TMTB EOD Wrap

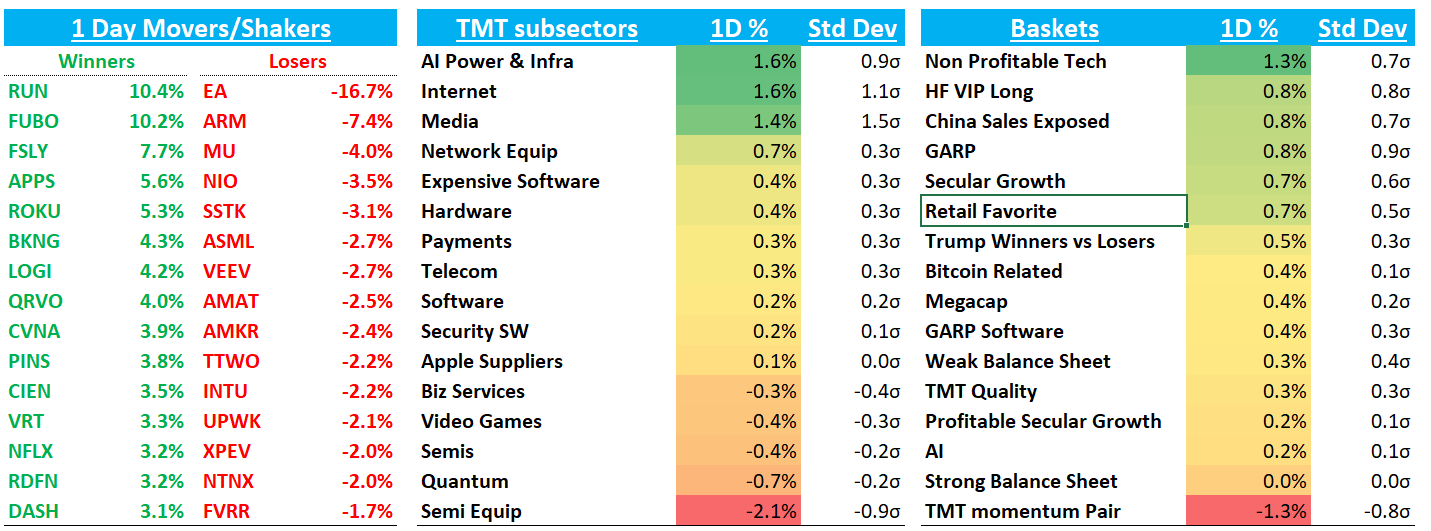

QQQ +20bps - semis finished down while strength in Internet and AI Power led the way higher. Early weakness in Stargate like ORCL +1.2%; MSFT flat; and NVDA +10bps ended being bought up — just another sign how price action decidedly more positive now vs. early last week. Despite the slight up day, lots of names up 1%+ on my screen.

Trump was at Davos calling for OPEC to lower oil prices, central banks to lower interest rates and reiterated stance on slashing taxes and regulation. Talked up relationship with China. BTC -1.5% recovered some gains as Trump tea leaves mean he might buy BTC. The 2 yr dipped slightly while 10 year rose 3bps. Fed expects continue to hold stay with 40bps worth of cuts priced in for 2025..

Post-close:

TXN -3% as Q4 inline/beat. Q1 looks inline vs street but slightly better than buyside. Overall looks fine and just giving back some gains from today.

TWLO +10% after better guidance at their analyst day with prelim Q4 guide at 11% vs street at 8%, ‘25 Op inc of $825-$850 vs street at $820, $2B buyback, 21-22% OM guide for FY2027 vs street at 19% and $3B of cum FCF ‘25-27

Let’s get to the recap…

Internet

NFLX +3.2% back to around where it opened yesterday after Wolfe upgraded saying results “buried” long standing concerns about a deep slowdown after ‘23/’24 barrage of password sharing interventions.

