“Know what you own, and know why you own it.”

— Peter Lynch

130 updated Charts & Commentary on all major Markets — for your weekend reading.

“Don’t start the week without it”

NEW DEVELOPMENTS

STOCKS: Volatility picking up on schedule.

“Losses will continue until morale improves.”

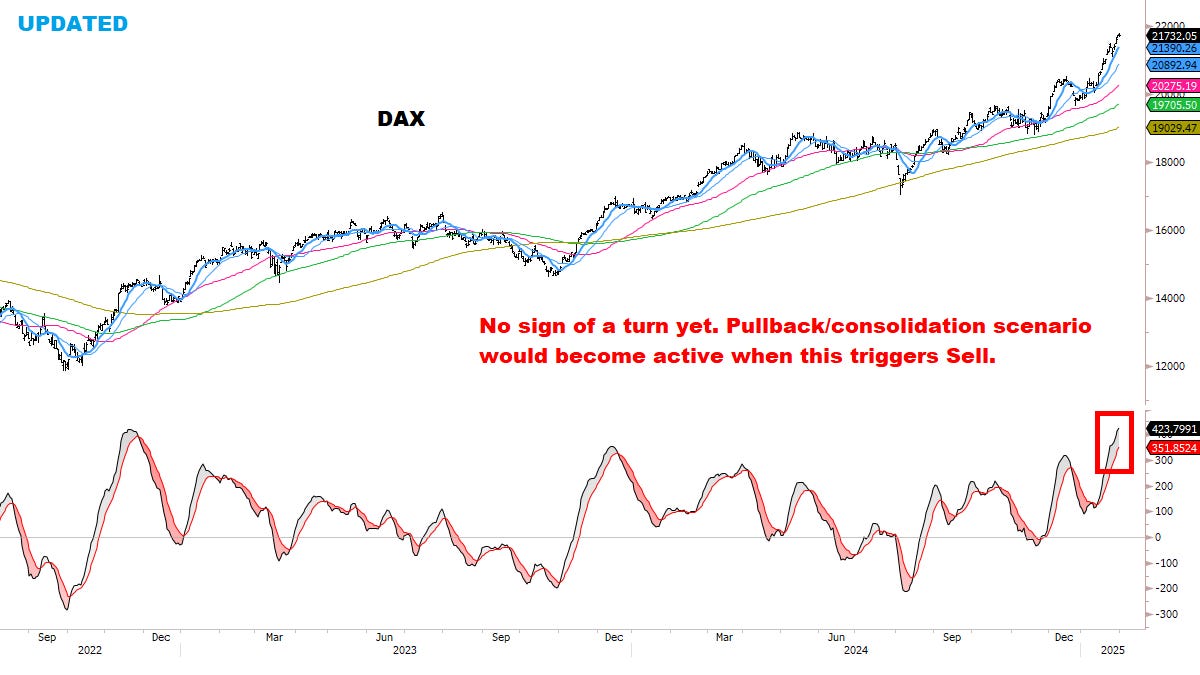

International Markets leading the charge.

Full list of Buy/Sell setups + Key levels for next week.

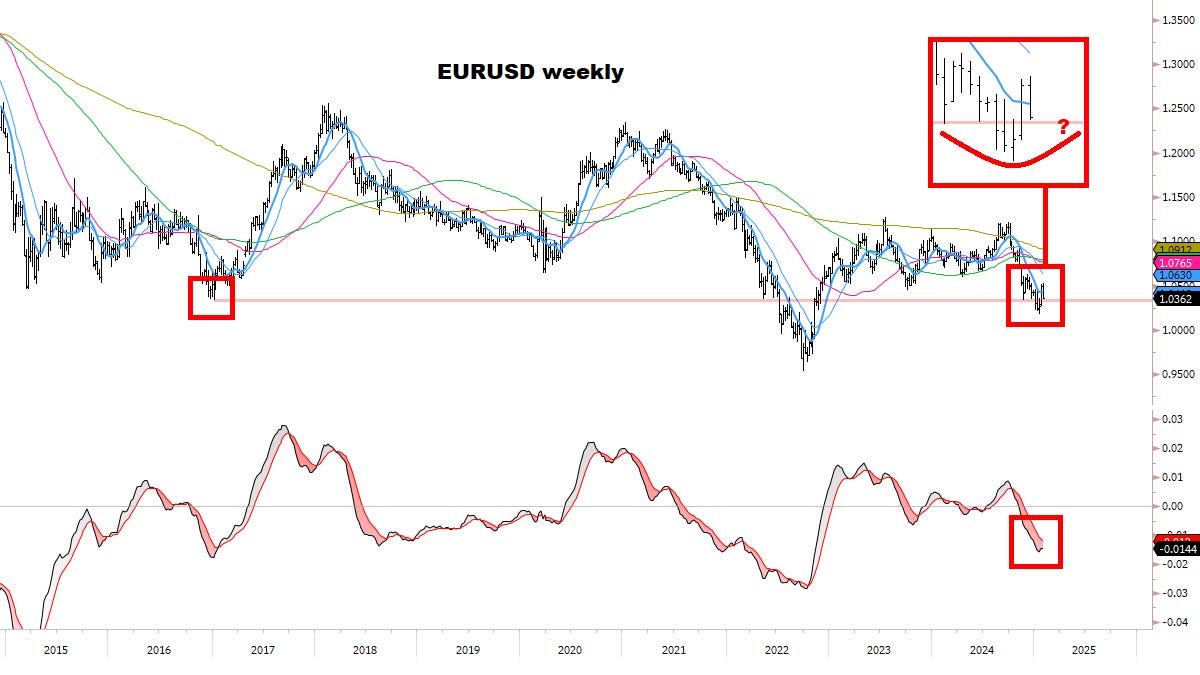

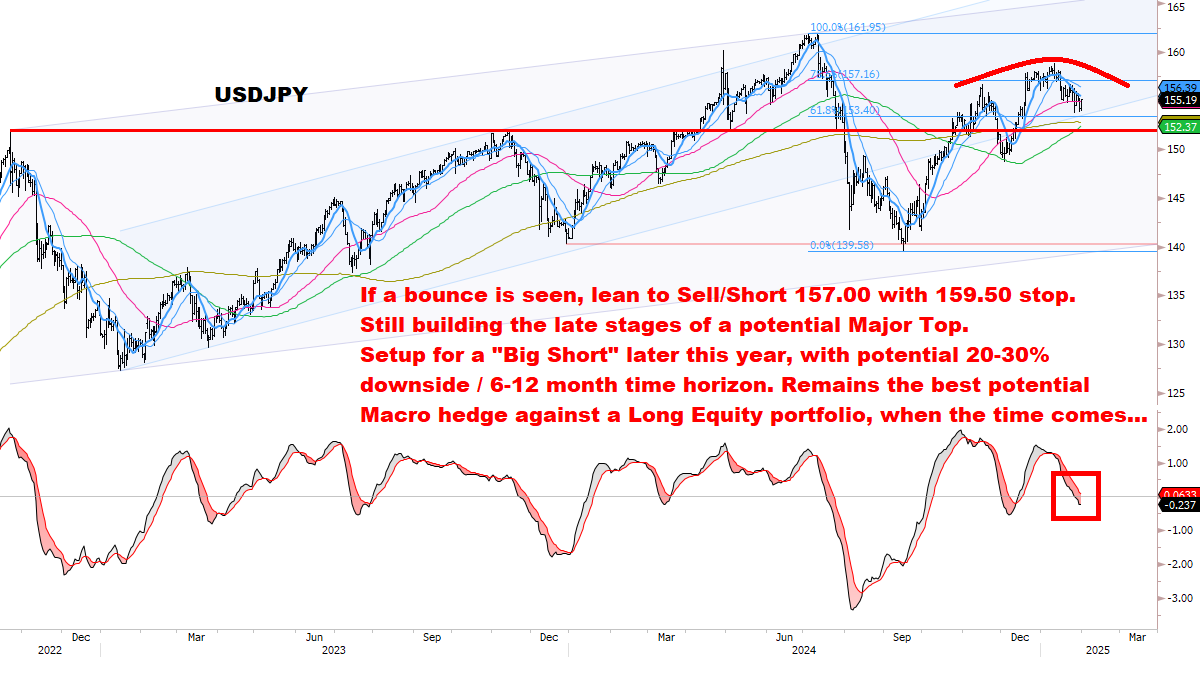

RATES & FX: Tracking the Trend.

