经纪人需要将美元钞票装入袋子并带到你的经纪人办公室,而是因为实际过程是从那时继承下来的。它缓慢、手动,有时会出问题;很多股票交易“失败”。

Subscribe to the Bloomberg Crypto podcast to listen to this story. New chapters every Sunday.

订阅彭博加密货币播客,收听这个故事。每周日更新新章节。

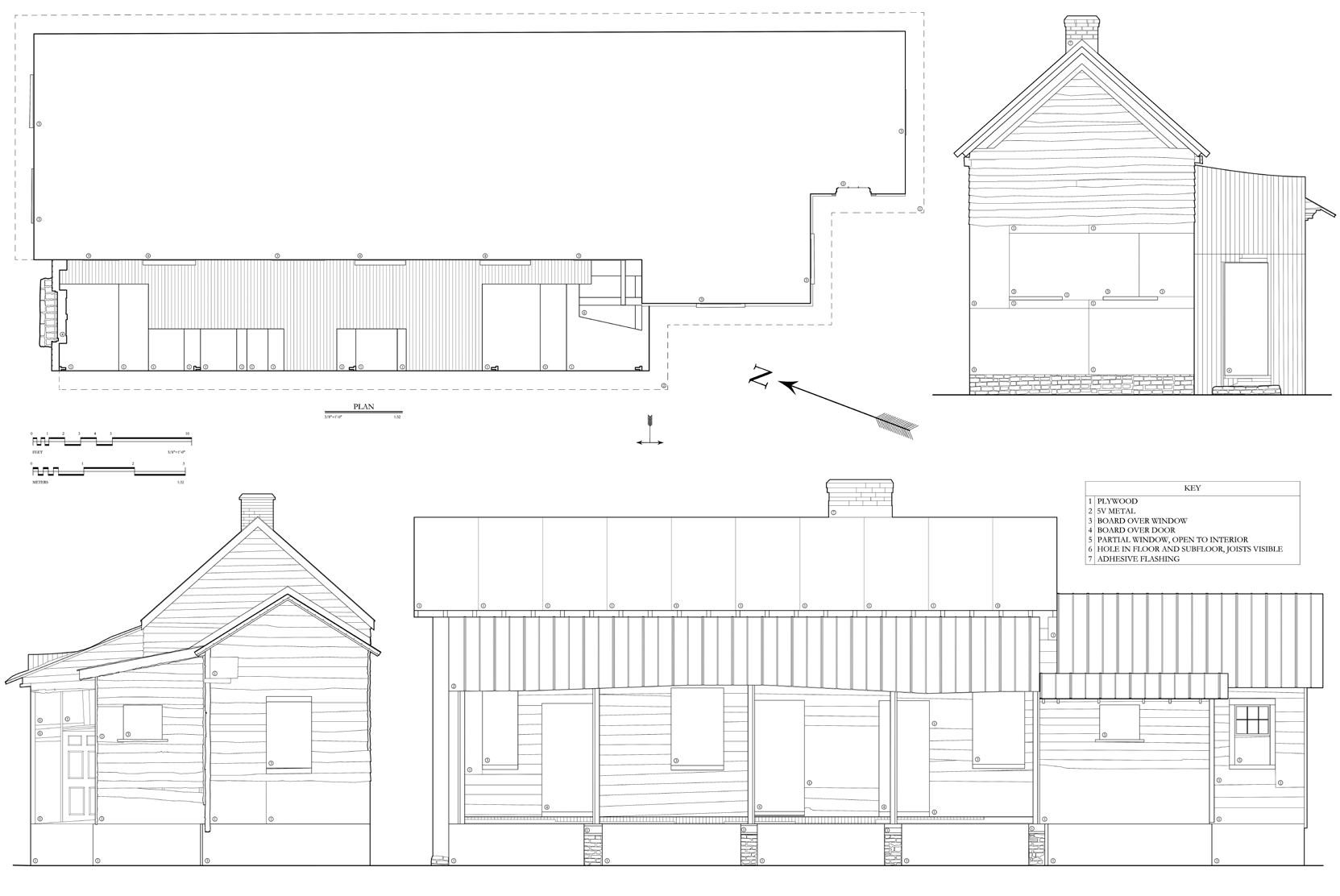

Don’t even get me started on the property registry. If you buy a house, you have to go to a ceremony—a “closing”—where a bunch of people with jobs like “title company lawyer” mutter incantations that let you own the house. It can take hours.

别提房产登记册了。如果你买了一所房子,你需要参加一个仪式——“结算”——其中一群人拥有像“房产公司律师”这样的工作,他们念念有词,让你拥有这所房子。这可能需要几个小时。

If your model of how a database should work comes from modern computers, the hours of incantations seem insane. “There should be an API,” you might think: There should be an application programming interface allowing each of these databases to interact with the others. If your bank is thinking about giving you a mortgage, it should be able to query the property database automatically and find out that you own your house, rather than send a lawyer to the county clerk’s office. And it should be able to query the Department of Motor Vehicles registry automatically and get your driver’s license for identification purposes, and query your brokerage account automatically and examine your assets.

如果你的数据库工作模型来自现代计算机,那么这些念念有词的小时数看起来简直疯狂。“应该有一个 API,”你可能会想:应该有一个应用程序编程接口,允许这些数据库相互交互。如果你的银行考虑给你一份抵押贷款,它应该能够自动查询房产数据库,查明你拥有这所房子,而不是派律师到县书记员办公室去。同时,它也应该能够自动查询机动车辆管理局登记册,获取你的驾驶执照,以便身份验证,并自动查询你的证券账户,检查你的资产。

What if we rewrote all the databases from scratch, in modern computer languages using modern software engineering principles, with the goal of making them interact with one another seamlessly?

假设我们从头开始,用现代计算机语言和现代软件工程原则重写所有数据库,以实现它们之间的无缝交互?

If you did that, it would be almost like having one database, the database of life: I could send you money in exchange for your house, or you could send me social reputation in exchange for my participation in an online class, or whatever, all in the same computer system.

如果你那样做了,那几乎就像拥有一个数据库,生命数据库:我可以用钱换取你的房子,你可以用社交声誉换取我参加在线课程的参与,或者其他什么,都在同一个计算机系统中。

That would be convenient and powerful, but it would also be scary. It would put even more pressure on trust. Whoever runs that one database would, in a sense, run the world. Whom could you trust to do that?

这样做会非常方便和强大,但同时也非常可怕。这将给信任带来更大的压力。谁掌控那个数据库,实际上就掌控了世界。谁值得信任来做这件事?

What if there was one database, and everyone ran it?

假设只有一个数据库,而每个人都在使用它?

In 2008, Satoshi Nakamoto published a method for everyone to run a database, thus inventing “crypto.”

2008 年,中本聪发布了一种让每个人都能运行数据库的方法,从而发明了“加密货币”。

Well, I’m not sure that’s what Satoshi thought he was doing. Most immediately he was inventing Bitcoin: A Peer-to-Peer Electronic Cash System, which is the title of his famous white paper.

好吧,我不确定那是否是中本聪想做的事情。他最直接的成就是发明比特币:一种点对点的电子现金系统,这也是他著名的白皮书标题。

What Satoshi said he’d invented was a sort of cash for internet transactions, “an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” If I want to buy something from you for digital cash—Bitcoin—I just send you the Bitcoin and you send me the thing; no “trusted third party” such as a bank is involved.

佐藤说他发明了一种用于互联网交易的现金,“基于密码学证明而不是信任的电子支付系统,允许任何两方愿意交易直接相互交易,不需要第三方信任机构。”如果我想从你那里购买某样东西,用数字现金——比特币——我只要将比特币发送给你,你就将东西发送给我;不需要“第三方信任机构”,例如银行。

When I put it like that, it sounds as if Satoshi invented a system in which I can send you Bitcoin and nobody else is involved. What he actually invented was a system in which lots of other people are involved.

当我这样说时,听起来像是佐藤发明了一种系统,我可以将比特币发送给你,而没有其他人参与。实际上,他发明了一种系统,其中有许多其他人参与。

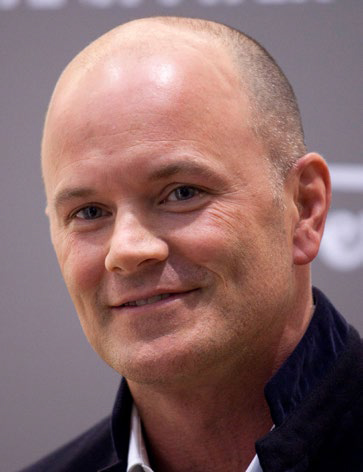

Hi! I’m Matt. I’m a former lawyer and investment banker. Now I’m a columnist at Bloomberg Opinion. In my day job, I write about finance. I like finance. It’s fun to write about. It’s a peculiar way of looking at the world, a series of puzzles, a set of structures that people have imposed on economic reality. Often those structures are arcane and off-putting, and it’s satisfying to understand what they’re up to. Everything in finance is accreted on top of a lot of other things in finance. Everything is weird and counterintuitive, and you often have to have a sense of financial history and market practice to understand why anyone is doing any of the things they’re doing.

嗨!我是马特。我曾经是律师和投资银行家,现在我是彭博观点的专栏作家。在我的日常工作中,我写关于金融的文章。我喜欢金融。写关于金融的文章很有趣。这是一种奇怪的看待世界的方式,一系列的谜团,一组人们强加于经济现实的结构。这些结构通常是晦涩难懂的,让人感到满意的是理解它们的用意。在金融领域,所有事情都是建立在许多其他金融事物之上的。所有事情都是怪异的、反直觉的,你经常需要具备金融史和市场实践的知识来理解人们为什么做这些事情。

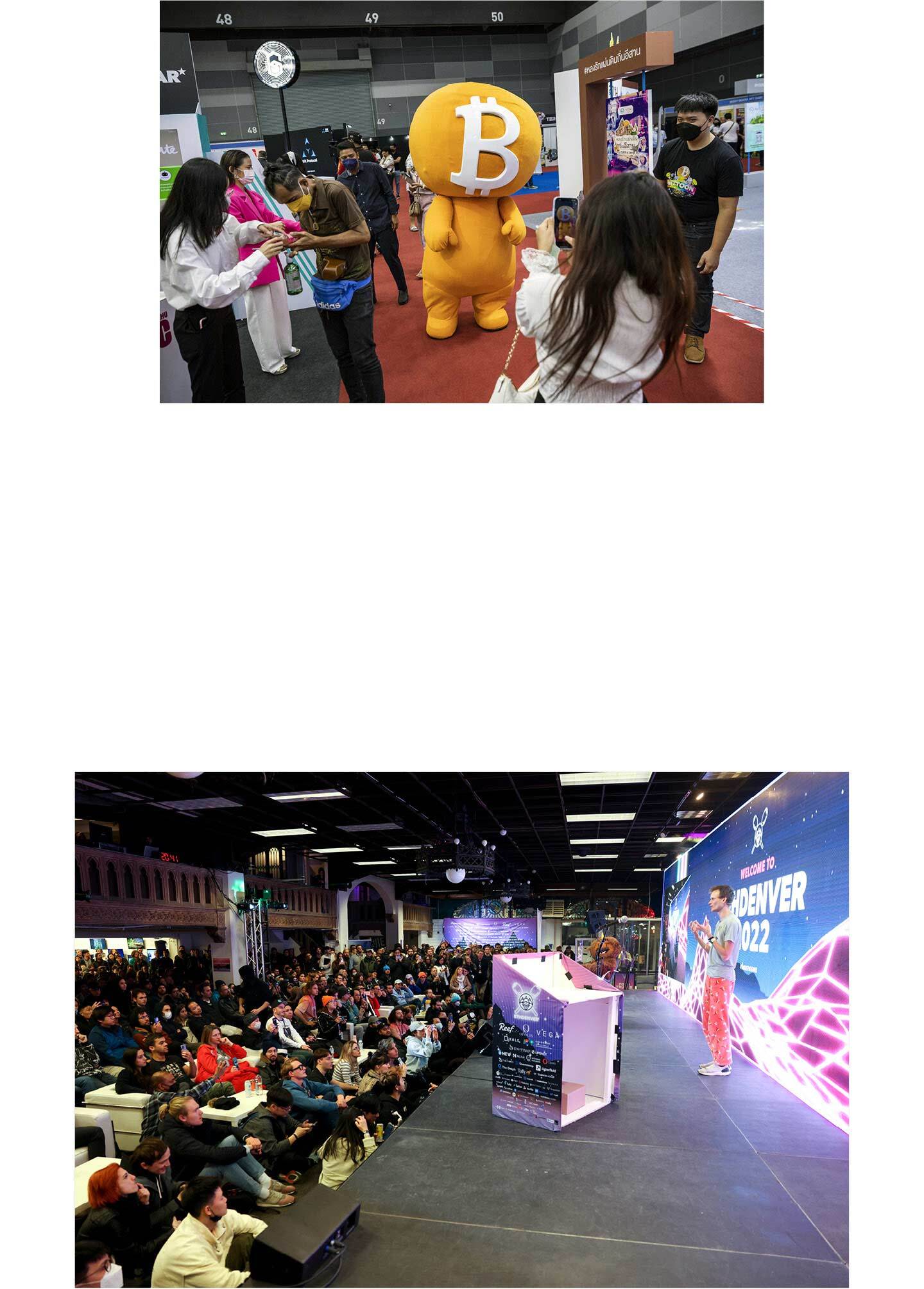

For the past few years the most polarizing thing in finance has been crypto. Crypto is a set of ideas and products and technologies that grew out of the Bitcoin white paper. But it’s also, let’s be clear, a set of lines on charts that went up. When Satoshi invented Bitcoin, one Bitcoin was worth zero dollars: It was just an idea he made up. At its peak last November, one Bitcoin was worth more than $67,000, and the total value of all the crypto in circulation was something like $3 trillion. Many people who got into crypto early got very rich very fast and were very annoying about it. They bought Lamborghinis and islands. They were pleased with themselves: They thought crypto was the future, and they were building the future and being properly and amply rewarded for it. They said things like “Have fun staying poor” and “NGMI” (“not gonna make it”) to people who didn’t own crypto. They were right and rich and wanted you to know it.