BKNG +4% / EXPE +1.8%: Strength in travel today as OpenAI operator not a big a threat as some thought (link / demo). Stocks had been weak over the past couple days over disintermediation fears, but seems a bit overblown now. Partners of OpenAI Operator include: DASH, CART, UBER, ESTY, TGT, EBAY, TRIP, BKNG

META +2% as Clev was out positive calling out strength driven by DR spend in retail/ecom…BAML also raised PT

RBLX +1.7% despite some mixed weekly data as Cowen raised estimates on their read of 3p data

ETSY +1.6% as Yipit called out better weekly data

CHWY +2% as Yip upticked on the weekly data and Argus upgraded to Buy

DASH +3% after sell-side positive on Home Depot deal saying if 5% of HD’s digital sales were to shift to DASH, could contribute 160bps to DASH GOV, which would be significant

Other strength: ROKU +5%; PINS +3%

CVNA +4% better action today following good 3p data yesterday

Semis

MU -4% after Hynix called out mixed NAND/DRAM pricing

Semi-cap weak on Hynix calling for more moderate capex: ASML -4%; AMAT -2.5%

Analog names strong today before TXN: ADI +2%; TXN +1.8%; NXPI +1.7%

ARM -7% as Semianalysis and other said Masa has to sell some stock to fund Stargate

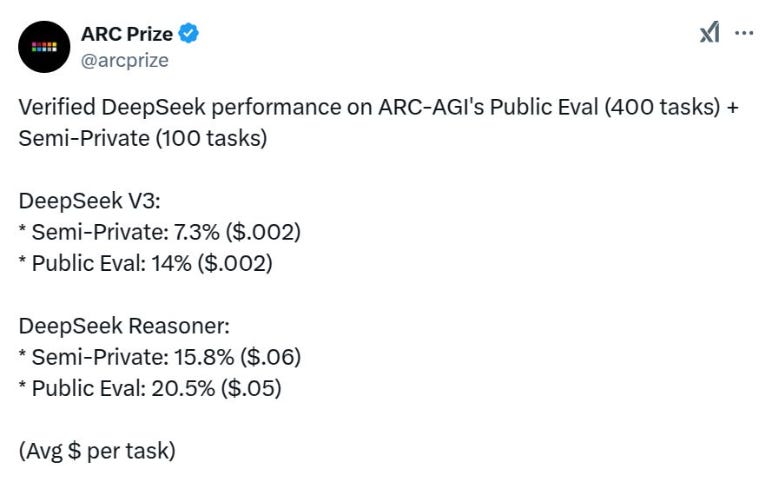

Other AI names mixed: AMD -60bps; NVDA +10bps; TSM +64bps; AVGO -25bps; MRVL +70bps…Lots of talk around DeepSeek R1

Software

ORCL +1% doesn’t stop…

VEEV-2.6% on GS’ double downgrade

PLTR +2.7% as Wedbush raised PT to $90 from $75

DDOG flat after being added to BAMLs Focus list as MS latest on sellside to say FY25 estimates too high

FTNT -80bps after DB said they could miss guidance

TEAM +1.8% acting better as MS previewed the q saying estimates conservative against “a backdrop of improving SMB spending, a resumption / uptick in digital transformation initiatives, strong channel feedback sequentially, sustained pricing power, and strong cross-sell momentum.”

Elsewhere

CIEN +3.5% - more strength as optical will be big winner from Stargate

AAPL -8bps as MS previewed saying they expect a March q guide down (5% below street) on “muted” iPhone demand

LOGI +4% as MS’ upgraded

TSLA -60bps continues to lag

PYPL flat at MS said their merchant acceptance tracker shows churn picking up with the worst quarterly performance detected since March 2019…According to MS, early bogeys +78-8% in 4 vs 6% in Q3; GP growth of ~4%

UPST +6% strong as 3p data has been particularly good heading into the q

EA -16% after their neg pre calling out weaker bookings - bears had a good day here as mgmt credibility pretty shot and core franchises slowing