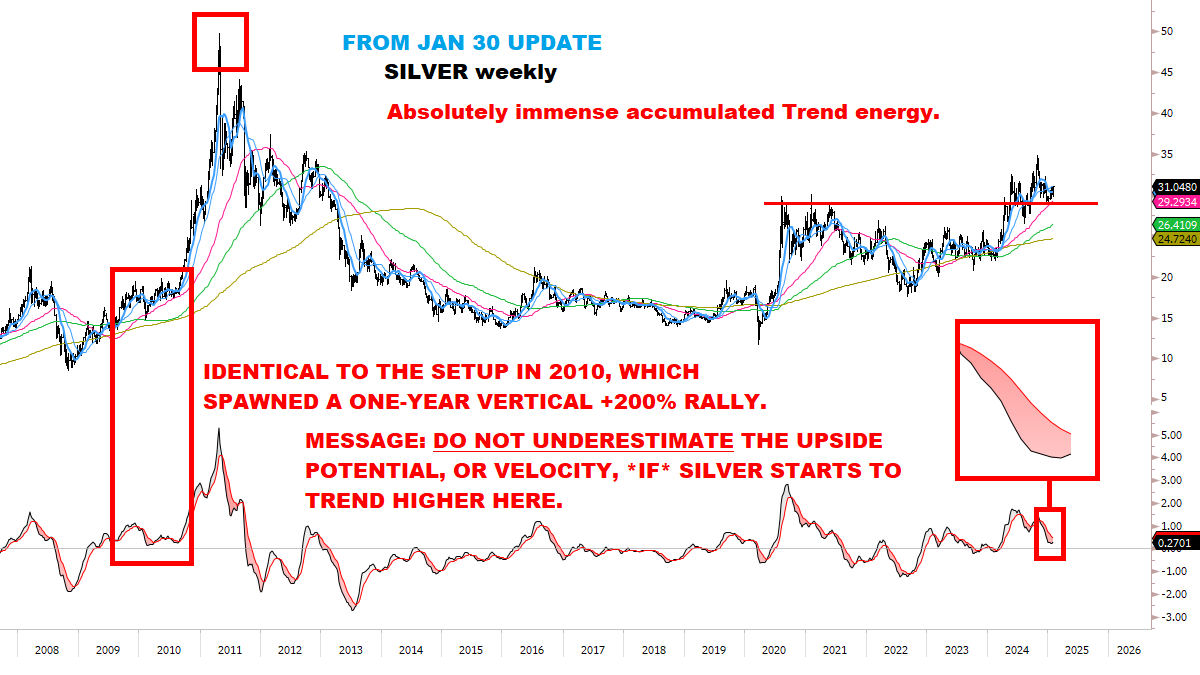

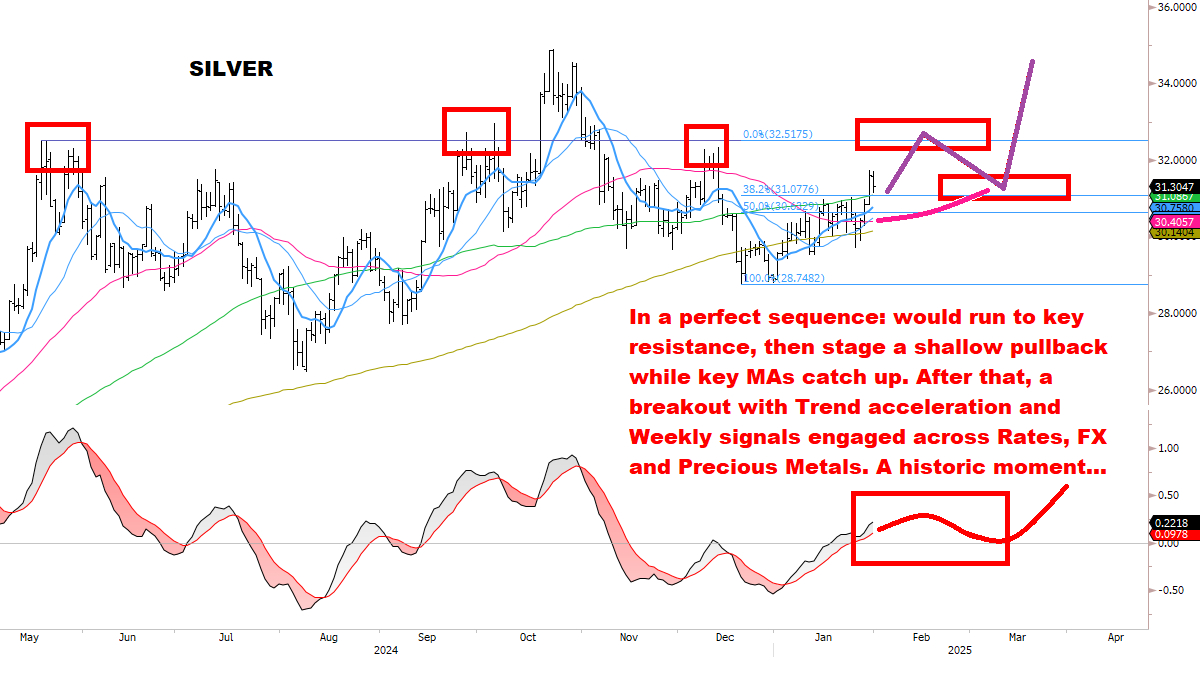

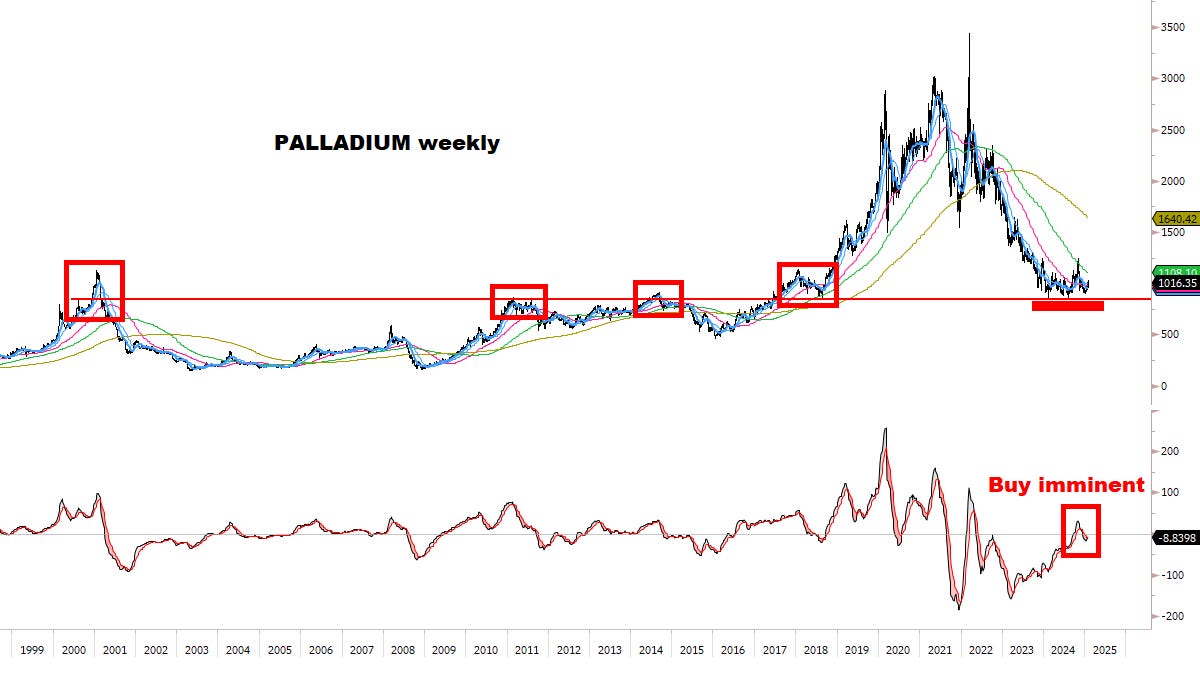

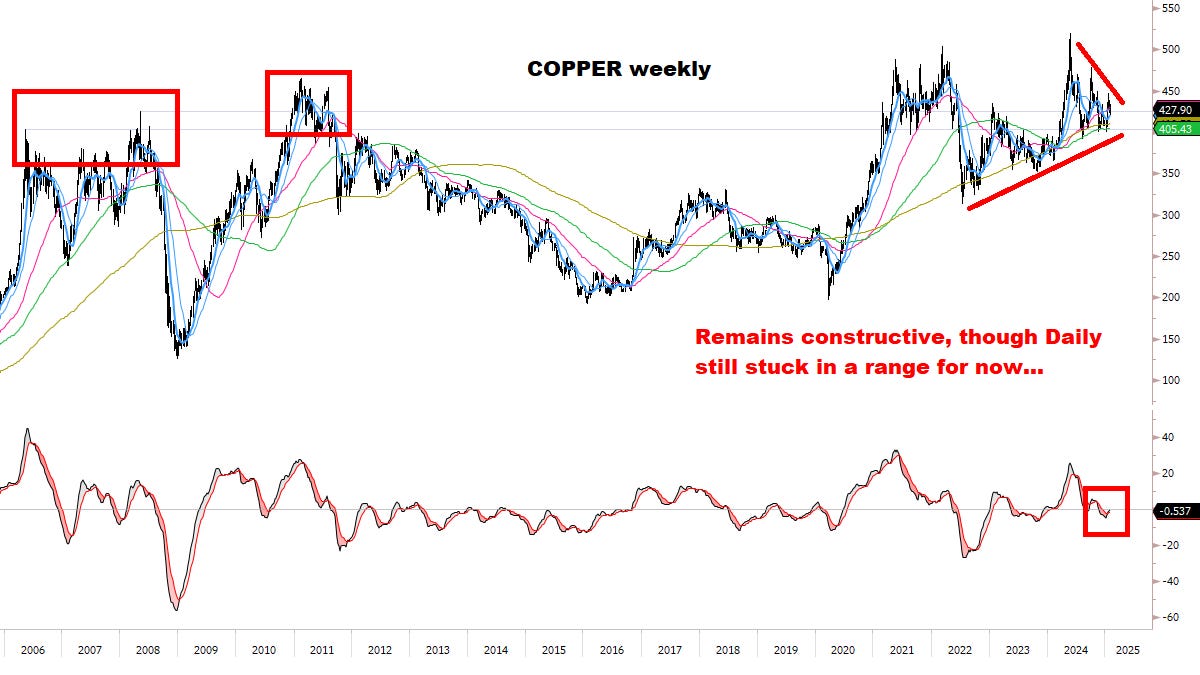

METALS: A perfect setup — now in motion.

Complete review of key Market Signals.

Full Charts & Commentary:

Core Models

Global Equities & Sectors

Volatility

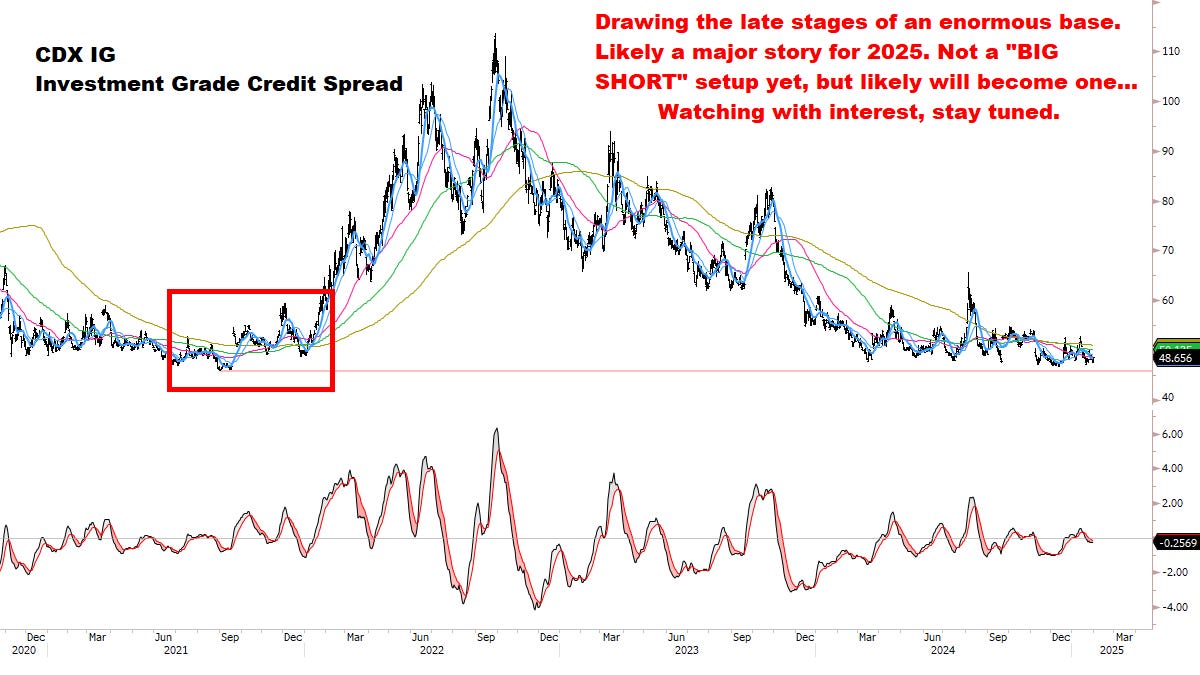

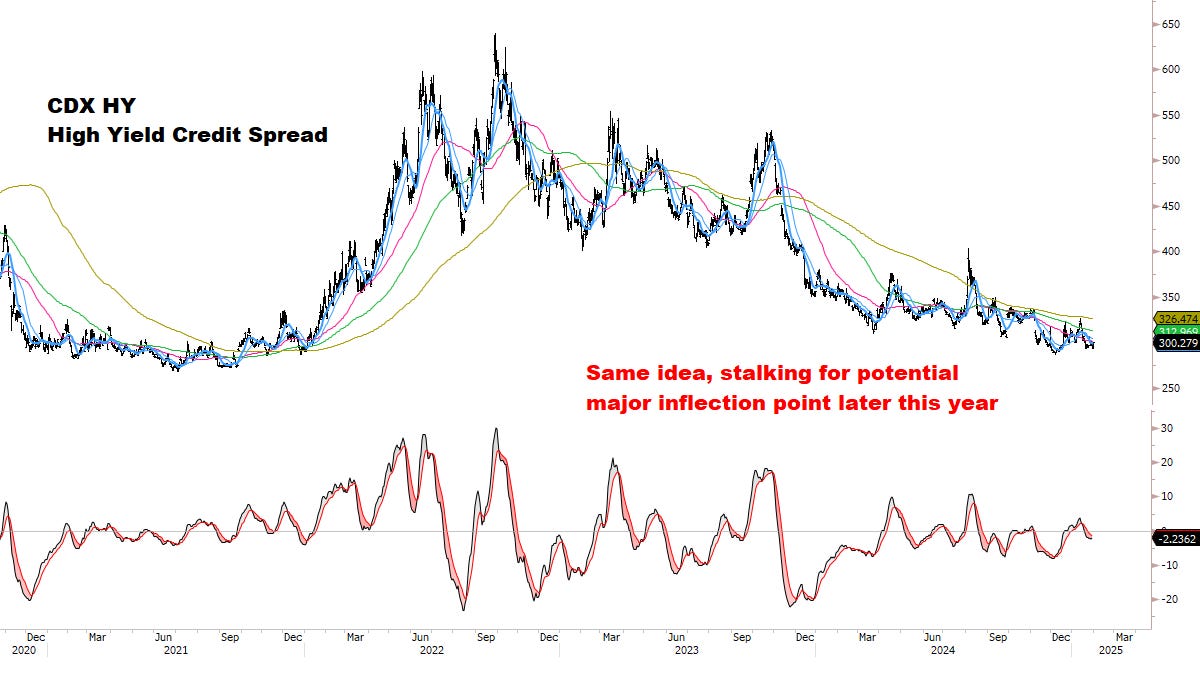

Rates & Credit

Currencies

Commodities

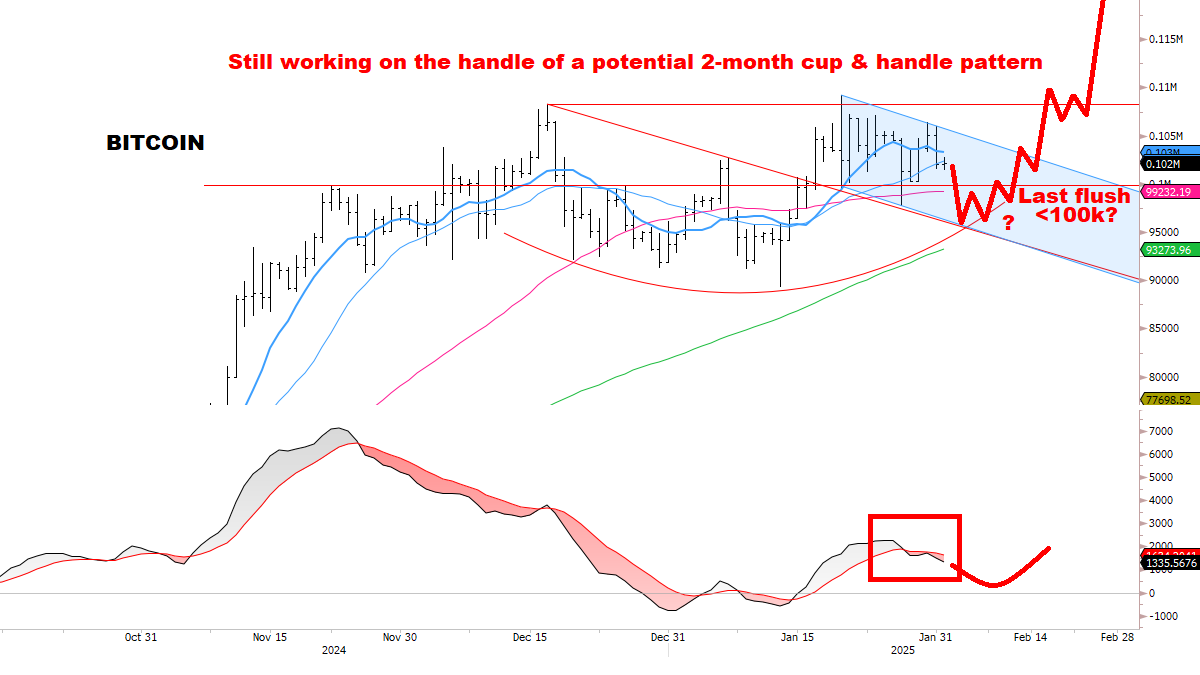

Bitcoin

Let’s get started:

SECTION 1

CORE MODELS & DATA

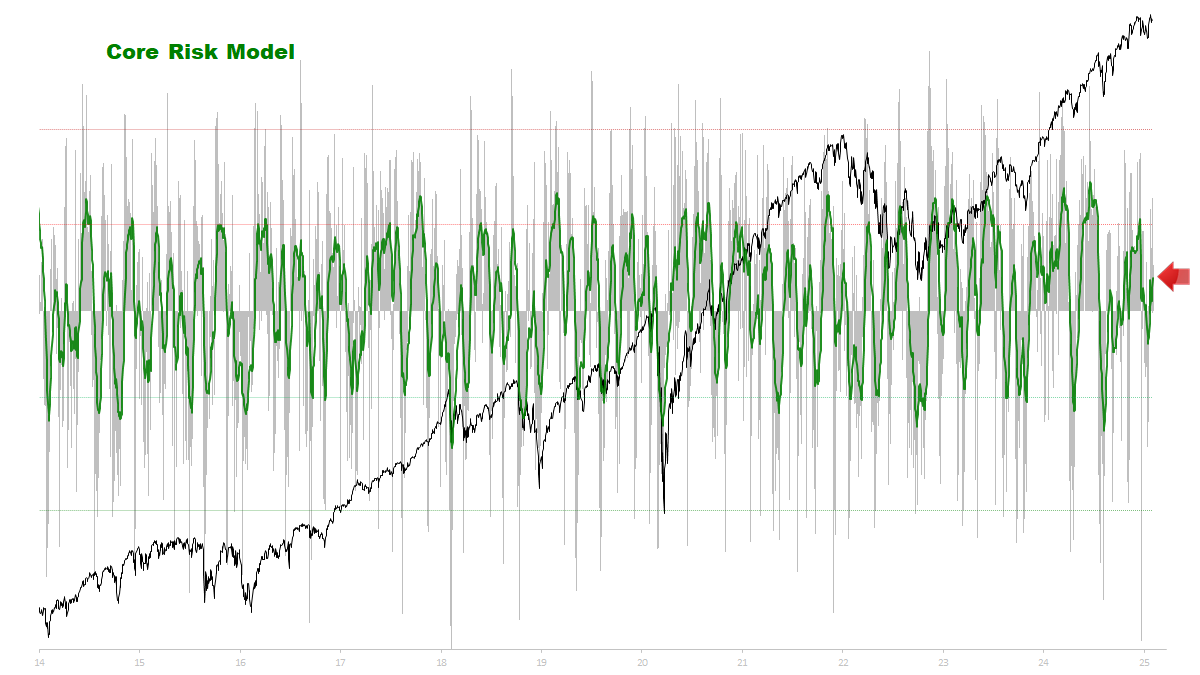

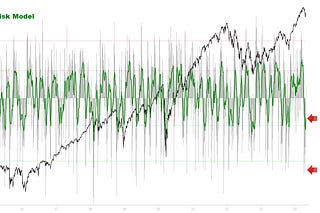

Core Risk is following the ideal sequence:

*The risk of choppy & rangebound action remains HIGH.

*The risk of a bigger correction remains relatively LOW.

Put/Call Ratios are the most extreme in three years.

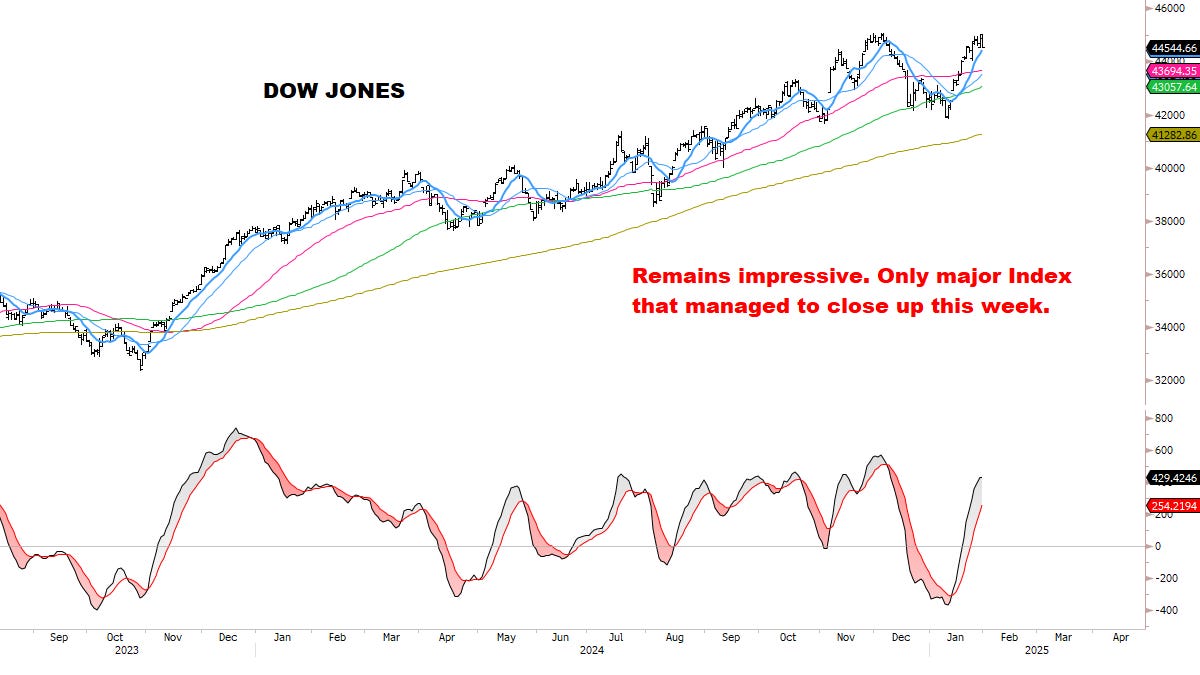

At the Index level, Stocks may need several weeks of choppy & rangebound action to increase conviction that a bigger Top is forming.