过去几年中,金融领域最具争议的事情就是加密货币。加密货币是一系列来自比特币白皮书的想法、产品和技术。但是,让我们明确一点,加密货币也是图表上的曲线不断上涨。当中本聪发明比特币时,一比特币的价值为零美元:它只是他的一个想法。去年十一月,一个比特币的价值超过了 67000 美元,全体加密货币的总价值约为 3 万亿美元。许多早期进入加密货币的人很快变得非常富有,也非常招人讨厌。他们购买兰博基尼和岛屿。他们对自己感到非常满意:他们认为加密货币是未来,并且他们正在建设未来,并因此获得了充分的回报。他们对不拥有加密货币的人说:“继续贫穷吧”和“NGMI”(“不可能成功”)。他们是正确的、富有的,并且想让你知道这一点。

Sign up for Matt Levine’s Money Stuff, a daily newsletter on the world of finance.

注册马特·莱文的《金融内幕》,一份关于金融世界的每日新闻简报。

Many other people weren’t into crypto. They got the not-entirely unjustified impression that it was mostly useful for crime or for Ponzi schemes. They asked questions like “What is this for?” or “Where did all this money come from?” or “If you’re building the future, what is the actual work you’re doing?” or “If you’re building the future, why does it seem so grim and awful?” And the crypto people, often, replied: “Have fun staying poor.”

许多其他人不喜欢加密货币。他们获得了不完全不公平的印象,即加密货币主要用于犯罪或庞氏骗局。他们问了类似“What is this for?”或“What did all this money come from?”或“If you’re building the future, what is the actual work you’re doing?”或“If you’re building the future, why does it seem so grim and awful?”的问题。加密货币人士经常回答:“祝你贫穷快乐。”

And then, this year, those lines on charts went down. The price of one Bitcoin fell below $20,000; the total value of crypto fell from $3 trillion to $1 trillion; some big crypto companies failed. If you’re a crypto skeptic, this was very satisfying, not just as a matter of schadenfreude but also because maybe now everyone will shut up about crypto and you can go back to not paying attention to it. For crypto enthusiasts, this was just a reason to double down on grinding: The crash would shake out the casual fans and leave the true believers to build the future together.

然后,这一年,那些图表上的线条下降了。一个比特币的价格跌破了 20,000 美元;加密货币的总价值从 3 万亿美元降至 1 万亿美元;一些大型加密货币公司倒闭。如果你是加密货币怀疑论者,这非常令人满意,不仅仅是出于幸灾乐祸,也因为现在每个人都可以不再关注加密货币了。对于加密货币爱好者来说,这只是一个理由,让他们继续努力:崩溃将淘汰掉非真正的粉丝,留下真正的信仰者一起建设未来。

In a sense it’s a dumb time to be talking about crypto, because the lines went down. But really it’s a good time to be talking about crypto. There’s a pause; there’s some repose. Whatever is left in crypto is not just speculation and get-rich-quick schemes. We can think about what crypto means—divorced, a little bit, from the lines going up.

从某种意义上说,现在讨论加密货币有点愚蠢,因为行情下跌了。但实际上,现在是讨论加密货币的好时机。现在有一个暂停,有一些喘息的机会。加密货币剩下的不仅仅是投机和快速致富的方案。我们可以思考加密货币的真正含义——至少有一点脱离涨势的影响。

I don’t have strong feelings either way about the value of crypto. I like finance. I think it’s interesting. And if you like finance—if you like understanding the structures that people build to organize economic reality—crypto is amazing. It’s a laboratory for financial intuitions. In the past 14 years, crypto has built a whole financial system from scratch. Crypto constantly reinvented or rediscovered things that finance had been doing for centuries. Sometimes it found new and better ways to do things.

我对加密货币的价值并不持有强烈的看法。我喜欢金融。我认为金融很有趣。如果你喜欢金融——如果你喜欢理解人们建立的经济现实结构——加密货币简直令人惊叹。它是一个金融直觉的实验室。在过去的 14 年中,加密货币从零开始建立了一个完整的金融系统。加密货币不断地重新发明或重新发现了金融界几百年来的成果。有时它找到新的、更好的方法来做事。

Often it found worse ways, heading down dead ends that traditional finance tried decades ago, with hilarious results.

经常它找到更糟糕的方法,走向传统金融几十年前尝试过的死胡同,结果非常可笑。

Often it hit on more or less the same solutions that traditional finance figured out, but with new names and new explanations. You can look at some crypto thing and figure out which traditional finance thing it replicates. If you do that, you can learn something about the crypto financial system—you can, for instance, make an informed guess about how the crypto thing might go wrong—but you can also learn something about the traditional financial system: The crypto replication gives you a new insight into the financial original.

通常情况下,它会找到与传统金融业相同或相似的解决方案,但使用新的名称和解释。你可以查看某个加密项目,弄清楚它是复制哪个传统金融项目。如果你这样做,你可以了解加密金融系统的一些信息——例如,你可以对加密项目可能出错的方式做出明智的猜测——同时,你也可以了解传统金融系统:加密复制为你提供了对金融原始版本的新见解。

Also, I have to say, as someone who writes about finance, I have a soft spot for stories of fraud and market manipulation and smart people putting one over on slightly less smart people. Often those stories are interesting and illuminating and, especially, funny. Crypto has a very high density of stories like that.

此外,我必须说,我作为一名金融撰稿人,对欺诈和市场操纵的故事,以及聪明人欺骗稍微不那么聪明的人的故事有着特别的 weakness。这些故事通常既有趣又有启发性,尤其是非常幽默。加密货币领域中充满了这样故事。

And so, now, I write a lot about crypto. Including quite a lot right here.

于是,现在,我写了很多关于加密货币的文章。包括这里的许多篇章。

I need to give you some warnings. First, I don’t write about crypto as a deeply embedded crypto expert. I’m not a true believer. I didn’t own any crypto until I started working on this article; now I own roughly $100 worth. I write about crypto as a person who enjoys human ingenuity and human folly and who finds a lot of both in crypto.

我需要提醒你一些事情。首先,我不是作为一个深入嵌入的加密货币专家来写关于加密货币的文章。我不是一个真正的信仰者。在开始写这篇文章之前,我不拥有任何加密货币,现在我拥有大约 100 美元的加密货币。我写关于加密货币的文章,是因为我喜欢人类的聪明才智和人类的愚蠢,并且在加密货币中发现了很多这两方面的内容。

Conversely, I didn’t sit down and write 40,000 words to tell you that crypto is dumb and worthless and will now vanish without a trace. That would be an odd use of time. My goal here is not to convince you that crypto is building the future and that if you don’t get on board you’ll stay poor. My goal is to convince you that crypto is interesting, that it has found some new things to say about some old problems, and that even when those things are wrong, they’re wrong in illuminating ways.

相反,我没有坐下来写 4 万字来告诉你加密货币是愚蠢的、毫无价值的,现在就会消失得无影无踪。那将是一个奇怪的时间使用方式。我的目标不是说服你加密货币正在建设未来,如果你不加入就会贫穷。我的目标是说服你,加密货币是有趣的,它发现了一些关于旧问题的新看法,即使这些看法是错误的,也是以启发的方式错误的。

Also, I’m a finance person. It seems to me that, 14 years on, crypto has a pretty well-developed financial system, and I’m going to talk about it a fair bit, because it’s pretty well-developed and because I like finance.

另外,我是一名金融人士。对我来说,十四年过去了,密码货币已经拥有了相当成熟的金融系统,我将会详细讨论它,因为它非常成熟,也因为我喜欢金融。

BUT NO ONE SHOULD CARE THAT MUCH ABOUT A FINANCIAL SYSTEM.

但是谁也没有必要那么关心一个金融系统。

A financial system is, well, a series of databases. It’s a way to shuffle around claims on tangible stuff; it’s an adjunct to the real world. A financial system is good if it makes it easier for farmers to grow food and families to own houses and businesses to make awesome computer games, if it helps to create and distribute abundance in real life. A financial system is bad if it trades abstract claims in ways that enrich the people doing the trading but don’t help anyone else.

金融系统其实是一系列数据库。它是将有形资产的所有权转移的方式,是现实世界的辅助工具。金融系统是好的,如果它使农民更容易种植粮食、家庭更容易拥有房屋、企业更容易制作出色的电脑游戏,并帮助创造和分配现实生活中的丰裕。如果金融系统只是交易抽象的所有权,以便交易者自身获利,而不帮助其他人,那么它就是坏的。

I … ehhh … uh. A salient question in crypto, for the past 14 years, has been: What is it good for? If you ask for an example of a business that actually uses crypto, the answers you’ll get are mostly financial businesses: “Well, we built a really great exchange for trading crypto.” Cool, OK. Sometimes these answers are plausibly about creating or distributing abundance: “Crypto lets emigrants send remittances cheaply and quickly.” That’s good. Often they’re about efficient gambling. Gambling is fun, nothing against it. But a financial system that was purely about gambling would be kind of limited.

过去 14 年来,密码学领域中一个突出的问题是:它有什么用途?如果你问哪些企业真正使用密码学,得到的答案大多是金融业务:“嗨,我们建立了一个非常棒的加密货币交易所。”好吧,OK。有时这些答案是关于创造或分配财富的:“密码学让移民能够快速廉价地汇款。”这很好。经常它们是关于高效赌博的。赌博是有趣的,我并不反对。但是一个纯粹以赌博为目的的金融系统将是相当有限的。

Meanwhile, crypto’s most ardent boosters say crypto is about building real, useful things. Crypto will redefine social relationships, and gaming, and computers. It will build the metaverse. Crypto is the vital component of the next leap in the internet; crypto will build “web3” to replace our current “web2.” Maybe? If you ask for an example of a business that actually uses crypto, you’ll get a ton of real, lucrative financial businesses, then some vague theoretical musings like “Well, maybe we could build a social media network on web3?”

同时,密码货币最坚定的支持者们称,密码货币是关于构建真正有用的东西的。密码货币将重新定义社交关系、游戏和计算机。它将构建元宇宙。密码货币是互联网下一个飞跃的关键组件;密码货币将构建“web3”,取代我们当前的“web2”。或者?如果你问哪些企业真正使用密码货币,你将得到一堆真正的、利润丰厚的金融业务,然后是一些模糊的理论猜测,例如“嗯,也许我们可以在 web3 上构建一个社交媒体网络?”

It’s still early. Maybe someone will build a really good social media network on web3. Maybe in 10 years, crypto and blockchains and tokens will be central to everything that’s done on the internet, and the internet will be (even more than it is now) central to everything that’s done in human life, and the crypto early adopters will all be right and rich while the rest of us will have fun staying poor, and schoolchildren will say, “I can’t believe anyone ever doubted the importance of Dogecoin.”

仍然为时尚早。也许有人会在 web3 上建立一个真正优秀的社交媒体网络。也许十年后,密码货币、区块链和代币将成为互联网上一切活动的核心,而互联网将(比现在更甚)成为人类生活中一切活动的核心,那时早期采用密码货币的人都会正确富有,而我们其他人将乐于贫穷,并且学校孩子们会说:“我不敢相信有人曾经怀疑过狗狗币的重要性。”

I don’t want to discount that possibility, and I do want to speculate about it a little bit, maybe sketch a picture of what that might mean. I’m not going to give you a road map for how we’ll get there. I’m not a tech person, and I’m not a true believer. But it is worth trying to understand what crypto could mean for the future of the internet, because the implications are sometimes utopian and sometimes dystopian and sometimes just a modestly more efficient base layer for stuff you do anyway. Plus the finance is cool, and it’s cool now.

我不想低估那种可能性,我想对此进行一些猜测,可能勾勒出它可能意味着什么的图景。我不打算为你提供一条到达那里的路线图。我不是技术专家,也不是真正的信仰者。但是,尝试理解加密技术对互联网未来的影响是值得的,因为其影响有时是乌托邦式的,有时是反乌托邦式的,有时只是使你日常所做的事情变得更高效一些。此外,加密金融非常酷,现在也很酷。

Before we go on, let me say some things about some names. First, “crypto.” This thing I’m writing about here: There’s not a great name for it. The standard name, which I’ll use a lot, is crypto, which I guess is short for “cryptocurrency.” This is not a great name, because 1) it emphasizes currency, and a lot of crypto is not particularly about currency, and 2) it emphasizes cryptography, and while crypto is in some deep sense about cryptography, most people in crypto are not doing a ton of cryptography. You can be a crypto expert or a crypto billionaire or a leading figure in crypto without knowing much about cryptography, and people who are cryptography experts sometimes get a bit snippy about the crypto people stealing their prefix.

在我们继续之前,让我说说一些名字的事情。首先,“加密货币”(crypto)。我在这里写的这个东西:它没有一个很好的名字。标准名字是我将经常使用的“加密货币”,我猜是“加密货币”的缩写。这不是一个很好的名字,因为 1)它强调货币,而很多加密货币并不特别关心货币,2)它强调密码学,而加密货币在某种深层意义上是关于密码学的,但大多数加密货币人并不做很多密码学工作。你可以是加密货币专家、加密货币亿万富翁或加密货币领军人物,而不需要知道很多密码学知识,而密码学专家有时会对加密货币人“偷走”他们的前缀感到有点儿不高兴。

There are other names for various topics in crypto—

加密领域中有多个主题的别称—

—and they’re sometimes used broadly to refer to a lot of what’s going on in crypto, but it’s not like they’re great either. So I’ll mostly stick with “crypto” as the general term.

