TMTB Mid-day Wrap

A bit of an early one today as I’m not sure I’ll be around right at the close…

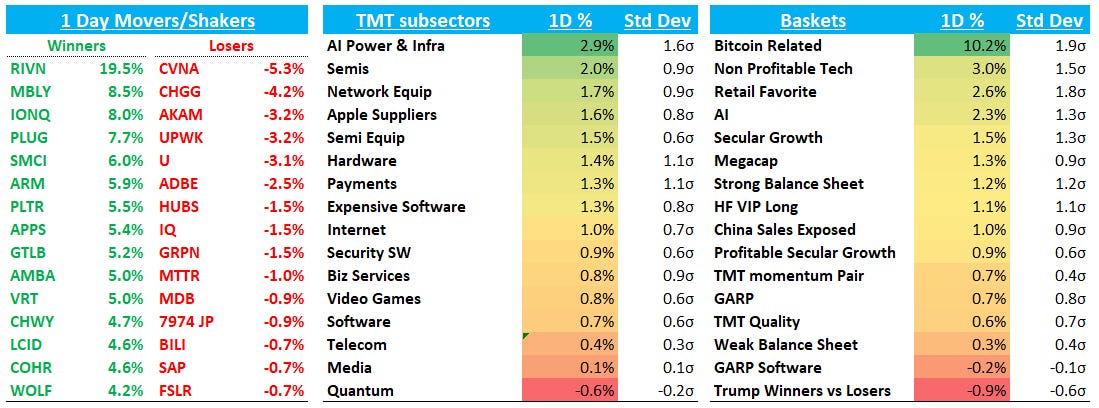

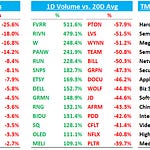

QQQs +1.4% led by Semis +2.2% again as investors gear up for CES which starts on Monday (Jensen kicks it off with his keynote on Monday at 6:30pm). Feels like investors are relaxing into the new year a bit following end of Dec. turbulence. Volume still low down 9%. Trump winners vs losers basket down -1.2% as we’re seeing a bit of laggard outperformance to start the year. Treasuries seeing modest pressure w yields up 1-2bps across the curve while fed expects continue to price in 43bps worth of cuts next year.

Let’s get to the good stuff…

Internet

CHWY +4.5% as Wolfe upgraded to Buy citing rev accel and margin expansion driven by improving customer growth, improving sector, autoship mix, new product and international expansion. 3p data here continues to look solid so would think stock continues to grind higher into the print and no risk of BC selling until after earnings

AMZN +1.7% as Yip data continues to show a nice beat to retail and Wolfe raised PT to $270 from $250

RDDT +8% - checks here continue to sound good, especially vs what street is looking for, setting up for potential accel on tougher comps which is typically a good set up. Also have wild card of LLM data deal.

SNAP +4% as JMP said new ad formats should be 3-4% tailwind to revs

CVNA -5% following Hindenburg short report yesterday despite JPM defending. We wrote some thoughts up this morning.

UBER +2.5% continues to act well despite mixed data from BTIG. Not first time in last couple weeks stock has shaken off neg news. Wolfe raised PT as well. \

LYFT +4%

NFLX flat continues to lag in the new year - Msci called out better gross adds to during holidays but also increased cancellations

GOOGL +1.3% as Youtube chief said YT still only in 1st or 2nd inning and thinkgs creators will supercharge growth with AI

JD +2.6% as Citi added to 90 day catalyst watch. Citi says JD's platform covers over 200 qualified subcategories with consumers participation from over 90% of counties and rural areas. Citi believes the strength of JD's platform and its ability to capture the continuation of trade-in initiatives "might have been underappreciated by investors." The company's early mover positioning in trade-in programs should support potentially stronger than expected merchandise volume and revenue growth in the first half of 2025 with upside risks to consensus estimates.

W - 2.5% on slight downtick at Yipit

Semis

MBLY +8% continues to act well hitting 3 months highs and now above where it was before they blew up end of July

AI stocks up nicely today ahead of CES: ARM +6%; NVDA +4% not too far away from ATHs; MU +2%; AMD +3%; MRVL +3%; TSM +2.6%…AVGO lagged again +50bps (haven’t seen anything here other than # shifting to semi laggards)

Software

ADBE -2.5% as UBS wrote a note detailing competitive threats co faces in AI driven future. Stock hit new 52wk lows today

U-3% given back some of the Roaring Kitty hype from yesterday

PLTR +6%/APP +3% back to their old ways

MSFT +70bps as ISI said stock due for a bit of a revenge trade in 2025

MDB -1% continues to lag as investors seem to be warming up to SNOW +1.4% instead

TEAM +80bps - Barclays hosted an expert call today…Summary: Insights from Atlassian reseller shows performance meeting expectations, with cloud growth of 33% globally (US +16%, EMEA +103%) offsetting planned data center decline. TEAM is showing increased contract flexibility while strategically pushing cloud migration, though larger customers likely to remain on data center despite pricing and multi-year deal limitations.

RNG flat shaking off a dg at RJ

Elsewhere

SQ +5.5% as RJ outlined the bull case of GPV accel

Other fintech strong: COIN +5%; AFRM +5%; UPST +3%; HOOD +1.8%

TSLA +4% bouncing back nicely from yesterday’s decline

TTWO +3% continues to act well as investors are warming up for GTA VI trade (trailer expected shortly)

RIVN +20% as they indicated the shortage of a shared component on R1 and RCV platforms is no longer a constraint on production and reported deliveries inline to slightly better than bogeys.

AAPL -50bps underperforming again on neg china data + China announcing subsidies for domestic handsets.

AKAM - 3% (didn’t see anything here)