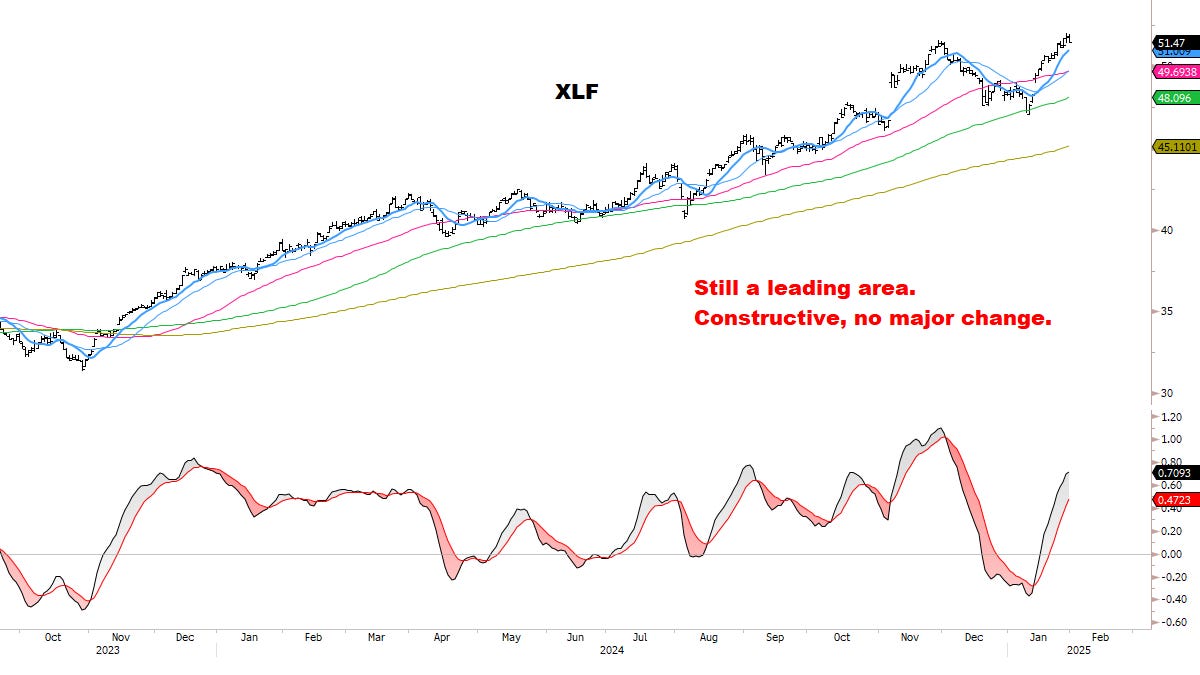

For now: focusing attention on potential Tactical Shorts for Sectors overbought at resistance vs. Tactical Longs for Sectors oversold at support. (Charts presented in detail in Section 2.)

For new subscribers, our Core 2025 “Hurricane Year” Strategy was published in December’s Special Report.

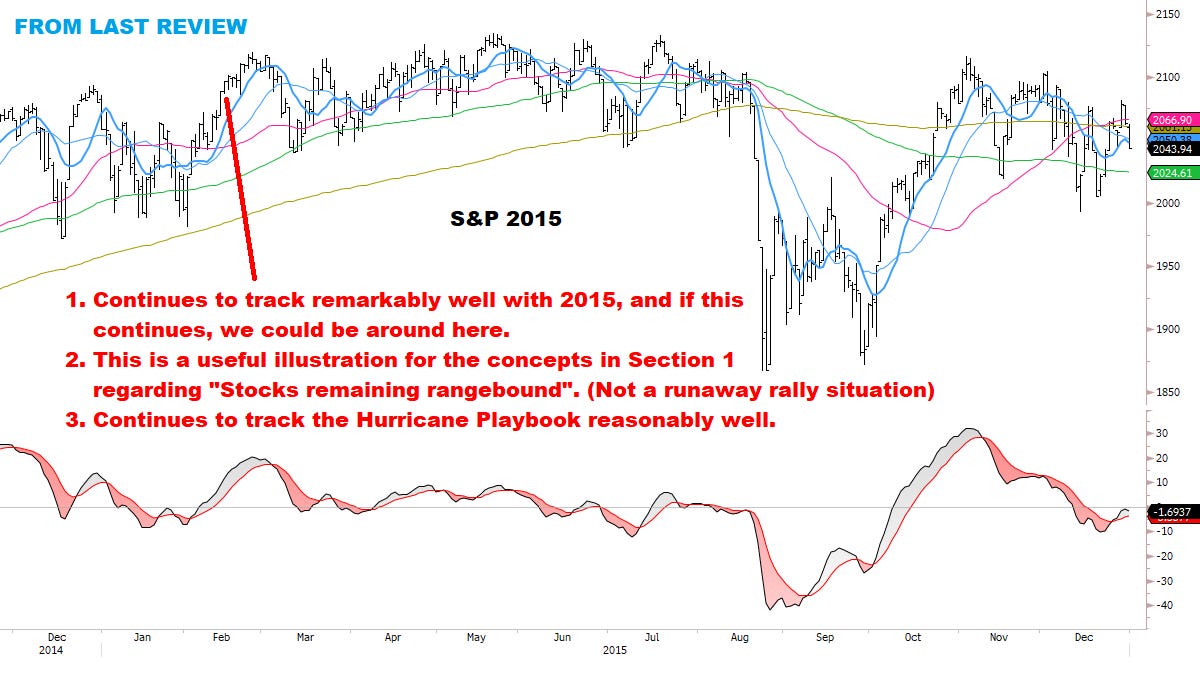

So far, Stocks and Sectors are behaving in line with prior Hurricane Years.

The high-Sharpe “easy days” are over…

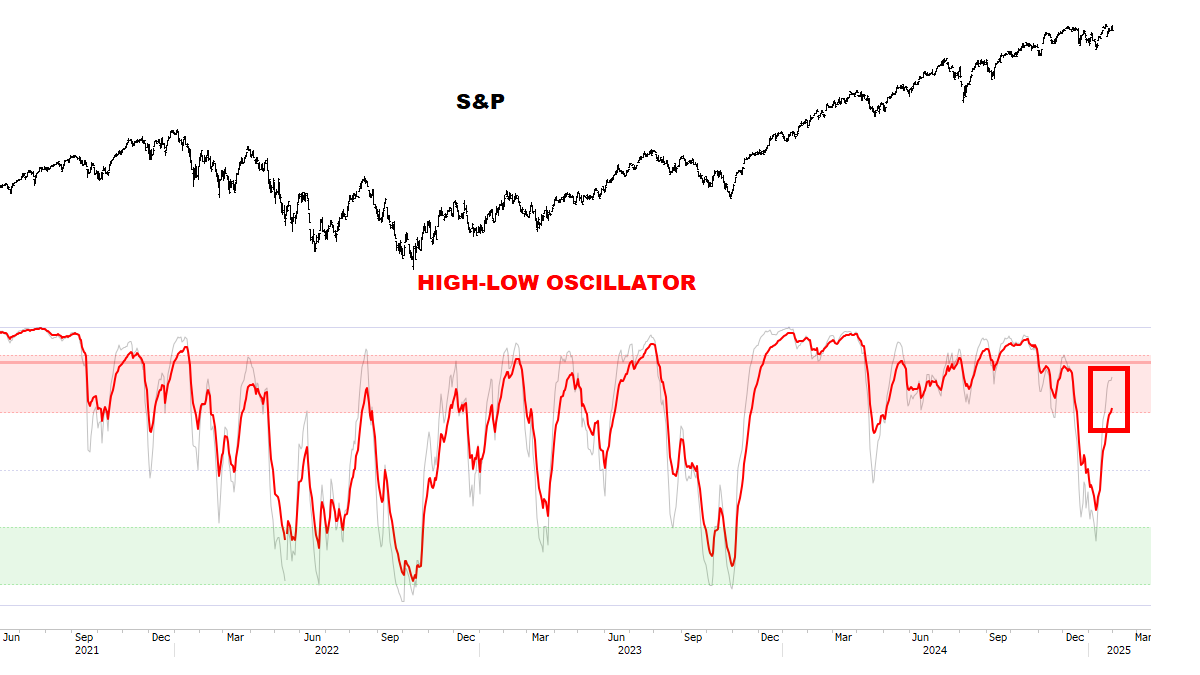

High-Low Oscillators remain on active Buy signals and are still rising.

*Stocks may get choppy Short-Term, but our ideal scenario / base case is a rally back to the overbought zone in the next 2-3 months (stay tuned).

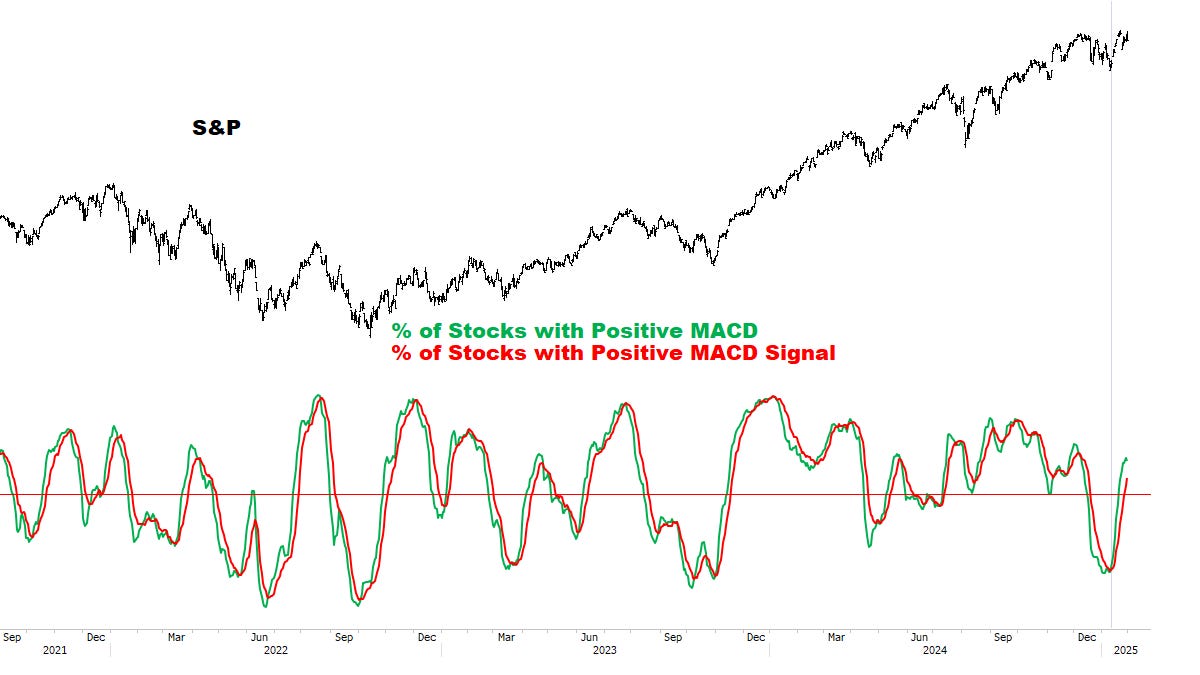

S&P MACD Profile remains constructive since the JAN 14 Buy signal — but is losing Momentum.