它们有时被广泛用于指代加密货币领域中的许多事情,但它们也不是非常出色。所以,我主要会使用“加密货币”这个通用术语。

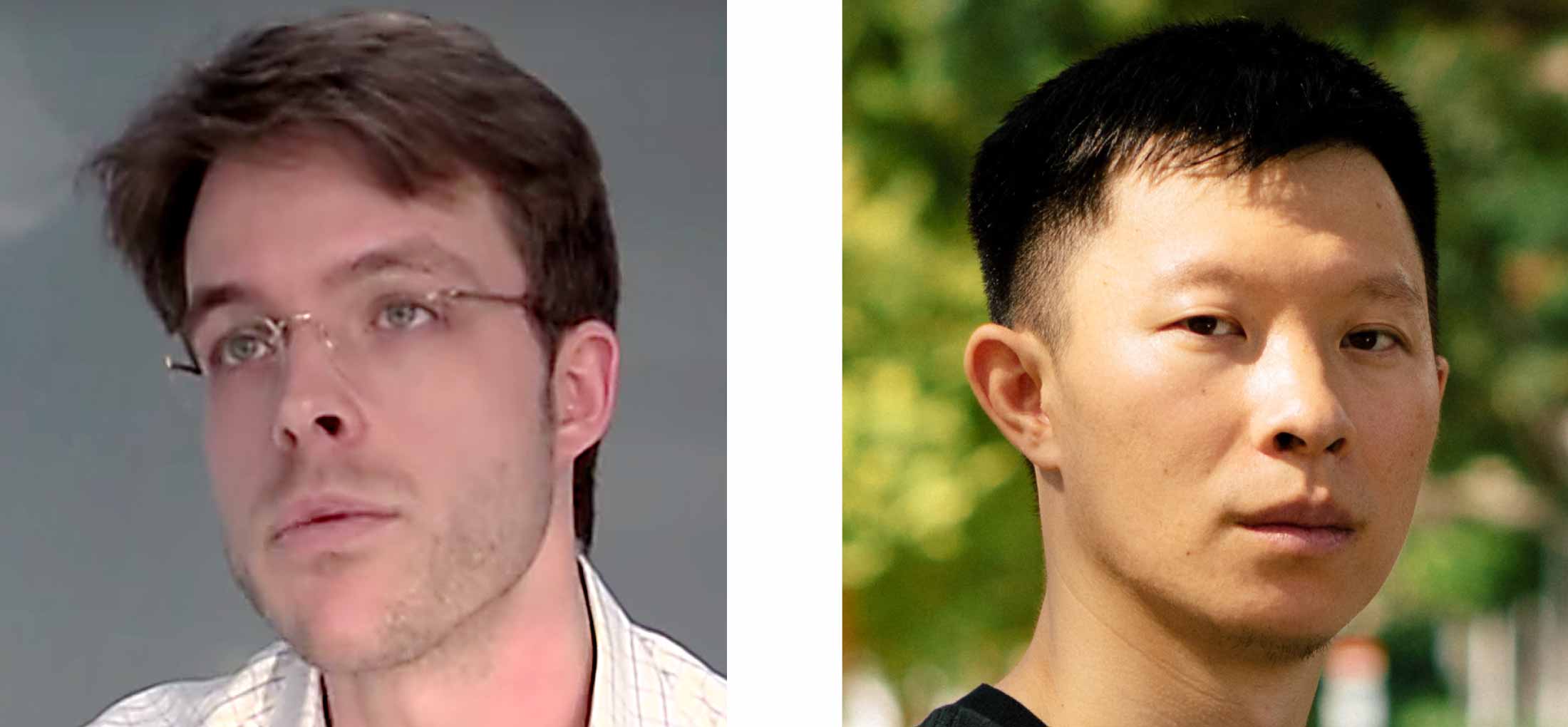

Second, “Satoshi Nakamoto.” That’s a pseudonym, and whoever wrote his white paper has done a reasonably good job of keeping himself, herself, or themselves pseudonymous ever since. (There’s a lot of speculation about who the author might be. Some of the funnier suggestions include Elon Musk and a random computer engineer named, uh, Satoshi Nakamoto. I’m going to call Satoshi Nakamoto “Satoshi” and use he/him pronouns, because most people do.)

其次是“中本聪”这个笔名,而白皮书的作者至今仍然做得很好地保持匿名。(关于作者的真实身份有很多猜测,一些比较有趣的猜测包括埃隆·马斯克和一个名叫中本聪的随机计算机工程师。我将称呼中本聪为“聪”并使用他/他的代词,因为大多数人都是这样做的。)

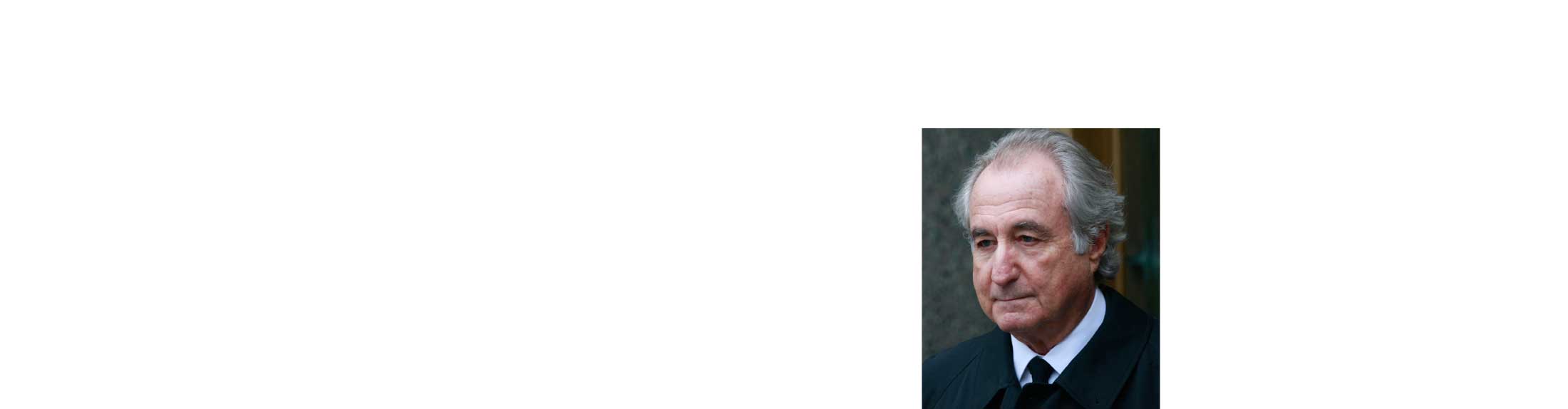

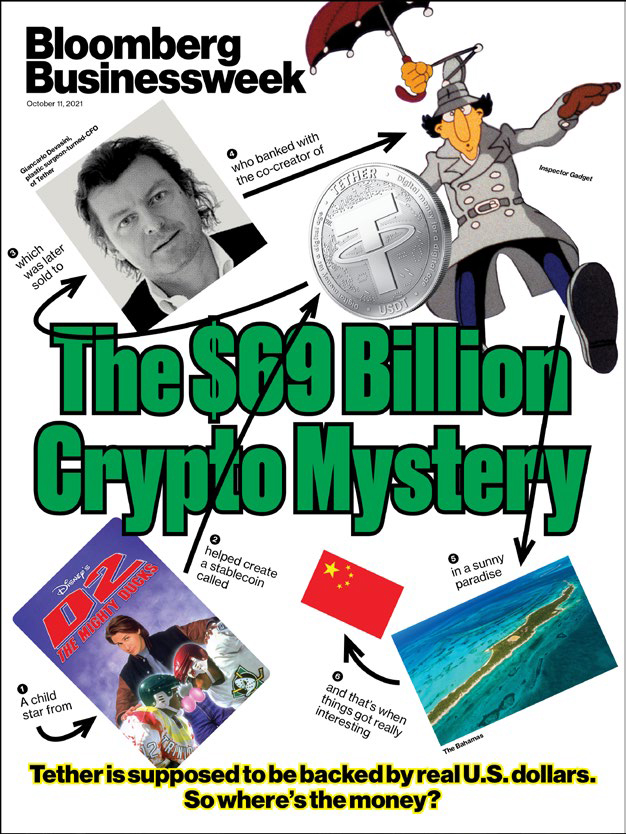

A related point. Other than (maybe?) Satoshi, basically everyone involved in cryptocurrency is a hilariously outsize personality. It’s a good bet that if you read an article about crypto, it will feature wild characters. (One story in Bloomberg Businessweek last year mentioned “sending billions of perfectly good US dollars to the Inspector Gadget co-creator’s Bahamian bank in exchange for digital tokens conjured by the Mighty Ducks guy and run by executives who are targets of a US criminal investigation.”) Except this one! There won’t be a single exciting person in this whole story. My goal here is to explain crypto, so that when you read about a duck guy doing crypto you can understand what it is that he’s doing.

相关一点是,除了(可能是)中本聪外,几乎所有参与加密货币的人都具有夸张的个性。如果你读到一篇关于加密货币的文章,很可能会遇到一些疯狂的人物。(去年《彭博商业周刊》的一篇报道提到,“将数十亿美元汇入《Inspector Gadget》创作者在巴哈马的银行,以换取由《 Mighty Ducks》人物创造的数字代币,而这些代币由受到美国刑事调查的高管管理。”)但是,这篇文章例外!这里不会出现任何激动人心的人物。我的目标是解释加密货币,以便当你读到关于鸭子哥哥做加密货币的事情时,你能理解他在做什么。

Cryptography is the study of secret messages, of coding and decoding. Most of what I talk about in this article won’t be about cryptography; it will be about, you know, Ponzis. But the base layer of crypto really is about cryptography, so it will be helpful to know a bit about it.

加密学是研究秘密信息的编码和解码的学科。大部分我在这篇文章中讨论的内容不会是关于加密学的,而是关于庞氏骗局。但是加密货币的基础层确实是关于加密学的,所以了解一点加密学知识会很有帮助。

The basic thing that happens in cryptography is that you have an input (a number, a word, a string of text), and you run some function on it, and it produces a different number or word or whatever as an output. The function might be the Caesar cipher (shift each letter of a word by one or more spots in the alphabet, so “Caesar” becomes “Dbftbs”), or pig Latin (shift the first consonants of the word to the end and add “-ay,” so “Caesar” becomes “Aesar-say”), or something more complicated.

密码学中最基本的事情是,你拥有一个输入(一个数字、一个单词、一个文本字符串),然后对其应用某个函数,产生一个不同的数字、单词或其他输出。这个函数可能是凯撒密码(将单词中的每个字母在字母表中移动一个或多个位置,因此“Caesar”变成了“Dbftbs”),或猪拉丁语(将单词的第一个辅音移到末尾并添加“-ay”,因此“Caesar”变成了“Aesar-say”),或者更复杂的东西。

A useful property in a cryptographic function is that it be “one-way.”4 This means it’s easy to turn the input string into the output string, but hard to do it in reverse; it’s easy to compute the function in one direction but impossible in the other. (The classic example is that multiplying two large prime numbers is quite straightforward; factoring an enormous number into two large primes is hard.) The Caesar cipher is easy to apply and easy to reverse, but some forms of encoding are easy to apply and much more difficult to reverse. That makes them better for secret codes.

密码函数中一个有用的特性是它是“单向”的。这意味着将输入字符串转换为输出字符串很容易,但反之则很难;在一个方向上计算函数很容易,而在另一个方向上则是不可能的。(经典的例子是乘两个大素数非常简单;而将一个庞大的数字分解为两个大素数则很难。)凯撒密码很容易应用和反转,但有些编码形式很容易应用却很难反转。这使它们更适合秘密代码。

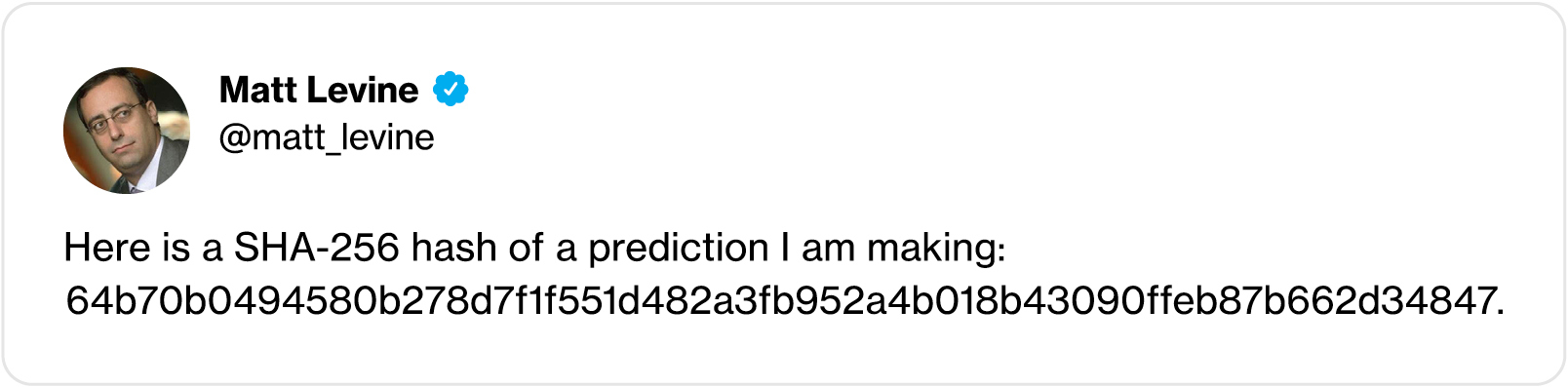

One example of this is a “hashing” function, which takes some input text and turns it into a long number of a fixed size. So I could run a hashing function on this article—a popular one is called SHA-256, which was invented by the National Security Agency5—and generate a long, incomprehensible number from it. (To make it more incomprehensible, it’s customary to write this number in hexadecimal, so that it will have the digits zero through 9 but also “a” through “f.”) I could send you the number and say, “I wrote an article and ran it through a SHA-256 hashing algorithm, and this number was the result.” You’d have the number, but you wouldn’t be able to make heads or tails of it. In particular, you couldn’t plop it into a computer program and decode it, turning the hash back into this article.