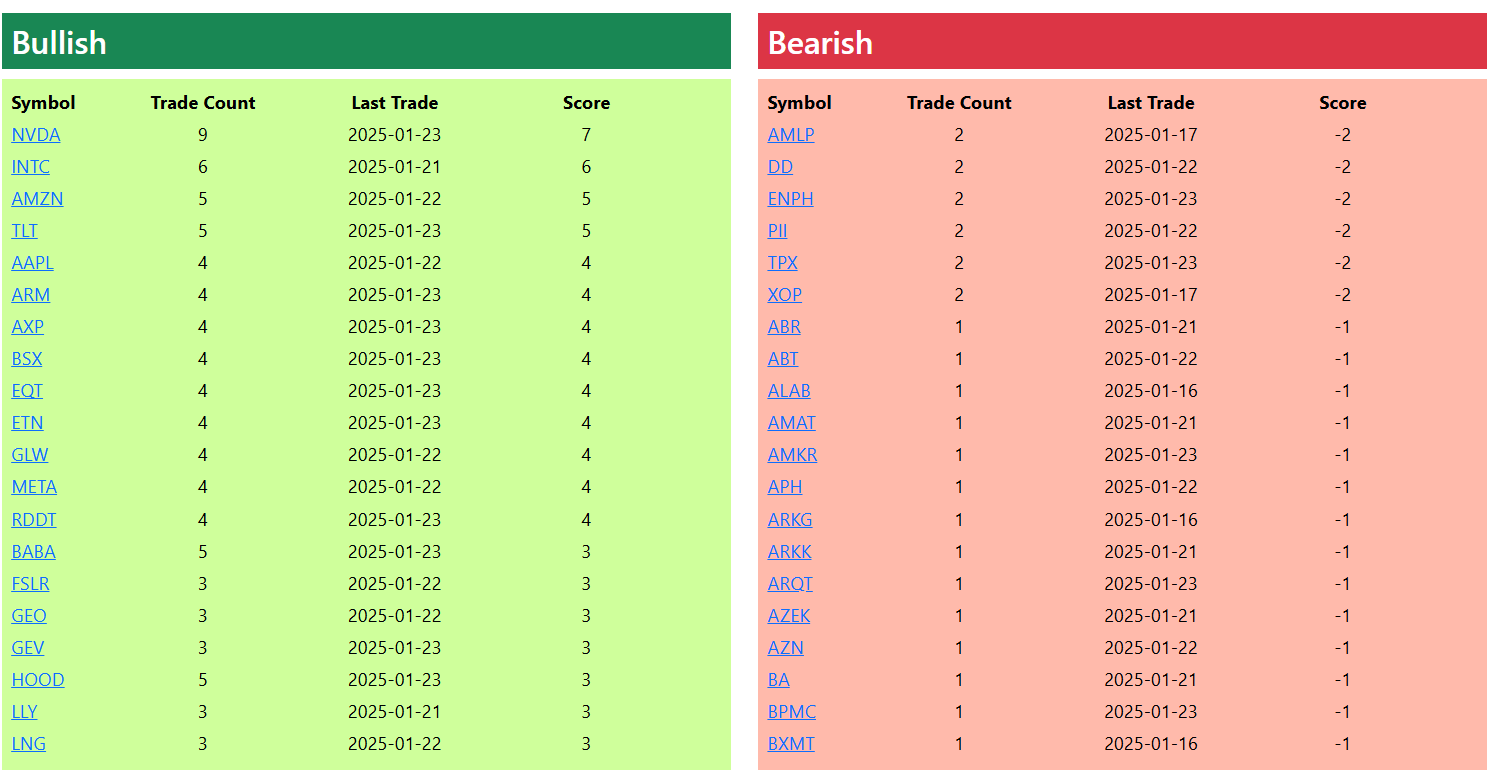

Bullish and Bearish Weekly Option Flow