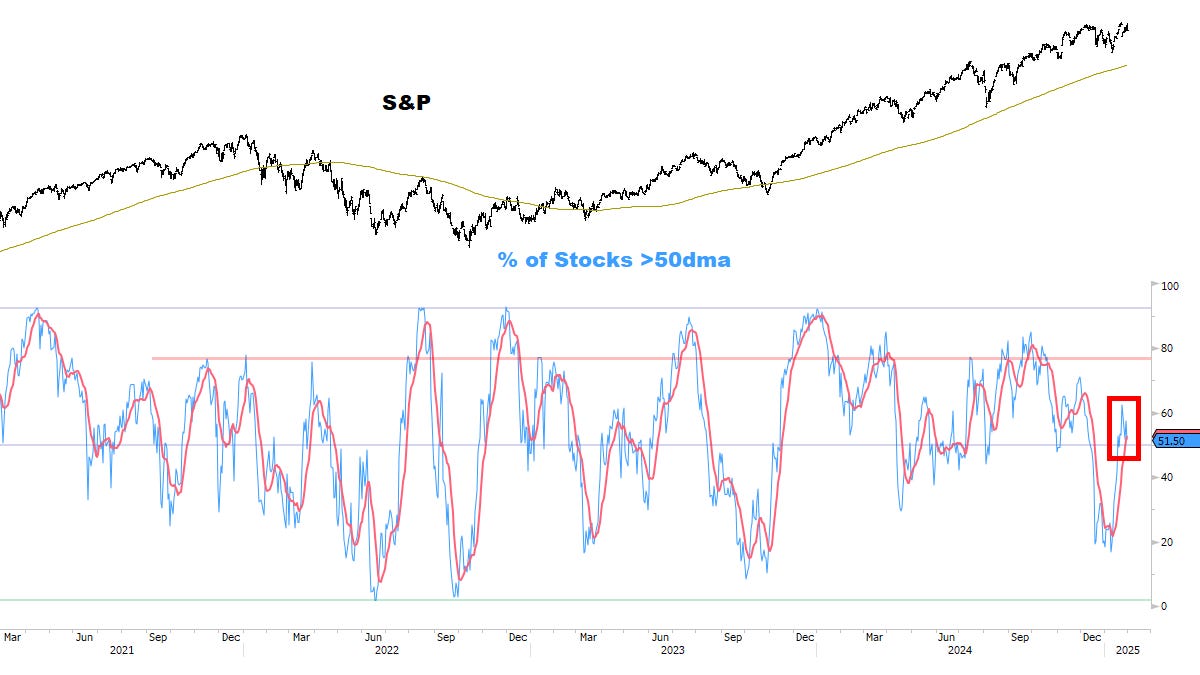

S&P 50dma Breadth is stalling at “neutral” and remains Tactically constructive.

*Stocks may get choppy Short-Term, but our ideal scenario / base case is a rally back to the overbought zone in the next 2-3 months (stay tuned).

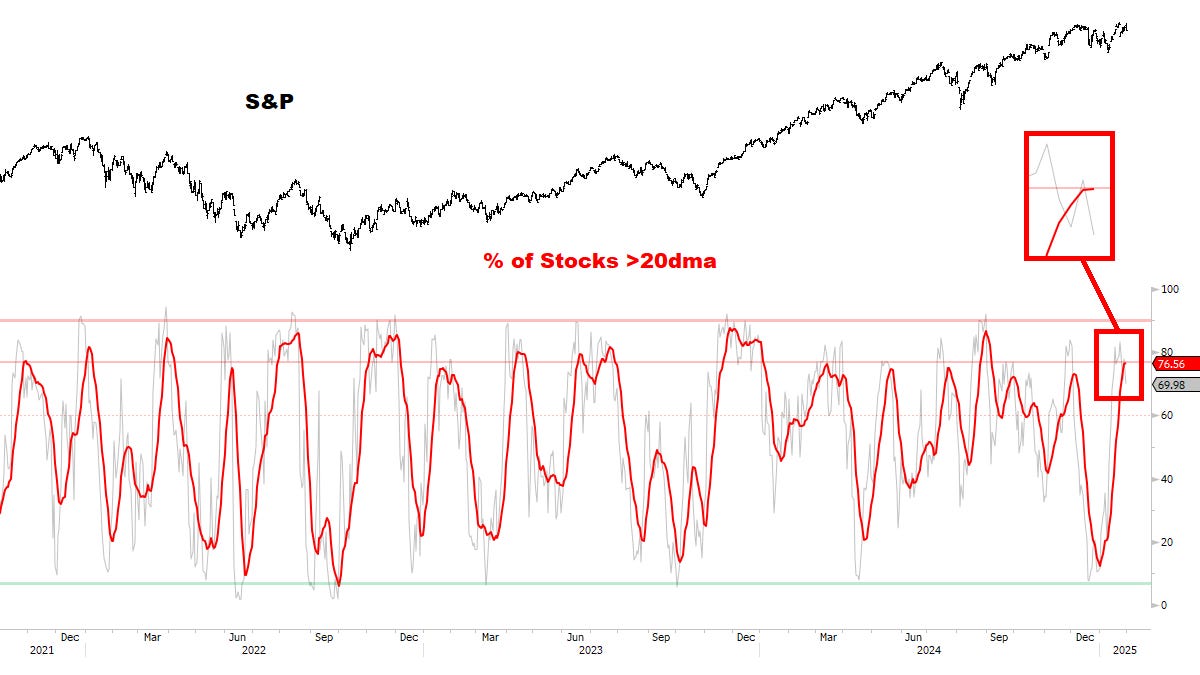

S&P 20dma Breadth remains Short-Term overbought:

As we wrote in last week’s Review: “After a torrid 2-week rally, this could lead to a pause.”

The red moving average may be turning DOWN, suggesting more Short-Term chop ahead.