这是一个“散列”函数的例子,它可以将某些输入文本转换为固定大小的长数字。因此,我可以将这篇文章输入到一个散列函数中——一个流行的例子是 SHA-256,它是由美国国家安全局开发的——并生成一个长的、无法理解的数字。(为了使这个数字更加难以理解,通常将其写成十六进制形式,这样它将包含从 0 到 9 的数字,以及从 “a” 到 “f” 的字母。)我可以将这个数字发送给你,并说:“我写了一篇文章,并将其输入到 SHA-256 散列算法中,结果就是这个数字。”你将拥有这个数字,但你无法理解它的含义。特别是,你不能将其输入到计算机程序中,并将其解码回这篇文章。

The hashing function is one-way; the hash tells you nothing about the article, even if you know the hashing function. The hashing function basically shuffles the data in the article: It takes each letter of the article, represented as a binary number (a series of bits, 0s and 1s), and then shuffles around the 0s and 1s lots of times, mashing them together until they are all jumbled up and unrecognizable. The hashing function gives clear step-by-step instructions for how to shuffle the bits together, but they don’t work in reverse.6 It’s like stirring cream into coffee: easy to do, hard to undo.

哈希函数是单向的;哈希值不会告诉你文章的任何信息,即使你知道哈希函数。哈希函数基本上是将文章中的数据混淆:它将文章中的每个字母表示为二进制数字(一系列的 0 和 1),然后将这些 0 和 1 混淆很多次,直到它们变得完全不可识别。哈希函数提供了明确的步骤指令来混淆这些位,但这些指令不能逆向工作。 6 这就像搅拌奶油入咖啡:容易做,但很难逆向。

Applying a SHA-256 algorithm will create a 64-digit number for data of any size you can imagine. Here’s a hash of the entire text of James Joyce’s 730-page novel Ulysses:

应用 SHA-256 算法将创建一个任意大小数据的 64 位数字。这里是詹姆斯·乔伊斯的 730 页小说《尤利西斯》的整个文本的哈希值:

It fits in the same space as the hash of “Hi! I’m Matt”:

它与“Hi I’m Matt”的哈希值占用相同的空间:

But what if I wrote “Hi, I’m Matt” with a comma? Then:

如果我写“Hi, I’m Matt”,加上一个逗号呢?那么:

There’s no apparent relationship between the numbers for “Hi! I’m Matt” and “Hi, I’m Matt.” The two original inputs were almost exactly identical; the hash outputs are wildly different. This is a critical part of the hashing function being one-way: If similar inputs mapped to similar outputs, then it would be too easy to reverse the function and decipher messages. But for practical purposes, each input maps to a random output.7

“Hi I’m Matt”和“Hi, I’m Matt.”这两个数字之间没有明显的关系。两个原始输入几乎相同,但哈希输出却截然不同。这是哈希函数单向性的关键部分:如果相似输入映射到相似输出,那么就太容易逆向函数并破译消息了。但从实际目的来说,每个输入都映射到一个随机输出。 7

What’s the point of a secret code that can’t be decoded? For one thing, it’s a way to verify. If I sent you a hash of this article, it wouldn’t give you the information you need to re-create the article.8 But if I then sent you the article, you could plop that into a computer program (the SHA-256 algorithm) and generate a hash. And the hash you generate will exactly match the number I sent you. And you’ll say, “Aha, yes, you hashed that article all right.” It’s impossible for you to decode the hash, but it’s easy for you to check that I had encoded it correctly.

一个不能被解密的秘密代码有什么用?一种用途是验证。如果我将这篇文章的哈希发送给你,它不会提供你重新创建文章所需的信息。 8 但是,如果我然后将文章发送给你,你可以将其输入计算机程序(SHA-256 算法)并生成哈希。然后,你生成的哈希将与我发送的数字完全匹配。你会说:“aha,yes,你确实对文章进行了哈希。”你无法解密哈希,但很容易检查我是否正确地编码了它。

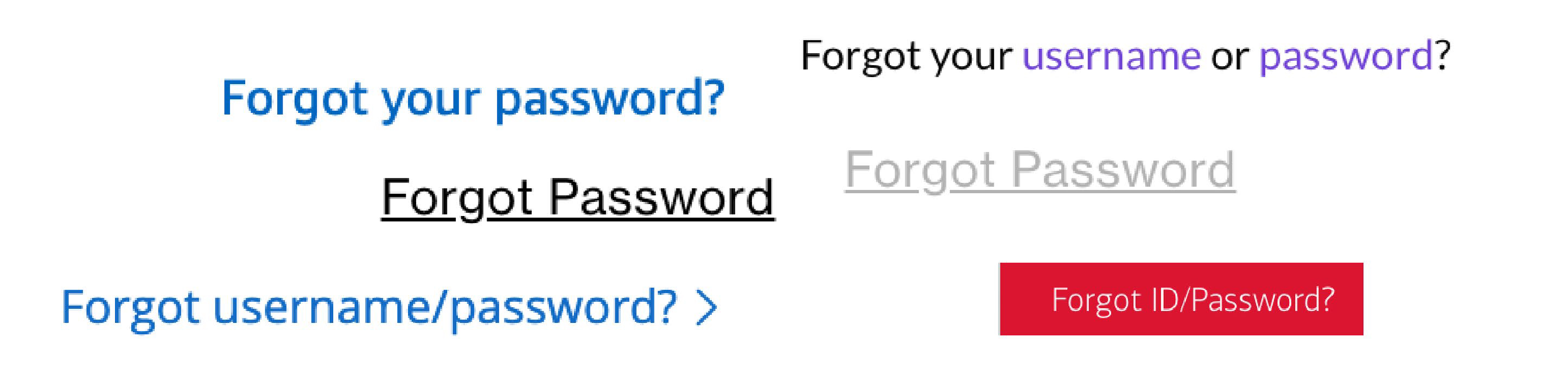

This would be dumb to do with this article, but the principle has uses. A simple, everyday one is passwords. If I have a computer system and you have a password to log in to the system, I need to be able to check that your password is correct. One way to do this is for my system to store your password and check what you type against what I’ve stored: I have a little text file with all the passwords, and it has “Password123” written next to your username, and you type “Password123” on the login screen, and my system checks what you type against the file and sees that they match and lets you log in. But this is a dangerous system: If someone steals the file, they would have everyone’s password. It’s better practice for me to hash the passwords. You type “Password123” as your password when setting up the account, and I run it through a hash function and get back

这样做文章可能很愚蠢,但这个原则有用处。一个简单的、日常的例子是密码。如果我有一个计算机系统,你有一个密码来登录系统,我需要能够检查你的密码是否正确。这样做的一种方法是我的系统存储你的密码,然后检查你输入的密码与存储的密码是否匹配:我有一个小文本文件,其中包含所有密码,旁边写着你的用户名,你在登录屏幕上输入“Password123”,我的系统检查你输入的密码与文件中的密码是否匹配,如果匹配就让你登录。但是,这是一个危险的系统:如果有人偷走了文件,他们就会拥有所有人的密码。因此,我更应该对密码进行哈希处理。你在设置账户时输入“Password123”作为密码,我将其通过哈希函数处理,得到

and I store that on my list. When you try to log in, you type your password, and I hash it again, and if it matches the hash on my list, I let you in. If someone steals the list, they can’t decode your password from the hash, so they can’t log in to the system.9

并将其存储在我的列表中。当你尝试登录时,你输入密码,我再次对其进行哈希处理,如果哈希值与列表中的哈希值匹配,我就让你登录。如果有人偷走了列表,他们无法从哈希值中解密出你的密码,因此无法登录系统。

There are other, more crypto-nerdy uses for hashing. One is a sort of time stamping. Let’s say you predict some future event, and you want to get credit when it does happen. But you don’t want to just go on Twitter now and say, “I predict that the Jets will win the Super Bowl in 2024,” to avoid being embarrassed or influencing the outcome or whatever. One thing you could do is write “the Jets will win the Super Bowl in 2024” on a piece of paper, put it in an envelope, seal the envelope, and ask me to keep it until the 2024 Super Bowl, after which you’ll tell me either to open the envelope or burn it. But this requires you and everyone else to trust me.

哈希还有其他更为“密码学 nerdy”的用途。其中一种是时间戳。假设你预测某个未来事件,并想在它发生时获得认可。但你不想现在就在 Twitter 上说“我预测 Jet 队将在 2024 年赢得超级碗”,以免感到尴尬或影响结果什么的。有一件事你可以做的是写下“Jet 队将在 2024 年赢得超级碗”,把它放在信封里,封好信封,然后请我保管到 2024 年超级碗后,你会告诉我是否打开信封或烧毁它。但这需要你和所有人信任我。

Another, trustless thing you could do is type “the Jets will win the Super Bowl in 2024” into a cryptographic hash generator, and it will spit out:

另一种不需要信任的方法是,你可以将“Jet 队将在 2024 年赢得超级碗”输入加密哈希生成器,它将生成:

and then you can tweet,

然后你可以发推特,

Everyone will say, “Well, aren’t you annoying,” but they won’t be able to decode your prediction. And then in a while, when the Jets win the Super Bowl, you can say, “See, I called it!” You retweet the hashed tweet and the plain text of your prediction. If anyone is so inclined, they can go to a hash calculator and check that the hash really matches your prediction. Then all the glory will accrue to you.

每个人都会说:“哇,你真烦人”,但是他们无法解密你的预测。然后,等 Jets 队赢得超级碗后,你可以说:“看,我早就预测到了!”你重新发布加密后的推文和你的预测原文。如果有人愿意,他们可以去哈希计算器那里检查哈希是否真的匹配你的预测。然后所有荣誉都会归于你。

Aside from hashing, another important one-way function is public-key encryption. I have two numbers, called a “public key” and a “private key.” These numbers are long and random-looking, but they’re related to each other: Using a publicly available algorithm, one number can be used to lock a message, and the other can unlock it. The two-key system solves a classic problem with codes: If the key I use to encrypt a message is the same one you’ll need to decode it, at some point I’ll have to have sent you that key. Anyone who steals the key in transit can read our messages.

除了哈希函数外,另一个重要的单向函数是公钥加密。我有两个数字,称为“公钥”和“私钥”。这些数字很长,看起来很随机,但它们之间有关联:使用公开可用的算法,一個数字可以用来锁定消息,而另一个数字可以解锁它。这个双钥系统解决了代码中一个经典的问题:如果我用来加密消息的密钥也是你需要用来解密的密钥,那么我最终将不得不将该密钥发送给你。任何在传输过程中窃取密钥的人都可以读取我们的消息。

With public-key encryption, no one needs to share the secret key. The public key is public: I can send it to everyone, post it on my Twitter feed, whatever. The private key is private, and I don’t give it to anyone. You want to send me a secret message. You write the message and run it through the encryption algorithm, which uses 1) the message and 2) my public key (which you have) to generate an encrypted message that you send to me. Then I run the message through a decryption program that uses 1) the encrypted message and 2) my private key (which only I have) to generate the original message, which I can read. You can encrypt the message using my public key, but nobody can decrypt it using the public key. Only I can decrypt it using my private key. (The function is one-way as far as you’re concerned, but I can reverse it with my private key.)

在公钥加密中,没有人需要共享秘钥。公钥是公开的:我可以将其发送给每个人,发布在我的 Twitter 账户上,等等。私钥是私有的,我不将其给任何人。你想给我发送一条秘密信息。你写下信息,然后使用加密算法对其进行加密,该算法使用 1) 信息和 2) 我的公钥(你拥有)生成一个加密信息,然后将其发送给我。然后,我使用解密程序对信息进行解密,该程序使用 1) 加密信息和 2) 我的私钥(只有我拥有)生成原始信息,我可以阅读。你可以使用我的公钥对信息进行加密,但是没有人可以使用公钥对其进行解密。只有我可以使用私钥对其进行解密。(从你角度看,这个函数是一条单行道,但是我可以使用私钥将其逆转。)

A related idea is a “digital signature.” Again, I have a public key and a private key. My public key is posted in my Twitter bio. I want to send you a message, and I want you to know that I wrote it. I run the message through an encryption program that uses 1) the message and 2) my private key. Then I send you 1) the original message and 2) the encrypted message.

一个相关的想法是“数字签名”。同样,我拥有一个公钥和一个私钥。我的公钥发布在我的 Twitter 个人资料中。我想给你发送一条信息,并且我想让你知道是我写的。我使用加密程序对信息进行加密,该程序使用 1) 信息和 2) 我的私钥。然后,我将 1) 原始信息和 2) 加密信息发送给你。

You use a decryption program that uses 1) the encrypted message and 2) my public key to decrypt the message. The decrypted message matches the original message. This proves to you that I encrypted the message. So you know that I wrote it. I could’ve just sent you a Twitter DM instead, but this is more cryptographic.

你使用解密程序对信息进行解密,该程序使用 1) 加密信息和 2) 我的公钥对信息进行解密。解密后的信息与原始信息匹配。这证明了我加密了信息。所以你知道是我写的。我本可以直接给你发送一条 Twitter DM,但是这更加加密。

Imagine a simple banking system in which bank accounts are public: There’s a public list of accounts, and each one has a (public) balance and public key. I say to you: “I control account No. 00123456789, which has $250 in it, and I’m going to send you $50.” I send you a digitally signed message saying “here’s $50,” and you decode that message using the public key for the account, and then you know that I do in fact control that account and everything checks out. That’s the basic idea at the heart of Bitcoin, though there are also more complicated ideas.

