TMTB EOD Wrap

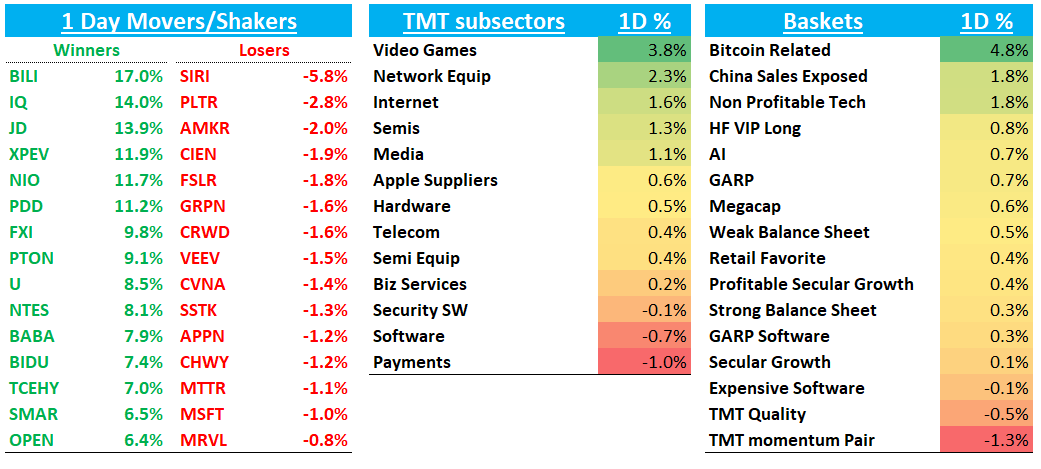

Buonasera. QQQs +48bps led by China exposed names while non-profitable tech also outperformed. Chian HSX Index was +9% following the country’s stimulus announcements. Treasures got a bid on some weaker macro data with 2 year dropping 5bps while 10 year dipped 1.5bps. Fed expects now pricing in 40bps worth of cuts in each of the final two meetings of the year.

Let’s get to the recap…

Internet

China names ripped: JD +14%; BAB+8%; NTES +8%; BIDU +7.5% despite a dg at HSBC

PINS +4% after back to back initiations at Buy, this time from Opco saying 3p integrations with AMZN/GOOGL are driving improvements to auction density and pricing while seeing upside to DAU and engagement

CVNA -1.4% on some mixed 3p data

Housing strong: Z +2.5%; OPEN +6%; RDFN +3% as yields dipped lower

Large cap lagged: GOOGL +27bps; AMZN flat; META -20bps

CART -35bps as MS cut numbers on weaker advertising

UBER +3.6% on better weekly Yip data and RJ initiation which said its view that the Uber AV narrative will swing from perceived risk (est. ~2% of bookings in Top U.S. 25 markets assuming Waymo 1P at 20% market share) to tailwind. RJ Uber/Waymo scenario analysis sees a +1-2% revenue tailwind as most likely

LYFT +5% also yip uptick on weekly data

DASH +1.5% on positive RJ intiation

ETSY +35bps despite weaker weekly Yip data

NFLX +2.4% continues to break out to new highs

SNAP +3.5% after announcing Google Gemini integration in their AI

RBLX +3.5% after better Yip data saying bookings accelerated in August

ROKU +3.5% / RDDT +3% as BAML pitched at a favorite ideas call (SPOT +3% was also pitched)

SIRI -6% as MS resumed at Sell

EXPE +3% as Msci said GBs tracking modestly ahead of street driven by strength in booked room nights

Semis

MBLY +6% as gov’t planned to ban Chinese/Russian sw in connected vehicles

NVDA +4% got a bid late in the day as MS had a TSM (+4%) out saying TSMC pulled in CoWoS capacity expansion to 80k wafers per month to 2025 from 2026 vs 60-70k, particularly from NVDA prior as INTC outsourcing to TSMC remains an additional upside driver. Barrons also said Jensen done selling for now.

Other AI names strong: ARM +1%; AVGO +1% now close to new highs; MRVL -90bps continued weakness from yesterday

Analog names strong as well: TXN +50bps; ON +1%; NXPI +1%

Software

SNOW -70bps after pricing convert

U +8.5% continues to rip as more shorts cover and call volume surged (h/t Jefferies). Sandbagged guidance + better news flow from Create pricing changes + bad news all priced = things can’t get worse recipe for short covering

SMAR +6.5% as they announced they will be acquired by Blackstone for $65.50 a share. Continues to pay to buy the first PE takeover rumor on sw stocks

Cloud names mixed: DDOG +95bps; ESTC +1.5%; CFLT +60bps; MDB +16bps

MSFT +1% / ADBE +1%

HUBS +1% as Msci said gross registrations on track to improve sequentially and est’s tracking above street

Elsewhere

TSLA +2% on a couple positive sell-side notes calling out China strength. Msci also said Cybertruck and Model 3 order trends offsetting weaker Model Y in the US

PYPL +1% continues to grind

AAPL +40bps

Bullish and Bearish Option Flow

See you all tomorrow!