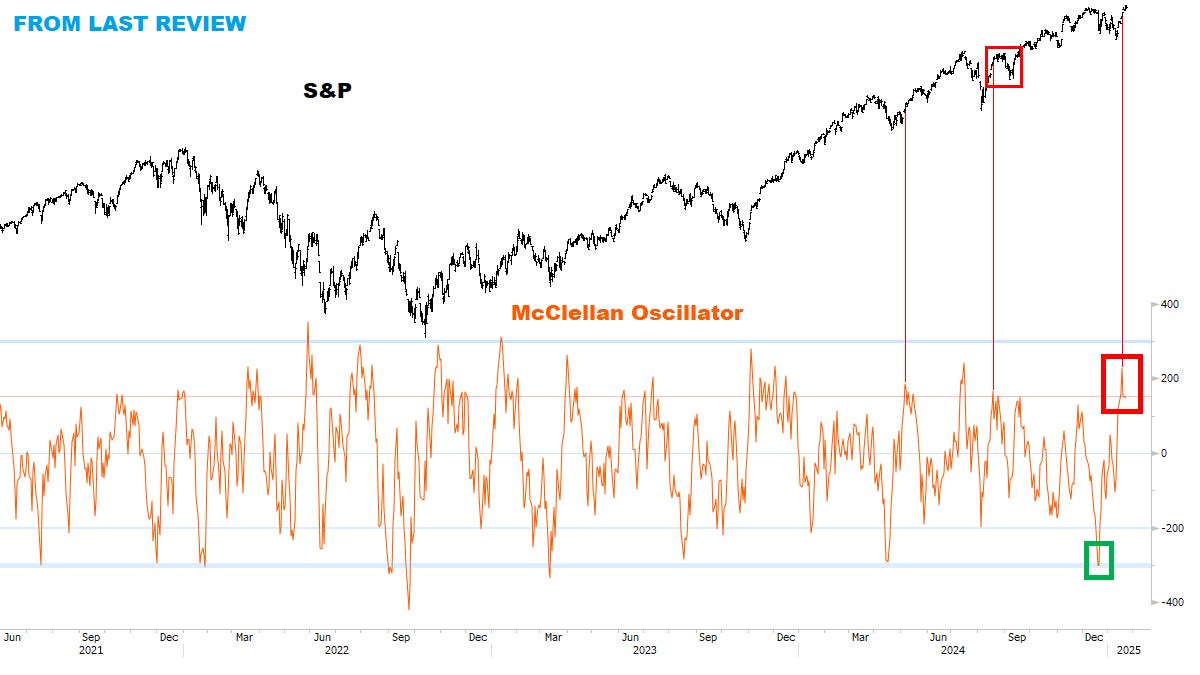

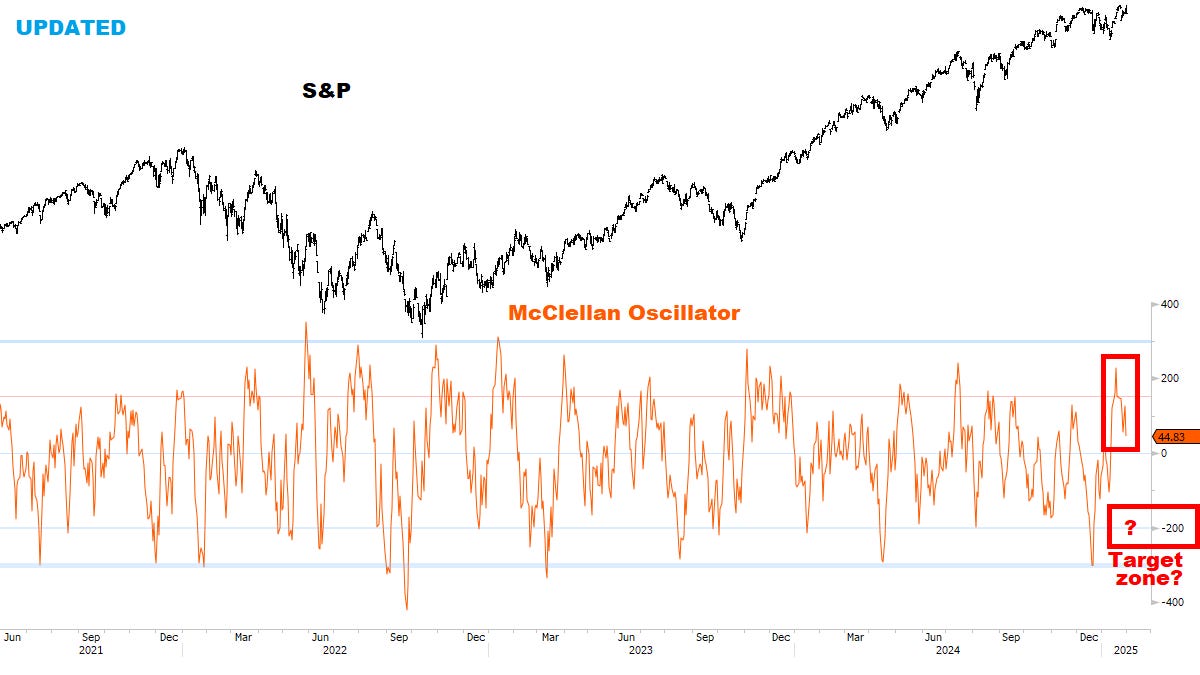

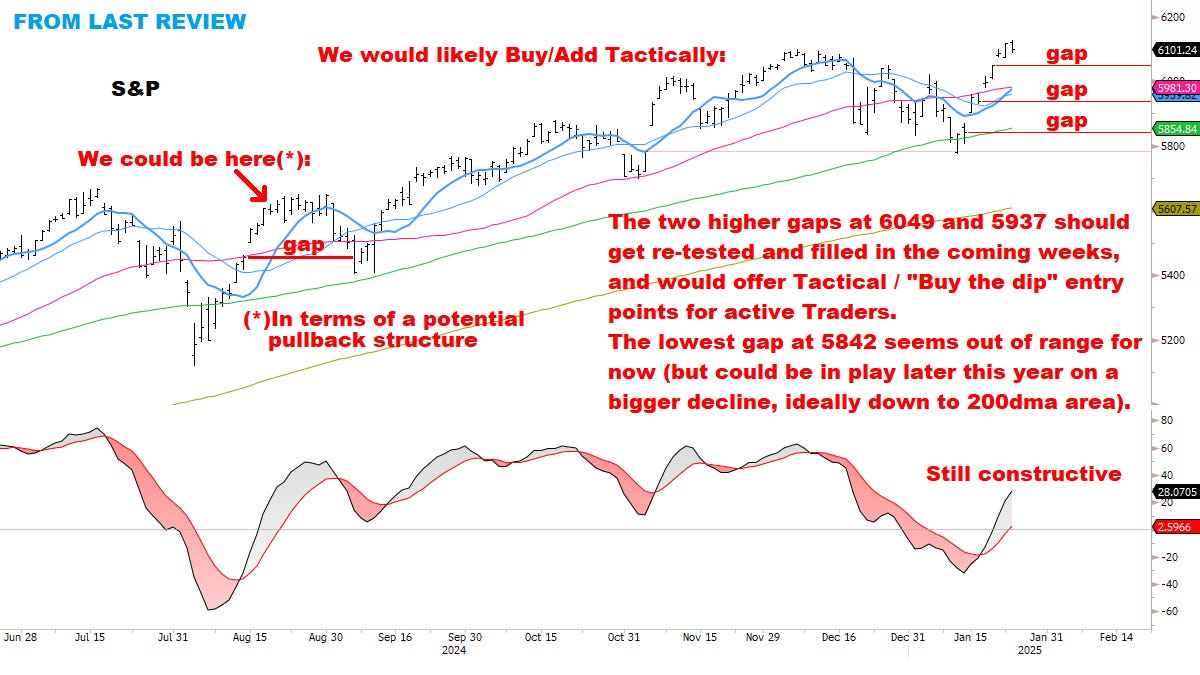

McClellan Oscillator is following the pattern discussed last week:

Coming after a Tactical low, this oversold-to-overbought pattern sometimes led to pullbacks / consolidations.

Similar to August 2024 (RED BOX) — at the time, Stocks also rallied “straight to the highs” — then S&P pulled back over the next weeks, retesting and filling open gaps for an tactical “Buy the dip”.

In Section 2, we’ll update the “Buy the dip” scenario from last week’s charts.

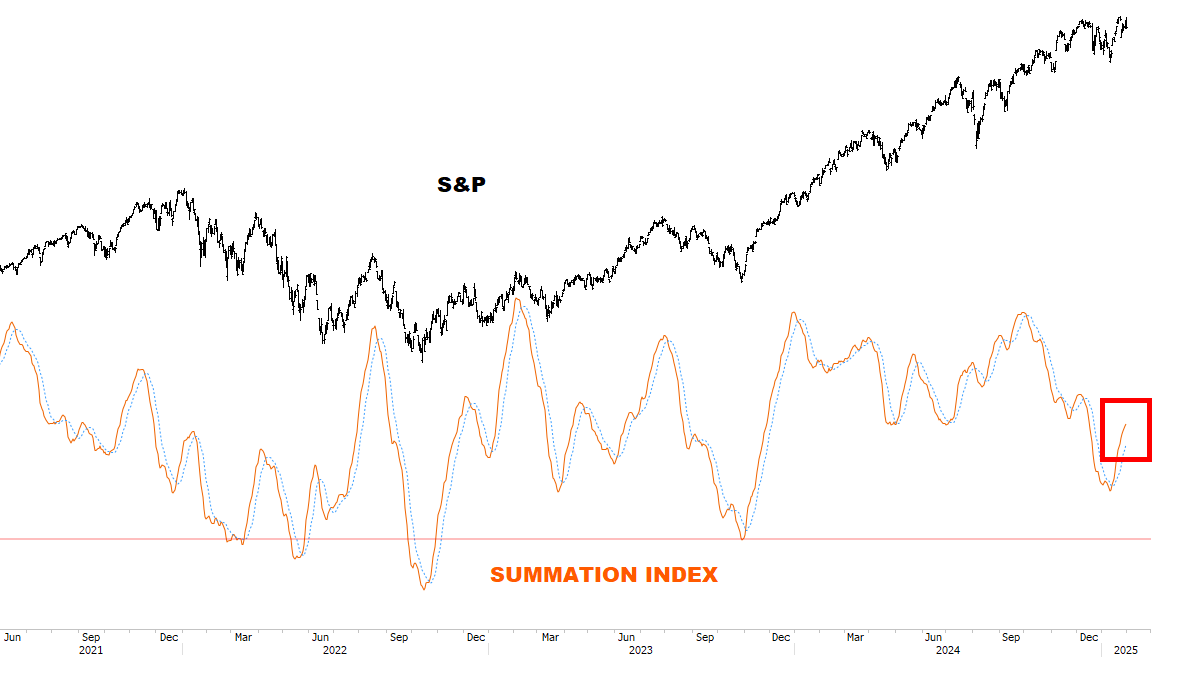

Summation Index remains on a Buy signal — suggesting the bigger picture is still “ok”, despite the increasing Short-Term risks.

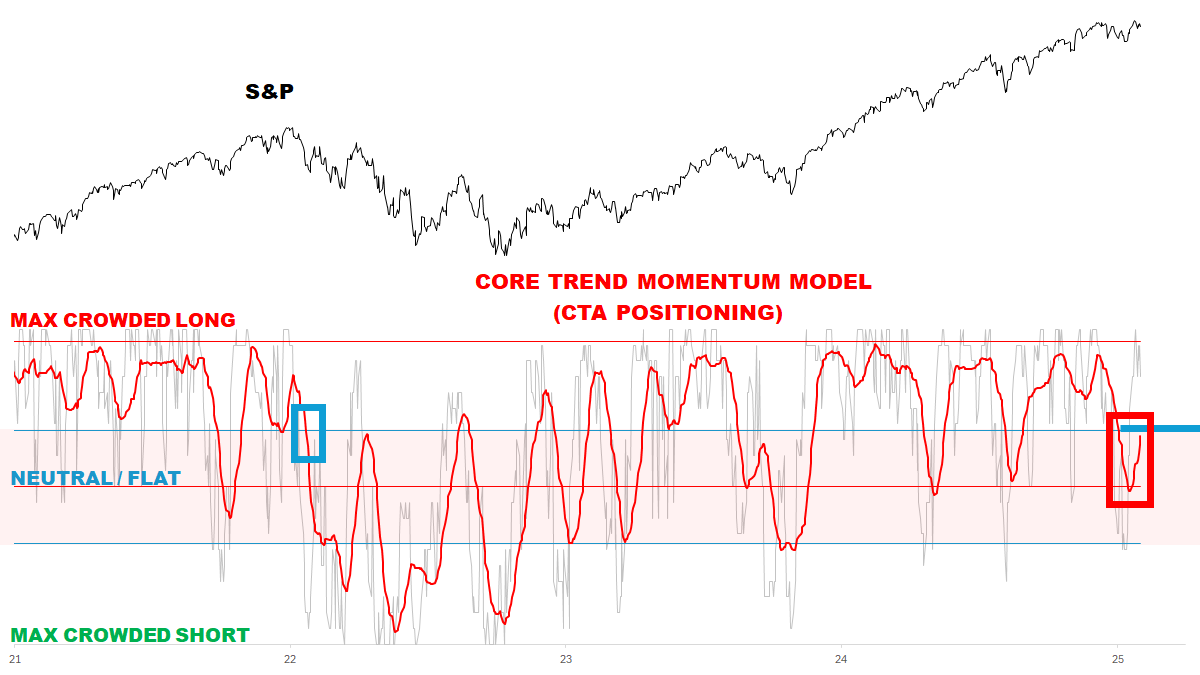

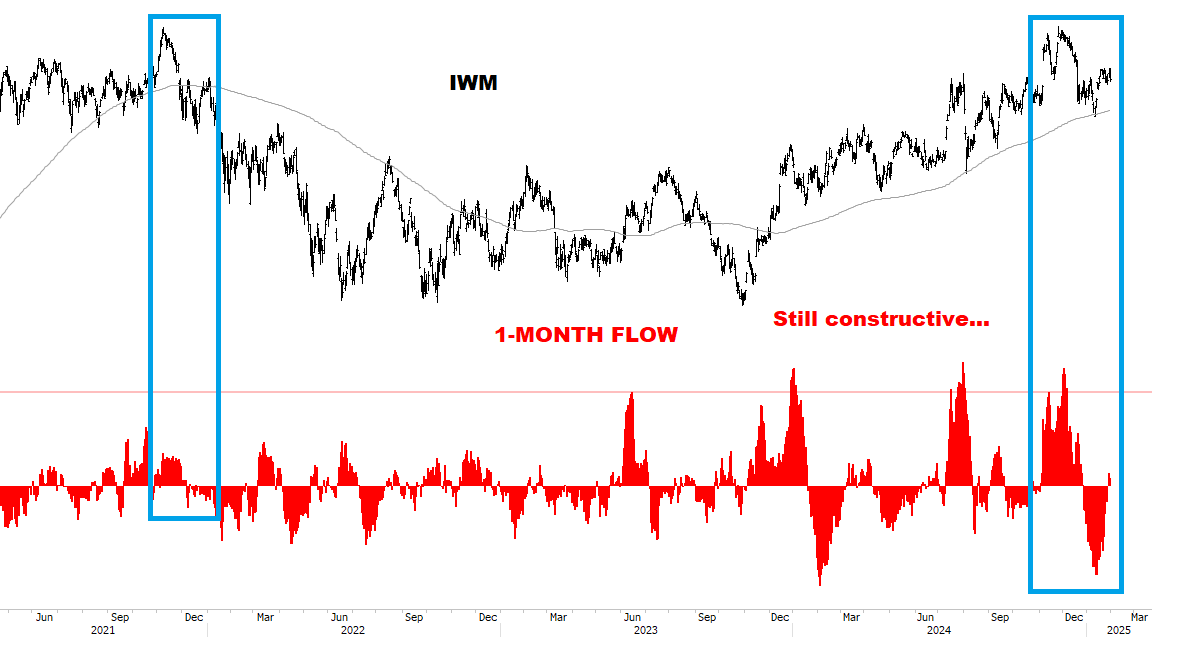

CTA Equity Positioning remains underweight — a constructive setup to “Buy the dips” if seen.