想象一个简单的银行系统,其中银行账户是公开的:有一份公开的账户列表,每个账户都有一个(公开的)余额和公开密钥。我对你说:“我控制账户编号 00123456789,该账户有 250 美元,我将向你发送 50 美元。”我发送一条数字签名的消息,内容是“这里有 50 美元”,然后你使用该账户的公开密钥解码该消息,从而知道我确实控制该账户,一切都检查通过。这是比特币核心思想的基本概念,尽管还有更多复杂的想法。

The simple form of Bitcoin goes like this. There’s a big public list of addresses, each with a unique label that looks like random numbers and letters, and some balance of Bitcoin in it. An address might have the label “1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa”10 and a balance of 68.6 Bitcoin. The address acts as a public key.11 If I “own” those Bitcoin, what that means is I possess the private key corresponding to that address, effectively the password accessing the account.

比特币的简单形式是这样的:有一份大型公开的地址列表,每个地址都有一个独特的标签,看起来像随机数字和字母,并且有一定的比特币余额。一个地址可能有标签“1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa” 10 ,余额为 68.6 比特币。该地址充当公开密钥 11 。如果我“拥有”这些比特币,那意味着我拥有该地址对应的私钥,实际上是账户的密码。

Because I have the private key, I can send you a Bitcoin by signing a message to you with my private key. You can check that signature against my public key and against the public list of addresses and Bitcoin balances. That information is enough for you to confirm that I control the Bitcoin that I’m sending you, but not enough for you to figure out my private key and steal the rest of my Bitcoin.

因为我拥有私钥,所以我可以通过使用私钥签名消息将比特币发送给你。你可以将签名与我的公钥和公众地址列表及比特币余额进行核对。那足够让你确认我控制着要发送给你的比特币,但不足以让你猜出我的私钥并窃取我的其他比特币。

That kind of means I can send you a Bitcoin without you trusting me, or me trusting you, or either of us trusting a bank to verify that I have the money. “We define an electronic coin as a chain of digital signatures,” Satoshi wrote. The combination of public address and private key is enough to define a coin. Cryptocurrency is called cryptocurrency because it’s a currency derived from cryptography.

这意味着我可以在不需要你信任我、我信任你或我们信任银行来验证我拥有资金的情况下将比特币发送给你。萨托西写道:“我们将电子币定义为数字签名链。”公钥和私钥的组合足以定义一枚币。加密货币之所以被称为加密货币,是因为它是来自密码学的货币。

You’ll notice that all we’ve done here is exchange a message, and somehow called the result of that a currency. The traditional financial system isn’t so different: Banks don’t move around sacks of gold or even very many paper bills. They’re keepers of databases. What happens, roughly, when I make a $100 payment to you is my bank sends a message to your bank telling it to update its ledger.

你会注意到,我们这里所做的只是交换了一条消息,然后奇怪地将结果称为货币。传统金融系统也没什么不同:银行不搬运金砖或大量纸币。它们是数据库的管理者。当我向你支付 100 美元时,大致上是我的银行向你的银行发送一条消息,告诉它更新账簿。

Similarly, in Bitcoin the messages change a (public) ledger of who holds what. But who maintains that? The rough answer is that the Bitcoin network—thousands of people who use Bitcoin and run its software on their computers—keeps the ledger, collaboratively and redundantly. There are thousands of copies of the ledger; every node on the network has its own list of how many Bitcoin are in each address.

类似地,在比特币中,这些消息改变了一个公共账簿,记录谁拥有什么。但是谁来维护这个账簿呢?大致的答案是比特币网络——成千上万使用比特币并在他们的计算机上运行其软件的人——共同和冗余地维护着这个账簿。网络中的每个节点都有其自己的账簿副本,记录每个地址中的比特币数量。

Then, when we do a transaction—when I send you a Bitcoin—we don’t just do it privately; we broadcast it to the entire network so everyone can update their lists. If I send you a Bitcoin from my address, and my signature on the transaction is valid, everyone will update their ledgers to add one Bitcoin to your address and subtract one from mine.

然后,当我们进行交易——当我向你发送比特币时——我们不仅仅私下进行;我们将其广播到整个网络,以便每个人可以更新他们的列表。如果我从我的地址向你发送比特币,并且我的交易签名有效,每个人都会更新他们的账本,将一比特币添加到你的地址并从我的地址中扣除。

The ledger is not really just a list of addresses and their balances; it’s actually a record of every single transaction.12 The ledger is maintained by everyone on the network keeping track of every transaction for themselves.13

账本不仅仅是一个地址和余额的列表;它实际上是每笔交易的记录。 12 账本是由网络上的每个人自己跟踪每笔交易来维护的。 13

That’s nice! But now, instead of trusting a bank to keep the ledger of your money, you’re trusting thousands of anonymous strangers.

这很好!但是现在,你不再信任银行来保存你的钱,而是信任成千上万的匿名陌生人。

Well it’s not quite as bad as that. Each transaction is provably correct: If I send a Bitcoin from my address to yours and sign it with my private key, the network will include the transaction; if I try to send a Bitcoin from someone else’s address to yours and don’t have the private key, everyone on the network can see that it’s fake and won’t include the transaction. Everyone runs open-source software to update the ledger for transactions that are verifiable. Everyone keeps the ledger, but you can prove that every transaction in the ledger is valid, so you don’t have to trust them too much.

嗯,这还不算太糟。每笔交易都是可证明的正确的:如果我从我的地址将比特币发送到你的地址,并用我的私钥签名,网络就会包括这笔交易;如果我尝试从别人的地址将比特币发送到你的地址,但没有私钥,每个人在网络上都可以看到这是假的,不会包括这笔交易。每个人都运行开源软件来更新可验证的交易的账簿。每个人都保留账簿,但你可以证明账簿中的每笔交易都是有效的,所以你不需要太信任他们。

Incidentally, I am saying that “everyone” keeps the ledger, and that was probably roughly true early in Bitcoin’s life, but no longer. There are thousands of people running “full nodes,” which download and maintain and verify the entire Bitcoin ledger themselves, using open-source official Bitcoin software. But there are millions more not doing that, just having some Bitcoin and trusting that everybody else will maintain the system correctly. Their basis for this trust, though, is slightly different from the basis for your trust in your bank. They could, in principle, verify that everyone verifying the transactions is verifying them correctly.

顺便说一下,我说“每个人”都保留账簿,这在比特币早期可能大致正确,但现在不再是这样。有数千人运行“完整节点”,它们下载、维护和验证整个比特币账簿,使用官方比特币开源软件。但还有数百万人没有这样做,只是拥有些比特币,并信任其他人会正确地维护系统。他们的信任基础与你信任银行的基础略有不同。他们原则上可以验证每个人验证交易的正确性。

Notice, too, that there’s a financial incentive for everyone to be honest: If everyone is honest, then this is a working payment system that might be valuable. If lots of people are dishonest and put fake transactions in their ledgers, then no one will trust Bitcoin and it will be worthless. What’s the point of stealing Bitcoin if the value of Bitcoin is zero?

另外,还有一个金融激励机制,鼓励每个人诚实:如果每个人都诚实,那么这就是一个可能有价值的支付系统。如果许多人不诚实,并将假交易添加到他们的账簿中,那么没有人会信任比特币,它将一文不值。偷窃比特币有什么意义,如果比特币的价值是零?

This is a standard approach in crypto: Crypto systems try to use economic incentives to make people act honestly, rather than trusting them to act honestly.

这是在加密领域中的标准做法:加密系统尝试使用经济激励来使人们诚实行事,而不是信任他们诚实行事。

That’s most of the story, but it leaves some small problems. Where did all the Bitcoin come from? It’s fine to say that everyone on the network keeps a ledger of every Bitcoin transaction that ever happened, and your Bitcoin can be traced back through a series of previous transactions. But traced back to what? How do you start the ledger?

这几乎是整个故事,但它留下了一些小问题。比特币从哪里来?说每个人在网络上都保留着每一笔比特币交易的账簿,你的比特币可以追溯到一系列之前的交易。但是追溯到什么?如何启动账簿?

Another problem is that the order of transactions matters: If I have one Bitcoin in my account and I send it to you, and then I send it to someone else, who actually has the Bitcoin? This seems almost trivial, but it’s tricky. Bitcoin is a decentralized network that works by broadcasting transactions to thousands of nodes, and there’s no guarantee they’ll all arrive in the same order everywhere. And if everyone doesn’t agree on the order, bad things—“double spending,” or people sending the same Bitcoin to two different places—can happen. “Transactions must be publicly announced,” wrote Satoshi, “and we need a system for participants to agree on a single history of the order in which they were received.”

另一个问题是交易顺序很重要:如果我账户中有一比特币,我将其发送给你,然后又将其发送给其他人,谁真正拥有这比特币?这似乎非常简单,但实际上很棘手。比特币是一个去中心化的网络,它通过向数千个节点广播交易来运作,但不能保证所有节点都以相同的顺序接收交易。如果大家不能就交易顺序达成一致,坏事就会发生——“双重支付”,或将同一比特币发送到两个不同的地方。佐藤写道:“交易必须公开宣布,我们需要一个系统,使参与者同意交易的顺序历史。”

That system, I’m sorry to say, is the blockchain.

那个系统,我很抱歉地说,就是区块链。

Every Bitcoin transaction is broadcast to the network. Some computers on the network—they’re called “miners”—compile the transactions as they arrive into a group called a “block.” At some point, a version of a block becomes, as it were, official: The list of transactions in that block, in the order in which they’re listed, becomes canonical, part of the official Bitcoin record. We say that the block has been “mined.”14 In Bitcoin, a new block is mined roughly every 10 minutes.15

比特币每笔交易都会被广播到网络上。一些网络上的计算机——它们被称为“矿工”——将到达的交易编译成一个称为“块”的组。某个时候,一个块的版本就会变得“官方”:该块中交易的列表,以它们被列出的顺序,变得规范化,成为比特币官方记录的一部分。我们说该块已经被“挖掘”。 14 在比特币中,大约每 10 分钟就会挖掘出一个新的块。 15

The miners then start compiling a new block, which will also eventually be mined and become official. Here’s where hashing becomes important. That new block will refer to the block before it by containing a hash of that block—this confirms that the block before it 1) is correct and accepted by the network and 2) came before it in time. Each block will refer to the previous block in a chain—oh, yes, a blockchain. The blockchain creates an official record of what transactions the network has agreed on and in what order. The hashes are time stamps; they create an agreed order of transactions.

矿工然后开始编译一个新的区块,该区块最终也将被挖掘并成为官方的。在这里,哈希变得非常重要。该新区块将通过包含前一个区块的哈希来引用前一个区块——这确认了前一个区块 1)是正确的并被网络接受的,2)是在时间上排在前面的。每个区块将通过链式引用前一个区块——哦,是的,一个区块链。区块链创建了网络上达成一致的交易记录及其顺序。哈希是时间戳;它们创建了交易的顺序。

You could imagine a simple system for doing this. Every 10 minutes a miner proposes a list of transactions, and all the computers on the Bitcoin network vote on it. If it gets a majority, it becomes official and is entered into the blockchain.

你可以想象一个简单的系统来实现这一点。每 10 分钟,矿工提出一份交易列表,然后比特币网络上的所有计算机投票。如果获得多数票,它将成为官方的并被记录到区块链中。

Unfortunately this is a bit too simple. There are no rules about who can join the Bitcoin network: Anyone who hooks up a computer and runs the open-source Bitcoin software can do it. You don’t have to prove you’re a good person, or even a person. You can hook up a thousand computers if you want.

不幸的是,这太简单了。加入比特币网络没有任何规则:任何人只要连接计算机并运行开源的比特币软件就可以做到这一点。你不需要证明你是一个好人,或者甚至是一个人。你可以连接一千台计算机,如果你愿意。

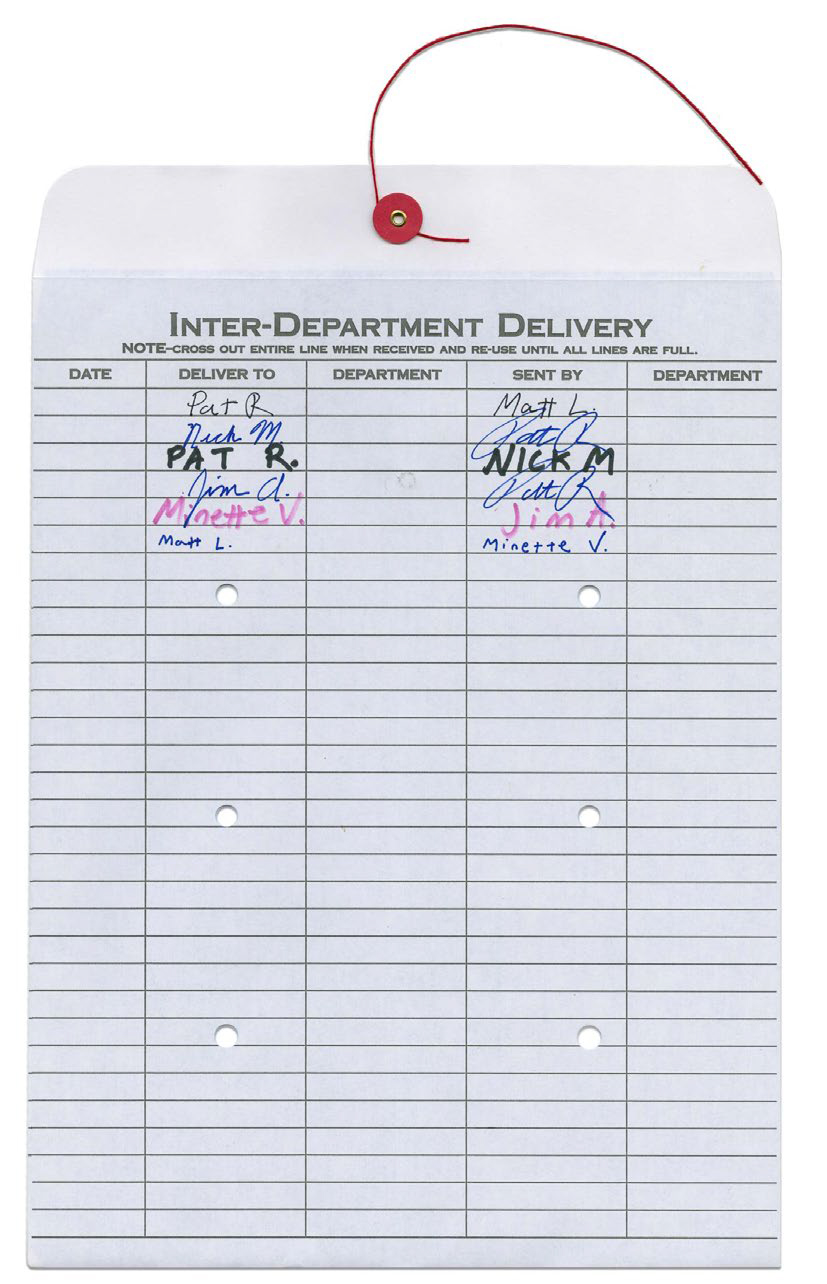

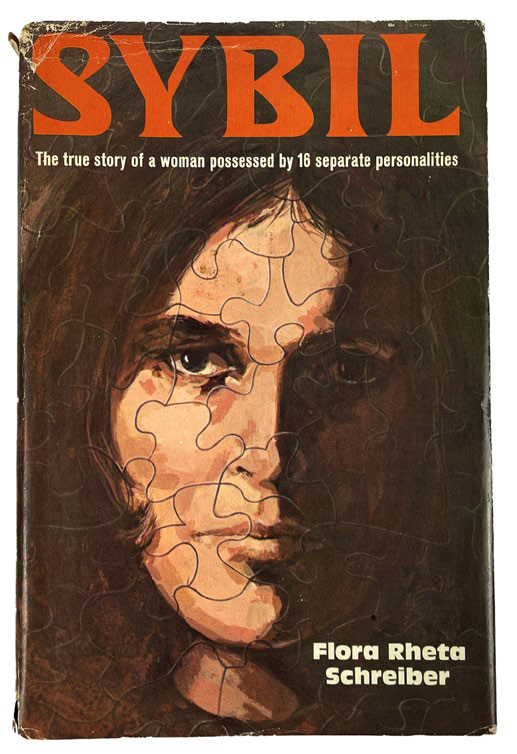

This creates a risk of what’s sometimes called a “Sybil attack,” named not after the ancient Greek prophetesses but, rather, after the 1973 book about a woman who claimed to have multiple personalities. The idea of a Sybil attack is that, in a system where the ledger is collectively maintained by the group and anyone can join the group without permission, you can spin up a bunch of computer nodes so that you look like thousands of people. Then you verify bad transactions to yourself, and everyone is like, “Ah, well, look at all of these people verifying the transactions,” and they accept your transactions as the majority consensus, and either you manage to steal some money or you at least throw the whole system into chaos.

这样做会带来一种所谓的“西比尔攻击”的风险,该名称并不是来自古希腊女预言家,而是来自 1973 年的一本关于一个女人声称拥有多重人格的书籍。西比尔攻击的想法是,在一个由集体维护的账本系统中,任何人都可以无需许可加入该系统,你可以启动一大批计算机节点,使自己看起来像成千上万的人。然后,你可以验证一些恶意交易,大家都会说:“哇,看看这些人都在验证交易”,然后他们会接受你的交易作为多数人的共识,或者你可以偷走一些钱,或者至少可以将整个系统扔进混乱中。

The solution to this is to make it expensive to verify transactions.

解决这个问题的方法是使交易验证变得昂贵。

To mine a block, Bitcoin miners do an absurd and costly thing. Again, it involves hashing. Each miner takes a summary of the list of transactions in the block, along with a hash of the previous block. Then the miner sticks another arbitrary number—called a “nonce”—on the end of the list. The miner runs the whole thing (list plus nonce) through a SHA-256 hashing algorithm. This generates a 64-digit hexadecimal number. If that number is small enough, then the miner has mined the block. If not, the miner tries again with a different nonce.

在挖掘一个区块时,比特币矿工会做一些荒谬而昂贵的事情。再次,这涉及到哈希运算。每个矿工都会将区块中的交易列表摘要与前一个区块的哈希值结合起来,然后矿工会在列表末尾添加一个任意数字——称为“nonce”。矿工会将整个列表(包括 nonce)通过 SHA-256 哈希算法运行。这将生成一个 64 位十六进制数字。如果该数字足够小,那么矿工就挖掘了该区块。如果不够小,矿工就会尝试使用不同的 nonce。

What “small enough” means is set by the Bitcoin software and can be adjusted to make it easier or harder to mine a block. (The goal is an average of one block every 10 minutes; the more miners there are and the faster their computers are, the harder it gets.) Right now, “small enough” means that the hash has to start with 19 zeros. A recent successful one looked like this:

比特币软件定义了什么是“足够小”,可以调整以使挖矿变得更容易或更难。目标是每 10 分钟平均挖出一个块;矿工越多、计算机越快,挖矿就越难。目前,“足够小”意味着哈希值必须以 19 个零开头。最近一个成功的哈希值看起来像这样:

It’s like a game of 20 questions where you’re constantly guessing a number that will work. Except you get no clues, and it’s many, many, many times more than 20 guesses. It is vanishingly, vanishingly unlikely that any particular input—any list of transactions plus a nonce—will hash to a number that starts with 19 zeros. The odds are roughly 75 sextillion-to-1 against. So the miners run the hash algorithm over and over again, trillions of times, guessing a different nonce each time, until they get a hash with the right number of zeros.16 The total hash rate of the Bitcoin network is something north of 200 million terahashes per second—that is, 200 quintillion hash calculations per second, which is 1) a lot but 2) a lot fewer than 75 sextillion. It takes many seconds—600 on average—at 200 quintillion hashes per second to guess the right nonce and mine a block.

这就像玩 20 个问题的游戏,你不断猜测一个有效的数字。只是你没有任何线索,而猜测的次数远远超过 20 次。任何特定的输入——任何交易列表加上一个随机数——哈希到以 19 个零开头的可能性微乎其微。概率大约是 75 sextillion 比 1。因此,矿工不断运行哈希算法,猜测不同的随机数,直到他们得到一个正确的哈希值。 16 比特币网络的总哈希率超过 200 万 terahashes 每秒——即每秒 200 quintillion 次哈希计算,这是一个很大的数字,但远远小于 75 sextillion。平均需要 600 秒,在 200 quintillion 次哈希计算每秒的情况下,猜测正确的随机数并挖出一个块。

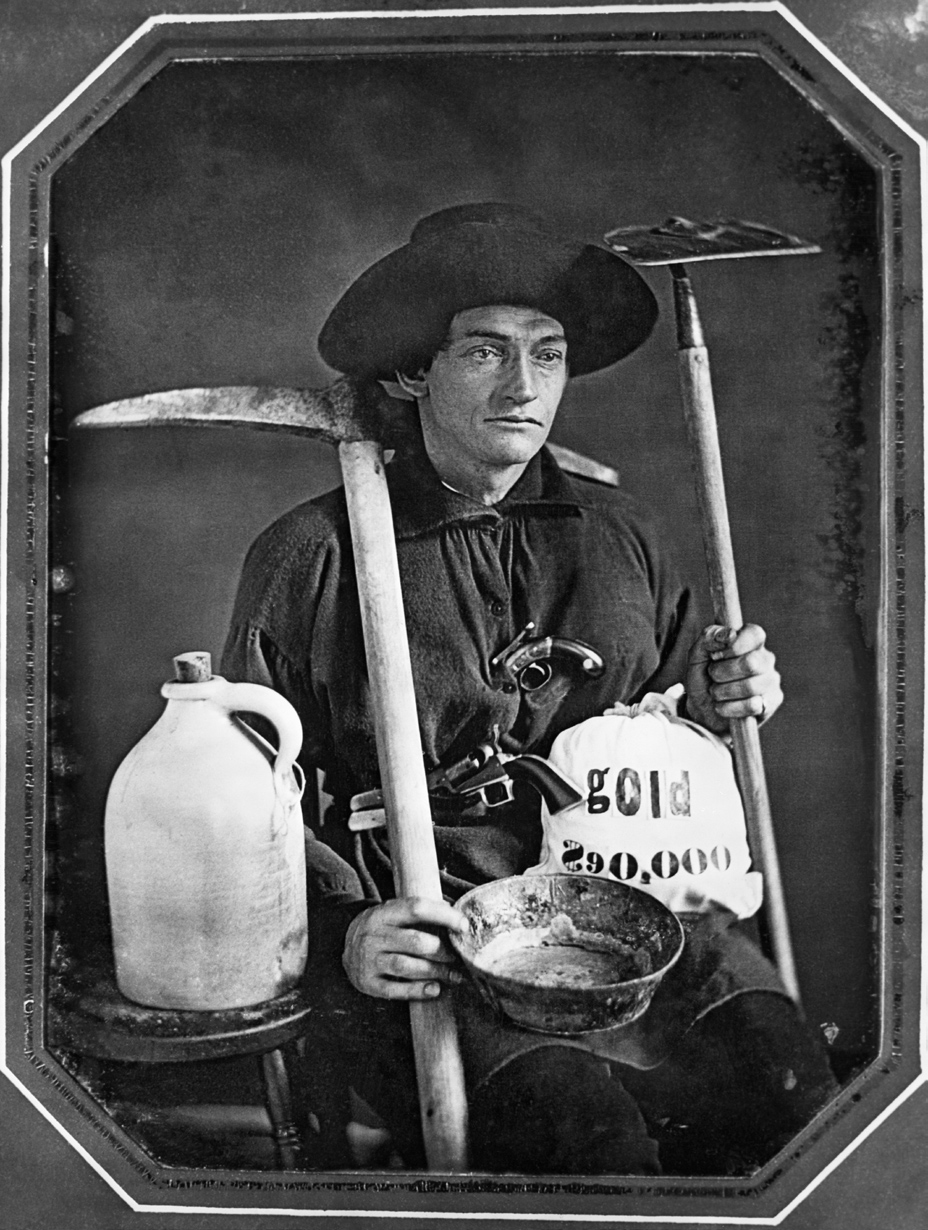

This is a race. Only one miner gets to mine a block, and that miner gets rewarded with Bitcoin. To mine a block is also to “mine” new coins—to pry them out of the system after much computational work, like finding a seam of gold after picking through rock. Hence the metaphor.

这是一场竞赛。只有一个矿工能够开采一个区块,并获得比特币奖励。开采一个区块也意味着“开采”新币——在系统中经过大量计算工作后,找到新的币,就像在岩石中找到金矿一样。因此,这是一个隐喻。

When miners find the right number of zeros, they publish the block and its hash to the Bitcoin network. Everyone else reviews the block and decides if it’s valid. (“Valid” means all the transactions on the list are valid, the hash is correct, it has the right number of zeros, etc.) If they do, then they start work on the next block: They take the hash of the previous block, plus the transactions that have come in since then, plus a new nonce, and try to find a new hash. Each block builds on the one before.

当矿工找到正确的零数时,他们将区块及其哈希值发布到比特币网络。其他人则审核该区块,决定其是否有效。(“有效”意味着列表上的所有交易都是有效的,哈希值正确,零数正确等等。)如果他们审核通过,则开始工作于下一个区块:他们取前一个区块的哈希值,加上自那时以来收到的交易,再加上一个新的随机数,然后尝试找到一个新的哈希值。每个区块都是基于前一个区块的。

All of this is incredibly costly: Miners need special hardware to do all of these hashing calculations over and over again, and these days run huge farms of always-on computers. Mining Bitcoin uses as much electricity as various medium-size countries. This is not great for the environment. The most famous description of Bitcoin, attributed to a Twitter poster, might be:

所有这些都是非常昂贵的:矿工需要特殊的硬件来进行这些哈希计算,并且这些天他们运行着巨大的、始终在线的计算机群。挖掘比特币使用的电力相当于一些中等规模国家的电力。这对环境不是很友好。比特币最著名的描述,来自一位 Twitter 用户,可能是:

And it is in some sense purely wasteful. People sometimes say Bitcoin miners are, like, solving difficult math problems to do their mining, but they aren’t, really. They’re brute-force guessing quintillions of numbers per second to try to get the right hash. No math problems are being solved, and nothing is added to the world’s knowledge, by those quintillions of guesses.

从某种意义上说,这完全是浪费。人们有时说比特币矿工在解决困难的数学问题,以便进行挖矿,但实际上他们不是。他们每秒猜测数十万亿个数字,试图获得正确的哈希值。这些猜测并没有解决任何数学问题,也没有为世界的知识贡献任何东西。

But the miners are solving an important problem for Bitcoin, which is the problem of keeping its network and its ledger of transactions secure. It’s demonstrably costly to confirm Bitcoin transactions, so it’s hard to fake, hard to run a Sybil attack. That’s why Satoshi, and everyone else, calls this method of confirming transactions “proof of work.” If you produce the right hash for a block, it proves you did a lot of costly computer work. You wouldn’t do that lightly.