S&P Sentiment remains muted, with room to recover in time.

VIX Sentiment remains extremely high — now back to **50**.

*Reiterating: Volatility expectations have room to drop significantly from here (a tailwind for Stocks).

*Don’t expect Stocks to collapse here — better to stay flexible, and be willing to step in at the range lows.

*We’ll cover levels of interest in Section 2.

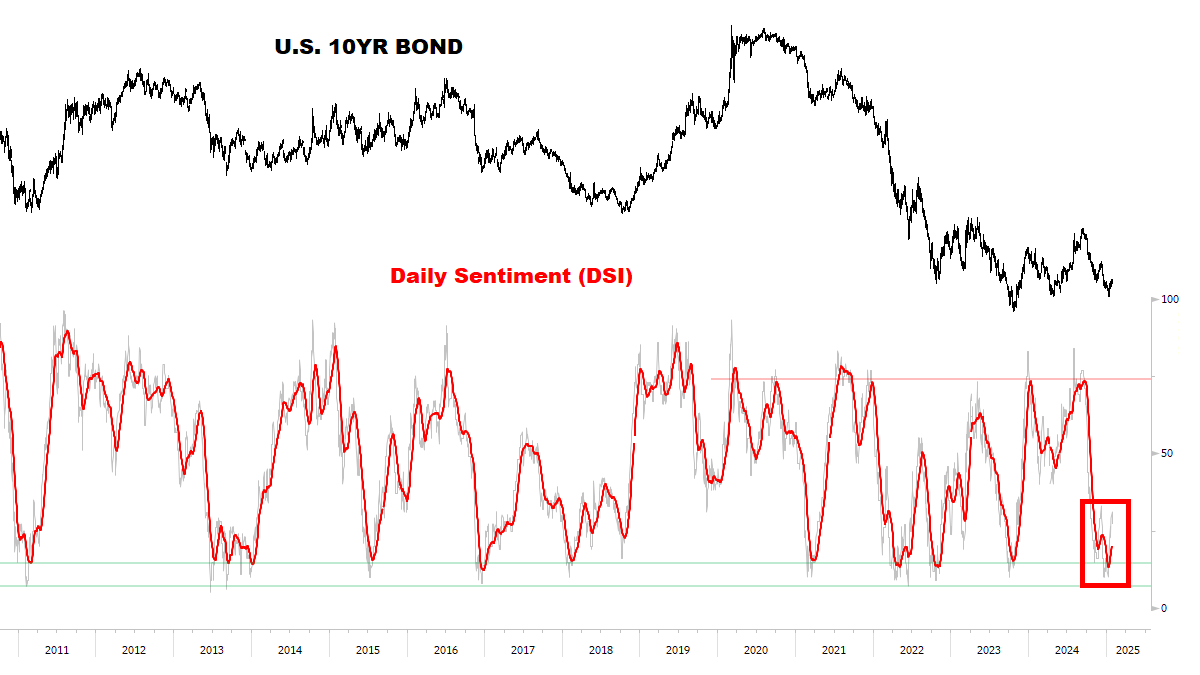

CTA Rates Positioning continues to suggest Bond Yields are just beginning to Trend lower, after turning down from a big topping signal.

*This continues to track as a potential major inflection point. Bias remains to Buy dips in Bonds (key levels in Section 2).

Bond Sentiment continues tracking a potential major turn.

BIG PICTURE: ISSUES REMAIN

Several imbalances are likely to impact Stocks later this year:

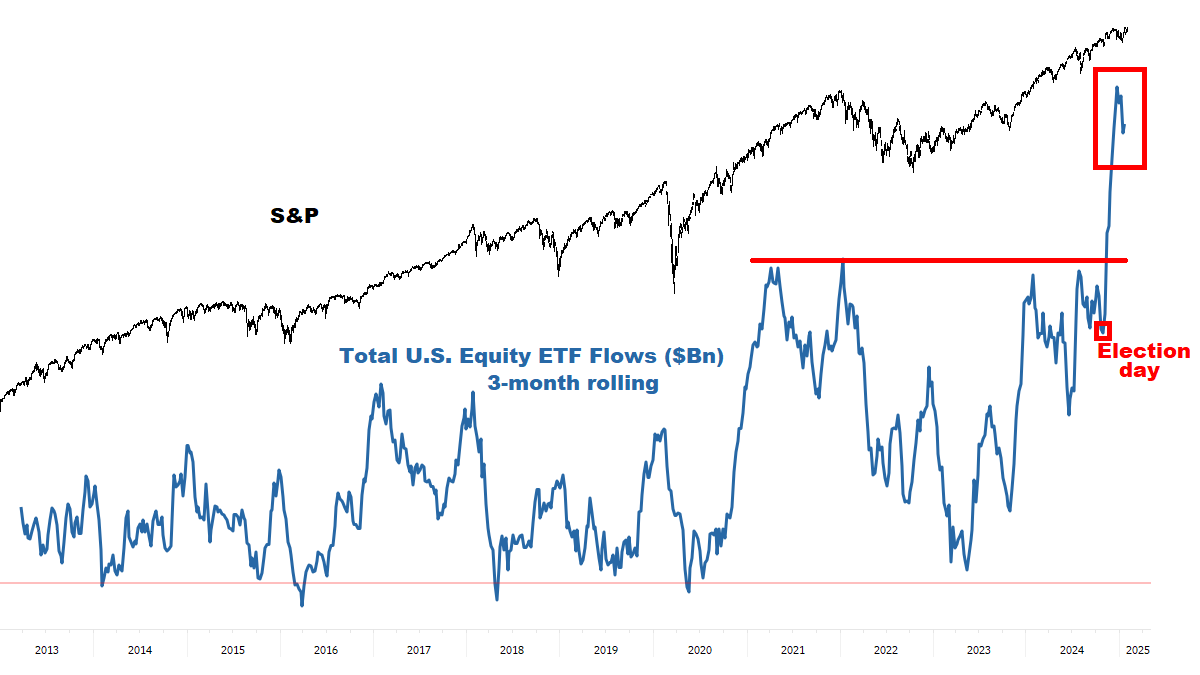

Equity Flows since the U.S. Election have shattered all prior records — and could be at risk.

*Especially as Tech and Semis begin to lose Momentum — more on this in Section 2.