但是矿工们正在解决比特币的一个重要问题,即保持其网络和交易记录的安全。确认比特币交易的成本是明显的,因此很难伪造,很难实施 Sybil 攻击。这就是为什么中本聪和其他人将这种确认交易的方法称为“工作量证明”。如果你为一个块生成了正确的哈希值,那就证明你进行了大量昂贵的计算工作。你不会轻易地做这种事情。

Proof-of-work mining is a mechanism for creating consensus among people with an economic stake in a system, without knowing anything else about them. You’d never mine Bitcoin if you didn’t want Bitcoin to be valuable. If you’re a Bitcoin miner, you’re invested in Bitcoin in some way; you’ve bought computers and paid for electricity and made an expensive, exhausting bet on Bitcoin. You have proven that you care, so you get a say in verifying the Bitcoin ledger. And you get paid. You get paid Bitcoin, which gives you even more of a stake in the system.

工作量证明挖矿是一种在系统中拥有经济利益的人之间达成共识的机制,不需要知道他们的其他任何信息。你永远不会挖掘比特币,除非你想让比特币变得有价值。如果你是一名比特币矿工,那么你一定以某种方式投资了比特币;你购买了计算机,支付了电费,并为比特币进行了昂贵、疲惫的赌注。你已经证明了你关心,所以你有权验证比特币账本。而且你还会得到报酬。你会得到比特币,这将使你在系统中拥有更多的利益。

These Bitcoin come out of nowhere; they’re generated by this mining, by the core Bitcoin software. In fact, all Bitcoin are generated by mining; there was never an initial allocation of Bitcoin to Satoshi Nakamoto or to early investors or anyone else. This is the answer to the question of where Bitcoin come from: They were all mined.

这些比特币来自无中生有;它们是通过矿工活动和核心比特币软件生成的。事实上,所有比特币都是通过矿工活动生成的;从来没有对萨托西·中本托或早期投资者等人的初始比特币分配。这是比特币来自何处的答案:它们都是通过矿工活动生成的。

Originally the mining reward, which is set by the software, was 50 Bitcoin per block; currently it’s 6.25 Bitcoin. One important point about these mining rewards is that they cost Bitcoin users money. Every block—roughly every 10 minutes—6.25 new Bitcoin are produced out of nowhere and paid to miners for providing security to the network. That works out to more than $6 billion per year.17 This cost is indirect: It is a form of inflation, and as the supply of Bitcoin grows,18 each coin in theory becomes worth a little less, all else being equal. Right now, the Bitcoin network is paying around 1.5% of its value per year to miners.

最初,矿工奖励是由软件设置的,每个区块 50 比特币;目前是 6.25 比特币。关于这些矿工奖励的一个重要点是,它们会花费比特币用户的钱。每个区块——大约每 10 分钟——6.25 个新的比特币会被创造出来,并支付给矿工,以换取他们为网络提供的安全保障。这相当于每年超过 60 亿美元。这笔费用是间接的:它是一种通货膨胀,当比特币供应增加时,每枚币的理论价值就会减少,其他条件不变。目前,比特币网络每年支付给矿工的价值约为其总价值的 1.5%。

That’s lower than the inflation rate of the US dollar. Still, it’s worth noting. Every year, the miners who keep the Bitcoin system secure capture a small but meaningful chunk of the total value of Bitcoin. Bitcoin users get something for that $6 billion:19

这甚至低于美元的通胀率。然而,这仍然值得注意。每年,保护比特币系统安全的矿工们都会获得比特币总价值的一小部分。为那 60 亿美元,比特币用户们得到了什么: 19

If you can make a lot of money mining Bitcoin, a lot of people will want to mine Bitcoin. This will make it harder for one person to accumulate most of the mining power in Bitcoin. If one person or group got a majority of the mining power, they could do bad things: They could mine a bad block—double-spending coins, reversing recent transactions, etc. (This is called a “51% attack.”) When there are billions of dollars up for grabs for miners, people will invest a lot of money in mining, and it will be expensive to compete with them. And if you invested billions of dollars to accumulate a majority of the mining power in Bitcoin, you would probably care a lot about maintaining the value of Bitcoin, and so you’d be unlikely to use your powers for evil.

如果挖掘比特币可以赚很多钱,那么很多人都会想挖掘比特币。这将使得一个人积累大多数的挖掘能力变得更加困难。如果一个人或团体获得了大多数的挖掘能力,他们可以做坏事:他们可以挖掘一个坏的区块——双花币、逆转最近的交易等。(这被称为“51%攻击”)。当有数十亿美元的奖励等待矿工时,人们会投资很多钱来挖掘,并且与他们竞争将变得非常昂贵。如果你投资了数十亿美元来积累大多数的挖掘能力,你可能非常关心维护比特币的价值,因此你不太可能使用你的权力来做坏事。

So, huh, that’s neat. OK, then. I’ve described in some detail the workings of the thing, Bitcoin, that Satoshi Nakamoto invented. But let’s take a step back: What exactly is it that he invented?

哦,嗯,这很有趣。好吧,那么。我已经详细描述了比特币的工作原理,这是 Satoshi Nakamoto 发明的东西。但是,让我们退一步:他到底发明了什么?

The simplest answer is that he invented Bitcoin.

最简单的答案是,他发明了比特币。

BITCOIN IS A BIG THING.

比特币是一个大事情。

At its peak, the total value of Bitcoin in the world was more than $1 trillion. There are thousands of articles about it; it has lots of investors and fans and believers. Some of these people are called “Bitcoin maximalists”; they believe that the only really interesting and valuable thing in the world of crypto is Bitcoin. Those people could stop here, I guess. There it is, Bitcoin.

在其巅峰时,比特币在全球的总价值超过了 1 万亿美元。有成千上万篇关于它的文章;它有很多投资者、粉丝和信仰者。其中一些人被称为“比特币最大主义者”;他们认为,crypto 世界中唯一真正有趣和有价值的东西就是比特币。那些人可能可以停下来了。那里就是比特币。

Here, though, I want to keep going. I want to talk about different ways that you might generalize Satoshi’s invention. There are different ways to interpret what Satoshi was up to and what he accomplished, and each interpretation points you to a different direction for crypto.

不过,我想继续下去。我想讨论 Satoshi 的发明可以被泛化的不同方式。有不同的方式来解释 Satoshi 在做什么和他所取得的成果,每种解释都会指向 crypto 的不同方向。

A minimal generalization of Bitcoin is something like: Satoshi invented a technology for people to send numbers to one another. That’s not nothing. Before Satoshi, I could’ve written you an email that said “132.51,” but you’d have no way of knowing whether I had the 132.51 on my computer or whether I’d already sent the 132.51 to someone else, and you’d have no way of proving to other people that you now had the 132.51 on your computer and could send it to them.

比特币的一个最小泛化是这样的:萨托西发明了一种技术,让人们可以互相发送数字。这不是什么都没有。在萨托西之前,我可以给你发一封电子邮件,说“132.51”,但是你不知道我是否已经在电脑上拥有了 132.51,或者我是否已经将其发送给了其他人,你也无法证明你现在拥有了电脑上的 132.51 并可以将其发送给其他人。

I realize that paragraph sounds very stupid, because it is. You definitely have 132.51 on your computer, as well as every other conceivable number; computers can generate numbers arbitrarily and more or less for free. Open a spreadsheet, type “132.51,” and there you go. In a sense, the technological accomplishment of Bitcoin is that it invented a decentralized way to create scarcity on computers. Bitcoin demonstrated a way for me to send you a computer message so that you’d have it and I wouldn’t, to move items of computer information between us in a way that limited their supply and transferred possession.

我意识到上一段话听起来很愚蠢,因为它确实如此。你肯定拥有电脑上的 132.51,以及其他任何可能的数字;计算机可以任意生成数字,几乎不花费任何成本。打开电子表格,输入“132.51”,就这样了。在某种意义上,比特币的技术成就是它发明了一种去中心化的方式来在计算机上创造稀缺性。比特币展示了一种方式,让我可以将电脑信息发送给你,使你拥有它,而我不再拥有,将信息从我们之间转移,限制供应并转移所有权。

But the technological accomplishment is not the whole story, arguably not even the most important part. The wild thing about Bitcoin is not that Satoshi invented a particular way for people to send numbers to one another and call them payments. It’s that people accepted the numbers as payments.

但是技术成就是不整个故事,可能甚至不是最重要的部分。比特币的野蛮之处不是萨托西发明了一种特殊的方式,让人们可以互相发送数字并称之为支付,而是人们接受了这些数字作为支付。

There’s nothing inherent in the technology that would make that happen. People might have read the Bitcoin white paper and said, “Huh, this is a cool way to send payments, but your problem is that you aren’t sending dollars, you’re sending this thing you just made up, and who wants that?” Well, most of them did say that, initially. But lots of people eventually decided that Bitcoin was valuable.

技术本身并没有什么固有的特性会导致这种情况。人们可能读过比特币白皮书,然后说:“哇,这是一种很酷的支付方式,但你的问题是你不是发送美元,而是发送你刚刚创造出来的东西,谁想要那种东西?”嗯,大多数人最初确实这么说。但是,许多人最终决定比特币是有价值的。

That’s weird! Satoshi was like,

这太奇怪了!中本聪就像,

And enough people were like,

而足够多的人就像,

that now crypto is a trillion-dollar business. That social fact, that Bitcoin was accepted by many millions of people as having a lot of value, might be the most impressive thing about Bitcoin, much more than the stuff about hashing.

现在加密货币已经是一家万亿美元的生意了。这一社会事实,比特币被数百万人接受为具有很高价值的,可能是比特币最让人印象深刻的事情,比哈希相关的东西更重要。

Here’s another extremely simple generalization of Bitcoin:

这是比特币另一个非常简单的概括:

As Bitcoin became more visible and valuable, people just … did … that? There was a rash of cryptocurrencies that were sometimes subtle variations on Bitcoin and sometimes just lazy knockoffs. “Shitcoins” is the mean name for them.

比特币变得更受关注和有价值时,人们就……做了那样?出现了一大批加密货币,有时是比特币的微妙变种,有时只是懒惰的山寨货。“垃圾币”是它们的贬义称呼。

In 2013 two software engineers threw together a cryptocurrency and gave it a logo of Doge, the talking shiba inu meme. They called it Dogecoin, and it was a parody of the coin boom. It’s worth about $8 billion today. I’m not going to explain that to you. Nobody is going to explain that to you. Certainly the guys who invented Dogecoin don’t understand it; one of them has taken to Twitter to say he hates it. It’s just, like, if you’re making up an arbitrary token that trades electronically, and you hope people will buy it for no particular reason, you might as well make it fun. Slap a talking dog on it; give people stuff to make jokes about online.

2013 年,两名软件工程师匆忙创造了一种加密货币,并将其标志设为会说话的柴犬 meme Doge。他们将其命名为狗狗币,是对币圈热潮的讽刺。今天它的价值约为 80 亿美元。我不想向你解释这件事。没人会向你解释这件事。狗狗币的创造者们也不理解它;其中一人甚至在 Twitter 上说他讨厌它。这只是,如果你创造了一个任意的电子交易 token,希望人们无缘无故地购买它,你可能会让它变得有趣。给它贴上一个会说话的狗的标志,让人们在线上开玩笑。

Incidentally, here’s a fun argument that was made against Bitcoin early in its life:

顺便说一下,有人曾经对比特币早期提出了一个有趣的反对意见:

This argument turned out to be mostly wrong. Socially, cryptocurrency is a coordination game; people want to have the coin that other people want to have, and some sort of abstract technical equivalence doesn’t make one cryptocurrency a good substitute for another. Social acceptance—legitimacy—is what makes a cryptocurrency valuable, and you can’t just copy the code for that.

这个论点证明大部分是错误的。从社会角度看, cryptocurrency 是一个协调游戏;人们想要拥有其他人想要拥有的币,而某种抽象的技术等同性并不使一个 cryptocurrency 成为另一个的良好替代。社会接受——合法性——是使 cryptocurrency 有价值的东西,你不能只是复制代码来获得它。

That’s a revealing fact: What makes Bitcoin valuable isn’t the elegance of its code, but its social acceptance.20 A thing that worked exactly like Bitcoin but didn’t have Bitcoin’s lineage—didn’t descend from Satoshi’s genesis block and was just made up by some copycat—would have the same technology but none of the value.

这是一个启示的事实:使比特币有价值的不是代码的优雅,而是社会接受。 20 一件东西如果像比特币一样工作,但没有比特币的血统——没有来自萨托西的创世区块,而只是某个抄袭者编造的——就会拥有相同的技术,但没有价值。

Here’s another generalization of Bitcoin:

这是比特币的另一个概括:

Satoshi made up an arbitrary token that trades electronically for some price.

佐托什创造了一个任意的电子交易代币,它的价格是多少。

The price turns out to be high and volatile.

结果,这个价格非常高且波动性强。

The price of an arbitrary token is … arbitrary?

任意代币的价格是……任意的?

This may not sound that great to you. But it’s very interesting as a matter of finance theory. Modern portfolio theory demonstrates that adding an uncorrelated asset to a portfolio can improve returns and reduce risk. Big institutions will invest in timberland or highway tolls or hurricane insurance, because they think that those things won’t act just like stocks or bonds, that they’ll diversify their portfolios, that they’ll hold up even in a world where stocks go down.

这可能听起来不太吸引人。但是,从金融理论角度来说,这非常有趣。现代投资组合理论表明,添加一个不相关的资产到投资组合中可以提高回报和降低风险。大型机构会投资于林地、高速公路通行费或飓风保险,因为他们认为这些东西不会像股票或债券那样运作,它们会分散投资组合,即使股票下跌也能保持不变。

To the extent that the price of Bitcoin 1) mostly goes up, though with lots of ups and downs along the way, and 2) goes up and down for reasons that are arbitrary and mysterious and not tied to, like, corporate earnings or the global economy, then Bitcoin is interesting to institutional investors.