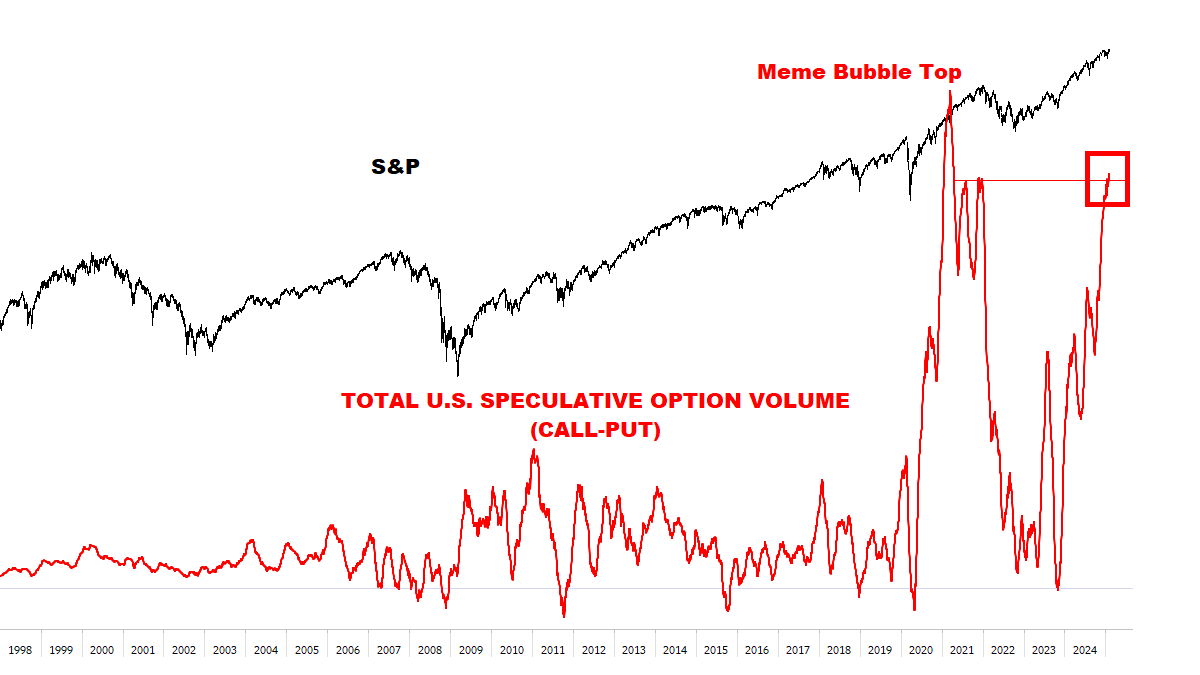

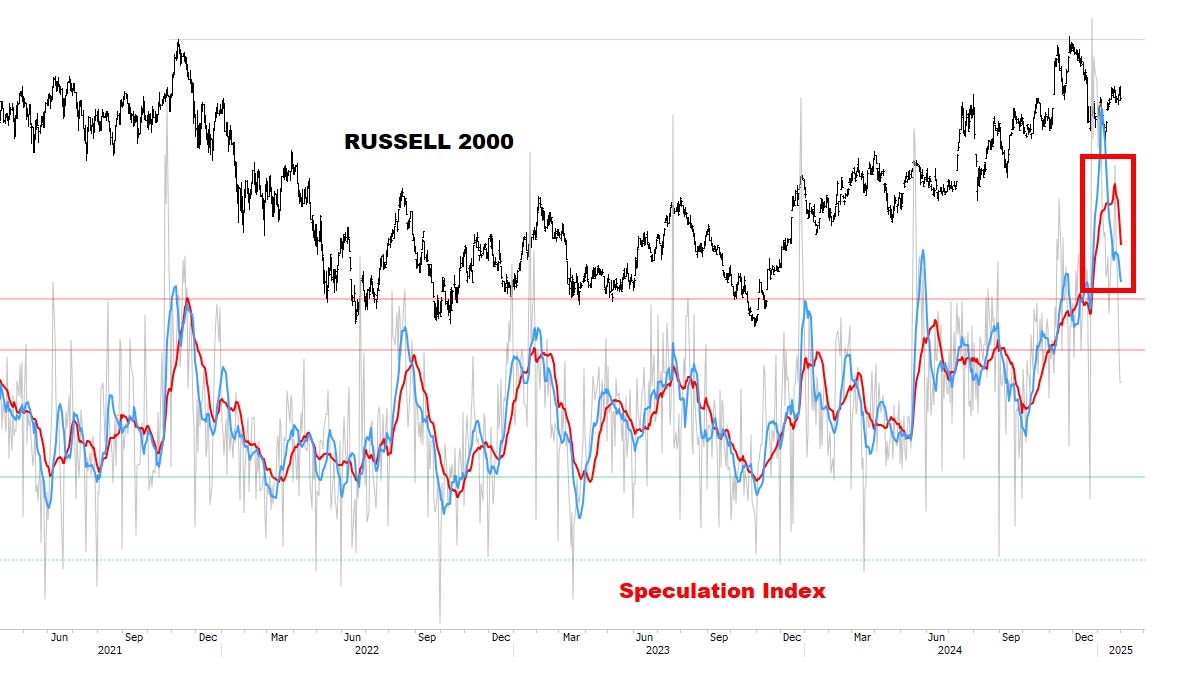

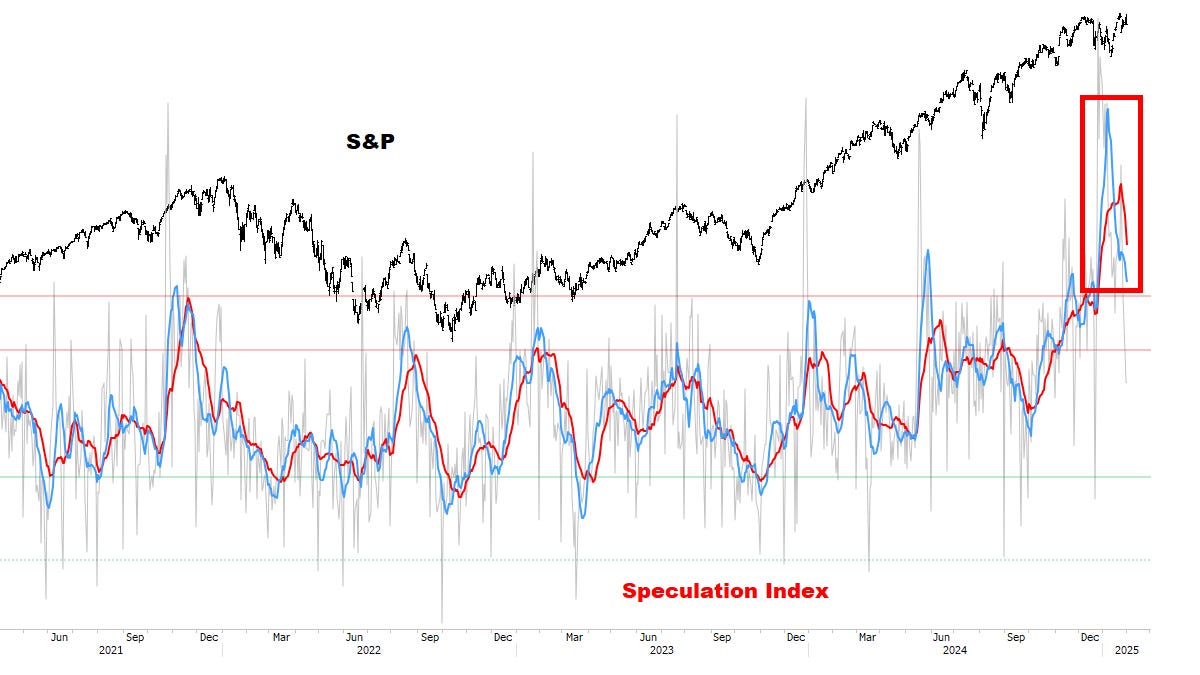

Speculative Option Volume just exceeded the late 2021 Top — only the Meme Bubble Top went higher. Stocks should (at best) remain in this range for a while.

Speculation Index remains an important signal for *most* Stocks to remain rangebound — and *eventually* a larger correction could take hold.

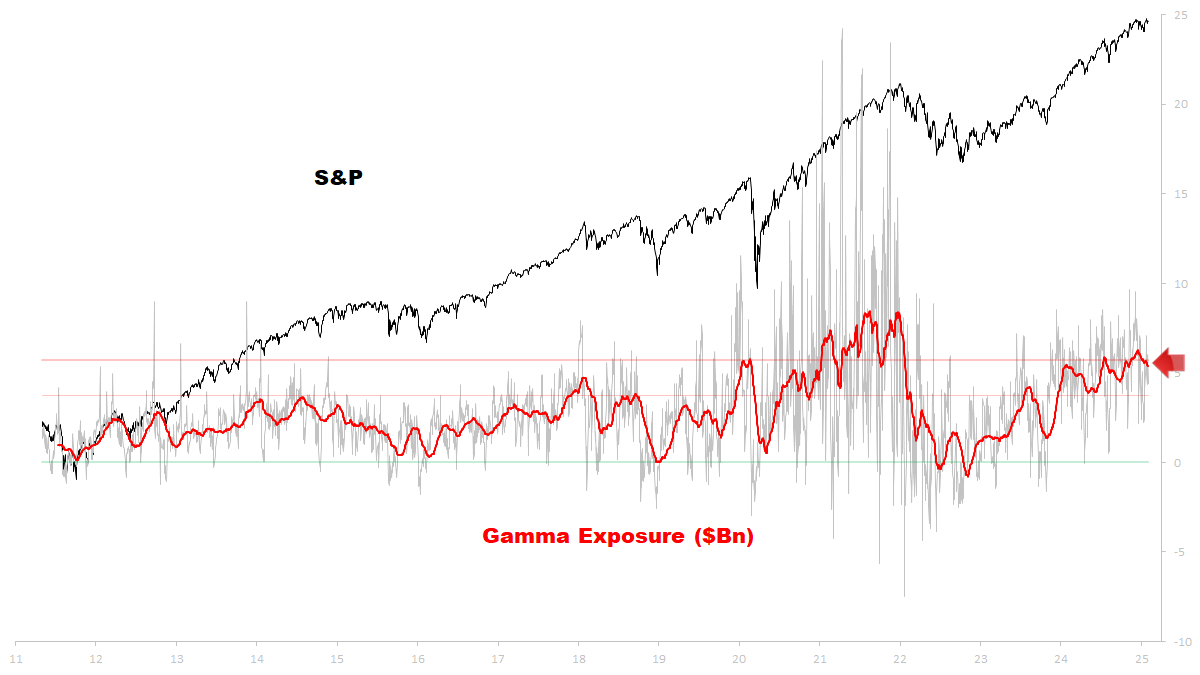

Option Skews and Gamma continue to display similar messages — don’t expect “runaway returns” here. This is a tired, crowded Market…

When Long-Term Breadth breaks down, it would likely begin a large correction.

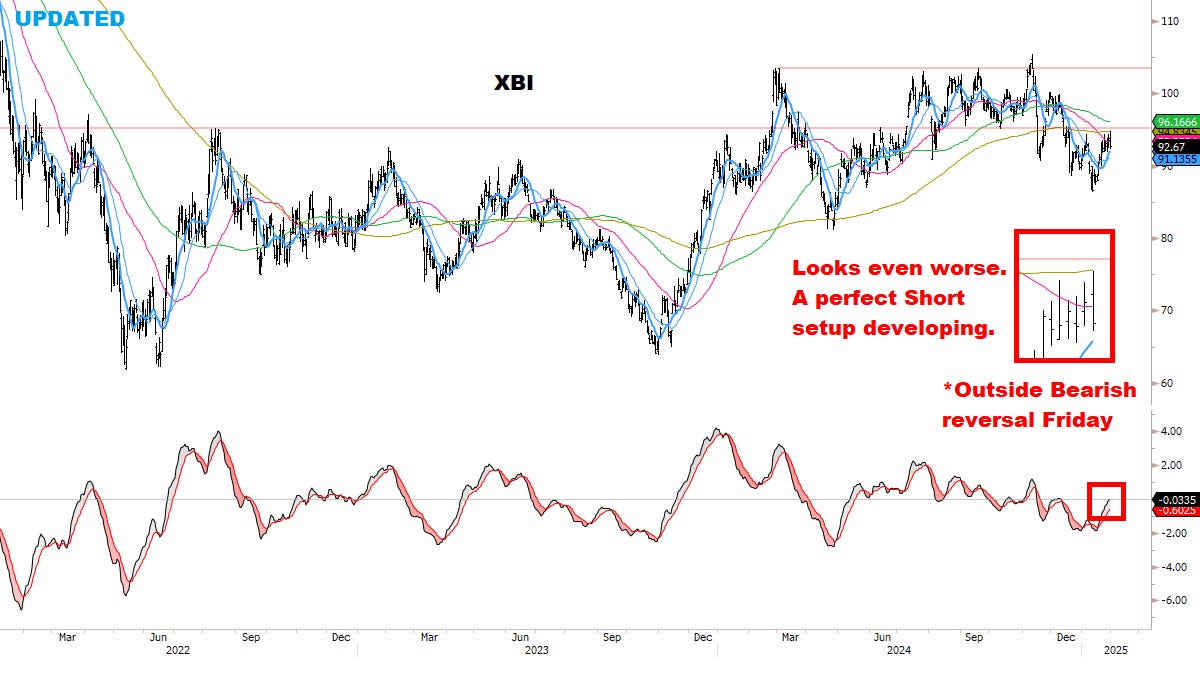

As discussed in the December Special Report, our core plan for opportunistic Shorts remains focused on the weakest areas developing bounce failures — potentially signaling the year’s biggest decliners.

As we’ll show in Section 2, the Sell list is already growing…

Thanks MC!