在比特币的价格主要上涨(尽管途中有很多起伏),且涨跌原因是任意的、神秘的,不与公司收益或全球经济挂钩的情况下,比特币对机构投资者来说非常有趣。

There are variations. For instance:

有些变化。例如:

Bitcoin is not just uncorrelated to regular financial stuff—it’s a hedge to inflation. If the Federal Reserve is printing money recklessly, the dollar will lose value, but Bitcoin is in limited supply and will maintain its value even as the dollar is inflated away.

比特币不仅与传统金融无关,还是一种通胀避险工具。如果美联储疯狂印钞,美元将贬值,但比特币供应有限,将保持其价值,即使美元被通胀稀释。

Bitcoin is like gold but more convenient. The value of gold is also somewhat arbitrary and mysterious, but it’s a store of value that’s not tied to corporate earnings and central bank policy. Investors who like gold should buy Bitcoin.

比特币像黄金,但更方便。黄金的价值也有一些任意和神秘,但它是一种不受企业利润和中央银行政策束缚的价值存储。喜欢黄金的投资者应该购买比特币。

Well, those are some things that people said. In practice, it turns out that the price of Bitcoin is pretty correlated with the stock market, especially tech stocks. Bitcoin hasn’t been a particularly effective inflation hedge: Its price rose during years when US inflation was low, and it’s fallen this year as inflation has increased. The right model of crypto prices might be that they go up during broad speculative bubbles when stock prices go up, and then they go down when those bubbles pop. That’s not a particularly appealing story for investors looking to diversify. You want stuff that goes up when the broad bubbles pop!

好吧,这些都是人们所说的。在实践中,事实证明比特币的价格与股票市场高度相关,特别是科技股。比特币并不是一种非常有效的通胀避险工具:其价格在美国通胀率低的年份上涨,而今年随着通胀率上涨而下跌。加密货币价格的正确模型可能是:在广泛的投机泡沫中,当股票价格上涨时,它们也上涨,而当泡沫破裂时,它们下跌。这不是投资者寻求多样化的特别吸引人的故事。你想要的是当大泡沫破裂时上涨的东西!

I’m not going to dwell on the meme-stock phenomenon here—I dwelt on it in this publication last December. But one important possibility is that the first generalization of Bitcoin, that an arbitrary tradeable electronic token can become valuable just because people want it to, permanently broke everyone’s brains about all of finance.

我不想在这里详细讨论 meme 股票现象——我去年十二月在这本出版物中已经讨论过了。但有一种重要可能性是,Bitcoin 的第一次泛化,即任意可交易的电子 token 只因为人们想要它就变得有价值,永久地改变了所有人对金融的看法。

Before the rise of Bitcoin, the conventional thing to say about a share of stock was that its price represented the market’s expectation of the present value of the future cash flows of the business. But Bitcoin has no cash flows; its price represents what people are willing to pay for it. Still, it has a high and fluctuating market price; people have gotten rich buying Bitcoin. So people copied that model, and the creation of and speculation on pure, abstract, scarce electronic tokens became a big business.

在 Bitcoin 崛起之前,对股票的传统看法是,其价格代表了市场对业务未来现金流的预期价值。但 Bitcoin 没有现金流;其价格代表了人们愿意为它支付的金额。然而,它具有高且波动的市场价格;人们通过购买 Bitcoin 变得富有。于是,人们复制了这个模式,纯粹抽象的稀缺电子 token 的创造和投机变成了一个大业务。

A share of stock is a scarce electronic token. It’s also something else! A claim on cash flows or whatever. But one thing that it is is an electronic token that’s in more or less limited supply. If you and your friends online want to make jokes and invest based on those jokes, then, depending on your sense of humor and which online chat group you’re in, you might buy either Dogecoin or GameStop Corp. stock, and for your purposes those things are not that different.

一只股票是一种稀缺的电子 token。它也是其他东西!对现金流的索赔或其他什么。但是,它确实是一种电子 token,供应量大致有限。如果你和你的在线朋友想根据幽默感和所在的在线聊天群来投资,那么,你可能会购买 Dogecoin 或 GameStop Corp. 的股票,对你来说,这两种东西没什么不同。

Here’s another, very different generalization of Bitcoin. In its sharpest form, it’s mostly attributed to programmer Vitalik Buterin, another colorful character whom we won’t discuss.21 It goes like this:

这是比特币另一个非常不同的概括。在其最尖锐的形式中,它主要归因于程序员维塔利克·布特林,另一个我们不讨论的有趣人物。它是这样子的:

Look, this thing you made is a big, sprawling computer. The blockchain is doing the functions of a computer. Specifically, it’s keeping a database of Bitcoin transactions.

看,这件你创造的东西是一个庞大的、复杂的计算机。区块链正在执行计算机的功能。具体来说,它正在维护比特币交易的数据库。

This computer has some fascinating properties. It’s distributed: The computer’s data aren’t kept on any one particular machine but spread out among lots of nodes. The blockchain creates a mechanism to make sure they all agree on what the database says. It’s decentralized: Different people run the database on their own separate machines. It’s secure and final: Because of how transactions are encoded into blocks, it’s more or less impossible for someone to reach back into the database and change a transaction from last week. And it’s trustless and permissionless: Anyone who wants to can download the blockchain or mine Bitcoin. The mining mechanism gives people incentives to collaborate and compete with one another to keep the database secure and up to date.

这台计算机有一些迷人的特性。它是分布式的:计算机的数据不存储在任何一台特定的机器上,而是分布在许多节点上。区块链创建了一种机制,以确保它们都同意数据库的内容。它是去中心化的:不同的个人在自己的独立机器上运行数据库。它是安全的和不可更改的:由于交易被编码到块中,因此几乎不可能有人回到数据库中更改上周的交易。并且它是无需信任和无需许可的:任何人都可以下载区块链或挖掘比特币。挖掘机制为人们提供了合作和竞争的激励,以保持数据库的安全和更新。

But it’s not a very good computer. Mostly it just keeps a list of payments.

但这不是一个非常好的计算机。它主要只是维护一份付款清单。

4. LET’S DO THE SAME THING, BUT MAKE IT A GOOD COMPUTER.

4. 让我们做同样的事情,但制造一台好的计算机。

The computer that Vitalik22 invented is generally called Ethereum, or the Ethereum Virtual Machine: It’s a virtual computer, distributed among thousands of redundant nodes. Each node knows the “state” of the computer—what’s in its memory—and each transaction on the system updates that state.

维塔利克发明的计算机通常被称为以太坊或以太坊虚拟机:它是一台虚拟计算机,分布在成千上万个冗余节点上。每个节点都知道计算机的“状态”—它的内存中的内容—每笔交易都会更新该状态。

Ethereum works a lot like Bitcoin: People create transactions, they broadcast them to the network, the transactions are included in a block, the blocks get chained together, everyone can see every transaction, etc. The currency of the Ethereum blockchain is called … I dunno, it’s common to call it “Ether,” though sometimes people say “Ethereum,” and often they just write “ETH.” (Similarly, Bitcoin is sometimes written “BTC.”) In conversation it’s mostly shortened to “Eth,” pronounced “Eeth.”

以太坊的工作方式与比特币非常相似:人们创建交易,然后将其广播到网络,交易被包含在一个块中,块被链接在一起,每个人都可以看到每笔交易,等等。以太坊区块链的货币通常被称为“以太”,有时人们也说“以太坊”,而且经常简写为“ETH。”(类似地,比特币有时也被写为“BTC。”)在对话中,它通常被缩短为“Eth”,发音为“以斯。”

But whereas Bitcoin transactions are mostly about sending payments,23 actions on Ethereum are conceived of more generally: Ethereum is a big virtual computer, and you send it instructions to do stuff on the computer. Some of those instructions are “Send 10 Ether from Address X to Address Y”: One thing in the computer’s memory is a database of Ethereum addresses and how much Ether is in each of them, and you can tell the computer to update the database.

但是,以太坊上的 23 操作与比特币交易不同,以太坊是一个大型虚拟计算机,你可以向其发送指令来执行任务。其中的一些指令是“从地址 X 向地址 Y 发送 10 个以太”:计算机的内存中有一份以太坊地址和每个地址中以太数量的数据库,你可以告诉计算机更新数据库。

But you can also write programs to run on the computer to do things automatically. One sort of program might be: Send 10 Ether to Address Y if something happens. Alice and Bob might want to bet on a football game, or on a presidential election, or on the price of Ether.24 They might write a computer program on the Ethereum Virtual Machine to do that. The program would have its own Ethereum account where it could keep Ether, and its programming logic would say something like “if the Jets win on Sunday”—or “if Joe Biden wins the election,” or “if Ether trades above $1,500 on November 1”—“then send the money in this account to Alice; otherwise send it to Bob.” Alice and Bob might then each send one Ether to the account, and it would whir along for a bit checking the football scores or the election results or the Ether price,25 and then when it had an answer to its question—who won the game or the election or is Ether above $1,500—it would automatically resolve the bet and send two Ether to the winner.

但是你也可以编写程序在计算机上自动执行任务。一种程序可能是:如果某事发生,则将 10 个以太币发送到地址 Y。Alice 和 Bob 可能想赌足球比赛、总统选举或以太币的价格。他们可能会编写一个在以太坊虚拟机上运行的计算机程序来实现这一点。该程序将拥有自己的以太坊账户,可以存储以太币,其编程逻辑将说些类似于“如果 Jet 队周日赢了”—或“如果 Joe 赢了选举”,或“如果以太币在 11 月 1 日交易价格超过 1500 美元”—“那么将账户中的钱发送给 Alice;否则将发送给 Bob。” Alice 和 Bob 可能然后各自将一个以太币发送到账户,然后它将检查足球比赛的结果、选举结果或以太币的价格,直到它找到问题的答案——谁赢了比赛或选举,或者以太币是否超过 1500 美元,然后自动解决赌注并将两个以太币发送给赢家。

Or you could have a program that says: “If anyone sends one Ether to this program, the program will send them back something nice.” “Something nice” is pretty hazy there, and frankly it’s pretty hazy in actual practice, but in concept anything that you can put into a computer program could be the reward here. So “send me one Ether and I will send you back a digital picture of a monkey” would be one possible program, and I guess it sounds like I’m joking, but for a while digital pictures of monkeys were selling for millions of dollars on Ethereum. Or there’s a thing called the Ethereum Name Service, or ENS, which allows people to register domain names like “matthewlevine.eth” and use them across various Ethereum functions. You send Ether to the ENS program, and it registers that name to you—you send in money, and it sends you back a domain.

或者你可以编写一个程序,说:“如果有人向这个程序发送一个以太币,这个程序将回馈一些好东西。”这里的“好东西”非常模糊,实际上也非常模糊,但从概念上讲,任何可以编入计算机程序的东西都可以作为回馈。因此,“发送我一个以太币,我将回馈一张数字猴子图片”就是一个可能的程序,我猜这听起来像是在开玩笑,但有一段时间数字猴子图片在以太坊上卖出了数百万美元。或者还有一个叫以太坊命名服务(ENS)的东西,它允许人们注册像“matthewlevine.eth”这样的域名,并在各种以太坊功能中使用它们。你向 ENS 程序发送以太币,它就会将该名称注册给你——你付钱,它回馈一个域名。

The standard analogy here is a vending machine: A vending machine is a computer in the real world, where you put in a dollar and you get back something that you want. You don’t negotiate with the vending machine, or make small talk about the weather while it rings you up. The vending machine’s side of the transaction is entirely automated. Its programming makes it respond deterministically to you putting in money and pressing buttons.

这里的标准类比是一个自动售货机:自动售货机是一个现实世界中的计算机,你投入一美元,然后得到你想要的东西。你不与自动售货机进行谈判,也不与它闲聊天气,而它只是根据你投入钱和按下的按钮来响应。其编程使其对你投入钱和按下的按钮做出确定的响应。

In the crypto world, these programs are called “smart contracts.” The name is a bit unfortunate. A smart contract is a computer program that runs on the blockchain. Some smart contracts look like contracts: Alice and Bob’s bet on the price of Ethereum looks a lot like a financial derivative, which is definitely a contract. Some smart contracts look like vending machines: They sit around in public waiting for people to put money in, and then they spit out goods. A vending machine is not exactly a normal contract, but it is a transaction, and people who are into philosophizing about contracts like thinking about vending machines.

在加密世界中,这些程序被称为“智能合约”。这个名字有点不幸。智能合约是一种在区块链上运行的计算机程序。一些智能合约看起来像合约:Alice 和 Bob 对以太坊价格的赌注看起来很像金融衍生品,这当然是一个合约。一些智能合约看起来像自动售货机:它们公开等待人们投入钱,然后吐出商品。自动售货机不是正常的合约,但它是一个交易,而哲学家们喜欢思考自动售货机。

But some smart contracts just look like, you know, computer programs. The concept is more general than the name. In the Ethereum white paper, Vitalik Buterin wrote:

但是,一些智能合约只是看起来像计算机程序。这个概念比名字更广泛。在以太坊白皮书中,Vitalik Buterin 写道:

Note that “contracts” in Ethereum should not be seen as something that should be “fulfilled” or “complied with”; rather, they are more like “autonomous agents” that live inside of the Ethereum execution environment, always executing a specific piece of code when “poked” by a message or transaction, and having direct control over their own ether balance and their own key/value store to keep track of persistent variables.

注意,以太坊中的“合约”不应该被看作是需要“履行”或“遵守”的东西;相反,它们更像“自治代理”,它们生活在以太坊执行环境中,总是在收到消息或交易时执行特定的代码,并且直接控制自己的以太币余额和自己的键值存储,以跟踪持久变量。

There are limits: Ethereum is a distributed computer, but it doesn’t have a keyboard and a monitor. It would be hard to play Call of Duty on the Ethereum Virtual Machine. But Ethereum’s blockchain and smart contracts can serve as sort of a back end to other types of programs. Developers build